ボリンジャーバンドとKラインの組み合わせ戦略

概要

これは,Bollinger BandsとK線形状を同時にエントリー信号として使用するトレンド追跡戦略である.これは,より長い時間周期でトレンドを捕捉することを目的としており,外為取引に適用される.

戦略原則

策略は,価格の標準差の範囲を計算してボリンジャー・バンドを確立し,帯幅は市場の波動性を表します.価格が上線または下線に近づくと,超買い超売り信号と見なされます.特定のK線形状のjudge入場と結合されます.

具体的には,多信号は:低点上方突破下軌,多頭吞食または下影K線が発生する.空信号は:高点下方突破上軌,空頭吞食または上影K線が発生する.

ストップ・モードは,事前に設定されたストップ・価格である. ストップ・モードは,価格がブリンの中央線を横切るときに部分的にストップする.

優位分析

この戦略は,トレンドと再突破の機会を組み合わせている. ボリンジャー帯は,トレンドと超買い超売りの機会を識別する. K線は,偽の突破を避けるために,再突破のタイミングを判断する.

ストップ・ストップ・ロスの設定は明確で,リスクは制御できる.長線操作に適し,取引頻度を減らす.

リスク分析

この戦略の最大のリスクは,トレンドを捉えられないか,激しい揺れが起こるかである.この場合,ストップダストは連続的にトリガーされます.

また,中線に依存するオフスタンドは,早すぎたり遅すぎたりする可能性がある.

パラメータの組み合わせを調整して最適化したり,より信頼性の高いK線形状を識別したり,波動率に応じて停止基準を修正して改善することもできる.

最適化の方向

他の指標と組み合わせて大周期的なトレンドを判断し,逆転操作を回避する。または,機械学習アルゴリズムの追加で最適なパラメータの組み合わせを判断する。

ストップ方式は,移動ストップまたは変動率ストップなどを考慮して利益を最大化することもできます.

要約する

これは,ボリンジャー帯とK線技術指標に基づく長期周期トレンド戦略である.基本戦略として使用するのに適しており,一定の信頼性と収益性の余地があるが,安定性を高めるために継続的なテストと最適化が必要である.

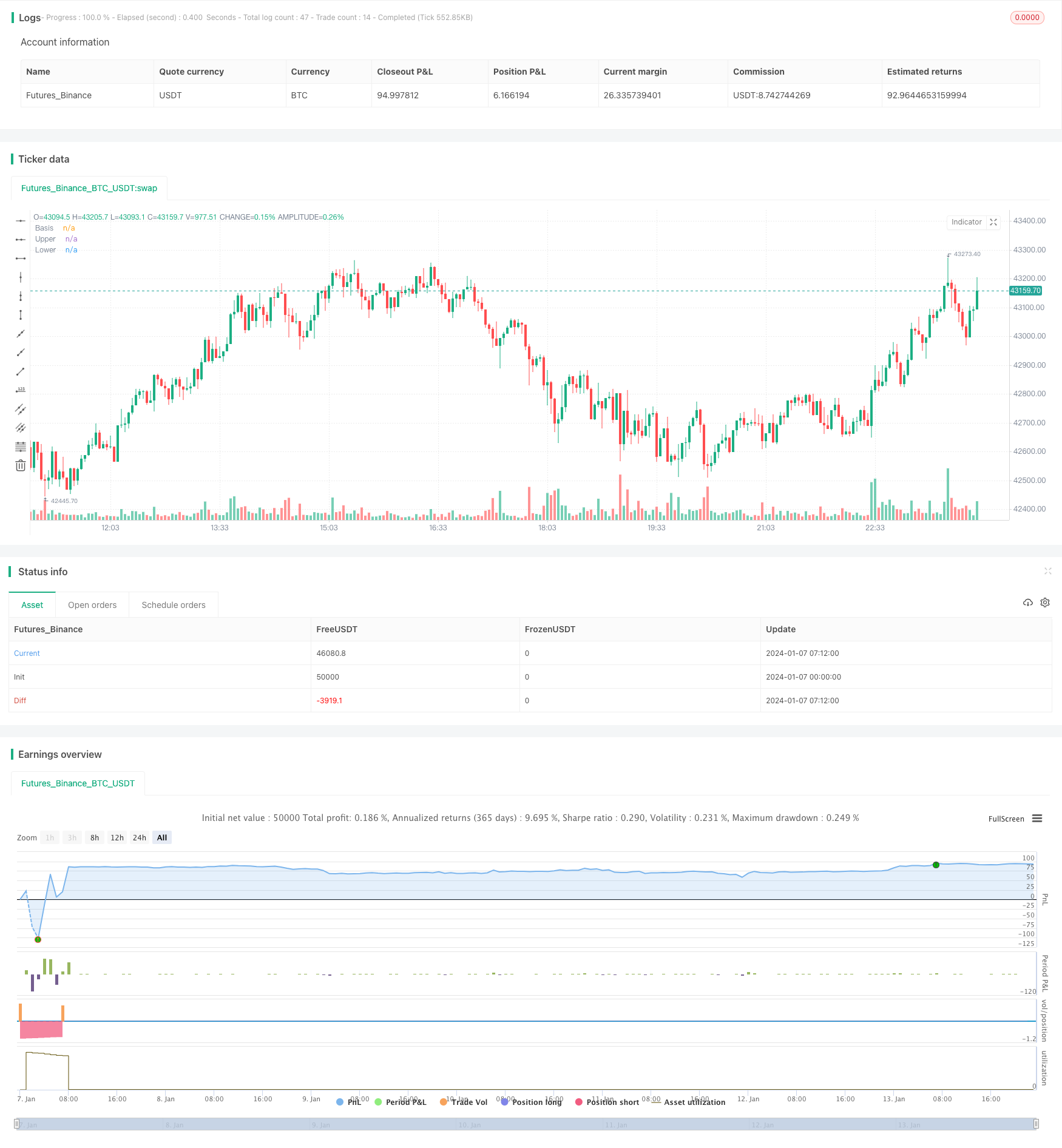

/*backtest

start: 2024-01-07 00:00:00

end: 2024-01-14 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("BB策略", overlay=true)

length = input(20, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

plot(basis, "Basis", color=#872323, offset = offset)

p1 = plot(upper, "Upper", color=color.teal, offset = offset)

p2 = plot(lower, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=#198787, transp=95)

diff=upper-lower

//plot(upper*0.9985, "Upper", color=color.white, offset = offset)

//plot(lower*1.0015, "Lower", color=color.white, offset = offset)

//Engulfing Candles

openBarPrevious = open[1]

closeBarPrevious = close[1]

openBarCurrent = open

closeBarCurrent = close

//If current bar open is less than equal to the previous bar close AND current bar open is less than previous bar open AND current bar close is greater than previous bar open THEN True

bullishEngulfing = openBarCurrent <= closeBarPrevious and openBarCurrent < openBarPrevious and

closeBarCurrent > openBarPrevious

//If current bar open is greater than equal to previous bar close AND current bar open is greater than previous bar open AND current bar close is less than previous bar open THEN True

bearishEngulfing = openBarCurrent >= closeBarPrevious and openBarCurrent > openBarPrevious and

closeBarCurrent < openBarPrevious

//bullishEngulfing/bearishEngulfing return a value of 1 or 0; if 1 then plot on chart, if 0 then don't plot

//plotshape(bullishEngulfing, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

//plotshape(bearishEngulfing, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

//alertcondition(bullishEngulfing, title="Bullish Engulfing", message="[CurrencyPair] [TimeFrame], Bullish candle engulfing previous candle")

//alertcondition(bearishEngulfing, title="Bearish Engulfing", message="[CurrencyPair] [TimeFrame], Bearish candle engulfing previous candle")

//Long Upper Shadow - Bearish

C_Len = 14 // ema depth for bodyAvg

C_ShadowPercent = 5.0 // size of shadows

C_ShadowEqualsPercent = 100.0

C_DojiBodyPercent = 5.0

C_Factor = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi = max(close, open)

C_BodyLo = min(close, open)

C_Body = C_BodyHi - C_BodyLo

C_BodyAvg = ema(C_Body, C_Len)

C_SmallBody = C_Body < C_BodyAvg

C_LongBody = C_Body > C_BodyAvg

C_UpShadow = high - C_BodyHi

C_DnShadow = C_BodyLo - low

C_HasUpShadow = C_UpShadow > C_ShadowPercent / 100 * C_Body

C_HasDnShadow = C_DnShadow > C_ShadowPercent / 100 * C_Body

C_WhiteBody = open < close

C_BlackBody = open > close

C_Range = high-low

C_IsInsideBar = C_BodyHi[1] > C_BodyHi and C_BodyLo[1] < C_BodyLo

C_BodyMiddle = C_Body / 2 + C_BodyLo

C_ShadowEquals = C_UpShadow == C_DnShadow or (abs(C_UpShadow - C_DnShadow) / C_DnShadow * 100) < C_ShadowEqualsPercent and (abs(C_DnShadow - C_UpShadow) / C_UpShadow * 100) < C_ShadowEqualsPercent

C_IsDojiBody = C_Range > 0 and C_Body <= C_Range * C_DojiBodyPercent / 100

C_Doji = C_IsDojiBody and C_ShadowEquals

patternLabelPosLow = low - (atr(30) * 0.6)

patternLabelPosHigh = high + (atr(30) * 0.6)

C_LongUpperShadowBearishNumberOfCandles = 1

C_LongShadowPercent = 75.0

C_LongUpperShadowBearish = C_UpShadow > C_Range/100*C_LongShadowPercent

//alertcondition(C_LongUpperShadowBearish, title = "Long Upper Shadow", message = "New Long Upper Shadow - Bearish pattern detected.")

//if C_LongUpperShadowBearish

// var ttBearishLongUpperShadow = "Long Upper Shadow\nTo indicate buyer domination of the first part of a session, candlesticks will present with long upper shadows, as well as short lower shadows, consequently raising bidding prices."

// label.new(bar_index, patternLabelPosHigh, text="LUS", style=label.style_label_down, color = color.red, textcolor=color.white, tooltip = ttBearishLongUpperShadow)

//gcolor(highest(C_LongUpperShadowBearish?1:0, C_LongUpperShadowBearishNumberOfCandles)!=0 ? color.red : na, offset=-(C_LongUpperShadowBearishNumberOfCandles-1))

C_Len1 = 14 // ema depth for bodyAvg

C_ShadowPercent1 = 5.0 // size of shadows

C_ShadowEqualsPercent1 = 100.0

C_DojiBodyPercent1 = 5.0

C_Factor1 = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi1 = max(close, open)

C_BodyLo1 = min(close, open)

C_Body1 = C_BodyHi1 - C_BodyLo1

C_BodyAvg1 = ema(C_Body1, C_Len1)

C_SmallBody1 = C_Body1 < C_BodyAvg1

C_LongBody1 = C_Body1 > C_BodyAvg1

C_UpShadow1 = high - C_BodyHi1

C_DnShadow1 = C_BodyLo1 - low

C_HasUpShadow1 = C_UpShadow1 > C_ShadowPercent1 / 100 * C_Body1

C_HasDnShadow1 = C_DnShadow1 > C_ShadowPercent1 / 100 * C_Body1

C_WhiteBody1 = open < close

C_BlackBody1 = open > close

C_Range1 = high-low

C_IsInsideBar1 = C_BodyHi1[1] > C_BodyHi1 and C_BodyLo1[1] < C_BodyLo1

C_BodyMiddle1 = C_Body1 / 2 + C_BodyLo1

C_ShadowEquals1 = C_UpShadow1 == C_DnShadow1 or (abs(C_UpShadow1 - C_DnShadow1) / C_DnShadow1 * 100) < C_ShadowEqualsPercent1 and (abs(C_DnShadow1 - C_UpShadow1) / C_UpShadow1 * 100) < C_ShadowEqualsPercent1

C_IsDojiBody1 = C_Range1 > 0 and C_Body1 <= C_Range1 * C_DojiBodyPercent1 / 100

C_Doji1 = C_IsDojiBody1 and C_ShadowEquals1

patternLabelPosLow1 = low - (atr(30) * 0.6)

patternLabelPosHigh1 = high + (atr(30) * 0.6)

C_LongLowerShadowBullishNumberOfCandles1 = 1

C_LongLowerShadowPercent1 = 75.0

C_LongLowerShadowBullish1 = C_DnShadow1 > C_Range1/100*C_LongLowerShadowPercent1

//alertcondition1(C_LongLowerShadowBullish1, title = "Long Lower Shadow", message = "New Long Lower Shadow - Bullish pattern detected.")

// Make input options that configure backtest date range

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2018, minval=1800, maxval=2100)

endDate = input(title="End Date", type=input.integer,

defval=1, minval=1, maxval=31)

endMonth = input(title="End Month", type=input.integer,

defval=11, minval=1, maxval=12)

endYear = input(title="End Year", type=input.integer,

defval=2030, minval=1800, maxval=2100)

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

//多單

if ((bullishEngulfing or C_LongLowerShadowBullish1) and inDateRange and cross(low,lower))

strategy.entry("L", strategy.long, qty=1,stop=(low[1]))

//strategy.close("L",comment = "L exit",when=cross(basis,close),qty_percent=50)

if crossunder(close,upper*0.9985)

strategy.close("L",comment = "L exit",qty_percent=1)

//空單

if (((bullishEngulfing == 0) or C_LongUpperShadowBearish) and inDateRange and cross(close,upper))

strategy.entry("S", strategy.short,qty= 1,stop=(high[1]))

//strategy.close("S",comment = "S exit",when=cross(basis,close),qty_percent=50)

if crossunder(lower*1.0015,close)

strategy.close("S",comment = "S exit",qty_percent=1)