QQEとMAをベースにした戦略をフォローする傾向

作者: リン・ハーンチャオチャン開催日:2023年12月29日 16時36分47秒タグ:

概要

これは,QQE (質量評価) 指標と移動平均値に基づいたトレンドフォロー戦略である.トレンド方向を決定し,移動平均値の方向によってフィルタリングされた迅速なQQEクロスに基づいて取引信号を生成する.

この戦略は,取引信号を決定するために3種類のQQEクロスを使用することができる: (1) スムーズRSIが0線を横切る; (2) スムーズRSIが高速QQE線を横切る; (3) RSIの

買い・売るシグナルは移動平均値で追加フィルターを追加することを選択できます. 閉じる価格は,速いMAライン (以下) よりも高く,速いMAラインは,ゆっくりしたMAライン (以下) よりも高く,取引信号を生成します.

この戦略は,シグナル対シグナルモードで自動取引に使用するのに適しています.

原則

この戦略の核心指標はQQEである.その計算式は以下の通りである.

Wilders_Period = RSILen * 2 - 1

Rsi = rsi(close,RSILen)

RSIndex = ema(Rsi, SF)

AtrRsi = abs(RSIndex - RSIndex[1])

MaAtrRsi = ema(AtrRsi, Wilders_Period)

DeltaFastAtrRsi = ema(MaAtrRsi,Wilders_Period) * QQEfactor

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

RSILen は RSI の長度期であり,SF は RSI のスムージングファクターである.QQE は本質的にスムージング RSI である.これは高速な ATR をベースに上下チャネルを計算し,チャネルの上での価格の交差は買い・売るシグナルを示す.

この戦略は,取引信号を識別するために3種類のQQEクロスを使用します.

- 円滑な RSI 横断 0 線 (XZ)

QQEzlong = RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort = RSIndex < 50 ? QQEzshort + 1 : 0

- 早速スウィング信号のように,スムーズなRSIが速いQQE線 (XQ) を横切る

QQExlong = FastAtrRsiTL < RSIndex ? QQExlong + 1 : 0

QQExshort = FastAtrRsiTL > RSIndex ? QQExshort + 1 : 0

- 確認されたスウィング信号のようなスムーズなRSI出口

値チャネル (XC)

threshhold = 10

QQEclong = RSIndex > (50 + threshhold) ? QQEclong + 1 : 0

QQEcshort = RSIndex < (50 - threshhold) ? QQEcshort + 1 : 0

上記3つのクロスのうち1つまたは複数のクロスを選択して入口・出口信号を識別できます.

買い/売るシグナルは,移動平均値で追加フィルターを追加することを選択できます.

// Filter condition

QQEflong = close > ma_medium AND

ma_medium > ma_slow AND

ma_fast > ma_medium

QQEfshort = close < ma_medium AND

ma_medium < ma_slow AND

ma_fast < ma_medium

これは横向市場での誤った信号を避けるのに役立ちます.

この戦略は,入口と出口で異なるQQEクロスを使用して自動取引に適しています.

Entry signal = XC OR XQ OR XZ

Exit signal = XQ OR XZ

利点

この戦略の利点は以下の通りです.

-

傾向と交差信号を決定するためにQQEインジケーターを使用する.QQE自体には,誤った信号を減少させることができる平滑化とノイズ削減の特徴があります.

-

移動平均値によるフィルターを追加することで,横向市場での誤った信号をさらに回避し,信号品質を改善することができます.

-

入口と出口に異なるQQEクロスを選択することで,自動取引が可能になります.

-

RSIのシグナルがスムーズな場合は遅延効果があり,買い/売るシグナルが塗り替えることはありません.

-

パラメータは,最適な組み合わせを見つけるために,異なる時間枠で最適化することができます.

リスク

この戦略にはいくつかのリスクもあります:

-

トレンド逆転時に誤った信号が発生する可能性があります.リスクを制御するためにストップロスを設定する必要があります.

-

不適切なパラメータ設定は戦略のパフォーマンスに影響を与えます.最適なパラメータを見つけるには複数のテストと最適化が必要です.

-

異なるシンボルと時間枠には テストとパラメータの調整が別々に必要です

-

メカニカルな取引には,引き下げや連続的な損失のリスクがあります.ポジションのサイズとリスク管理は必要です.

対応する解は次のとおりです.

-

損失が一定額に達すると,ストップロスを出口ポジションに設定します.

-

異なるパラメータの組み合わせを徹底的にテストして最適なパラメータを見つけます.

-

パラメータをシンボルとタイムフレームの特徴に応じて調整します

-

適切な資本管理,スケールインポジション,取引ポジションサイズごとにコントロールを使用します.

オプティマイゼーションの方向性

この戦略を最適化できるいくつかの方向性があります.

-

QQEパラメータを最適化します. RSI長さ,RSIスムージング長さ,高速ATR長さなど,最適なパラメータの組み合わせを見つけるために.

-

移動平均のパラメータを最適化し,QQE指標に最適に合うように期間,タイプなどを調整します.

-

入口と出口で異なるQQEクロスをテストして 最も安定した組み合わせを見つけます

-

異なるシンボルとタイムフレームに従ってパラメータを細かく調整します.より短いタイムフレームとイントラデイ取引のために短い期間を使用します.

-

ストップ・ロスのメカニズムを追加して 損失が一定パーセントに達すると ストップアウトします

-

位置のサイズを適正に削減し,異なる位置管理方法を試験する.

結論

この戦略は,トレンドとクロスを判断するためのQQE指標,およびフィルターのための移動平均値を活用して,取引信号を生成する.ライブ取引中に,信号品質を改善するためにパラメータを調整し,リスクを制御するために厳格なマネーマネジメントによって最適化することができる.この戦略は,信号から信号モードで自動取引に適しており,裁量取引にも役立ちます.論理とパラメータのさらなる最適化は,より多くの市場条件に適応できるようにすることができます.

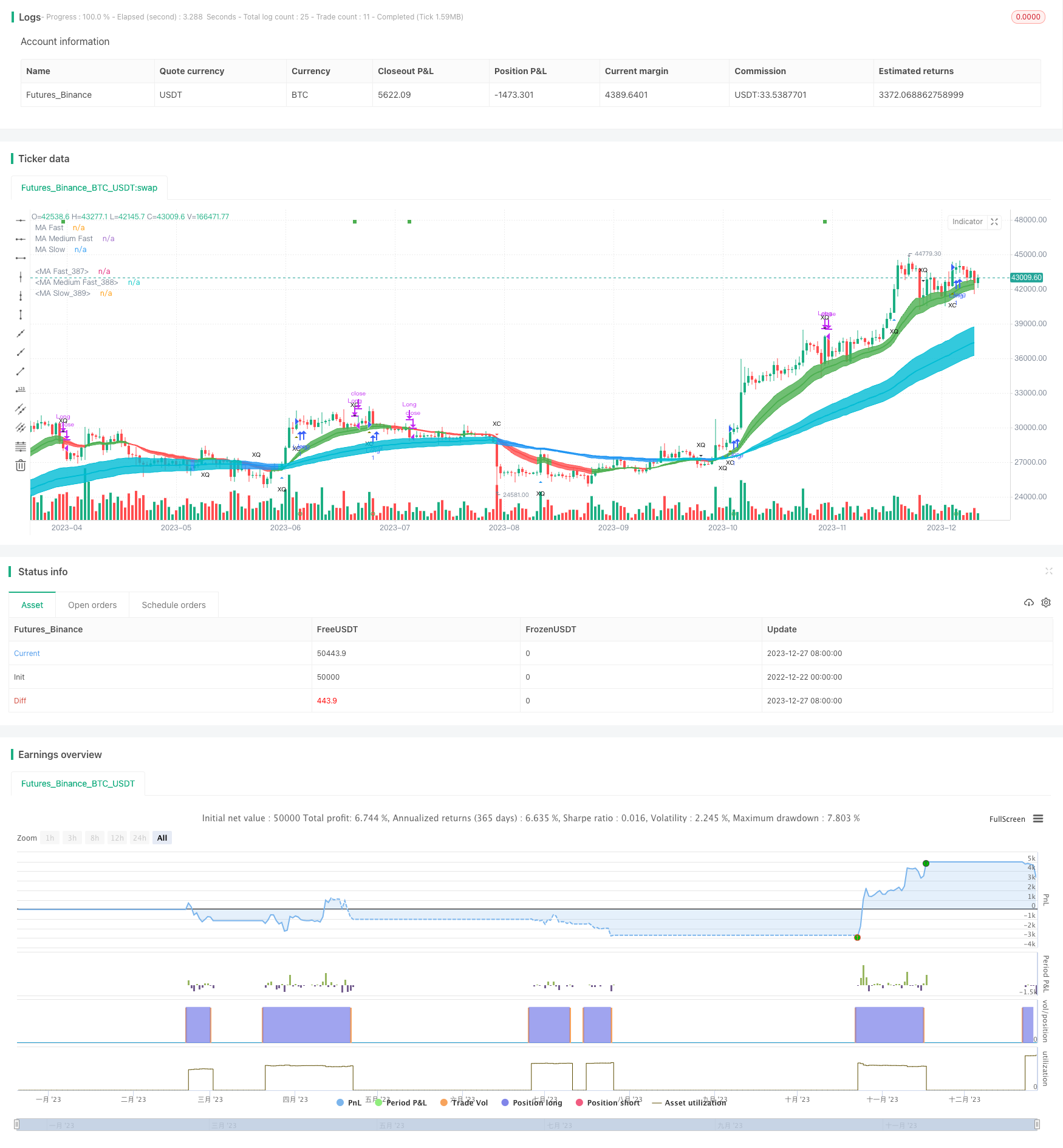

/*backtest

start: 2022-12-22 00:00:00

end: 2023-12-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//

//*** START of COMMENT OUT [Alerts]

strategy(title="[Backtest]QQE Cross v6.0 by JustUncleL", shorttitle="[BT]QQEX v6.0", overlay=true)

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [BackTest]

//study(title="[Alerts]QQE Cross v6.0 by JustUncleL", shorttitle="[AL]QQEX v6.0", overlay=true,max_bars_back=2000)

//*** END of COMMENT OUT [BackTest]

//

// Author: JustUncleL

// Date: 10-July-2016

// Version: v6, Major Release Nov-2018

//

// Description:

// A following indicator is Trend following that uses fast QQE crosses with Moving Averages

// for trend direction filtering. QQE or Qualitative Quantitative Estimation is based

// on the relative strength index (RSI), but uses a smoothing technique as an additional

// transformation. Three crosses can be selected (all selected by default):

// - Smooth RSI signal crossing ZERO (XZ)

// - Smooth RSI signal crossing Fast QQE line (XQ), this is like an early warning swing signal.

// - Smooth RSI signal exiting the RSI Threshhold Channel (XC), this is like a confirmed swing signal.

// An optimumal Smooth RSI threshold level is between 5% and 10% (default=10), it helps reduce

// the false swings.

// These signals can be selected to Open Short/Long and/or Close a trade, default is XC open

// trade and XQ (or opposite open) to Close trade.

//

// The (LONG/SHORT) alerts can be optionally filtered by the Moving Average Ribbons:

// - For LONG alert the Close must be above the fast MA Ribbon and

// fast MA Ribbon must be above the slow MA Ribbon.

// - For SHORT alert the Close must be below the fast MA Ribbon and

// fast MA Ribbon must be below the slow MA Ribbon.

// and/or directional filter:

// - For LONG alert the Close must be above the medium MA and the

// directional of both MA ribbons must be Bullish.

// - For SELL alert the Close must be below the medium MA and the

// directional of both MA ribbons must be Bearish.

//

// This indicator is designed to be used as a Signal to Signal trading BOT

// in automatic or semi-automatic way (start and stop when conditions are suitable).

// - For LONG and SHORT alerts I recommend you use "Once per Bar" alarm option

// - For CLOSE alerts I recommend you use "Once per Bar Close" alarm option

// (* The script has been designed so that long/short signals come at start of candles *)

// (* and close signals come at the end of candles *)

//

// Mofidifications:

// 6.0 - Major Release Version

// - Added second MA ribbon to help filter signals to the trend direction.

// - Modified Alert filtering to include second MA Ribbon

// - Change default settings to reflect Signal to Signal BOT parameters.

// - Removed older redunant alerts.

//

// 5.0 - Development series

//

// 4.1 - Fix bug with painting Buy/Sell arrows when non-repaint shunt mode selected.

// - Added option to alert just the first Buy/Sell alert after a trend swing

// - Added Long and Short Alarms. When combined with the "first Buy/Sell" in trend option,

// It is now possible to use this indicator to interface with AutoView

// or ProfitView. I suggest using the "QQEX XZ Alert" alarm to exit Long or Short

// trade. Use only "Once per bar Close" option for Alarms. This is not a full

// fledged trading BOT though with TP/SL settings.

//

// - Changed QQE defaults to be a bit smoother (8, 5, 3) instead of (6, 3, 2.618).

//

// 4.0 - Added implied GPL copyright notice.

// - Changed defaults to use HullMAs instead of EMAs.

// 3.0 - No repaint on BUY/SELL alert, however, now trades should be taken when the BUY/SELL

// Alert is displayed. The alarm is still generated on the previous candle so you can

// still get a pre-warning, this enables you time to analyse the pending alert.

// - Added option to test success of alerted trades, highlight successful and failed trade bars

// and show simple stats: success rate and number of trades (out of 5000), this will help

// tune the settings for timeframe and currency PAIR.

// 2.0 - Added code to use the medium moving average (EMA20) rising/falling for additional

// trend direction filter.

// - Remove Moving Average cross over signals and other options not used in this indicator.

// - Added code to distinguish between the crosses, now only show Thresh Hold crosses as BUY/SELL

// alerts.

// - Modidied default settings to more well known MA's and slightly different QQE settings, these

// work well at lower timeframes.

// - Added circle plots at bottom of chart to show when actual BUY/SELL alerts occur.

// 1.0 - original

//

// References:

// Some Code borrowed from:

// - "Scalp Jockey - MTF MA Cross Visual Strategizer by JayRogers"

// - "QQE MT4 by glaz"

// Inspiration from:

// - http://www.forexstrategiesresources.com/binary-options-strategies-ii/189-aurora-binary-trading/

// - http://www.forexstrategiesresources.com/metatrader-4-trading-systems-v/652-qqe-smoothed-trading/

// - http://dewinforex.com/forex-indicators/qqe-indicator-not-quite-grail-but-accurately-defines-trend-and-flat.html

// - "Binary option trading by two previous bars" by radixvinni

//

//

// -----------------------------------------------------------------------------

// Copyright 2015 Glaz,JayRogers

//

// Copyright 2016,2017,2018 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

// Use Alternate Anchor TF for MAs

anchor = input(4,minval=0,maxval=100,title="Relative TimeFrame Multiplier for Second MA Ribbon (0=none, max=100)")

//

// - INPUTS START

// Fast MA - type, source, length

showAvgs = input(true,title="Show Moving Average Lines")

type1 = input(defval="EMA", title="Fast MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len1 = input(defval=16, title="Fast - Length", minval=1)

gamma1 = 0.33

// Medium Fast MA - type, source, length

type2 = input(defval="EMA", title="Medium MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len2 = input(defval=21, title="Medium - Length", minval=1)

gamma2 = 0.55

// Slow MA - type, source, length

type3 = input(defval="EMA", title="Slow MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len3 = input(defval=26, title="Slow Length", minval=1)

gamma3 = 0.77

//

// QQE rsi Length, Smoothing, fast ATR factor, source

RSILen = input(14,title='RSI Length')

SF = input(8,title='RSI Smoothing Factor')

QQEfactor = input(5.0,type=float,title='Fast QQE Factor')

threshhold = input(10, title="RSI Threshhold")

//

sQQEx = input(true,title="Show QQE Signal crosses")

sQQEz = input(false,title="Show QQE Zero crosses")

sQQEc = input(true,title="Show QQE Thresh Hold Channel Exits")

//

tradeSignal = input("XC", title="Select which QQE signal to Buy/Sell", options=["XC","XQ","XZ"])

closeSignal = input("XQ", title="Select which QQE signal to Close Order", options=["XC","XQ","XZ"])

//

xfilter = input(true, title="Filter XQ Buy/Sell Orders by Threshold" )

filter = input(false,title="Use Moving Average Filter")

dfilter = input(true, title="Use Trend Directional Filter" )

ufirst = input(false, title="Only Alert First Buy/Sell in a new Trend")

RSIsrc = input(close,title="Source")

src = RSIsrc // MA source

srcclose= RSIsrc

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made by JustUncleL*//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [Alerts]

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(6, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(12, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod = time >= testPeriodStart and time <= testPeriodStop ? true : false

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

// - INPUTS END

gold = #FFD700

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

// - FUNCTIONS

// - variant(type, src, len, gamma)

// Returns MA input selection variant, default to SMA if blank or typo.

// SuperSmoother filter

// © 2013 John F. Ehlers

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier, base on time in mins

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := not isintraday? 1 : mult // Only available Daily or less

// Anchor is a relative multiplier based on current TF.

mult = anchor>0 ? anchor : 1

// - FUNCTIONS END

// - Fast ATR QQE

//

Wilders_Period = RSILen * 2 - 1

//

Rsi = rsi(RSIsrc,RSILen)

RSIndex = ema(Rsi, SF)

AtrRsi = abs(RSIndex[1] - RSIndex)

MaAtrRsi = ema(AtrRsi, Wilders_Period)

DeltaFastAtrRsi = ema(MaAtrRsi,Wilders_Period) * QQEfactor

//

newshortband= RSIndex + DeltaFastAtrRsi

newlongband= RSIndex - DeltaFastAtrRsi

longband = 0.0

shortband=0.0

trend = 0

longband:=RSIndex[1] > longband[1] and RSIndex > longband[1] ? max(longband[1],newlongband) : newlongband

shortband:=RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? min(shortband[1],newshortband) : newshortband

trend:=cross(RSIndex, shortband[1])? 1 : cross(longband[1], RSIndex) ? -1 : nz(trend[1],1)

FastAtrRsiTL = trend==1 ? longband : shortband

// - SERIES VARIABLES

// MA's

ma_fast = variant(type1, srcclose, len1, gamma1)

ma_medium = variant(type2, srcclose, len2, gamma2)

ma_slow = variant(type3, srcclose, len3, gamma3)

// MA's

ma_fast_alt = variant(type1, srcclose, len1*mult, gamma1)

ma_medium_alt = variant(type2, srcclose, len2*mult, gamma2)

ma_slow_alt = variant(type3, srcclose, len3*mult, gamma3)

// Get Direction From Medium Moving Average

direction = rising(ma_medium,3) ? 1 : falling(ma_medium,3) ? -1 : 0

altDirection = rising(ma_medium_alt,3) ? 1 : falling(ma_medium_alt,3) ? -1 : 0

//

// Find all the QQE Crosses

QQExlong = 0, QQExlong := nz(QQExlong[1])

QQExshort = 0, QQExshort := nz(QQExshort[1])

QQExlong := FastAtrRsiTL< RSIndex ? QQExlong+1 : 0

QQExshort := FastAtrRsiTL> RSIndex ? QQExshort+1 : 0

// Zero cross

QQEzlong = 0, QQEzlong := nz(QQEzlong[1])

QQEzshort = 0, QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex>=50 ? QQEzlong+1 : 0

QQEzshort := RSIndex<50 ? QQEzshort+1 : 0

//

// Thresh Hold channel Crosses give the BUY/SELL alerts.

QQEclong = 0, QQEclong := nz(QQEclong[1])

QQEcshort = 0, QQEcshort := nz(QQEcshort[1])

QQEclong := RSIndex>(50+threshhold) ? QQEclong+1 : 0

QQEcshort := RSIndex<(50-threshhold) ? QQEcshort+1 : 0

//

// Check Filtering.

QQEflong = mult == 1 ? (not filter or (srcclose>ma_medium and ma_medium>ma_slow and ma_fast>ma_medium)) and (not dfilter or (direction>0 )) :

(not filter or (ma_medium>ma_medium_alt and srcclose>ma_fast and ma_fast>ma_medium)) and (not dfilter or (direction>0 and altDirection>0 and srcclose>ma_medium))

QQEfshort = mult == 1 ? (not filter or (srcclose<ma_medium and ma_medium<ma_slow and ma_fast<ma_medium)) and (not dfilter or (direction<0 )) :

(not filter or (ma_medium<ma_medium_alt and srcclose<ma_fast and ma_fast<ma_medium)) and (not dfilter or (direction<0 and altDirection<0 and srcclose<ma_medium))

QQExfilter = (not xfilter or RSIndex>(50+threshhold) or RSIndex<(50-threshhold))

//

// Get final BUY / SELL alert determination

buy_ = 0, buy_ := nz(buy_[1])

sell_ = 0, sell_ := nz(sell_[1])

// Make sure Buy/Sell are non-repaint and occur after close signal.

buy_ := tradeSignal=="XC"? (QQEclong[1]==1 and QQEflong[1] ? buy_+1 : 0) :

tradeSignal=="XQ"? (QQExlong[1]==1 and QQEflong[1] and QQExfilter[1]? buy_+1 : 0) :

tradeSignal=="XZ"? (QQEzlong[1]==1 and QQEflong[1] ? buy_+1 : 0) : 0

sell_ := tradeSignal=="XC"? (QQEcshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) :

tradeSignal=="XQ"? (QQExshort[1]==1 and QQEfshort[1] and QQExfilter[1]? sell_+1 : 0) :

tradeSignal=="XZ"? (QQEzshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) : 0

//

// Find the first Buy/Sell in trend swing.

Buy = 0, Buy := nz(Buy[1])

Sell = 0, Sell := nz(Sell[1])

Buy := sell_>0 ? 0 : buy_==1 or Buy>0 ? Buy+1 : Buy

Sell := buy_>0 ? 0 : sell_==1 or Sell>0 ? Sell+1 : Sell

// Select First or all buy/sell alerts.

buy = ufirst ? Buy : buy_

sell = ufirst ? Sell : sell_

closeLong = 0, closeLong := nz(closeLong[1])

closeShort = 0, closeShort := nz(closeShort[1])

closeLong := closeSignal=="XC" ? (QQEcshort==1 ? closeLong+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExshort==1 ? closeLong+1 : 0) : ((QQExshort==1 or QQEzshort or QQEcshort) ? closeLong+1 : 0) :

closeSignal=="XZ" ? (QQEzshort==1 ? closeLong+1 : 0) : 0

closeShort := closeSignal=="XC" ? (QQEclong==1 ? closeShort+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExlong==1 ? closeShort+1 : 0) : ((QQExlong==1 or QQEzlong or QQEclong==1) ? closeShort+1 : 0) :

closeSignal=="XZ" ? (QQEzlong==1 ? closeShort+1 : 0) : 0

tradestate = 0, tradestate := nz(tradestate[1])

tradestate := tradestate==0 ? (buy==1 ? 1 : sell==1 ? 2 : 0) : (tradestate==1 and closeLong==1) or (tradestate==2 and closeShort==1)? 0 : tradestate

isLong = change(tradestate) and tradestate==1

isShort = change(tradestate) and tradestate==2

isCloseLong = change(tradestate) and tradestate==0 and nz(tradestate[1])==1

isCloseShort = change(tradestate) and tradestate==0 and nz(tradestate[1])==2

// - SERIES VARIABLES END

// - PLOTTING

// Ma's

tcolor = direction<0?red:green

ma1=plot(showAvgs?ma_fast:na, title="MA Fast", color=tcolor, linewidth=1, transp=0)

ma2=plot(showAvgs?ma_medium:na, title="MA Medium Fast", color=tcolor, linewidth=2, transp=0)

ma3=plot(showAvgs?ma_slow:na, title="MA Slow", color=tcolor, linewidth=1, transp=0)

fill(ma1,ma3,color=tcolor,transp=90)

// Ma's

altTcolor=altDirection<0?blue:aqua

ma4=plot(showAvgs and mult>1?ma_fast_alt:na, title="MA Fast", color=altTcolor, linewidth=1, transp=0)

ma5=plot(showAvgs and mult>1?ma_medium_alt:na, title="MA Medium Fast", color=altTcolor, linewidth=2, transp=0)

ma6=plot(showAvgs and mult>1?ma_slow_alt:na, title="MA Slow", color=altTcolor, linewidth=1, transp=0)

fill(ma4,ma6,color=altTcolor,transp=90)

// QQE exit from Thresh Hold Channel

plotshape(sQQEc and QQEclong==1 and not isLong, title="QQE X Over Channel", style=shape.triangleup, location=location.belowbar, text="XC", color=olive, transp=20, size=size.tiny)

plotshape(sQQEc and QQEcshort==1 and not isShort, title="QQE X Under Channel", style=shape.triangledown, location=location.abovebar, text="XC", color=red, transp=20, size=size.tiny)

// QQE crosses

plotshape(sQQEx and QQExlong==1 and QQEclong!=1 and not isLong, title="QQE Cross Over", style=shape.triangleup, location=location.belowbar, text="XQ", color=blue, transp=20, size=size.tiny)

plotshape(sQQEx and QQExshort==1 and QQEcshort!=1 and not isShort, title="QQE Cross Under", style=shape.triangledown, location=location.abovebar, text="XQ", color=black, transp=20, size=size.tiny)

// Signal crosses zero line

plotshape(sQQEz and QQEzlong==1 and QQEclong!=1 and not isLong and QQExlong!=1, title="QQE Zero Cross Over", style=shape.triangleup, location=location.belowbar, text="XZ", color=aqua, transp=20, size=size.tiny)

plotshape(sQQEz and QQEzshort==1 and QQEcshort!=1 and not isShort and QQExshort!=1, title="QQE Zero Cross Under", style=shape.triangledown, location=location.abovebar, text="XZ", color=fuchsia, transp=20, size=size.tiny)

//

//*** START of COMMENT OUT [BackTest]

//plotshape(isLong, title="QQEX Long", style=shape.arrowup, location=location.belowbar, text="Open\nLONG", color=lime, textcolor=green, transp=0, size=size.small)

//plotshape(isShort, title="QQEX Short", style=shape.arrowdown, location=location.abovebar, text="Open\nSHORT", color=red, textcolor=maroon, transp=0, size=size.small)

//plotshape(isCloseLong, title="QQEX Close Long", style=shape.arrowdown, location=location.abovebar, text="Close\nLONG", color=gray, textcolor=gray, transp=0, size=size.small)

//plotshape(isCloseShort, title="QQEX Close Short", style=shape.arrowup, location=location.belowbar, text="Close\nSHORT", color=gray, textcolor=gray, transp=0, size=size.small)

//*** END of COMMENT OUT [BackTest]

// - PLOTTING END

// - ALERTING

//*** START of COMMENT OUT [Alerts]

if testPeriod

strategy.entry("Long", 1, when=isLong)

strategy.close("Long", when=isCloseLong )

strategy.entry("Short", 0, when=isShort)

strategy.close("Short", when=isCloseShort )

//end if

//*** END of COMMENT OUT [Alerts]

//*** START of COMMENT OUT [BackTest]

//

// Signal to Signal BOT Alerts.

//

//alertcondition(isLong, title="QQEX Long", message="QQEX LONG") // use "Once per Bar" option

//alertcondition(isShort, title="QQEX Short", message="QQEX SHORT") // use "Once per Bar" option

//alertcondition(isCloseLong, title="QQEX Close Long", message="QQEX CLOSE LONG") // use "Once per Bar Close" option

//alertcondition(isCloseShort, title="QQEX Close Short", message="QQEX CLOSE SHORT") // use "Once per Bar Close" option

//

//*** END of COMMENT OUT [BackTest]

// show only when alert condition is met and bar closed.

plotshape(isLong or isShort,title= "Cross Alert Completed", location=location.bottom, color=isShort?red:green, transp=0, style=shape.circle,size=size.auto,offset=0)

plotshape(isCloseShort[1] or isCloseLong[1],title= "Close Order", location=location.top, color=isCloseShort[1]?red:green, transp=0, style=shape.square,size=size.auto,offset=-1)

// - ALERTING END

//EOF

- カルマンフィルターと平均逆転に基づいたトランシティブ比率取引戦略

- 逆線形回帰戦略

- BankNifty スーパートレンド トレーディング戦略

- 臨時地帯戦略

- ストップ・損失を後押しするダブル移動平均戦略

- 複数のタイムフレームのモメンタムブレイク戦略

- ピボットポイント ゴールデン比 高いものを買う 低いものを売る戦略

- シンプル・ムービング・メアディアに基づくトレード・戦略

- 2つの移動平均ボリンガー帯 MACD取引戦略

- Bollinger Bands と RSI のクロスオーバー 戦略

- 量重量平均価格戦略

- 定量的な二重指標戦略

- モメント トラッキング 戦略

- RSI インディケーター改善取引戦略

- トレンド逆転モメント指標 クロスオーバー追跡戦略

- 複数のタイムフレームのブレイクアウト戦略

- 勢いと資金流の交差点 キャッシング戦略

- トレンド戦略をフォローするダイナミックな収益

- 10EMA ダブルクロストレンド追跡戦略

- ダイナミックピボットポイントバックテスト戦略