カスタマイズ可能な非リペイント HTF MACD MFI スケーブルボット戦略

作者: リン・ハーンチャオチャン開催日:2023年12月22日12時47分21秒タグ:

概要

この戦略は,MACDとMFIインジケーターを使用して高度にカスタマイズ可能な非再塗装組み合わせ戦略であり,アルゴリズム取引ボットに適しています. 取引信号を生成するためにトレンドとモメントインジケーターの両方を組み込み,偽の信号を避けるために追加のフィルターを備えています.

戦略の論理

この戦略は,市場動向方向を決定するためにMACD指標を使用する.MACDは,MACDヒストグラムを得るためにスロームービング平均を高速ムービング平均から減算し,シグナルラインとしてMACDのEMAを使用して計算されるトレンドフォローするインパルス指標である.シグナルライン上のクロスオーバーは購入信号を与え,下のクロスオーバーは販売信号を与える.

さらに,MFI指標は,価格と量の両方の情報を組み込むことで,市場における過買い/過売りレベルを測定するために使用されます.MFIは0から100の間を振動し,20未満の値は過買い地域を示し,80を超える値は過買い地域を示します.

誤った信号をフィルタリングするために,戦略はトレンドフィルターとRSIフィルターも実装する.価格が上昇傾向にあり,RSIが限界を下回っている場合にのみ購入信号が生成される.

戦略 の 利点

- 市場状態の評価をより堅牢にするために複数の指標を組み合わせ,勝率を向上させる

- フィルタリングメカニズムは 誤った信号を回避し,不必要な取引を減らす

- 高度にカスタマイズ可能なパラメータとフィルター,異なる楽器や取引の好みに適応可能

- 手動取引に使用したり,自動取引のためのアルゴリズムボットに接続することができます.

リスクと緩和策

-

パラメータの調節が不十分なら 誤った信号が発信される

-

最適な設定を見つけるために異なるパラメータの組み合わせをテストする

-

パラメータは"サイズ"ではなく,各機器ごとに別々のテスト/最適化が必要です

-

高い取引頻度はコストと滑り込みリスクを増加させる

-

取引頻度を減らすためにフィルターを調整する

-

ライブ取引中にコストを注意深く監視する

戦略の最適化のための方向性

- パラメータの安定性を評価するために,より長いデータ期間の試験

- インディケーターパラメータの異なる組み合わせを試す

- 安定性を高めるために指標の重量を最適化する

- 不必要な取引を避けるためにより多くのフィルターを追加します.

結論

これは,市場状態を測定するためにトレンドとモメントインジケーターの両方を組み合わせて高度にカスタマイズ可能なトレンドフォロー戦略であり,リスクを制御するためにフィルタリングメカニズムを効果的に使用します.手動取引に使用したり,高度な自動化のためにアルゴリズムボットに接続したりできます.長期的に追跡および最適化する価値のある戦略です.

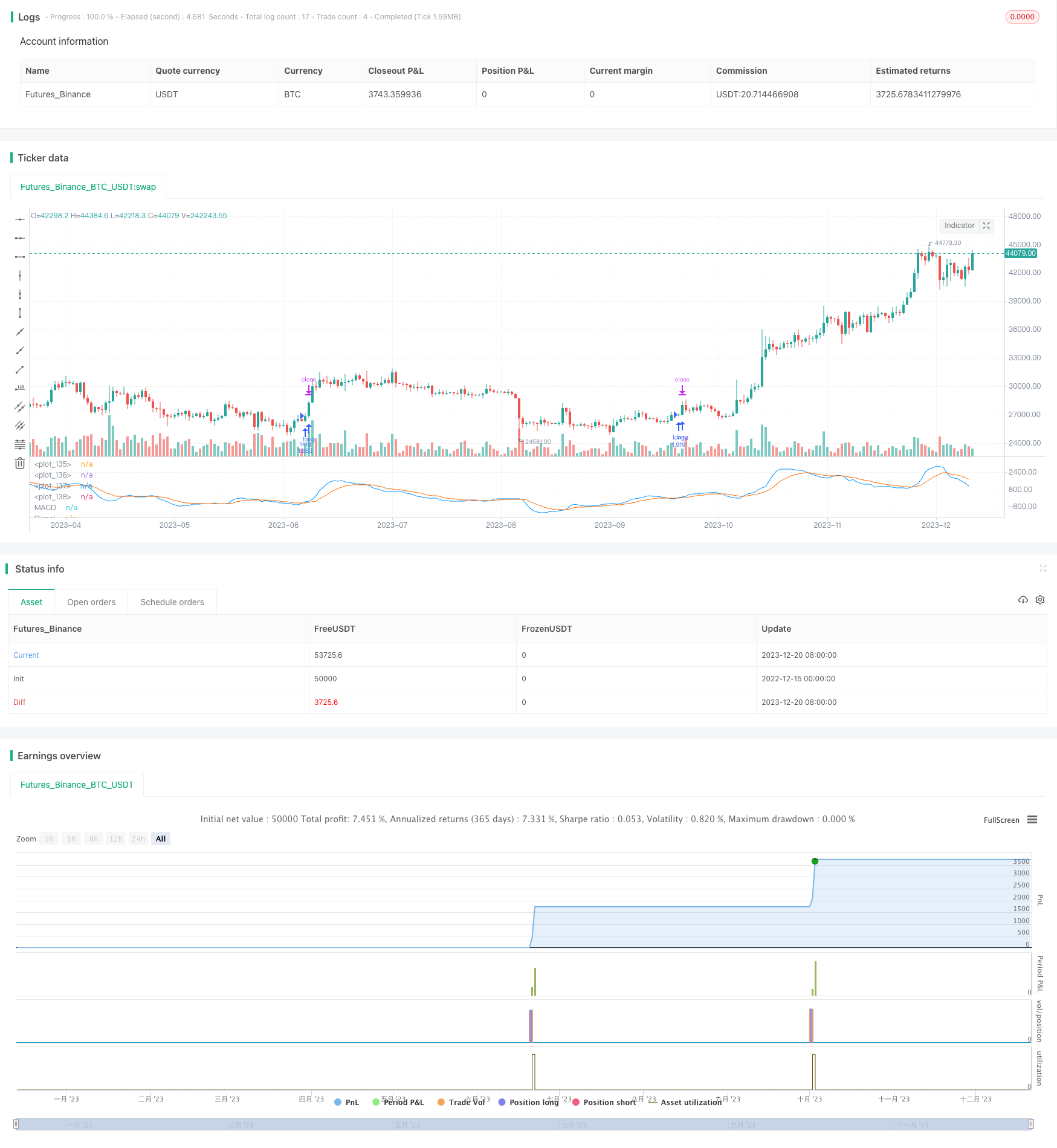

/*backtest

start: 2022-12-15 00:00:00

end: 2023-12-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//(c) Wunderbit Trading

//Modified by Mauricio Zuniga - Trade at your own risk

//This script was originally shared on Wunderbit website as a free open source script for the community. (https://help.wundertrading.com/en/articles/5246468-macd-mfi-trading-bot-for-ftx)

//

//WHAT THIS SCRIPT DOES:

// This is a scalping script originally intended to be used on altorightmic bot trading.

// This strategy is based on the trend-following momentum indicator. It includes the Money Flow index as an additional point for entry.

//HOW IT DOES IT:

// It uses a combination of MACD and MFI indicators to create entry signals. Parameters for each indicator have been surfaced for user configurability.

// Take profits are fixed, but stop loss uses ATR configuration to minimize losses and close profitably.

//HOW IS MY VERSION ORIGINAL:

// I started trying to deploy this script myself in my algorithmic tradingg but ran into some issues which I have tried to address in this version.

// Delayed Signals : The script has been refactored to use a time frame drop down. The higher time frame can be run on a faster chart (recommended on one minute chart for fastest signal confirmation and relay to algotrading platform.

// Repainting Issues : All indicators have been recoded to use the security function that checks to see if the current calculation is in realtime, if it is, then it uses the previous bar for calculation.

// If you are still experiencing repainting issues based on intended (or non intended use), please provide a report with screenshot and explanation so I can try to address.

// Filtering : I have added to additional filters an ABOVE EMA Filter and a BELOW RSI Filter (both can be turned on and off)

// Customizable Long and Clos Messages : This allows someone to use the script for algorithmic trading without having to alter code. It also means you can use one indicator for all of your different alterts required for your bots.

//HOW TO USE IT:

// Find a pair with high volatility - I have found it works particularly well with 3L and 3S tokens for crypto. although it the limitation is that confrigurations I have found to work typically have low R/R ratio, but very high win rate and profit factor.

// Ieally set one minute chart for bots, but you can use other charts for manual trading. The signal will be delayed by one bar but I have found configurations that still test well.

// Select a time frame in configuration for your indicator calculations.

// I like ot use 5 and 15 minutes for scalping scenarios, but I am interested in hearing back from other community memebers.

// Optimize your indicator without filters (trendFilter and RSI Filter)

// Use the TrendFilter and RSI Filter to further refine your signals for entry.

//@version=4

strategy("Customizable HTF MACD Strategy v1.2", overlay=false, pyramiding=0, commission_type=strategy.commission.percent, commission_value=0.07, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, currency = currency.USD)

openlongcomment = "Comment In Here"

closelongcomment = ""

openshortcomment = ""

closeshortcommment = ""

//RES

res = input(title="Resolution", type=input.resolution, defval="5", group="Strategy", inline="1")

comment = input(title="Open Long Comment", type=input.string, defval="",group="Strategy", inline="1")

if not(comment == "")

openlongcomment := comment

// FUNCTIONS

Ema(src,p) =>

ema = 0.

sf = 2/(p+1)

ema := nz(ema[1] + sf*(src - ema[1]),src)

Sma(src,p) => a = cum(src), (a - a[max(p,0)])/max(p,0)

Atr(p, res) =>

atr = 0.

highHTF = security(syminfo.tickerid, res, high[barstate.isrealtime ? 1 : 0])

lowHTF = security(syminfo.tickerid, res, low[barstate.isrealtime ? 1 : 0])

closeHTF = security(syminfo.tickerid, res, close[barstate.isrealtime ? 1 : 0])

Tr = max(highHTF - lowHTF, max(abs(highHTF - closeHTF[1]), abs(lowHTF - closeHTF[1])))

atr := nz(atr[1] + (Tr - atr[1])/p,Tr)

ribbon_period = input(39, "Period", step=1)

htfClose = security(syminfo.tickerid, res, close[barstate.isrealtime ? 1 : 0])

leadLine1 = ema(htfClose, ribbon_period)

leadLine2 = sma(htfClose, ribbon_period)

// p3 = plot(leadLine1, color= #53b987, title="EMA", transp = 50, linewidth = 1)

// p4 = plot(leadLine2, color= #eb4d5c, title="SMA", transp = 50, linewidth = 1)

// fill(p3, p4, transp = 60, color = leadLine1 > leadLine2 ? #53b987 : #eb4d5c)

//Upward Trend

UT=leadLine2 < leadLine1

DT=leadLine2>leadLine1

//FILTER LOGIC

aboveTrend = input(true, title="Use Trend", group="Filters", inline='1', type=input.bool)

TrendLength = input(3, minval=1, title="Trend MA", group="Filters", inline='1', type=input.integer)

aboveTrendFilter = sma(htfClose,TrendLength)

useRSI = input(true, title="Use RSI", group="Filters", inline='2', type=input.bool)

RSILength = input(34, minval=1, title="RSI Length", group="Filters", inline='2') // used to calculate RSI

belowRSIFilter = input(50, minval=1, title="Buy Below RSI Filter", group="Filters", inline='2') // only buy if its below this RSI - doesn't seem to work as expected

rsi = rsi(htfClose,RSILength)

if not(useRSI)

belowRSIFilter = 100

if not(aboveTrend)

aboveTrendFilter = -1

// MACD

fast_length = input(title="Fast Length", type=input.integer, defval=7)

slow_length = input(title="Slow Length", type=input.integer, defval=23)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 10)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=false)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=false)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

srcHTF = security(syminfo.tickerid, res, src[barstate.isrealtime ? 1 : 0])

// Calculating

fast_ma = sma_source ? Sma(srcHTF, fast_length) : Ema(srcHTF, fast_length)

slow_ma = sma_source ? Sma(srcHTF, slow_length) : Ema(srcHTF, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? Sma(macd, signal_length) : Ema(macd, signal_length)

hist = macd - signal

//plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

plot(macd, title="MACD", color=col_macd, transp=0)

plot(signal, title="Signal", color=col_signal, transp=0)

/// MFI

MFIsource = hlc3

sourceHTF = security(syminfo.tickerid, res, MFIsource[barstate.isrealtime ? 1 : 0])

length = input(15, minval=1)

lower = input(12, minval=0, maxval=50)

upper = input(80, minval=50, maxval=100)

// DrawMFI_f=input(true, title="Draw MFI?", type=bool)

HighlightBreaches=input(true, title="Highlight Oversold/Overbought?")

volumeHTF = security(syminfo.tickerid, res, volume[barstate.isrealtime ? 1 : 0])

// MFI

upper_s = sum(volumeHTF * (change(sourceHTF) <= 0 ? 0 : sourceHTF), length)

lower_s = sum(volumeHTF * (change(sourceHTF) >= 0 ? 0 : sourceHTF), length)

mf = rsi(upper_s, lower_s)

mfp = plot(mf, color=color.new(color.gray,0), linewidth=1)

top = hline(upper, color=color.new(color.gray, 100), linewidth=1, editable=false)

bottom = hline(lower, color=color.new(color.gray,100), linewidth=1, editable=false)

hline(0, color=color.new(color.black,100), editable=false)

hline(100, color=color.new(color.black,100), editable=false)

// Breaches

b_color = (mf > upper) ? color.new(color.red,70) : (mf < lower) ? color.new(color.green,60) : na

bgcolor(HighlightBreaches ? b_color : na)

fill(top, bottom, color=color.gray, transp=75)

// TAKE PROFIT AND STOP LOSS

long_tp1_inp = input(1, title='Long Take Profit 1 %', step=0.1)/100

long_tp1_qty = input(20, title="Long Take Profit 1 Qty", step=1)

long_trailing = input(1.3, title='Trailing Stop Long', step=0.1) / 100

long_take_level_1 = strategy.position_avg_price * (1 + long_tp1_inp)

// Stop Loss

multiplier = input(2, "SL Mutiplier", minval=1, step=0.1)

ATR_period=input(40,"ATR period", minval=1, step=1)

// Strategy

entry_long=(crossover(macd,signal) or (crossover(mf,lower) and leadLine2 < leadLine1)) and rsi < belowRSIFilter and close > aboveTrendFilter

entry_price_long=valuewhen(entry_long,close,0)

//SL_floating_long = entry_price_long -( (entry_price_long)*multiplier/100)//*Atr(ATR_period,res)

//SL_floating_long = entry_price_long - multiplier*Atr(ATR_period,res)

SL_floating_long = entry_price_long - multiplier*Atr(ATR_period,res)

exit_long= close < SL_floating_long

///// BACKTEST PERIOD ///////

testStartYear = input(2018, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear, testStartMonth, testStartDay, 0, 0)

testStopYear = input(9999, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(31, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear, testStopMonth, testStopDay, 0, 0)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

if testPeriod()

if UT

strategy.entry("long", strategy.long, when=entry_long == true, comment=openlongcomment)

strategy.exit("TP1","long", qty_percent=long_tp1_qty, limit=long_take_level_1)

strategy.exit("Trail stop","long", comment=closelongcomment, trail_points=entry_price_long * long_trailing / syminfo.mintick, trail_offset=entry_price_long * long_trailing / syminfo.mintick)

strategy.close("long", exit_long == true, comment=closelongcomment )

- RSIのブレイクアウト戦略は定量的な取引戦略です

- 移動平均のクロスオーバー戦略は,定量的な取引戦略です.

- モメントブレイク 移動平均取引戦略

- スローハイケンアシ 指数関数移動平均取引戦略

- 定量モデルに基づく高性能アルゴリズム取引戦略

- ボリンジャー・モメンタム・ブレイクアウト戦略

- パラボリックSARとEMAのトレンド追跡戦略

- 高低戦略が破綻した

- 低ピラミッドリスク追跡戦略

- TSLA 量的な取引システム 複数の時間枠

- ダブル指数関数移動平均値とALMA戦略

- 定量的な取引価格突破戦略

- エラーズ・フィッシャーストカスティック相対活力指数戦略

- 二重モメンタムブレークスルーと波動性フィルタリング アルゴリズム取引戦略

- 複数移動平均の包括的戦略

- 価格逆転RSIコンボ戦略

- 雲雲双移動平均突破戦略

- MACD ゴールデンクロス デスクロス トレンド 戦略をフォロー

- カメ の 傾向 に 従う 戦略

- 双重確認 ドンチアンチャンネル トレンド戦略