다기간에 기반한 SMA에 기반한 전략을 따르는 경향

저자:차오장, 날짜: 2024-02-04 14:50:24태그:

전반적인 설명

이 전략은 트렌드를 식별하고 따라가기 위해 다른 기간과 여러 SMA 라인을 결합합니다. 핵심 아이디어는: 트렌드를 결정하기 위해 다른 기간과 SMA의 상승/하락 방향을 비교하십시오. 단기 SMA가 장기 기간 SMA를 넘을 때 길게 이동하고 짧은 SMA가 긴 SMA를 넘을 때 짧게 이동합니다. ZeroLagEMA는 입출을 확인하는 데도 사용됩니다.

전략 논리

- 각각 10, 20, 50, 100 및 200의 기간을 가진 5개의 SMA 라인을 사용합니다.

- 트렌드를 결정하기 위해 이 5개의 SMA의 방향을 비교하십시오. 예를 들어, 10~20~100~200주기 SMA가 함께 상승할 때 상승 추세를 나타냅니다. 모두 하락할 때 하락 추세를 나타냅니다.

- 트레이딩 신호를 생성하기 위해 SMA의 값을 다른 기간과 비교합니다. 예를 들어, 10 기간 SMA가 20 기간 SMA를 넘을 때, 길게 가십시오. 10 기간 SMA가 20 기간 SMA를 넘을 때 짧게 가십시오.

- 진입 확인 및 출구 신호를 위해 ZeroLagEMA를 사용하십시오. 빠른 ZeroLagEMA가 느린 ZeroLagEMA를 넘을 때 길게 이동하고, 아래에 넘을 때 길게 종료하십시오. 쇼트에 대한 판단 논리는 반대입니다.

장점

- 여러 개의 SMA를 서로 다른 기간으로 결합하면 시장 트렌드를 효과적으로 결정할 수 있습니다.

- SMA 값을 비교하면 입출입 규칙이 생성됩니다.

- ZeroLagEMA 필터는 불필요한 트레이드를 피하고 안정성을 향상시킵니다.

- 트렌드 판단과 트레이딩 신호를 결합하면 트렌드를 따라 트레이딩이 이루어집니다.

위험 과 해결책

- 시장이 고집합될 때, 빈번한 SMA 크로스오버는 불필요한 손실을 초래할 수 있습니다.

- 솔루션: 유효하지 않은 신호 입력을 피하기 위해 ZeroLagEMA 필터를 높입니다.

- 여러 기간 SMA를 판단하면 급격한 단기 가격 변동에 신속하게 대응하지 못하는 다소 후진이 있습니다.

- 해결책: 판단을 돕기 위해 MACD와 같은 더 빠른 지표를 추가하십시오.

최적화 방향

- 가장 좋은 조합을 찾기 위해 SMA 기간 매개 변수를 최적화합니다.

- 손실을 더 제한하기 위해 트레일링 스톱과 같은 스톱 손실 전략을 추가하십시오.

- 포지션 사이즈 메커니즘을 추가하여 강력한 트렌드에 대한 베팅을 증가시키고 통합에 대한 베팅을 감소시킵니다.

- MACD와 KDJ와 같은 더 많은 보조 지표를 통합하여 전반적인 안정성을 향상시킵니다.

결론

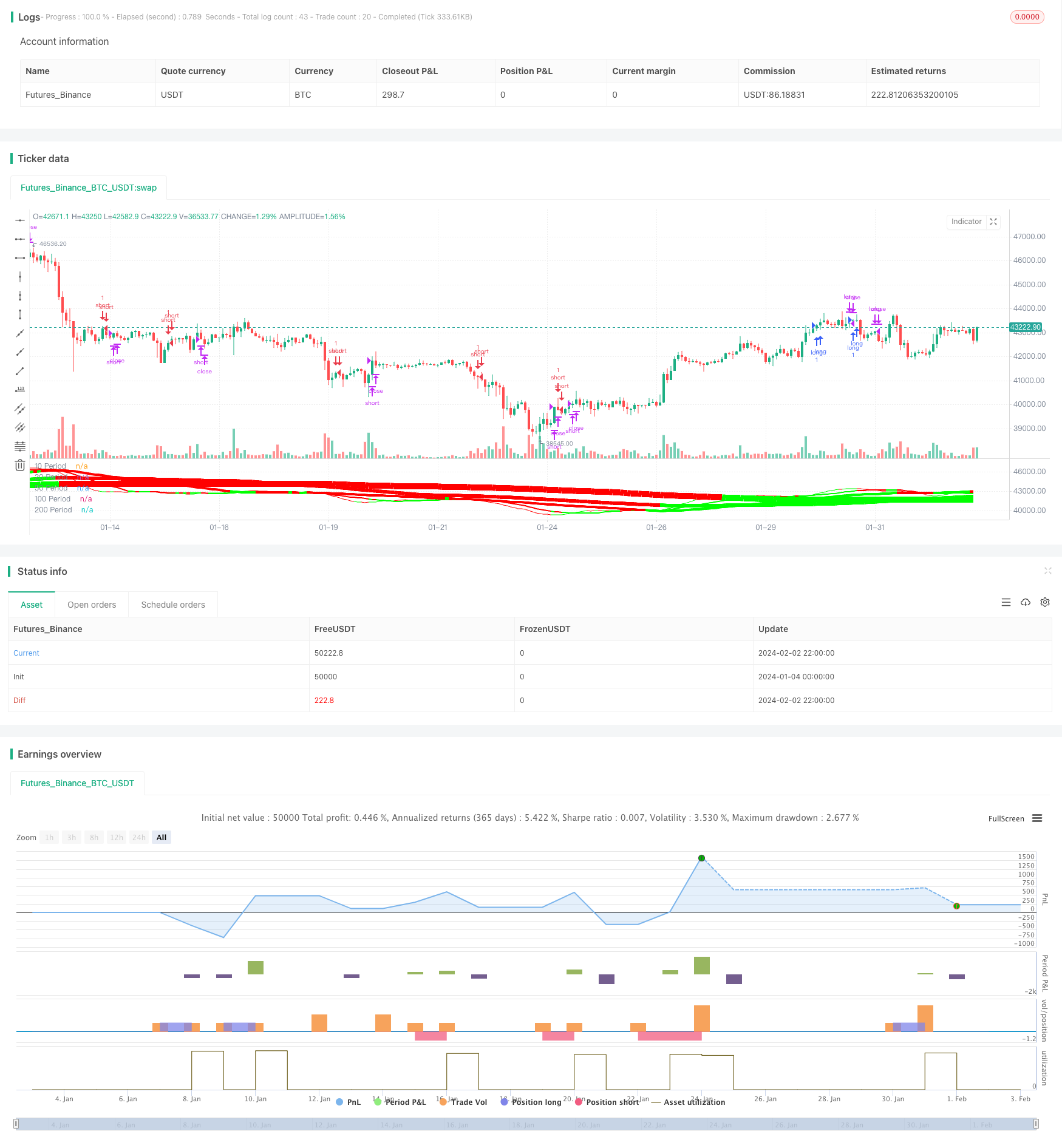

이 전략은 여러 기간 SMA를 결합하여 시장 트렌드를 효과적으로 결정하고 정량화 된 거래 신호를 생성합니다. ZeroLagEMA는 승률을 향상시킵니다. 요약하자면, 전략은 주목할만한 결과로 거래 후 정량 트렌드를 달성했습니다. 추가 최적화 기간, 스톱 로스, 포지션 사이징 등을 통해 라이브 거래에 대한 전략을 강화 할 수 있습니다.

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Forex MA Racer - SMA Performance /w ZeroLag EMA Trigger", shorttitle = "FX MA Racer (5x SMA, 2x zlEMA)", overlay=false )

// === INPUTS ===

hr0 = input(defval = true, title = "=== SERIES INPUTS ===")

smaSource = input(defval = close, title = "SMA Source")

sma1Length = input(defval = 10, title = "SMA 1 Length")

sma2Length = input(defval = 20, title = "SMA 2 Length")

sma3Length = input(defval = 50, title = "SMA 3 Length")

sma4Length = input(defval = 100, title = "SMA 4 Length")

sma5Length = input(defval = 200, title = "SMA 5 Length")

smaDirSpan = input(defval = 4, title = "SMA Direction Span")

zlmaSource = input(defval = close, title = "ZeroLag EMA Source")

zlmaFastLength = input(defval = 9, title = "ZeroLag EMA Fast Length")

zlmaSlowLength = input(defval = 21, title = "ZeroLag EMA Slow Length")

hr1 = input(defval = true, title = "=== PLOT TIME LIMITER ===")

useTimeLimit = input(defval = true, title = "Use Start Time Limiter?")

// set up where we want to run from

startYear = input(defval = 2018, title = "Start From Year", minval = 0, step = 1)

startMonth = input(defval = 02, title = "Start From Month", minval = 0,step = 1)

startDay = input(defval = 01, title = "Start From Day", minval = 0,step = 1)

startHour = input(defval = 00, title = "Start From Hour", minval = 0,step = 1)

startMinute = input(defval = 00, title = "Start From Minute", minval = 0,step = 1)

hr2 = input(defval = true, title = "=== TRAILING STOP ===")

useStop = input(defval = false, title = "Use Trailing Stop?")

slPoints = input(defval = 200, title = "Stop Loss Trail Points", minval = 1)

slOffset = input(defval = 400, title = "Stop Loss Trail Offset", minval = 1)

// === /INPUTS ===

// === SERIES SETUP ===

// Fast ZeroLag EMA

zema1=ema(zlmaSource, zlmaFastLength)

zema2=ema(zema1, zlmaFastLength)

d1=zema1-zema2

zlemaFast=zema1+d1

// Slow ZeroLag EMA

zema3=ema(zlmaSource, zlmaSlowLength)

zema4=ema(zema3, zlmaSlowLength)

d2=zema3-zema4

zlemaSlow=zema3+d2

// Simple Moving Averages

period10 = sma(close, sma1Length)

period20 = sma(close, sma2Length)

period50 = sma(close, sma3Length)

period100 = sma(close, sma4Length)

period200 = sma(close, sma5Length)

// === /SERIES SETUP ===

// === PLOT ===

// colors of plotted MAs

p1 = (close < period10) ? #FF0000 : #00FF00

p2 = (close < period20) ? #FF0000 : #00FF00

p3 = (close < period50) ? #FF0000 : #00FF00

p4 = (close < period100) ? #FF0000 : #00FF00

p5 = (close < period200) ? #FF0000 : #00FF00

plot(period10, title='10 Period', color = p1, linewidth=1)

plot(period20, title='20 Period', color = p2, linewidth=2)

plot(period50, title='50 Period', color = p3, linewidth=4)

plot(period100, title='100 Period', color = p4, linewidth=6)

plot(period200, title='200 Period', color = p5, linewidth=10)

// === /PLOT ===

//BFR = BRFIB ? (maFast+maSlow)/2 : abs(maFast - maSlow)

// === STRATEGY ===

// calculate SMA directions

direction10 = rising(period10, smaDirSpan) ? +1 : falling(period10, smaDirSpan) ? -1 : 0

direction20 = rising(period20, smaDirSpan) ? +1 : falling(period20, smaDirSpan) ? -1 : 0

direction50 = rising(period50, smaDirSpan) ? +1 : falling(period50, smaDirSpan) ? -1 : 0

direction100 = rising(period100, smaDirSpan) ? +1 : falling(period100, smaDirSpan) ? -1 : 0

direction200 = rising(period200, smaDirSpan) ? +1 : falling(period200, smaDirSpan) ? -1 : 0

// conditions

// SMA Direction Trigger

dirUp = direction10 > 0 and direction20 > 0 and direction100 > 0 and direction200 > 0

dirDn = direction10 < 0 and direction20 < 0 and direction100 < 0 and direction200 < 0

longCond = (period10>period20) and (period20>period50) and (period50>period100) and dirUp//and (close > period10) and (period50>period100) //and (period100>period200)

shortCond = (period10<period20) and (period20<period50) and dirDn//and (period50<period100) and (period100>period200)

longExit = crossunder(zlemaFast, zlemaSlow) or crossunder(period10, period20)

shortExit = crossover(zlemaFast, zlemaSlow) or crossover(period10, period20)

// entries and exits

startTimeOk() =>

// get our input time together

inputTime = timestamp(syminfo.timezone, startYear, startMonth, startDay, startHour, startMinute)

// check the current time is greater than the input time and assign true or false

timeOk = time > inputTime ? true : false

// last line is the return value, we want the strategy to execute if..

// ..we are using the limiter, and the time is ok -OR- we are not using the limiter

r = (useTimeLimit and timeOk) or not useTimeLimit

if( true )

// entries

strategy.entry("long", strategy.long, when = longCond)

strategy.entry("short", strategy.short, when = shortCond)

// trailing stop

if (useStop)

strategy.exit("XL", from_entry = "long", trail_points = slPoints, trail_offset = slOffset)

strategy.exit("XS", from_entry = "short", trail_points = slPoints, trail_offset = slOffset)

// exits

strategy.close("long", when = longExit)

strategy.close("short", when = shortExit)

// === /STRATEGY ===

더 많은

- RSI 및 볼린거 대역에 기초한 양적 거래 전략

- SMA와 롤링 트렌드 라인을 기반으로 한 양적 거래 전략

- 주간 옵션 거래 전략

- 강력한 EMA 및 RSI 양적 거래 전략

- 볼링거 밴드 및 RSI 조합 거래 전략

- 반신 촛불 MACD 격차 트렌드 전략

- 이중 이동 평균 크로스 타임프레임 거래 전략

- 이중 지표 스토카스틱 RSI와 EMA 거래 전략

- 전략에 따른 SMA 크로스오버 상승 추세

- 볼링거 밴드 브레이크업 양적 거래 전략

- 시장 감정에 기반한 이치모쿠의 브레이크업 전략

- 동적 다중 지표 양적 거래 전략

- 산호 트렌드 역전 전략

- 동력에 기반한 스윙 트레이딩 전략

- 모멘텀 브레이크업 거래 전략

- 트렌드 라이딩 RSI 스윙 캡처 전략

- 이중 레일 패러볼릭 SAR 볼링거 밴드 전략

- 삼배 기하급수적 이동 평균 이익 취득 및 중지 손실 전략

- 돈치안 채널 너비 거래 전략

- 최적화된 이동 평균 크로스오버 전략