세 가지 지표로 감정에 의해 주도되는 브레이크업 전략

저자:차오장, 날짜: 2024-01-17 17:53:55태그:

전반적인 설명

이 전략은 QQE Mod 지표, SSL 하이브리드 지표 및 Waddah Attar Explosion 지표를 통합하여 거래 신호를 형성하고 여러 지표에 의해 주도되는 정서 브레이크업 전략에 속합니다. 이는 비교적 고품질의 브레이크업 전략인 가짜 브레이크업을 피하여 브레이크업 전에 시장 정서를 판단 할 수 있습니다.

전략 논리

이 전략의 핵심 논리는 세 가지 지표로 구성된 거래 결정에 기반합니다.

QQE 모드 표시기: 이 지표는 RSI 지표를 개선하여 시장 정서를 판단하는 데 더 민감하게 만듭니다. 이 전략은 하위 반전 및 상위 반전 신호를 결정하는 데 사용됩니다.

SSL 하이브리드 표시기: 이 지표는 시장 신호를 결정하기 위해 여러 이동 평균의 돌파구 상황을 포괄적으로 고려합니다. 이 전략은 채널 돌파구 패턴을 결정하는 데 사용합니다.

와다 아타르 폭발 지표: 이 지표는 채널 내의 가격의 폭발력을 판단합니다. 이 전략은 파업 도중의 추진력이 충분 여부를 결정하는 데 사용됩니다.

QQE 지표가 하위 반전 신호를 발산하고 SSL 지표가 채널 상위 브레이크아웃을 표시하고 Waddah Attar 지표가 폭발적인 추진력을 결정하면이 전략은 구매 결정을 생성합니다. 세 개의 지표가 동시에 반대 신호를 발산하면 판매 결정을합니다.

이 전략은 또한 정확한 스톱 로스를 설정하고 최대한의 이익을 확보하기 위해 수익을 취합니다. 이것은 고품질의 감정에 기반한 브레이크 아웃 전략입니다.

이점 분석

이 전략은 다음과 같은 장점을 가지고 있습니다.

- 시장 정서를 결정하고 거짓 파업 위험을 피하기 위해 여러 지표를 통합합니다.

- 포괄적으로 반전 지표, 채널 지표 및 동력 지표를 고려하여 브레이크 오브 중에 높은 확인 정도를 보장합니다.

- 고 정밀 이동 스톱 손실을 채택하여 위험을 제한하고 수익을 차단하십시오.

- 매개 변수는 좋은 안정성으로 많은 최적화 테스트를 통과했습니다 중장기 보유에 적합합니다

- 지표 매개 변수는 더 광범위한 시장 조건에 맞게 전략 스타일을 조정하도록 구성 할 수 있습니다.

위험 분석

이 전략의 주요 위험은 다음과 같습니다.

- 그것은 지속적인 하락 추세 동안 더 작은 손실 거래를 생성하는 경향이 있습니다.

- 그것은 몇몇 시장에서 매우 실패할 수 있는 여러 동시에 표시자 신호에 의존합니다.

- QQE와 같은 여러 지표에 대한 과도한 최적화 위험이 있습니다. 매개 변수는 신중하게 설정해야합니다.

- 이동 스톱 손실은 일부 비정상적인 시장 조건에서 정상적인 역할을 할 수 없습니다.

위의 위험을 해결하기 위해 지표 매개 변수를 보다 안정적으로 조정하고 적당하게 보유 기간을 늘려 더 높은 수익률을 얻도록 제안합니다.

최적화 방향

이 전략은 다음과 같은 측면에서 더 이상 최적화 될 수 있습니다.

- 표시기의 매개 변수를 조정하여 더 안정적이거나 민감하게 만듭니다.

- 변동성에 기반한 위치 사이즈 최적화 모듈을 추가

- 동적으로 시장 조건을 평가하기 위해 기계 학습 위험 제어 모듈을 추가

- 심층 학습 모델을 사용하여 지표 패턴을 예측하고 의사 결정 정확도를 향상시킵니다.

- 거짓 유출의 확률을 줄이기 위해 크로스 타임프레임 분석을 도입

결론

이 전략은 효율적인 감정 중심의 브레이크아웃 전략을 구축하기 위해 여러 주류 감정 지표의 장점을 통합합니다. 많은 저품질의 브레이크아웃으로 인한 위험을 성공적으로 피하고 수익을 잠금하기 위해 고정도 스톱 로스 개념을 갖추고 있습니다. 학습 및 활용 가치가있는 성숙하고 신뢰할 수있는 브레이크아웃 전략입니다. 지속적인 매개 변수 최적화 및 모델 예측으로 인해 더 일관된 과도한 수익을 창출 할 가능성이 있습니다.

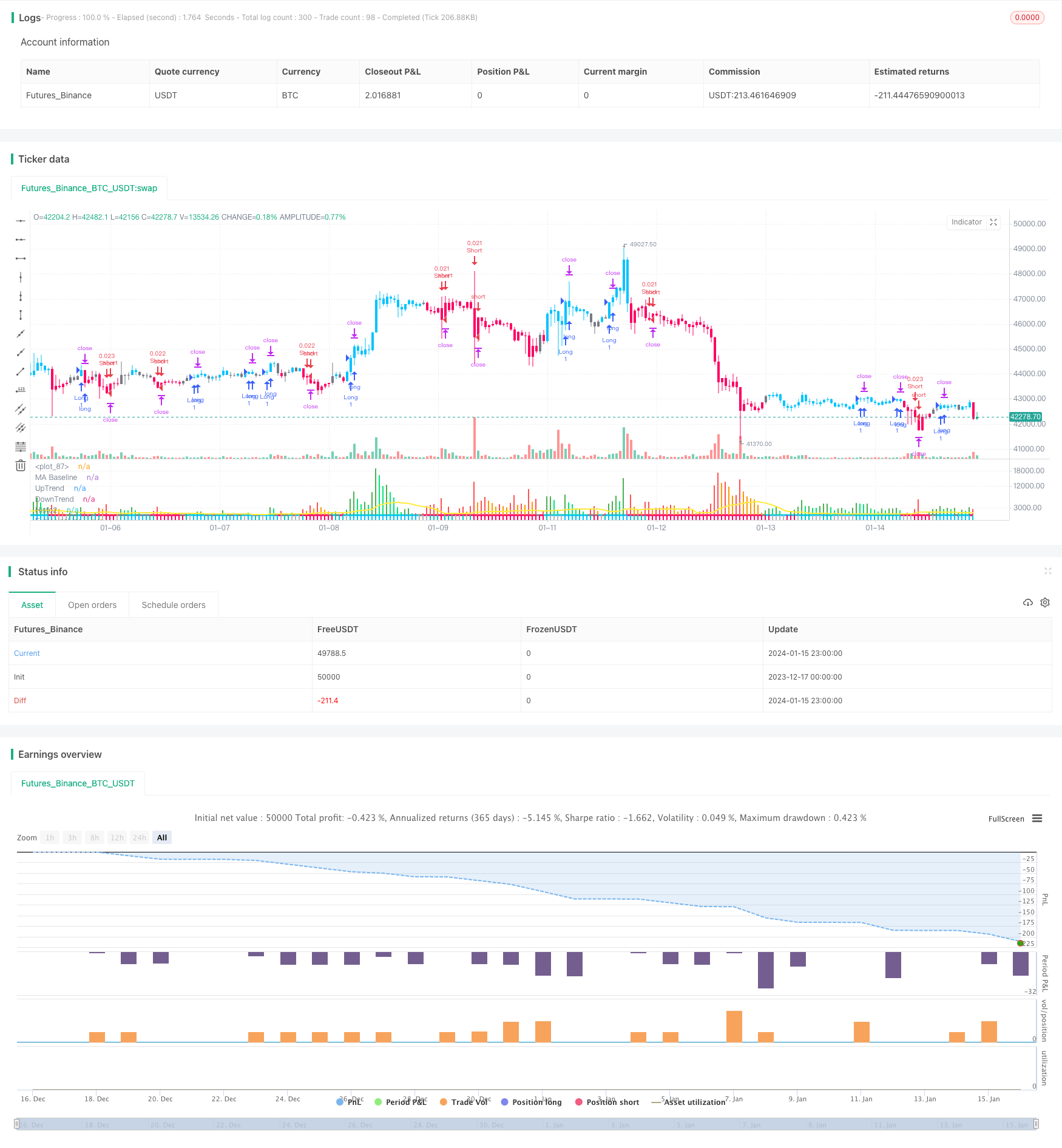

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Strategy based on the 3 indicators:

// - QQE MOD

// - SSL Hybrid

// - Waddah Attar Explosion

//

// Strategy was designed for the purpose of back testing.

// See strategy documentation for info on trade entry logic.

//

// Credits:

// - QQE MOD: Mihkel00 (https://www.tradingview.com/u/Mihkel00/)

// - SSL Hybrid: Mihkel00 (https://www.tradingview.com/u/Mihkel00/)

// - Waddah Attar Explosion: shayankm (https://www.tradingview.com/u/shayankm/)

//@version=5

strategy("QQE MOD + SSL Hybrid + Waddah Attar Explosion", overlay=false)

// =============================================================================

// STRATEGY INPUT SETTINGS

// =============================================================================

// ---------------

// Risk Management

// ---------------

swingLength = input.int(10, "Swing High/Low Lookback Length", group='Strategy: Risk Management', tooltip='Stop Loss is calculated by the swing high or low over the previous X candles')

accountRiskPercent = input.float(2, "Account percent loss per trade", step=0.1, group='Strategy: Risk Management', tooltip='Each trade will risk X% of the account balance')

// ----------

// Date Range

// ----------

start_year = input.int(title='Start Date', defval=2022, minval=2010, maxval=3000, group='Strategy: Date Range', inline='1')

start_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

start_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

end_year = input.int(title='End Date', defval=2023, minval=1800, maxval=3000, group='Strategy: Date Range', inline='2')

end_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

end_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

in_date_range = true

// =============================================================================

// INDICATORS

// =============================================================================

// -------

// QQE MOD

// -------

RSI_Period = input.int(6, title='RSI Length', group='Indicators: QQE Mod Settings')

SF = input.int(6, title='RSI Smoothing', group='Indicators: QQE Mod Settings')

QQE = input.int(3, title='Fast QQE Factor', group='Indicators: QQE Mod Settings')

ThreshHold = input.int(3, title='Thresh-hold', group='Indicators: QQE Mod Settings')

qqeSrc = input(close, title='RSI Source', group='Indicators: QQE Mod Settings')

Wilders_Period = RSI_Period * 2 - 1

Rsi = ta.rsi(qqeSrc, RSI_Period)

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

cross_1 = ta.cross(longband[1], RSIndex)

trend := ta.cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

length = input.int(50, minval=1, title='Bollinger Length', group='Indicators: QQE Mod Settings')

qqeMult = input.float(0.35, minval=0.001, maxval=5, step=0.1, title='BB Multiplier', group='Indicators: QQE Mod Settings')

basis = ta.sma(FastAtrRsiTL - 50, length)

dev = qqeMult * ta.stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

//qqe_color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

Zero = hline(0, color=color.white, linestyle=hline.style_dotted, linewidth=1, display=display.none)

RSI_Period2 = input.int(6, title='RSI Length', group='Indicators: QQE Mod Settings')

SF2 = input.int(5, title='RSI Smoothing', group='Indicators: QQE Mod Settings')

QQE2 = input.float(1.61, title='Fast QQE2 Factor', group='Indicators: QQE Mod Settings')

ThreshHold2 = input.int(3, title='Thresh-hold', group='Indicators: QQE Mod Settings')

src2 = input(close, title='RSI Source', group='Indicators: QQE Mod Settings')

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = ta.rsi(src2, RSI_Period2)

RsiMa2 = ta.ema(Rsi2, SF2)

AtrRsi2 = math.abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ta.ema(AtrRsi2, Wilders_Period2)

dar2 = ta.ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ? math.max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ? math.min(shortband2[1], newshortband2) : newshortband2

cross_2 = ta.cross(longband2[1], RSIndex2)

trend2 := ta.cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver : RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

plot(RsiMa2 - 50, color=hcolor2, title='Histo2', style=plot.style_columns, transp=50)

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

plot(Greenbar1 and Greenbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Up', style=plot.style_columns, color=color.new(#00c3ff, 0))

plot(Redbar1 and Redbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Down', style=plot.style_columns, color=color.new(#ff0062, 0))

// ----------

// SSL HYBRID

// ----------

show_Baseline = input(title='Show Baseline', defval=true)

show_SSL1 = input(title='Show SSL1', defval=false)

show_atr = input(title='Show ATR bands', defval=true)

//ATR

atrlen = input(14, 'ATR Period')

mult = input.float(1, 'ATR Multi', step=0.1)

smoothing = input.string(title='ATR Smoothing', defval='WMA', options=['RMA', 'SMA', 'EMA', 'WMA'])

ma_function(source, atrlen) =>

if smoothing == 'RMA'

ta.rma(source, atrlen)

else

if smoothing == 'SMA'

ta.sma(source, atrlen)

else

if smoothing == 'EMA'

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input.string(title='SSL1 / Baseline Type', defval='HMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'])

len = input(title='SSL1 / Baseline Length', defval=60)

SSL2Type = input.string(title='SSL2 / Continuation Type', defval='JMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'McGinley'])

len2 = input(title='SSL 2 Length', defval=5)

SSL3Type = input.string(title='EXIT Type', defval='HMA', options=['DEMA', 'TEMA', 'LSMA', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'McGinley', 'MF'])

len3 = input(title='EXIT Length', defval=15)

src = input(title='Source', defval=close)

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

kidiv = input.int(defval=1, maxval=4, title='Kijun MOD Divider')

jurik_phase = input(title='* Jurik (JMA) Only - Phase', defval=3)

jurik_power = input(title='* Jurik (JMA) Only - Power', defval=1)

volatility_lookback = input(10, title='* Volatility Adjusted (VAMA) Only - Volatility lookback length')

//MF

beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Modular Filter, General Filter Only - Beta')

feedback = input(false, title='Modular Filter Only - Feedback')

z = input.float(0.5, title='Modular Filter Only - Feedback Weighting', step=0.1, minval=0, maxval=1)

//EDSMA

ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20)

ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3])

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = feedback ? z * src + (1 - z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta * b + (1 - beta) * c

lower = beta * c + (1 - beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, volatility_lookback)

vol_down = ta.lowest(dev, volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / kidiv), ta.highest(len / kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2 ? get2PoleSSF(avgZeros, ssfLength) : get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true)

multy = input.float(0.2, step=0.05, title='Base Channel Multiplier')

Keltma = ma(maType, src, len)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, len)

upperk = Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open * 1

close_pos = close * 1

difference = math.abs(close_pos - open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = ta.crossover(close, sslExit)

base_cross_Short = ta.crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title='Color Bars', defval=true)

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

plotarrow(codiff, colorup=color.new(#00c3ff, 20), colordown=color.new(#ff0062, 20), title='Exit Arrows', maxheight=20, offset=0, display=display.none)

p1 = plot(0, color=color_bar, linewidth=3, title='MA Baseline', transp=0)

barcolor(show_color_bar ? color_bar : na)

// ---------------------

// WADDAH ATTAR EXPLOSION

// ---------------------

sensitivity = input.int(180, title="Sensitivity", group='Indicators: Waddah Attar Explosion')

fastLength=input.int(20, title="FastEMA Length", group='Indicators: Waddah Attar Explosion')

slowLength=input.int(40, title="SlowEMA Length", group='Indicators: Waddah Attar Explosion')

channelLength=input.int(20, title="BB Channel Length", group='Indicators: Waddah Attar Explosion')

waeMult=input.float(2.0, title="BB Stdev Multiplier", group='Indicators: Waddah Attar Explosion')

calc_macd(source, fastLength, slowLength) =>

fastMA = ta.ema(source, fastLength)

slowMA = ta.ema(source, slowLength)

fastMA - slowMA

calc_BBUpper(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis + dev

calc_BBLower(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis - dev

t1 = (calc_macd(close, fastLength, slowLength) - calc_macd(close[1], fastLength, slowLength))*sensitivity

e1 = (calc_BBUpper(close, channelLength, waeMult) - calc_BBLower(close, channelLength, waeMult))

trendUp = (t1 >= 0) ? t1 : 0

trendDown = (t1 < 0) ? (-1*t1) : 0

plot(trendUp, style=plot.style_columns, linewidth=1, color=(trendUp<trendUp[1]) ? color.lime : color.green, transp=45, title="UpTrend", display=display.none)

plot(trendDown, style=plot.style_columns, linewidth=1, color=(trendDown<trendDown[1]) ? color.orange : color.red, transp=45, title="DownTrend", display=display.none)

plot(e1, style=plot.style_line, linewidth=2, color=color.yellow, title="ExplosionLine", display=display.none)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// QQE Mod

qqeGreenBar = Greenbar1 and Greenbar2

qqeRedBar = Redbar1 and Redbar2

qqeBuy = qqeGreenBar and not qqeGreenBar[1]

qqeSell = qqeRedBar and not qqeRedBar[1]

// SSL Hybrid

sslBuy = close > upperk and close > BBMC

sslSell = close < lowerk and close < BBMC

// Waddah Attar Explosion

waeBuy = trendUp > 0 and trendUp > e1

waeSell = trendDown > 0 and trendDown > e1

inLong = strategy.position_size > 0

inShort = strategy.position_size < 0

longCondition = qqeBuy and sslBuy and waeBuy and in_date_range

shortCondition = qqeSell and sslSell and waeSell and in_date_range

swingLow = ta.lowest(source=low, length=swingLength)

swingHigh = ta.highest(source=high, length=swingLength)

longStopPercent = math.abs((1 - (swingLow / close)) * 100)

shortStopPercent = math.abs((1 - (swingHigh / close)) * 100)

// Position sizing (default risk 2% per trade)

riskAmt = strategy.equity * accountRiskPercent / 100

longQty = math.abs(riskAmt / longStopPercent * 100) / close

shortQty = math.abs(riskAmt / shortStopPercent * 100) / close

if (longCondition and not inShort and not inLong)

strategy.entry("Long", strategy.long, qty=longQty)

strategy.exit("Long SL/TP", from_entry="Long", stop=swingLow, alert_message='Long SL Hit')

buyLabel = label.new(x=bar_index, y=high[1], color=color.green, style=label.style_label_up)

label.set_y(id=buyLabel, y=0)

label.set_tooltip(id=buyLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(longQty) + " Swing low: " + str.tostring(swingLow) + " Stop Percent: " + str.tostring(longStopPercent))

if (shortCondition and not inLong and not inShort)

strategy.entry("Short", strategy.short, qty=shortQty)

strategy.exit("Short SL/TP", from_entry="Short", stop=swingHigh, alert_message='Short SL Hit')

sellLabel = label.new(x=bar_index, y=high[1], color=color.red, style=label.style_label_up)

label.set_y(id=sellLabel, y=0)

label.set_tooltip(id=sellLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(shortQty) + " Swing high: " + str.tostring(swingHigh) + " Stop Percent: " + str.tostring(shortStopPercent))

openTradesInProfit() =>

result = 0.

for i = 0 to strategy.opentrades-1

result += strategy.opentrades.profit(i)

result > 0

exitLong = inLong and base_cross_Short and openTradesInProfit()

strategy.close(id = "Long", when = exitLong, comment = "Closing Long", alert_message="Long TP Hit")

exitShort = inShort and base_cross_Long and openTradesInProfit()

strategy.close(id = "Short", when = exitShort, comment = "Closing Short", alert_message="Short TP Hit")

// =============================================================================

// DATA WINDOW PLOTTING

// =============================================================================

plotchar(0, "===========", "", location = location.top, color=#141823)

plotchar(0, "BUY SIGNALS:", "", location = location.top, color=#141823)

plotchar(0, "===========", "", location = location.top, color=#141823)

plotchar(qqeBuy, "QQE Mod: Buy Signal", "", location = location.top, color=qqeBuy ? color.green : color.orange)

plotchar(sslBuy, "SSL Hybrid: Buy Signal", "", location = location.top, color=sslBuy ? color.green : color.orange)

plotchar(waeBuy, "Waddah Attar Explosion: Buy Signal", "", location = location.top, color=waeBuy ? color.green : color.orange)

plotchar(inLong, "inLong", "", location = location.top, color=inLong ? color.green : color.orange)

plotchar(exitLong, "Exit Long", "", location = location.top, color=exitLong ? color.green : color.orange)

plotchar(0, "============", "", location = location.top, color=#141823)

plotchar(0, "SELL SIGNALS:", "", location = location.top, color=#141823)

plotchar(0, "============", "", location = location.top, color=#141823)

plotchar(qqeSell, "QQE Mod: Sell Signal", "", location = location.top, color=qqeSell ? color.red : color.orange)

plotchar(sslSell, "SSL Hybrid: Sell Signal", "", location = location.top, color=sslSell ? color.red : color.orange)

plotchar(waeSell, "Waddah Attar Explosion: Sell Signal", "", location = location.top, color=waeSell ? color.red : color.orange)

plotchar(inShort, "inShort", "", location = location.top, color=inShort ? color.red : color.orange)

plotchar(exitShort, "Exit Short", "", location = location.top, color=exitShort ? color.red : color.orange)

- 파라볼리 SAR, 주식 및 증권 지표 기반의 다중 시간 프레임 양적 거래 전략

- 금의 빠른 돌파구 EMA 거래 전략

- 이중 요인 추진력 추적 역전 전략

- 동력 역전 거래 전략

- DCA 전략과 결합한 볼링거 대역 및 RSI

- 엠마 풀백 짧은 전략

- 노로밴드 모멘텀 포지션 전략

- 이중 확인 역행 트렌드 추적 전략

- MACD 지표에 기반한 OBV 양상 거래 전략

- 하락 추세 전략 후 달러 가격 평균화

- 이동 평균, 가격 패턴 및 부피에 기초한 트렌드 역전 전략

- 이중 이동 평균 전략

- 동력 이동 평균 크로스오버 거래 전략

- 이중 이동 평균 금십자 전략

- 모멘텀 웨이브 볼링거 밴드 트렌드 전략

- 리버스 모멘텀 거래 전략

- 대역 통과 평균 PB 지표 전략

- RSI와 피보나치 5분 거래 전략

- MACD 양적 전략과 결합된 삼중 이동 평균

- 모멘텀 브레이크오웃 최적화