Strategi Stop Loss Berasaskan TFO dan ATR

Penulis:ChaoZhang, Tarikh: 2023-12-04 13:32:41Tag:

Ringkasan

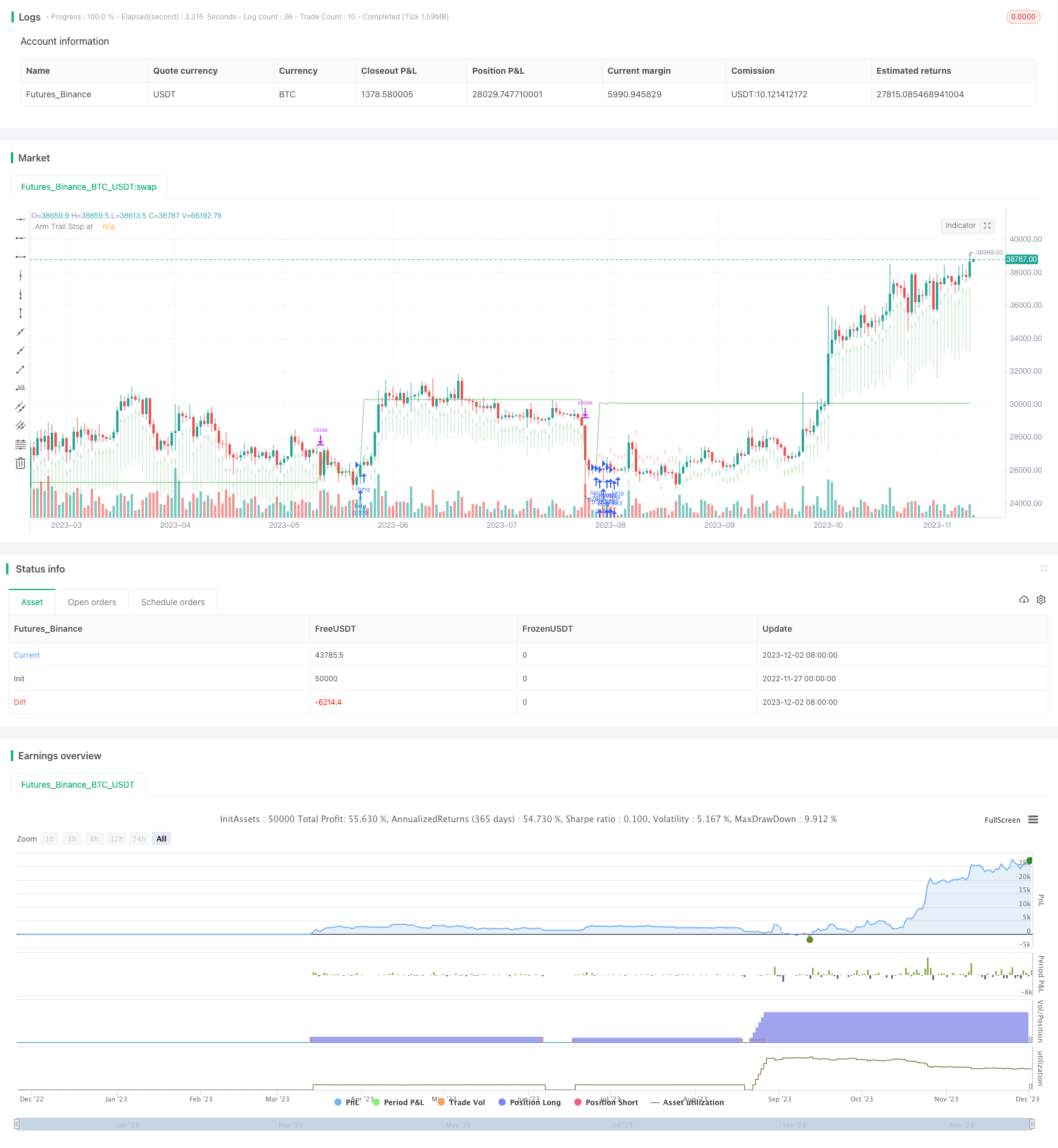

Strategi ini direka berdasarkan penunjuk Dr. John Ehlers' Trend Flex Oscillator (TFO) dan Average True Range (ATR). Ia sesuai untuk pasaran lembu dan akan membuka kedudukan panjang apabila tindakan harga oversold kelihatan berbalik. Ia biasanya menutup kedudukan dalam beberapa hari kecuali ditangkap dalam pasaran beruang, dalam hal ini ia bertahan. Strategi ini mempermudah pengujian belakang dengan membuat parameter boleh dikonfigurasi, tetapi hasil pengujian belakang tidak boleh dipercayai sepenuhnya.

Logika Strategi

Strategi ini menggabungkan penunjuk TFO dan ATR untuk menentukan masuk dan keluar.

Syarat kemasukan: Apabila TFO jatuh di bawah ambang (menunjukkan tahap oversold) dan TFO telah meningkat dari bar sebelumnya (menunjukkan pembalikan TFO ke atas), dan ATR di atas ambang turun naik yang ditetapkan (menunjukkan peningkatan turun naik pasaran), kedudukan panjang dibuka.

Syarat keluar: Apabila TFO meningkat di atas ambang (menunjukkan tahap overbought) dan ATR di atas ambang yang ditetapkan, semua kedudukan panjang ditutup. Di samping itu, stop loss terakhir keluar dari semua kedudukan apabila harga jatuh di bawah tahap stop terakhir. Pengguna boleh memilih untuk membenarkan strategi keluar berdasarkan isyarat penunjuk atau berdasarkan semata-mata pada stop loss.

Strategi ini membolehkan sehingga 15 kedudukan panjang serentak. Parameter boleh diselaraskan untuk jangka masa yang berbeza.

Kelebihan

-

Menggabungkan analisis trend dan turun naik memberikan isyarat yang stabil. TFO menangkap isyarat pembalikan trend awal dan ATR mengenal pasti lonjakan turun naik.

-

Parameter masuk, keluar dan stop loss yang boleh disesuaikan memberikan fleksibiliti. Pengguna boleh mengoptimumkan berdasarkan keadaan pasaran.

-

Stop loss terbina dalam melindungi daripada pergerakan melampau.

-

Sokongan untuk piramida dan keluar separa membolehkan keuntungan kompaun di pasaran lembu.

Risiko

-

Hanya untuk jangka panjang, tiada mekanisme shorting, tidak boleh mendapat keuntungan daripada pasaran yang jatuh, pasaran bear yang teruk boleh menyebabkan kerugian besar.

-

Penyesuaian parameter yang tidak baik boleh menyebabkan perdagangan berlebihan atau entri dan keluar yang terlepas.

-

Dalam pergerakan yang melampau, stop loss boleh gagal dan tidak menghalang kerugian besar.

-

Ujian belakang tidak sepenuhnya mencerminkan prestasi langsung.

Peluang Peningkatan

-

Garis stop loss bergerak boleh ditambah untuk keluar tepat pada masanya dan perlindungan ke bawah yang lebih baik.

-

Mekanisme pendek boleh ditambah untuk membolehkan keuntungan semasa penurunan pasaran apabila TFO berbalik ke bawah dan ATR cukup tinggi.

-

Lebih banyak penapis seperti perubahan jumlah boleh mengurangkan kesan pergerakan harga yang tidak menentu.

-

Jangka masa dan parameter yang berbeza boleh diuji untuk mencari kombinasi yang paling berkesan.

Kesimpulan

Strategi ini menggabungkan kekuatan analisis trend dan turun naik menggunakan TFO dan ATR untuk menentukan arah pasaran. Mekanisme seperti piramid, penutupan separa dan kehilangan berhenti menyusul membolehkan gabungan keuntungan sambil mengawal risiko semasa pasaran lembu. Terdapat ruang untuk penambahbaikan melalui lebih banyak penapis penunjuk dan pengoptimuman parameter. Ia mencapai matlamat asas strategi kuant dan layak penyelidikan dan aplikasi lanjut.

/*backtest

start: 2022-11-27 00:00:00

end: 2023-12-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Chart0bserver

//

// Open Source attributions:

// portions © allanster (date window code)

// portions © Dr. John Ehlers (Trend Flex Oscillator)

//

// READ THIS CAREFULLY!!! ----------------//

// This code is provided for educational purposes only. The results of this strategy should not be considered investment advice.

// The user of this script acknolwedges that it can cause serious financial loss when used as a trading tool

// This strategy has a bias for HODL (Holds on to Losses) meaning that it provides NO STOP LOSS protection!

// Also note that the default behavior is designed for up to 15 open long orders, and executes one order to close them all at once.

// Opening a long position is predicated on The Trend Flex Oscillator (TFO) rising after being oversold, and ATR above a certain volatility threshold.

// Closing a long is handled either by TFO showing overbought while above a certain ATR level, or the Trailing Stop Loss. Pick one or both.

// If the strategy is allowed to sell before a Trailing Stop Loss is triggered, you can set a "must exceed %". Do not mistake this for a stop loss.

// Short positions are not supported in this version. Back-testing should NEVER be considered an accurate representation of actual trading results.

//@version=5

strategy('TFO + ATR Strategy with Trailing Stop Loss', 'TFO ATR Trailing Stop Loss', overlay=true, pyramiding=15, default_qty_type=strategy.cash, default_qty_value=10000, initial_capital=150000, currency='USD', commission_type=strategy.commission.percent, commission_value=0.5)

strategy.risk.allow_entry_in(strategy.direction.long) // There will be no short entries, only exits from long.

// -----------------------------------------------------------------------------------------------------------//

// Back-testing Date Range code ----------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

fromMonth = input.int(defval=9, title='From Month', minval=1, maxval=12, group='Back-Testing Start Date')

fromDay = input.int(defval=1, title='From Day', minval=1, maxval=31, group='Back-Testing Start Date')

fromYear = input.int(defval=2021, title='From Year', minval=1970, group='Back-Testing Start Date')

thruMonth = 1 //input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12, group="Back-Testing Date Range")

thruDay = 1 //input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31, group="Back-Testing Date Range")

thruYear = 2112 //input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970, group="Back-Testing Date Range")

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => // create function "within window of time

time >= start and time <= finish ? true : false

// Date range code -----//

// -----------------------------------------------------------------------------------------------------------//

// ATR Indicator Code --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

length = 18 //input(title="ATR Length", defval=18, minval=1)

Period = 18 //input(18,title="ATR EMA Period")

basicEMA = ta.ema(close, length)

ATR_Function = ta.ema(ta.tr(true), length)

EMA_ATR = ta.ema(ATR_Function, Period)

ATR = ta.ema(ta.tr(true), length)

ATR_diff = ATR - EMA_ATR

volatility = 100 * ATR_diff / EMA_ATR // measure of spread between ATR and EMA

volatilityAVG = math.round((volatility + volatility[1] + volatility[2]) / 3)

buyVolatility = input.int(3, 'Min Volatility for Buy', minval=-20, maxval=20, step=1, group='Average True Range')

sellVolatility = input.int(13, 'Min Volatility for Sell', minval=-10, maxval=20, step=1, group='Average True Range')

useAvgVolatility = input.bool(defval=false, title='Average the Volatility over 3 bars', group='Average True Range')

// End of ATR ------------/

// -----------------------------------------------------------------------------------------------------------//

// TFO Indicator code --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

trendflex(Series, PeriodSS, PeriodTrendFlex, PeriodEMA) =>

var SQRT2xPI = math.sqrt(8.0) * math.asin(1.0) // 4.44288293815 Constant

alpha = SQRT2xPI / PeriodSS

beta = math.exp(-alpha)

gamma = -beta * beta

delta = 2.0 * beta * math.cos(alpha)

float superSmooth = na

superSmooth := (1.0 - delta - gamma) * (Series + nz(Series[1])) * 0.5 + delta * nz(superSmooth[1]) + gamma * nz(superSmooth[2])

E = 0.0

for i = 1 to PeriodTrendFlex by 1

E += superSmooth - nz(superSmooth[i])

E

epsilon = E / PeriodTrendFlex

zeta = 2.0 / (PeriodEMA + 1.0)

float EMA = na

EMA := zeta * epsilon * epsilon + (1.0 - zeta) * nz(EMA[1])

return_1 = EMA == 0.0 ? 0.0 : epsilon / math.sqrt(EMA)

return_1

upperLevel = input.float(1.2, 'TFO Upper Level', minval=0.1, maxval=2.0, step=0.1, group='Trend Flex Ocillator')

lowerLevel = input.float(-0.9, 'TFO Lower Level', minval=-2.0, maxval=-0.1, step=0.1, group='Trend Flex Ocillator')

periodTrendFlex = input.int(14, 'TrendFlex Period', minval=2, group='Trend Flex Ocillator')

useSuperSmootherOveride = true //input( true, "Apply SuperSmoother Override Below*", input.bool, group="Trend Flex Ocillator")

periodSuperSmoother = 8.0 //input(8.0, "SuperSmoother Period*", input.float , minval=4.0, step=0.5, group="Trend Flex Ocillator")

postSmooth = 33 //input(33.0, "Post Smooth Period**", input.float , minval=1.0, step=0.5, group="Trend Flex Ocillator")

trendFlexOscillator = trendflex(close, periodSuperSmoother, periodTrendFlex, postSmooth)

// End of TFO -------------//

// -----------------------------------------------------------------------------------------------------------//

// HODL Don't sell if losing n% ---------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

sellOnStrategy = input.bool(defval=true, title='Allow Stategy to close positions', group='Selling Conditions')

doHoldLoss = true // input(defval = true, title = "Strategy can sell for a loss", type = input.bool, group="Selling Conditions")

holdLoss = input.int(defval=0, title='Value (%) must exceed ', minval=-25, maxval=10, step=1, group='Selling Conditions')

totalInvest = strategy.position_avg_price * strategy.position_size

openProfitPerc = strategy.openprofit / totalInvest

bool acceptableROI = openProfitPerc * 100 > holdLoss

// -----------------------//

// -----------------------------------------------------------------------------------------------------------//

// Buying and Selling conditions -------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

if useAvgVolatility

volatility := volatilityAVG

volatility

tfoBuy = trendFlexOscillator < lowerLevel and trendFlexOscillator[1] < trendFlexOscillator // Always make a purchase if TFO is in this lowest range

atrBuy = volatility > buyVolatility

tfoSell = ta.crossunder(trendFlexOscillator, upperLevel)

consensusBuy = tfoBuy and atrBuy

consensusSell = tfoSell and volatility > sellVolatility

if doHoldLoss

consensusSell := consensusSell and acceptableROI

consensusSell

// --------------------//

// -----------------------------------------------------------------------------------------------------------//

// Tracing & Debugging --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

plotchar(strategy.opentrades, 'Number of open trades', ' ', location.top)

plotarrow(100 * openProfitPerc, 'Profit on open longs', color.new(color.green, 75), color.new(color.red, 75))

// plotchar(strategy.position_size, "Shares on hand", " ", location.top)

// plotchar(totalInvest, "Total Invested", " ", location.top)

// plotarrow(strategy.openprofit, "Open profit dollar amount", color.new(color.green,100), color.new(color.red, 100))

// plotarrow(strategy.netprofit, "Net profit for session", color.new(color.green,100), color.new(color.red, 100))

// plotchar(acceptableROI, "Acceptable ROI", " ", location.top)

// plotarrow(volatility, "ATR volatility value", color.new(color.green,75), color.new(color.red, 75))

// plotchar(strategy.position_avg_price, "Avgerage price of holdings", " ", location.top)

// plotchar(volatilityAVG, "AVG volatility", " ", location.top)

// plotchar(fiveBarsVal, "change in 5bars", " ", location.top)

// plotchar(crossingUp, "crossingUp", "x", location.belowbar, textcolor=color.white)

// plotchar(crossingDown, "crossingDn", "x", location.abovebar, textcolor=color.white)

// plotchar(strategy.closedtrades, "closedtrades", " ", location.top)

// plotchar(strategy.wintrades, "wintrades", " ", location.top)

// plotchar(strategy.losstrades, "losstrades", " ", location.top)

// plotchar(close, "close", " ", location.top)

//--------------------//

// -----------------------------------------------------------------------------------------------------------//

// Trade Alert Execution ------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

strategy.entry('long', strategy.long, when=window() and consensusBuy, comment='long')

if sellOnStrategy

strategy.close('long', when=window() and consensusSell, qty_percent=100, comment='Strat')

// -----------------------------------------------------------------------------------------------------------//

// Trailing Stop Loss logic -------------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

useTrailStop = input.bool(defval=true, title='Set Trailing Stop Loss on avg positon value', group='Selling Conditions')

arm = input.float(defval=15, title='Trailing Stop Arms At (%)', minval=1, maxval=30, step=1, group='Selling Conditions') * 0.01

trail = input.float(defval=2, title='Trailing Stop Loss (%)', minval=0.25, maxval=9, step=0.25, group='Selling Conditions') * 0.1

longStopPrice = 0.0

stopLossPrice = 0.0

if strategy.position_size > 0

longStopPrice := strategy.position_avg_price * (1 + arm)

stopLossPrice := strategy.position_avg_price * ((100 - math.abs(holdLoss)) / 100) // for use with 'stop' in strategy.exit

stopLossPrice

else

longStopPrice := close

longStopPrice

// If you want to hide the Trailing Stop Loss threshold (green line), comment this out

plot(longStopPrice, 'Arm Trail Stop at', color.new(color.green, 60), linewidth=2)

if strategy.position_size > 0 and useTrailStop

strategy.exit('exit', 'long', when=window(), qty_percent=100, trail_price=longStopPrice, trail_offset=trail * close / syminfo.mintick, comment='Trail')

//-----------------------------------------------------------------------------------------------------------//

- Strategi Pengesanan Purata Bergerak Dinamik

- Strategi Dagangan Osilasi Purata Bergerak Berganda

- EMA band + Leledc + Bollinger band trend mengikut strategi

- Analisis Strategi RSI Cepat

- Strategi Perdagangan Penembusan Volatiliti Beradaptasi

- Strategi Saham Purata Bergerak Eksponensial Tinggi Minus

- Strategi Penembusan Saluran Donchian

- Bitcoin - MA Crossover Strategi

- Fisher Transform Backtest Strategi

- 123 Strategi Kembalikan dan STARC Bands Combo

- Strategi kuantitatif Multifactor Great Delight

- Ikuti Strategi Barisan

- Strategi Perdagangan Purata Bergerak Eksponensial Empat

- Strategi Dagangan Crossover Purata Bergerak Eksponensial

- Strategi silang purata bergerak berganda

- Momentum Strategi Dagangan Purata Bergerak Berganda

- Multi mengambil keuntungan dan hentikan kerugian Gelombang Trend Mengikuti strategi

- Strategi Dagangan Dua Arah Berdasarkan RSI dan STOCH RSI

- Strategi Penembusan EMA Golden Cross Cepat dan Lambat

- RSI dan gabungan purata bergerak MT5 Strategi Scalping Martingale