Purata pergerakan mengikut strategi berdasarkan SSL

Gambaran keseluruhan

Strategi ini adalah strategi yang menggunakan indikator saluran SSL untuk menilai trend pasaran dan mengikuti trend dengan garis rata sebagai asas. Ia berlaku untuk garis 4 jam dan garis matahari untuk garis panjang dan panjang.

Prinsip Strategi

Saluran SSL terdiri daripada garis kelta rata-rata dan amplitudo sebenar. Ia dapat menentukan arah trend pasaran. Ia berfungsi sebagai isyarat bullish apabila harga menembusi ke atas dan isyarat bearish apabila ia menembusi ke bawah.

Strategi menggunakan indikator garis rata seperti EMA untuk mengira garis rata asas. Garis rata ini dapat menyaring beberapa pecah palsu.

Strategi ini akan melakukan lebih banyak apabila harga menembusi garisan SSL atas, dan kosong apabila harga menembusi garisan SSL bawah.

Stop loss mempunyai peratusan stop loss, ATR stop loss dan melihat kembali harga minimum / harga tertinggi stop loss. Stop loss adalah N kali ganda stop loss. Parameter tertentu ditentukan oleh pengguna.

Analisis kelebihan

Saluran SSL menilai arah trend dengan tepat, mengurangkan isyarat palsu. Bekerja sama dengan ikatan sejajar sebagai asas untuk masuk ke pasaran, mengelakkan mengejar hujung.

Anda boleh memilih pelbagai jenis garis rata-rata yang fleksibel untuk menyesuaikan diri dengan keadaan pasaran yang lebih luas.

Stop loss adalah fleksibel dan boleh mengawal risiko. Stop loss multiplier juga boleh diatur secara fleksibel untuk memenuhi pelbagai keutamaan.

Ia juga boleh digunakan untuk membuat lebih banyak kerja kosong dan memanfaatkan peluang dua hala di pasaran.

Analisis risiko

Indeks garis rata-rata berada di belakang, dan kemungkinan kerugian berkumpul.

Dalam keadaan gegaran, apabila melintas di atas atau di bawah landasan, ia akan berbalik dan mudah terjebak.

ATR dan Stop Loss Review mungkin terlalu longgar apabila berlaku penembusan yang tidak normal, dan kerugian akan meningkat.

Langkah-langkah untuk menangani risiko:

- Sesuai menyesuaikan parameter garis rata, atau pilih jenis lain garis rata.

- Mempertingkatkan kemusnahan dan menghentikan kemusnahan tepat pada masanya.

- Menambahkan faktor perkalian ke dalam ATR, atau menyesuaikan kitaran semak semula.

Arah pengoptimuman

- Uji lebih banyak jenis penunjuk rata-rata untuk mencari parameter terbaik.

- Parameter kitaran ATR yang dioptimumkan untuk menghentikan kerugian.

- Uji parameter pengekalan kerugian yang berbeza.

- Uji faktor risiko yang berbeza.

ringkaskan

Strategi ini menggabungkan penggunaan SSL untuk menilai trend dan penunjuk garis rata untuk mengesahkan masuk ke pasaran, untuk mengikuti trend dengan berkesan. Ia menyediakan cara berhenti dan berhenti yang fleksibel, untuk mendapatkan keuntungan yang lebih tinggi sambil mengawal risiko. Dengan terus menguji dan mengoptimumkan parameter, prestasi perdagangan yang lebih baik dapat diperoleh. Ia adalah strategi yang berkesan yang bernilai dijejaki dan digunakan dalam jangka masa panjang.

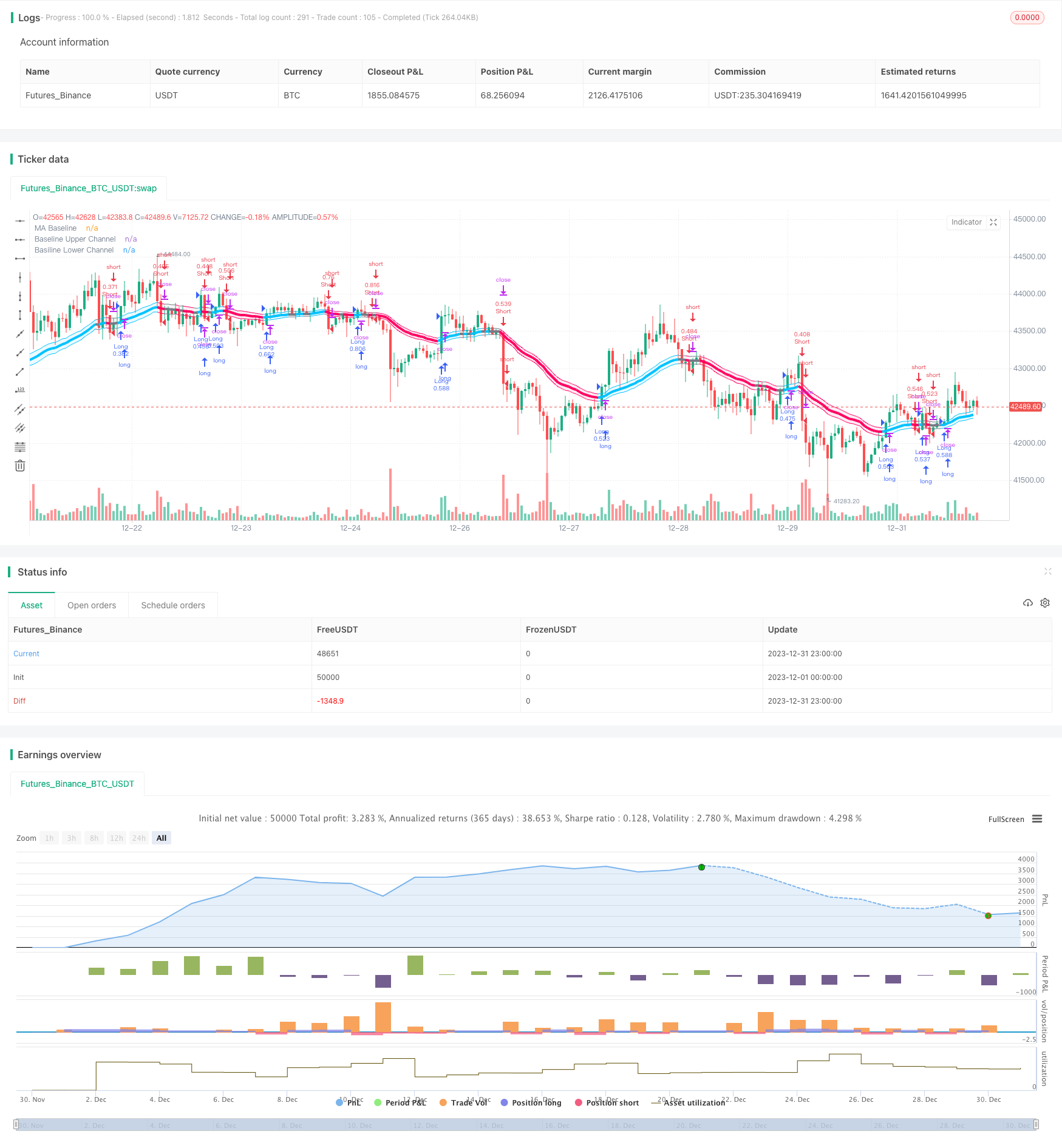

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Thanks to @kevinmck100 for opensource strategy template and @Mihkel00 for SSL Hybrid

// @fpemehd

// @version=5

strategy(title = '[fpemehd] SSL Baseline Strategy',

shorttitle = '[f] SSL',

overlay = true)

// # ========================================================================= #

// # Inputs

// # ========================================================================= #

// 1. Time

i_start = input (defval = timestamp("20 Jan 1990 00:00 +0900"), title = "Start Date", tooltip = "Choose Backtest Start Date", inline = "Start Date", group = "Time" )

i_end = input (defval = timestamp("20 Dec 2030 00:00 +0900"), title = "End Date", tooltip = "Choose Backtest End Date", inline = "End Date", group = "Time" )

inDateRange = true

// 2. Inputs for direction: Long? Short? Both?

// i_longEnabled = input.bool(defval = true , title = "Long?", tooltip = "Enable Long Position Trade?", inline = "1", group = "Long / Short" )

// i_shortEnabled = input.bool(defval = true , title = "Short?", tooltip = "Enable Short Position Trade?", inline = "1", group = "Long / Short" )

// 3. Shared inputs for Long and Short

//// 3-1. Inputs for Stop Loss Type: ATR or Percent?

i_slType = input.string (defval = "ATR", title = "SL Type ", group = "Strategy: Stop Loss Conditions", options = ["Percent", "ATR", "Previous LL / HH"], tooltip = "Stop Loss based on %? ATR?", inline = "1")

i_slPercent = input.float (defval = 3, title = "SL % ", group = "Strategy: Stop Loss Conditions", inline = "2")

i_slAtrLength = input.int (14, "SL ATR Length ", group = "Strategy: Stop Loss Conditions", inline = "3", minval = 0, maxval = 10000)

i_slAtrMultiplier = input.float (4, "SL ATR Multiplier", group = "Strategy: Stop Loss Conditions", inline = "3", minval = 0, step = 0.1, tooltip = "Length of ATR used to calculate Stop Loss. \nSize of StopLoss is determined by multiplication of ATR value. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

i_slLookBack = input.int(30, "Lowest Price Before Entry", group = "Strategy: Stop Loss Conditions", inline = "4", minval = 30, step = 1, tooltip = "Lookback to find the Lowest Price. \nStopLoss is determined by the Lowest price of the look back period. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

//// 3-2. Inputs for Quantity & Risk Manangement: Take Profit

i_riskReward = input.float(2, "Risk : Reward Ratio ", group = "Strategy: Risk Management", inline = "1", minval = 0, step = 0.1, tooltip = "Previous high or low (long/short dependant) is used to determine TP level. 'Risk : Reward' ratio is then used to calculate SL based of previous high/low level.\n\nIn short, the higher the R:R ratio, the smaller the SL since TP target is fixed by previous high/low price data.")

i_accountRiskPercent = input.float(1, "Portfolio Risk %", group = "Strategy: Risk Management", inline = "1", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

// 4. Inputs for Drawings

i_showTpSlBoxes = input.bool(false, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

i_showLabels = input.bool(false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "1", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

i_showDashboard = input.bool(false, "Show Dashboard", group = "Strategy: Drawings", inline = "1", tooltip = "Show Backtest Results")

i_show_color_bar = input.bool(false , "Color Bars", group = "Strategy: Drawings", inline = "1")

// 5. Inputs for Indicators

//// 5-1. Inputs for Indicator - 1: SSL Hybrid

i_useTrueRange = input.bool(defval = true , title = "use true range for Keltner Channel?", tooltip = "", inline = " ", group = "1: SSL Hybrid")

i_maType = input.string(defval='EMA', title='Baseline Type', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'],group = "1: SSL Hybrid")

i_len = input.int(defval=30,title='Baseline Length', group = "1: SSL Hybrid")

i_multy = input.float(0.2, step=0.05, title='Base Channel Multiplier', group = "1: SSL Hybrid")

// Input for Baseline

i_kidiv = input.int(defval=1, maxval=4, minval=0, title='Kijun MOD Divider',inline="Kijun v2", group="1: SSL Hybrid")

i_jurik_phase = input.int(defval=3, title='Baseline Type = JMA -> Jurik Phase', inline='JMA',group="1: SSL Hybrid")

i_jurik_power = input.int(defval=1, title='Baseline Type = JMA -> Jurik Power', inline='JMA',group="1: SSL Hybrid")

i_volatility_lookback = input.int(defval=10, title='Baseline Type = VAMA -> Volatility lookback length', inline='VAMA',group="1: SSL Hybrid")

// MF

i_beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Baseline Type = MF (Modular Filter, General Filter) ->Beta', inline='MF',group="1: SSL Hybrid")

i_feedback = input.bool(defval=false, title='Baseline Type = MF (Modular Filter) -> Use Feedback?', inline='MF',group="1: SSL Hybrid")

i_z = input.float(0.5, title='Baseline Type = MF (Modular Filter) -> Feedback Weighting', step=0.1, minval=0, maxval=1, inline='MF',group="1: SSL Hybrid")

// EDSMA

i_ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20, inline='EDSMA',group="1: SSL Hybrid")

i_ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3], inline='EDSMA',group="1: SSL Hybrid")

// # ========================================================================= #

// # Functions for Stop Loss & Take Profit & Plots

// # ========================================================================= #

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if i_showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if i_showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if i_showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##") + "\nExit Price: " + str.tostring(close,"#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + " " + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// # ========================================================================= #

// # Entry, Close Logic

// # ========================================================================= #

// 1. Calculate Indicators

//// 1-1. Calculate Indicators for SSL Hybrid Baseline

////// TEMA

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

////// EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = i_feedback ? i_z * src + (1 - i_z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = i_beta * b + (1 - i_beta) * c

lower = i_beta * c + (1 - i_beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, i_volatility_lookback)

vol_down = ta.lowest(dev, i_volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = i_jurik_phase < -100 ? 0.5 : i_jurik_phase > 100 ? 2.5 : i_jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, i_jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / i_kidiv), ta.highest(len / i_kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = i_ssfPoles == 2 ? get2PoleSSF(avgZeros, i_ssfLength) : get3PoleSSF(avgZeros, i_ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

////// Keltner Baseline Channel (Baseline)

BBMC = ma(i_maType, close, i_len)

Keltma = ma(i_maType, close, i_len)

range_1 = i_useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, i_len)

upperk = Keltma + rangema * i_multy

lowerk = Keltma - rangema * i_multy

// 2. Entry Condition for Long and Short

// Condition 1

bullSSL = close > upperk

bearSSL = close < lowerk

// Enter Position based on Condition 1

goLong = inDateRange and bullSSL

goShort = inDateRange and bearSSL

// # ========================================================================= #

// # Position Control Logic (Entry & Exit)

// # ========================================================================= #

// 1. Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

// 2. Entry decisions

openLong = (goLong and not inLong) // Long entry condition & not in long position

openShort = (goShort and not inShort) // Short entry condition & not in short position

flippingSides = (goLong and inShort) or (goShort and inLong) // (Long entry condition & in short position) and the opposite

enteringTrade = openLong or openShort // Entering Long or Short Condition

inTrade = inLong or inShort

// 3. Stop Loss & Take Profit Percent

lowestLow = ta.lowest(source = low, length = i_slLookBack)

highestHigh = ta.highest(source = high, length = i_slLookBack)

llhhSLPercent = openLong ? math.abs((close - lowestLow) / close) * 100 : openShort ? math.abs((highestHigh - close) / close) * 100 : na

atr = ta.atr(i_slAtrLength)

slAmount = atr * i_slAtrMultiplier

slPercent = i_slType == 'ATR' ? math.abs((1 - (close - slAmount) / close) * 100) : i_slType == 'Percent' ? i_slPercent : llhhSLPercent

tpPercent = slPercent * i_riskReward

// 4. Risk calculations & Quantity Management

riskAmt = strategy.equity * i_accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

// 5. Open Position

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

// Can add more take profit Actions

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// # ========================================================================= #

// # Plots (Bar Color, Plot, Label, Boxes)

// # ========================================================================= #

// 1. SSL Hybrid Baseline

longColor = #00c3ff

shortColor = #ff0062

color_bar = close > upperk ? longColor : close < lowerk ? shortColor : color.gray

p1 = plot(BBMC, color=color.new(color=color_bar, transp=0), linewidth=4, title='MA Baseline')

// 2. Bar color Based On SSL Hybrid Baseline

barcolor(i_show_color_bar ? color_bar : na)

up_channel = plot(upperk, color=color_bar, title='Baseline Upper Channel')

low_channel = plot(lowerk, color=color_bar, title='Basiline Lower Channel')

fill(up_channel, low_channel, color.new(color=color_bar, transp=90))

// 3. Stoploss Boxes

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

entryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

if (inTrade and exitTriggered)

inShort := false

inLong := false

printTpSlHitBox(tradeEntryBar + 1, bar_index, slHit, tpHit, entryPrice, slPrice, tpPrice)

printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, entryPrice, pnl)

if barstate.islastconfirmedhistory and strategy.position_size != 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// 4. Data Windows

plotchar(slPrice, "Stop Loss Price", "")

plotchar(tpPrice, "Take Profit Price", "")

// 5. Showing Labels

plotDebugLabels = false

if plotDebugLabels

if bar_index == tradeEntryBar

printLabel(bar_index, "Position size: " + str.tostring(entryQty * close, "#.##"))

// 6. Showing Dashboard

if i_showDashboard

var bgcolor = color.new(color.black,0)

// Keep track of Wins/Losses streaks

newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

varip int winRow = 0

varip int lossRow = 0

varip int maxWinRow = 0

varip int maxLossRow = 0

if newWin

lossRow := 0

winRow := winRow + 1

if winRow > maxWinRow

maxWinRow := winRow

if newLoss

winRow := 0

lossRow := lossRow + 1

if lossRow > maxLossRow

maxLossRow := lossRow

// Prepare stats table

var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

if barstate.islastconfirmedhistory

// Update table

dollarReturn = strategy.netprofit

f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

_profit = (strategy.netprofit / strategy.initial_capital) * 100

f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

_numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

_winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)