SSLチャネルと波動トレンドに基づく定量取引戦略

概要

この戦略は,主にSSLチャネル指標と波浪トレンド指標をベースに,他の補助指標と組み合わせて,より完全な量化取引戦略を実現している.この戦略名は,核心指標SSLチャネルと波浪トレンド,および量化取引のキーワードを含んで,要件を満たしている.

戦略原則

この戦略の入場条件は6つあり,その内2つが中心条件であり,具体的には以下の通りである.

- SSL混合指標のベースラインは青 (上昇) または赤 (下降)

- SSLチャネルの指標は上叉 (看板) または下叉 (看板)

- 波動トレンド指数は上叉 (看板) または下叉 (看板)

- 入口K線の高さは値を超えない

- 入口K線はブリン通路内にある.

- 停止点は均線に触れない

これらの6つの条件が同時に満たされると,戦略は多額の入場または空売りを行う.ストップダストはATR指標の数値に基づいて計算され,ストップダストはストップダストのRisk Reward Ratioの倍である.

この戦略は,停止損失設定,ポジションサイズ制御,最大撤回制御を含む完全なリスク管理機構を備えている.同時に,この戦略は,グラフに補助線を描画し,各回の停止位と停止位,および特定の損益状況を直視することができます.これは分析と最適化戦略に非常に役立ちます.

優位分析

この戦略の最大の利点は,SSL通道指標を用いてトレンド方向の判断の正確性が非常に高いこと,再は波浪トレンドなどの指標と連携して確認を行うことで,偽信号を大幅に減らすことができるということです.同時に,厳格な入場条件は,不要な取引を避けるため,取引回数を減らし,取引コストを削減することができます.

さらに,この戦略の完善したリスクと資金管理機構もまた大きな利点である.事前に設定された良い止損と停止戦略は,単一取引の最大損失を効果的に制御することができる.さらに,ポジション規模の制御と組み合わせて,アカウントの最大引き上げを許容範囲で制御することができる.

リスク分析

この戦略の最大のリスクは,厳格な入場条件によっていくつかの取引機会が逃れ,収益性に一定の影響を与えるというものである.市場が揺れ動いているとき,この戦略の収益性も割引される.

また,波動的傾向などの指標は,市場傾向の効果を判断し,偽突破などの市場異常の影響を受けることがあります.この場合,パラメータを調整する必要があり,または他の指標を追加して確認する必要があります.

全体として,この戦略のリスクは制御可能である.パラメータの調整と最適化により,戦略を異なる市場環境により適応させることができる.

最適化の方向

この戦略は,次のいくつかの方向に最適化できます.

波動のトレンドのパラメータを最適化して,トレンドの転換点をより正確に判断します.

KDJ,MACDなどの他の指標を追加して確認し,偽突破の影響を避ける

異なる品種,異なる周期でパラメータを調整して最適化することができ,戦略の安定性を高めることができます.

機械学習アルゴリズムを追加し,歴史データから訓練し,リアルタイムで戦略パラメータを最適化します.

高周波因子などのアルゴリズムを利用して,戦略の取引頻度と収益性を高める

これらの最適化策の実施により,この戦略の収益性と安定性がより高いレベルに達すると期待されています.

要約する

全体として,この戦略は,複数の指標と厳格な入場メカニズムを統合し,高い勝率を確保しながら,良いリスク管理効果も実現している.将来の最適化方向と組み合わせると,この戦略は,大きな発展の可能性があり,推奨される量化取引戦略である.

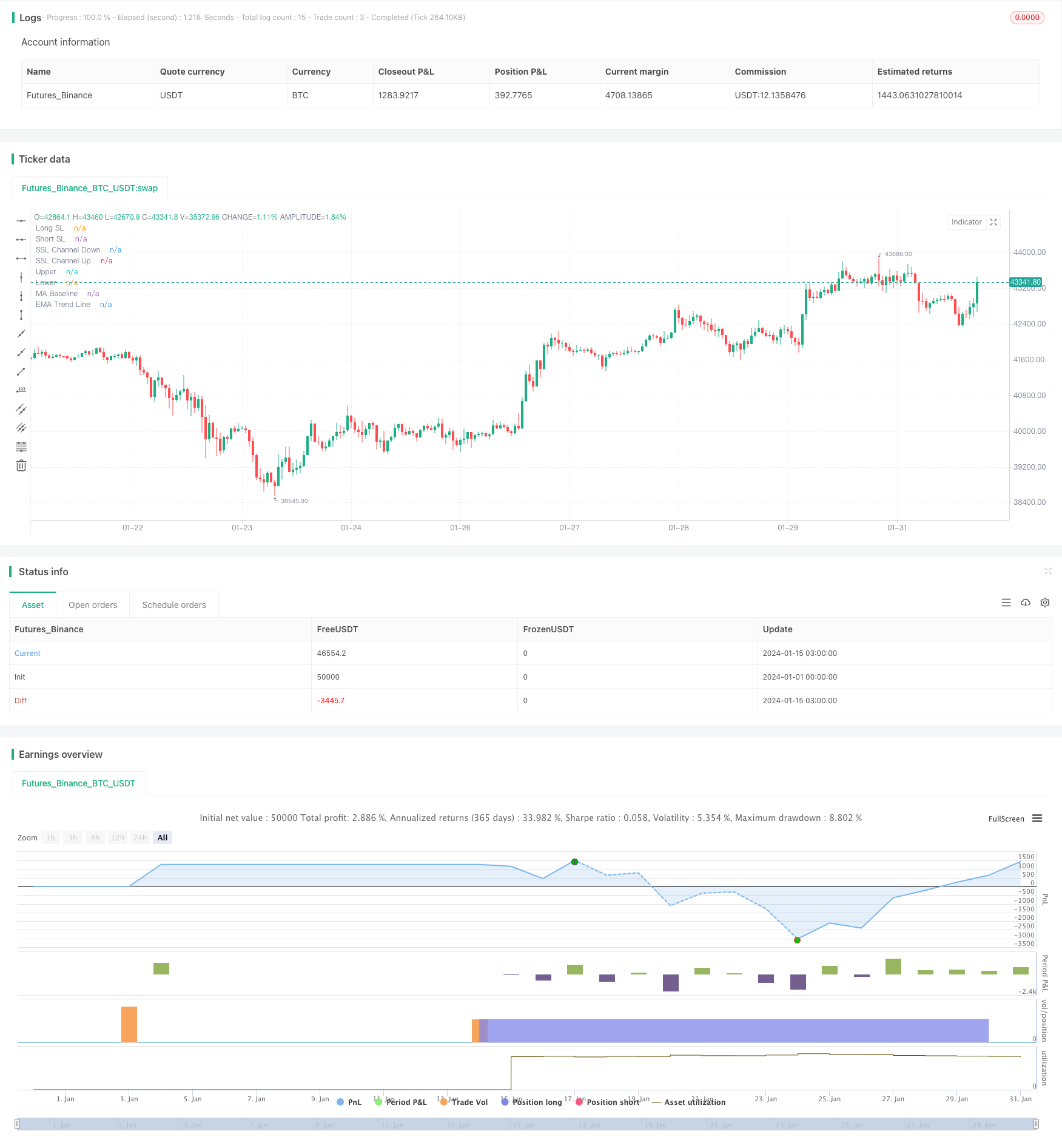

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kevinmck100

// @credits

// - Wave Trend: Indicator: WaveTrend Oscillator [WT] by @LazyBear

// - SSL Channel: SSL channel by @ErwinBeckers

// - SSL Hybrid: SSL Hybrid by @Mihkel00

// - Keltner Channels: Keltner Channels Bands by @ceyhun

// - Candle Height: Candle Height in Percentage - Columns by @FreeReveller

// - NNFX ATR: NNFX ATR by @sueun123

//

// Strategy: Based on the YouTube video "This Unique Strategy Made 47% Profit in 2.5 Months [SSL + Wave Trend Strategy Tested 100 Times]" by TradeSmart.

// @description

//

// Strategy incorporates the following features:

//

// - Risk management: Configurable X% loss per stop loss

// Configurable R:R ratio

//

// - Trade entry: Based on strategy conditions below

//

// - Trade exit: Based on strategy conditions below

//

// - Backtesting: Configurable backtesting range by date

//

// - Chart drawings: Each entry condition indicator can be turned on and off

// TP/SL boxes drawn for all trades. Can be turned on and off

// Trade exit information labels. Can be turned on and off

// NOTE: Trade drawings will only be applicable when using overlay strategies

//

// - Alerting: Alerts on LONG and SHORT trade entries

//

// - Debugging: Includes section with useful debugging techniques

//

// Strategy conditions:

//

// - Trade entry: LONG: C1: SSL Hybrid baseline is BLUE

// C2: SSL Channel crosses up (green on top)

// C3: Wave Trend crosses up (represented by pink candle body)

// C4: Entry candle height is not greater than configured threshold

// C5: Entry candle is inside Keltner Channel (wicks or body depending on configuration)

// C6: Take Profit target does not touch EMA (represents resistance)

//

// SHORT: C1: SSL Hybrid baseline is RED

// C2: SSL Channel crosses down (red on top)

// C3: Wave Trend crosses down (represented by orange candle body)

// C4: Entry candle height is not greater than configured threshold

// C5: Entry candle is inside Keltner Channel (wicks or body depending on configuration)

// C6: Take Profit target does not touch EMA (represents support)

//

// - Trade exit: Stop Loss: Size configurable with NNFX ATR multiplier

// Take Profit: Calculated from Stop Loss using R:R ratio

//@version=5

INITIAL_CAPITAL = 1000

DEFAULT_COMMISSION = 0.02

MAX_DRAWINGS = 500

IS_OVERLAY = true

strategy("SSL + Wave Trend Strategy", overlay = IS_OVERLAY, initial_capital = INITIAL_CAPITAL, currency = currency.NONE, max_labels_count = MAX_DRAWINGS, max_boxes_count = MAX_DRAWINGS, max_lines_count = MAX_DRAWINGS, default_qty_type = strategy.cash, commission_type = strategy.commission.percent, commission_value = DEFAULT_COMMISSION)

// =============================================================================

// INPUTS

// =============================================================================

// ----------------------

// Trade Entry Conditions

// ----------------------

useSslHybrid = input.bool (true, "Use SSL Hybrid Condition", group = "Strategy: Entry Conditions", inline = "SC1")

useKeltnerCh = input.bool (true, "Use Keltner Channel Condition ", group = "Strategy: Entry Conditions", inline = "SC2")

keltnerChWicks = input.bool (true, "Keltner Channel Include Wicks", group = "Strategy: Entry Conditions", inline = "SC2")

useEma = input.bool (true, "Target not touch EMA Condition", group = "Strategy: Entry Conditions", inline = "SC3")

useCandleHeight = input.bool (true, "Use Candle Height Condition", group = "Strategy: Entry Conditions", inline = "SC4")

candleHeight = input.float (1.0, "Candle Height Threshold ", group = "Strategy: Entry Conditions", inline = "SC5", minval = 0, step = 0.1, tooltip = "Percentage difference between high and low of a candle. Expressed as a decimal. Lowering this value will filter out trades on volatile candles.")

// ---------------------

// Trade Exit Conditions

// ---------------------

slAtrMultiplier = input.float (1.7, "Stop Loss ATR Multiplier ", group = "Strategy: Exit Conditions", inline = "EC1", minval = 0, step = 0.1, tooltip = "Size of StopLoss is determined by multiplication of ATR value. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

// ---------------

// Risk Management

// ---------------

riskReward = input.float (2.5, "Risk : Reward 1 :", group = "Strategy: Risk Management", inline = "RM1", minval = 0, step = 0.1, tooltip = "Used to determine Take Profit level. Take Profit will be Stop Loss multiplied by this value.")

accountRiskPercent = input.float (1, "Portfolio Risk % ", group = "Strategy: Risk Management", inline = "RM2", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

// ----------

// Date Range

// ----------

startYear = input.int (2022, "Start Date ", group = "Strategy: Date Range", inline = "DR1", minval = 1900, maxval = 2100)

startMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

startDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

endYear = input.int (2100, "End Date ", group = "Strategy: Date Range", inline = "DR2", minval = 1900, maxval = 2100)

endMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

endDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

// ----------------

// Display Settings

// ----------------

showTpSlBoxes = input.bool (true, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "D1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

showLabels = input.bool (false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "D2", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

// ------------------

// Indicator Settings

// ------------------

// Indicator display options

showSslHybrid = input.bool (true, "Show SSL Hybrid", group = "Indicators: Drawings", inline = "ID1")

showSslChannel = input.bool (true, "Show SSL Channel", group = "Indicators: Drawings", inline = "ID2")

showEma = input.bool (true, "Show EMA", group = "Indicators: Drawings", inline = "ID3")

showKeltner = input.bool (true, "Show Keltner Channel", group = "Indicators: Drawings", inline = "ID4")

showWaveTrend = input.bool (true, "Show Wave Trend Flip Candles", group = "Indicators: Drawings", inline = "ID5")

showAtrSl = input.bool (true, "Show ATR Stop Loss Bands", group = "Indicators: Drawings", inline = "ID6")

// Wave Trend Settings

n1 = input.int (10, "Channel Length ", group = "Indicators: Wave Trend", inline = "WT1")

n2 = input.int (21, "Average Length ", group = "Indicators: Wave Trend", inline = "WT2")

obLevel1 = input.int (60, "Over Bought Level 1 ", group = "Indicators: Wave Trend", inline = "WT3")

obLevel2 = input.int (53, "Over Bought Level 2 ", group = "Indicators: Wave Trend", inline = "WT4")

osLevel1 = input.int (-60, "Over Sold Level 1 ", group = "Indicators: Wave Trend", inline = "WT5")

osLevel2 = input.int (-53, "Over Sold Level 2 ", group = "Indicators: Wave Trend", inline = "WT6")

// SSL Channel Settings

sslChLen = input.int (10, "Period ", group = "Indicators: SSL Channel", inline = "SC1")

// SSL Hybrid Settings

// Show/hide Inputs

show_color_bar = input.bool (false, "Show Color Bars", group = "Indicators: SSL Hybrid", inline = "SH2")

// Baseline Inputs

maType = input.string ("HMA", "Baseline Type ", group = "Indicators: SSL Hybrid", inline = "SH3", options=["SMA", "EMA", "DEMA", "TEMA", "LSMA", "WMA", "MF", "VAMA", "TMA", "HMA", "JMA", "Kijun v2", "EDSMA", "McGinley"])

len = input.int (60, "Baseline Length ", group = "Indicators: SSL Hybrid", inline = "SH4")

src = input.source (close, "Source ", group = "Indicators: SSL Hybrid", inline = "SH5")

kidiv = input.int (1, "Kijun MOD Divider ", group = "Indicators: SSL Hybrid", inline = "SH6", maxval=4)

jurik_phase = input.int (3, "* Jurik (JMA) Only - Phase ", group = "Indicators: SSL Hybrid", inline = "SH7")

jurik_power = input.int (1, "* Jurik (JMA) Only - Power ", group = "Indicators: SSL Hybrid", inline = "SH8")

volatility_lookback = input.int (10, "* Volatility Adjusted (VAMA) Only - Volatility lookback length", group = "Indicators: SSL Hybrid", inline = "SH9")

//Modular Filter Inputs

beta = input.float (0.8, "Modular Filter, General Filter Only - Beta ", group = "Indicators: SSL Hybrid", inline = "SH10", minval=0, maxval=1, step=0.1)

feedback = input.bool (false, "Modular Filter Only - Feedback", group = "Indicators: SSL Hybrid", inline = "SH11")

z = input.float (0.5, "Modular Filter Only - Feedback Weighting ", group = "Indicators: SSL Hybrid", inline = "SH12", step=0.1, minval=0, maxval=1)

//EDSMA Inputs

ssfLength = input.int (20, "EDSMA - Super Smoother Filter Length ", group = "Indicators: SSL Hybrid", inline = "SH13", minval=1)

ssfPoles = input.int (2, "EDSMA - Super Smoother Filter Poles ", group = "Indicators: SSL Hybrid", inline = "SH14", options=[2, 3])

///Keltner Baseline Channel Inputs

useTrueRange = input.bool (true, "Use True Range?", group = "Indicators: SSL Hybrid", inline = "SH15")

multy = input.float (0.2, "Base Channel Multiplier ", group = "Indicators: SSL Hybrid", inline = "SH16", step=0.05)

// EMA Settings

emaLength = input.int (200, "EMA Length ", group = "Indicators: EMA", inline = "E1", minval = 1)

// Keltner Channel Settings

kcLength = input.int (20, "Length ", group = "Indicators: Keltner Channel", inline = "KC1", minval=1)

kcMult = input.float (1.5, "Multiplier ", group = "Indicators: Keltner Channel", inline = "KC2")

kcSrc = input.source (close, "Source ", group = "Indicators: Keltner Channel", inline = "KC3")

alen = input.int (10, "ATR Length ", group = "Indicators: Keltner Channel", inline = "KC4", minval=1)

// Candle Height in Percentage Settings

chPeriod = input.int (20, "Period ", group = "Indicators: Candle Height", inline = "CH1")

// NNFX ATR Settings

nnfxAtrLength = input.int (14, "Length ", group = "Indicators: NNFX ATR (Stop Loss Settings)", inline = "ATR1", minval = 1)

nnfxSmoothing = input.string ("RMA", "Smoothing ", group = "Indicators: NNFX ATR (Stop Loss Settings)", inline = "ATR3", options = ["RMA", "SMA", "EMA", "WMA"])

// =============================================================================

// INDICATORS

// =============================================================================

// ----------

// Wave Trend

// ----------

ap = hlc3

esa = ta.ema(ap, n1)

d = ta.ema(math.abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ta.ema(ci, n2)

wt1 = tci

wt2 = ta.sma(wt1, 4)

// Show Wave Trend crosses on chart as colour changes (pink bullish, orange bearish)

wtBreakUp = ta.crossover (wt1, wt2)

wtBreakDown = ta.crossunder (wt1, wt2)

barColour = showWaveTrend ? wtBreakUp ? color.fuchsia : wtBreakDown ? color.orange : na : na

barcolor(color = barColour)

// -----------

// SSL Channel

// -----------

smaHigh = ta.sma(high, sslChLen)

smaLow = ta.sma(low, sslChLen)

var int sslChHlv = na

sslChHlv := close > smaHigh ? 1 : close < smaLow ? -1 : sslChHlv[1]

sslChDown = sslChHlv < 0 ? smaHigh : smaLow

sslChUp = sslChHlv < 0 ? smaLow : smaHigh

plot(showSslChannel ? sslChDown : na, "SSL Channel Down", linewidth=1, color=color.new(color.red, 30))

plot(showSslChannel ? sslChUp : na, "SSL Channel Up", linewidth=1, color=color.new(color.lime, 30))

// ----------

// SSL Hybrid

// ----------

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf:= c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == "TMA"

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == "MF"

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = feedback ? z * src + (1 - z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta * b + (1 - beta) * c

lower = beta * c + (1 - beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == "LSMA"

result := ta.linreg(src, len, 0)

result

if type == "SMA" // Simple

result := ta.sma(src, len)

result

if type == "EMA" // Exponential

result := ta.ema(src, len)

result

if type == "DEMA" // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == "TEMA" // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == "WMA" // Weighted

result := ta.wma(src, len)

result

if type == "VAMA" // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, volatility_lookback)

vol_down= ta.lowest(dev, volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == "HMA" // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == "JMA" // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == "Kijun v2"

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / kidiv), ta.highest(len / kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == "McGinley"

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == "EDSMA"

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2 ? get2PoleSSF(avgZeros, ssfLength) : get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter= stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

Keltma = ma(maType, src, len)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, len)

upperk = Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//COLORS

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

//PLOTS

p1 = plot(showSslHybrid ? BBMC : na, color=color.new(color_bar, 0), linewidth=4, title="MA Baseline")

barcolor(show_color_bar ? color_bar : na)

// ---

// EMA

// ---

ema = ta.ema(close, emaLength)

plot(showEma ? ema : na, "EMA Trend Line", color.white)

// ----------------

// Keltner Channels

// ----------------

kcMa = ta.ema(kcSrc, kcLength)

KTop2 = kcMa + kcMult * ta.atr(alen)

KBot2 = kcMa - kcMult * ta.atr(alen)

upperPlot = plot(showKeltner ? KTop2 : na, color=color.new(color.blue, 0), title="Upper", style = plot.style_stepline)

lowerPlot = plot(showKeltner ? KBot2 : na, color=color.new(color.blue, 0), title="Lower", style = plot.style_stepline)

// ---------------------------

// Candle Height in Percentage

// ---------------------------

percentHL = (high - low) / low * 100

percentRed = open > close ? (open - close) / close * 100 : 0

percentGreen= open < close ? (close - open) / open * 100 : 0

// --------

// NNFX ATR

// --------

function(source, length) =>

if nnfxSmoothing == "RMA"

ta.rma(source, nnfxAtrLength)

else

if nnfxSmoothing == "SMA"

ta.sma(source, nnfxAtrLength)

else

if nnfxSmoothing == "EMA"

ta.ema(source, nnfxAtrLength)

else

ta.wma(source, nnfxAtrLength)

formula(number, decimals) =>

factor = math.pow(10, decimals)

int(number * factor) / factor

nnfxAtr = formula(function(ta.tr(true), nnfxAtrLength), 5) * slAtrMultiplier

//Sell

longSlAtr = nnfxAtrLength ? close - nnfxAtr : close + nnfxAtr

shortSlAtr = nnfxAtrLength ? close + nnfxAtr : close - nnfxAtr

plot(showAtrSl ? longSlAtr : na, "Long SL", color = color.new(color.red, 35), linewidth = 1, trackprice = true, editable = true, style = plot.style_stepline)

plot(showAtrSl ? shortSlAtr : na, "Short SL", color = color.new(color.red, 35), linewidth = 1, trackprice = true, editable = true, style = plot.style_stepline)

// =============================================================================

// FUNCTIONS

// =============================================================================

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// See strategy description at top for details on trade entry/exit logis

// ----------

// CONDITIONS

// ----------

// Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

// Exit calculations

slAmount = nnfxAtr

slPercent = math.abs((1 - (close - slAmount) / close) * 100)

tpPercent = slPercent * riskReward

tpPoints = percentAsPoints(tpPercent)

tpTarget = calcProfitTrgtPrice(tpPoints, wtBreakUp)

inDateRange = true

// Condition 1: SSL Hybrid blue for long or red for short

bullSslHybrid = useSslHybrid ? close > upperk : true

bearSslHybrid = useSslHybrid ? close < lowerk : true

// Condition 2: SSL Channel crosses up for long or down for short

bullSslChannel = ta.crossover(sslChUp, sslChDown)

bearSslChannel = ta.crossover(sslChDown, sslChUp)

// Condition 3: Wave Trend crosses up for long or down for short

bullWaveTrend = wtBreakUp

bearWaveTrend = wtBreakDown

// Condition 4: Entry candle heignt <= 0.6 on Candle Height in Percentage

candleHeightValid = useCandleHeight ? percentGreen <= candleHeight and percentRed <= candleHeight : true

// Condition 5: Entry candle is inside Keltner Channel

withinCh = keltnerChWicks ? high < KTop2 and low > KBot2 : open < KTop2 and close < KTop2 and open > KBot2 and close > KBot2

insideKeltnerCh = useKeltnerCh ? withinCh : true

// Condition 6: TP target does not touch 200 EMA

bullTpValid = useEma ? not (close < ema and tpTarget > ema) : true

bearTpValid = useEma ? not (close > ema and tpTarget < ema) : true

// Combine all entry conditions

goLong = inDateRange and bullSslHybrid and bullSslChannel and bullWaveTrend and candleHeightValid and insideKeltnerCh and bullTpValid

goShort = inDateRange and bearSslHybrid and bearSslChannel and bearWaveTrend and candleHeightValid and insideKeltnerCh and bearTpValid

// Entry decisions

openLong = (goLong and not inLong)

openShort = (goShort and not inShort)

flippingSides = (goLong and inShort) or (goShort and inLong)

enteringTrade = openLong or openShort

inTrade = inLong or inShort

// Risk calculations

riskAmt = strategy.equity * accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

alert(message="BUY Trade Entry Alert", freq=alert.freq_once_per_bar_close)

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

alert(message="SELL Trade Entry Alert", freq=alert.freq_once_per_bar_close)

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// =============================================================================

// DRAWINGS

// =============================================================================

// -----------

// TP/SL Boxes

// -----------

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

entryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

// Print boxes for trades closed at profit or loss

if (inTrade and exitTriggered)

inShort := false

inLong := false

// printTpSlHitBox(tradeEntryBar + 1, bar_index, slHit, tpHit, entryPrice, slPrice, tpPrice)

// printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, entryPrice, pnl)

// Print TP/SL box for current open trade

if barstate.islastconfirmedhistory and strategy.position_size != 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// =============================================================================

// DEBUGGING

// =============================================================================

// Data window plots

plotchar(goLong, "Enter Long", "")

plotchar(goShort, "Enter Short", "")