Strategi Capture Crossover Songsang

Gambaran keseluruhan

Strategi menangkap silang berbalik adalah strategi gabungan yang menggabungkan perdagangan berbalik dan penyambung indikator. Ia menghasilkan isyarat perdagangan terlebih dahulu menggunakan bentuk harga yang berbalik, dan kemudian memfilternya dengan gabungan penyambung polygonal indikator rawak, untuk menangkap peluang berbalik dalam pasaran jangka pendek.

Prinsip Strategi

Strategi ini terdiri daripada dua sub-strategi:

- 123 Strategi berbalik

- Apabila harga penutupan bergerak dari titik tinggi ke titik rendah dalam dua hari, jika pada hari ke-9 indikator rawak berada di bawah satu nilai tertentu, ia akan menghasilkan isyarat beli

- Apabila harga penutupan bergerak dari paras rendah ke paras tinggi dalam tempoh dua hari, jika pada hari ke-9 indikator acak berada di paras tinggi (lebih daripada satu nilai), ia akan menghasilkan isyarat jual

- Strategi acak penunjuk garpu

- Apabila garis %K turun dari atas ke bawah ke bawah garis %D, dan pada masa yang sama garis%K dan%D berada di kawasan overbuy, menghasilkan isyarat jual

- Apabila garis %K menembusi garis %D dari bawah ke atas, dan kedua-dua garis %K dan %D berada di kawasan oversold, menghasilkan isyarat beli

Strategi gabungan ini menilai isyarat dari kedua-dua strategi anak dan menghasilkan isyarat perdagangan sebenar apabila isyarat perdagangan dari kedua-dua strategi anak sama.

Kelebihan Strategik

Strategi ini menggabungkan pembalikan dan penyambungan petunjuk untuk menilai harga dan maklumat petunjuk secara menyeluruh, yang dapat menyaring isyarat palsu dengan berkesan, mengeksploitasi peluang pembalikan yang berpotensi, dan meningkatkan kadar pulangan keuntungan.

Kelebihan khusus termasuk:

- Menangkap pasaran berbalik, berbalik lebih cepat, tidak perlu menunggu lama untuk isyarat goyah

- Pengujian silang dua strategi meningkatkan ketepatan isyarat

- Meningkatkan peluang kemenangan dengan menggunakan penilaian harga dan analisis penunjuk

Risiko Strategik

Strategi ini juga mempunyai risiko:

- Apabila pasaran bergolak, harga sukar untuk membalikkan arah dalam jangka pendek, dan ia mudah menyebabkan isyarat yang salah.

- Penetapan parameter penunjuk yang tidak betul juga boleh menjejaskan kualiti isyarat

- Tidak dapat mengawal masa, ada risiko masa

Risiko ini boleh dikawal dengan menyesuaikan parameter penunjuk, menetapkan mekanisme hentikan kerugian dan sebagainya.

Arah pengoptimuman strategi

Strategi ini boleh dioptimumkan dari segi berikut:

- Menyesuaikan parameter penunjuk, mengoptimumkan kombinasi parameter

- Menambah isyarat penapisan penunjuk lain, seperti penunjuk kuantiti.

- Parameter penunjuk yang disesuaikan mengikut ciri-ciri pelbagai jenis dan keadaan pasaran

- Peningkatan risiko kawalan strategi hentikan kerugian

- Pemahaman isyarat dengan teknologi pembelajaran mesin

ringkaskan

Strategi penangkapan silang terbalik menggunakan kelebihan pelbagai strategi secara komprehensif, dengan kebolehan keuntungan yang lebih kuat dengan syarat mengawal risiko. Dengan terus mengoptimumkan dan memperbaiki, anda boleh membuat strategi yang sesuai dengan gaya anda sendiri, dari mampu menghadapi keadaan pasaran yang berubah-ubah.

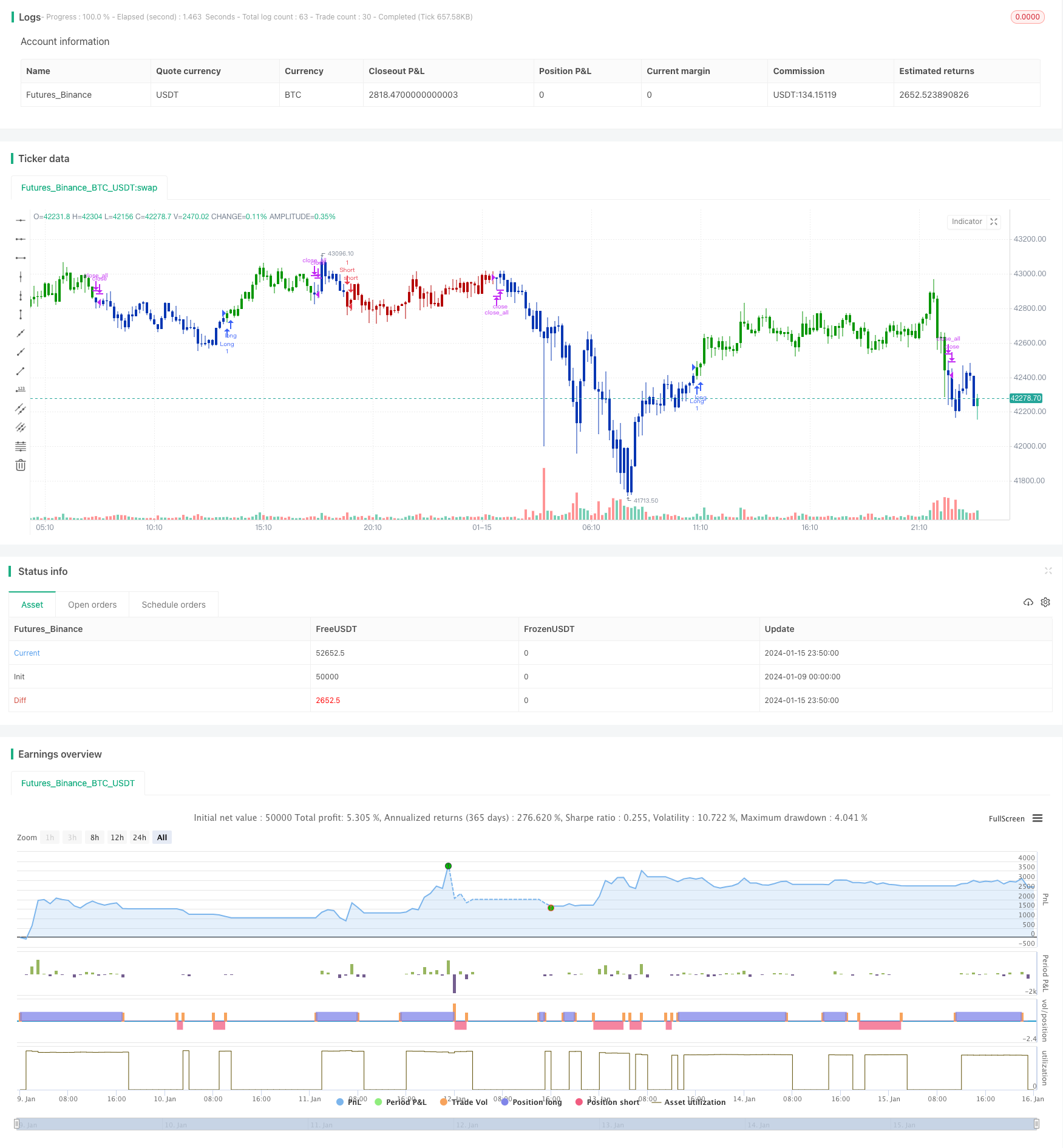

/*backtest

start: 2024-01-09 00:00:00

end: 2024-01-16 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 15/09/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This back testing strategy generates a long trade at the Open of the following

// bar when the %K line crosses below the %D line and both are above the Overbought level.

// It generates a short trade at the Open of the following bar when the %K line

// crosses above the %D line and both values are below the Oversold level.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

StochCross(Length, DLength,Oversold,Overbought) =>

pos = 0.0

vFast = stoch(close, high, low, Length)

vSlow = sma(vFast, DLength)

pos := iff(vFast < vSlow and vFast > Overbought and vSlow > Overbought, 1,

iff(vFast >= vSlow and vFast < Oversold and vSlow < Oversold, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Stochastic Crossover", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Stochastic Crossover ----")

LengthSC = input(7, minval=1)

DLengthSC = input(3, minval=1)

Oversold = input(20, minval=1)

Overbought = input(70, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posmStochCross = StochCross(LengthSC, DLengthSC,Oversold,Overbought)

pos = iff(posReversal123 == 1 and posmStochCross == 1 , 1,

iff(posReversal123 == -1 and posmStochCross == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )