MACD 이중 이동 평균 추적 전략

저자:차오장, 날짜: 2023-12-18 12:25:13태그:

전반적인 설명

이 전략은MACD 이중 이동 평균 추적 전략MACD 지표의 황금 십자와 이중 이동 평균의 죽음의 십자 를 거래 신호로 사용하며, 단기 가격 움직임을 추적하기 위해 전날의 최저 가격과 함께 스톱 로스 포인트를 사용합니다.

전략 논리

- 빠른 EMA를 계산합니다. 가까운,5), 느린 EMA를 계산합니다. 가까운8 그리고 신호 SMA를 계산합니다. 가까운3

- 긴 신호 정의: 빠른 MA가 느린 MA를 넘을 때

- 짧은 신호를 정의합니다. 빠른 MA가 느린 MA보다 낮을 때 또는 종료 가격이 전날의 최저 가격보다 낮을 때

- 포지션 크기는 초기 자본 2천 달러 (USD) 를 종료 가격으로 나누는 것입니다.

- 짧은 신호를 사용하여 Stop Loss로 긴 포지션을 닫습니다.

이점 분석

- MACD 지표를 사용하여 과잉 구매 및 과잉 판매 구역을 결정하고, 가짜 브레이크오웃을 피하여 트레이딩 신호를 형성하기 위해 이중 MA를 사용합니다.

- 단기 트렌드를 추적하고 적시에 스톱 로스

- 포지션 크기의 동적 조정은 과도하게 큰 단일 손실을 피합니다.

위험 분석

- MACD 지표는 지연 효과, 단기 기회를 놓칠 수 있습니다.

- 이중 MA 거래 신호는 잘못된 신호를 생성할 수 있습니다.

- 스톱 손실 포인트는 너무 공격적이며, 높은 빈도로 중단됩니다

최적화 방향

- 지표 감수성을 향상시키기 위해 MACD 매개 변수 조합을 최적화하십시오.

- 시장 통합에서 잘못된 신호를 피하기 위해 트렌드 판단을 추가하십시오.

- 시장 변동성을 평가하기 위해 변동성 지수와 결합, 손실 중지 지점을 조정

요약

이 전략은 고전적인 MACD 이중 이동 평균 조합 지표를 사용하여 과잉 구매 및 과잉 판매 구역을 결정하고, 거래 신호를 생성하며, 동적 위치 사이징 및 전날의 최저 가격을 단기 가격 변동을 포착하기 위해 스톱 로스 포인트 디자인으로 도입합니다. 전반적인 전략 논리는 명확하고 이해하기 쉽습니다. 추가 테스트 및 최적화 가치가 있습니다.

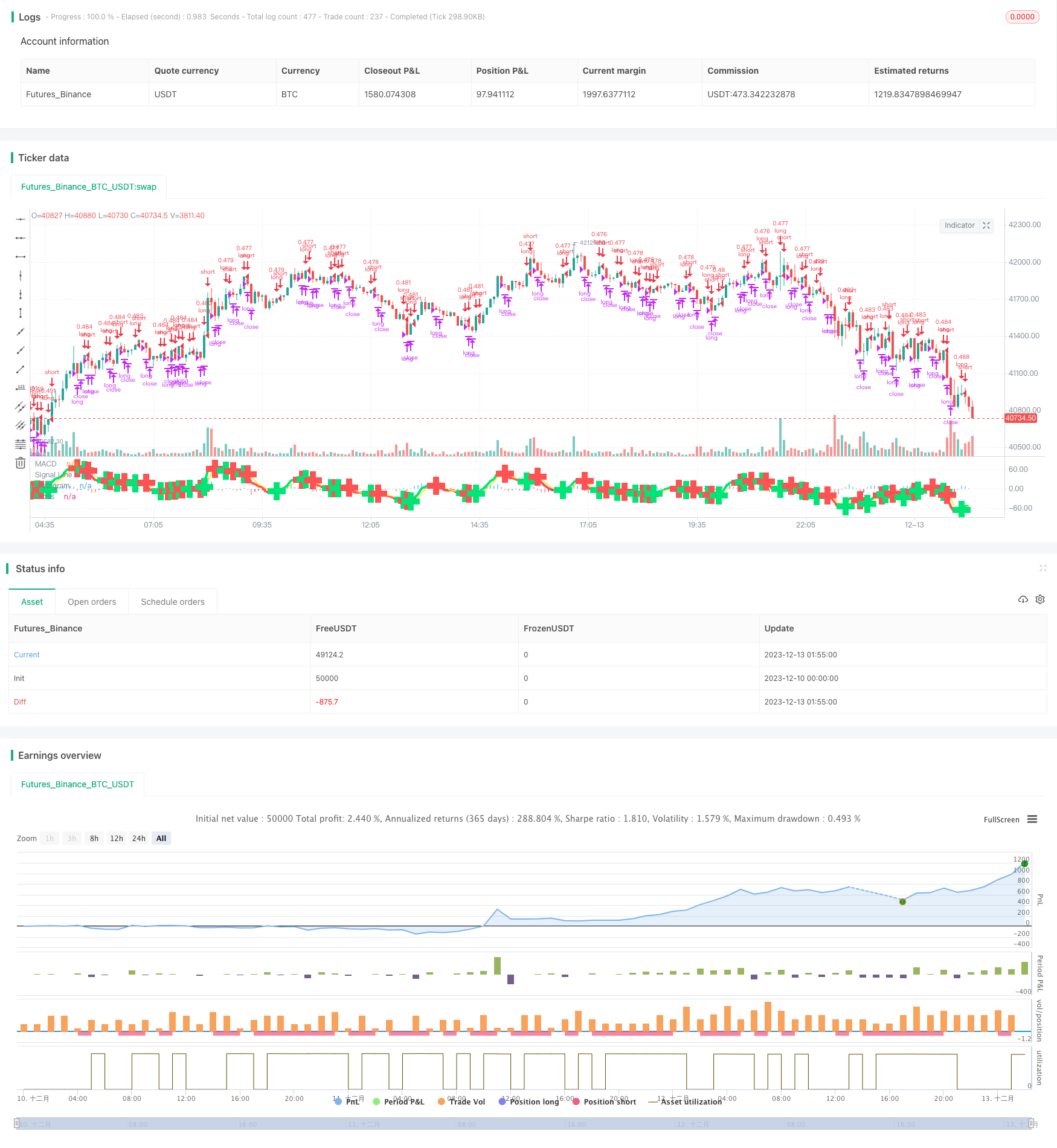

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-13 02:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

// macd/cam v1 strategizing Chris Moody Macd indicator https://www.tradingview.com/script/OQx7vju0-MacD-Custom-Indicator-Multiple-Time-Frame-All-Available-Options/

// macd/cam v2 changing to macd 5,8,3

// macd/cam v2.1

// Sell when lower than previous day low.

// Initial capital of $2k. Buy/sell quantity of initial capital / close price

// Quitar short action

// Note: custom 1-week resolution seems to put AMD at 80% profitable

strategy(title="MACD/CAM 2.1", shorttitle="MACD/CAM 2.1") //

source = close

//get inputs from options

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="60")

smd = input(true, title="Show MacD & Signal Line? Also Turn Off Dots Below")

sd = input(true, title="Show Dots When MacD Crosses Signal Line?")

sh = input(true, title="Show Histogram?")

macd_colorChange = input(true,title="Change MacD Line Color-Signal Line Cross?")

hist_colorChange = input(true,title="MacD Histogram 4 Colors?")

venderLowerPrev = input(true,title="Vender cuando closing price < previous day low?")

res = useCurrentRes ? timeframe.period : resCustom

fastLength = input(5, minval=1), slowLength=input(8,minval=1)

signalLength=input(3,minval=1)

// find exponential moving average of price as x and fastLength var as y

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

// simple moving average

signal = sma(macd, signalLength)

hist = macd - signal

outMacD = request.security(syminfo.tickerid, res, macd)

outSignal = request.security(syminfo.tickerid, res, signal)

outHist = request.security(syminfo.tickerid, res, hist)

histA_IsUp = outHist > outHist[1] and outHist > 0

histA_IsDown = outHist < outHist[1] and outHist > 0

histB_IsDown = outHist < outHist[1] and outHist <= 0

histB_IsUp = outHist > outHist[1] and outHist <= 0

//MacD Color Definitions

macd_IsAbove = outMacD >= outSignal

macd_IsBelow = outMacD < outSignal

plot_color = hist_colorChange ? histA_IsUp ? aqua : histA_IsDown ? blue : histB_IsDown ? red : histB_IsUp ? maroon :yellow :gray

macd_color = macd_colorChange ? macd_IsAbove ? lime : red : red

signal_color = macd_colorChange ? macd_IsAbove ? yellow : yellow : lime

circleYPosition = outSignal

plot(smd and outMacD ? outMacD : na, title="MACD", color=macd_color, linewidth=4)

plot(smd and outSignal ? outSignal : na, title="Signal Line", color=signal_color, style=line ,linewidth=2)

plot(sh and outHist ? outHist : na, title="Histogram", color=plot_color, style=histogram, linewidth=4)

circleCondition = sd and cross(outMacD, outSignal)

// Determine long and short conditions

longCondition = circleCondition and macd_color == lime

redCircle = circleCondition and macd_color == red

redCirclePrevLow = redCircle or low<low[1]

shortCondition = redCircle

if (venderLowerPrev)

shortCondition = redCirclePrevLow

strategy.initial_capital = 20000

// Set quantity to initial capital / closing price

cantidad = strategy.initial_capital/close

// Submit orders

strategy.entry(id="long", long=true, qty=cantidad, when=longCondition)

strategy.close(id="long", when=shortCondition)

plot(circleCondition ? circleYPosition : na, title="Cross", style=cross, linewidth=10, color=macd_color)

// hline(0, '0 Line', linestyle=solid, linewidth=2, color=white)

더 많은

- 선형 회귀 및 이동 평균에 기초한 회귀 거래 전략을 따르는 경향

- MACD 로봇 거래 전략

- 볼링거 밴드 이중 표준편차 거래 전략

- MACD 및 RSI 크로스오버 신호에 기초한 거래 전략

- 바이에스 조건 RSI 거래 전략

- 피보트 역전 전략

- TSI 지표와 Hull 이동 평균에 기초한 양적 거래 전략

- 채널 트렌드 전략

- CCI의 장기적 전략

- 이동 평균 리본 전략

- X48 - 데이 라이트 헌터 전략 최적화 및 적응

- 하이킨-아시 - 0.5% 변경 단기 거래 전략

- 긍정적인 채널 EMA 트레일링 스톱 전략

- 갈릴레오 갈릴레이의 이동 평균 크로스오버 전략

- 윌리엄스 지표의 AC 백테스트 전략

- 낮은 변동성 방향 구매와 수익 취득 및 손실 중지

- 이동평균에 기초한 고정 비율의 스톱 로스 및 영업 전략

- 이중 EMA 및 가격 변동 지수에 기초한 양적 거래 전략

- 모멘텀 브레이크오웃 양방향 추적 전략

- 슈퍼 트렌드 LSMA 장기 전략