Strategi kuantitatif mengikut arah aliran berasaskan SAR

Gambaran keseluruhan

Strategi jurang spekulatif adalah strategi perdagangan kuantitatif untuk mengesan trend, yang menggunakan kurva kelancaran SAR sebagai isyarat perdagangan utama, ditambah dengan pelbagai penapis seperti EMA, momentum pemalsuan dan pendorong turun naik, untuk mengenal pasti titik perubahan trend dengan mengkonfigurasi parameter SAR, untuk mengesan trend yang rendah. Ini adalah strategi yang sangat sesuai untuk pelaburan jangka panjang.

Prinsip Strategi

Strategi ini menggunakan SAR garis paralisis sebagai penunjuk isyarat perdagangan utama. SAR dapat menentukan dengan berkesan titik-titik perubahan trend harga, dan apabila simbol SAR berubah, ia bermaksud bahawa trend telah berubah.

Di samping itu, strategi ini juga menawarkan pilihan penembusan SAR. Iaitu, apabila harga telah menembusi nilai SAR terakhir sebelum SAR belum sepenuhnya terbalik, isyarat akan dihasilkan. Ini dapat meningkatkan kepekaan strategi.

Untuk menyaring isyarat palsu, strategi ini juga memperkenalkan EMA, momentum penekanan dan tiga penapis tambahan yang boleh digunakan secara berasingan atau dalam kombinasi untuk mengesahkan trend harga dan kebolehpercayaan isyarat perdagangan.

Akhirnya, strategi ini menawarkan tiga jenis hentian kerugian, iaitu hentian tetap, hentian tetap, dan hentian peratusan ganjaran risiko. Ini menjadikan strategi ini fleksibel untuk menyesuaikan diri dengan pelbagai jenis jenis perdagangan.

Analisis kelebihan

SAR dapat menentukan dengan tepat perubahan trend harga, dan dapat menangkap trend harga baru dalam masa yang tepat, sesuai untuk mengesan trend garis tengah dan panjang.

Tetapan pelbagai penapis mengurangkan kemungkinan penembusan palsu dan meningkatkan kebolehpercayaan isyarat.

Konfigurasi mudah dan fleksibel, parameter boleh disesuaikan untuk menyesuaikan dengan pelbagai jenis perdagangan.

Ia menawarkan pelbagai cara untuk menghentikan kerugian dan mencari keseimbangan antara risiko dan pulangan.

Ia boleh disambungkan secara langsung ke robot perdagangan untuk membolehkan perdagangan automatik.

Analisis risiko

Di bawah pasaran yang tidak trend, mungkin terdapat lebih banyak isyarat palsu dan perdagangan yang tidak sah.

Penetapan parameter SAR yang tidak betul juga boleh menjejaskan ketepatan penilaian isyarat.

Sebagai strategi trend-following, garis hentian mudah dicapai dalam pasaran yang bergolak.

Untuk risiko di atas, parameter SAR atau parameter penapis boleh disesuaikan dengan sewajarnya untuk mengurangkan kebarangkalian perdagangan yang tidak berkesan. Had Stop Loss juga boleh dilonggarkan dengan sewajarnya untuk menahan turun naik pasaran yang lebih besar.

Arah pengoptimuman

Optimasi parameter SAR. Anda boleh mengoptimumkan parameter langkah dan inkremental SAR melalui data pengesanan semula sejarah, untuk mendapatkan strategi perdagangan yang lebih stabil dan cekap.

Memperkenalkan penunjuk penilaian trend. Menambah penunjuk penilaian bantu seperti MACD, DMI dan lain-lain kepada strategi untuk meningkatkan kemampuan penilaian trend.

Mengoptimumkan nisbah ganjaran risiko. Sesuaikan parameter peratusan stop loss dan nisbah ganjaran risiko untuk mengambil risiko yang lebih tinggi untuk mendapatkan keuntungan yang lebih tinggi.

Tambah varian mata wang asing. Strategi ini hanya menyokong perdagangan mata wang digital dan boleh diperluaskan untuk menyokong varian mata wang asing, komoditi dan pasaran sekuriti.

ringkaskan

Celah spekulasi adalah strategi kuantitatif jenis trend yang sangat praktikal. Ia bertindak balas dengan sensitif, keputusan isyarat boleh dipercayai, dan keuntungan yang stabil dalam jangka masa panjang boleh diperoleh melalui pengurusan hentian hentian. Pengoptimuman parameter dan peraturan yang sesuai dapat meningkatkan lagi kecekapan strategi. Ini adalah strategi kuantitatif yang cekap yang bernilai digunakan dalam jangka masa panjang.

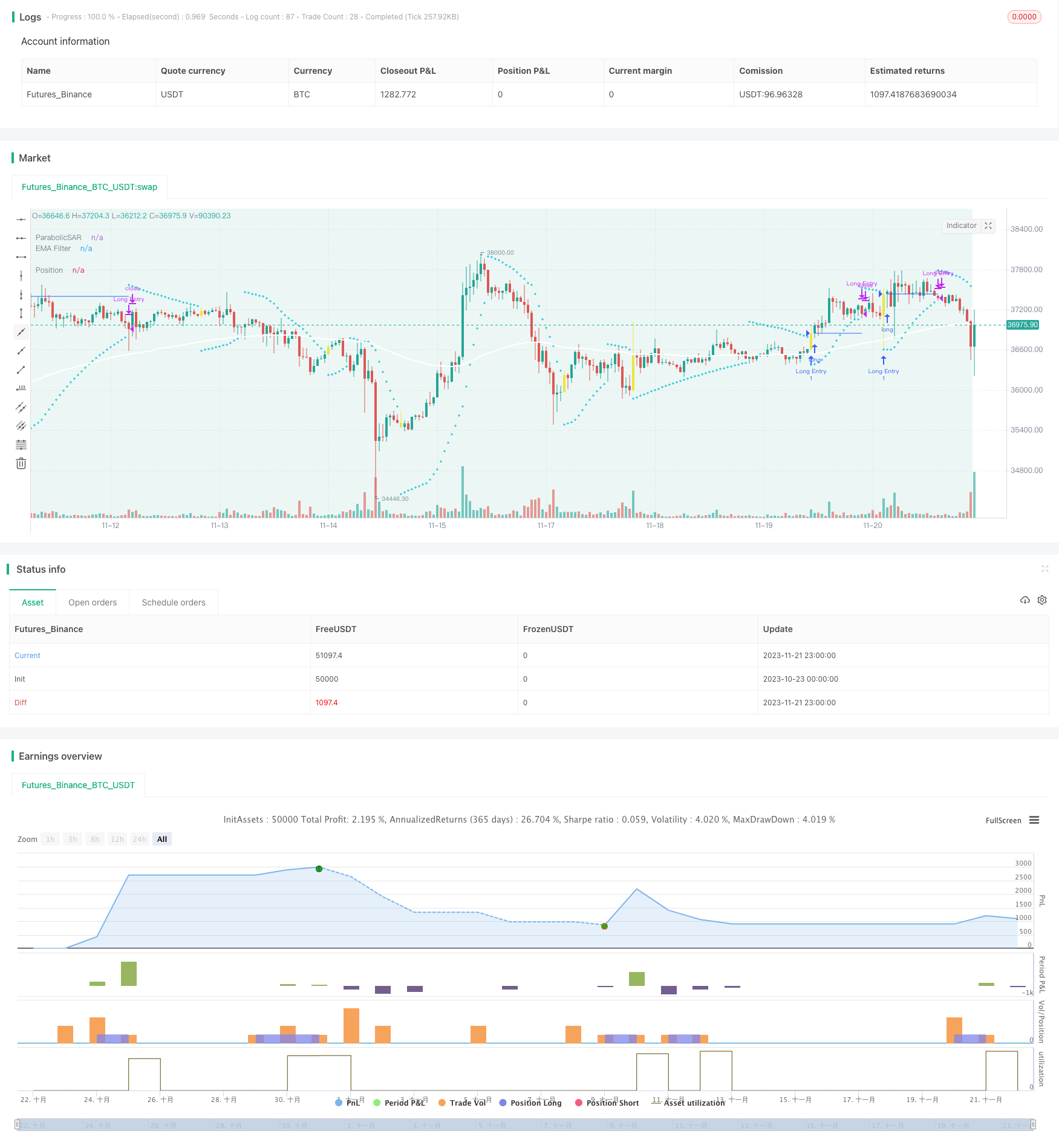

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//VERSION =================================================================================================================

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// This strategy is intended to study.

// It can also be used to signal a bot to open a deal by providing the Bot ID, email token and trading pair in the strategy settings screen.

// As currently written, this strategy uses a SAR PARABOLIC to send signal, and EMA, Squeeze Momentum, Volatility Oscilator as filter.

// There are two enter point, when SAR Flips, or Breakout Point - the last SAR Value before it Flips.

// There are tree options for exit: SAR Flips, Fixed Stop Loss ande Fixed Take Profit in % and Risk Reward tha can be set, 0.5/1, 1/1, 1/2 etc.

//Autor M4TR1X_BR

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

//STRATEGY ================================================================================================================

strategy(title = 'BT-SAR Ema, Squeeze, Voltatility',

shorttitle = 'SAR ESV',

overlay = true)

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// INPUTS =================================================================================================================

// TIME INPUTS

usefromDate = input.bool(defval = true, title = 'Start date', inline = '0', group = "Time Filters")

initialDate = input(defval = timestamp('01 Jan 2022 00:00 UTC'), title = '', inline = "0",group = 'Time Filters',tooltip="This start date is in the time zone of the exchange ")

usetoDate = input.bool(defval = true, title = 'End date', inline = '1', group = "Time Filters")

finalDate = input(defval = timestamp('31 Dec 2029 23:59 UTC'), title = '', inline = "1",group = 'Time Filters',tooltip="This end date is in the time zone of the exchange")

// TIME LOGIC

inTradeWindow = true

// SAR PARABOLIC INPUTS ==================================================================================================

string sargroup= "SAR PARABOLIC ========================================="

start = input.float(defval=0.02,title='Start',inline='',group = sargroup)

increment = input.float(defval=0.02,title='Increment',inline='',group = sargroup)

maximum = input.float(defval=0.2,title='Maximo',inline='',group = sargroup)

// SAR PARABOLIC LOGIC

out = ta.sar(start, increment, maximum)

// SAR FLIP OR BREAKOUT OPTIONS

string bkgroup ='SAR TRADE SIGNAL ====================================== '

sarTradeSignal =input.string(defval='SAR Flip',title='SAR Trade Signal', options= ['SAR Flip','SAR Breakout'],group=bkgroup, tooltip='SAR Flip: Once the parabolic SAR flips it will send a signal, SAR Breakout: Will wait the price cross last Sar Value before it flips.')

nBars = input.int(defval=4,title='Bars',group=bkgroup, tooltip ='Define the number of bars for a entry when the price cross breakout point')

float sarBreakoutPoint= ta.valuewhen((close[1] < out[1]) and (close > out),out[1],0) //Get Sar Breakout Point

bool check = (close[1] < out[1]) and (close > out) //Verify when sar flips

bool BreakoutPrice = sarTradeSignal=='SAR Breakout'? (ta.barssince(check) < nBars) and ((open < sarBreakoutPoint) and (close > sarBreakoutPoint)): (ta.barssince(check) < nBars) and (close > out)

barcolor (check? color.yellow:na,title="Signal Bar color" )

// MOVING AVERAGES INPUTS ================================================================================================

string magroup = "Moving Average ========================================"

useEma = input.bool(defval = true, title = 'Moving Average Filter',inline='', group= magroup,tooltip='This will enable or disable Exponential Moving Average Filter on Strategy')

emaType=input.string (defval='Ema',title='Type',options=['Ema','Sma'],inline='', group= magroup)

emaSource = input.source(defval=close,title=" Source",inline="", group= magroup)

emaLength = input.int(defval=100,title="Length",minval=0,inline='', group= magroup)

// MOVING AVERAGE LOGIC

float ema = emaType=='Ema'? ta.ema(emaSource,emaLength): ta.sma(emaSource,emaLength)

// VOLATILITY OSCILLATOR =================================================================================================

string vogroup = "VOLATILITY OSCILLATOR ================================="

useVltFilter=input.bool(defval=true,title="Volatility Oscillator Filter",inline='',group= vogroup,tooltip='This will enable or disable Volatility Oscillator filter on Strategy')

vltFilterLength = input.int(defval=100,title="Volatility Oscillator",inline='',group=vogroup)

vltFilterSpike = close - open

vltFilterX = ta.stdev(vltFilterSpike,vltFilterLength)

vltFilterY = ta.stdev(vltFilterSpike,vltFilterLength) * -1

// SQUEEZE MOMENTUM INPUTS ==============================================================================================

string sqzgroup = "SQUEEZE MOMENTUM ====================================="

useSqzFilter=input.bool(defval=true,title="Squeeze Momentum Filter",inline='',group= sqzgroup, tooltip='This will enable or disable Squeeze Momentum filter on Strategy')

sqzFilterlength = input.int(defval=20, title='Bollinger Bands Length',inline='',group= sqzgroup)

sqzFiltermult = input.float(defval=2.0, title='Boliinger Bands Mult',inline='',group= sqzgroup)

keltnerLength = input.int(defval=20, title='Keltner Channel Length',inline='',group= sqzgroup)

keltnerMult = input.float(defval=1.5, title='Keltner Channel Mult',inline='',group= sqzgroup)

useTrueRange = input(true, title='Use TrueRange (KC)', inline='',group= sqzgroup)

// CALCULATE BOLLINGER BANDS

sqzFilterSrc = close

basis = ta.sma(sqzFilterSrc, sqzFilterlength)

dev = keltnerMult * ta.stdev(sqzFilterSrc, sqzFilterlength)

upperBB = basis + dev

lowerBB = basis - dev

// CALCULATE KELTNER CHANNEL

sma = ta.sma(sqzFilterSrc, keltnerLength)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.sma(range_1, keltnerLength)

upperKC = sma + rangema * keltnerMult

lowerKC = sma - rangema * keltnerMult

// CHECK IF BOLLINGER BANDS IS IN OR OUT OF KELTNER CHANNEL

sqzOn = lowerBB > lowerKC and upperBB < upperKC

sqzOff = lowerBB < lowerKC and upperBB > upperKC

noSqz = sqzOn == false and sqzOff == false

// SQUEEZE MOMENTUM LOGIC

val = ta.linreg(sqzFilterSrc - math.avg(math.avg(ta.highest(high, keltnerLength), ta.lowest(low, keltnerLength)),ta.sma(close, keltnerLength)), keltnerLength, 0)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// TAKE PROFIT STOP LOSS INPUTS =========================================================================================

string tkpgroup='Take Profit =================================================='

tpType = input.string(defval = 'SAR Flip', title='Take Profit and Stop Loss', options=['SAR Flip','Fixed % TP/SL', 'Risk Reward TP/SL'], group=tkpgroup )

longTakeProfitPerc = input.float(defval = 1.5, title = 'Fixed TP %', minval = 0.05, step = 0.5, group=tkpgroup, tooltip = 'The percentage increase to set the take profit price target.')/100

longLossPerc = input.float(defval=1.0, title="Fixed Long SL %", minval=0.1, step=0.5, group = tkpgroup, tooltip = 'The percentage increase to set the Long Stop Loss price target.') * 0.01

//shortLossPerc = input.float(defval=1.5, title="Fixed Short SL (%)", minval=0.1, step=0.5, group = tkpgroup, tooltip = 'The percentage increase to set the Short Stop Loss price target.') * 0.01

longTakeProfitRR = input.float(defval = 1, title = 'Risk Reward TP', minval = 0.25, step = 0.25, group=tkpgroup, tooltip = 'The Risk Reward parameter.')

var plotStopLossRR = input.bool(defval=false, title='Show RR Stop Loss', group=tkpgroup)

//enableStopLossRR = input.bool(defval = false, title = 'Enable Risk Reward TP',group=tkpgroup, tooltip = 'Enable Variable Stop Loss.')

string trpgroup='Traling Profit ==============================================='

enableTrailing = input.bool(defval = false, title = 'Enable Trailing',group=trpgroup, tooltip = 'Enable or disable the trailing for take profit.')

trailingTakeProfitDeviationPerc = input.float(defval = 0.1, title = 'Trailing Take Profit Deviation %', minval = 0.01, maxval = 100, step = 0.01, group=trpgroup, tooltip = 'The step to follow the price when the take profit limit is reached.') / 100

// BOT MESSAGES

string msgroup='Alert Message For Bot ========================================='

messageEntry = input.string("", title="Strategy Entry Message",group=msgroup)

messageExit =input.string("",title="Strategy Exit Message",group=msgroup)

messageClose = input.string("", title="Strategy Close Message",group=msgroup)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITIONS =============================================================================================================

//VERIFY IF THE BUY FILTERS ARE ON OR OFF

bool emaFilterBuy = useEma? (close > ema):(close >= ema) or (close <= ema)

bool volatilityFilterBuy = useVltFilter? (vltFilterSpike > vltFilterX) : (vltFilterSpike >= 0) or (vltFilterSpike <= 0)

bool sqzFilterBuy = useSqzFilter? (val > val[1]): (val >= val[1] or val <=val[1])

bool sarflip = (close > out)

//LONG / SHORT POSITIONS LOGIC

//Var 'check' will verify if the SAR flips and if the exit price occurs it will limit in bars number a new entry on the same signal.

bool limitEntryNumbers = (ta.barssince(check) < nBars)

bool openLongPosition = sarTradeSignal == 'SAR Flip'? (sarflip and emaFilterBuy and volatilityFilterBuy and sqzFilterBuy and limitEntryNumbers) :sarTradeSignal=='SAR Breakout'? (BreakoutPrice and emaFilterBuy and volatilityFilterBuy and sqzFilterBuy): na

bool openShortPosition = na

bool closeLongPosition= tpType=='SAR Flip'? (close < out):na

bool closeShortPosition=na

// CHEK OPEN POSITONS =====================================================================================================

// open signal when not already into a position

bool validOpenLongPosition = openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) <= 0

bool longIsActive = validOpenLongPosition or strategy.opentrades.size(strategy.opentrades - 1) > 0

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// TAKE PROFIT STOP LOSS CONFIG ==========================================================================================

// FIXED TAKE PROFIT IN %

float posSize = strategy.opentrades.entry_price(strategy.opentrades - 1) //Get the entry price

var float longTakeProfitPrice = na

longTakeProfitPrice := if (longIsActive)

if (openLongPosition and not (strategy.opentrades.size(strategy.opentrades - 1) > 0))

posSize * (1 + longTakeProfitPerc)

else

nz(longTakeProfitPrice[1], close * (1 + longTakeProfitPerc))

else

na

longTrailingTakeProfitStepTicks = longTakeProfitPrice * trailingTakeProfitDeviationPerc / syminfo.mintick

// FIXED STOP LOSS IN %

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

//shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// TAKE PROFIT BY RISK/REWARD

// Set stop loss

tta = not (strategy.opentrades.size(strategy.opentrades - 1) > 0)

float lastb = ta.valuewhen(check and tta,ta.lowest(low,5),0) - (10 * syminfo.mintick)

// TAKE PROFIT CALCULATION

float stopLossRisk = (posSize - lastb)

float takeProfitRR = posSize + (longTakeProfitRR * stopLossRisk)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITION ORDERS =====================================================================================================

// LOGIC ===============================================================================================================

// getting into LONG position

if (openLongPosition) and (inTradeWindow)

strategy.entry(id = 'Long Entry', direction = strategy.long, alert_message=messageEntry)

//submit exit orders for trailing take profit price

if (longIsActive) and (inTradeWindow)

strategy.exit(id = 'Long Take Profit', from_entry = 'Long Entry', limit = enableTrailing ? na : tpType=='Fixed % TP/SL'? longTakeProfitPrice: tpType == 'Risk Reward TP/SL'? takeProfitRR:na, trail_price = enableTrailing ? longTakeProfitPrice : na, trail_offset = enableTrailing ? longTrailingTakeProfitStepTicks : na, stop = tpType =='Fixed % TP/SL' ? longStopPrice: tpType == 'Risk Reward TP/SL'? lastb:na) //, alert_message='{ "action": "close_at_market_price", "message_type": "bot", "bot_id": 9330698, "email_token": "392265bc-84eb-4a54-a99c-758383ff9449", "delay_seconds": 0,"pair":"USDT_{{ticker}}" }')

if (closeLongPosition)

strategy.close(id = 'Long Entry', alert_message='{ "action": "close_at_market_price", "message_type": "bot", "bot_id": 9330698, "email_token": "392265bc-84eb-4a54-a99c-758383ff9449", "delay_seconds": 0,"pair":"USDT_{{ticker}}" }')

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// PLOTS ===============================================================================================================

// TRADE WINDOW ========================================================================================================

bgcolor(color = inTradeWindow ? color.new(#089981,90):na, title = 'Time Window')

// SAR PARABOLIC

var sarColor = color.new(#00bcd4,0)

plot(out, "ParabolicSAR", color=sarColor, linewidth=1,style=plot.style_cross)

//BREAKOUT LINE

var plotBkPoint = input.bool(defval=false, title='Show Breakout Point', group=bkgroup)

plot(series = (sarTradeSignal=='SAR Breakout' and plotBkPoint == true)? sarBreakoutPoint:na, title = 'Breakout line', color =color.new(#ffeb3b,50) , linewidth = 1, style = plot.style_linebr, offset = 0)

// EMA/SMA

var emafilterColor = color.new(color.white, 0)

plot(series=useEma? ema:na, title = 'EMA Filter', color = emafilterColor, linewidth = 2, style = plot.style_line)

// ENTRY PRICE

var posColor = color.new(#2962ff, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr,offset=0)

// FIXED TAKE PROFIT

var takeProfitColor = color.new(#ba68c8, 0)

plot(series = tpType=='Fixed % TP/SL'? longTakeProfitPrice:na, title = 'Fixed TP', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 0)

// FIXED STOP LOSS

var stopLossColor = color.new(#ff0000, 0)

plot(series = tpType=='Fixed % TP/SL' ? longStopPrice:na, title = 'Fixed SL', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 0)

// RISK REWARD TAKE PROFIT

var takeProfitRRColor = color.new(#ba68c8, 0)

plot(series=tpType == 'Risk Reward TP/SL'? takeProfitRR:na,title='Risk Reward TP',color=takeProfitRRColor,linewidth=1,style=plot.style_linebr)

// STOP LOSS RISK REWARD

plot(series = (check and plotStopLossRR)? lastb:na, title = 'Last Bottom', color =color.new(#ff0000,0), linewidth = 2, style = plot.style_linebr, offset = 0)

// ======================================================================================================================