슈퍼 스칼퍼 - 5분 15분

저자:차오장, 날짜: 2022-05-24 16:20:58태그:RMASMAEMAWMARSIATR

이 전략은 RSI와 ATR 밴드를 기반으로 5와 15 분 시간 프레임에서 더 잘 작동합니다. 실시간으로 사용하기 전에 1: 2R로 충분한 백 테스트를 수행하십시오.

스크린 기호에서 거래에 대한 입력만, 추가 구매/판매 알림을 사용하여 수익을 기록하거나 SL를 추적합니다.

또한 65의 골든 크로스 오버와 21의 EMA를 추가했습니다.

백테스트

/*backtest

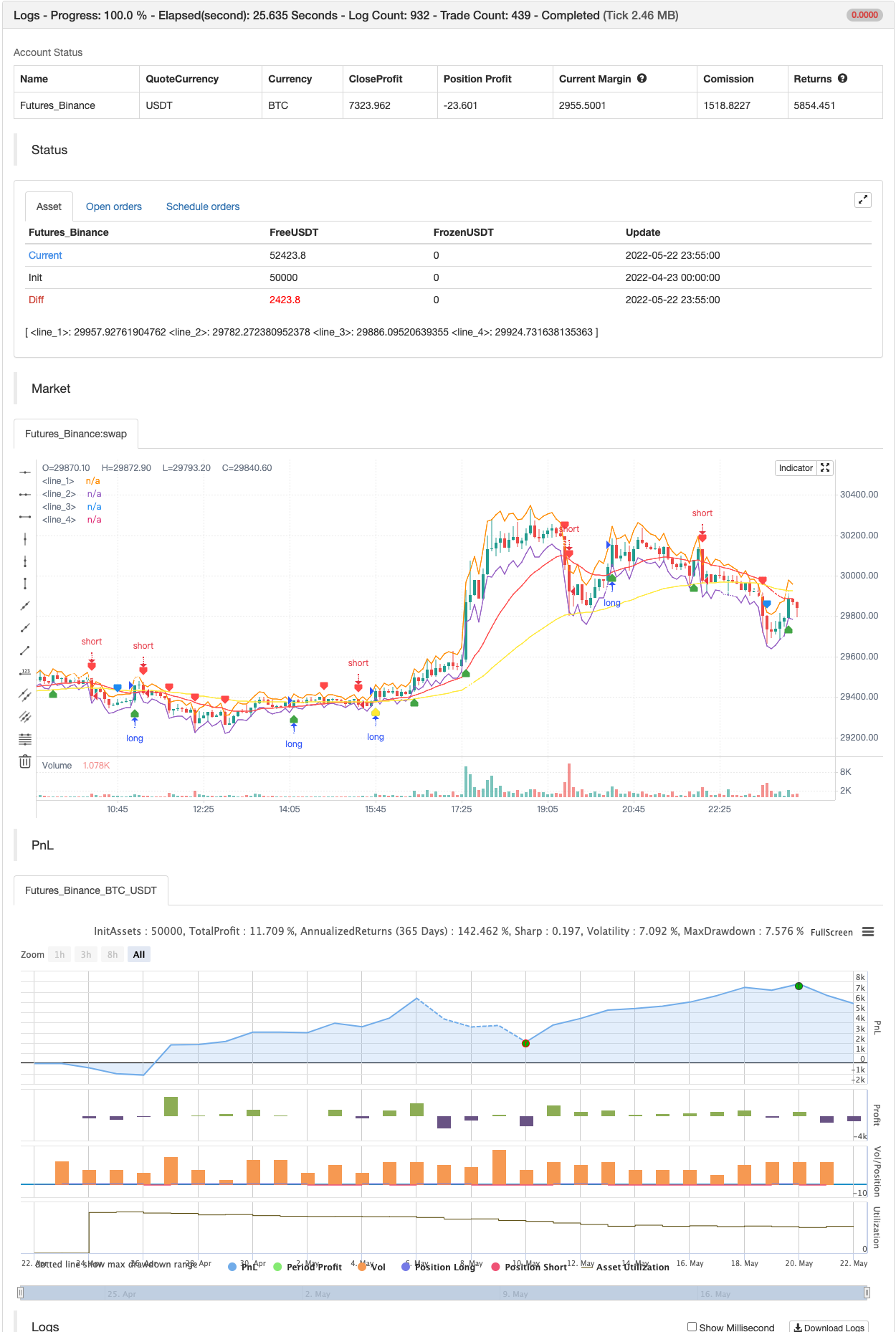

start: 2022-04-23 00:00:00

end: 2022-05-22 23:59:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Revision: Updated script to pine script version 5

//added Double RSI for Long/Short prosition trend confirmation instead of single RSI

strategy("Super Scalper - 5 Min 15 Min", overlay=true)

source = close

atrlen = input.int(14, "ATR Period")

mult = input.float(1, "ATR Multi", step=0.1)

smoothing = input.string(title="ATR Smoothing", defval="WMA", options=["RMA", "SMA", "EMA", "WMA"])

ma_function(source, atrlen) =>

if smoothing == "RMA"

ta.rma(source, atrlen)

else

if smoothing == "SMA"

ta.sma(source, atrlen)

else

if smoothing == "EMA"

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

// Create Indicator's

ShortEMAlen = input.int(21, "Fast EMA")

LongEMAlen = input.int(65, "Slow EMA")

shortSMA = ta.ema(close, ShortEMAlen)

longSMA = ta.ema(close, LongEMAlen)

RSILen1 = input.int(25, "Fast RSI Length")

RSILen2 = input.int(100, "Slow RSI Length")

rsi1 = ta.rsi(close, RSILen1)

rsi2 = ta.rsi(close, RSILen2)

atr = ta.atr(atrlen)

//RSI Cross condition

RSILong = rsi1 > rsi2

RSIShort = rsi1 < rsi2

// Specify conditions

longCondition = open < lower_band

shortCondition = open > upper_band

GoldenLong = ta.crossover(shortSMA,longSMA)

Goldenshort = ta.crossover(longSMA,shortSMA)

plotshape(shortCondition, title="Sell Label", text="Sell", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

plotshape(longCondition, title="Buy Label", text="Buy", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

plotshape(Goldenshort, title="Golden Sell Label", text="Golden Crossover Short", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.blue, textcolor=color.white, transp=0)

plotshape(GoldenLong, title="Golden Buy Label", text="Golden Crossover Long", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.yellow, textcolor=color.white, transp=0)

// Execute trade if condition is True

if (longCondition)

stopLoss = low - atr * 2

takeProfit = high + atr * 5

strategy.entry("long", strategy.long, when = RSILong)

if (shortCondition)

stopLoss = high + atr * 2

takeProfit = low - atr * 5

strategy.entry("short", strategy.short, when = RSIShort)

// Plot ATR bands to chart

////ATR Up/Low Bands

plot(upper_band)

plot(lower_band)

// Plot Moving Averages

plot(shortSMA, color = color.red)

plot(longSMA, color = color.yellow)

관련 내용

- 멀티 슬라이드 오브라인 다이내믹 크로스 트렌드 추적 및 멀티 확인 양적 거래 전략

- 슈퍼 스칼퍼

- ESSMA

- 슈퍼 점프 턴 백 볼링거 밴드

- 구매/판매로 EMA ADX RSI를 스칼핑

- VAWSI와 트렌드 지속적 역전 전략이 결합된 동적 길이를 계산하는 다지표 통합 분석 시스템

- 다일리얼 크로스 보조 RSI 동적 매개 변수 정량화 거래 전략

- 동적 RSI 스마트 선택 시간파운드 거래 전략

- SSL 하이브리드

- 다중 지표 동적 자율 조정 ATR 변동률 전략

더 많은 내용

- 스토카스틱 + RSI, 이중 전략

- 스윙 헐/rsi/EMA 전략

- 스칼핑 스윙 거래 도구 R1-4

- 가장 좋은 삼키기 + 탈출 전략

- Bollinger Awesome 알렛 R1

- 다중 거래소 통합 플러그인

- 삼각수당 (작은 통화의 거래 가격 차이)

- bybit 역계약 동적 격자 (特異格子)

- MT4 MT5 + 동적 변수 NOT-REPAINT

- 매트릭스 시리즈

- 상대적 강도 지수 - 격차 - 자유

- 선형 회귀 ++

- 에너지 바와 함께 레드K 듀얼 바더

- 통합 구역 - 라이브

- 양적 질적 평가

- 이동 평균 크로스 알림, 다중 시간 프레임 (MTF)

- MACD 재충전 전략

- 슈퍼트렌드 이동 평균

- 거래 ABC

- 15MIN BTCUSDTPERP BOT