Bollinger Bands dan Strategi Gabungan K-line

Gambaran keseluruhan

Ini adalah strategi untuk mengesan trend yang menggunakan Bollinger Bands dan K-Line sebagai isyarat kemasukan. Ia bertujuan untuk menangkap trend dalam jangka masa yang lebih lama dan sesuai untuk perdagangan forex.

Prinsip Strategi

Strategi ini membina Bollinger Bands dengan mengira Jarak standard deviasi harga. Bandwidth mewakili turun naik pasaran. Ia dianggap sebagai isyarat overbought dan oversold apabila harga hampir naik atau turun.

Khususnya, melakukan banyak isyarat adalah: titik rendah ke atas menembusi bawah landasan, dan terdapat banyak penelan atau garis K yang panjang. Isyarat kosong adalah: titik tinggi ke bawah menembusi atas landasan, dan terdapat penelan kosong atau garis K yang panjang.

Stop loss ialah harga stop loss yang telah ditetapkan terlebih dahulu. Stop loss ialah harga yang terhenti ketika harga melewati garis tengah Brin.

Analisis kelebihan

Strategi ini menggabungkan trend dan peluang masuk semula. Bollinger band dapat mengenal pasti trend dan peluang jual beli yang berlebihan. Garis K menilai masa masuk semula dan mengelakkan perobosan palsu.

Tetapan stop loss jelas, risiko boleh dikawal. Ia sesuai untuk operasi garis panjang, mengurangkan frekuensi perdagangan.

Analisis risiko

Risiko terbesar dalam strategi ini adalah kegagalan untuk menangkap trend atau kejatuhan yang kuat. Dalam kes ini, hentian akan dicetuskan secara berturut-turut.

Di samping itu, penangguhan keluar dari padang bergantung pada garisan tengah, dan mungkin berlaku penangguhan terlalu awal atau terlalu lewat.

Ia boleh dioptimumkan dengan menyesuaikan kombinasi parameter, mengenal pasti bentuk K-line yang lebih dipercayai, atau mengubah piawaian penangguhan mengikut kadar lonjakan.

Arah pengoptimuman

Ia boleh digabungkan dengan petunjuk lain untuk menentukan trend kitaran besar, mengelakkan operasi berlawanan arah. Atau menambah algoritma pembelajaran mesin untuk menentukan kombinasi parameter terbaik.

Penghentian juga boleh diubah menjadi penghentian bergerak atau mengambil kira penghentian kadar turun naik dan sebagainya untuk memaksimumkan keuntungan.

ringkaskan

Ini adalah strategi trend jangka panjang berdasarkan Bollinger Bands dan K-Line Technical Indicators. Ia sesuai untuk digunakan sebagai strategi asas, mempunyai kebolehpercayaan dan ruang untuk keuntungan, tetapi masih memerlukan ujian dan pengoptimuman berterusan untuk meningkatkan kestabilan.

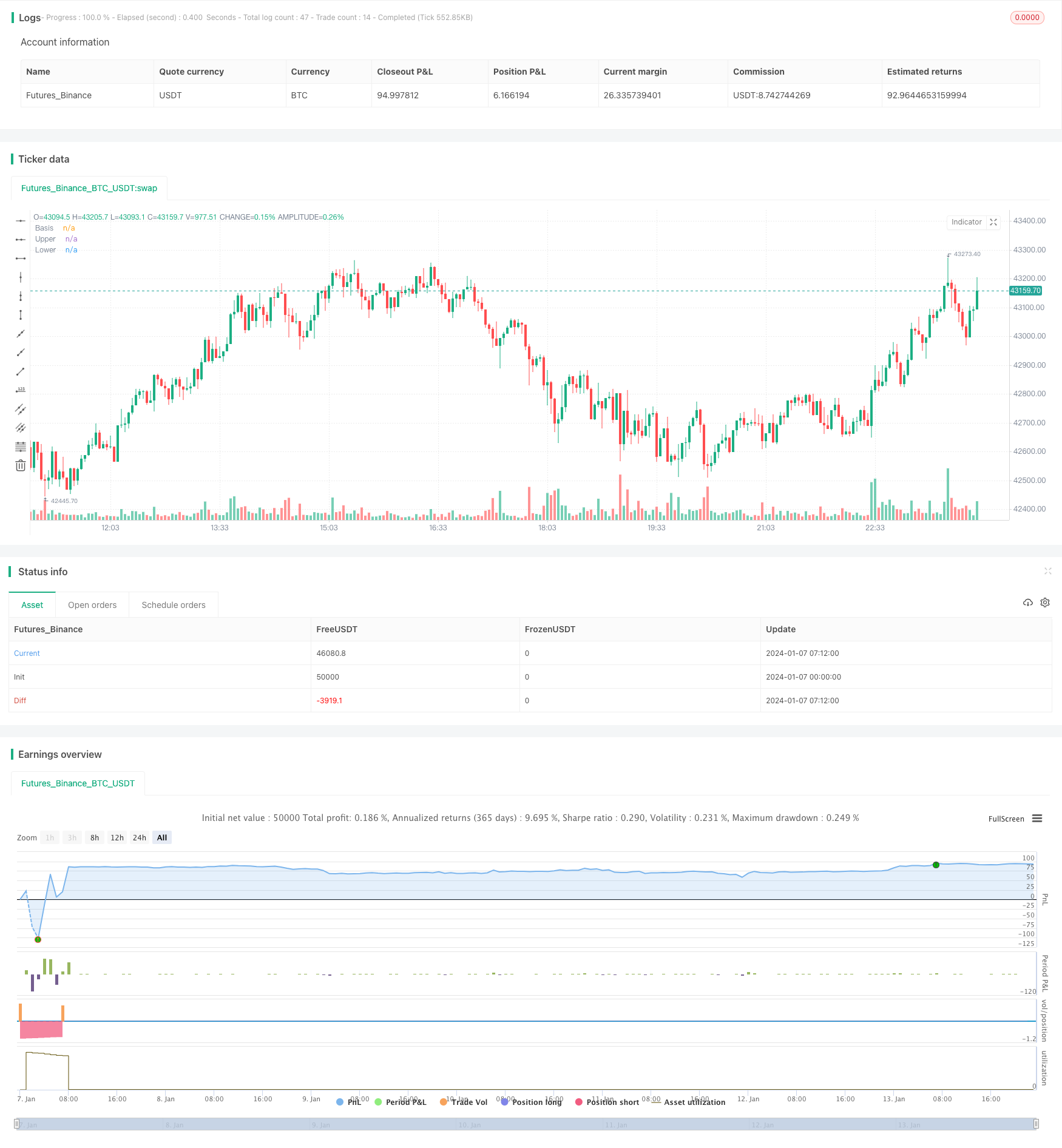

/*backtest

start: 2024-01-07 00:00:00

end: 2024-01-14 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("BB策略", overlay=true)

length = input(20, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

plot(basis, "Basis", color=#872323, offset = offset)

p1 = plot(upper, "Upper", color=color.teal, offset = offset)

p2 = plot(lower, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=#198787, transp=95)

diff=upper-lower

//plot(upper*0.9985, "Upper", color=color.white, offset = offset)

//plot(lower*1.0015, "Lower", color=color.white, offset = offset)

//Engulfing Candles

openBarPrevious = open[1]

closeBarPrevious = close[1]

openBarCurrent = open

closeBarCurrent = close

//If current bar open is less than equal to the previous bar close AND current bar open is less than previous bar open AND current bar close is greater than previous bar open THEN True

bullishEngulfing = openBarCurrent <= closeBarPrevious and openBarCurrent < openBarPrevious and

closeBarCurrent > openBarPrevious

//If current bar open is greater than equal to previous bar close AND current bar open is greater than previous bar open AND current bar close is less than previous bar open THEN True

bearishEngulfing = openBarCurrent >= closeBarPrevious and openBarCurrent > openBarPrevious and

closeBarCurrent < openBarPrevious

//bullishEngulfing/bearishEngulfing return a value of 1 or 0; if 1 then plot on chart, if 0 then don't plot

//plotshape(bullishEngulfing, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

//plotshape(bearishEngulfing, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

//alertcondition(bullishEngulfing, title="Bullish Engulfing", message="[CurrencyPair] [TimeFrame], Bullish candle engulfing previous candle")

//alertcondition(bearishEngulfing, title="Bearish Engulfing", message="[CurrencyPair] [TimeFrame], Bearish candle engulfing previous candle")

//Long Upper Shadow - Bearish

C_Len = 14 // ema depth for bodyAvg

C_ShadowPercent = 5.0 // size of shadows

C_ShadowEqualsPercent = 100.0

C_DojiBodyPercent = 5.0

C_Factor = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi = max(close, open)

C_BodyLo = min(close, open)

C_Body = C_BodyHi - C_BodyLo

C_BodyAvg = ema(C_Body, C_Len)

C_SmallBody = C_Body < C_BodyAvg

C_LongBody = C_Body > C_BodyAvg

C_UpShadow = high - C_BodyHi

C_DnShadow = C_BodyLo - low

C_HasUpShadow = C_UpShadow > C_ShadowPercent / 100 * C_Body

C_HasDnShadow = C_DnShadow > C_ShadowPercent / 100 * C_Body

C_WhiteBody = open < close

C_BlackBody = open > close

C_Range = high-low

C_IsInsideBar = C_BodyHi[1] > C_BodyHi and C_BodyLo[1] < C_BodyLo

C_BodyMiddle = C_Body / 2 + C_BodyLo

C_ShadowEquals = C_UpShadow == C_DnShadow or (abs(C_UpShadow - C_DnShadow) / C_DnShadow * 100) < C_ShadowEqualsPercent and (abs(C_DnShadow - C_UpShadow) / C_UpShadow * 100) < C_ShadowEqualsPercent

C_IsDojiBody = C_Range > 0 and C_Body <= C_Range * C_DojiBodyPercent / 100

C_Doji = C_IsDojiBody and C_ShadowEquals

patternLabelPosLow = low - (atr(30) * 0.6)

patternLabelPosHigh = high + (atr(30) * 0.6)

C_LongUpperShadowBearishNumberOfCandles = 1

C_LongShadowPercent = 75.0

C_LongUpperShadowBearish = C_UpShadow > C_Range/100*C_LongShadowPercent

//alertcondition(C_LongUpperShadowBearish, title = "Long Upper Shadow", message = "New Long Upper Shadow - Bearish pattern detected.")

//if C_LongUpperShadowBearish

// var ttBearishLongUpperShadow = "Long Upper Shadow\nTo indicate buyer domination of the first part of a session, candlesticks will present with long upper shadows, as well as short lower shadows, consequently raising bidding prices."

// label.new(bar_index, patternLabelPosHigh, text="LUS", style=label.style_label_down, color = color.red, textcolor=color.white, tooltip = ttBearishLongUpperShadow)

//gcolor(highest(C_LongUpperShadowBearish?1:0, C_LongUpperShadowBearishNumberOfCandles)!=0 ? color.red : na, offset=-(C_LongUpperShadowBearishNumberOfCandles-1))

C_Len1 = 14 // ema depth for bodyAvg

C_ShadowPercent1 = 5.0 // size of shadows

C_ShadowEqualsPercent1 = 100.0

C_DojiBodyPercent1 = 5.0

C_Factor1 = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi1 = max(close, open)

C_BodyLo1 = min(close, open)

C_Body1 = C_BodyHi1 - C_BodyLo1

C_BodyAvg1 = ema(C_Body1, C_Len1)

C_SmallBody1 = C_Body1 < C_BodyAvg1

C_LongBody1 = C_Body1 > C_BodyAvg1

C_UpShadow1 = high - C_BodyHi1

C_DnShadow1 = C_BodyLo1 - low

C_HasUpShadow1 = C_UpShadow1 > C_ShadowPercent1 / 100 * C_Body1

C_HasDnShadow1 = C_DnShadow1 > C_ShadowPercent1 / 100 * C_Body1

C_WhiteBody1 = open < close

C_BlackBody1 = open > close

C_Range1 = high-low

C_IsInsideBar1 = C_BodyHi1[1] > C_BodyHi1 and C_BodyLo1[1] < C_BodyLo1

C_BodyMiddle1 = C_Body1 / 2 + C_BodyLo1

C_ShadowEquals1 = C_UpShadow1 == C_DnShadow1 or (abs(C_UpShadow1 - C_DnShadow1) / C_DnShadow1 * 100) < C_ShadowEqualsPercent1 and (abs(C_DnShadow1 - C_UpShadow1) / C_UpShadow1 * 100) < C_ShadowEqualsPercent1

C_IsDojiBody1 = C_Range1 > 0 and C_Body1 <= C_Range1 * C_DojiBodyPercent1 / 100

C_Doji1 = C_IsDojiBody1 and C_ShadowEquals1

patternLabelPosLow1 = low - (atr(30) * 0.6)

patternLabelPosHigh1 = high + (atr(30) * 0.6)

C_LongLowerShadowBullishNumberOfCandles1 = 1

C_LongLowerShadowPercent1 = 75.0

C_LongLowerShadowBullish1 = C_DnShadow1 > C_Range1/100*C_LongLowerShadowPercent1

//alertcondition1(C_LongLowerShadowBullish1, title = "Long Lower Shadow", message = "New Long Lower Shadow - Bullish pattern detected.")

// Make input options that configure backtest date range

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2018, minval=1800, maxval=2100)

endDate = input(title="End Date", type=input.integer,

defval=1, minval=1, maxval=31)

endMonth = input(title="End Month", type=input.integer,

defval=11, minval=1, maxval=12)

endYear = input(title="End Year", type=input.integer,

defval=2030, minval=1800, maxval=2100)

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

//多單

if ((bullishEngulfing or C_LongLowerShadowBullish1) and inDateRange and cross(low,lower))

strategy.entry("L", strategy.long, qty=1,stop=(low[1]))

//strategy.close("L",comment = "L exit",when=cross(basis,close),qty_percent=50)

if crossunder(close,upper*0.9985)

strategy.close("L",comment = "L exit",qty_percent=1)

//空單

if (((bullishEngulfing == 0) or C_LongUpperShadowBearish) and inDateRange and cross(close,upper))

strategy.entry("S", strategy.short,qty= 1,stop=(high[1]))

//strategy.close("S",comment = "S exit",when=cross(basis,close),qty_percent=50)

if crossunder(lower*1.0015,close)

strategy.close("S",comment = "S exit",qty_percent=1)