Strategi Dagangan Berbilang Tempoh Berdasarkan Indeks Volatiliti dan Osilator Stochastic

Penulis:ChaoZhang, Tarikh: 2023-12-21 14:34:42Tag:

Ringkasan Strategi ini menggabungkan indeks turun naik VIX dan osilator stokastik RSI melalui komposisi penunjuk dalam tempoh masa yang berbeza, untuk mencapai kemasukan pecah yang cekap dan keluar yang terlalu banyak dibeli / terlalu banyak dijual. Strategi ini mempunyai ruang yang besar untuk pengoptimuman dan boleh disesuaikan dengan persekitaran pasaran yang berbeza.

Prinsip-prinsip

-

Mengira indeks turun naik VIX: mengambil harga tertinggi dan terendah selama 20 hari yang lalu untuk mengira turun naik. VIX yang tinggi menunjukkan panik pasaran manakala VIX yang rendah menunjukkan kepuasan pasaran.

-

Mengira pengayun RSI: mengambil perubahan harga dalam tempoh 14 hari yang lalu. RSI di atas 70 menunjukkan keadaan overbought dan RSI di bawah 30 menunjukkan keadaan oversold.

-

Gabungkan kedua-dua penunjuk. pergi panjang apabila VIX melanggar jalur atas atau persentil tertinggi. menutup panjang apabila RSI melebihi 70.

Kelebihan

- Mengintegrasikan beberapa penunjuk untuk penilaian masa pasaran yang komprehensif.

- Penunjuk di seluruh jangka masa mengesahkan satu sama lain dan meningkatkan ketepatan keputusan.

- Parameter yang boleh disesuaikan boleh dioptimumkan untuk instrumen perdagangan yang berbeza.

Risiko

- Penyesuaian parameter yang tidak betul boleh menyebabkan beberapa isyarat palsu.

- Satu penunjuk keluar mungkin terlepas pembalikan harga.

Cadangan Pengoptimuman

- Masukkan lebih banyak penunjuk pengesahan seperti purata bergerak dan pita Bollinger ke entri masa.

- Tambah lebih banyak penunjuk keluar seperti corak lilin pembalikan.

Ringkasan Strategi ini menggunakan VIX untuk mengukur masa pasaran dan tahap risiko, dan menapis perdagangan yang tidak menguntungkan menggunakan bacaan overbought / oversold dari RSI, untuk memasuki pada masa yang sesuai dan keluar tepat pada masanya dengan berhenti.

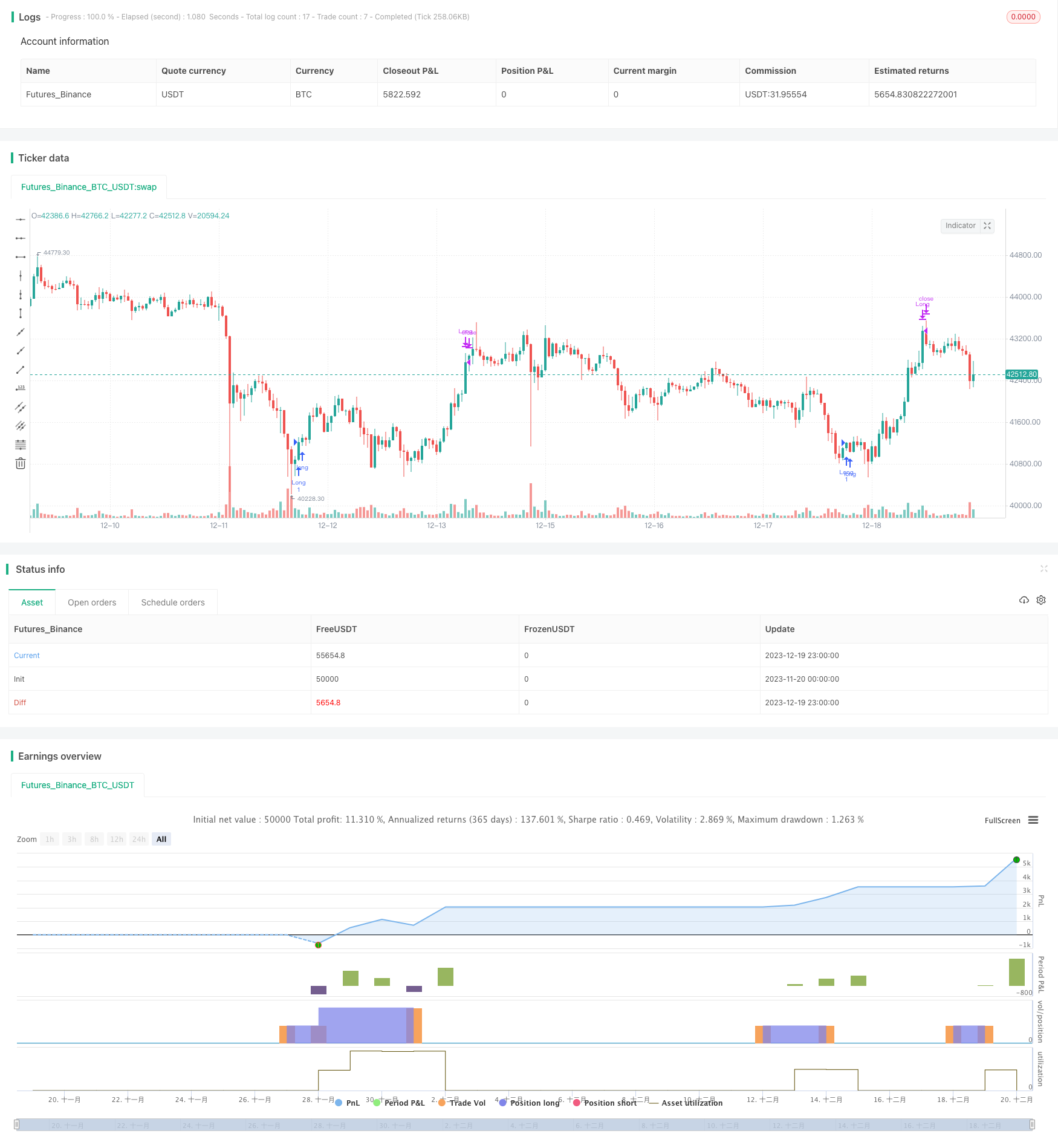

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © timj

strategy('Vix FIX / StochRSI Strategy', overlay=true, pyramiding=9, margin_long=100, margin_short=100)

Stochlength = input.int(14, minval=1, title="lookback length of Stochastic")

StochOverBought = input.int(80, title="Stochastic overbought condition")

StochOverSold = input.int(20, title="Stochastic oversold condition")

smoothK = input(3, title="smoothing of Stochastic %K ")

smoothD = input(3, title="moving average of Stochastic %K")

k = ta.sma(ta.stoch(close, high, low, Stochlength), smoothK)

d = ta.sma(k, smoothD)

///////////// RSI

RSIlength = input.int( 14, minval=1 , title="lookback length of RSI")

RSIOverBought = input.int( 70 , title="RSI overbought condition")

RSIOverSold = input.int( 30 , title="RSI oversold condition")

RSIprice = close

vrsi = ta.rsi(RSIprice, RSIlength)

///////////// Double strategy: RSI strategy + Stochastic strategy

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input.float(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

new = input(false, title="-------Text Plots Below Use Original Criteria-------" )

sbc = input(false, title="Show Text Plot if WVF WAS True and IS Now False")

sbcc = input(false, title="Show Text Plot if WVF IS True")

new2 = input(false, title="-------Text Plots Below Use FILTERED Criteria-------" )

sbcFilt = input(true, title="Show Text Plot For Filtered Entry")

sbcAggr = input(true, title="Show Text Plot For AGGRESSIVE Filtered Entry")

ltLB = input.float(40, minval=25, maxval=99, title="Long-Term Look Back Current Bar Has To Close Below This Value OR Medium Term--Default=40")

mtLB = input.float(14, minval=10, maxval=20, title="Medium-Term Look Back Current Bar Has To Close Below This Value OR Long Term--Default=14")

str = input.int(3, minval=1, maxval=9, title="Entry Price Action Strength--Close > X Bars Back---Default=3")

//Alerts Instructions and Options Below...Inputs Tab

new4 = input(false, title="-------------------------Turn On/Off ALERTS Below---------------------" )

new5 = input(false, title="----To Activate Alerts You HAVE To Check The Boxes Below For Any Alert Criteria You Want----")

sa1 = input(false, title="Show Alert WVF = True?")

sa2 = input(false, title="Show Alert WVF Was True Now False?")

sa3 = input(false, title="Show Alert WVF Filtered?")

sa4 = input(false, title="Show Alert WVF AGGRESSIVE Filter?")

//Williams Vix Fix Formula

wvf = ((ta.highest(close, pd)-low)/(ta.highest(close, pd)))*100

sDev = mult * ta.stdev(wvf, bbl)

midLine = ta.sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (ta.highest(wvf, lb)) * ph

//Filtered Bar Criteria

upRange = low > low[1] and close > high[1]

upRange_Aggr = close > close[1] and close > open[1]

//Filtered Criteria

filtered = ((wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh))

filtered_Aggr = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and not (wvf < upperBand and wvf < rangeHigh)

//Alerts Criteria

alert1 = wvf >= upperBand or wvf >= rangeHigh ? 1 : 0

alert2 = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh) ? 1 : 0

alert3 = upRange and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered ? 1 : 0

alert4 = upRange_Aggr and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered_Aggr ? 1 : 0

//Coloring Criteria of Williams Vix Fix

col = wvf >= upperBand or wvf >= rangeHigh ? color.lime : color.gray

isOverBought = (ta.crossover(k,d) and k > StochOverBought) ? 1 : 0

isOverBoughtv2 = k > StochOverBought ? 1 : 0

filteredAlert = alert3 ? 1 : 0

aggressiveAlert = alert4 ? 1 : 0

if (filteredAlert or aggressiveAlert)

strategy.entry("Long", strategy.long)

if (isOverBought)

strategy.close("Long")

- Strategi Dagangan Jangka Pendek Berdasarkan Penunjuk Volatiliti Chaikin

- Strategi Pengesanan Trend Crossover MA Berganda

- Super Trend Triple Strategi

- Strategy Stop Loss yang Dinamik

- Strategi Crossover Purata Bergerak dengan Stop-Loss dan Take-Profit

- Strategi pembalikan purata berdasarkan purata bergerak

- Strategi Dagangan Frekuensi Tinggi Berdasarkan Bollinger Bands

- Strategi Dagangan Awan Ichimoku Kuantitatif

- Strategi Momentum Berdasarkan Model Penembusan Bottom Berganda

- Strategi Pusaran Stochastic

- Strategi Dagangan Ikan Rendah CCI yang Diperluaskan

- Strategi Momentum Berdasarkan Squeeze LazyBear

- Strategi Hentian Keuntungan Sawtooth yang Melalui Lantai Berdasarkan Purata Bergerak

- Strategi Dagangan Purata Bergerak Bertingkat Dinamik

- Strategi Lilin Terakhir

- Strategi Kuantitatif Pembalikan Indeks Volume Negatif

- Triple Supertrend Breakout Strategi

- MACD Strategi Kekuatan Relatif

- Sistem Tiga Naga

- Perdagangan teratas hanya berdasarkan strategi EMA8 mingguan