Strategi dagangan terobosan dua hala berdasarkan K-line

Gambaran keseluruhan

Ini adalah strategi perdagangan dua hala yang berdasarkan K-Line. Ia akan menghasilkan isyarat perdagangan apabila harga penutupan K-Line semasa mempunyai penembusan pada harga tertinggi dan terendah dua garis K terdahulu.

Prinsip Strategi

Logik asas strategi ini adalah:

Definisi isyarat lembu:

bull = close > open and close > math.max(close[2], open[2]) and low[1] < low[2] and high[1] < high[2]Iaitu, harga penutupan K semasa adalah lebih besar daripada harga bukaan dan lebih besar daripada harga tertinggi dua baris K terdahulu, sementara harga terendah K semasa adalah lebih rendah daripada harga terendah K terdahulu.Definisi isyarat beruang:

bear = close < open and close < math.min(close[2], open[2]) and low[1] > low[2] and high[1] > high[2]Iaitu, harga penutupan K semasa adalah lebih rendah daripada harga pembukaan dan lebih rendah daripada harga minimum dua baris K sebelumnya, dan harga tertinggi K semasa adalah lebih tinggi daripada harga tertinggi K sebelumnya.Apabila menyalakan isyarat lembu, buat lebih; apabila menyalakan isyarat beruang, buat kosong.

Anda boleh menetapkan kedudukan Stop Loss dan Stop Stop.

Strategi ini menggunakan ciri-ciri penembusan dua arah untuk menilai perubahan trend dengan menembusi julat harga utama, dan menghasilkan isyarat perdagangan.

Analisis kelebihan

Ini adalah strategi penembusan yang agak mudah dan intuitif, dengan kelebihan berikut:

Logiknya jelas, mudah difahami dan tidak terlalu tinggi.

Penembusan adalah isyarat dagangan yang biasa dan mudah membentuk trend.

Ia juga membolehkan anda melakukan lebih banyak shorting dan berdagang dua hala, meningkatkan peluang keuntungan.

Fleksibiliti untuk menetapkan Stop Loss Stop dan mengawal risiko

Analisis risiko

Strategi ini mempunyai beberapa risiko:

Ia adalah risiko yang tinggi dan perlu dipantau dengan teliti.

Ia boleh menyebabkan isyarat palsu.

Peraturan parameter yang tidak betul boleh menyebabkan perdagangan berlebihan.

Pengaturan yang tidak betul pada stop loss juga boleh menjejaskan ruang keuntungan.

Anda boleh mengoptimumkan parameter dan memilih varieti yang sesuai untuk mengurangkan risiko.

Arah pengoptimuman

Strategi ini boleh dioptimumkan dalam beberapa aspek:

Parameter pengoptimuman, seperti parameter kitaran penembusan, stop loss stop loss, dan sebagainya.

Menambah syarat penapisan untuk mengelakkan isyarat silap seperti penipuan, gegaran dan sebagainya.

Menggunakan indikator trend untuk mengelakkan penyesuaian.

Mengoptimumkan pengurusan dana, memperbaiki algoritma kedudukan.

Parameter berbeza untuk pelbagai varieti, boleh diuji dan dioptimumkan.

ringkaskan

Ini adalah strategi mudah berdasarkan pemikiran dua hala. Ia mempunyai kelebihan yang jelas dan mudah dilaksanakan, tetapi terdapat risiko pengawasan tertentu. Dengan optimasi parameter dan syarat, anda boleh mengharapkan kesan strategi yang lebih baik.

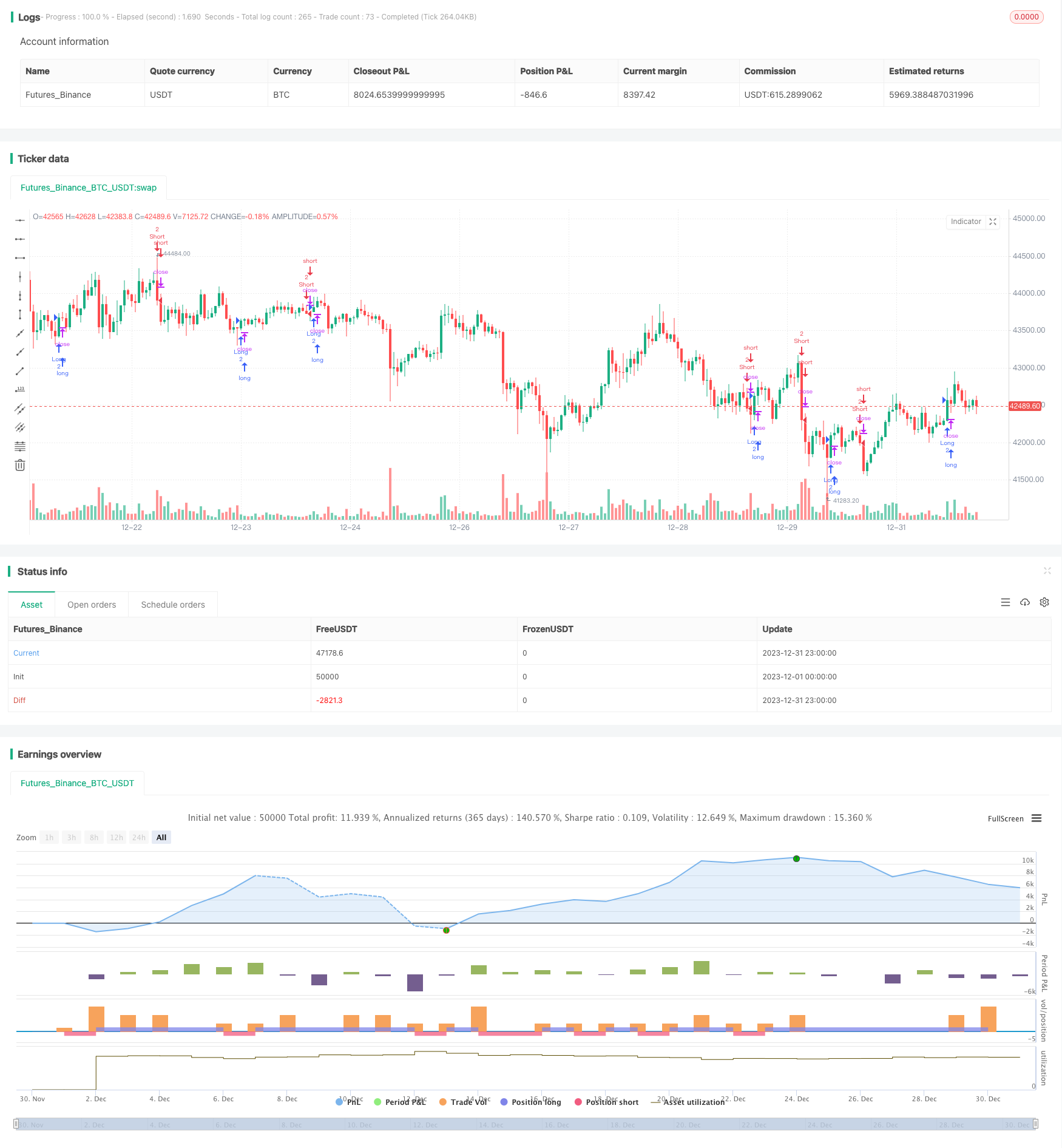

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// # ========================================================================= #

// # | Strategy |

// # ========================================================================= #

SystemName = "Strategy Template Autoview"

TradeId = "S"

// These values are used both in the strategy() header and in the script's relevant inputs as default values so they match.

// Unless these values match in the script's Inputs and the TV backtesting Properties, results between them cannot be compared.

InitCapital = 1000000

InitPosition = 2

InitCommission = 0.075

InitPyramidMax = 1

CalcOnorderFills = false

ProcessOrdersOnClose = true // display the signals one candle earlier

CalcOnEveryTick = true // forward testing

//CloseEntriesRule = "ANY"

strategy(title=SystemName, shorttitle=SystemName,

overlay=true, pyramiding=InitPyramidMax, initial_capital=InitCapital, default_qty_type=strategy.fixed, process_orders_on_close=ProcessOrdersOnClose,

default_qty_value=InitPosition, commission_type=strategy.commission.percent, commission_value=InitCommission, calc_on_order_fills=CalcOnorderFills,

calc_on_every_tick=CalcOnEveryTick,

precision=6, max_lines_count=500, max_labels_count=500)

// # ========================================================================= #

// # ========================================================================= #

// # || Alerts ||

// # ========================================================================= #

// # ========================================================================= #

show_alerts_debug = input.bool(true, title = "Show Alerts Debug Label?", group = "Debug")

//i_alert_txt_entry_long = input.text_area(defval = "", title = "Long Entry Message", group = "Alerts")

//i_alert_txt_entry_short = input.text_area(defval = "", title = "Short Entry Message", group = "Alerts")

//i_alert_txt_exit_long = input.text_area(defval = "", title = "Long Exit Message", group = "Alerts")

//i_alert_txt_exit_short = input.text_area(defval = "", title = "Short Exit Message", group = "Alerts")

i_broker_mode = input.string("DEMO", title = "Use Demo or Live Broker", options=["DEMO", "LIVE"], group = "Automation")

i_broker_name = input.string("Tradovate", title = "Broker Name", options=["Tradovate", "AscendEX", "Binance", "Binance Futures", "Binance US", "Binance Delivery", "Kraken", "Deribit", "Poloniex", "Okcoin", "Bitfinex", "Oanda", "Kucoin", "Okex", "Bybit", "FTX", "Bitmex", "Alpaca", "Gemini"], group = "Automation")

i_enable_trades = input.bool(true, title = "Enable trades?", group = "Automation", tooltip = "If not enabled, disables live trades, but more importantly, it will output what Autoview is going to do when you go live.")

i_account_name = input.string("*", title = "Account Name", group = "Automation")

i_symbol_name = input.string("btcusd_perp", title = "Symbol Name", group = "Automation")

nb_contracts = input.int(2, title = "Nb Contracts", group = "Automation")

use_delay = input.bool(false, title = "Use Delay between orders", group = "Automation", inline = "delay")

i_delay_qty = input.int(1, title = "Delay in seconds", group = "Automation", inline = "delay")

i_use_borrow_repay = input.bool(false, title = "Use Borrow/Repay Mode?", group = "Binance Automation")

i_asset_borrow_repay = input.string("BTC", title = "Asset to Borrow/Repay", group = "Binance Automation")

i_qty_borrow_repay = input.float(1., title = "Quantity of assets to borrow?", group = "Binance Automation")

// # ========================================================================= #

// # ========================================================================= #

// # || Dates Range Filtering ||

// # ========================================================================= #

// # ========================================================================= #

DateFilter = input(false, "Date Range Filtering", group="Date")

// ————— Syntax coming from https://www.tradingview.com/blog/en/new-parameter-for-date-input-added-to-pine-21812/

i_startTime = input(defval = timestamp("01 Jan 2019 13:30 +0000"), title = "Start Time", group="Date")

i_endTime = input(defval = timestamp("30 Dec 2021 23:30 +0000"), title = "End Time", group="Date")

TradeDateIsAllowed() => true

// # ========================================================================= #

// # | Custom Exits |

// # ========================================================================= #

//use_custom_exit = input.bool(true, title = "Use Custom Exits?", group = "Custom Exits")

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

use_sl = input.string("None", title = "Select Stop Loss Mode", options=["None", "Percent", "Price"], group = "Stop Loss")

sl_input_perc = input.float(3, minval = 0, title = "Stop Loss (%)", group = "Stop Loss (%)") * 0.01

sl_input_pips = input.float(30, minval = 0, title = "Stop Loss (USD)", group = "Stop Loss (USD)")

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

use_tp = input.string("None", title = "Select Take Profit Mode", options=["None", "Percent", "Price"], group = "Take Profit")

tp_input_perc = input.float(3, minval = 0, title = "Take Profit (%)", group = "Take Profit (%)") * 0.01

tp_input_pips = input.float(30, minval = 0, title = "Take Profit (USD)", group = "Take Profit (USD)")

// # ========================================================================= #

// # | Consolidated Entries |

// # ========================================================================= #

bull = close > open and close > math.max(close[2], open[2]) and low[1] < low[2] and high[1] < high[2] // low < low[1] and low[1] < low[2]

bear = close < open and close < math.min(close[2], open[2]) and low[1] > low[2] and high[1] > high[2] // low < low[1] and low[1] < low[2]

// # ========================================================================= #

// # | Entry Price |

// # ========================================================================= #

entry_long_price = ta.valuewhen(condition=bull and strategy.position_size[1] <= 0, source=close, occurrence=0)

entry_short_price = ta.valuewhen(condition=bear and strategy.position_size[1] >= 0, source=close, occurrence=0)

var float entry_price = 0.

if bull

entry_price := entry_long_price

if bear

entry_price := entry_short_price

// # ========================================================================= #

// # || Global Trend Variables ||

// # ========================================================================= #

T1_sinceUP = ta.barssince(bull)

T1_sinceDN = ta.barssince(bear)

T1_nUP = ta.crossunder(T1_sinceUP,T1_sinceDN)

T1_nDN = ta.crossover(T1_sinceUP,T1_sinceDN)

T1_sinceNUP = ta.barssince(T1_nUP)

T1_sinceNDN = ta.barssince(T1_nDN)

T1_BuyTrend = T1_sinceDN > T1_sinceUP

T1_SellTrend = T1_sinceDN < T1_sinceUP

T1_SellToBuy = T1_BuyTrend and T1_SellTrend[1]

T1_BuyToSell = T1_SellTrend and T1_BuyTrend[1]

T1_ChangeTrend = T1_BuyToSell or T1_SellToBuy

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

var float final_SL_Long = 0.

var float final_SL_Short = 0.

if use_sl == "Percent"

final_SL_Long := entry_long_price * (1 - sl_input_perc)

final_SL_Short := entry_short_price * (1 + sl_input_perc)

else if use_sl == "Price"

final_SL_Long := entry_long_price - (sl_input_pips)

final_SL_Short := entry_short_price + (sl_input_pips)

plot(strategy.position_size > 0 and use_sl != "None" ? final_SL_Long : na, title = "SL Long", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

plot(strategy.position_size < 0 and use_sl != "None" ? final_SL_Short : na, title = "SL Short", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

var float final_TP_Long = 0.

var float final_TP_Short = 0.

if use_tp == "Percent"

final_TP_Long := entry_long_price * (1 + tp_input_perc)

final_TP_Short := entry_short_price * (1 - tp_input_perc)

else if use_tp == "Price"

final_TP_Long := entry_long_price + (tp_input_pips)

final_TP_Short := entry_short_price - (tp_input_pips)

plot(strategy.position_size > 0 and use_tp != "None" ? final_TP_Long : na, title = "TP Long", color = color.orange, linewidth=2, style=plot.style_linebr)

plot(strategy.position_size < 0 and use_tp != "None" ? final_TP_Short : na, title = "TP Short", color = color.orange, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | AutoView Calls |

// # ========================================================================= #

float quantity = nb_contracts

string product_type_ticker = i_symbol_name

var string broker_mode = ""

if i_broker_mode == "DEMO"

broker_mode := switch i_broker_name

"Tradovate" => "tradovatesim"

"Ascendex" => "ascendex-sandbox"

"Binance Futures" => "binancefuturestestnet"

"Binance Delivery" => "binancedeliverytestnet"

"Oanda" => "oandapractice"

"Bitmex" => "bitmextestnet"

"Bybit" => "bybittestnet"

"Alpaca" => "alpacapaper"

"Kucoin" => "kucoinsandbox"

"Deribit" => "deribittestnet"

"Gemini" => "gemini-sandbox"

=> i_broker_name

else // "LIVE"

broker_mode := switch i_broker_name

"Tradovate" => "tradovate"

"Ascendex" => "ascendex"

"Binance Futures" => "binancefutures"

"Binance Delivery" => "binancedelivery"

"Binance" => "binance"

"Oanda" => "oanda"

"Kraken" => "kraken"

"Deribit" => "deribit"

"Bitfinex" => "bitfinex"

"Poloniex" => "poloniex"

"Bybit" => "bybit"

"Okcoin" => "okcoin"

"Kucoin" => "kucoin"

"FTX" => "ftx"

"Bitmex" => "bitmex"

"Alpaca" => "alpaca"

"Gemini" => "gemini"

=> i_broker_name

enable_trades = i_enable_trades ? "" : " d=1"

string delay_qty = use_delay ? " delay=" + str.tostring(i_delay_qty) : ""

i_alert_txt_entry_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=short c=position t=market" +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty

i_alert_txt_entry_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=long c=position t=market" +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty

var string temp_txt_SL_long = ""

var string temp_txt_SL_short = ""

var string temp_txt_TP_long = ""

var string temp_txt_TP_short = ""

if use_sl == "Percent"

temp_txt_SL_long := "sl=-" + str.tostring(sl_input_perc * 100) + "%"

temp_txt_SL_short := "sl=" + str.tostring(sl_input_perc * 100) + "%"

else if use_sl == "Price"

temp_txt_SL_long := "fsl=" + str.tostring(final_SL_Long)

temp_txt_SL_short := "fsl=" + str.tostring(final_SL_Short)

if use_tp == "Percent"

temp_txt_TP_long := "p=" + str.tostring(tp_input_perc * 100) + "%"

temp_txt_TP_short := "p=-" + str.tostring(tp_input_perc * 100) + "%"

else if use_tp == "Price"

temp_txt_TP_long := "fpx=" + str.tostring(final_TP_Long)

temp_txt_TP_short := "fpx=" + str.tostring(final_TP_Short)

i_alert_txt_exit_SL_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long c=position t=market " + temp_txt_SL_long + enable_trades

i_alert_txt_exit_SL_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short c=position t=market " + temp_txt_SL_short + enable_trades

i_alert_txt_exit_TP_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long c=position t=market " + temp_txt_TP_long + enable_trades

i_alert_txt_exit_TP_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short c=position t=market " + temp_txt_TP_short + enable_trades

string final_alert_txt_entry_long = i_alert_txt_entry_long

string final_alert_txt_entry_short = i_alert_txt_entry_short

if i_use_borrow_repay and i_broker_name == "Binance"

final_alert_txt_entry_long := "a=" + i_account_name + " e=" + broker_mode + "y=borrow w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=short c=position t=market" + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + "y=repay w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades

final_alert_txt_entry_short := "a=" + i_account_name + " e=" + broker_mode + "y=borrow w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=long c=position t=market" + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + "y=repay w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades

//i_alert_txt_entry_long := final_alert_txt_entry_long

//i_alert_txt_entry_short := final_alert_txt_entry_short

if show_alerts_debug and barstate.islastconfirmedhistory

var label lblTest = na

label.delete(lblTest)

string label_txt = i_alert_txt_entry_long

if use_sl != "None"

label_txt := label_txt + "\n" + i_alert_txt_exit_SL_long

if use_tp != "None"

label_txt := label_txt + "\n" + i_alert_txt_exit_TP_long

t = time + (time - time[1]) * 25

lblTest := label.new(

x = t,

y = ta.highest(50),

text = label_txt,

xloc = xloc.bar_time,

yloc = yloc.price,

color = color.new(color = color.gray, transp = 0),

style = label.style_label_left,

textcolor = color.new(color = color.white, transp = 0),

size = size.large

)

// # ========================================================================= #

// # | Strategy Calls and Alerts |

// # ========================================================================= #

if bull and TradeDateIsAllowed()

strategy.entry(id = "Long", direction = strategy.long, comment = "Long", alert_message = i_alert_txt_entry_long, qty = nb_contracts)

alert(i_alert_txt_entry_long, alert.freq_once_per_bar)

else if bear and TradeDateIsAllowed()

strategy.entry(id = "Short", direction = strategy.short, comment = "Short", alert_message = i_alert_txt_entry_short, qty = nb_contracts)

alert(i_alert_txt_entry_short, alert.freq_once_per_bar)

//quantity := quantity * 2

strategy.exit(id = "Exit Long", from_entry = "Long", stop = (use_sl != "None") ? final_SL_Long : na, comment_loss = "Long Exit SL", alert_loss = (use_sl != "None") ? i_alert_txt_exit_SL_long : na, limit = (use_tp != "None") ? final_TP_Long : na, comment_profit = "Long Exit TP", alert_profit = (use_tp != "None") ? i_alert_txt_exit_TP_long : na)

strategy.exit(id = "Exit Short", from_entry = "Short", stop = (use_sl != "None") ? final_SL_Short : na, comment_loss = "Short Exit SL", alert_loss = (use_sl != "None") ? i_alert_txt_exit_SL_short : na, limit = (use_tp != "None") ? final_TP_Short : na, comment_profit = "Short Exit TP", alert_profit = (use_tp != "None") ? i_alert_txt_exit_TP_short : na)

if strategy.position_size > 0 and low < final_SL_Long and use_sl != "None"

alert(i_alert_txt_exit_SL_long, alert.freq_once_per_bar)

else if strategy.position_size < 0 and high > final_SL_Short and use_sl != "None"

alert(i_alert_txt_exit_SL_short, alert.freq_once_per_bar)

if strategy.position_size > 0 and high > final_TP_Long and use_tp != "None"

alert(i_alert_txt_exit_TP_long, alert.freq_once_per_bar)

else if strategy.position_size < 0 and low < final_TP_Short and use_tp != "None"

alert(i_alert_txt_exit_TP_short, alert.freq_once_per_bar)

// # ========================================================================= #

// # | Reset Variables |

// # ========================================================================= #