스토카스틱 이동 평균 전략

저자:차오장, 날짜: 2023-12-19 11:41:40태그:

전반적인 설명

이 전략은 트렌드를 따라가며 계속되는 방식으로 기하급수적인 이동 평균 (EMA) 과 스토카스틱 오시레이터를 결합하고 몇 가지 멋진 기능과 함께합니다. 이 전략을 특히 altcoin 거래를 위해 설계했지만 Bitcoin 자체와 일부 Forex 쌍에서 똑같이 잘 작동합니다.

전략 논리

이 전략은 거래 신호를 잠금 해제하기 위해 4 가지 필수 조건이 있습니다. 아래의 긴 거래에 대한 이러한 조건을 찾으십시오 (단거리 거래에 대해 정확히 반대 방향으로 작동합니다)

- 빠른 EMA는 느린 EMA보다 높아야 합니다.

- 스토카스틱 K% 라인은 과잉 매입 영역에 있어야 합니다.

- 스토카스틱 K% 라인은 스토카스틱 D% 라인을 넘어야 합니다.

- 느린 EMA와 빠른 EMA 사이의 폐쇄 가격 모든 조건이 맞으면 다음 촛불을 열면 거래가 시작됩니다.

이점 분석

이 전략은 EMA와 스토카스틱의 장점을 결합하여 중장기 거래에 적합한 트렌드의 시작과 지속을 효과적으로 포착합니다. 동시에 전략은 사용자가 거래 스타일과 시장 특성에 따라 조정 할 수있는 많은 사용자 지정 매개 변수를 제공합니다.

특히 전략의 장점은 다음과 같습니다.

- EMA 교차로에서 트렌드 방향을 판단하고 신호 안정성과 신뢰성을 향상시킵니다.

- 스토카스틱 판사는 회전 기회를 찾기 위해 과소매와 과소매 수준을 높였습니다.

- 두 가지 지표를 결합하여, 트렌드와 평균 반전을 모두 나타냅니다.

- ATR은 자동으로 스톱 로스 거리를 계산하여 시장 변동성에 따라 스톱을 조정합니다.

- 각기 다른 사용자의 필요를 충족시키기 위해 조정 가능한 위험 보상 비율

- 사용자가 시장에 따라 조정할 수 있는 여러 가지 사용자 지정 매개 변수를 제공합니다.

위험 분석

이 전략의 주요 위험은 다음과 같습니다.

- EMA 교차로에는 잘못된 브레이크가 있을 수 있어 잘못된 신호가 발생한다.

- 스토카스틱 자체는 뒤떨어진 특성을 가지고 있으며, 가격 반전을위한 최고의 타이밍을 놓칠 수 있습니다.

- 단일 전략은 끊임없이 변화하는 시장 환경에 완전히 적응할 수 없습니다.

위의 위험을 줄이기 위해 다음의 조치를 취할 수 있습니다.

- 너무 많은 잘못된 신호를 피하기 위해 EMA 기간 매개 변수를 조정합니다.

- 신뢰성 있는 신호를 보장하기 위해 트렌드 및 지원 수준을 판단하기 위해 더 많은 지표를 포함

- 거래별로 위험 노출을 제어하기 위한 명확한 자금 관리 전략을 정의합니다.

- 다른 전략이 신호를 확인하고 안정성을 향상시킬 수 있도록 조합 전략을 채택하십시오.

최적화 방향

이 전략은 다음 측면에서 더 이상 최적화 될 수 있습니다.

- 변동성 기반 포지션 조정 모듈을 추가합니다. 변동성이 급증할 때 크기를 줄이고 평온할 때 크기를 증가시킵니다.

- 예를 들어 일일 또는 주간 트렌드를 결합하는 것과 같은 역 트렌드 거래를 피하기 위해 더 높은 시간 프레임 트렌드의 판단을 추가합니다.

- 신호 생성에 도움이 되는 기계 학습 모델을 추가합니다. 역사적인 데이터에 기반한 기차 분류 모델을 추가합니다.

- 금전 관리 모듈을 최적화하여 정류장과 크기를 더 지능화합니다.

결론

이 전략은 높은 시간 프레임 시장 환경과 현재 가격 행동 모두를 고려하여 트렌드 다음과 평균 반전의 장점을 통합합니다. 실시간 추적 및 테스트를 가치가있는 효과적인 전략입니다. 매개 변수에 대한 지속적인 최적화, 트렌드 판단 모듈 등을 추가함으로써 여전히 더 많은 연구 노력에 쏟아 부을 가치가있는 성능 향상에 큰 여지가 있습니다.

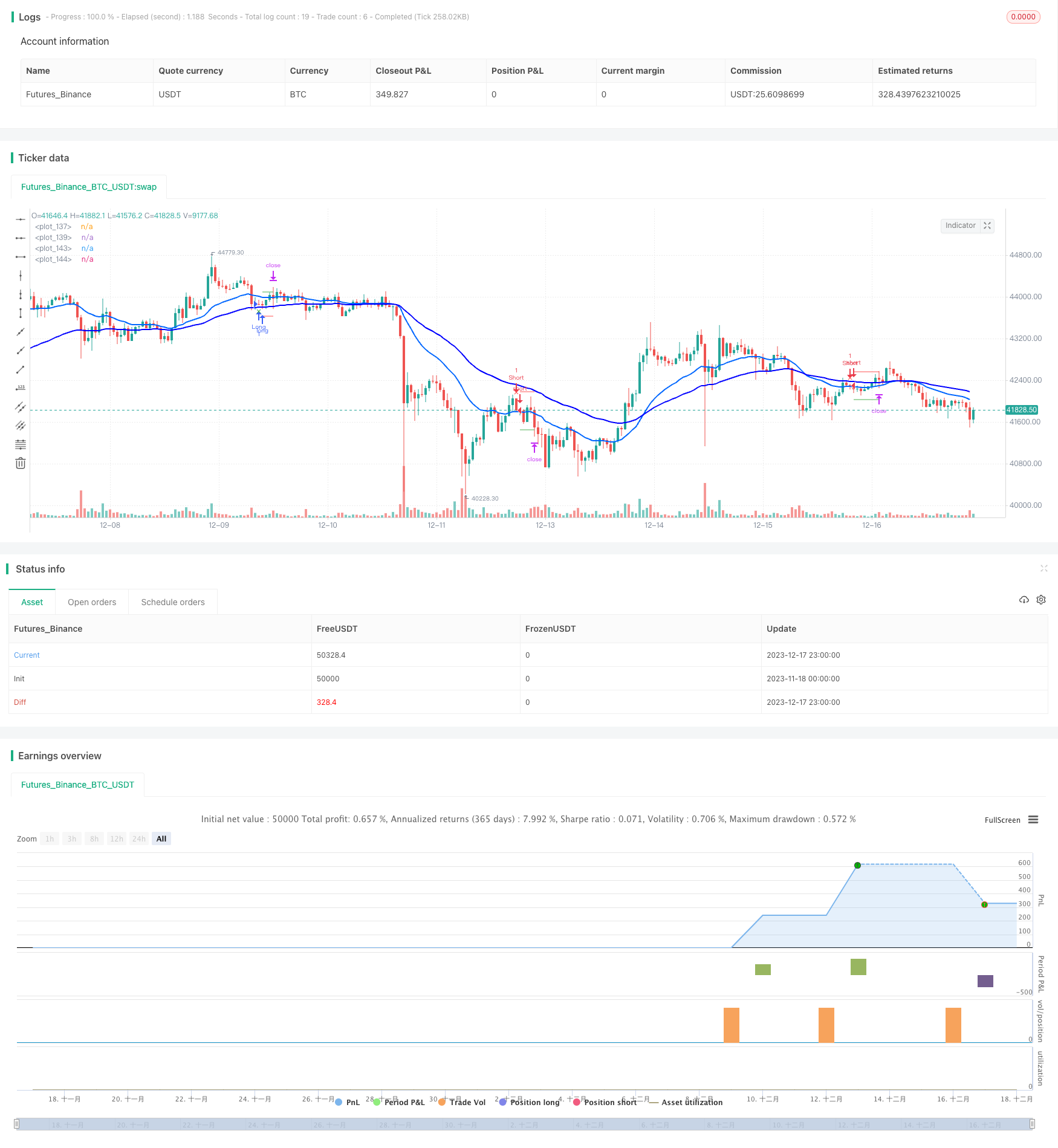

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LucasVivien

// Since this Strategy may have its stop loss hit within the opening candle, consider turning on 'Recalculate : After Order is filled' in the strategy settings, in the "Properties" tabs

//@version=5

strategy("Stochastic Moving Average", shorttitle="Stoch. EMA", overlay=true, default_qty_type= strategy.cash, initial_capital=10000, default_qty_value=100)

//==============================================================================

//============================== USER INPUT ================================

//==============================================================================

var g_tradeSetup = " Trade Setup"

activateLongs = input.bool (title="Long Trades" , defval=true , inline="A1", group=g_tradeSetup, tooltip="")

activateShorts = input.bool (title="Short Trades" , defval=true , inline="A1", group=g_tradeSetup, tooltip="")

rr = input.float(title="Risk : Reward" , defval=1 , minval=0, maxval=100 , step=0.1, inline="" , group=g_tradeSetup, tooltip="")

RiskEquity = input.bool (title="Risk = % Equity ", defval=false , inline="A2", group=g_tradeSetup, tooltip="Set stop loss size as a percentage of 'Initial Capital' -> Strategy Parameter -> Properties tab (Low liquidity markets will affect will prevent to get an exact amount du to gaps)")

riskPrctEqui = input.float(title="" , defval=1 , minval=0, maxval=100 , step=0.1, inline="A2", group=g_tradeSetup, tooltip="")

RiskUSD = input.bool (title="Risk = $ Amount " , defval=false , inline="A3", group=g_tradeSetup, tooltip="Set stop loss size as a fixed Base currency amount (Low liquidity markets will affect will prevent to get an exact amount du to gaps)")

riskUSD = input.float(title="" , defval=1000, minval=0, maxval=1000000000, step=100, inline="A3", group=g_tradeSetup, tooltip="")

var g_stopLoss = " Stop Loss"

atrMult = input.float(title="ATR Multiplier", defval=1 , minval=0, maxval=100 , step=0.1, tooltip="", inline="", group=g_stopLoss)

atrLen = input.int (title="ATR Lookback" , defval=14, minval=0, maxval=1000, step=1 , tooltip="", inline="", group=g_stopLoss)

var g_stochastic = " Stochastic"

Klen = input.int (title="K%" , defval=14, minval=0, maxval=1000, step=1, inline="S2", group=g_stochastic, tooltip="")

Dlen = input.int (title=" D%" , defval=3 , minval=0, maxval=1000, step=1, inline="S2", group=g_stochastic, tooltip="")

OBstochLvl = input.int (title="OB" , defval=80, minval=0, maxval=100 , step=1, inline="S1", group=g_stochastic, tooltip="")

OSstochLvl = input.int (title=" OS" , defval=20, minval=0, maxval=100 , step=1, inline="S1", group=g_stochastic, tooltip="")

OBOSlookback = input.int (title="Stoch. OB/OS lookback", defval=0 , minval=0, maxval=100 , step=1, inline="" , group=g_stochastic, tooltip="This option allow to look 'x' bars back for a value of the Stochastic K line to be overbought or oversold when detecting an entry signal (if 0, looks only at current bar. if 1, looks at current and previous and so on)")

OBOSlookbackAll = input.bool (title="All must be OB/OS" , defval=false , inline="" , group=g_stochastic, tooltip="If turned on, all bars within the Stochastic K line lookback period must be overbought or oversold to return a true signal")

entryColor = input.color(title=" " , defval=#00ffff , inline="S3", group=g_stochastic, tooltip="")

baseColor = input.color(title=" " , defval=#333333 , inline="S3", group=g_stochastic, tooltip="Will trun to designated color when stochastic gets to opposite extrem zone of current trend / Number = transparency")

transp = input.int (title=" " , defval=50, minval=0, maxval=100, step=10, inline="S3", group=g_stochastic, tooltip="")

var g_ema = " Exp. Moving Average"

ema1len = input.int (title="Fast EMA ", defval=21, minval=0, maxval=1000, step=1, inline="E1", group=g_ema, tooltip="")

ema2len = input.int (title="Slow EMA ", defval=50, minval=0, maxval=1000, step=1, inline="E2", group=g_ema, tooltip="")

ema1col = input.color(title=" " , defval=#0066ff , inline="E1", group=g_ema, tooltip="")

ema2col = input.color(title=" " , defval=#0000ff , inline="E2", group=g_ema, tooltip="")

var g_referenceMarket =" Reference Market"

refMfilter = input.bool (title="Reference Market Filter", defval=false , inline="", group=g_referenceMarket)

market = input (title="Market" , defval="BTC_USDT:swap", inline="", group=g_referenceMarket)

res = input.timeframe(title="Timeframe" , defval="30" , inline="", group=g_referenceMarket)

len = input.int (title="EMA Length" , defval=50 , inline="", group=g_referenceMarket)

//==============================================================================

//========================== FILTERS & SIGNALS =============================

//==============================================================================

//------------------------------ Stochastic --------------------------------

K = ta.stoch(close, high, low, Klen)

D = ta.sma(K, Dlen)

stochBullCross = ta.crossover(K, D)

stochBearCross = ta.crossover(D, K)

OSstoch = false

OBstoch = false

for i = 0 to OBOSlookback

if K[i] < OSstochLvl

OSstoch := true

else

if OBOSlookbackAll

OSstoch := false

for i = 0 to OBOSlookback

if K[i] > OBstochLvl

OBstoch := true

else

if OBOSlookbackAll

OBstoch := false

//---------------------------- Moving Averages -----------------------------

ema1 = ta.ema(close, ema1len)

ema2 = ta.ema(close, ema2len)

emaBull = ema1 > ema2

emaBear = ema1 < ema2

//---------------------------- Price source --------------------------------

bullRetraceZone = (close < ema1 and close >= ema2)

bearRetraceZone = (close > ema1 and close <= ema2)

//--------------------------- Reference market -----------------------------

ema = ta.ema(close, len)

emaHTF = request.security(market, res, ema [barstate.isconfirmed ? 0 : 1])

closeHTF = request.security(market, res, close[barstate.isconfirmed ? 0 : 1])

bullRefMarket = (closeHTF > emaHTF or closeHTF[1] > emaHTF[1])

bearRefMarket = (closeHTF < emaHTF or closeHTF[1] < emaHTF[1])

//-------------------------- SIGNAL VALIDATION -----------------------------

validLong = stochBullCross and OSstoch and emaBull and bullRetraceZone

and activateLongs and (refMfilter ? bullRefMarket : true) and strategy.position_size == 0

validShort = stochBearCross and OBstoch and emaBear and bearRetraceZone

and activateShorts and (refMfilter ? bearRefMarket : true) and strategy.position_size == 0

//==============================================================================

//=========================== STOPS & TARGETS ==============================

//==============================================================================

SLdist = ta.atr(atrLen) * atrMult

longSL = close - SLdist

longSLDist = close - longSL

longTP = close + (longSLDist * rr)

shortSL = close + SLdist

shortSLDist = shortSL - close

shortTP = close - (shortSLDist * rr)

var SLsaved = 0.0

var TPsaved = 0.0

if validLong or validShort

SLsaved := validLong ? longSL : validShort ? shortSL : na

TPsaved := validLong ? longTP : validShort ? shortTP : na

//==============================================================================

//========================== STRATEGY COMMANDS =============================

//==============================================================================

if validLong

strategy.entry("Long", strategy.long,

qty = RiskEquity ? ((riskPrctEqui/100)*strategy.equity)/longSLDist : RiskUSD ? riskUSD/longSLDist : na)

if validShort

strategy.entry("Short", strategy.short,

qty = RiskEquity ? ((riskPrctEqui/100)*strategy.equity)/shortSLDist : RiskUSD ? riskUSD/shortSLDist : na)

strategy.exit(id="Long Exit" , from_entry="Long" , limit=TPsaved, stop=SLsaved, when=strategy.position_size > 0)

strategy.exit(id="Short Exit", from_entry="Short", limit=TPsaved, stop=SLsaved, when=strategy.position_size < 0)

//==============================================================================

//============================= CHART PLOTS ================================

//==============================================================================

//---------------------------- Stops & Targets -----------------------------

plot(strategy.position_size != 0 or (strategy.position_size[1] != 0 and strategy.position_size == 0) ? SLsaved : na,

color=color.red , style=plot.style_linebr)

plot(strategy.position_size != 0 or (strategy.position_size[1] != 0 and strategy.position_size == 0) ? TPsaved : na,

color=color.green, style=plot.style_linebr)

//--------------------------------- EMAs -----------------------------------

l1 = plot(ema1, color=#0066ff, linewidth=2)

l2 = plot(ema2, color=#0000ff, linewidth=2)

//-------------------------- Stochastic gradient ---------------------------

// fill(l1, l2, color.new(color.from_gradient(K, OSstochLvl, OBstochLvl,

// emaBull ? entryColor : emaBear ? baseColor : na,

// emaBull ? baseColor : emaBear ? entryColor : na), transp))

//---------------------------- Trading Signals -----------------------------

plotshape(validLong, color=color.green, location=location.belowbar, style=shape.xcross, size=size.small)

plotshape(validShort, color=color.red , location=location.abovebar, style=shape.xcross, size=size.small)

//---------------------------- Reference Market ----------------------------

bgcolor(bullRefMarket and refMfilter ? color.new(color.green,90) : na)

bgcolor(bearRefMarket and refMfilter ? color.new(color.red ,90) : na)

더 많은

- 볼링거 밴드 브레이크업 거래 전략

- 라구에르 RSI 거래 전략

- 역동적인 재입구 구매 전용 전략

- 바위처럼 단단한 VIP 양자 전략

- 골든 크로스 최적화 이동 평균 크로스오버 거래 전략

- 이동평균을 가로질러 전략

- 라지 베어 기반의 웨이브 트렌드 트레이딩 전략

- 8일 연장 전략

- 이동 평균 회전 전략

- 동적 MA 크로스오버 트렌드 전략

- 모멘텀 오스실레이션 이동 평균 전략으로 볼링거 밴드를 가로질러

- RSI 볼링거 밴드 단기 거래 전략

- 슈퍼 트렌드 추적 중지 손실 전략

- Intraday 전략에 따른 MACD 트렌드

- 이중 요인 평균 반전 추적 전략

- 트렌드 추적 전략

- 다중 지표 조합 적응 트렌드 전략

- 촛불 패턴 거래 전략

- SMA 오프셋 변동 거래 전략

- 슈퍼 트렌드 확인을 이용한 5-10-20일 EMA 크로스오버에 기반한 전략