Bollinger Band Crossover Ke Bawah RSI Pullback Strategi Dagangan

Gambaran keseluruhan

Strategi ini menggunakan indikator Bollinger Bands untuk menentukan sama ada harga memasuki kawasan overbought dan oversold, dan digabungkan dengan indikator RSI untuk menentukan sama ada ada terdapat peluang untuk membalikkan semula, membuat ruang kosong apabila kawasan overbought membentuk garpu mati, dan berhenti ketika harga naik melebihi jalur Bollinger Bands.

Prinsip Strategi

Strategi ini berdasarkan kepada prinsip-prinsip berikut:

- Apabila harga penutupan berada di atas rantaian Bollinger Bands, ia menunjukkan aset memasuki zon overbought dan ada peluang untuk membalikkan.

- RSI boleh digunakan untuk menilai kawasan yang terlalu banyak dibeli dan dijual. RSI>70 adalah kawasan yang terlalu banyak dibeli.

- Tekan posisi kosong apabila harga penutupan bergerak dari bawah.

- Apabila RSI berundur dari zon overbought atau triggered oleh titik henti, hentikan kedudukan.

Analisis kelebihan

Strategi ini mempunyai kelebihan berikut:

- Menggunakan Brin Belt untuk menilai kawasan overbought dan oversold untuk meningkatkan kadar kejayaan perdagangan

- Mengelakkan kerugian yang tidak perlu dengan menggunakan penapis RSI

- Rasio keuntungan tinggi, kawalan risiko maksimum

Analisis risiko

Strategi ini mempunyai risiko berikut:

- Peningkatan berterusan selepas penembusan menyebabkan kerugian semakin meluas

- RSI gagal untuk kembali pada masa yang tepat, kekalahan meluas

- Berpegang Saham Unilateral, Tidak Boleh Berdagang

Anda boleh mengurangkan risiko dengan:

- Menyesuaikan titik henti dengan betul, berhenti tepat pada masanya

- Gabungan Indeks Lain Untuk Menentukan RSI Berbalik

- Menggabungkan Indeks Garis Persamaan, untuk menentukan sama ada masuk dalam penyusunan semula

Arah pengoptimuman

Strategi ini boleh dioptimumkan dengan:

- Optimumkan parameter Brin Belt untuk lebih banyak varieti perdagangan

- Mengoptimumkan parameter RSI untuk meningkatkan kesan indikator

- Menambah kombinasi lain untuk menentukan titik perubahan

- Menambah logik perdagangan berbilang kepala

- Menggabungkan strategi hentian kerugian dengan penyesuaian hentian kerugian secara dinamik

ringkaskan

Strategi ini secara keseluruhannya adalah strategi perdagangan garis pendek cepat yang tipikal di kawasan overbought. Ia menggunakan jalur Burin untuk menentukan titik jual beli, sinyal penapisan RSI. Ia mengawal tahap risiko dengan menghentikan kerugian yang munasabah. Ia boleh meningkatkan keberkesanan dengan pengoptimuman parameter, indikator gabungan, menambah logik pembukaan kedudukan dan sebagainya.

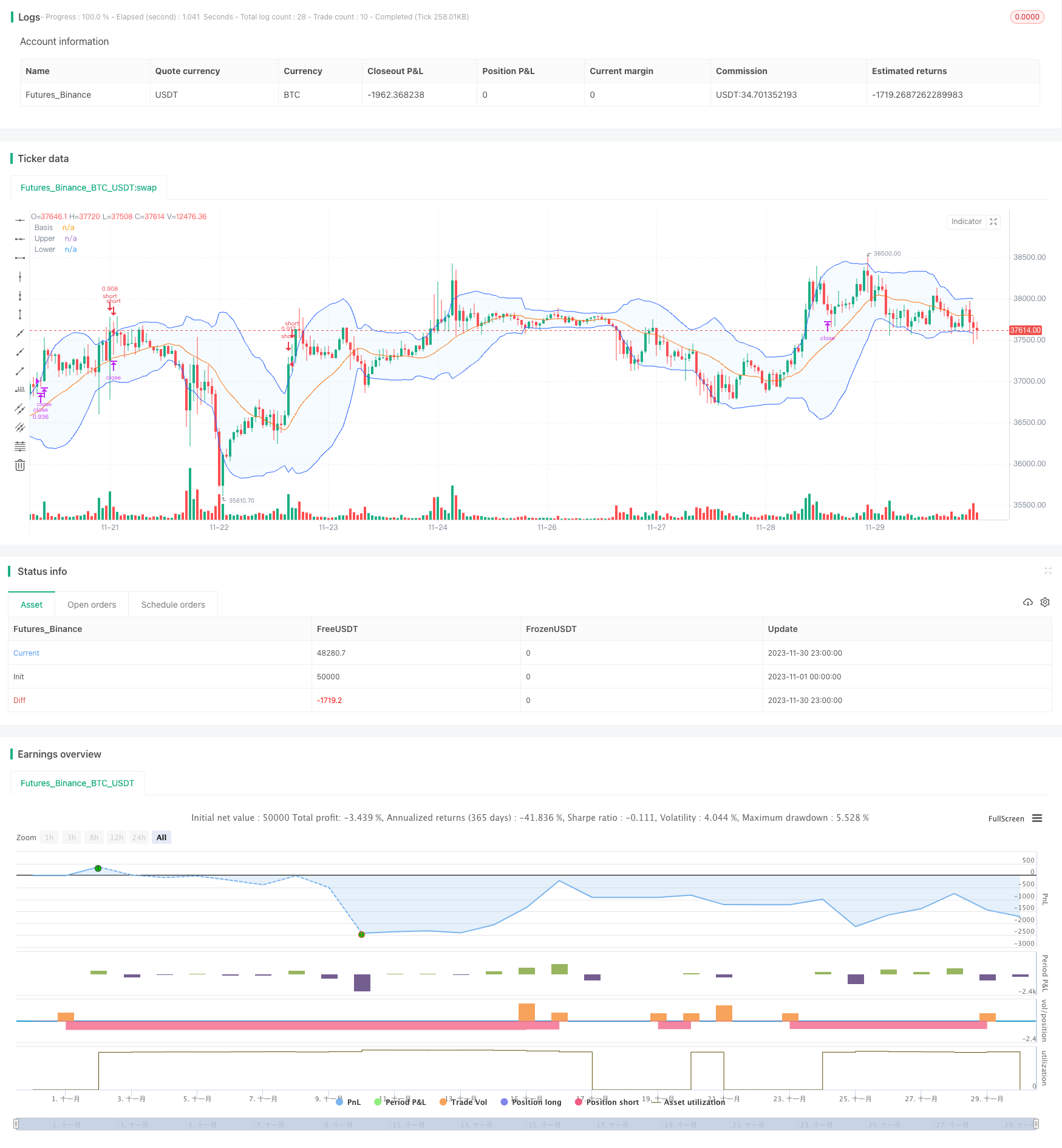

/*backtest

start: 2023-11-01 00:00:00

end: 2023-11-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

strategy("Bollinger Band Below Price with RSI",

overlay=true,

initial_capital=1000,

process_orders_on_close=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=70,

commission_type=strategy.commission.percent,

commission_value=0.1)

showDate = input(defval=true, title='Show Date Range')

timePeriod = time >= timestamp(syminfo.timezone, 2022, 1, 1, 0, 0)

notInTrade = strategy.position_size <= 0

//Bollinger Bands Indicator

length = input.int(20, minval=1)

src = input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// RSI inputs and calculations

lengthRSI = 14

RSI = ta.rsi(close, lengthRSI)

// Configure trail stop level with input options

longTrailPerc = input.float(title='Trail Long Loss (%)', minval=0.0, step=0.1, defval=3) * 0.01

shortTrailPerc = input.float(title='Trail Short Loss (%)', minval=0.0, step=0.1, defval=3) * 0.01

// Determine trail stop loss prices

//longStopPrice = 0.0

shortStopPrice = 0.0

//longStopPrice := if strategy.position_size > 0

//stopValue = close * (1 - longTrailPerc)

//math.max(stopValue, longStopPrice[1])

//else

//0

shortStopPrice := if strategy.position_size < 0

stopValue = close * (1 + shortTrailPerc)

math.min(stopValue, shortStopPrice[1])

else

999999

//Entry and Exit

strategy.entry(id="short", direction=strategy.short, when=ta.crossover(close, upper) and RSI < 70 and timePeriod and notInTrade)

if (ta.crossover(upper, close) and RSI > 70 and timePeriod)

strategy.exit(id='close', limit = shortStopPrice)