개요

이 전략은 3개의 오픈소스 지표를 결합하여 여러 시간축의 추세를 판단하고, 수익을 잠금하기 위해 스톱로스를 설정한다. 구체적으로, 전략은 AK MACD BB 지표를 사용하여 단기 트렌드 방향을 판단하고, SSL 지표는 일부 가짜 신호를 필터링하고, 마지막으로 합성 거래량 지표 VSF를 사용하여 실제 매매 의도를 판단하여 현장 시기를 판단한다. 동시에, 전략은 수익을 잠금하기 위해 스톱로스 스톱포드를 미리 설정하여, 단일 거래의 손실 위험을 크게 줄일 수 있다.

전략 원칙

- AK MACD BB 지표

이 지표는 브린 띠를 MACD 지표에 적용하여, MACD 지표선이 브린 띠를 뚫고 궤도에 오르면 구매 신호를 발생시키고, 궤도에 오르면 판매 신호를 발생시킨다.

- SSL 지표

SSL 지표는 가격이 평균선을 뚫고 있는지 판단하고 재검토 신호를 감지한다. 가격 상단선이 평균선을 통과하고 SSL 지표가 파란색이면 상승 추세이며, 가격 하단선이 평균선을 통과하고 SSL 지표가 빨간색이면 하향 추세이며 거래 신호를 낸다.

- VSF 지표

VSF 지표는 구매자와 판매자의 힘을 판단한다. 전략은 구매자 힘이나 판매자 힘이 50% 이상일 때만 신호를 발산하고, 무효 돌파구를 피한다.

- 손해 차단

전략에는 4개의 progressive take profit이 포함되어 있으며, 1.5배에서 3배의 이익 간격이 설정되어 있습니다. 또한 2%의 고정된 스톱로스가 설정되어 있으며, 단일 거래의 최대 손실을 효과적으로 제어합니다.

우위 분석

- 다중 지표 조합, 정확한 판단

다양한 지표로 다중 시간축 트렌드를 판단할 수 있으며, 가짜 신호를 필터링하여 보다 정확한 판단을 할 수 있다.

- 자동 스톱 손실, 위험 제어

전략에 내장된 스톱 스톱 손실 설정으로 단일 거래 손실을 2% 정도로 조절하여 큰 손실을 방지할 수 있다.

- 우수한 데이터입니다.

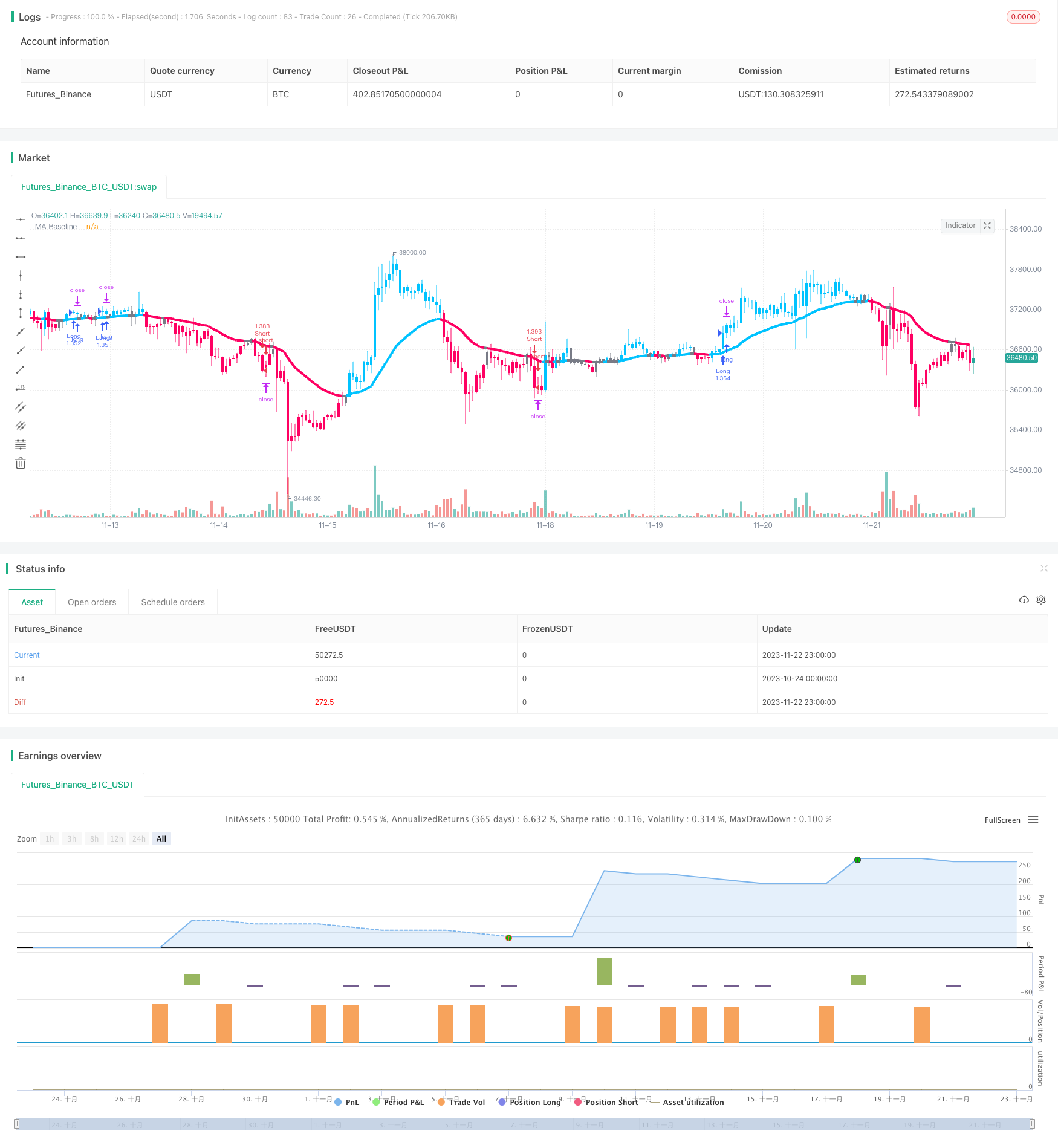

100개의 거래 중 74%의 거래가 수익을 냈고, 427%의 거래가 수익을 냈다고 발표자 회고가 밝혔다.

위험과 대책 분석

- 시장의 급격한 변동 위험

대등급 간격의 흔들림이 있을 때, 수차례의 작은 손실이 발생할 수 있다. 이 때 고정된 중지 손실의 크기를 조정할 수 있다, 또는 거래를 일시 중지할 수 있다.

- 다중 머리 공허 머리 제한 위험

현재 전략은 할 수 있는 것 이상으로 할 수 있다. 할 수 있는 것 이상으로 할 수 있다. 할 수 있는 것 이상으로 할 수 있다.

- 거래 시간 위험

전략은 5분 데이터를 사용하여 판단하고, 거래일 중 몇 시간 정도의 데이터가 있다면 샘플의 양이 부족하고, 신호는 신뢰할 수 없습니다.

전략 최적화 방향

- 정지파수 최적화

다양한 Stop Loss 레벨을 테스트하여 최적의 파라미터를 찾을 수 있다. 너무 작은 Stop Loss은 위험을 효과적으로 제어할 수 없으며, 너무 큰 Stop Loss은 더 많은 수익을 놓칠 수 있다.

- 자동 위치 조정 추가

트래킹 스톱 또는 이동 스톱을 설정하여 수익을 고정시킬 수 있으며 특정 조건에 따라 더 많은 수익을 얻기 위해 포지션을 올릴 수 있습니다.

- 다른 지표와 함께

다른 지표의 조합을 테스트하여 어떤 지표의 조합이 가장 효과적인지를 판단할 수 있다. 또한 더 많은 지표를 추가하여 교차 검증을 할 수 있다.

- 변수 최적화

다른 변수를 통해 재검사하여 변수 최적화 방향을 찾을 수 있다. 이 전략에서, 브린띠 변수 또는 평균선 변수를 변경하면 더 좋은 결과가 나올 수 있다.

요약하다

이 전략은 트렌드 방향을 판단하는 여러 지표를 통합하고 자동으로 스톱 스톱을 설정하여 강력한 트렌드에서 이익을 얻을 수 있으며 단일 거래 손실을 매우 작은 범위에서 제어 할 수 있습니다. 발행자의 피드백 데이터에 따르면, 수익률과 수익률은 매우 이상적입니다. 약간의 최적화를 통해 전략의 안정성과 수익성을 더욱 향상시킬 수 있습니다.

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © myn

//@version=5

strategy('Strategy Myth-Busting #7 - MACDBB+SSL+VSF - [MYN]', max_bars_back=5000, overlay=true, pyramiding=0, initial_capital=1000, currency='USD', default_qty_type=strategy.percent_of_equity, default_qty_value=1.0, commission_value=0.075, use_bar_magnifier = false)

/////////////////////////////////////

//* Put your strategy logic below *//

/////////////////////////////////////

//nwVqTuPe6yo

//5 min

//ak MACD BB by AlgoKid

//Disable bar colors in style

//SSL hybrid by mihkel00

// Style disable all but bar colors and ma baseline

// Change SSL1 baseline length from 60 to 30

// Change SSL1 baseline type from HMA to EMA

//volume strength Finder by Saravanan

// Get rid of bar colors on style

// Trading Rules

// SSL Hybrid.

// Buy only when price action is closed above the EMA and the line is blue color.

// Sell priace action must be closed below the EMA and the line is red color

// Volume Indicator

// Buy when Buyers strength / volume is higher than sellers volume

// Opposite

// General trading rules

// Short

// Price action must be moving below the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from red to gray or from red to blue.

// If the price action is touching the EMA but the line does not change the color, the pullback is not confirmed.

// Once we have this pullback we're going to be waiting for the MACD to issue a new continuation short signal. A red circle must appear on the indicator and these circles should not be touching accross the zero level while they are being greeen

// Sellers strength above 50% at the time the MACD indiactor issues a new short signal.

// Stop Loss at EMA line 1:1.5 risk ratio.

// Functions universal to strategy

f_priorBarsSatisfied(_objectToEval, _numOfBarsToLookBack) =>

returnVal = false

for i = 0 to _numOfBarsToLookBack

if (_objectToEval[i] == true)

returnVal = true

// AK MACD BB v 1.00 by Algokid

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//indicator('AK MACD BB v 1.00')

length = input.int(10, minval=1, title='BB Periods',group="AK MACD BB")

dev = input.float(1, minval=0.0001, title='Deviations')

//MACD

fastLength = input.int(12, minval=1)

slowLength = input.int(26, minval=1)

signalLength = input.int(9, minval=1)

fastMA = ta.ema(close, fastLength)

slowMA = ta.ema(close, slowLength)

macd = fastMA - slowMA

//BollingerBands

Std = ta.stdev(macd, length)

Upper = Std * dev + ta.sma(macd, length)

Lower = ta.sma(macd, length) - Std * dev

//Band1 = plot(Upper, color=color.new(color.gray, 0), style=plot.style_line, linewidth=2, title='Upper Band')

//Band2 = plot(Lower, color=color.new(color.gray, 0), style=plot.style_line, linewidth=2, title='lower Band')

//fill(Band1, Band2, color=color.new(color.blue, 75), title='Fill')

mc = macd >= Upper ? color.lime : color.red

// Indicator

//plot(macd, color=mc, style=plot.style_circles, linewidth=3)

zeroline = 0

//plot(zeroline, color=color.new(color.orange, 0), linewidth=2, title='Zeroline')

//buy

//barcolor(macd > Upper ? color.yellow : na)

//short

//barcolor(macd < Lower ? color.aqua : na)

//needs improvments

MACDBBNumBarsBackToLookForMACDToBelowZero = input(1, title="Number Of bars to look back to ensure MACD isn't above/below Zero Line?")

// Sell when MACD to issue a new continuation short signal. A new red circle must appear on the indicator and these circles should not be touching accross the zero level while they were previously green

MACDBBENtryShort = mc == color.red and macd < zeroline and f_priorBarsSatisfied(macd < zeroline and mc == color.lime, MACDBBNumBarsBackToLookForMACDToBelowZero)

// Buy when MACD to issue a new continuation long signal. A new green circle must appear on the indicator and these circles should not be touching accross the zero level while they were previously red

MACDBBENtryLong = mc == color.lime and macd > zeroline and f_priorBarsSatisfied(macd > zeroline and mc == color.red, MACDBBNumBarsBackToLookForMACDToBelowZero)

// SSL Hybrid by Mihkel00

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//@version=5

//AK MACD BB

//created by Algokid , February 24,2015

//@version=5

//By Mihkel00

// This script is designed for the NNFX Method, so it is recommended for Daily charts only.

// Tried to implement a few VP NNFX Rules

// This script has a SSL / Baseline (you can choose between the SSL or MA), a secondary SSL for continiuation trades and a third SSL for exit trades.

// Alerts added for Baseline entries, SSL2 continuations, Exits.

// Baseline has a Keltner Channel setting for "in zone" Gray Candles

// Added "Candle Size > 1 ATR" Diamonds from my old script with the criteria of being within Baseline ATR range.

// Credits

// Strategy causecelebre https://www.tradingview.com/u/causecelebre/

// SSL Channel ErwinBeckers https://www.tradingview.com/u/ErwinBeckers/

// Moving Averages jiehonglim https://www.tradingview.com/u/jiehonglim/

// Moving Averages everget https://www.tradingview.com/u/everget/

// "Many Moving Averages" script Fractured https://www.tradingview.com/u/Fractured/

//indicator('SSL Hybrid', overlay=true)

show_Baseline = input(title='Show Baseline', defval=true, group="SSL Hybrid")

show_SSL1 = input(title='Show SSL1', defval=false)

show_atr = input(title='Show ATR bands', defval=true)

//ATR

atrlen = input(14, 'ATR Period')

mult = input.float(1, 'ATR Multi', step=0.1)

smoothing = input.string(title='ATR Smoothing', defval='WMA', options=['RMA', 'SMA', 'EMA', 'WMA'])

ma_function(source, atrlen) =>

if smoothing == 'RMA'

ta.rma(source, atrlen)

else

if smoothing == 'SMA'

ta.sma(source, atrlen)

else

if smoothing == 'EMA'

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input.string(title='SSL1 / Baseline Type', defval='EMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'])

len = input(title='SSL1 / Baseline Length', defval=30)

SSL2Type = input.string(title='SSL2 / Continuation Type', defval='JMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'McGinley'])

len2 = input(title='SSL 2 Length', defval=5)

//

SSL3Type = input.string(title='EXIT Type', defval='HMA', options=['DEMA', 'TEMA', 'LSMA', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'McGinley', 'MF'])

len3 = input(title='EXIT Length', defval=15)

src = input(title='Source', defval=close)

//

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

kidiv = input.int(defval=1, maxval=4, title='Kijun MOD Divider')

jurik_phase = input(title='* Jurik (JMA) Only - Phase', defval=3)

jurik_power = input(title='* Jurik (JMA) Only - Power', defval=1)

volatility_lookback = input(10, title='* Volatility Adjusted (VAMA) Only - Volatility lookback length')

//MF

beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Modular Filter, General Filter Only - Beta')

feedback = input(false, title='Modular Filter Only - Feedback')

z = input.float(0.5, title='Modular Filter Only - Feedback Weighting', step=0.1, minval=0, maxval=1)

//EDSMA

ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20)

ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3])

//----

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = feedback ? z * src + (1 - z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta * b + (1 - beta) * c

lower = beta * c + (1 - beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, volatility_lookback)

vol_down = ta.lowest(dev, volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / kidiv), ta.highest(len / kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2 ? get2PoleSSF(avgZeros, ssfLength) : get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true)

multy = input.float(0.2, step=0.05, title='Base Channel Multiplier')

Keltma = ma(maType, src, len)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, len)

upperk = Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open * 1

close_pos = close * 1

difference = math.abs(close_pos - open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

candlesize_violation = atr_violation and InRange

//plotshape(candlesize_violation, color=color.new(color.white, 0), size=size.tiny, style=shape.diamond, location=location.top, title='Candle Size > 1xATR')

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//SSL2 VALUES

Hlv2 = int(na)

Hlv2 := close > maHigh ? 1 : close < maLow ? -1 : Hlv2[1]

sslDown2 = Hlv2 < 0 ? maHigh : maLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = ta.crossover(close, sslExit)

base_cross_Short = ta.crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title='Color Bars', defval=true)

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

//plotarrow(codiff, colorup=color.new(#00c3ff, 20), colordown=color.new(#ff0062, 20), title='Exit Arrows', maxheight=20, offset=0)

p1 = plot(show_Baseline ? BBMC : na, color=color_bar, linewidth=4, title='MA Baseline', transp=0)

//DownPlot = plot(show_SSL1 ? sslDown : na, title='SSL1', linewidth=3, color=color_ssl1, transp=10)

barcolor(show_color_bar ? color_bar : na)

//up_channel = plot(show_Baseline ? upperk : na, color=color_bar, title='Baseline Upper Channel')

//low_channel = plot(show_Baseline ? lowerk : na, color=color_bar, title='Basiline Lower Channel')

//fill(up_channel, low_channel, color=color_bar, transp=90)

////SSL2 Continiuation from ATR

atr_crit = input.float(0.9, step=0.1, title='Continuation ATR Criteria')

upper_half = atr_slen * atr_crit + close

lower_half = close - atr_slen * atr_crit

buy_inatr = lower_half < sslDown2

sell_inatr = upper_half > sslDown2

sell_cont = close < BBMC and close < sslDown2

buy_cont = close > BBMC and close > sslDown2

sell_atr = sell_inatr and sell_cont

buy_atr = buy_inatr and buy_cont

atr_fill = buy_atr ? color.green : sell_atr ? color.purple : color.white

//LongPlot = plot(sslDown2, title='SSL2', linewidth=2, color=atr_fill, style=plot.style_circles, transp=0)

//u = plot(show_atr ? upper_band : na, '+ATR', color=color.new(color.white, 80))

//l = plot(show_atr ? lower_band : na, '-ATR', color=color.new(color.white, 80))

//ALERTS

alertcondition(ta.crossover(close, sslDown), title='SSL Cross Alert', message='SSL1 has crossed.')

alertcondition(ta.crossover(close, sslDown2), title='SSL2 Cross Alert', message='SSL2 has crossed.')

alertcondition(sell_atr, title='Sell Continuation', message='Sell Continuation.')

alertcondition(buy_atr, title='Buy Continuation', message='Buy Continuation.')

alertcondition(ta.crossover(close, sslExit), title='Exit Sell', message='Exit Sell Alert.')

alertcondition(ta.crossover(sslExit, close), title='Exit Buy', message='Exit Buy Alert.')

alertcondition(ta.crossover(close, upperk), title='Baseline Buy Entry', message='Base Buy Alert.')

alertcondition(ta.crossover(lowerk, close), title='Baseline Sell Entry', message='Base Sell Alert.')

// Buy only when price action is closed above the EMA and the line is blue color.

SSLHybridEntryLong1 = src > BBMC and color_bar == #00c3ff

// Sell only when action must be closed below the EMA and the line is red color

SSLHybridEntryShort1 = src < BBMC and color_bar == #ff0062

sslHybridNumBarsBackToLookForPullBack = input(4, title="Number Of bars back to look for SSL pullback")

// Buy when Price action must be moving above the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from blue to gray or from blue to red.

SSLHybridEntryLong2 = color_bar == #00c3ff and (f_priorBarsSatisfied(color_bar == #ff0062,sslHybridNumBarsBackToLookForPullBack) or f_priorBarsSatisfied(color_bar == color.gray, sslHybridNumBarsBackToLookForPullBack))

// Sell when Price action must be moving below the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from red to gray or from red to blue.

SSLHybridEntryShort2 = color_bar == #ff0062 and (f_priorBarsSatisfied(color_bar == #00c3ff,sslHybridNumBarsBackToLookForPullBack) or f_priorBarsSatisfied(color_bar == color.gray, sslHybridNumBarsBackToLookForPullBack))

SSLHybridEntryLong = SSLHybridEntryLong1 and SSLHybridEntryLong2

SSLHybridEntryShort = SSLHybridEntryShort1 and SSLHybridEntryShort2

// Price action must be moving below the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from red to gray or from red to blue.

// If the price action is touching the EMA but the line does not change the color, the pullback is not confirmed.

// Volume Strength Finder by Saravanan_Ragavan

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Saravanan_Ragavan

//@version=5

//indicator('Volume Strength Finder', 'VSF', overlay=true)

T1 = time(timeframe.period, '0915-0916:23456')

T2 = time(timeframe.period, '0915-1530:23456')

Y = bar_index

Z1 = ta.valuewhen(T1, bar_index, 0)

L = Y - Z1 + 1

SSPV = 0.00

SSNV = 0.00

pdw = 0.00

ndw = 0.00

total_w = 0.00

for i = 1 to L - 1 by 1

total_w := high[i] - low[i]

positive = close[i] - low[i]

negative = high[i] - close[i]

pdw := positive / total_w * 100

ndw := negative / total_w * 100

SSPV := volume[i] * pdw / 100 + SSPV

SSNV := volume[i] * ndw / 100 + SSNV

SSNV

total_v = SSPV + SSNV

Pos = SSPV / total_v * 100

Neg = SSNV / total_v * 100

bgc = SSPV > SSNV ? color.green : SSPV < SSNV ? color.red : color.white

//barcolor(bgc)

var table sDisplay = table.new(position.top_right, 1, 5, bgcolor=color.aqua, frame_width=2, frame_color=color.black)

if barstate.islast

table.cell(sDisplay, 0, 0, 'Today\'s Volume : ' + str.tostring(total_v), text_color=color.white, text_size=size.large, bgcolor=color.aqua)

table.cell(sDisplay, 0, 1, 'Buyers Volume: ' + str.tostring(math.round(SSPV)), text_color=color.white, text_size=size.large, bgcolor=color.green)

table.cell(sDisplay, 0, 2, 'Sellers Volume: ' + str.tostring(math.round(SSNV)), text_color=color.white, text_size=size.large, bgcolor=color.red)

table.cell(sDisplay, 0, 3, 'Buyers Strength: ' + str.tostring(math.round(Pos)) + '%', text_color=color.white, text_size=size.large, bgcolor=color.green)

table.cell(sDisplay, 0, 4, 'Sellers Strength: ' + str.tostring(math.round(Neg)) + '%', text_color=color.white, text_size=size.large, bgcolor=color.red)

// Sellers strength above 50% at the time the MACD indiactor issues a new short signal.

VSFShortEntry = math.round(Neg) > 50

// Buyers strength above 50% at the time the MACD indiactor issues a new long signal.

VSFLongEntry = math.round(Pos) > 50

//////////////////////////////////////

//* Put your strategy rules below *//

/////////////////////////////////////

longCondition = SSLHybridEntryLong and VSFLongEntry and MACDBBENtryLong

shortCondition =SSLHybridEntryShort and VSFShortEntry and MACDBBENtryShort

//define as 0 if do not want to use

closeLongCondition = 0

closeShortCondition = 0

// ADX

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

adxEnabled = input.bool(defval = false , title = "Average Directional Index (ADX)", tooltip = "", group ="ADX" )

adxlen = input(14, title="ADX Smoothing", group="ADX")

adxdilen = input(14, title="DI Length", group="ADX")

adxabove = input(25, title="ADX Threshold", group="ADX")

adxdirmov(len) =>

adxup = ta.change(high)

adxdown = -ta.change(low)

adxplusDM = na(adxup) ? na : (adxup > adxdown and adxup > 0 ? adxup : 0)

adxminusDM = na(adxdown) ? na : (adxdown > adxup and adxdown > 0 ? adxdown : 0)

adxtruerange = ta.rma(ta.tr, len)

adxplus = fixnan(100 * ta.rma(adxplusDM, len) / adxtruerange)

adxminus = fixnan(100 * ta.rma(adxminusDM, len) / adxtruerange)

[adxplus, adxminus]

adx(adxdilen, adxlen) =>

[adxplus, adxminus] = adxdirmov(adxdilen)

adxsum = adxplus + adxminus

adx = 100 * ta.rma(math.abs(adxplus - adxminus) / (adxsum == 0 ? 1 : adxsum), adxlen)

adxsig = adxEnabled ? adx(adxdilen, adxlen) : na

isADXEnabledAndAboveThreshold = adxEnabled ? (adxsig > adxabove) : true

//Backtesting Time Period (Input.time not working as expected as of 03/30/2021. Giving odd start/end dates

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

useStartPeriodTime = input.bool(true, 'Start', group='Date Range', inline='Start Period')

startPeriodTime = input(timestamp('1 Jan 2019'), '', group='Date Range', inline='Start Period')

useEndPeriodTime = input.bool(true, 'End', group='Date Range', inline='End Period')

endPeriodTime = input(timestamp('31 Dec 2030'), '', group='Date Range', inline='End Period')

start = useStartPeriodTime ? startPeriodTime >= time : false

end = useEndPeriodTime ? endPeriodTime <= time : false

calcPeriod = true

// Trade Direction

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tradeDirection = input.string('Long and Short', title='Trade Direction', options=['Long and Short', 'Long Only', 'Short Only'], group='Trade Direction')

// Percent as Points

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

per(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

// Take profit 1

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp1 = input.float(title='Take Profit 1 - Target %', defval=1, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 1')

q1 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 1')

// Take profit 2

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp2 = input.float(title='Take Profit 2 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 2')

q2 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 2')

// Take profit 3

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp3 = input.float(title='Take Profit 3 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 3')

q3 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 3')

// Take profit 4

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp4 = input.float(title='Take Profit 4 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit')

/// Stop Loss

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

stoplossPercent = input.float(title='Stop Loss (%)', defval=2, minval=0.01, group='Stop Loss') * 0.01

slLongClose = close < strategy.position_avg_price * (1 - stoplossPercent)

slShortClose = close > strategy.position_avg_price * (1 + stoplossPercent)

/// Leverage

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

leverage = input.float(1, 'Leverage', step=.5, group='Leverage')

contracts = math.min(math.max(.000001, strategy.equity / close * leverage), 1000000000)

/// Trade State Management

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

isInLongPosition = strategy.position_size > 0

isInShortPosition = strategy.position_size < 0

/// ProfitView Alert Syntax String Generation

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

alertSyntaxPrefix = input.string(defval='CRYPTANEX_99FTX_Strategy-Name-Here', title='Alert Syntax Prefix', group='ProfitView Alert Syntax')

alertSyntaxBase = alertSyntaxPrefix + '\n#' + str.tostring(open) + ',' + str.tostring(high) + ',' + str.tostring(low) + ',' + str.tostring(close) + ',' + str.tostring(volume) + ','

/// Trade Execution

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

longConditionCalc = (longCondition and isADXEnabledAndAboveThreshold)

shortConditionCalc = (shortCondition and isADXEnabledAndAboveThreshold)

if calcPeriod

if longConditionCalc and tradeDirection != 'Short Only' and isInLongPosition == false

strategy.entry('Long', strategy.long, qty=contracts)

alert(message=alertSyntaxBase + 'side:long', freq=alert.freq_once_per_bar_close)

if shortConditionCalc and tradeDirection != 'Long Only' and isInShortPosition == false

strategy.entry('Short', strategy.short, qty=contracts)

alert(message=alertSyntaxBase + 'side:short', freq=alert.freq_once_per_bar_close)

//Inspired from Multiple %% profit exits example by adolgo https://www.tradingview.com/script/kHhCik9f-Multiple-profit-exits-example/

strategy.exit('TP1', qty_percent=q1, profit=per(tp1))

strategy.exit('TP2', qty_percent=q2, profit=per(tp2))

strategy.exit('TP3', qty_percent=q3, profit=per(tp3))

strategy.exit('TP4', profit=per(tp4))

strategy.close('Long', qty_percent=100, comment='SL Long', when=slLongClose)

strategy.close('Short', qty_percent=100, comment='SL Short', when=slShortClose)

strategy.close_all(when=closeLongCondition or closeShortCondition, comment='Close Postion')

/// Dashboard

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Inspired by https://www.tradingview.com/script/uWqKX6A2/ - Thanks VertMT

// showDashboard = input.bool(group="Dashboard", title="Show Dashboard", defval=true)

// f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

// _cellText = _title + "\n" + _value

// table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// // Draw dashboard table

// if showDashboard

// var bgcolor = color.new(color.black,0)

// // Keep track of Wins/Losses streaks

// newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

// newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

// varip int winRow = 0

// varip int lossRow = 0

// varip int maxWinRow = 0

// varip int maxLossRow = 0

// if newWin

// lossRow := 0

// winRow := winRow + 1

// if winRow > maxWinRow

// maxWinRow := winRow

// if newLoss

// winRow := 0

// lossRow := lossRow + 1

// if lossRow > maxLossRow

// maxLossRow := lossRow

// // Prepare stats table

// var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

// if barstate.islastconfirmedhistory

// // Update table

// dollarReturn = strategy.netprofit

// f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

// f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

// _profit = (strategy.netprofit / strategy.initial_capital) * 100

// f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

// _numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

// f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

// _winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

// f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

// f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

// f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

// f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

// f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)