Strategi Stop Loss Pengesanan Trend Berganda Kuat

Penulis:ChaoZhang, Tarikh: 2023-11-16 15:50:54Tag:

Ringkasan

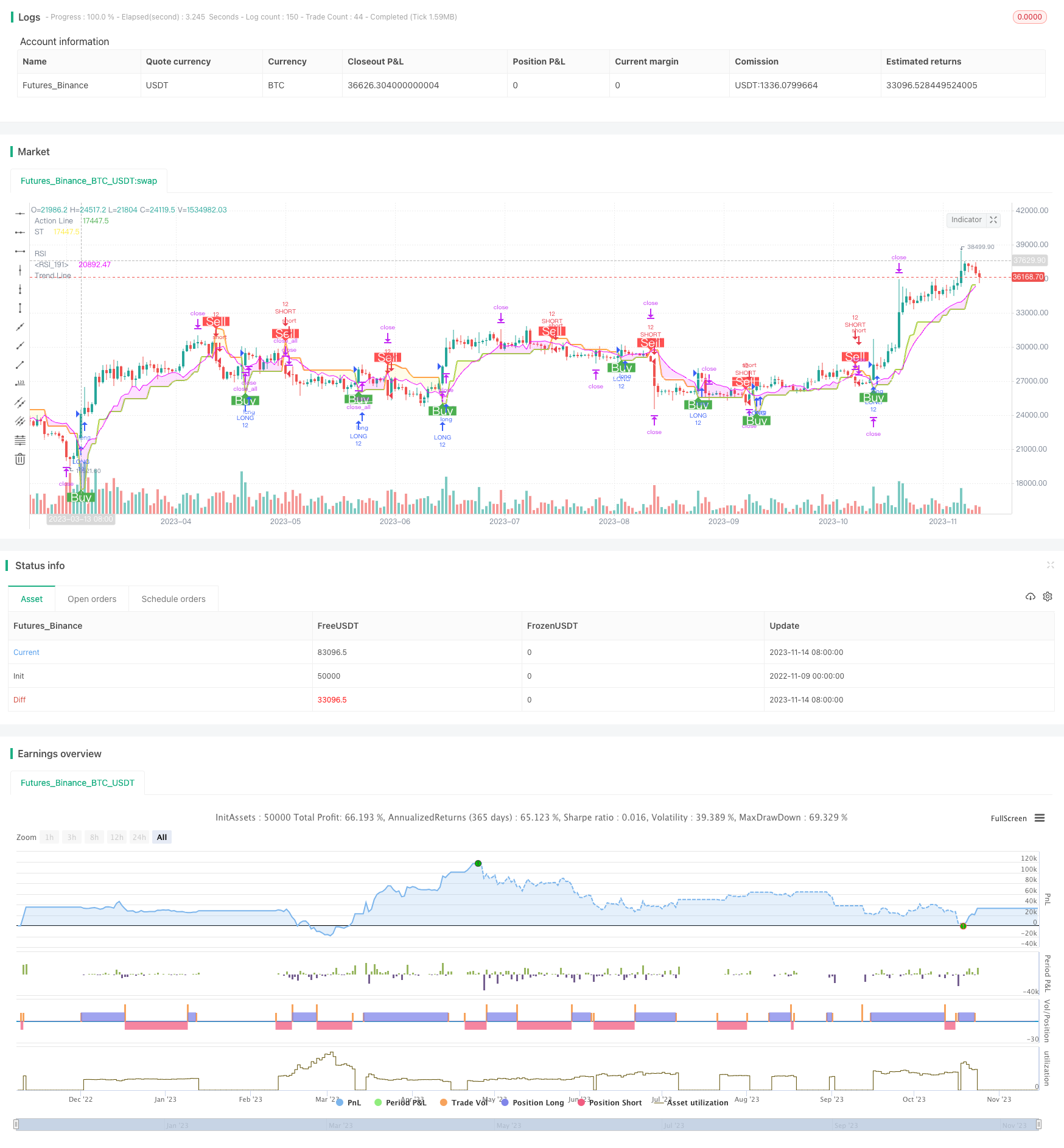

Strategi ini direka dengan mekanisme pengesanan trend berganda berdasarkan Supertrend dan Indeks Kekuatan Relatif untuk menentukan dengan tepat trend pasaran dan menetapkan titik stop loss dan mengambil keuntungan yang munasabah. Strategi ini mempunyai titik stop loss yang mengesan pergerakan pasaran, mengambil mata keuntungan berdasarkan trend, dan penghakiman trend berganda, yang dapat mengawal risiko perdagangan individu dengan berkesan dan mencapai pulangan yang sangat kuat di pasaran trend.

Logika Strategi

-

Mengira Supertrend untuk menentukan arah trend utama. Supertrend boleh menilai arah trend dengan tepat dan memberikan titik masuk yang ideal.

-

Mengira Indeks Kekuatan Relatif (RSI) sebagai penunjuk tambahan untuk penilaian trend. RSI yang tinggi menunjukkan trend menaik dalam pasaran lembu. RSI yang rendah menunjukkan trend menurun dalam pasaran beruang.

-

Pergi panjang apabila harga penutupan melintasi di atas garis Supertrend, dan pergi pendek apabila harga penutupan melanggar di bawah garis Supertrend.

-

Tetapkan titik stop loss dan take profit dengan munasabah. Apabila pergi panjang, tetapkan garis Supertrend sebagai stop loss, dan garis Supertrend ditambah keuntungan munasabah sebagai mengambil keuntungan. Apabila pergi pendek, tetapkan garis Supertrend sebagai stop loss, dan garis Supertrend dikurangkan keuntungan munasabah sebagai mengambil keuntungan.

-

Titik stop loss akan melayang mengikut turun naik pasaran. Apabila pasaran bergerak ke arah yang menguntungkan, garis stop loss akan bergerak ke arah yang menguntungkan untuk mendapatkan keuntungan.

-

Hanya masukkan perdagangan apabila RSI sejajar dengan Supertrend, yang menunjukkan trend semasa yang lebih kuat.

Analisis Kelebihan

-

Mekanisme penilaian trend dua boleh mengurangkan isyarat palsu dan meningkatkan kestabilan strategi.

-

Titik-titik stop loss bergerak dengan trend untuk memaksimumkan kunci keuntungan dan mengelakkan stop loss awal.

-

Penggunaan RSI menapis beberapa isyarat perdagangan yang lemah.

-

Posisi keuntungan yang munasabah memaksimumkan keuntungan.

-

Parameter strategi yang boleh diselaraskan boleh dioptimumkan untuk produk dan keadaan pasaran yang berbeza.

-

Pengeluaran yang boleh dikawal memberi strategi keupayaan pengurusan risiko yang kuat.

Analisis Risiko

-

Dalam kes peristiwa angsa hitam seperti berita dasar penting, perubahan pasaran yang besar boleh menghentikan kedudukan dan menyebabkan kerugian besar.

-

Tetapan parameter yang tidak betul boleh menyebabkan stop loss yang tidak munasabah dan mengambil mata keuntungan, memperbesar kerugian atau mengecilkan keuntungan.

-

Perbezaan antara RSI dan Supertrend boleh menghasilkan isyarat palsu semasa pasaran yang terikat julat.

Arahan pengoptimuman

-

Mengoptimumkan parameter tempoh ATR untuk produk yang berbeza.

-

Mengoptimumkan tetapan RSI untuk mencari keadaan trend tambahan yang lebih stabil.

-

Menggabungkan penunjuk lain seperti Bollinger Bands dan KDJ untuk menetapkan peraturan kemasukan dan keluar yang lebih tepat.

-

Uji strategi mengambil keuntungan yang berbeza seperti hentian, hentian keuntungan, hentian wick dan lain-lain untuk meningkatkan keuntungan.

-

Sesuaikan saiz kedudukan berdasarkan hasil backtest untuk mengurangkan risiko perdagangan tunggal.

Kesimpulan

Strategi ini menunjukkan kestabilan dan keuntungan yang kuat secara keseluruhan. Penghakiman trend berganda menapis bunyi bising dengan berkesan dan strategi stop loss / mengambil keuntungan mengunci keuntungan dan mengawal risiko. Pengoptimuman berterusan parameter dan keadaan masuk / keluar akan membolehkan prestasi yang baik di pelbagai persekitaran pasaran. Ia boleh berfungsi sebagai strategi templat yang sangat baik untuk perdagangan kuantitatif dan bernilai penyelidikan dan aplikasi yang mendalam.

/*backtest

start: 2022-11-09 00:00:00

end: 2023-11-15 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2019 Mauricio Pimenta | exit490

// SuperTrend with Trailing Stop Loss script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @exit490

// Revision: v1.0.0

// Date: 5-Aug-2019

//

// Description

// ===========

// SuperTrend is a moving stop and reversal line based on the volatility (ATR).

// The strategy will ride up your stop loss when price moviment 1%.

// The strategy will close your operation when the market price crossed the stop loss.

// The strategy will close operation when the line based on the volatility will crossed

//

// The strategy has the following parameters:

//

// INITIAL STOP LOSS - Where can isert the value to first stop.

// POSITION TYPE - Where can to select trade position.

// ATR PERIOD - To select number of bars back to execute calculation

// ATR MULTPLIER - To add a multplier factor on volatility

// BACKTEST PERIOD - To select range.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealers. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades multplierFactoriplierFactoriple trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

strategy(title='DEO SESSSION', shorttitle='DEO S', overlay=true, precision=8, calc_on_order_fills=true, calc_on_every_tick=true, backtest_fill_limits_assumption=0, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=1000, currency=currency.USD, linktoseries=true)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === BACKTEST RANGE ===

backTestSectionFrom = input(title='════════════ FROM ════════════', defval=true)

// selected dates

i_startTime = input(title="START FILTER", defval=timestamp("02 Jan 2023 00:00 +0000"), group="RISK MANAGEMENT", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="END FILTER", defval=timestamp("12 Dec 2100 00:00 +0000"), group="RISK MANAGEMENT", tooltip="End date & time to stop searching for setups")

afterStartDate = true

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

parameterSection = input(title='══════════ STRATEGY ══════════', defval=true)

// === INPUT TO SELECT POSITION ===

positionType = input.string(defval='LONG', title='Position Type', options=['LONG', 'SHORT'])

// === INPUT TO SELECT INITIAL STOP LOSS

initialStopLossPercent = input.float(defval=3.0, minval=0.0, title='Initial Stop Loss')

// === INPUT TO SELECT BARS BACK

barsBack = input(title='ATR Period', defval=1)

// === INPUT TO SELECT MULTPLIER FACTOR

multplierFactor = input.float(title='ATR multplierFactoriplier', step=0.1, defval=3.0)

RSI = input.int(title='RSI', defval=7, minval=1, maxval=100)

calcSection = input(title='══════════ LOT CALC ══════════', defval=true)

accountBalance = input.float(title="ACCOUNT BALANCE", defval=250000, minval=1, group="INPUTS")

entryPrice = input.float(title="ENTRY PRICE", defval=100, minval=1, group="INPUTS")

slPrice = input.float(title="STOP LOSS PRICE", defval=100, minval=1, group="INPUTS")

riskPer = input.float(title="RISK USD", defval=1, minval=0.1, group="INPUTS")

lotSize = input.float(title="LOT SIZE", defval=10, minval=0.1, group="INPUTS")

RiskSize = riskPer

qtyLongTargetPrice = math.abs((RiskSize / ((entryPrice - slPrice) * syminfo.pointvalue)) / lotSize)

trendcSection = input(title='══════════ TREND LINE ══════════', defval=true)

// ema trend

tLen = input.int(200, minval=1, title="Trend Line")

tSrc = input(close, title="Source")

thisEma = ta.ema(tSrc, tLen)

plot(thisEma, title = "Trend Line",color=#ffffff)

MTSection = input(title='══════════ MT LOGIN ══════════', defval=true)

exchange = input.string(defval='MT5', title='EXCHANGE', options=['MT4', 'MT5'])

mtLogin= input.string(defval="", title='MT LOGIN', group = "mt")

mtPassword =input.string(defval='', title='MT PASSWORD', group = "mt")

mtServer =input.string(defval='', title='MT SERVER', group = "mt")

mtIsOn = input.string(defval='ON', title='STRATEGY ON', options=['ON', 'OFF'])

mtEntryMode = input.string(defval='CLOSE OPEN', title='ENTRY MODE', options=['CLOSE OPEN', 'OPEN'])

displaySection = input(title='══════════ DISPLAY LOGIN ══════════', defval=true)

displayTable = input(title="DISPLAY TABLE", defval=false, group = 'PRODUCTION', tooltip = "MAKES YOUR STRATEGY TRIGGER SLOWER")

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// LOGIC TO FIND DIRECTION WHEN THERE IS TREND CHANGE ACCORDING VOLATILITY

atr = multplierFactor * ta.atr(barsBack)

longStop = hl2 - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = hl2 + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

direction = 1

direction := nz(direction[1], direction)

direction := direction == -1 and close > shortStopPrev ? 1 : direction == 1 and close < longStopPrev ? -1 : direction

longColor = color.blue

shortColor = color.blue

var valueToPlot = 0.0

var colorToPlot = color.white

if direction == 1

valueToPlot := longStop

colorToPlot := color.green

colorToPlot

else

valueToPlot := shortStop

colorToPlot := color.red

colorToPlot

//RSI

src = close

ep = 2 * RSI - 1

auc = ta.ema(math.max(src - src[1], 0), ep)

adc = ta.ema(math.max(src[1] - src, 0), ep)

x1 = (RSI - 1) * (adc * 70 / (100 - 70) - auc)

ub = x1 >= 0 ? src + x1 : src + x1 * (100 - 70) / 70

x2 = (RSI - 1) * (adc * 30 / (100 - 30) - auc)

lb = x2 >= 0 ? src + x2 : src + x2 * (100 - 30) / 30

//Affichage

plot(math.avg(ub, lb), color=color.white ,linewidth=1, title='RSI')

plot(valueToPlot == 0.0 ? na : valueToPlot, title='Action Line', linewidth=2, color=color.new(colorToPlot, 0))

plotshape(direction == 1 and direction[1] == -1 ? longStop : na, title='Buy', style=shape.labelup, location=location.absolute, size=size.normal, text='Buy', textcolor=color.new(color.white, 0), color=color.new(color.green, 0))

plotshape(direction == -1 and direction[1] == 1 ? shortStop : na, title='Sell', style=shape.labeldown, location=location.absolute, size=size.normal, text='Sell', textcolor=color.new(color.white, 0), color=color.new(color.red, 0))

p_ma1 = plot(valueToPlot, title = "ST", color = color.rgb(255, 236, 66))

p_ma2 = plot(math.avg(ub, lb), title = "RSI", color = color.rgb(234, 0, 255))

// Definitions: Trends

TrendUp1() =>

valueToPlot > math.avg(ub, lb)

TrendDown1() =>

valueToPlot < math.avg(ub, lb)

trendColor1 = TrendUp1() ? color.rgb(255, 236, 66, 85): TrendDown1() ? color.rgb(234, 0, 255, 85) : color.rgb(255, 255, 255, 85)

fill(p_ma1, p_ma2, color=trendColor1)

longCondition () =>

ta.crossover(close, valueToPlot)

shortCondition () =>

ta.crossunder(close, valueToPlot)

IsLongShort() =>

strategy.position_size != 0

getNewLotSize() =>

math.abs(riskPer / (close - valueToPlot))

// plot(getNewLotSize(), "new lot size")

newLotS = getNewLotSize()

alertManagement = str.tostring(exchange) + "," + str.tostring(mtLogin) + "," +str.tostring(mtPassword) + ","

alertManagement += str.tostring(mtServer) + "," + str.tostring(newLotS)

// alertManagement += str.tostring(stopLoss) + "," + str.tostring(applyingSL) + "," + str.tostring(applyTrailingStop) + ","

// alertManagement += str.tostring(exchange) + "," + str.tostring(exchangeAccount) + "," + str.tostring(slAmount) + "," + str.tostring(closeTpAmount) + ","

// alertManagement += str.tostring(exchangeLeverage) + "," + str.tostring(exchangeLeverageType) + ","

// alertManagement += str.tostring(mtLogin) + "," + str.tostring(mtPassword) + "," + str.tostring(mtServer) + "," + str.tostring(mtLot) + ","

// alertManagement += str.tostring(mtTp) + "," + str.tostring(mtTs) + "," + str.tostring(orderStrategy)

// alertManagement = "alertManagement"

myStop = 0.0

myTarget = 0.0

if (longCondition())

qtyLongTargetPrice := math.abs((RiskSize / ((close - valueToPlot) * syminfo.pointvalue)) / lotSize)

if IsLongShort()

strategy.close_all(comment = "close all entries")

strategy.entry("LONG", strategy.long, qty=12, comment="LONG", alert_message=alertManagement)

strategy.exit("TPL", "LONG", stop=valueToPlot, limit= close + (close - valueToPlot), comment="Target", alert_message=alertManagement)

if (shortCondition())

qtyLongTargetPrice := math.abs((RiskSize / ((close - valueToPlot) * syminfo.pointvalue)) / lotSize)

if IsLongShort()

strategy.close_all(comment = "close all entries")

strategy.entry("SHORT", strategy.short, qty=12, comment="SHORT", alert_message=alertManagement)

strategy.exit("TPS", "SHORT", stop=valueToPlot, limit= close + (close - valueToPlot), comment="Target", alert_message=alertManagement)

// Calculate the average profit per open trade

// avgProfit = profitSum / strategy.opentrades

getTotalProfit()=>

// Sum the profit of all open trades

profitSum = 0.0

for tradeNumber = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNumber) > 0

profitSum += strategy.closedtrades.profit(tradeNumber)

result = profitSum

getTotalLoss()=>

// Sum the profit of all open trades

lossSum = 0.0

for tradeNumber = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNumber) < 0

lossSum += strategy.closedtrades.profit(tradeNumber)

result = lossSum

maxLossRun()=>

lossRun = 0.0

currentMaxLoss = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNo) < 0.0

lossRun += strategy.closedtrades.profit(tradeNo)

else

currentMaxLoss := math.min(currentMaxLoss, lossRun)

lossRun := 0.0

result = currentMaxLoss

TotalTrades() =>

strategy.closedtrades + strategy.opentrades

maxDrawDown() =>

maxDrawdown = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxDrawdown := math.max(maxDrawdown, strategy.closedtrades.max_drawdown(tradeNo))

result = maxDrawdown

maxRunUp() =>

maxRunup = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxRunup := math.max(maxRunup, strategy.closedtrades.max_runup(tradeNo))

result = maxRunup

tradeMaxLossReached() =>

maxLoss = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxLoss := math.min(maxLoss, strategy.closedtrades.profit(tradeNo))

result = maxLoss

tradingStartTime() =>

strategy.closedtrades.entry_time(0)

daysBetween(t1, t2) => (t1 - t2) / 86400000

// Table

var InfoPanel = table.new(position = position.bottom_right, columns = 2, rows = 40, border_width = 1)

ftable(_table_id, _column, _row, _text, _bgcolor) =>

table.cell(_table_id, _column, _row, _text, 0, 0, color.black, text.align_right, text.align_center, size.small, _bgcolor)

tfString(int timeInMs) =>

// @function Produces a string corresponding to the input time in days, hours, and minutes.

// @param (series int) A time value in milliseconds to be converted to a string variable.

// @returns (string) A string variable reflecting the amount of time from the input time.

float s = timeInMs / 100000

float m = s / 60

float h = m / 60

float d = h / 24

float mo = d / 30.416

int tm = math.floor(m % 60)

int tr = math.floor(h % 24)

int td = math.floor(d % 30.416)

int tmo = math.floor(mo % 12)

int ys = math.floor(d / 365)

string result =

switch

d == 30 and tr == 10 and tm == 30 => "1M"

d == 7 and tr == 0 and tm == 0 => "1W"

=>

string yStr = ys ? str.tostring(ys) + "Y " : ""

string moStr = tmo ? str.tostring(tmo) + "M " : ""

string dStr = td ? str.tostring(td) + "D " : ""

string hStr = tr ? str.tostring(tr) + "H " : ""

string mStr = tm ? str.tostring(tm) + "min" : ""

yStr + moStr + dStr + hStr + mStr

if displayTable

maxLossRunInMarket= maxLossRun()

maxLossReached = tradeMaxLossReached()

tradeMaxLossReached = tradeMaxLossReached()

tradingInDays=daysBetween(time, tradingStartTime())

totalTrades=TotalTrades()

- Strategi Perdagangan Grid Tetap

- Indeks Kekuatan Relatif Strategi Long/Short

- Dual Momentum Breakout Strategi

- Strategi Perdagangan Pembalikan Purata Berdasarkan Bollinger Bands dan Rasio Emas

- Trend Momentum Berikutan Strategi Osislasi

- WaveTrend dan CMF Berasaskan Trend Mengikut Strategi

- Adaptive Bollinger Trend Tracking Strategi

- Strategi RSI Moving Average Crossover Multi-Timeframe

- Strategi Penembusan Trend Berdasarkan Bollinger Bands

- Adaptive Regularised Moving Average Cross-Market Arbitrage Strategy

- Strategi Penunjuk Momentum

- Strategi Kebalikan Heikin-Ashi

- Strategi Penembusan Osilasi Dinamik

- Trend Berikutan Strategi Crossover EMA 5 Minit

- Trend RSI Mengikut Strategi

- Strategi Perbezaan RSI

- Strategi Dagangan DCA Bertingkat Berkuantiti

- Pengecualian purata bergerak berganda digabungkan dengan Trend Indikator ATR Mengikut Strategi

- Strategi Multi Trend

- Strategi Harga Kesetaraan