Strategi ATR berjangka mata wang digital pelbagai spesies (tutorial)

Penulis:FMZ~Lydia, Dicipta: 2022-11-08 10:34:22, Dikemas kini: 2023-09-15 20:55:33

Baru-baru ini, beberapa pengguna platform kami berharap untuk memindahkan strategi MyLanguage ke dalam strategi JavaScript, yang dapat menambah banyak idea pengoptimuman dengan fleksibel. Malah mengembangkan strategi ke versi pelbagai spesies. Kerana strategi MyLanguage biasanya merupakan strategi trend, dan banyak daripadanya dilaksanakan berdasarkan model harga penutupan. Antarmuka API pertukaran permintaan strategi tidak terlalu kerap, yang sesuai untuk pemindahan ke versi strategi pelbagai spesies. Dalam artikel ini, kami akan mengambil strategi MyLanguage yang mudah sebagai contoh untuk memindahkannya ke dalam versi bahasa JavaScript yang mudah. Tujuan utama adalah pengajaran dan penyelidikan sokongan.

Strategi MyLanguage untuk Dipindahkan

TR:=MAX(MAX((H-L),ABS(REF(C,1)-H)),ABS(REF(C,1)-L));

ATR:=EMA(TR,LENGTH2);

MIDLINE^^EMA((H + L + C)/3,LENGTH1);

UPBAND^^MIDLINE + N*ATR;

DOWNBAND^^MIDLINE - N*ATR;

BKVOL=0 AND C>=UPBAND AND REF(C,1)<REF(UPBAND,1),BPK;

SKVOL=0 AND C<=DOWNBAND AND REF(C,1)>REF(DOWNBAND,1),SPK;

BKVOL>0 AND C<=MIDLINE,SP(BKVOL);

SKVOL>0 AND C>=MIDLINE,BP(SKVOL);

// stop loss

// stop loss

C>=SKPRICE*(1+SLOSS*0.01),BP;

C<=BKPRICE*(1-SLOSS*0.01),SP;

AUTOFILTER;

Logik perdagangan strategi ini adalah mudah. Pertama, mengira ATR mengikut parameter, kemudian mengira purata harga tertinggi, terendah dan penutupan semua BAR K-line, dan kemudian mengira penunjuk EMA mengikut data purata. Akhirnya, menggabungkan ATR dan pekali N dalam parameter untuk mengira upBand dan downBand.

Posisi pembukaan dan jualan adalah berdasarkan harga penutupan. Buka kedudukan panjang apabila ia mengatasi upBand dan menjual kedudukan pembukaan (apabila memegang kedudukan pendek). Buka kedudukan pendek apabila ia mengatasi downBand dan menjual kedudukan pembukaan. Apabila harga penutupan mencapai garis tengah, kedudukan akan ditutup, dan apabila harga penutupan mencapai harga stop loss, kedudukan juga akan ditutup (stop loss mengikut SLOSS, SLOSS adalah 1, iaitu 0.01, iaitu 1%). Strategi ini dilaksanakan dalam model harga penutupan.

OK, jika kita memahami keperluan strategik dan idea MyLanguage, kita boleh mula menanamkan mereka.

Prototaip Strategi Pemindahan dan Reka Bentuk

Tidak banyak kod prototaip strategi, dari 1 hingga 200 baris. Untuk memudahkan pembelajaran idea-idea penulisan strategi, komen ditulis secara langsung dalam kod strategi.

// parse params parameters, and parse strings as objects

var arrParam = JSON.parse(params)

// this function creates a chart configuration

function createChartConfig(symbol, atrPeriod, emaPeriod, index) { // symbol : trading pair, atrPeriod : ATR parameter period , emaPeriod : EMA parameter period, exchange object index corresponding to index

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K-line data series

name: symbol,

id: symbol + "-" + index,

data: []

}, {

type: 'line', // EMA

name: symbol + ',EMA:' + emaPeriod,

data: [],

}, {

type: 'line', // upBand

name: symbol + ',upBand' + atrPeriod,

data: []

}, {

type: 'line', // downBand

name: symbol + ',downBand' + atrPeriod,

data: []

}, {

type: 'flags',

onSeries: symbol + "-" + index,

data: [],

}

]

}

return chart

}

// main Logic

function process(e, kIndex, c) { // e is the exchange object, exchanges [0]..., kIndex is the K-line data series in the chart, and c is the chart object

// obtain K-line data

var r = e.GetRecords(e.param.period)

if (!r || r.length < e.param.atrPeriod + 2 || r.length < e.param.emaPeriod + 2) {

// if the K-line data length is insufficient, return

return

}

// calculate ATR indicators

var atr = TA.ATR(r, e.param.atrPeriod)

var arrAvgPrice = []

_.each(r, function(bar) {

arrAvgPrice.push((bar.High + bar.Low + bar.Close) / 3)

})

// calculate EMA indicators

var midLine = TA.EMA(arrAvgPrice, e.param.emaPeriod)

// calculate upBand and downBand

var upBand = []

var downBand = []

_.each(midLine, function(mid, index) {

if (index < e.param.emaPeriod - 1 || index < e.param.atrPeriod - 1) {

upBand.push(NaN)

downBand.push(NaN)

return

}

upBand.push(mid + e.param.trackRatio * atr[index])

downBand.push(mid - e.param.trackRatio * atr[index])

})

// draw the chart

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == e.state.lastBarTime) {

// update

c.add(kIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

c.add(kIndex + 1, [r[i].Time, midLine[i]], -1)

c.add(kIndex + 2, [r[i].Time, upBand[i]], -1)

c.add(kIndex + 3, [r[i].Time, downBand[i]], -1)

} else if (r[i].Time > e.state.lastBarTime) {

// add

e.state.lastBarTime = r[i].Time

c.add(kIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

c.add(kIndex + 1, [r[i].Time, midLine[i]])

c.add(kIndex + 2, [r[i].Time, upBand[i]])

c.add(kIndex + 3, [r[i].Time, downBand[i]])

}

}

// check the position

var pos = e.GetPosition()

if (!pos) {

return

}

var holdAmount = 0

var holdPrice = 0

if (pos.length > 1) {

throw "long and short positions are checked at the same time!"

} else if (pos.length != 0) {

holdAmount = pos[0].Type == PD_LONG ? pos[0].Amount : -pos[0].Amount

holdPrice = pos[0].Price

}

if (e.state.preBar == -1) {

e.state.preBar = r[r.length - 1].Time

}

// check the signal

if (e.state.preBar != r[r.length - 1].Time) { // closing price model

if (holdAmount <= 0 && r[r.length - 3].Close < upBand[upBand.length - 3] && r[r.length - 2].Close > upBand[upBand.length - 2]) { // the closing price cross over the upBand

if (holdAmount < 0) { // hold a short positions, close them

Log(e.GetCurrency(), "close short positions", "#FF0000")

$.CoverShort(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: 'close', text: "close short positions"})

}

// open long positions

Log(e.GetCurrency(), "open long positions", "#FF0000")

$.OpenLong(e, e.param.symbol, 10)

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: 'long', text: "open long positions"})

} else if (holdAmount >= 0 && r[r.length - 3].Close > downBand[downBand.length - 3] && r[r.length - 2].Close < downBand[downBand.length - 2]) { // the closing price cross down the downBand

if (holdAmount > 0) { // hold long positions, close them

Log(e.GetCurrency(), "close long positions", "#FF0000")

$.CoverLong(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: 'close', text: "close long positions"})

}

// open short positions

Log(e.GetCurrency(), "open short positions", "#FF0000")

$.OpenShort(e, e.param.symbol, 10)

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: 'short', text: "open short positions"})

} else {

// close positions

if (holdAmount > 0 && (r[r.length - 2].Close <= holdPrice * (1 - e.param.stopLoss) || r[r.length - 2].Close <= midLine[midLine.length - 2])) { // Hold a long position, the closing price is less than or equal to the midline, stop loss at the opening price

Log(e.GetCurrency(), "trigger midline or stop loss, close long positions", "#FF0000")

$.CoverLong(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: 'close', text: "close long positions"})

} else if (holdAmount < 0 && (r[r.length - 2].Close >= holdPrice * (1 + e.param.stopLoss) || r[r.length - 2].Close >= midLine[midLine.length - 2])) { // Hold a short position, the closing price is greater than or equal to the midline, stop loss at the opening price

Log(e.GetCurrency(), "trigger midline or stop loss, close short positions", "#FF0000")

$.CoverShort(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: 'close', text: "close short positions"})

}

}

e.state.preBar = r[r.length - 1].Time

}

}

function main() {

var arrChartConfig = []

if (arrParam.length != exchanges.length) {

throw "Parameters and exchange objects do not match!"

}

var arrState = _G("arrState")

_.each(exchanges, function(e, index) {

if (e.GetName() != "Futures_Binance") {

throw "The exchange is not supported!"

}

e.param = arrParam[index]

e.state = {lastBarTime: 0, symbol: e.param.symbol, currency: e.GetCurrency()}

if (arrState) {

if (arrState[index].symbol == e.param.symbol && arrState[index].currency == e.GetCurrency()) {

Log("restore:", e.state)

e.state = arrState[index]

} else {

throw "The restored data does not match the current settings!"

}

}

e.state.preBar = -1 // initial setting -1

e.SetContractType(e.param.symbol)

Log(e.GetName(), e.GetLabel(), "set contracts:", e.param.symbol)

arrChartConfig.push(createChartConfig(e.GetCurrency(), e.param.atrPeriod, e.param.emaPeriod, index))

})

var chart = Chart(arrChartConfig)

chart.reset()

while (true) {

_.each(exchanges, function(e, index) {

process(e, index + index * 4, chart)

Sleep(500)

})

}

}

function onexit() {

// record e.state

var arrState = []

_.each(exchanges, function(e) {

arrState.push(e.state)

})

Log("record:", arrState)

_G("arrState", arrState)

}

Parameter strategi:

var params = '[{

"symbol" : "swap", // contract code

"period" : 86400, // K-line period, 86,400 seconds is a day

"stopLoss" : 0.07, // stop loss factor, 0.07 or 7%

"atrPeriod" : 10, // ATR indicator parameters

"emaPeriod" : 10, // EMA indicator parameters

"trackRatio" : 1, // upBand and downBand coefficients

"openRatio" : 0.1 // The reserved opening percentage, which is not supported for now

}, {

"symbol" : "swap",

"period" : 86400,

"stopLoss" : 0.07,

"atrPeriod" : 10,

"emaPeriod" : 10,

"trackRatio" : 1,

"openRatio" : 0.1

}]'

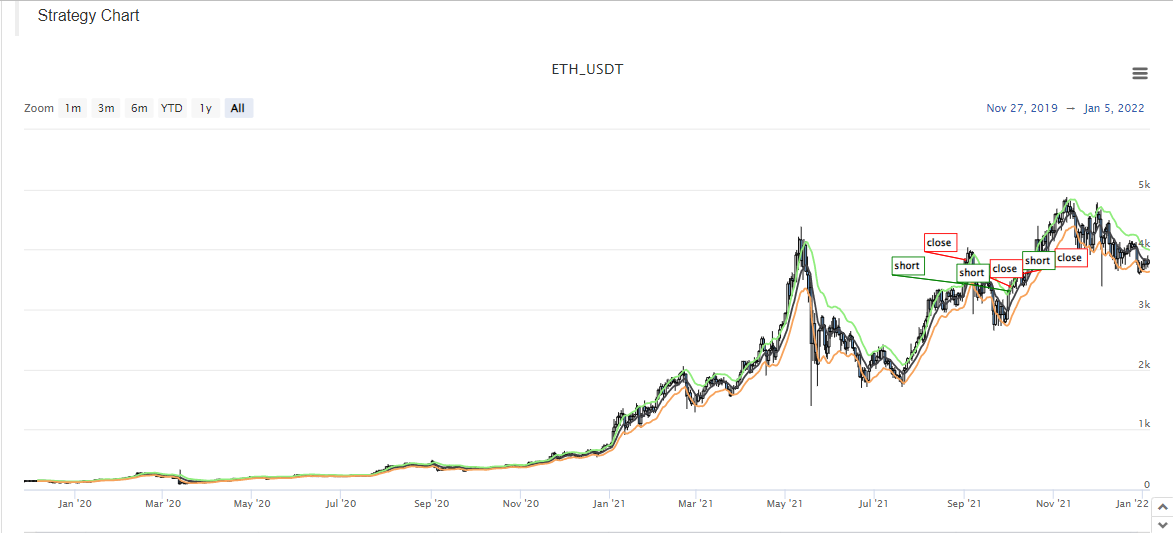

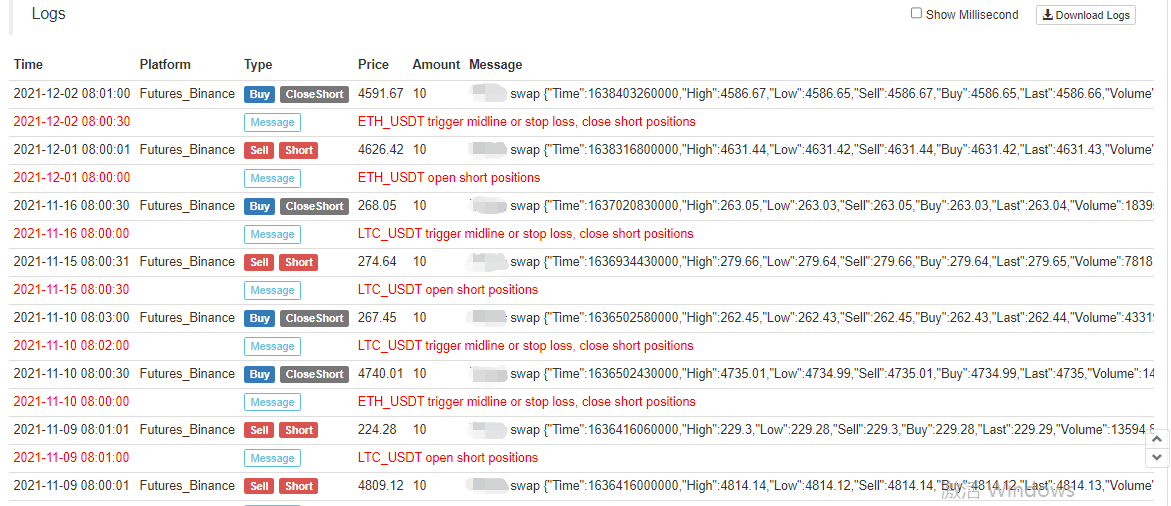

Tangkapan skrin ujian belakang:

Kod sumber strategi:https://www.fmz.com/strategy/339344

Strategi adalah untuk backtesting dan pembelajaran penyelidikan sahaja. sila ubah, mengoptimumkan, dan merujuk kepada bot sebenar sendiri.

- Pengenalan kepada Arbitraj Lead-Lag dalam Cryptocurrency (2)

- Pendahuluan mengenai Lead-Lag dalam mata wang digital (2)

- Perbincangan mengenai Penerimaan Isyarat Luaran Platform FMZ: Penyelesaian Lengkap untuk Menerima Isyarat dengan Perkhidmatan Http Terbina dalam Strategi

- Penyelidikan penerimaan isyarat luaran platform FMZ: strategi penyelesaian lengkap untuk penerimaan isyarat perkhidmatan HTTP terbina dalam

- Pengenalan kepada Arbitraj Lead-Lag dalam Cryptocurrency (1)

- Perkenalkan led-lag suite dalam mata wang digital ((1)

- Perbincangan mengenai penerimaan isyarat luaran Platform FMZ: API Terpanjang VS Strategi Perkhidmatan HTTP Terbina dalam

- Penyelidikan penerimaan isyarat luaran platform FMZ: API yang diperluaskan vs strategi perkhidmatan HTTP terbina dalam

- Perbincangan mengenai Kaedah Ujian Strategi Berdasarkan Random Ticker Generator

- Mengkaji kaedah ujian strategi berdasarkan penjana pasaran rawak

- Ciri baru FMZ Quant: Gunakan fungsi _Serve untuk membuat perkhidmatan HTTP dengan mudah

- Dapatkan 80 kali dalam 5 hari, Kuasa Strategi Frekuensi Tinggi

- Penyelidikan dan Contoh mengenai Maker Spots dan Futures Hedging Strategy Design

- Membina Pangkalan Data Kuantitatif FMZ dengan SQLite

- Cara Menugaskan Data Versi Berbeza ke Strategi Sewa Melalui Metadata Kod Sewa Strategi

- Arbitraj faedah Binance kadar pembiayaan kekal (Pasar Bull semasa 100% Tahunan)

- Strategi Titik Peralihan Mata Wang Digital Futures Double-EMA (Tutorial)

- Langganan Strategi Saham Baru untuk Spot Mata Wang Digital (Tutorial)

- Menyampaikan idea dengan 60 baris kod -- Strategi Penangkapan Ikan Bawah Kontrak

- Strategi EMA Double Multi-varieti Mata Wang Digital Spot (Tutorial)

- Reka bentuk Sistem Pengurusan Pengaturcaraan Pengaturcaraan Berasaskan FMZ Quant (2)

- Menulis alat perdagangan separa automatik dengan menggunakan bahasa Pine

- Terokai Reka Bentuk Strategi Frekuensi Tinggi dari Perubahan Ajaib LeeksReaper

- Analisis Strategi LeeksReaper (2)

- "Magic Double EMA Strategy" daripada Veteran YouTube

- Pelaksanaan bahasa JavaScript penunjuk Fisher dan melukis pada FMZ

- Contoh reka bentuk strategi dYdX

- Reka bentuk Sistem Pengurusan Pengaturcaraan Pengaturcaraan Berasaskan FMZ Quant (1)

- Analisis Strategi LeeksReaper ((1)

- Strategi lindung nilai dinamik Delta Options Deribit

- Status terkini dan operasi disyorkan strategi kadar pembiayaan