デュアルトレンドフィルターに基づく定量取引戦略

概要

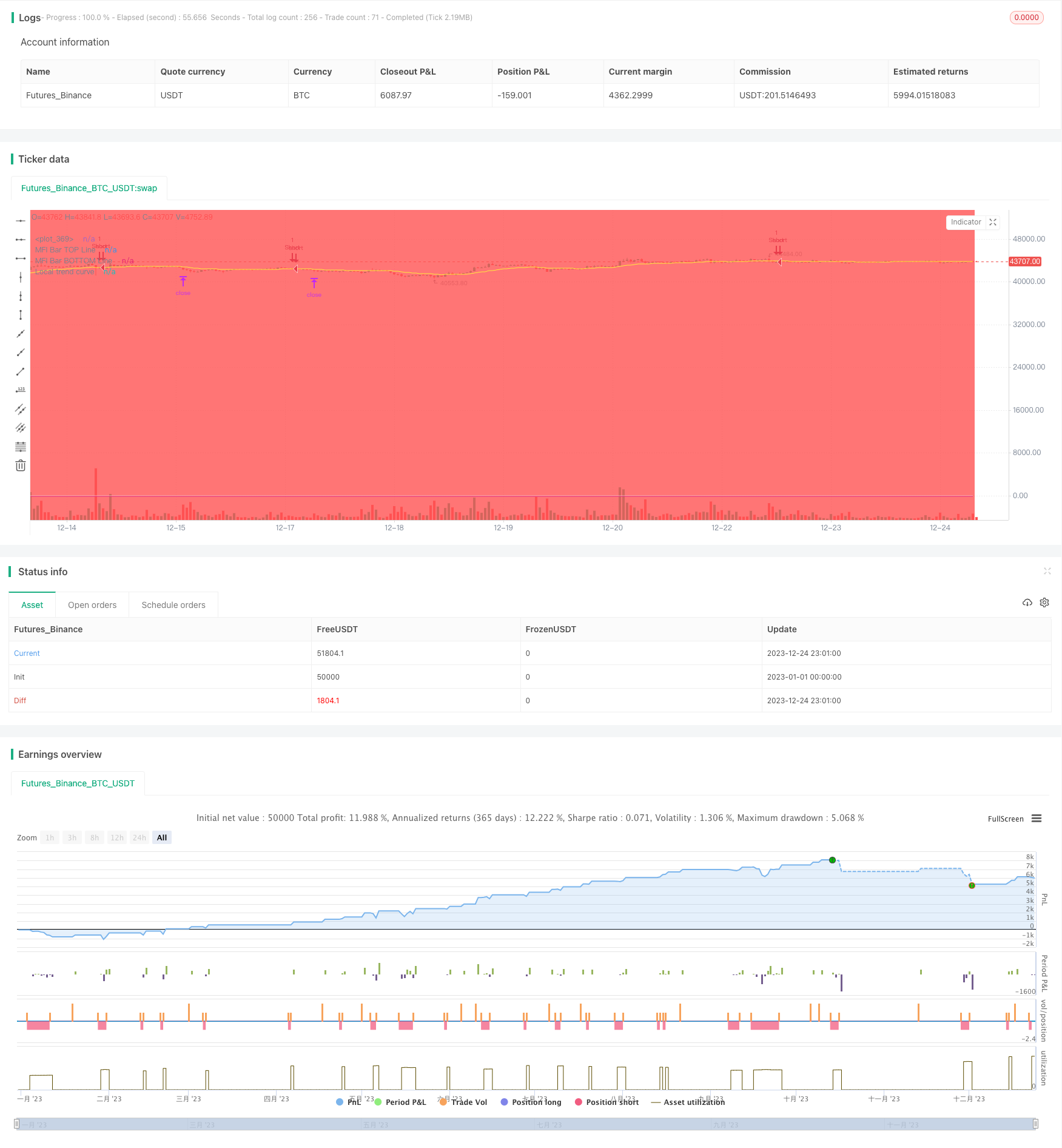

これは,二重のトレンドフィルターを活用して取引を量化する戦略である. この戦略は,グローバルトレンドフィルターとローカルトレンドフィルターを同時に組み合わせて,トレンドの方向が正しいときにのみポジションを開くことを保証する. さらに,この戦略は,RSIフィルター,価格フィルター,斜率フィルターなどの他の多くのフィルタリング条件を設定し,取引シグナルの信頼性をさらに高めるために使用します. 外場では,ストップ・ロスの価格とストップ・価格がプレセットされています. 全体的に,これは安定し,正確な量化取引戦略です.

戦略原則

この戦略の核心的な論理は,二重のトレンドフィルターに基づいています.全局的なトレンドフィルターは,高周期EMAによる市場の全体的な動きを判断し,ローカルなトレンドフィルターは,低周期EMAによる局所的な動きを判断します.両者がトレンドを判断したときにのみ,ポジションを開きます.

具体的には,戦略はBTCUSDTのEMAラインを計算して,全体的な市場が上昇傾向にあるか下落傾向にあるかを判断する,これは全局的なトレンドフィルターである.同時に,戦略は本契約のEMAラインを計算して,局所的な市場の動きを判断する,これはローカルトレンドフィルターである.両者がトレンドが一致すると,さらに他の複数の補助フィルターと組み合わせると,戦略は取引信号を生じ,止損停止価格開設を予め設定する.

取引シグナルが決定された後,戦略は直ちに下場し,取引を開始する.同時に,戦略は,前もって,ストップ価格とストップ損失価格を設定する.価格がストップまたはストップを触発すると,戦略は自動的にストップまたはストップする.

優位分析

これは,安定した信頼性の高い量化取引戦略であり,主な利点は以下の通りです.

双方向のフィルタリングにより,偽信号のほとんどはフィルタリングされ,取引信号はより信頼性が高く精度が高くなります.

RSIフィルター,価格フィルターなどの複数の補助フィルターと組み合わせて,信号の質をさらに向上させる.

自動でストップ・ストップ・ストップ・価格を操作し,人工の監視を必要とせず,取引リスクを低減する.

戦略パラメータは,より多くの取引品種に対応してカスタマイズすることができ,強い適応性があります.

戦略は明確で分かりやすく,改善の最適化に便利で,拡大の余地があります.

リスク分析

この戦略には多くの利点があるものの,取引上のリスクがいくつか存在します.

ダブルトレンドフィルターは入場時刻を正確に決定しない。フィルターパラメータを調整することで最適化することができる。

ストップ・ストップ・損失価格設定が不正確で,早すぎるストップ・ストップまたはストップ・損失である可能性があります.異なるパラメータの組み合わせをテストして最適な解決策を見つけることができます.

取引品種と周期の選択が不適切であり,戦略の無効性につながる可能性がある.異なる取引品種に対してパラメータの調整とテストをそれぞれ行うことを推奨する.

過剰適合のリスクはある. 戦略の安定性を確保するために,より多くの市場環境で反省が必要である.

最適化の方向

この戦略は以下の方向から最適化できます.

双重フィルターのパラメータを調整して,最適なパラメータの組み合わせを見つけます.

補助フィルターをテストし,最適なものを選択する.

ストップ・ストップ・ロスのアルゴリズムを最適化し,よりスマートにします.

戦略の動態調整を機械学習などの手段で試す.

戦略の安定性を高めるため,より多くの取引品種とより長い周期で反省します.

要約する

この戦略は,全体として,安定し,正確で,容易に最適化できる量化取引戦略である.これは,ダブルトレンドフィルターと複数の補助フィルターを組み合わせて取引信号を生成する.これは,ほとんどのノイズをフィルターし,信号をより正確かつ信頼性のあるものにする.同時に,戦略の内置の止まり止まりの設定は,取引リスクを減らすことができる.これは,非常に実戦価値のある戦略であり,最適化および検証後に,直接実店舗投入することができる.それは,大きな拡張可能性があり,深入な研究に値する量化戦略である.

/*backtest

start: 2023-01-01 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title = 'Cipher_B', overlay=true )

// PARAMETERS {

// WaveTrend

wtShow = input(true, title = 'Show WaveTrend', type = input.bool)

wtBuyShow = input(true, title = 'Show Buy dots', type = input.bool)

wtGoldShow = input(true, title = 'Show Gold dots', type = input.bool)

wtSellShow = input(true, title = 'Show Sell dots', type = input.bool)

wtDivShow = input(true, title = 'Show Div. dots', type = input.bool)

vwapShow = input(true, title = 'Show Fast WT', type = input.bool)

wtChannelLen = input(9, title = 'WT Channel Length', type = input.integer)

wtAverageLen = input(12, title = 'WT Average Length', type = input.integer)

wtMASource = input(hlc3, title = 'WT MA Source', type = input.source)

wtMALen = input(3, title = 'WT MA Length', type = input.integer)

// WaveTrend Overbought & Oversold lines

obLevel = input(53, title = 'WT Overbought Level 1', type = input.integer)

obLevel2 = input(60, title = 'WT Overbought Level 2', type = input.integer)

obLevel3 = input(100, title = 'WT Overbought Level 3', type = input.integer)

osLevel = input(-53, title = 'WT Oversold Level 1', type = input.integer)

osLevel2 = input(-60, title = 'WT Oversold Level 2', type = input.integer)

osLevel3 = input(-75, title = 'WT Oversold Level 3', type = input.integer)

// Divergence WT

wtShowDiv = input(true, title = 'Show WT Regular Divergences', type = input.bool)

wtShowHiddenDiv = input(false, title = 'Show WT Hidden Divergences', type = input.bool)

showHiddenDiv_nl = input(true, title = 'Not apply OB/OS Limits on Hidden Divergences', type = input.bool)

wtDivOBLevel = input(45, title = 'WT Bearish Divergence min', type = input.integer)

wtDivOSLevel = input(-65, title = 'WT Bullish Divergence min', type = input.integer)

// Divergence extra range

wtDivOBLevel_addshow = input(false, title = 'Show 2nd WT Regular Divergences', type = input.bool)

wtDivOBLevel_add = input(15, title = 'WT 2nd Bearish Divergence', type = input.integer)

wtDivOSLevel_add = input(-40, title = 'WT 2nd Bullish Divergence 15 min', type = input.integer)

// RSI+MFI

rsiMFIShow = input(true, title = 'Show MFI', type = input.bool)

rsiMFIperiod = input(60,title = 'MFI Period', type = input.integer)

rsiMFIMultiplier = input(150, title = 'MFI Area multiplier', type = input.float)

rsiMFIPosY = input(2.5, title = 'MFI Area Y Pos', type = input.float)

// RSI

rsiShow = input(false, title = 'Show RSI', type = input.bool)

rsiSRC = input(close, title = 'RSI Source', type = input.source)

rsiLen = input(14, title = 'RSI Length', type = input.integer)

rsiOversold = input(30, title = 'RSI Oversold', minval = 50, maxval = 100, type = input.integer)

rsiOverbought = input(60, title = 'RSI Overbought', minval = 0, maxval = 50, type = input.integer)

// Divergence RSI

rsiShowDiv = input(false, title = 'Show RSI Regular Divergences', type = input.bool)

rsiShowHiddenDiv = input(false, title = 'Show RSI Hidden Divergences', type = input.bool)

rsiDivOBLevel = input(60, title = 'RSI Bearish Divergence min', type = input.integer)

rsiDivOSLevel = input(30, title = 'RSI Bullish Divergence min', type = input.integer)

// RSI Stochastic

stochShow = input(true, title = 'Show Stochastic RSI', type = input.bool)

stochUseLog = input(true, title=' Use Log?', type = input.bool)

stochAvg = input(false, title='Use Average of both K & D', type = input.bool)

stochSRC = input(close, title = 'Stochastic RSI Source', type = input.source)

stochLen = input(14, title = 'Stochastic RSI Length', type = input.integer)

stochRsiLen = input(14, title = 'RSI Length ', type = input.integer)

stochKSmooth = input(3, title = 'Stochastic RSI K Smooth', type = input.integer)

stochDSmooth = input(3, title = 'Stochastic RSI D Smooth', type = input.integer)

// Divergence stoch

stochShowDiv = input(false, title = 'Show Stoch Regular Divergences', type = input.bool)

stochShowHiddenDiv = input(false, title = 'Show Stoch Hidden Divergences', type = input.bool)

// Schaff Trend Cycle

tcLine = input(false, title="Show Schaff TC line", type=input.bool)

tcSRC = input(close, title = 'Schaff TC Source', type = input.source)

tclength = input(10, title="Schaff TC", type=input.integer)

tcfastLength = input(23, title="Schaff TC Fast Lenght", type=input.integer)

tcslowLength = input(50, title="Schaff TC Slow Length", type=input.integer)

tcfactor = input(0.5, title="Schaff TC Factor", type=input.float)

// Sommi Flag

sommiFlagShow = input(false, title = 'Show Sommi flag', type = input.bool)

sommiShowVwap = input(false, title = 'Show Sommi F. Wave', type = input.bool)

sommiVwapTF = input('720', title = 'Sommi F. Wave timeframe', type = input.string)

sommiVwapBearLevel = input(0, title = 'F. Wave Bear Level (less than)', type = input.integer)

sommiVwapBullLevel = input(0, title = 'F. Wave Bull Level (more than)', type = input.integer)

soomiFlagWTBearLevel = input(0, title = 'WT Bear Level (more than)', type = input.integer)

soomiFlagWTBullLevel = input(0, title = 'WT Bull Level (less than)', type = input.integer)

soomiRSIMFIBearLevel = input(0, title = 'Money flow Bear Level (less than)', type = input.integer)

soomiRSIMFIBullLevel = input(0, title = 'Money flow Bull Level (more than)', type = input.integer)

// Sommi Diamond

sommiDiamondShow = input(false, title = 'Show Sommi diamond', type = input.bool)

sommiHTCRes = input('60', title = 'HTF Candle Res. 1', type = input.string)

sommiHTCRes2 = input('240', title = 'HTF Candle Res. 2', type = input.string)

soomiDiamondWTBearLevel = input(0, title = 'WT Bear Level (More than)', type = input.integer)

soomiDiamondWTBullLevel = input(0, title = 'WT Bull Level (Less than)', type = input.integer)

// macd Colors

macdWTColorsShow = input(false, title = 'Show MACD Colors', type = input.bool)

macdWTColorsTF = input('240', title = 'MACD Colors MACD TF', type = input.string)

darkMode = input(false, title = 'Dark mode', type = input.bool)

// Colors

colorRed = #ff0000

colorPurple = #e600e6

colorGreen = #3fff00

colorOrange = #e2a400

colorYellow = #ffe500

colorWhite = #ffffff

colorPink = #ff00f0

colorBluelight = #31c0ff

colorWT1 = #90caf9

colorWT2 = #0d47a1

colorWT2_ = #131722

colormacdWT1a = #4caf58

colormacdWT1b = #af4c4c

colormacdWT1c = #7ee57e

colormacdWT1d = #ff3535

colormacdWT2a = #305630

colormacdWT2b = #310101

colormacdWT2c = #132213

colormacdWT2d = #770000

// } PARAMETERS

// FUNCTIONS {

// Divergences

f_top_fractal(src) => src[4] < src[2] and src[3] < src[2] and src[2] > src[1] and src[2] > src[0]

f_bot_fractal(src) => src[4] > src[2] and src[3] > src[2] and src[2] < src[1] and src[2] < src[0]

f_fractalize(src) => f_top_fractal(src) ? 1 : f_bot_fractal(src) ? -1 : 0

f_findDivs(src, topLimit, botLimit, useLimits) =>

fractalTop = f_fractalize(src) > 0 and (useLimits ? src[2] >= topLimit : true) ? src[2] : na

fractalBot = f_fractalize(src) < 0 and (useLimits ? src[2] <= botLimit : true) ? src[2] : na

highPrev = valuewhen(fractalTop, src[2], 0)[2]

highPrice = valuewhen(fractalTop, high[2], 0)[2]

lowPrev = valuewhen(fractalBot, src[2], 0)[2]

lowPrice = valuewhen(fractalBot, low[2], 0)[2]

bearSignal = fractalTop and high[2] > highPrice and src[2] < highPrev

bullSignal = fractalBot and low[2] < lowPrice and src[2] > lowPrev

bearDivHidden = fractalTop and high[2] < highPrice and src[2] > highPrev

bullDivHidden = fractalBot and low[2] > lowPrice and src[2] < lowPrev

[fractalTop, fractalBot, lowPrev, bearSignal, bullSignal, bearDivHidden, bullDivHidden]

// RSI+MFI

f_rsimfi(_period, _multiplier, _tf) => security(syminfo.tickerid, _tf, sma(((close - open) / (high - low)) * _multiplier, _period) - rsiMFIPosY)

// WaveTrend

f_wavetrend(src, chlen, avg, malen, tf) =>

tfsrc = security(syminfo.tickerid, tf, src)

esa = ema(tfsrc, chlen)

de = ema(abs(tfsrc - esa), chlen)

ci = (tfsrc - esa) / (0.015 * de)

wt1 = security(syminfo.tickerid, tf, ema(ci, avg))

wt2 = security(syminfo.tickerid, tf, sma(wt1, malen))

wtVwap = wt1 - wt2

wtOversold = wt2 <= osLevel

wtOverbought = wt2 >= obLevel

wtCross = cross(wt1, wt2)

wtCrossUp = wt2 - wt1 <= 0

wtCrossDown = wt2 - wt1 >= 0

wtCrosslast = cross(wt1[2], wt2[2])

wtCrossUplast = wt2[2] - wt1[2] <= 0

wtCrossDownlast = wt2[2] - wt1[2] >= 0

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCrosslast, wtCrossUplast, wtCrossDownlast, wtVwap]

// Schaff Trend Cycle

f_tc(src, length, fastLength, slowLength) =>

ema1 = ema(src, fastLength)

ema2 = ema(src, slowLength)

macdVal = ema1 - ema2

alpha = lowest(macdVal, length)

beta = highest(macdVal, length) - alpha

gamma = (macdVal - alpha) / beta * 100

gamma := beta > 0 ? gamma : nz(gamma[1])

delta = gamma

delta := na(delta[1]) ? delta : delta[1] + tcfactor * (gamma - delta[1])

epsilon = lowest(delta, length)

zeta = highest(delta, length) - epsilon

eta = (delta - epsilon) / zeta * 100

eta := zeta > 0 ? eta : nz(eta[1])

stcReturn = eta

stcReturn := na(stcReturn[1]) ? stcReturn : stcReturn[1] + tcfactor * (eta - stcReturn[1])

stcReturn

// Stochastic RSI

f_stochrsi(_src, _stochlen, _rsilen, _smoothk, _smoothd, _log, _avg) =>

src = _log ? log(_src) : _src

rsi = rsi(src, _rsilen)

kk = sma(stoch(rsi, rsi, rsi, _stochlen), _smoothk)

d1 = sma(kk, _smoothd)

avg_1 = avg(kk, d1)

k = _avg ? avg_1 : kk

[k, d1]

// MACD

f_macd(src, fastlen, slowlen, sigsmooth, tf) =>

fast_ma = security(syminfo.tickerid, tf, ema(src, fastlen))

slow_ma = security(syminfo.tickerid, tf, ema(src, slowlen))

macd = fast_ma - slow_ma,

signal = security(syminfo.tickerid, tf, sma(macd, sigsmooth))

hist = macd - signal

[macd, signal, hist]

// MACD Colors on WT

f_macdWTColors(tf) =>

hrsimfi = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, tf)

[macd, signal, hist] = f_macd(close, 28, 42, 9, macdWTColorsTF)

macdup = macd >= signal

macddown = macd <= signal

macdWT1Color = macdup ? hrsimfi > 0 ? colormacdWT1c : colormacdWT1a : macddown ? hrsimfi < 0 ? colormacdWT1d : colormacdWT1b : na

macdWT2Color = macdup ? hrsimfi < 0 ? colormacdWT2c : colormacdWT2a : macddown ? hrsimfi < 0 ? colormacdWT2d : colormacdWT2b : na

[macdWT1Color, macdWT2Color]

// Get higher timeframe candle

f_getTFCandle(_tf) =>

_open = security(heikinashi(syminfo.tickerid), _tf, open, barmerge.gaps_off, barmerge.lookahead_off)

_close = security(heikinashi(syminfo.tickerid), _tf, close, barmerge.gaps_off, barmerge.lookahead_off)

_high = security(heikinashi(syminfo.tickerid), _tf, high, barmerge.gaps_off, barmerge.lookahead_off)

_low = security(heikinashi(syminfo.tickerid), _tf, low, barmerge.gaps_off, barmerge.lookahead_off)

hl2 = (_high + _low) / 2.0

newBar = change(_open)

candleBodyDir = _close > _open

[candleBodyDir, newBar]

// Sommi flag

f_findSommiFlag(tf, wt1, wt2, rsimfi, wtCross, wtCrossUp, wtCrossDown) =>

[hwt1, hwt2, hwtOversold, hwtOverbought, hwtCross, hwtCrossUp, hwtCrossDown, hwtCrosslast, hwtCrossUplast, hwtCrossDownlast, hwtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, tf)

bearPattern = rsimfi < soomiRSIMFIBearLevel and

wt2 > soomiFlagWTBearLevel and

wtCross and

wtCrossDown and

hwtVwap < sommiVwapBearLevel

bullPattern = rsimfi > soomiRSIMFIBullLevel and

wt2 < soomiFlagWTBullLevel and

wtCross and

wtCrossUp and

hwtVwap > sommiVwapBullLevel

[bearPattern, bullPattern, hwtVwap]

f_findSommiDiamond(tf, tf2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown) =>

[candleBodyDir, newBar] = f_getTFCandle(tf)

[candleBodyDir2, newBar2] = f_getTFCandle(tf2)

bearPattern = wt2 >= soomiDiamondWTBearLevel and

wtCross and

wtCrossDown and

not candleBodyDir and

not candleBodyDir2

bullPattern = wt2 <= soomiDiamondWTBullLevel and

wtCross and

wtCrossUp and

candleBodyDir and

candleBodyDir2

[bearPattern, bullPattern]

// } FUNCTIONS

// CALCULATE INDICATORS {

// RSI

rsi = rsi(rsiSRC, rsiLen)

rsiColor = rsi <= rsiOversold ? colorGreen : rsi >= rsiOverbought ? colorRed : colorPurple

// RSI + MFI Area

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

rsiMFIColor = rsiMFI > 0 ? #3ee145 : #ff3d2e

// Calculates WaveTrend

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCross_last, wtCrossUp_last, wtCrossDown_last, wtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, timeframe.period)

// Stochastic RSI

[stochK, stochD] = f_stochrsi(stochSRC, stochLen, stochRsiLen, stochKSmooth, stochDSmooth, stochUseLog, stochAvg)

// Schaff Trend Cycle

tcVal = f_tc(tcSRC, tclength, tcfastLength, tcslowLength)

// Sommi flag

[sommiBearish, sommiBullish, hvwap] = f_findSommiFlag(sommiVwapTF, wt1, wt2, rsiMFI, wtCross, wtCrossUp, wtCrossDown)

//Sommi diamond

[sommiBearishDiamond, sommiBullishDiamond] = f_findSommiDiamond(sommiHTCRes, sommiHTCRes2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown)

// macd colors

[macdWT1Color, macdWT2Color] = f_macdWTColors(macdWTColorsTF)

// WT Divergences

[wtFractalTop, wtFractalBot, wtLow_prev, wtBearDiv, wtBullDiv, wtBearDivHidden, wtBullDivHidden] = f_findDivs(wt2, wtDivOBLevel, wtDivOSLevel, true)

[wtFractalTop_add, wtFractalBot_add, wtLow_prev_add, wtBearDiv_add, wtBullDiv_add, wtBearDivHidden_add, wtBullDivHidden_add] = f_findDivs(wt2, wtDivOBLevel_add, wtDivOSLevel_add, true)

[wtFractalTop_nl, wtFractalBot_nl, wtLow_prev_nl, wtBearDiv_nl, wtBullDiv_nl, wtBearDivHidden_nl, wtBullDivHidden_nl] = f_findDivs(wt2, 0, 0, false)

wtBearDivHidden_ = showHiddenDiv_nl ? wtBearDivHidden_nl : wtBearDivHidden

wtBullDivHidden_ = showHiddenDiv_nl ? wtBullDivHidden_nl : wtBullDivHidden

wtBearDivColor = (wtShowDiv and wtBearDiv) or (wtShowHiddenDiv and wtBearDivHidden_) ? colorRed : na

wtBullDivColor = (wtShowDiv and wtBullDiv) or (wtShowHiddenDiv and wtBullDivHidden_) ? colorGreen : na

wtBearDivColor_add = (wtShowDiv and (wtDivOBLevel_addshow and wtBearDiv_add)) or (wtShowHiddenDiv and (wtDivOBLevel_addshow and wtBearDivHidden_add)) ? #9a0202 : na

wtBullDivColor_add = (wtShowDiv and (wtDivOBLevel_addshow and wtBullDiv_add)) or (wtShowHiddenDiv and (wtDivOBLevel_addshow and wtBullDivHidden_add)) ? #1b5e20 : na

// RSI Divergences

[rsiFractalTop, rsiFractalBot, rsiLow_prev, rsiBearDiv, rsiBullDiv, rsiBearDivHidden, rsiBullDivHidden] = f_findDivs(rsi, rsiDivOBLevel, rsiDivOSLevel, true)

[rsiFractalTop_nl, rsiFractalBot_nl, rsiLow_prev_nl, rsiBearDiv_nl, rsiBullDiv_nl, rsiBearDivHidden_nl, rsiBullDivHidden_nl] = f_findDivs(rsi, 0, 0, false)

rsiBearDivHidden_ = showHiddenDiv_nl ? rsiBearDivHidden_nl : rsiBearDivHidden

rsiBullDivHidden_ = showHiddenDiv_nl ? rsiBullDivHidden_nl : rsiBullDivHidden

rsiBearDivColor = (rsiShowDiv and rsiBearDiv) or (rsiShowHiddenDiv and rsiBearDivHidden_) ? colorRed : na

rsiBullDivColor = (rsiShowDiv and rsiBullDiv) or (rsiShowHiddenDiv and rsiBullDivHidden_) ? colorGreen : na

// Stoch Divergences

[stochFractalTop, stochFractalBot, stochLow_prev, stochBearDiv, stochBullDiv, stochBearDivHidden, stochBullDivHidden] = f_findDivs(stochK, 0, 0, false)

stochBearDivColor = (stochShowDiv and stochBearDiv) or (stochShowHiddenDiv and stochBearDivHidden) ? colorRed : na

stochBullDivColor = (stochShowDiv and stochBullDiv) or (stochShowHiddenDiv and stochBullDivHidden) ? colorGreen : na

// Small Circles WT Cross

signalColor = wt2 - wt1 > 0 ? color.red : color.lime

// Buy signal.

buySignal = wtCross and wtCrossUp and wtOversold

buySignalDiv = (wtShowDiv and wtBullDiv) or

(wtShowDiv and wtBullDiv_add) or

(stochShowDiv and stochBullDiv) or

(rsiShowDiv and rsiBullDiv)

buySignalDiv_color = wtBullDiv ? colorGreen :

wtBullDiv_add ? color.new(colorGreen, 60) :

rsiShowDiv ? colorGreen : na

// Sell signal

sellSignal = wtCross and wtCrossDown and wtOverbought

sellSignalDiv = (wtShowDiv and wtBearDiv) or

(wtShowDiv and wtBearDiv_add) or

(stochShowDiv and stochBearDiv) or

(rsiShowDiv and rsiBearDiv)

sellSignalDiv_color = wtBearDiv ? colorRed :

wtBearDiv_add ? color.new(colorRed, 60) :

rsiBearDiv ? colorRed : na

// Gold Buy

lastRsi = valuewhen(wtFractalBot, rsi[2], 0)[2]

wtGoldBuy = ((wtShowDiv and wtBullDiv) or (rsiShowDiv and rsiBullDiv)) and

wtLow_prev <= osLevel3 and

wt2 > osLevel3 and

wtLow_prev - wt2 <= -5 and

lastRsi < 30

// } CALCULATE INDICATORS

// DRAW {

bgcolor(darkMode ? color.new(#000000, 80) : na)

zLine = plot(0, color = color.new(colorWhite, 50))

// MFI BAR

rsiMfiBarTopLine = plot(rsiMFIShow ? -95 : na, title = 'MFI Bar TOP Line', transp = 100)

rsiMfiBarBottomLine = plot(rsiMFIShow ? -99 : na, title = 'MFI Bar BOTTOM Line', transp = 100)

fill(rsiMfiBarTopLine, rsiMfiBarBottomLine, title = 'MFI Bar Colors', color = rsiMFIColor, transp = 75)

Global=input(title="Use Global trend?", defval=true, type=input.bool, group="Trend Settings")

regimeFilter_frame=input(title="Global trend timeframe", defval="5", options=['D','60','5'], group="Trend Settings")

regimeFilter_length=input(title="Global trend length", defval=1700, type=input.integer, group="Trend Settings")

localFilter_length=input(title="Local trend filter length", defval=20, type=input.integer, group="Trend Settings")

localFilter_frame=input(title="Local trend filter timeframe", defval="60", options=['D','60', '5'], group="Trend Settings")

Div_1=input(title="Only divergencies for long", defval=true, type=input.bool, group="Trend Settings")

Div_2=input(title="Only divergencies for short", defval=true, type=input.bool, group="Trend Settings")

sommi_diamond_on=input(title="Sommi diamond alerts", defval=false, type=input.bool, group="Trend Settings")

Cancel_all=input(title="Cancel all positions if price crosses local sma? (yellow line)", defval=false, type=input.bool, group="Trend Settings")

a_1=input(title="TP long", defval=0.95,step=0.5, type=input.float, group="TP/SL Settings")

a_1_div=input(title="TP long div", defval=0.95,step=0.5, type=input.float, group="TP/SL Settings")

a_2=input(title="TP short", defval=0.95,step=1, type=input.float, group="TP/SL Settings")

b_1=input(title="SL long", defval=5,step=0.1, type=input.float, group="TP/SL Settings")

b_2=input(title="SL short", defval=5,step=0.1, type=input.float, group="TP/SL Settings")

RSI_filter_checkbox = input(title="RSI filter ON", defval=false, type=input.bool, group="Trend Settings")

Price_filter_checkbox=input(title="Price filter ON", defval=false, type=input.bool, group="Trend Settings")

Price_filter_1_long=input(title="Long Price filter from", defval=1000, type=input.integer, group="Trend Settings")

Price_filter_2_long=input(title="Long Price filter to", defval=1200, type=input.integer, group="Trend Settings")

Price_filter_1_short=input(title="Short Price filter from", defval=1000, type=input.integer, group="Trend Settings")

Price_filter_2_short=input(title="Short Price filter to", defval=1200, type=input.integer, group="Trend Settings")

Local_filter_checkbox=input(title="Use Local trend?", defval=true, type=input.bool, group="Trend Settings")

slope_checkbox = input(title="Use Slope filter?", defval=false, type=input.bool, group="Slope Settings")

slope_number_long = input(title="Slope number long", defval=-0.3,step=0.01, type=input.float, group="Slope Settings")

slope_number_short = input(title="Slope number short", defval=0.16,step=0.01, type=input.float, group="Slope Settings")

slope_period = input(title="Slope period", defval=300, type=input.integer, group="Slope Settings")

long_on = input(title="Only long?", defval=true, type=input.bool, group="Position Settings")

short_on = input(title="Only short?", defval=true, type=input.bool, group="Position Settings")

volume_ETH_spot_checkbox = input(title="Volume filter?", defval=false, type=input.bool, group="Volume Settings")

volume_ETH_spot_number_more = input(title="Volume no more than:", defval=3700, type=input.integer, group="Volume Settings")

volume_ETH_spot_number_less = input(title="Volume no less than:", defval=600, type=input.integer, group="Volume Settings")

limit_checkbox = input(title="Shift open position?", defval=false, type=input.bool, group="Shift Settings")

limit_shift = input(title="How many % to shift?", defval=0.5,step=0.01, type=input.float, group="Shift Settings")

cancel_in = input(title="Cancel position in #bars?", defval=false, type=input.bool, group="Cancel Settings")

cancel_in_num = input(title="Number of bars", defval=96, type=input.integer, group="Cancel Settings")

//Name of ticker

_str=tostring(syminfo.ticker)

_chars = str.split(_str, "")

int _len = array.size(_chars)

int _beg = max(0, _len - 4)

string[] _substr = array.new_string(0)

if _beg < _len

_substr := array.slice(_chars, 0, _beg)

string _return = array.join(_substr, "")

//Hour sma

basis = security(syminfo.tickerid, localFilter_frame, ema(close, localFilter_length))

plot(basis, title="Local trend curve", color=color.yellow, style=plot.style_linebr)

//Trend calculation with EMA

f_sec(_market, _res, _exp) => security(_market, _res, _exp[barstate.isconfirmed ? 0 : 1])

ema = sma(close, regimeFilter_length)

emaValue = f_sec("BTC_USDT:swap", regimeFilter_frame, ema)

marketPrice = f_sec("BTC_USDT:swap", regimeFilter_frame, close)

regimeFilter = Global?(marketPrice > emaValue or marketPrice[1] > emaValue[1]):true

reverse_regime=Global?(marketPrice < emaValue or marketPrice[1] < emaValue[1]):true

bgcolor(Global?regimeFilter ? color.green : color.red:color.yellow)

//Local trend

regimeFilter_local = Local_filter_checkbox ? close > basis: true //or close[1] > basis[1]

reverse_regime_local = Local_filter_checkbox ? close < basis: true //or close[1] < basis[1]

//RSI filter

up = rma(max(change(close), 0), 14)

down = rma(-min(change(close), 0), 14)

rsi_ = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ema(rsi_,12)

//local incline

sma =security(syminfo.tickerid, '60', ema(close, 15))

slope = (sma - sma[slope_period]) / slope_period

slope_filter_long = slope_checkbox? slope > slope_number_long : true

slope_filter_short = slope_checkbox? slope < slope_number_short : true

var long_check = true

var short_check = true

if RSI_filter_checkbox

long_check:= rsiMA<40

short_check:= rsiMA>60

//

validlow = Div_1 ? buySignalDiv or wtGoldBuy : buySignal or buySignalDiv or wtGoldBuy

validhigh = Div_2 ? sellSignalDiv : sellSignal or sellSignalDiv

//check volume of ETHUSDT

volume_ETH_spot = volume

volume_ETH_spot_filter = volume_ETH_spot_checkbox? volume_ETH_spot < volume_ETH_spot_number_more and volume_ETH_spot > volume_ETH_spot_number_less : true

// Check if we have confirmation for our setup

var Price_long = true

if Price_filter_checkbox

Price_long:=close>Price_filter_1_long and close<Price_filter_2_long

var Price_short = true

if Price_filter_checkbox

Price_short:=close>Price_filter_1_short and close<Price_filter_2_short

validlong = sommi_diamond_on ? sommiBullishDiamond and strategy.position_size == 0 and barstate.isconfirmed and regimeFilter_local and regimeFilter : validlow and strategy.position_size == 0 and barstate.isconfirmed and regimeFilter_local and Price_long and long_check and slope_filter_long and volume_ETH_spot_filter

validshort = sommi_diamond_on ? sommiBearishDiamond and strategy.position_size == 0 and barstate.isconfirmed and reverse_regime_local and reverse_regime : validhigh and strategy.position_size == 0 and barstate.isconfirmed and reverse_regime_local and Price_short and short_check and slope_filter_short and volume_ETH_spot_filter

// Save trade stop & target & position size if a valid setup is detected

var tradeStopPrice = 0.0

var tradeTargetPrice = 0.0

var TP=0.0

var limit_price=0.0

//Detect valid long setups & trigger alert

if validlong

if buySignalDiv or wtGoldBuy

limit_price:=limit_checkbox? close*(1-limit_shift*0.01) : close

tradeStopPrice := limit_price*(1-b_1*0.01)

tradeTargetPrice := limit_price*(1+a_1_div*0.01)

TP:= a_1_div

else

limit_price:=limit_checkbox? close*(1-limit_shift*0.01) : close

tradeStopPrice := limit_price*(1-b_1*0.01)

tradeTargetPrice := limit_price*(1+a_1*0.01)

TP:= a_1

// if validlong

// if buySignalDiv or wtGoldBuy

// limit_price:=close

// tradeStopPrice := limit_price*(1-b_1*0.01)

// tradeTargetPrice := limit_price*(1+a_1_div*0.01)

// TP:= a_1_div

// else

// limit_price:=close

// tradeStopPrice := limit_price*(1-b_1*0.01)

// tradeTargetPrice := limit_price*(1+a_1*0.01)

// TP:= a_1

// Detect valid short setups & trigger alert

if validshort

limit_price:=limit_checkbox? close*(1+limit_shift*0.01) : close

tradeStopPrice := limit_price*(1+b_2*0.01)

tradeTargetPrice := limit_price*(1-a_2*0.01)

TP:= a_2

// if validshort

// limit_price:= close

// tradeStopPrice := limit_price*(1+b_2*0.01)

// tradeTargetPrice := limit_price*(1-a_2*0.01)

// TP:= a_2

if cancel_in and barssince(validlong) == cancel_in_num or barssince(validshort) == cancel_in_num

strategy.cancel_all()

if long_on

strategy.entry (id="Long", long=strategy.long, limit=limit_price, when=validlong, comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "buy",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "long"\n' + '}')

if short_on

strategy.entry (id="Short", long=strategy.short, limit=limit_price, when=validshort,comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "sell",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "short",\n' + ' "sl": {\n' + ' "enabled": true\n' + ' }\n' + '}')

// condition:=true

// if Cancel_all and strategy.position_size > 0 and (reverse_regime_local or reverse_regime)

// strategy.close_all(when=strategy.position_size != 0, comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "sell",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "flat"\n' + '}')

if Cancel_all and strategy.position_size > 0 and reverse_regime_local

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "sell",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if Cancel_all and strategy.position_size < 0 and regimeFilter_local

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "buy",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if cancel_in and strategy.position_size > 0 and barssince(validlong) > cancel_in_num

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "sell",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if cancel_in and strategy.position_size < 0 and barssince(validshort) > cancel_in_num

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "buy",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

// Exit trades whenever our stop or target is hit

strategy.exit(id="Long Exit", from_entry="Long", limit=tradeTargetPrice, stop=tradeStopPrice, when=strategy.position_size > 0)

strategy.exit(id="Short Exit", from_entry="Short", limit=tradeTargetPrice,stop=tradeStopPrice, when=strategy.position_size < 0)