再帰的移動トレンド移動平均と123パターン反転を組み合わせた組み合わせ戦略

作成日:

2024-02-21 16:02:32

最終変更日:

2024-02-21 16:02:32

コピー:

3

クリック数:

708

1

フォロー

1628

フォロワー

概要

この戦略は,回帰移動均線と123形反転の2つの戦略を組み合わせて,戦略の安定性と収益性を向上させるための総合的な信号を形成します.

原則

123 形を逆転する

このセクションは,Ulf Jensenの”私はどのように期貨市場で3倍の収益を上げることができるか”という書籍の内容を参考にしています.その買取シグナルは:近2日収束価格が上昇し,9日周期のSTO SLOWK値が50を下回ったときに多めに買い;売りシグナルは:近2日収束価格が低下し,9日周期のSTO FASTK値が50を下回ったときに空きです.

転帰移動平均線

この部分は,回帰多項式合称と呼ばれる技術を採用している.このアイデアは,過去数日の価格と,その日の価格を使用して,次の日の価格を予測することである.予測価格が昨日実際の価格よりも高いとき,空を見,逆に,見ることが多い.

利点

この組み合わせ戦略は,2つの戦略の優位性を発揮し,単一の戦略の限界を回避します.123形状の逆転は,価格が逆転するときに大きな動きを捉えることができます.また,リケージー移動平均線は,価格の動きの方向をより正確に判断することができます.両者は組み合わせて,より強力な統合信号を形成することができます.

リスクと解決策

- 123形反転は,短期的な価格変動により誤信号を発する可能性がある。ノイズをフィルターするためにパラメータを適切に調整できます。

- 転帰的移動傾向均線は突発的な出来事に対する反応が遅いかもしれない.局所的な傾向を判断するために他の指標と組み合わせて考慮することができる.

- 2つの戦略信号が一致しない場合がある.この場合,双方の信号が出たときにのみポジションを開くことを考慮するか,市場状況に応じて1つの信号のみに従うことを選択する.

最適化の方向

- 異なる周期パラメータの組み合わせをテストし,最適なパラメータペアを探します.

- 自動ストップメカニズムを導入できます

- 異なる品種や市場環境に応じてパラメータを調整できます

- 他の戦略や指標と組み合わせることで,より強力な統合システムを作ることが考えられます.

要約する

この戦略は,2つの異なるタイプの戦略を統合して使用し,統合信号を生成することによって安定性を高めます.同時に,両者の優位性を組み合わせて,価格の逆転点でキャッチし,価格の将来の動きを判断できます.継続的な最適化であれば,より優れたパフォーマンスを期待できます.

ストラテジーソースコード

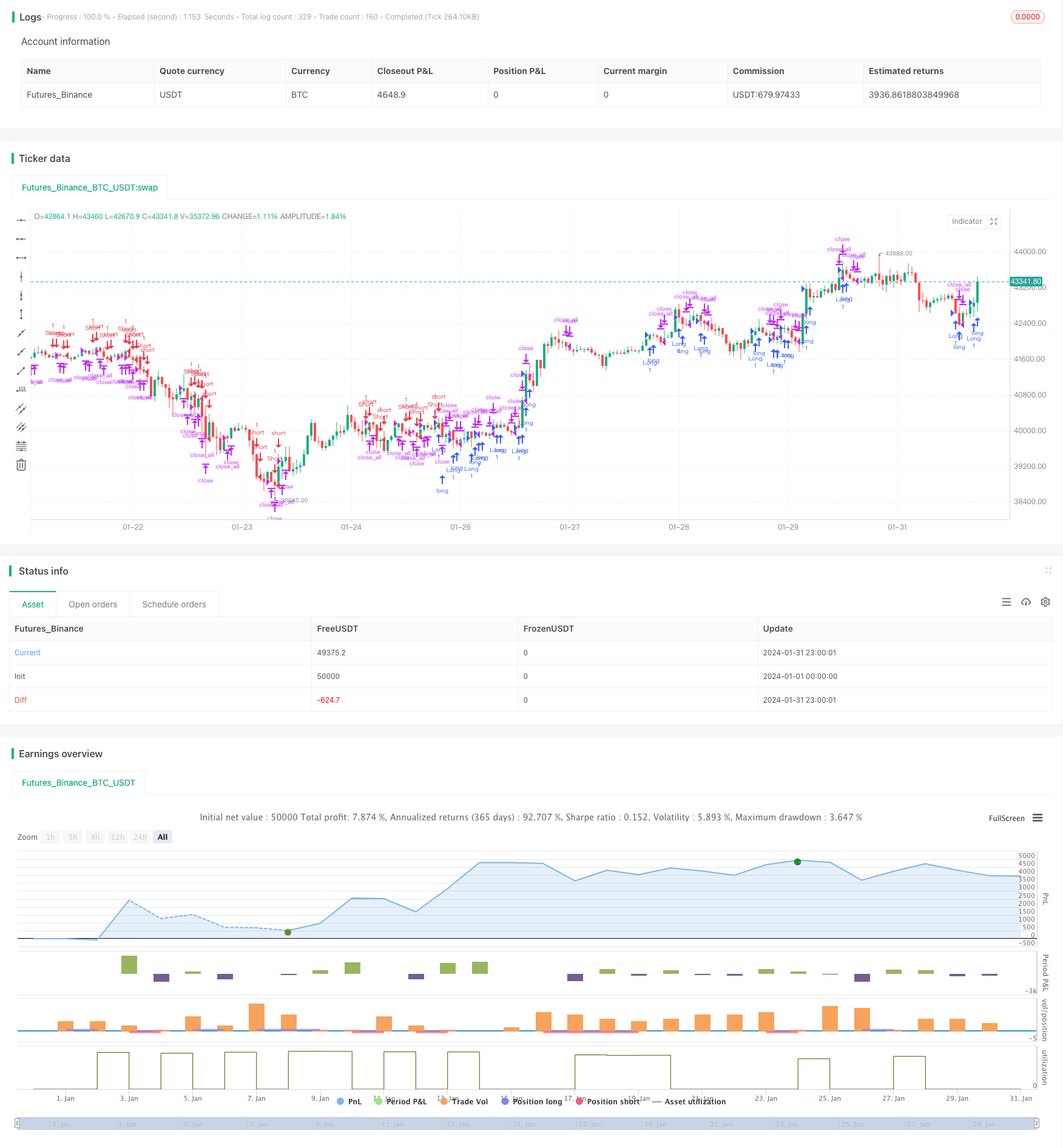

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 01/06/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Taken from an article "The Yen Recused" in the December 1998 issue of TASC,

// written by Dennis Meyers. He describes the Recursive MA in mathematical terms

// as "recursive polynomial fit, a technique that uses a small number of past values

// of the estimated price and today's price to predict tomorrows price."

// Red bars color - short position. Green is long.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

RMTA(Length) =>

pos = 0.0

Bot = 0.0

nRes = 0.0

Alpha = 2 / (Length+1)

Bot := (1-Alpha) * nz(Bot[1],close) + close

nRes := (1-Alpha) * nz(nRes[1],close) + (Alpha*(close + Bot - nz(Bot[1], 0)))

pos:= iff(nRes > close[1], -1,

iff(nRes < close[1], 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Recursive Moving Trend Average", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Recursive Moving Trend Average ----")

LengthRMTA = input(21, minval=3)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posRMTA = RMTA(LengthRMTA)

pos = iff(posReversal123 == 1 and posRMTA == 1 , 1,

iff(posReversal123 == -1 and posRMTA == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )