三重指標 感情を駆使した脱出戦略

作者: リン・ハーンチャオチャン開催日:2024年1月17日 17時53分55秒タグ:

概要

この戦略は,QQE Mod指標,SSLハイブリッド指標およびWaddah Attar Explosion指標を組み込み,取引信号を形成し,複数の指標主導のセンチメントブレイクアウト戦略に属しています.これはブレイクアウトの前に市場のセンチメントを判断し,偽ブレイクアウトを避けることができます.これは比較的高品質のブレイクアウト戦略です.

戦略の論理

この戦略の基本的な論理は,3つの指標によって形成された取引決定に基づいています.

QQE Mod インディケーター: この指標は,市場情勢を判断する際により敏感になるため,RSI指標を改善します.この戦略は,底部逆転と上部逆転信号を決定するために使用します.

SSL ハイブリッド インディケーター: この指標は,複数の移動平均値の突破状況を包括的に考慮し,市場の兆候を決定します.この戦略は,チャネル突破パターンを決定するために使用します.

ワッダ・アター爆発指標: この指標は,チャネル内の価格の爆発力を判断します.この戦略では,ブレイク時の勢いが十分かどうかを判断します.

QQEインジケーターが底部逆転信号を発信し,SSLインジケーターがチャネルトップブレイクアウトを示し,Waddah Attarインジケーターが爆発的な勢いを決定すると,この戦略は購入決定を生成する.3つのインジケーターが対照的な信号を同期的に発信すると,売却決定を下す.

ストップ・ロスを正確に設定し 利益を最大限に確保します 高品質な感情主導の脱出戦略です

利点分析

この戦略には以下の利点があります.

- 市場情勢を判断し,偽のブレイクのリスクを回避するために複数の指標を統合する

- 突破中に高い確認度を確保するために,全面的に逆転指標,チャネル指標,インパルス指標を検討

- 高精度移動ストップ損失を導入し,リスクを制限し,利益をロックします

- 中期および長期保持に適した良好な安定性,多くの最適化テストを通過したパラメータ

- インディケーターパラメータは,より広範な市場条件に合わせて戦略のスタイルを調整するために設定できます.

リスク分析

この戦略の主なリスクは以下のとおりです.

- 持続的な下落傾向の間,より小さな損失取引を生む傾向があります.

- 複数の同時インディケーターの信号に依存し,一部の市場で異常な失敗を起こす可能性があります.

- QQEのような複数の指標に対して過度に最適化されるリスクがあり,パラメータは慎重に設定する必要があります.

- 移動ストップ損失は,いくつかの異常な市場条件で通常の役割を果たすことはできません.

上記のリスクに対処するために,指標パラメータをより安定するように調整し,より高い利益率を得るために保持期間を適切に延長することを提案します.

オプティマイゼーションの方向性

この戦略は,次の側面でさらに最適化できます.

- インディケーターのパラメータを調整し,より安定または敏感にする

- 波動性に基づくポジションサイズ最適化モジュールを追加する

- 市場状況を動的に評価するための機械学習リスク管理モジュールを追加する

- ディープラーニングモデルを利用して指標パターンを予測し,意思決定の正確性を向上させる

- 誤ったブレイクの可能性を減らすためにクロスタイムフレーム分析を導入する

結論

この戦略は,複数の主流のセンチメント指標の利点を統合して,効率的なセンチメント主導のブレイクアウト戦略を構築する.多くの低品質のブレイクアウトがもたらすリスクを成功裏に回避し,利益をロックするために高精度ストップ損失概念を特徴としています.これは学習とレバレッジに値する成熟した信頼性の高いブレイクアウト戦略です.継続的なパラメータ最適化とモデル予測により,より一貫した過剰なリターンを生み出す可能性があります.

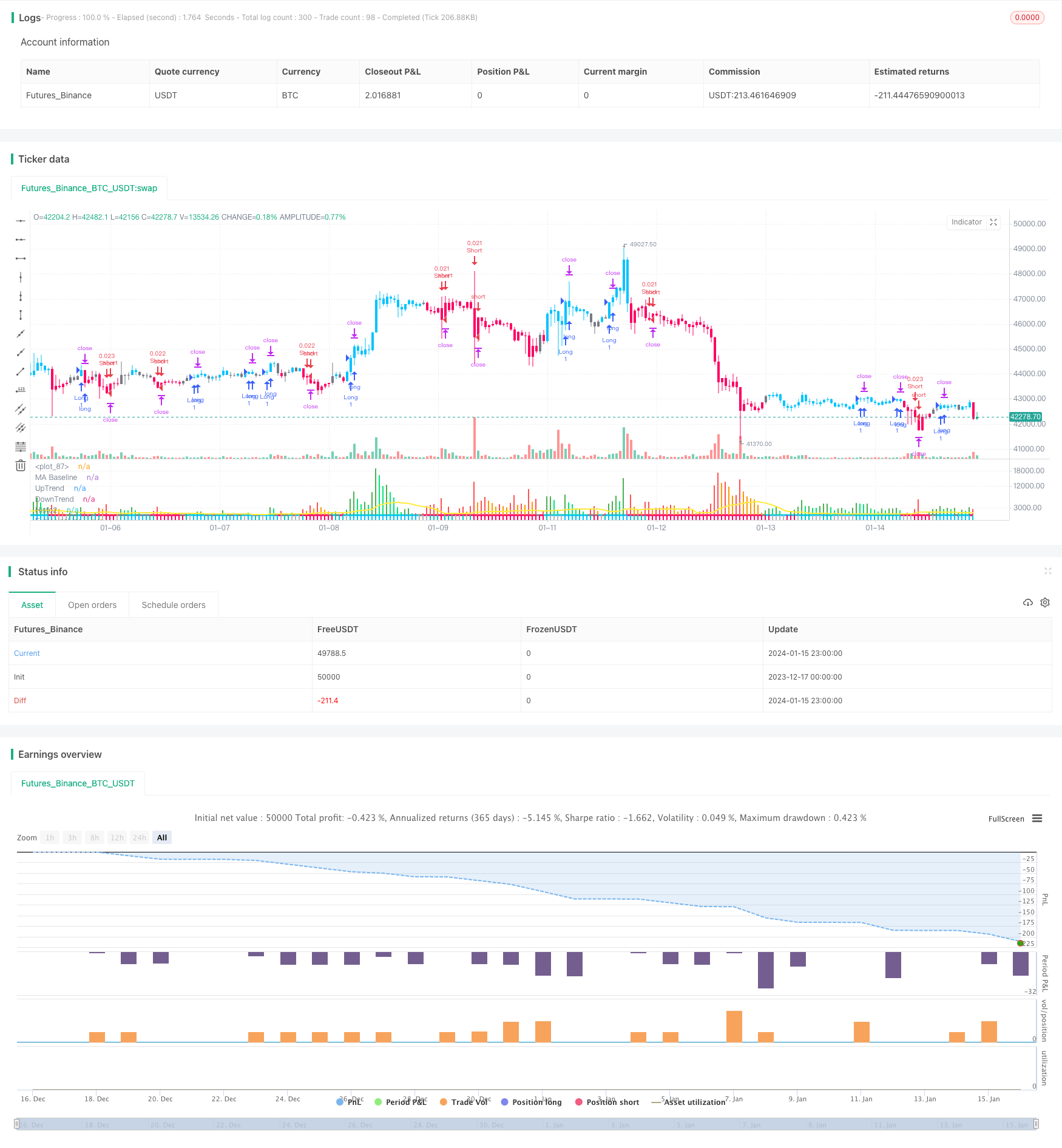

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Strategy based on the 3 indicators:

// - QQE MOD

// - SSL Hybrid

// - Waddah Attar Explosion

//

// Strategy was designed for the purpose of back testing.

// See strategy documentation for info on trade entry logic.

//

// Credits:

// - QQE MOD: Mihkel00 (https://www.tradingview.com/u/Mihkel00/)

// - SSL Hybrid: Mihkel00 (https://www.tradingview.com/u/Mihkel00/)

// - Waddah Attar Explosion: shayankm (https://www.tradingview.com/u/shayankm/)

//@version=5

strategy("QQE MOD + SSL Hybrid + Waddah Attar Explosion", overlay=false)

// =============================================================================

// STRATEGY INPUT SETTINGS

// =============================================================================

// ---------------

// Risk Management

// ---------------

swingLength = input.int(10, "Swing High/Low Lookback Length", group='Strategy: Risk Management', tooltip='Stop Loss is calculated by the swing high or low over the previous X candles')

accountRiskPercent = input.float(2, "Account percent loss per trade", step=0.1, group='Strategy: Risk Management', tooltip='Each trade will risk X% of the account balance')

// ----------

// Date Range

// ----------

start_year = input.int(title='Start Date', defval=2022, minval=2010, maxval=3000, group='Strategy: Date Range', inline='1')

start_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

start_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

end_year = input.int(title='End Date', defval=2023, minval=1800, maxval=3000, group='Strategy: Date Range', inline='2')

end_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

end_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

in_date_range = true

// =============================================================================

// INDICATORS

// =============================================================================

// -------

// QQE MOD

// -------

RSI_Period = input.int(6, title='RSI Length', group='Indicators: QQE Mod Settings')

SF = input.int(6, title='RSI Smoothing', group='Indicators: QQE Mod Settings')

QQE = input.int(3, title='Fast QQE Factor', group='Indicators: QQE Mod Settings')

ThreshHold = input.int(3, title='Thresh-hold', group='Indicators: QQE Mod Settings')

qqeSrc = input(close, title='RSI Source', group='Indicators: QQE Mod Settings')

Wilders_Period = RSI_Period * 2 - 1

Rsi = ta.rsi(qqeSrc, RSI_Period)

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

cross_1 = ta.cross(longband[1], RSIndex)

trend := ta.cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

length = input.int(50, minval=1, title='Bollinger Length', group='Indicators: QQE Mod Settings')

qqeMult = input.float(0.35, minval=0.001, maxval=5, step=0.1, title='BB Multiplier', group='Indicators: QQE Mod Settings')

basis = ta.sma(FastAtrRsiTL - 50, length)

dev = qqeMult * ta.stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

//qqe_color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

Zero = hline(0, color=color.white, linestyle=hline.style_dotted, linewidth=1, display=display.none)

RSI_Period2 = input.int(6, title='RSI Length', group='Indicators: QQE Mod Settings')

SF2 = input.int(5, title='RSI Smoothing', group='Indicators: QQE Mod Settings')

QQE2 = input.float(1.61, title='Fast QQE2 Factor', group='Indicators: QQE Mod Settings')

ThreshHold2 = input.int(3, title='Thresh-hold', group='Indicators: QQE Mod Settings')

src2 = input(close, title='RSI Source', group='Indicators: QQE Mod Settings')

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = ta.rsi(src2, RSI_Period2)

RsiMa2 = ta.ema(Rsi2, SF2)

AtrRsi2 = math.abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ta.ema(AtrRsi2, Wilders_Period2)

dar2 = ta.ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ? math.max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ? math.min(shortband2[1], newshortband2) : newshortband2

cross_2 = ta.cross(longband2[1], RSIndex2)

trend2 := ta.cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver : RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

plot(RsiMa2 - 50, color=hcolor2, title='Histo2', style=plot.style_columns, transp=50)

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

plot(Greenbar1 and Greenbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Up', style=plot.style_columns, color=color.new(#00c3ff, 0))

plot(Redbar1 and Redbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Down', style=plot.style_columns, color=color.new(#ff0062, 0))

// ----------

// SSL HYBRID

// ----------

show_Baseline = input(title='Show Baseline', defval=true)

show_SSL1 = input(title='Show SSL1', defval=false)

show_atr = input(title='Show ATR bands', defval=true)

//ATR

atrlen = input(14, 'ATR Period')

mult = input.float(1, 'ATR Multi', step=0.1)

smoothing = input.string(title='ATR Smoothing', defval='WMA', options=['RMA', 'SMA', 'EMA', 'WMA'])

ma_function(source, atrlen) =>

if smoothing == 'RMA'

ta.rma(source, atrlen)

else

if smoothing == 'SMA'

ta.sma(source, atrlen)

else

if smoothing == 'EMA'

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input.string(title='SSL1 / Baseline Type', defval='HMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'])

len = input(title='SSL1 / Baseline Length', defval=60)

SSL2Type = input.string(title='SSL2 / Continuation Type', defval='JMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'McGinley'])

len2 = input(title='SSL 2 Length', defval=5)

SSL3Type = input.string(title='EXIT Type', defval='HMA', options=['DEMA', 'TEMA', 'LSMA', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'McGinley', 'MF'])

len3 = input(title='EXIT Length', defval=15)

src = input(title='Source', defval=close)

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

kidiv = input.int(defval=1, maxval=4, title='Kijun MOD Divider')

jurik_phase = input(title='* Jurik (JMA) Only - Phase', defval=3)

jurik_power = input(title='* Jurik (JMA) Only - Power', defval=1)

volatility_lookback = input(10, title='* Volatility Adjusted (VAMA) Only - Volatility lookback length')

//MF

beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Modular Filter, General Filter Only - Beta')

feedback = input(false, title='Modular Filter Only - Feedback')

z = input.float(0.5, title='Modular Filter Only - Feedback Weighting', step=0.1, minval=0, maxval=1)

//EDSMA

ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20)

ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3])

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = feedback ? z * src + (1 - z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta * b + (1 - beta) * c

lower = beta * c + (1 - beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, volatility_lookback)

vol_down = ta.lowest(dev, volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / kidiv), ta.highest(len / kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2 ? get2PoleSSF(avgZeros, ssfLength) : get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true)

multy = input.float(0.2, step=0.05, title='Base Channel Multiplier')

Keltma = ma(maType, src, len)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, len)

upperk = Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open * 1

close_pos = close * 1

difference = math.abs(close_pos - open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = ta.crossover(close, sslExit)

base_cross_Short = ta.crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title='Color Bars', defval=true)

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

plotarrow(codiff, colorup=color.new(#00c3ff, 20), colordown=color.new(#ff0062, 20), title='Exit Arrows', maxheight=20, offset=0, display=display.none)

p1 = plot(0, color=color_bar, linewidth=3, title='MA Baseline', transp=0)

barcolor(show_color_bar ? color_bar : na)

// ---------------------

// WADDAH ATTAR EXPLOSION

// ---------------------

sensitivity = input.int(180, title="Sensitivity", group='Indicators: Waddah Attar Explosion')

fastLength=input.int(20, title="FastEMA Length", group='Indicators: Waddah Attar Explosion')

slowLength=input.int(40, title="SlowEMA Length", group='Indicators: Waddah Attar Explosion')

channelLength=input.int(20, title="BB Channel Length", group='Indicators: Waddah Attar Explosion')

waeMult=input.float(2.0, title="BB Stdev Multiplier", group='Indicators: Waddah Attar Explosion')

calc_macd(source, fastLength, slowLength) =>

fastMA = ta.ema(source, fastLength)

slowMA = ta.ema(source, slowLength)

fastMA - slowMA

calc_BBUpper(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis + dev

calc_BBLower(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis - dev

t1 = (calc_macd(close, fastLength, slowLength) - calc_macd(close[1], fastLength, slowLength))*sensitivity

e1 = (calc_BBUpper(close, channelLength, waeMult) - calc_BBLower(close, channelLength, waeMult))

trendUp = (t1 >= 0) ? t1 : 0

trendDown = (t1 < 0) ? (-1*t1) : 0

plot(trendUp, style=plot.style_columns, linewidth=1, color=(trendUp<trendUp[1]) ? color.lime : color.green, transp=45, title="UpTrend", display=display.none)

plot(trendDown, style=plot.style_columns, linewidth=1, color=(trendDown<trendDown[1]) ? color.orange : color.red, transp=45, title="DownTrend", display=display.none)

plot(e1, style=plot.style_line, linewidth=2, color=color.yellow, title="ExplosionLine", display=display.none)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// QQE Mod

qqeGreenBar = Greenbar1 and Greenbar2

qqeRedBar = Redbar1 and Redbar2

qqeBuy = qqeGreenBar and not qqeGreenBar[1]

qqeSell = qqeRedBar and not qqeRedBar[1]

// SSL Hybrid

sslBuy = close > upperk and close > BBMC

sslSell = close < lowerk and close < BBMC

// Waddah Attar Explosion

waeBuy = trendUp > 0 and trendUp > e1

waeSell = trendDown > 0 and trendDown > e1

inLong = strategy.position_size > 0

inShort = strategy.position_size < 0

longCondition = qqeBuy and sslBuy and waeBuy and in_date_range

shortCondition = qqeSell and sslSell and waeSell and in_date_range

swingLow = ta.lowest(source=low, length=swingLength)

swingHigh = ta.highest(source=high, length=swingLength)

longStopPercent = math.abs((1 - (swingLow / close)) * 100)

shortStopPercent = math.abs((1 - (swingHigh / close)) * 100)

// Position sizing (default risk 2% per trade)

riskAmt = strategy.equity * accountRiskPercent / 100

longQty = math.abs(riskAmt / longStopPercent * 100) / close

shortQty = math.abs(riskAmt / shortStopPercent * 100) / close

if (longCondition and not inShort and not inLong)

strategy.entry("Long", strategy.long, qty=longQty)

strategy.exit("Long SL/TP", from_entry="Long", stop=swingLow, alert_message='Long SL Hit')

buyLabel = label.new(x=bar_index, y=high[1], color=color.green, style=label.style_label_up)

label.set_y(id=buyLabel, y=0)

label.set_tooltip(id=buyLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(longQty) + " Swing low: " + str.tostring(swingLow) + " Stop Percent: " + str.tostring(longStopPercent))

if (shortCondition and not inLong and not inShort)

strategy.entry("Short", strategy.short, qty=shortQty)

strategy.exit("Short SL/TP", from_entry="Short", stop=swingHigh, alert_message='Short SL Hit')

sellLabel = label.new(x=bar_index, y=high[1], color=color.red, style=label.style_label_up)

label.set_y(id=sellLabel, y=0)

label.set_tooltip(id=sellLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(shortQty) + " Swing high: " + str.tostring(swingHigh) + " Stop Percent: " + str.tostring(shortStopPercent))

openTradesInProfit() =>

result = 0.

for i = 0 to strategy.opentrades-1

result += strategy.opentrades.profit(i)

result > 0

exitLong = inLong and base_cross_Short and openTradesInProfit()

strategy.close(id = "Long", when = exitLong, comment = "Closing Long", alert_message="Long TP Hit")

exitShort = inShort and base_cross_Long and openTradesInProfit()

strategy.close(id = "Short", when = exitShort, comment = "Closing Short", alert_message="Short TP Hit")

// =============================================================================

// DATA WINDOW PLOTTING

// =============================================================================

plotchar(0, "===========", "", location = location.top, color=#141823)

plotchar(0, "BUY SIGNALS:", "", location = location.top, color=#141823)

plotchar(0, "===========", "", location = location.top, color=#141823)

plotchar(qqeBuy, "QQE Mod: Buy Signal", "", location = location.top, color=qqeBuy ? color.green : color.orange)

plotchar(sslBuy, "SSL Hybrid: Buy Signal", "", location = location.top, color=sslBuy ? color.green : color.orange)

plotchar(waeBuy, "Waddah Attar Explosion: Buy Signal", "", location = location.top, color=waeBuy ? color.green : color.orange)

plotchar(inLong, "inLong", "", location = location.top, color=inLong ? color.green : color.orange)

plotchar(exitLong, "Exit Long", "", location = location.top, color=exitLong ? color.green : color.orange)

plotchar(0, "============", "", location = location.top, color=#141823)

plotchar(0, "SELL SIGNALS:", "", location = location.top, color=#141823)

plotchar(0, "============", "", location = location.top, color=#141823)

plotchar(qqeSell, "QQE Mod: Sell Signal", "", location = location.top, color=qqeSell ? color.red : color.orange)

plotchar(sslSell, "SSL Hybrid: Sell Signal", "", location = location.top, color=sslSell ? color.red : color.orange)

plotchar(waeSell, "Waddah Attar Explosion: Sell Signal", "", location = location.top, color=waeSell ? color.red : color.orange)

plotchar(inShort, "inShort", "", location = location.top, color=inShort ? color.red : color.orange)

plotchar(exitShort, "Exit Short", "", location = location.top, color=exitShort ? color.red : color.orange)

- パラボリックSAR,ストックおよび証券指標に基づく多期数値取引戦略

- ゴールドの急速な突破 EMA取引戦略

- 2つの要素によるモメント追跡逆転戦略

- モメント・リバーサル・トレーディング・戦略

- Bollinger Band と RSI を DCA 戦略と混ぜる

- エマ・プルバック ショート戦略

- ノロバンドのモメンタムポジション戦略

- 二重確認逆転傾向追跡戦略

- MACD インディケーター駆動型 OBV 量子取引戦略

- ダウントレンド戦略後のドルコスト平均値

- 移動平均値,価格パターン,および量に基づいたトレンド逆転戦略

- 2重移動平均戦略

- モメント・ムービング・平均クロスオーバー・トレード戦略

- 二重移動平均金十字戦略

- モメント・ウェーブ ボリンガー・バンド トレンド戦略

- 逆勢トレード戦略

- バンドパス平均PB指標戦略

- RSI&フィボナッチ5分トレード戦略

- 三重移動平均とMACD定量戦略を組み合わせた

- モメントブレイク最適化