"Magic Double EMA Strategy" daripada Veteran YouTube

Penulis:FMZ~Lydia, Dicipta: 2022-11-07 12:02:31, Dikemas kini: 2024-11-29 19:00:54

Magic Double EMA Strategy daripada Veteran YouTube

Dalam isu ini, kami akan membincangkan

Penunjuk yang digunakan oleh strategi

- Indikator EMA

Demi kesederhanaan reka bentuk, kita tidak akan menggunakan Eksponensial Purata Bergerak yang disenaraikan dalam video, kita akan menggunakan ta.ema terbina dalam pandangan perdagangan sebaliknya (ia sebenarnya sama).

- VuManChu Swing Free Indikator

Ini adalah penunjuk pada Trading View, kita perlu pergi ke Trading View dan mengambil kod sumber.

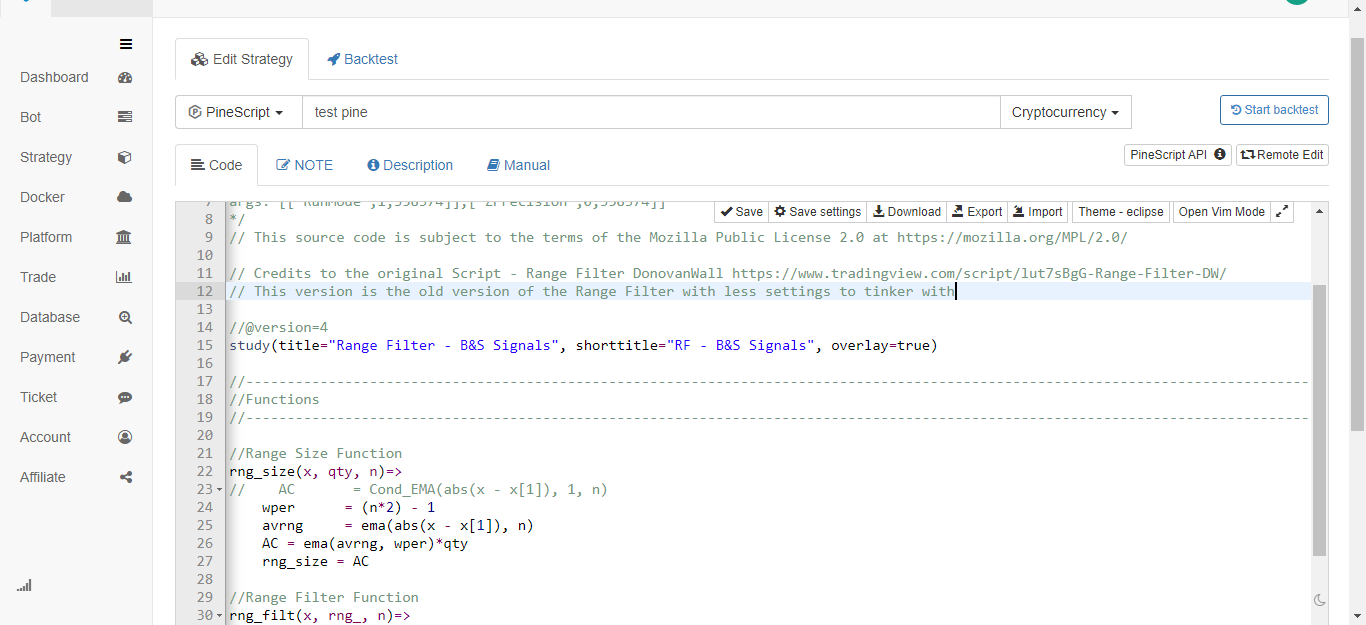

Kod VuManChu Swing Free:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Credits to the original Script - Range Filter DonovanWall https://www.tradingview.com/script/lut7sBgG-Range-Filter-DW/

// This version is the old version of the Range Filter with less settings to tinker with

//@version=4

study(title="Range Filter - B&S Signals", shorttitle="RF - B&S Signals", overlay=true)

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Functions

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Size Function

rng_size(x, qty, n)=>

// AC = Cond_EMA(abs(x - x[1]), 1, n)

wper = (n*2) - 1

avrng = ema(abs(x - x[1]), n)

AC = ema(avrng, wper)*qty

rng_size = AC

//Range Filter Function

rng_filt(x, rng_, n)=>

r = rng_

var rfilt = array.new_float(2, x)

array.set(rfilt, 1, array.get(rfilt, 0))

if x - r > array.get(rfilt, 1)

array.set(rfilt, 0, x - r)

if x + r < array.get(rfilt, 1)

array.set(rfilt, 0, x + r)

rng_filt1 = array.get(rfilt, 0)

hi_band = rng_filt1 + r

lo_band = rng_filt1 - r

rng_filt = rng_filt1

[hi_band, lo_band, rng_filt]

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Inputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Source

rng_src = input(defval=close, type=input.source, title="Swing Source")

//Range Period

rng_per = input(defval=20, minval=1, title="Swing Period")

//Range Size Inputs

rng_qty = input(defval=3.5, minval=0.0000001, title="Swing Multiplier")

//Bar Colors

use_barcolor = input(defval=false, type=input.bool, title="Bar Colors On/Off")

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Definitions

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Filter Values

[h_band, l_band, filt] = rng_filt(rng_src, rng_size(rng_src, rng_qty, rng_per), rng_per)

//Direction Conditions

var fdir = 0.0

fdir := filt > filt[1] ? 1 : filt < filt[1] ? -1 : fdir

upward = fdir==1 ? 1 : 0

downward = fdir==-1 ? 1 : 0

//Trading Condition

longCond = rng_src > filt and rng_src > rng_src[1] and upward > 0 or rng_src > filt and rng_src < rng_src[1] and upward > 0

shortCond = rng_src < filt and rng_src < rng_src[1] and downward > 0 or rng_src < filt and rng_src > rng_src[1] and downward > 0

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni[1]

longCondition = longCond and CondIni[1] == -1

shortCondition = shortCond and CondIni[1] == 1

//Colors

filt_color = upward ? #05ff9b : downward ? #ff0583 : #cccccc

bar_color = upward and (rng_src > filt) ? (rng_src > rng_src[1] ? #05ff9b : #00b36b) :

downward and (rng_src < filt) ? (rng_src < rng_src[1] ? #ff0583 : #b8005d) : #cccccc

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Outputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Filter Plot

filt_plot = plot(filt, color=filt_color, transp=67, linewidth=3, title="Filter")

//Band Plots

h_band_plot = plot(h_band, color=color.new(#05ff9b, 100), title="High Band")

l_band_plot = plot(l_band, color=color.new(#ff0583, 100), title="Low Band")

//Band Fills

fill(h_band_plot, filt_plot, color=color.new(#00b36b, 92), title="High Band Fill")

fill(l_band_plot, filt_plot, color=color.new(#b8005d, 92), title="Low Band Fill")

//Bar Color

barcolor(use_barcolor ? bar_color : na)

//Plot Buy and Sell Labels

plotshape(longCondition, title = "Buy Signal", text ="BUY", textcolor = color.white, style=shape.labelup, size = size.normal, location=location.belowbar, color = color.new(color.green, 0))

plotshape(shortCondition, title = "Sell Signal", text ="SELL", textcolor = color.white, style=shape.labeldown, size = size.normal, location=location.abovebar, color = color.new(color.red, 0))

//Alerts

alertcondition(longCondition, title="Buy Alert", message = "BUY")

alertcondition(shortCondition, title="Sell Alert", message = "SELL")

Logika Strategi

Indikator EMA: strategi menggunakan dua EMA, satu adalah garis cepat (parameter tempoh kecil) dan yang lain adalah garis perlahan (parameter tempoh besar).

-

perjanjian kedudukan panjang Garis cepat berada di atas garis perlahan.

-

perjanjian kedudukan pendek Garis laju berada di bawah garis perlahan.

Indikator VuManChu Swing Free: Indikator VuManChu Swing Free digunakan untuk menghantar isyarat dan menilai sama ada untuk meletakkan pesanan dalam kombinasi dengan keadaan lain. Ia dapat dilihat dari kod sumber indikator VuManChu Swing Free bahawa pembolehubah longCondition mewakili isyarat membeli dan pembolehubah shortCondition mewakili isyarat menjual. Kedua-dua pembolehubah ini akan digunakan untuk penulisan keadaan pesanan seterusnya.

Sekarang mari kita bercakap tentang keadaan pencetus khusus isyarat perdagangan:

-

Peraturan untuk memasuki kedudukan panjang: Harga penutupan garis K positif harus berada di atas garis cepat EMA, kedua-dua EMA harus menjadi kedudukan panjang (garis cepat di atas garis perlahan), dan penunjuk VuManChu Swing Free harus menunjukkan isyarat beli (longCondition adalah benar).

-

Peraturan untuk memasuki kedudukan pendek (berbeza dengan kedudukan panjang): Harga penutupan garis K negatif harus berada di bawah garis pantas EMA, kedua-dua EMA harus menjadi kedudukan pendek (garis pantas di bawah garis perlahan), dan penunjuk VuManChu Swing Free harus menunjukkan isyarat jual (shortCondition adalah benar).

Adakah logik perdagangan sangat mudah? Oleh kerana video sumber tidak menentukan profit stop dan loss stop, saya akan menggunakan moderat profit stop dan loss stop kaedah bebas, menggunakan titik tetap untuk stop loss, dan mengesan profit stop.

Reka bentuk kod

Kod untuk indikator VuManChu Swing Free, kami masukkan ke dalam kod strategi kami secara langsung tanpa sebarang perubahan.

Kemudian sejurus selepas itu, kita menulis sekeping kod bahasa Pine yang melaksanakan fungsi perdagangan:

// extend

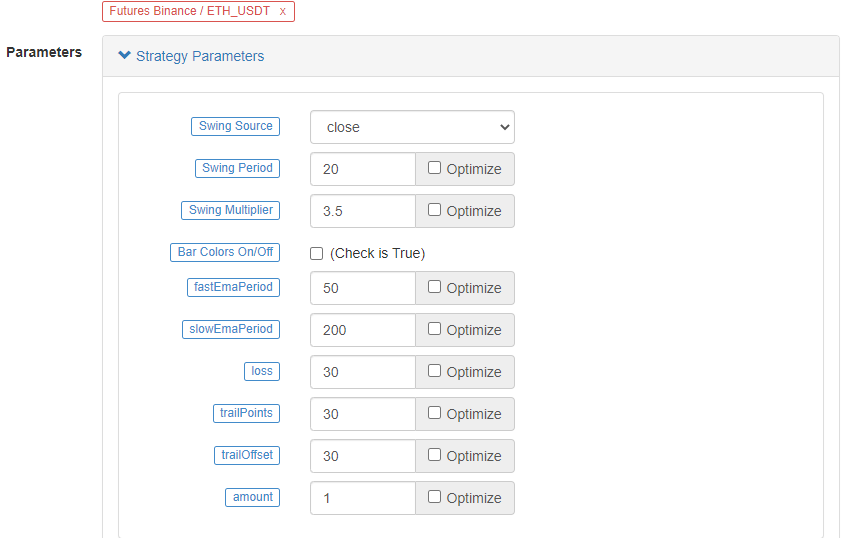

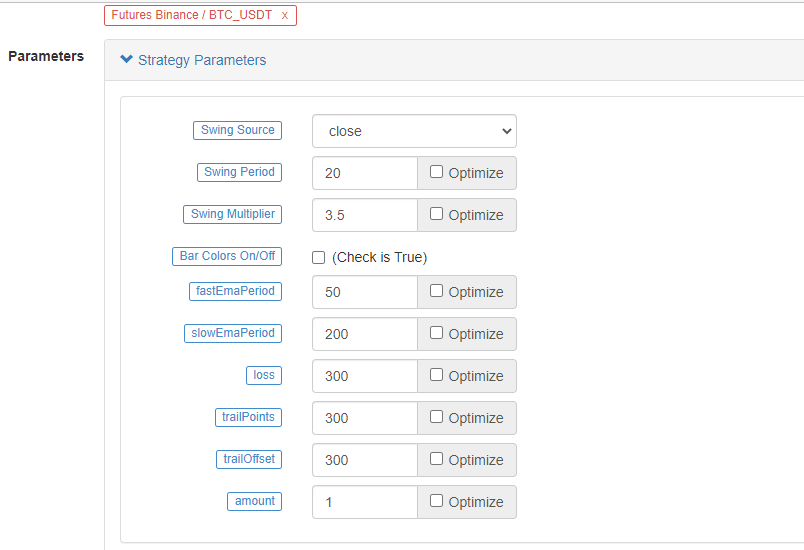

fastEmaPeriod = input(50, "fastEmaPeriod") // fast line period

slowEmaPeriod = input(200, "slowEmaPeriod") // slow line period

loss = input(30, "loss") // stop loss points

trailPoints = input(30, "trailPoints") // number of trigger points for moving stop loss

trailOffset = input(30, "trailOffset") // moving stop profit offset (points)

amount = input(1, "amount") // order amount

emaFast = ta.ema(close, fastEmaPeriod) // calculate the fast line EMA

emaSlow = ta.ema(close, slowEmaPeriod) // calculate the slow line EMA

buyCondition = longCondition and emaFast > emaSlow and close > open and close > emaFast // entry conditions for long positions

sellCondition = shortCondition and emaFast < emaSlow and close < open and close < emaFast // entry conditions for short positions

if buyCondition and strategy.position_size == 0

strategy.entry("long", strategy.long, amount)

strategy.exit("exit_long", "long", amount, loss=loss, trail_points=trailPoints, trail_offset=trailOffset)

if sellCondition and strategy.position_size == 0

strategy.entry("short", strategy.short, amount)

strategy.exit("exit_short", "short", amount, loss=loss, trail_points=trailPoints, trail_offset=trailOffset)

A.Itdapat dilihat bahawa apabila buyCondition adalah benar, iaitu:

- Variabel longCondition benar (Penunjuk VuManChu Swing Free menghantar isyarat kedudukan panjang).

- emaFast > emaSlow (penyesuaian kedudukan panjang EMA).

- close > open (bererti BAR semasa positif), close > emaFast (bererti harga penutupan di atas garis pantas EMA).

Tiga syarat untuk bertahan lama.

B.Apabila sellCondition adalah benar, tiga syarat untuk membuat kedudukan pendek berlaku (tidak diulangi di sini).

Kemudian kita menggunakan fungsi strategi.entry untuk memasuki dan membuka kedudukan dalam kes jika keadaan penghakiman isyarat pencetus, dan menetapkanstrategy.exitfungsi untuk menghentikan kerugian dan jejak keuntungan pada masa yang sama.

Kod Lengkap

/*backtest

start: 2022-01-01 00:00:00

end: 2022-10-08 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

args: [["ZPrecision",0,358374]]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Credits to the original Script - Range Filter DonovanWall https://www.tradingview.com/script/lut7sBgG-Range-Filter-DW/

// This version is the old version of the Range Filter with less settings to tinker with

//@version=4

study(title="Range Filter - B&S Signals", shorttitle="RF - B&S Signals", overlay=true)

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Functions

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Size Function

rng_size(x, qty, n)=>

// AC = Cond_EMA(abs(x - x[1]), 1, n)

wper = (n*2) - 1

avrng = ema(abs(x - x[1]), n)

AC = ema(avrng, wper)*qty

rng_size = AC

//Range Filter Function

rng_filt(x, rng_, n)=>

r = rng_

var rfilt = array.new_float(2, x)

array.set(rfilt, 1, array.get(rfilt, 0))

if x - r > array.get(rfilt, 1)

array.set(rfilt, 0, x - r)

if x + r < array.get(rfilt, 1)

array.set(rfilt, 0, x + r)

rng_filt1 = array.get(rfilt, 0)

hi_band = rng_filt1 + r

lo_band = rng_filt1 - r

rng_filt = rng_filt1

[hi_band, lo_band, rng_filt]

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Inputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Source

rng_src = input(defval=close, type=input.source, title="Swing Source")

//Range Period

rng_per = input(defval=20, minval=1, title="Swing Period")

//Range Size Inputs

rng_qty = input(defval=3.5, minval=0.0000001, title="Swing Multiplier")

//Bar Colors

use_barcolor = input(defval=false, type=input.bool, title="Bar Colors On/Off")

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Definitions

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Filter Values

[h_band, l_band, filt] = rng_filt(rng_src, rng_size(rng_src, rng_qty, rng_per), rng_per)

//Direction Conditions

var fdir = 0.0

fdir := filt > filt[1] ? 1 : filt < filt[1] ? -1 : fdir

upward = fdir==1 ? 1 : 0

downward = fdir==-1 ? 1 : 0

//Trading Condition

longCond = rng_src > filt and rng_src > rng_src[1] and upward > 0 or rng_src > filt and rng_src < rng_src[1] and upward > 0

shortCond = rng_src < filt and rng_src < rng_src[1] and downward > 0 or rng_src < filt and rng_src > rng_src[1] and downward > 0

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni[1]

longCondition = longCond and CondIni[1] == -1

shortCondition = shortCond and CondIni[1] == 1

//Colors

filt_color = upward ? #05ff9b : downward ? #ff0583 : #cccccc

bar_color = upward and (rng_src > filt) ? (rng_src > rng_src[1] ? #05ff9b : #00b36b) :

downward and (rng_src < filt) ? (rng_src < rng_src[1] ? #ff0583 : #b8005d) : #cccccc

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Outputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Filter Plot

filt_plot = plot(filt, color=filt_color, transp=67, linewidth=3, title="Filter")

//Band Plots

h_band_plot = plot(h_band, color=color.new(#05ff9b, 100), title="High Band")

l_band_plot = plot(l_band, color=color.new(#ff0583, 100), title="Low Band")

//Band Fills

fill(h_band_plot, filt_plot, color=color.new(#00b36b, 92), title="High Band Fill")

fill(l_band_plot, filt_plot, color=color.new(#b8005d, 92), title="Low Band Fill")

//Bar Color

barcolor(use_barcolor ? bar_color : na)

//Plot Buy and Sell Labels

plotshape(longCondition, title = "Buy Signal", text ="BUY", textcolor = color.white, style=shape.labelup, size = size.normal, location=location.belowbar, color = color.new(color.green, 0))

plotshape(shortCondition, title = "Sell Signal", text ="SELL", textcolor = color.white, style=shape.labeldown, size = size.normal, location=location.abovebar, color = color.new(color.red, 0))

//Alerts

alertcondition(longCondition, title="Buy Alert", message = "BUY")

alertcondition(shortCondition, title="Sell Alert", message = "SELL")

// extend

fastEmaPeriod = input(50, "fastEmaPeriod")

slowEmaPeriod = input(200, "slowEmaPeriod")

loss = input(30, "loss")

trailPoints = input(30, "trailPoints")

trailOffset = input(30, "trailOffset")

amount = input(1, "amount")

emaFast = ta.ema(close, fastEmaPeriod)

emaSlow = ta.ema(close, slowEmaPeriod)

buyCondition = longCondition and emaFast > emaSlow and close > open and close > emaFast

sellCondition = shortCondition and emaFast < emaSlow and close < open and close < emaFast

if buyCondition and strategy.position_size == 0

strategy.entry("long", strategy.long, amount)

strategy.exit("exit_long", "long", amount, loss=loss, trail_points=trailPoints, trail_offset=trailOffset)

if sellCondition and strategy.position_size == 0

strategy.entry("short", strategy.short, amount)

strategy.exit("exit_short", "short", amount, loss=loss, trail_points=trailPoints, trail_offset=trailOffset)

Ujian belakang

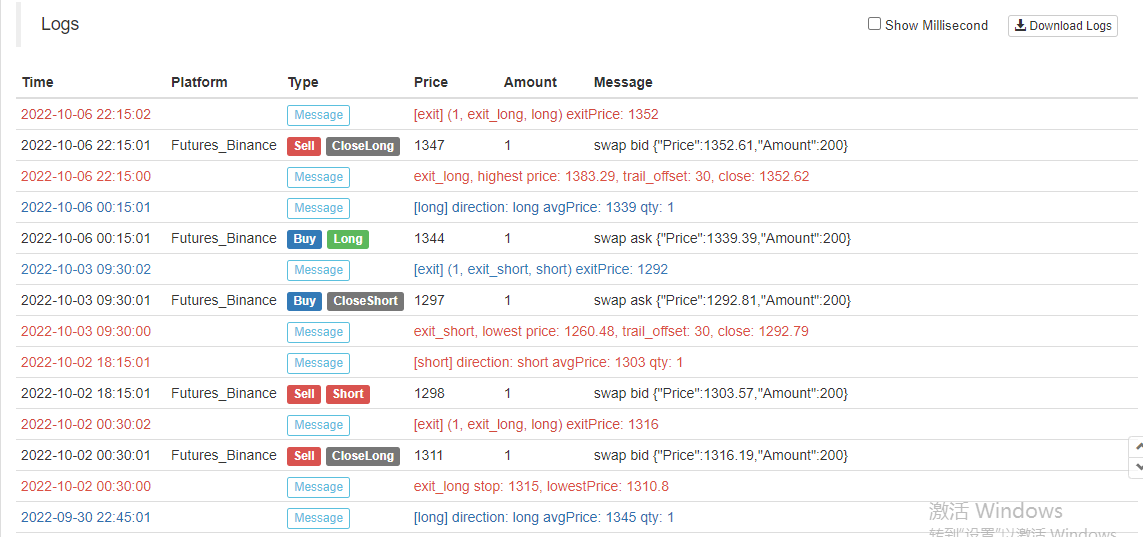

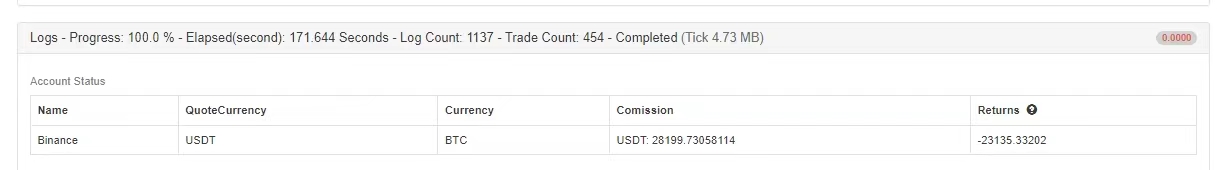

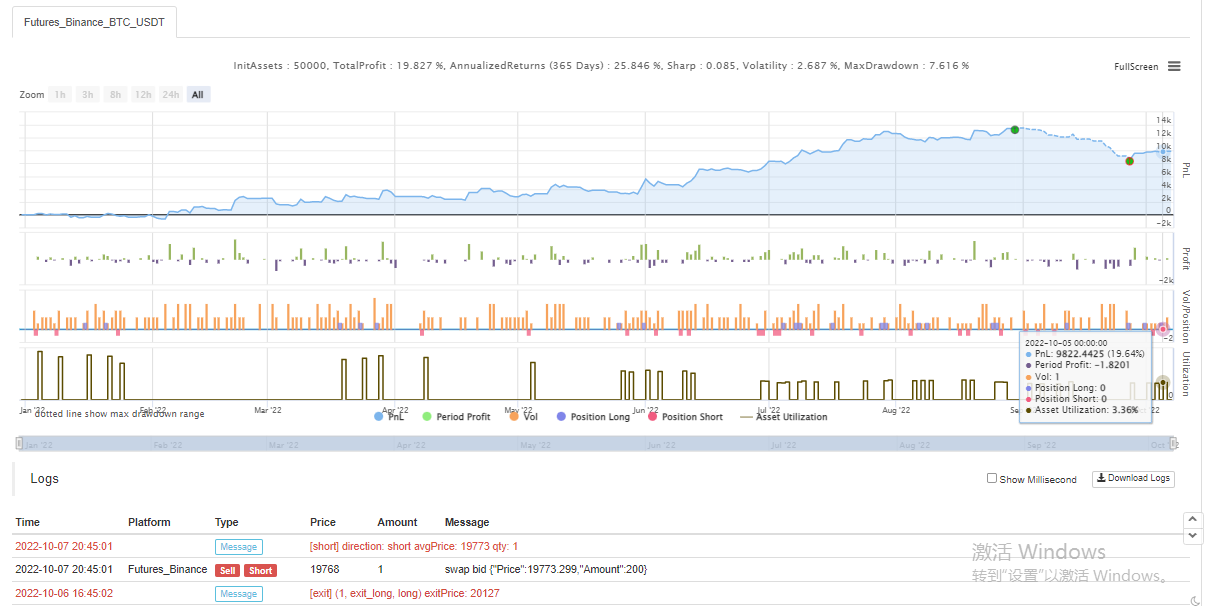

Julat masa ujian belakang adalah dari Januari 2022 hingga Oktober 2022. Tempoh garis K adalah 15 minit dan model harga penutupan digunakan untuk ujian belakang. Pasaran memilih kontrak kekal Binance ETH_USDT. Parameter ditetapkan mengikut 50 tempoh garis pantas dan 200 tempoh garis perlahan dalam video sumber. Parameter lain tetap tidak berubah secara lalai. Saya menetapkan titik stop loss dan penjejakan titik stop profit kepada 30 mata secara subjektif.

Hasil backtesting adalah biasa, dan nampaknya parameter stop-loss mempunyai beberapa pengaruh terhadap hasil backtesting. Saya merasakan bahawa aspek ini masih perlu dioptimumkan dan direka. Walau bagaimanapun, selepas isyarat strategik mencetuskan perdagangan, kadar kemenangan masih OK.

Mari kita cuba kontrak kekal BTC_USDT yang berbeza:

Hasil backtest pada BTC juga sangat menguntungkan:

Strategi daripada:https://www.fmz.com/strategy/385745

Nampaknya kaedah perdagangan ini agak boleh dipercayai untuk memahami trend, anda boleh terus mengoptimumkan reka bentuk mengikut idea ini. Dalam artikel ini, kita tidak hanya belajar tentang idea strategi purata bergerak berganda, tetapi juga belajar bagaimana memproses dan mempelajari strategi veteran di YouTube. OK, kod strategi di atas hanya bata dan mortar saya, hasil backtest tidak mewakili hasil bot sebenar tertentu, kod strategi, reka bentuk hanya untuk rujukan. Terima kasih atas sokongan anda, kami akan melihat anda lain kali!

- Pengenalan kepada Arbitraj Lead-Lag dalam Cryptocurrency (2)

- Pendahuluan mengenai Lead-Lag dalam mata wang digital (2)

- Perbincangan mengenai Penerimaan Isyarat Luaran Platform FMZ: Penyelesaian Lengkap untuk Menerima Isyarat dengan Perkhidmatan Http Terbina dalam Strategi

- Penyelidikan penerimaan isyarat luaran platform FMZ: strategi penyelesaian lengkap untuk penerimaan isyarat perkhidmatan HTTP terbina dalam

- Pengenalan kepada Arbitraj Lead-Lag dalam Cryptocurrency (1)

- Perkenalkan led-lag suite dalam mata wang digital ((1)

- Perbincangan mengenai penerimaan isyarat luaran Platform FMZ: API Terpanjang VS Strategi Perkhidmatan HTTP Terbina dalam

- Penyelidikan penerimaan isyarat luaran platform FMZ: API yang diperluaskan vs strategi perkhidmatan HTTP terbina dalam

- Perbincangan mengenai Kaedah Ujian Strategi Berdasarkan Random Ticker Generator

- Mengkaji kaedah ujian strategi berdasarkan penjana pasaran rawak

- Ciri baru FMZ Quant: Gunakan fungsi _Serve untuk membuat perkhidmatan HTTP dengan mudah

- Arbitraj faedah Binance kadar pembiayaan kekal (Pasar Bull semasa 100% Tahunan)

- Strategi Titik Peralihan Mata Wang Digital Futures Double-EMA (Tutorial)

- Langganan Strategi Saham Baru untuk Spot Mata Wang Digital (Tutorial)

- Menyampaikan idea dengan 60 baris kod -- Strategi Penangkapan Ikan Bawah Kontrak

- Strategi EMA Double Multi-varieti Mata Wang Digital Spot (Tutorial)

- Reka bentuk Sistem Pengurusan Pengaturcaraan Pengaturcaraan Berasaskan FMZ Quant (2)

- Strategi ATR berjangka mata wang digital pelbagai spesies (tutorial)

- Menulis alat perdagangan separa automatik dengan menggunakan bahasa Pine

- Terokai Reka Bentuk Strategi Frekuensi Tinggi dari Perubahan Ajaib LeeksReaper

- Analisis Strategi LeeksReaper (2)

- Pelaksanaan bahasa JavaScript penunjuk Fisher dan melukis pada FMZ

- Contoh reka bentuk strategi dYdX

- Reka bentuk Sistem Pengurusan Pengaturcaraan Pengaturcaraan Berasaskan FMZ Quant (1)

- Analisis Strategi LeeksReaper ((1)

- Strategi lindung nilai dinamik Delta Options Deribit

- Status terkini dan operasi disyorkan strategi kadar pembiayaan

- Tinjauan Pasaran Mata Wang Digital pada tahun 2021 dan Strategi 10 Kali Paling Sederhana yang Hilang

- Model Faktor Mata Wang Digital

- "Strategi EMA Berganda yang Ajaib" dari YouTube

- Menulis alat dagangan separa automatik menggunakan bahasa Pine