ゼロラグ重ね合わせ移動平均とカンチレバーライン出口取引戦略の組み合わせ

作成日:

2024-01-22 10:03:05

最終変更日:

2024-01-22 10:03:05

コピー:

0

クリック数:

1934

1

フォロー

1628

フォロワー

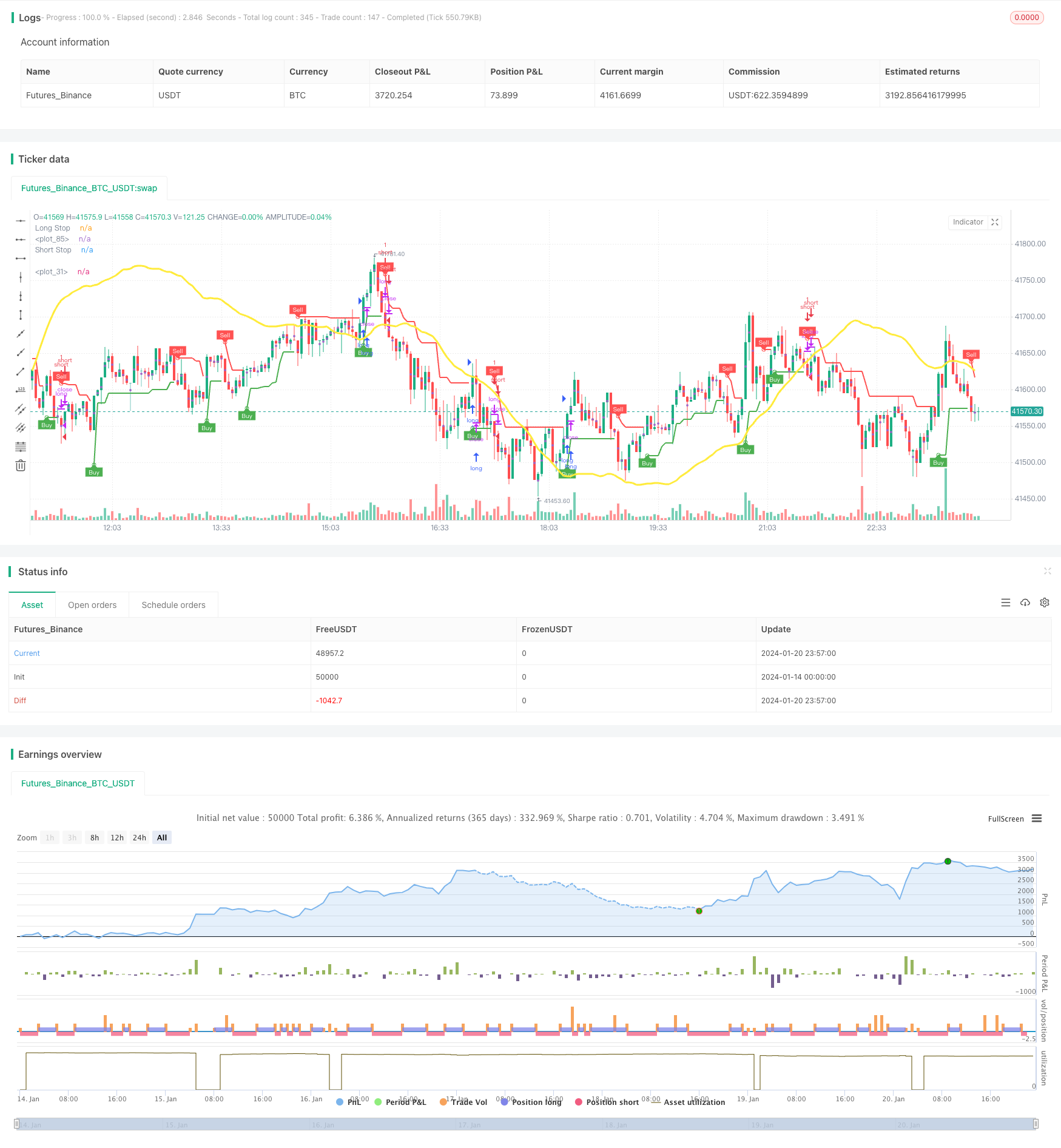

概要

この戦略の主な考えは,ゼロ・ラグデッド・オーバープレッシング・ムービング・エーバーン (ZLSMA) の指標を組み合わせてトレンドの方向を判断し,懸垂線出口 (CE) の指標を組み合わせて,より正確な入場と出場のタイミングを探すことである.ZLSMAはトレンドの指標であり,トレンドの変化を早期に判断することができる.CEはATRを計算することで,出場点位を動的に調整し,ストップ・ロースを効果的に制御することができる.この戦略は,主に中短線操作に適している.

戦略原則

ZLSMA セクション:

- 線形回帰法を用いてそれぞれ130周期の長さのLMA線を計算する.

- 2つのLMA線を重ねて,eqに割り当てられた差値が得られる.

- 最後に,元のLMA線からeq差値を加え,ゼロ・ラグデッド・オーバーレイディング・ムービング・アワーZLSMA。を構成する.

CE部分:

- ATR指標を計算し,係数 ((デフォルト2)) で,最近の高点または低点からの動的距離を決定する.

- 閉店価格が最近の多頭ストップラインまたは空頭ストップラインを超えると,そのストップラインを適切に調整します.

- ストップラインの位置の変化による閉盘価格の判断により多空方向を行う.

入場時間:

- ZLSMAはトレンドの方向を判断し,CEはシグナルを発した時に入場する.

スタート・ストップ:

- 長線には固定ストップとストップがある.

- ショートラインはCEの動的出口を固定ストップに置き換える.

優位分析

- ZLSMAは,偽の突破を回避するために,早めにトレンドを判断することができます.

- CEは市場の変動に応じて出口地点を柔軟に調整できます.

- 戦略のリスク/リターン比率はカスタマイズできます.

- 長線・短線は,止損止の方法によって異なるが,同時にリスクを制御することができる.

リスク分析

- パラメータ設定を誤って設定すると,出力率が増加したり,止損範囲が拡大したりする可能性があります.

- 状況が急激に逆転すれば,止損が破られる危険性がある.

最適化の方向

- 異なる市場と時間周期のパラメータ最適化をテストできます.

- 波動率または特定の周期に応じてストップ・ストップ・損失パラメータの調整を考慮することができます.

- 他の指標やモデルと組み合わせることで 収益率を上げることができます.

要約する

この戦略は,主にゼロ・ラグデッドの叠加移動平均を用いてトレンドの方向を判断し,懸垂線出口指標と組み合わせて,より正確な入場出場タイミングを探している.戦略の利点は,カスタマイズ可能なストップ・ストップの比率であり,懸垂線出口の動態調整は,市場状況に応じてリスクをコントロールできる.次のステップは,パラメータ最適化と戦略の組み合わせを試みて,安定性と収益性をさらに向上させる.

ストラテジーソースコード

/*backtest

start: 2024-01-14 00:00:00

end: 2024-01-21 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © GGkurg

//@version=5

strategy(title = "ZLSMA + Chandelier Exit", shorttitle="ZLSMA + CE", overlay=true)

var GRP1 = "take profit / stop loss"

TP = input(title='long TP%', defval=2.0, inline = "1", group = GRP1)

SL = input(title='long SL%', defval=2.0, inline = "1", group = GRP1)

TP2 = input(title='short TP', defval=2.0, inline = "2", group = GRP1)

SL2 = input(title='short SL', defval=2.0, inline = "2", group = GRP1)

//-------------------------------------------------calculations

takeProfitPrice = strategy.position_avg_price * (1+(TP/100))

stopLossPrice = strategy.position_avg_price * (1-(SL/100))

takeProfitPrice2 = strategy.position_avg_price * (1-(TP2/100))

stopLossPrice2 = strategy.position_avg_price * (1+(SL2/100))

//---------------------------------------ZLSMA - Zero Lag LSMA

var GRP2 = "ZLSMA settings"

length1 = input(title='Length', defval=130, inline = "1", group = GRP2)

offset1 = input(title='Offset', defval=0, inline = "2", group = GRP2)

src = input(close, title='Source', inline = "3", group = GRP2)

lsma = ta.linreg(src, length1, offset1)

lsma2 = ta.linreg(lsma, length1, offset1)

eq = lsma - lsma2

zlsma = lsma + eq

plot(zlsma, color=color.new(color.yellow, 0), linewidth=3)

//---------------------------------------ZLSMA conditisions

//---------long

longc1 = close > zlsma

longclose1 = close < zlsma

//---------short

shortc1 = close < zlsma

shortclose1 = close > zlsma

//---------------------------------------Chandelier Exit

var string calcGroup = 'Chandelier exit settings'

length = input.int(title='ATR Period', defval=1, group=calcGroup)

mult = input.float(title='ATR Multiplier', step=0.1, defval=2.0, group=calcGroup)

useClose = input.bool(title='Use Close Price for Extremums', defval=true, group=calcGroup)

var string visualGroup = 'Visuals'

showLabels = input.bool(title='Show Buy/Sell Labels', defval=true, group=visualGroup)

highlightState = input.bool(title='Highlight State', defval=true, group=visualGroup)

var string alertGroup = 'Alerts'

awaitBarConfirmation = input.bool(title="Await Bar Confirmation", defval=true, group=alertGroup)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

var color longColor = color.green

var color shortColor = color.red

var color longFillColor = color.new(color.green, 90)

var color shortFillColor = color.new(color.red, 90)

var color textColor = color.new(color.white, 0)

longStopPlot = plot(dir == 1 ? longStop : na, title='Long Stop', style=plot.style_linebr, linewidth=2, color=color.new(longColor, 0))

buySignal = dir == 1 and dir[1] == -1

plotshape(buySignal ? longStop : na, title='Long Stop Start', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(longColor, 0))

plotshape(buySignal and showLabels ? longStop : na, title='Buy Label', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(longColor, 0), textcolor=textColor)

shortStopPlot = plot(dir == 1 ? na : shortStop, title='Short Stop', style=plot.style_linebr, linewidth=2, color=color.new(shortColor, 0))

sellSignal = dir == -1 and dir[1] == 1

plotshape(sellSignal ? shortStop : na, title='Short Stop Start', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(shortColor, 0))

plotshape(sellSignal and showLabels ? shortStop : na, title='Sell Label', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(shortColor, 0), textcolor=textColor)

midPricePlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, display=display.none, editable=false)

longStateFillColor = highlightState ? dir == 1 ? longFillColor : na : na

shortStateFillColor = highlightState ? dir == -1 ? shortFillColor : na : na

fill(midPricePlot, longStopPlot, title='Long State Filling', color=longStateFillColor)

fill(midPricePlot, shortStopPlot, title='Short State Filling', color=shortStateFillColor)

await = awaitBarConfirmation ? barstate.isconfirmed : true

alertcondition(dir != dir[1] and await, title='Alert: CE Direction Change', message='Chandelier Exit has changed direction!')

alertcondition(buySignal and await, title='Alert: CE Buy', message='Chandelier Exit Buy!')

alertcondition(sellSignal and await, title='Alert: CE Sell', message='Chandelier Exit Sell!')

//---------------------------------------Chandelier Exit conditisions

//---------long

longc2 = buySignal

longclose2 = sellSignal

//---------short

shortc2 = sellSignal

shortclose2 = buySignal

//---------------------------------------Long entry and exit

if longc1 and longc2

strategy.entry("long", strategy.long)

if strategy.position_avg_price > 0

strategy.exit("close long", "long", limit = takeProfitPrice, stop = stopLossPrice, alert_message = "close all orders")

if longclose1 and longclose2 and strategy.opentrades == 1

strategy.close("long","ema long cross", alert_message = "close all orders")

//---------------------------------------Short entry and exit

if shortc1 and shortc2

strategy.entry("short", strategy.short)

if strategy.position_avg_price > 0

strategy.exit("close short", "short", limit = takeProfitPrice2, stop = stopLossPrice2, alert_message = "close all orders")

if shortclose1 and shortclose2 and strategy.opentrades == 1

strategy.close("close short","short", alert_message = "close all orders")