Strategi Gabungan Pembalikan Momentum

Gambaran keseluruhan

Strategi ini menggunakan kombinasi dua indikator momentum untuk mencari peluang perdagangan yang lebih banyak. Yang pertama adalah strategi pembalikan indikator acak-acak yang dikemukakan oleh Wolf Jansen dalam bukunya. Yang kedua adalah harga sintesis yang tidak trend yang dikemukakan oleh John Ehlers.

Prinsip Strategi

Prinsip strategi pembalikan penunjuk acak acak dalam bahagian pertama adalah: apabila harga penutupan dua hari berturut-turut lebih rendah daripada harga penutupan hari sebelumnya, dan garis cepat lebih tinggi daripada garis perlahan; apabila harga penutupan dua hari berturut-turut lebih tinggi daripada harga penutupan hari sebelumnya, dan garis cepat lebih rendah daripada garis perlahan, maka kosong.

Rumus pengiraan harga sintesis ke arah penurunan trend bagi bahagian kedua ialah:

DSP = EMA ((HL/2, 0.25 kitaran) - EMA ((HL/2, 0.5 kitaran)

Di mana HL / 2 adalah titik pertengahan harga yang tinggi dan rendah, 0.25 kitaran EMA mewakili trend harga dalam jangka pendek, 0.5 kitaran EMA mewakili trend harga dalam jangka panjang. Harga sintesis ke arah trend mewakili kenaikan dan penurunan harga berbanding dengan kitaran dominan.

Strategi ini mempertimbangkan gabungan kedua-dua isyarat penunjuk. Hanya apabila kedua-dua penunjuk menghantar isyarat membeli atau menjual pada masa yang sama, kedudukan akan dibuka.

Analisis kelebihan

- Menggunakan dua jenis penunjuk untuk menyaring isyarat ketidakpastian dan mengurangkan kesilapan perdagangan

- Kedua-dua indikator saling disahkan untuk meningkatkan kebolehpercayaan isyarat

- Strategi pembalikan indikator acak dan pantas untuk menangkap peluang pembalikan jangka pendek

- Trend ke arah arah harga sintetik yang boleh dikenali dalam trend garis panjang

- Gabungan dua jenis penunjuk, boleh menangkap perubahan dan mengikuti trend, fleksibiliti yang tinggi

Analisis risiko

- Penunjuk acak yang cepat dan lambat tidak berfungsi dengan baik di tengah-tengah pergolakan

- Harga sintesis ke arah trend mungkin memberi isyarat yang salah sebelum titik perubahan trend

- Berdagang hanya apabila kedua-dua petunjuk memberi isyarat pada masa yang sama, mungkin kehilangan sebahagian peluang

- Parameter yang betul diperlukan untuk mencapai kesan gabungan

Arah pengoptimuman

- Anda boleh menguji parameter yang berbeza untuk mengoptimumkan prestasi

- Anda boleh mencuba pelbagai penunjuk berat, seperti penundaan kepada isyarat harga sintesis trend

- Stop loss boleh ditambah untuk mengawal risiko

- Lebih banyak jenis penunjuk boleh disatukan untuk membina model pelbagai faktor

ringkaskan

Strategi ini menggabungkan dua indikator momentum yang berbeza untuk meningkatkan kualiti isyarat melalui penapisan berganda, dan mengawal risiko sambil mengekalkan frekuensi perdagangan. Tetapi perlu memperhatikan batasan indikator itu sendiri dan mengoptimumkan parameter dengan sewajarnya.

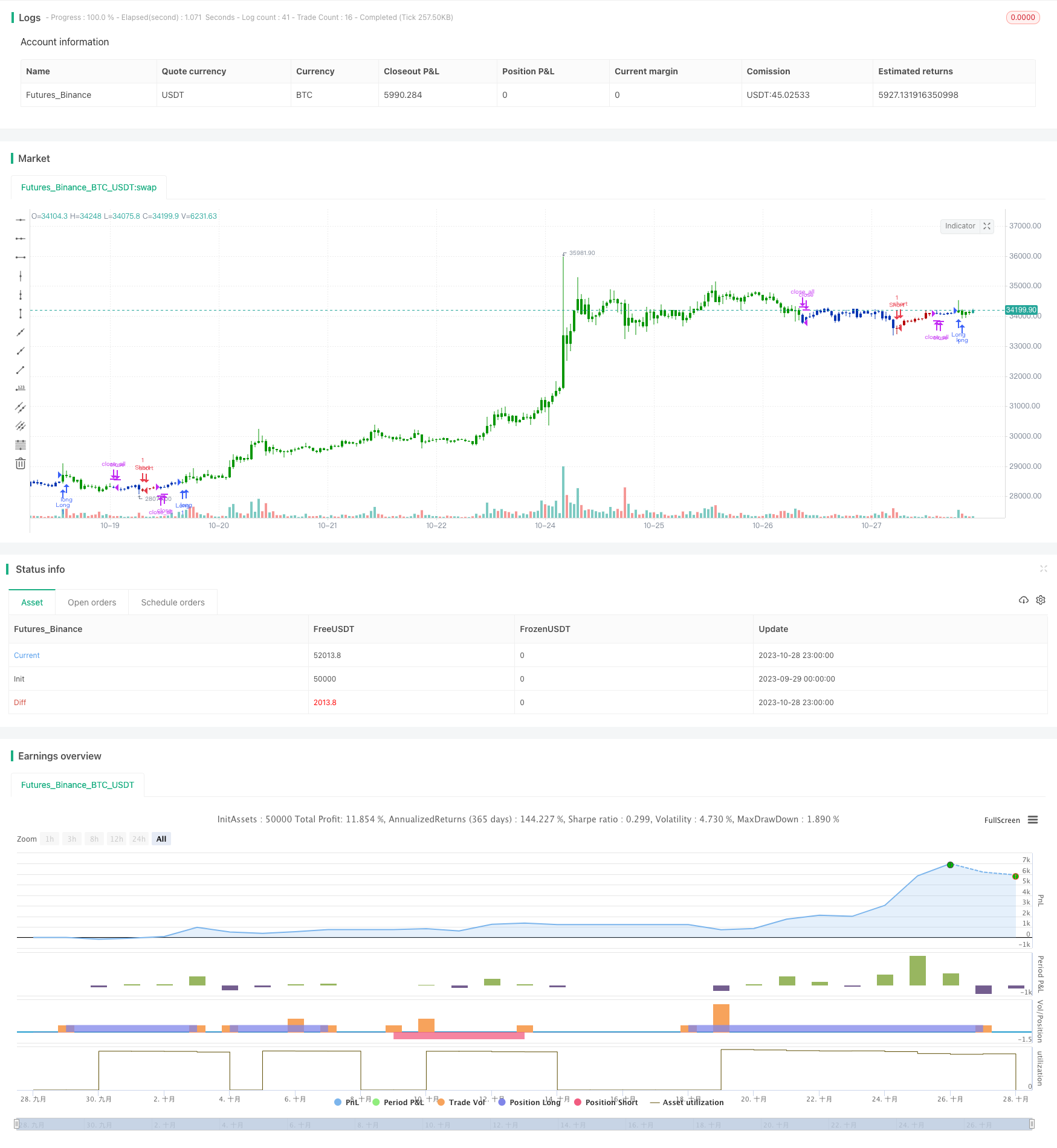

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 18/11/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Detrended Synthetic Price is a function that is in phase with the

// dominant cycle of real price data. This DSP is computed by subtracting

// a half-cycle exponential moving average (EMA) from the quarter cycle

// exponential moving average.

// See "MESA and Trading Market Cycles" by John Ehlers pages 64 - 70.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

D_DSP(Length, SellBand, BuyBand) =>

pos = 0.0

xHL2 = hl2

xEMA1 = ema(xHL2, Length)

xEMA2 = ema(xHL2, 2 * Length)

xEMA1_EMA2 = xEMA1 - xEMA2

pos := iff(xEMA1_EMA2 > SellBand, 1,

iff(xEMA1_EMA2 < BuyBand, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & D_DSP (Detrended Synthetic Price) V 2", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthDSP = input(14, minval=1)

SellBand = input(-25)

BuyBand = input(25)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posD_DSP = D_DSP(LengthDSP, SellBand, BuyBand)

pos = iff(posReversal123 == 1 and posD_DSP == 1 , 1,

iff(posReversal123 == -1 and posD_DSP == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )