高速RSI反転取引戦略

作成日:

2024-03-01 11:55:56

最終変更日:

2024-03-01 11:55:56

コピー:

2

クリック数:

633

1

フォロー

1628

フォロワー

概要

急速RSI反転取引戦略は,急速RSI指標,K線実体フィルター,最大最小値フィルター,SMA均線フィルターを組み合わせてトレンド反転ポイントを判断し,低リスクの反転取引を実現する.この戦略は,短期的な反転機会を捕捉することを目的としている.

戦略原則

この戦略は,以下の指標に基づいて判断されます.

RSIの指標として,: RSIをRMA関数で計算し,より迅速なオーバーバイオーバーセール信号をキャッチするために,より敏感にします.

K線実体フィルター: K線実体サイズがEMA実体平均線の1/5を超えることを要求し,の変化が小さい場合.

最大最小値のフィルター価格の革新が高かったか低かったかを判断し,トレンドの逆転を確認する.

SMA均線フィルター価格がSMA平均線を突破し,判断基準を増やすことを要求する.

上記の複数の条件が同時にトリガーされたときに取引シグナルが生成される.具体的論理は:

多頭入場:急速RSI指標は超売り区域より低いAND K線はEMA線より大きいANDは最小値でBREAK ANDの価格がSMA線を越える

空頭入場:急速なRSI指標が超売り区域より高いAND K線実体がEMA実体平均線より大きいANDの最大値がBREAK AND価格の下を通過するSMA平均線

値退出:急速なRSIが正常に戻る

戦略的優位性

この戦略の利点は以下の通りです.

- 短期的な反転による波動を捉える

- RSIは非常に敏感です.

- マルチフィルタリングにより偽信号が減少する

- リスクは管理可能で,撤退は少ない.

リスクと最適化

この戦略にはいくつかのリスクがあります.

- 逆転の失敗によるリスク

- パラメータの最適化スペースは限られています.

更に最適化するには

- 取引量フィルターと組み合わせた

- ストップ・ロスの策略を増やす

- オプティマイズパラメータの組み合わせ

要約する

この戦略は,全体的に低リスクの短期反転取引戦略である.それは,急速なRSI指標によって買い売り点を判断し,複数のフィルターを使用して偽信号を減らすことで,リスクが制御可能な反転取引を実現し,ショートライン操作に適している.この戦略は,さらに最適化され,大きな発展の可能性を持っています.

ストラテジーソースコード

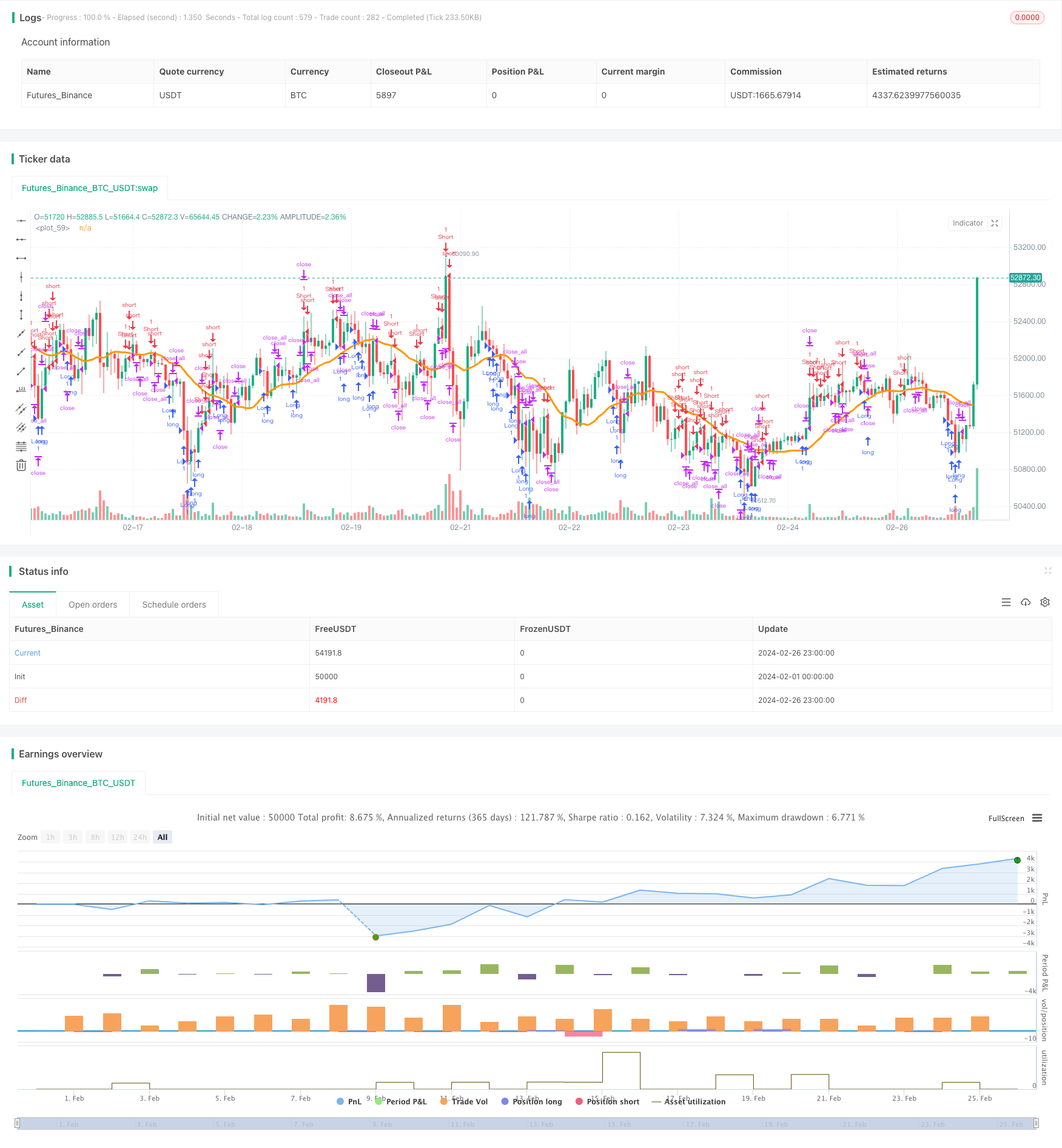

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-26 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=3

strategy(title = "Noro's Fast RSI Strategy v1.4", shorttitle = "Fast RSI str 1.4", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 5)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usersi = input(true, defval = true, title = "Use Fast RSI Strategy")

usemm = input(true, defval = true, title = "Use Min/Max Strategy")

usesma = input(true, defval = true, title = "Use SMA Filter")

smaperiod = input(20, defval = 20, minval = 2, maxval = 1000, title = "SMA Filter Period")

rsiperiod = input(7, defval = 7, minval = 2, maxval = 50, title = "RSI Period")

limit = input(30, defval = 30, minval = 1, maxval = 100, title = "RSI limit")

rsisrc = input(close, defval = close, title = "RSI Price")

rsibars = input(1, defval = 1, minval = 1, maxval = 20, title = "RSI Bars")

mmbars = input(1, defval = 1, minval = 1, maxval = 5, title = "Min/Max Bars")

showsma = input(false, defval = false, title = "Show SMA Filter")

showarr = input(false, defval = false, title = "Show Arrows")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

fastup = rma(max(change(rsisrc), 0), rsiperiod)

fastdown = rma(-min(change(rsisrc), 0), rsiperiod)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Limits

bar = close > open ? 1 : close < open ? -1 : 0

uplimit = 100 - limit

dnlimit = limit

//RSI Bars

upsignal = fastrsi > uplimit ? 1 : 0

dnsignal = fastrsi < dnlimit ? 1 : 0

uprsi = sma(upsignal, rsibars) == 1

dnrsi = sma(dnsignal, rsibars) == 1

//Body

body = abs(close - open)

emabody = ema(body, 30)

//MinMax Bars

min = min(close, open)

max = max(close, open)

minsignal = min < min[1] and bar == -1 and bar[1] == -1 ? 1 : 0

maxsignal = max > max[1] and bar == 1 and bar[1] == 1 ? 1 : 0

mins = sma(minsignal, mmbars) == 1

maxs = sma(maxsignal, mmbars) == 1

//SMA Filter

sma = sma(close, smaperiod)

colorsma = showsma ? blue : na

plot(sma, color = colorsma, linewidth = 3)

//Signals

up1 = bar == -1 and (strategy.position_size == 0 or close < strategy.position_avg_price) and dnrsi and body > emabody / 5 and usersi

dn1 = bar == 1 and (strategy.position_size == 0 or close > strategy.position_avg_price) and uprsi and body > emabody / 5 and usersi

up2 = mins and (close > sma or usesma == false) and usemm

dn2 = maxs and (close < sma or usesma == false) and usemm

exit = ((strategy.position_size > 0 and fastrsi > dnlimit and bar == 1) or (strategy.position_size < 0 and fastrsi < uplimit and bar == -1)) and body > emabody / 2

//Arrows

col = exit ? black : up1 or dn1 ? blue : up2 or dn2 ? red : na

needup = up1 or up2

needdn = dn1 or dn2

needexitup = exit and strategy.position_size < 0

needexitdn = exit and strategy.position_size > 0

plotarrow(showarr and needup ? 1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needdn ? -1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needexitup ? 1 : na, colorup = black, colordown = black, transp = 0)

plotarrow(showarr and needexitdn ? -1 : na, colorup = black, colordown = black, transp = 0)

//Trading

if up1 or up2

strategy.entry("Long", strategy.long, needlong == false ? 0 : na)

if dn1 or dn2

strategy.entry("Short", strategy.short, needshort == false ? 0 : na)

if time > timestamp(toyear, tomonth, today, 00, 00) or exit

strategy.close_all()