Trend Mengikut Strategi Berdasarkan Penguraian Siri Masa dan Bollinger Bands Bertimbang Volume

Penulis:ChaoZhang, Tarikh: 2023-11-24 11:29:40Tag:

Ringkasan

Strategi ini mengintegrasikan penguraian siri masa, harga purata berwajaran volum, Bollinger Bands dan delta (OBV-PVT) 4 penunjuk teknikal untuk membuat penilaian pelbagai dimensi mengenai trend harga, keadaan overbought dan oversold.

Prinsip-prinsip

- Menggunakan penguraian siri masa untuk menghilangkan bunyi bising dan periodik dalam harga untuk penilaian trend yang lebih tepat;

- Mengira harga baharu yang diberi berat volum berdasarkan garis trend;

- Mengira lebar peratusan Bollinger Bands (BB%B) harga penutupan untuk menentukan keadaan overbought dan oversold;

- Mengira BB%B Delta ((OBV-PVT) sebagai ukuran perbezaan harga-volume;

- Menghasilkan isyarat dagangan berdasarkan penyambungan penunjuk harga-volume dan Bollinger Bands overshoots dan undershoots.

Kelebihan

- Menggabungkan ciri harga, jumlah dan statistik untuk penilaian yang kukuh;

- BB%B digabungkan dengan Delta ((OBV-PVT) lebih baik mengenal pasti keadaan overbought / oversold jangka pendek;

- Isyarat silang harga-volume menapis beberapa isyarat palsu.

Risiko

- Penyesuaian parameter yang terlalu rumit;

- Ketegangan jangka pendek boleh meningkatkan kerugian;

- Perbezaan harga-volume tidak sepenuhnya menapis isyarat palsu.

Parameter seperti purata bergerak, lebar Bollinger Bands dan nisbah risiko-balasan boleh dioptimumkan untuk mengurangkan kekerapan perdagangan sambil meningkatkan pulangan yang disesuaikan dengan risiko setiap perdagangan.

Kesimpulan

Mengintegrasikan alat seperti penguraian siri masa, Bollinger Bands, penunjuk OBV, strategi ini menggabungkan hubungan harga-volume, sifat statistik dan analisis trend untuk mengenal pasti pembalikan jangka pendek dan menangkap trend utama.

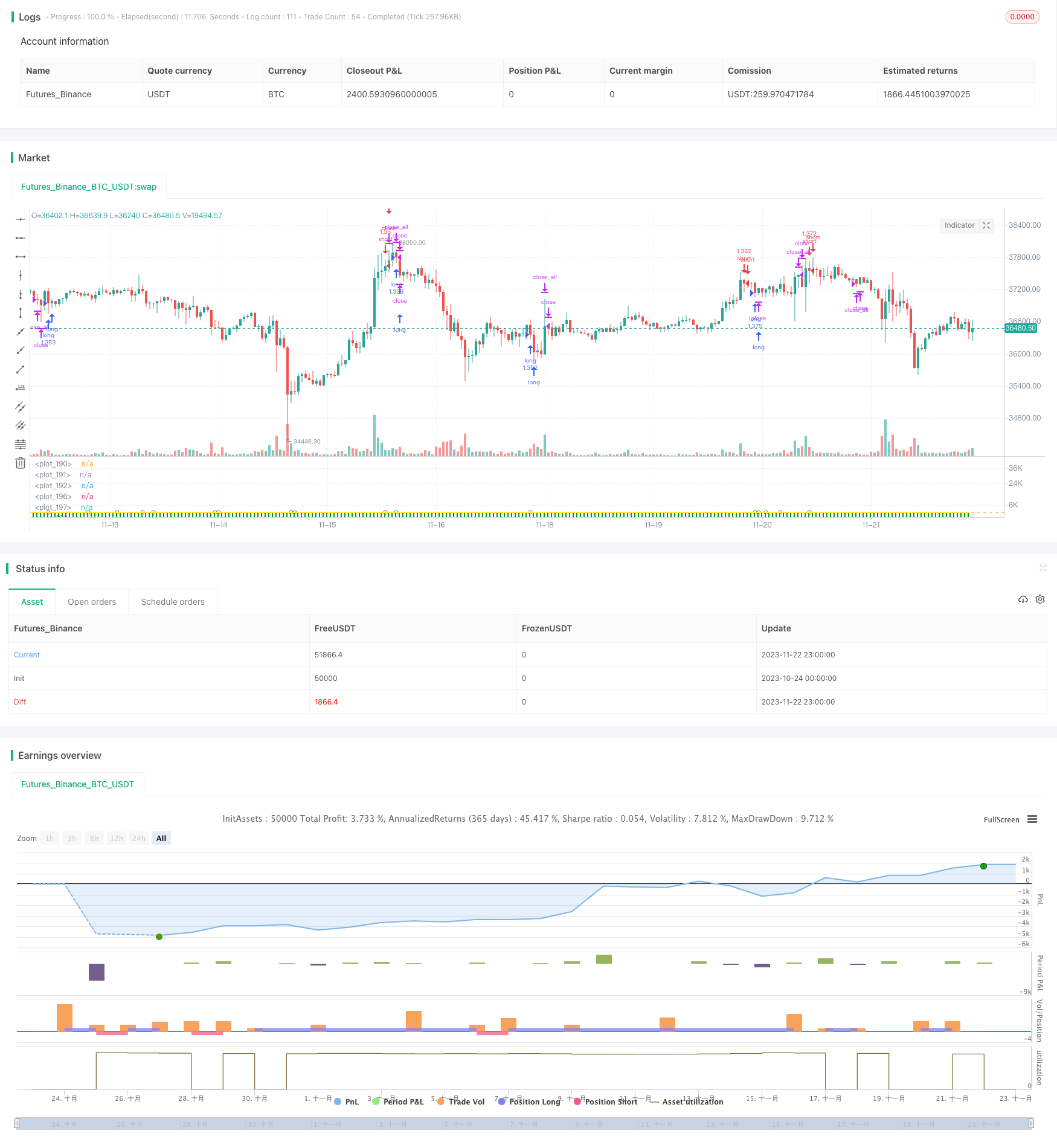

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © oakwhiz and tathal

//@version=4

strategy("BBPBΔ(OBV-PVT)BB", default_qty_type=strategy.percent_of_equity, default_qty_value=100)

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2010, minval=1800, maxval=2100)

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31)

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12)

endYear = input(title="End Year", type=input.integer,

defval=2021, minval=1800, maxval=2100)

// Normalize Function

normalize(_src, _min, _max) =>

// Normalizes series with unknown min/max using historical min/max.

// _src : series to rescale.

// _min, _min: min/max values of rescaled series.

var _historicMin = 10e10

var _historicMax = -10e10

_historicMin := min(nz(_src, _historicMin), _historicMin)

_historicMax := max(nz(_src, _historicMax), _historicMax)

_min + (_max - _min) * (_src - _historicMin) / max(_historicMax - _historicMin, 10e-10)

// STEP 2:

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

// Stop loss & Take Profit Section

sl_inp = input(2.0, title='Stop Loss %')/100

tp_inp = input(4.0, title='Take Profit %')/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

icreturn = false

innercandle = if (high < high[1]) and (low > low[1])

icreturn := true

src = close

float change_src = change(src)

float i_obv = cum(change_src > 0 ? volume : change_src < 0 ? -volume : 0*volume)

float i_pvt = pvt

float result = change(i_obv - i_pvt)

float nresult = ema(normalize(result, -1, 1), 20)

length = input(20, minval=1)

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ema(nresult, length)

dev = mult * stdev(nresult, length)

upper = basis + dev

lower = basis - dev

bbr = (nresult - lower)/(upper - lower)

////////////////INPUTS///////////////////

lambda = input(defval = 1000, type = input.float, title = "Smoothing Factor (Lambda)", minval = 1)

leng = input(defval = 100, type = input.integer, title = "Filter Length", minval = 1)

srcc = close

///////////Construct Arrays///////////////

a = array.new_float(leng, 0.0)

b = array.new_float(leng, 0.0)

c = array.new_float(leng, 0.0)

d = array.new_float(leng, 0.0)

e = array.new_float(leng, 0.0)

f = array.new_float(leng, 0.0)

/////////Initialize the Values///////////

//for more details visit:

// https://asmquantmacro.com/2015/06/25/hodrick-prescott-filter-in-excel/

ll1 = leng-1

ll2 = leng-2

for i = 0 to ll1

array.set(a,i, lambda*(-4))

array.set(b,i, src[i])

array.set(c,i, lambda*(-4))

array.set(d,i, lambda*6 + 1)

array.set(e,i, lambda)

array.set(f,i, lambda)

array.set(d, 0, lambda + 1.0)

array.set(d, ll1, lambda + 1.0)

array.set(d, 1, lambda * 5.0 + 1.0)

array.set(d, ll2, lambda * 5.0 + 1.0)

array.set(c, 0 , lambda * (-2.0))

array.set(c, ll2, lambda * (-2.0))

array.set(a, 0 , lambda * (-2.0))

array.set(a, ll2, lambda * (-2.0))

//////////////Solve the optimization issue/////////////////////

float r = array.get(a, 0)

float s = array.get(a, 1)

float t = array.get(e, 0)

float xmult = 0.0

for i = 1 to ll2

xmult := r / array.get(d, i-1)

array.set(d, i, array.get(d, i) - xmult * array.get(c, i-1))

array.set(c, i, array.get(c, i) - xmult * array.get(f, i-1))

array.set(b, i, array.get(b, i) - xmult * array.get(b, i-1))

xmult := t / array.get(d, i-1)

r := s - xmult*array.get(c, i-1)

array.set(d, i+1, array.get(d, i+1) - xmult * array.get(f, i-1))

array.set(b, i+1, array.get(b, i+1) - xmult * array.get(b, i-1))

s := array.get(a, i+1)

t := array.get(e, i)

xmult := r / array.get(d, ll2)

array.set(d, ll1, array.get(d, ll1) - xmult * array.get(c, ll2))

x = array.new_float(leng, 0)

array.set(x, ll1, (array.get(b, ll1) - xmult * array.get(b, ll2)) / array.get(d, ll1))

array.set(x, ll2, (array.get(b, ll2) - array.get(c, ll2) * array.get(x, ll1)) / array.get(d, ll2))

for j = 0 to leng-3

i = leng-3 - j

array.set(x, i, (array.get(b,i) - array.get(f,i)*array.get(x,i+2) - array.get(c,i)*array.get(x,i+1)) / array.get(d, i))

//////////////Construct the output///////////////////

o5 = array.get(x,0)

////////////////////Plottingd///////////////////////

TimeFrame = input('1', type=input.resolution)

start = security(syminfo.tickerid, TimeFrame, time)

//------------------------------------------------

newSession = iff(change(start), 1, 0)

//------------------------------------------------

vwapsum = 0.0

vwapsum := iff(newSession, o5*volume, vwapsum[1]+o5*volume)

volumesum = 0.0

volumesum := iff(newSession, volume, volumesum[1]+volume)

v2sum = 0.0

v2sum := iff(newSession, volume*o5*o5, v2sum[1]+volume*o5*o5)

myvwap = vwapsum/volumesum

dev2 = sqrt(max(v2sum/volumesum - myvwap*myvwap, 0))

Coloring=close>myvwap?color.green:color.red

av=myvwap

showBcol = input(false, type=input.bool, title="Show barcolors")

showPrevVWAP = input(false, type=input.bool, title="Show previous VWAP close")

prevwap = 0.0

prevwap := iff(newSession, myvwap[1], prevwap[1])

nprevwap= normalize(prevwap, 0, 1)

l1= input(20, minval=1)

src2 = close

mult1 = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis1 = sma(src2, l1)

dev1 = mult1 * stdev(src2, l1)

upper1 = basis1 + dev1

lower1 = basis1 - dev1

bbr1 = (src - lower1)/(upper1 - lower1)

az = plot(bbr, "Δ(OBV-PVT)", color.rgb(0,153,0,0), style=plot.style_columns)

bz = plot(bbr1, "BB%B", color.rgb(0,125,125,50), style=plot.style_columns)

fill(az, bz, color=color.white)

deltabbr = bbr1 - bbr

oneline = hline(1)

twoline = hline(1.2)

zline = hline(0)

xx = input(.3)

yy = input(.7)

zz = input(-1)

xxx = hline(xx)

yyy = hline(yy)

zzz = hline(zz)

fill(oneline, twoline, color=color.red, title="Sell Zone")

fill(yyy, oneline, color=color.orange, title="Slightly Overbought")

fill(yyy, zline, color=color.white, title="DO NOTHING ZONE")

fill(zzz, zline, color=color.green, title="GO LONG ZONE")

l20 = crossover(deltabbr, 0)

l30 = crossunder(deltabbr, 0)

l40 = crossover(o5, 0)

l50 = crossunder(o5, 0)

z1 = bbr1 >= 1

z2 = bbr1 < 1 and bbr1 >= .7

z3 = bbr1 < .7 and bbr1 >= .3

z4 = bbr1 < .3 and bbr1 >= 0

z5 = bbr1 < 0

a1 = bbr >= 1

a2 = bbr < 1 and bbr >= .7

a4 = bbr < .3 and bbr >= 0

a5 = bbr < 0

b4 = deltabbr < .3 and deltabbr >= 0

b5 = deltabbr < 0

c4 = o5 < .3 and o5 >= 0

c5 = o5 < 0

b1 = deltabbr >= 1

b2 = deltabbr < 1 and o5 >= .7

c1 = o5 >= 1

c2 = o5 < 1 and o5 >= .7

///

n = input(16,"Period")

H = highest(hl2,n)

L = lowest(hl2,n)

hi = H[1]

lo = L[1]

up = high>hi

dn = low<lo

lowerbbh = lowest(10)[1]

bbh = (low == open ? open < lowerbbh ? open < close ? close > ((high[1] - low[1]) / 2) + low[1] :na : na : na)

plot(normalize(av,-1,1), linewidth=2, title="Trendline", color=color.yellow)

long5 = close < av and av[0] > av[1]

sell5 = close > av

cancel = false

if open >= high[1]

cancel = true

long = (long5 or z5 or a5) and (icreturn or bbh or up)

sell = ((z1 or a1) or (l40 and l20)) and (icreturn or dn) and (c1 or b1)

short = ((z1 or z2 or a1 or sell5) and (l40 or l20)) and icreturn

buy= (z5 or z4 or a5 or long5) and (icreturn or dn)

plotshape(long and not sell ? -0.5 : na, title="Long", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green, transp=0)

plotshape(short and not sell? 1 : na, title="Short", location=location.absolute, style=shape.circle, size=size.tiny, color=color.red, transp=0)

if (inDateRange)

strategy.entry("long", true, when = long )

if (inDateRange) and (strategy.position_size > 0)

strategy.close_all(when = sell or cancel)

if (inDateRange)

strategy.entry("short", false, when = short )

if (inDateRange) and (strategy.position_size < 0)

strategy.close_all(when = buy)

Lebih lanjut

- Strategi Pengesanan Trend Grid Bollinger Band Moving Average yang Lanjutan

- Indikator Ichimoku Kinko Hyo Strategi Trend Keseimbangan

- Indikator Harga Volume Strategi Dagangan Seimbang

- Strategi Garis Panjang SMA yang Disesuaikan

- Strategi Arbitraj Purata Bergerak Berganda

- Strategi Pelaburan Kuantitatif Berdasarkan Tarikh Beli Bulanan

- Strategi Perdagangan Penyimpangan Standard Bertingkat

- Strategi Perdagangan Kepelbagaian Purata Bergerak

- Strategi Crossover EMA

- Strategi Dagangan Crossover EMA Jangka Pendek, Jangka Menengah dan Jangka Panjang

- Strategi Perdagangan Kuantitatif Osilator Harga

- Trend Multi-penunjuk Mengikut Strategi

- CCI Dual Timeframe Trend Mengikut Strategi

- Strategi Pengesanan Trend T3-CCI

- Strategi Penembusan SuperTrend Jangka Masa

- Strategi gabungan purata bergerak pembalikan momentum

- Peningkatan purata bergerak dinamik Strategi Martin

- Kombo Pembalikan Momentum Dual-Rail Strategi Pemadan

- Ichimoku Cloud Quant Strategi

- Adaptive mengambil keuntungan dan strategi berhenti kerugian berdasarkan bingkai masa berganda dan penunjuk momentum