概要

この戦略は、移動平均 (MA)、相対力指数 (RSI)、移動平均収束拡散 (MACD)、ボリンジャーバンド (BB) など、いくつかの古典的なテクニカル指標を組み合わせた包括的な取引システムです。システムはこれらの指標の協調的な連携を利用して、市場でより正確な売買シグナルを見つけ、それによって取引の成功率を向上させます。

戦略原則

この戦略では、主に以下の側面を含む多層信号検証メカニズムを採用しています。

- 短期(9日間)と長期(21日間)の移動平均線のクロスオーバーを使用して、基本的なトレンドの方向を決定します。

- RSI(14日間)を使用して買われすぎと売られすぎの領域を特定し、70と30を主要なレベルとして設定します。

- MACD(12、26、9)を使用して、トレンドの強さと可能性のある転換点を確認します。

- ボリンジャーバンド(20日、2標準偏差)を使用して、価格変動の範囲と潜在的な反転ポイントを決定します。

システムは以下の条件下で取引シグナルを生成します。

- 主要な買いシグナル: 短期移動平均が長期移動平均を上回る

- 主要な売りシグナル: 短期移動平均が長期移動平均を下回る

- 補助的な買いシグナル: RSIが30を下回り、MACDヒストグラムがプラスで、価格がボリンジャーバンドの下限に達する

- 補助的な売りシグナル: RSI が 70 を超え、MACD ヒストグラムがマイナスで、価格がボリンジャーバンドの上限に達している

戦略的優位性

- 多次元分析:複数のテクニカル指標を統合することで、より包括的な市場分析の視点が提供されます。

- 信号確認メカニズム:主信号と補助信号の組み合わせにより、誤信号の影響を軽減できます。

- 完璧なリスク管理: ボリンジャーバンドとRSIの組み合わせを使用して、エントリーポイントのリスクを管理します。

- トレンド追跡能力:MAとMACDの連携により、主なトレンドを把握できるだけでなく、トレンドの転換点も特定できます。

- 強力な視覚化効果:システムは、背景色のプロンプトや形状マーカーを含む明確なグラフィカルインターフェースを提供します。

戦略リスク

- シグナルヒステリシス:移動平均自体にヒステリシスがあり、最適ではないエントリーポイントにつながる可能性があります。

- 不安定な市場のリスク: 横ばいで不安定な市場では、誤ったシグナルが頻繁に発生する可能性があります。

- 矛盾する指標: 複数の指標が特定の時間に矛盾するシグナルを生成する可能性がある

- パラメータの感度: 戦略の効果はパラメータ設定に敏感であり、十分なパラメータの最適化が必要です。

戦略最適化の方向性

- 動的パラメータ調整: 各指標のパラメータは市場のボラティリティに応じて自動的に調整されます。

- 市場環境分類: さまざまな市場環境の認識メカニズムを追加し、さまざまな市場状況でさまざまなシグナルの組み合わせを使用します。

- ストップロスメカニズムの改善: トレーリングストップロスやATRベースのストップロスなど、より柔軟なストップロススキームを追加

- ポジション管理の最適化: シグナルの強さと市場のボラティリティに基づいてポジションサイズを動的に調整します

- 時間枠の調整: 信号の信頼性を向上させるために、複数の時間枠分析を追加することを検討してください。

要約する

これは、複数のテクニカル指標の相乗効果を通じて取引シグナルを提供する、適切に設計された多次元取引戦略システムです。この戦略の主な利点は、包括的な分析フレームワークと厳格なシグナル確認メカニズムにありますが、パラメータの最適化や市場環境への適応性などの問題にも注意を払う必要があります。推奨される最適化の方向性では、この戦略にはまだ改善の余地が大いにあります。

ストラテジーソースコード

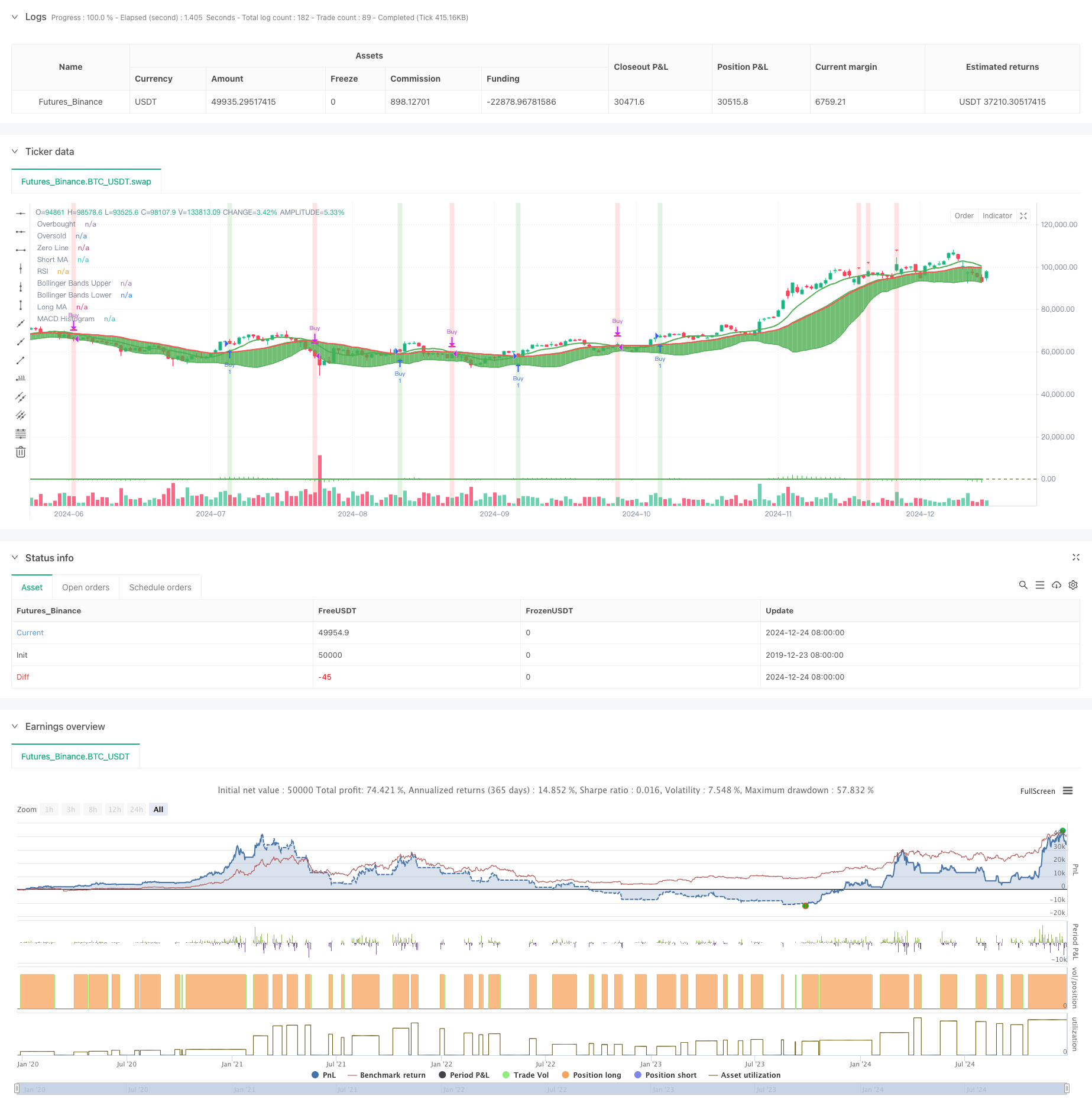

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ultimate Buy/Sell Indicator", overlay=true)

// Inputs for Moving Averages

shortMaLength = input.int(9, title="Short MA Length", minval=1)

longMaLength = input.int(21, title="Long MA Length", minval=1)

// Inputs for RSI

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=1, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=1, maxval=100)

// Inputs for MACD

macdShortLength = input.int(12, title="MACD Short EMA Length", minval=1)

macdLongLength = input.int(26, title="MACD Long EMA Length", minval=1)

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing", minval=1)

// Inputs for Bollinger Bands

bbLength = input.int(20, title="Bollinger Bands Length", minval=1)

bbMultiplier = input.float(2.0, title="Bollinger Bands Multiplier", minval=0.1)

// Calculate Moving Averages

shortMa = ta.sma(close, shortMaLength)

longMa = ta.sma(close, longMaLength)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdShortLength, macdLongLength, macdSignalSmoothing)

macdHist = macdLine - signalLine

// Calculate Bollinger Bands

[bbUpper, bbBasis, bbLower] = ta.bb(close, bbLength, bbMultiplier)

// Define colors

colorPrimary = color.new(color.green, 0)

colorSecondary = color.new(color.red, 0)

colorBackgroundBuy = color.new(color.green, 80)

colorBackgroundSell = color.new(color.red, 80)

colorTextBuy = color.new(color.green, 0)

colorTextSell = color.new(color.red, 0)

// Plot Moving Averages

plot(shortMa, color=colorPrimary, linewidth=2, title="Short MA")

plot(longMa, color=colorSecondary, linewidth=2, title="Long MA")

// Plot Bollinger Bands

bbUpperLine = plot(bbUpper, color=colorPrimary, linewidth=1, title="Bollinger Bands Upper")

bbLowerLine = plot(bbLower, color=colorPrimary, linewidth=1, title="Bollinger Bands Lower")

fill(bbUpperLine, bbLowerLine, color=color.new(colorPrimary, 90))

// Buy/Sell Conditions based on MA cross

buySignal = ta.crossover(shortMa, longMa)

sellSignal = ta.crossunder(shortMa, longMa)

// Execute Buy/Sell Orders

if buySignal

strategy.entry("Buy", strategy.long, 1)

strategy.close("Sell", qty_percent=1) // Close all positions when selling

if sellSignal

strategy.close("Sell", qty_percent=1) // Close all positions when selling

strategy.close("Buy") // Close any remaining buy positions

// Plot Buy/Sell Signals for MA crossovers

plotshape(series=buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Sell Signal")

// Background Color based on Buy/Sell Signal for MA crossovers

bgcolor(buySignal ? colorBackgroundBuy : na, title="Buy Signal Background")

bgcolor(sellSignal ? colorBackgroundSell : na, title="Sell Signal Background")

// Plot RSI with Overbought/Oversold Levels

hline(rsiOverbought, "Overbought", color=colorSecondary, linestyle=hline.style_dashed, linewidth=1)

hline(rsiOversold, "Oversold", color=colorPrimary, linestyle=hline.style_dashed, linewidth=1)

plot(rsi, color=colorPrimary, linewidth=2, title="RSI")

// Plot MACD Histogram

plot(macdHist, color=colorPrimary, style=plot.style_histogram, title="MACD Histogram", linewidth=2)

hline(0, "Zero Line", color=color.new(color.gray, 80))

// Additional Buy/Sell Conditions based on RSI, MACD, and Bollinger Bands

additionalBuySignal = rsi < rsiOversold and macdHist > 0 and close < bbLower

additionalSellSignal = rsi > rsiOverbought and macdHist < 0 and close > bbUpper

// Plot Additional Buy/Sell Signals

plotshape(series=additionalBuySignal and not buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Additional Buy Signal")

plotshape(series=additionalSellSignal and not sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Additional Sell Signal")

// Background Color based on Additional Buy/Sell Signal

bgcolor(additionalBuySignal and not buySignal ? colorBackgroundBuy : na, title="Additional Buy Signal Background")

bgcolor(additionalSellSignal and not sellSignal ? colorBackgroundSell : na, title="Additional Sell Signal Background")