多期SMAに基づいた戦略をフォローする傾向

作者: リン・ハーンチャオチャン開催日: 2024-02-04 14:50:24タグ:

概要

この戦略は,トレンドを特定し,フォローするために,異なる期間の複数のSMAラインを組み合わせます. 基本的な考え方は:トレンドを決定するために,異なる期間のSMAの上昇/下落方向を比較すること. 短期SMAが長期SMAを横切るときはロング,短期のSMAがロングSMAを下回るときはショート. ZeroLagEMAは,エントリーと出口を確認するためにも使用されます.

戦略の論理

- 5つのSMAラインをそれぞれ10,20,50,100,200の周期で使用する.

- これらの5つのSMAの方向性を比較して傾向を決定します.例えば,10~20~100~200期SMAが同時に上昇している場合,上昇傾向を示し,すべて下落している場合,下落傾向を示します.

- SMAの値を異なる期間に比較して取引信号を生成する.例えば,10期SMAが20期SMAを横切るとロング;10期SMAが20期SMAを下回るとショート.

- 入口確認と出口信号のためにZeroLagEMAを使用します.高速なZeroLagEMAが遅いZeroLagEMAを横切るとロングで,下を横切るとロングで出口します.ショートに対する判断論理は逆です.

利点

- 異なる期間の複数のSMAを組み合わせることで,市場の傾向を効果的に決定することができます.

- SMA値を比較することで,入口と出口に関する定量的なルールが生成される.

- ZeroLagEMAフィルターは不要な取引を避け,安定性を向上させます.

- トレンド判断とトレード信号を組み合わせることで トレンドをフォローするトレンドが得られます

リスク と 解決策

- 市場が整合状態に入ると,頻繁なSMAクロスオーバーは多余損失を引き起こす可能性があります.

- 解決策: 無効な信号入力を避けるために ZeroLagEMA フィルターを増加させる.

- 複数の期間のSMAから判断すると,短期の急激な価格変動に迅速に対応できず,少し遅れている.

- 解決策:判断を助けるためにMACDのようなより速い指標を追加します.

オプティマイゼーションの方向性

- 最適な組み合わせを見つけるために SMA 周期パラメータを最適化します

- ストップ・ロスの戦略を追加します.

- ポジションサイズメカニズムを追加し,強いトレンドでの賭けを増やし,統合での賭けを減らす.

- MACDやKDJなどの補助指標を追加して 全体的な安定性を向上させる

結論

この戦略は,複数の期間のSMAを組み合わせて市場傾向を効果的に決定し,定量化された取引信号を生成する. ZeroLagEMAは,勝利率を改善する. 要するに,この戦略は,注目すべき結果を得て,取引後に定量的な傾向を達成した.さらなる最適化期間,ストップ損失,ポジションサイジングなど,ライブ取引のための戦略を強化することができます.

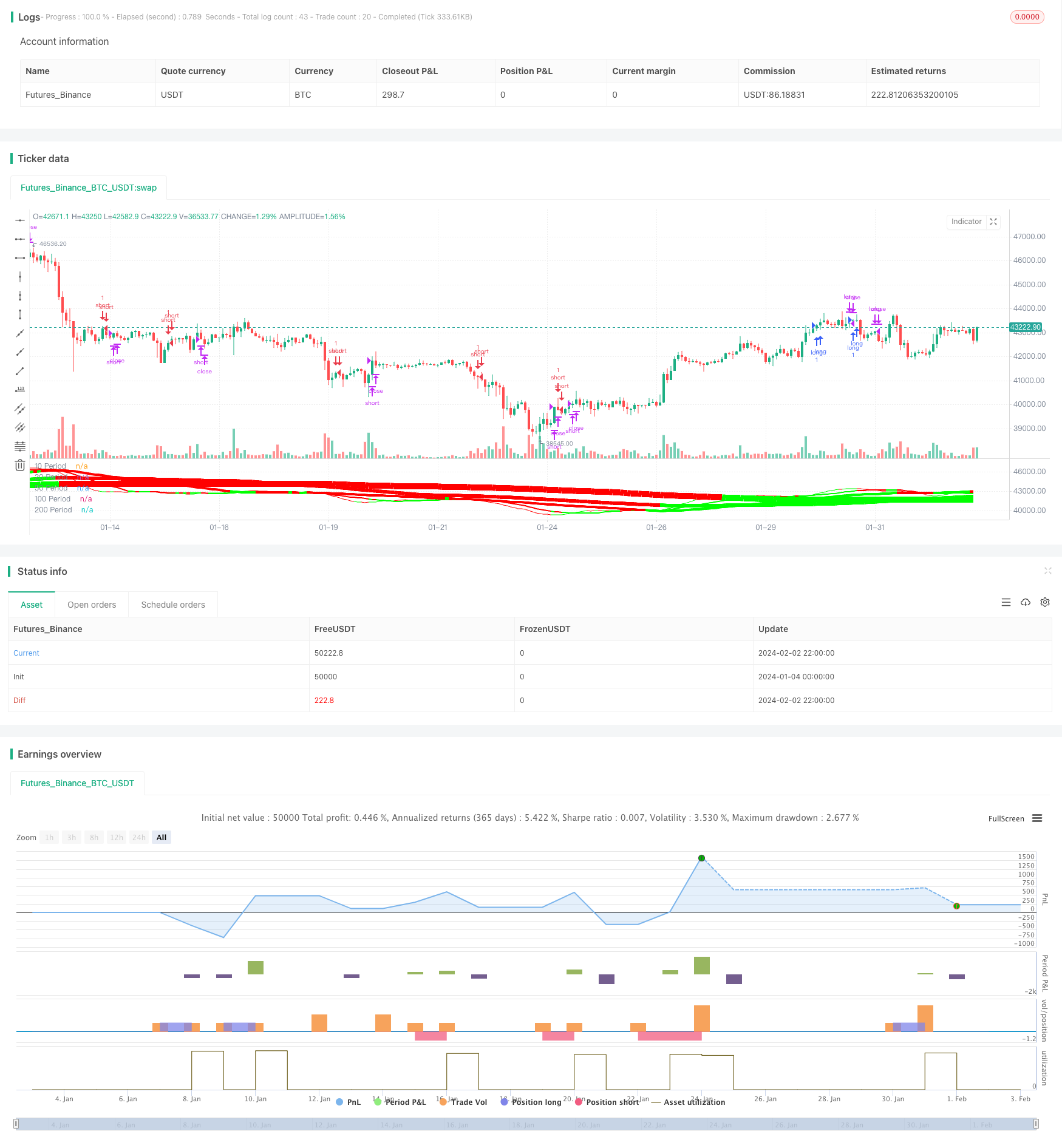

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Forex MA Racer - SMA Performance /w ZeroLag EMA Trigger", shorttitle = "FX MA Racer (5x SMA, 2x zlEMA)", overlay=false )

// === INPUTS ===

hr0 = input(defval = true, title = "=== SERIES INPUTS ===")

smaSource = input(defval = close, title = "SMA Source")

sma1Length = input(defval = 10, title = "SMA 1 Length")

sma2Length = input(defval = 20, title = "SMA 2 Length")

sma3Length = input(defval = 50, title = "SMA 3 Length")

sma4Length = input(defval = 100, title = "SMA 4 Length")

sma5Length = input(defval = 200, title = "SMA 5 Length")

smaDirSpan = input(defval = 4, title = "SMA Direction Span")

zlmaSource = input(defval = close, title = "ZeroLag EMA Source")

zlmaFastLength = input(defval = 9, title = "ZeroLag EMA Fast Length")

zlmaSlowLength = input(defval = 21, title = "ZeroLag EMA Slow Length")

hr1 = input(defval = true, title = "=== PLOT TIME LIMITER ===")

useTimeLimit = input(defval = true, title = "Use Start Time Limiter?")

// set up where we want to run from

startYear = input(defval = 2018, title = "Start From Year", minval = 0, step = 1)

startMonth = input(defval = 02, title = "Start From Month", minval = 0,step = 1)

startDay = input(defval = 01, title = "Start From Day", minval = 0,step = 1)

startHour = input(defval = 00, title = "Start From Hour", minval = 0,step = 1)

startMinute = input(defval = 00, title = "Start From Minute", minval = 0,step = 1)

hr2 = input(defval = true, title = "=== TRAILING STOP ===")

useStop = input(defval = false, title = "Use Trailing Stop?")

slPoints = input(defval = 200, title = "Stop Loss Trail Points", minval = 1)

slOffset = input(defval = 400, title = "Stop Loss Trail Offset", minval = 1)

// === /INPUTS ===

// === SERIES SETUP ===

// Fast ZeroLag EMA

zema1=ema(zlmaSource, zlmaFastLength)

zema2=ema(zema1, zlmaFastLength)

d1=zema1-zema2

zlemaFast=zema1+d1

// Slow ZeroLag EMA

zema3=ema(zlmaSource, zlmaSlowLength)

zema4=ema(zema3, zlmaSlowLength)

d2=zema3-zema4

zlemaSlow=zema3+d2

// Simple Moving Averages

period10 = sma(close, sma1Length)

period20 = sma(close, sma2Length)

period50 = sma(close, sma3Length)

period100 = sma(close, sma4Length)

period200 = sma(close, sma5Length)

// === /SERIES SETUP ===

// === PLOT ===

// colors of plotted MAs

p1 = (close < period10) ? #FF0000 : #00FF00

p2 = (close < period20) ? #FF0000 : #00FF00

p3 = (close < period50) ? #FF0000 : #00FF00

p4 = (close < period100) ? #FF0000 : #00FF00

p5 = (close < period200) ? #FF0000 : #00FF00

plot(period10, title='10 Period', color = p1, linewidth=1)

plot(period20, title='20 Period', color = p2, linewidth=2)

plot(period50, title='50 Period', color = p3, linewidth=4)

plot(period100, title='100 Period', color = p4, linewidth=6)

plot(period200, title='200 Period', color = p5, linewidth=10)

// === /PLOT ===

//BFR = BRFIB ? (maFast+maSlow)/2 : abs(maFast - maSlow)

// === STRATEGY ===

// calculate SMA directions

direction10 = rising(period10, smaDirSpan) ? +1 : falling(period10, smaDirSpan) ? -1 : 0

direction20 = rising(period20, smaDirSpan) ? +1 : falling(period20, smaDirSpan) ? -1 : 0

direction50 = rising(period50, smaDirSpan) ? +1 : falling(period50, smaDirSpan) ? -1 : 0

direction100 = rising(period100, smaDirSpan) ? +1 : falling(period100, smaDirSpan) ? -1 : 0

direction200 = rising(period200, smaDirSpan) ? +1 : falling(period200, smaDirSpan) ? -1 : 0

// conditions

// SMA Direction Trigger

dirUp = direction10 > 0 and direction20 > 0 and direction100 > 0 and direction200 > 0

dirDn = direction10 < 0 and direction20 < 0 and direction100 < 0 and direction200 < 0

longCond = (period10>period20) and (period20>period50) and (period50>period100) and dirUp//and (close > period10) and (period50>period100) //and (period100>period200)

shortCond = (period10<period20) and (period20<period50) and dirDn//and (period50<period100) and (period100>period200)

longExit = crossunder(zlemaFast, zlemaSlow) or crossunder(period10, period20)

shortExit = crossover(zlemaFast, zlemaSlow) or crossover(period10, period20)

// entries and exits

startTimeOk() =>

// get our input time together

inputTime = timestamp(syminfo.timezone, startYear, startMonth, startDay, startHour, startMinute)

// check the current time is greater than the input time and assign true or false

timeOk = time > inputTime ? true : false

// last line is the return value, we want the strategy to execute if..

// ..we are using the limiter, and the time is ok -OR- we are not using the limiter

r = (useTimeLimit and timeOk) or not useTimeLimit

if( true )

// entries

strategy.entry("long", strategy.long, when = longCond)

strategy.entry("short", strategy.short, when = shortCond)

// trailing stop

if (useStop)

strategy.exit("XL", from_entry = "long", trail_points = slPoints, trail_offset = slOffset)

strategy.exit("XS", from_entry = "short", trail_points = slPoints, trail_offset = slOffset)

// exits

strategy.close("long", when = longExit)

strategy.close("short", when = shortExit)

// === /STRATEGY ===

もっと

- RSIとボリンジャー・バンドに基づいた定量的な取引戦略

- SMAとローリングトレンドラインに基づいた定量的な取引戦略

- ストカスティック・ウィークリー・オプション・トレーディング・戦略

- 強力な EMA と RSI の量的な取引戦略

- Bollinger Bands と RSI 組み合わせの取引戦略

- デミゴッドキャンドルスタイク MACD ダイバージェンス トレンド 戦略をフォローする

- 2つの移動平均のクロスタイムフレーム取引戦略

- 双指標ストカスティックRSIとEMA取引戦略

- 戦略をフォローするSMAクロスオーバー上昇傾向

- ボリンジャー・バンドス ブレイク量的な取引戦略

- 市場情緒に基づく イチモク・ブレークアウト戦略

- ダイナミックな多指標量的な取引戦略

- コラル・トレンド・プルバック・戦略

- スウィング・トレーディング・戦略

- モメントブレイク・トレード戦略

- トレンドライディング RSI スイングキャプチャー戦略

- 双軌パラボリックSARボリンガー帯戦略

- トリプル指数関数移動平均利益とストップ損失戦略

- ドンチアン運河幅取引戦略

- 最適化された移動平均のクロスオーバー戦略