Strategi Perdagangan Jangka Pendek Momentum Breakout

Gambaran keseluruhan

Strategi ini menjejaki data perdagangan SPY, menggabungkan pelbagai isyarat petunjuk teknikal seperti purata bergerak, MACD, RSI, dan lain-lain, untuk menilai pergerakan jangka pendek dengan tepat dan membuat keputusan membeli dan menjual untuk mendapatkan keuntungan dari perdagangan garis pendek.

Prinsip Strategi

Logik utama strategi ini adalah berdasarkan kepada indikator teknikal berikut untuk menilai trend jangka pendek dan masa masuk:

- Fork emas dan Fork mati pada purata bergerak indeks ((EMA) pada hari ke-5 dan ke-13 digunakan untuk menilai pembalikan trend kosong.

- Indeks MACD menilai sama ada terdapat pergerakan ke atas.

- Indeks ADX menilai sama ada terdapat trend.

- RSI menunjukkan kekuatan trend.

Dengan mengoptimumkan parameter indikator di atas, menentukan titik peralihan polygon yang penting. Apabila syarat 5⁄6 dipenuhi, isyarat putih menunjukkan L atau S, dan apabila enam syarat telah dipenuhi, isyarat bentuk △ emas ditunjukkan pada penutupan carta tersebut.

Syarat-syarat untuk membuat isyarat pembelian:

EMA 5 hari lebih besar daripada EMA 13 hari dan MACD lebih rendah daripada 0.5 dan ADX lebih tinggi daripada 20 dan MACD lebih tinggi daripada 0 dan garis isyarat lebih tinggi daripada -0.1 dan RSI lebih tinggi daripada 40

Syarat-syarat untuk menjual:

EMA 5 hari kurang daripada EMA 13 hari dan MACD lebih tinggi daripada -0.5 dan ADX lebih tinggi daripada 20 dan garis isyarat lebih rendah daripada 0 dan MACD lebih rendah daripada 0 dan RSI lebih rendah daripada 60

Analisis kelebihan

Strategi ini mempunyai kelebihan berikut:

- Di samping itu, ia juga boleh digunakan untuk mengesan kepastian yang lebih tinggi dengan menggabungkan pelbagai isyarat.

- Sensitiviti dan ketepatan penilaian diseimbangkan melalui pengoptimuman parameter.

- Penghakiman isyarat ringkas dan jelas, had operasi rendah.

- Ia sesuai untuk perdagangan jangka pendek dan sesuai dengan keutamaan risiko kebanyakan pelabur.

- Mengambil kira keperluan operasi cakera keras, mengelakkan turun naik yang tinggi pada masa akhir.

Analisis risiko

Strategi ini juga mempunyai risiko:

- Tetapan parameter yang tidak betul boleh menyebabkan risiko kesalahan pertimbangan. Perlu terus diuji dan dioptimumkan.

- Satu jenama, tidak dapat membahagikan risiko industri dan aset.

- Bayaran dan risiko tergelincir yang disebabkan oleh transaksi yang kerap.

- Tidak dapat membina gudang pada waktu akhir mungkin terlepas beberapa peluang.

Arah pengoptimuman

Strategi ini boleh terus dioptimumkan dari dimensi-dimensi berikut:

- Ujian mengubahsuai tetapan parameter untuk meningkatkan ketepatan penilaian.

- Tambahlah parameter stop loss untuk mengawal kerugian tunggal.

- Mengoptimumkan masa pembukaan kedudukan, menapis masa-masa lonjakan yang tinggi di hujung.

- Menambah varieti lain sebagai sasaran strategi.

- Menggabungkan algoritma pembelajaran mesin untuk meningkatkan keupayaan penyesuaian parameter.

ringkaskan

Strategi ini dengan mengesan data SPY, menggabungkan pelbagai petunjuk teknikal seperti purata bergerak, MACD, RSI untuk menilai trend jangka pendek, frekuensi operasi tinggi, penarikan balik rendah, sangat sesuai untuk perdagangan garis pendek. Boleh terus dioptimumkan dari pelbagai dimensi, dengan ruang penambahbaikan yang besar.

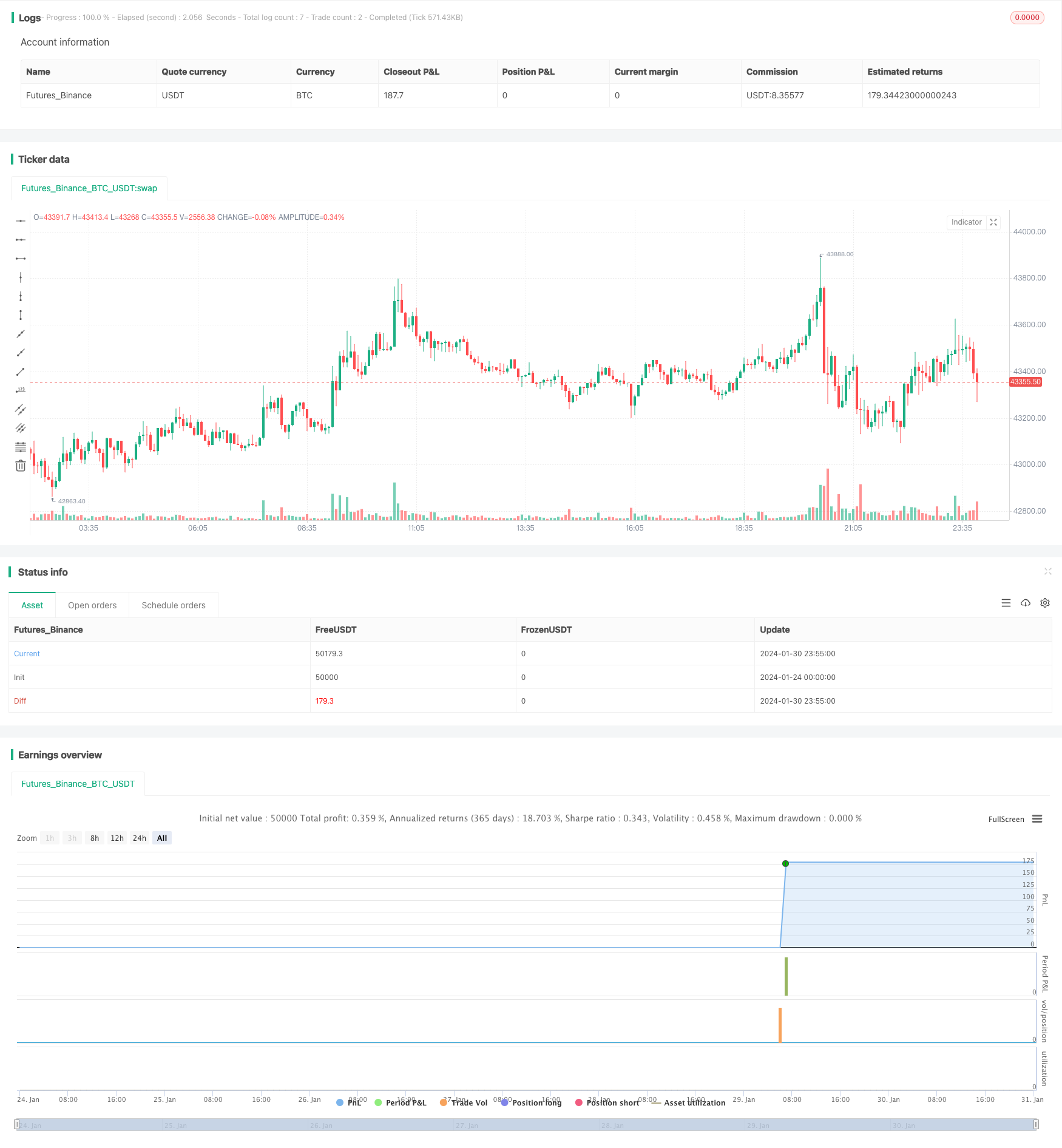

/*backtest

start: 2024-01-24 00:00:00

end: 2024-01-31 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="SPY 1 Minute Day Trader", overlay=true)

//This script has been created to take into account how the following variables impact trend for SPY 1 Minute

//The SPY stop losses/take profit have been set at 30 cents which equates to 15 cents on SPY 1 DTE ATM contracts

//5 ema vs 13 ema : A cross establishes start of trend

//MACD (Line, Signal & Slope) : If you have momentum

//ADX : if you are trending

//RSI : If the trend has strength

//The above has been optimized to determine pivot points in the trend using key values for these 6 indicators

//bounce up = ema5 > ema13 and macdLine < .5 and adx > 20 and macdSlope > 0 and signalLine > -.1 and rsiSignal > 40

//bounce down = ema5 < ema13 and macdLine > -.5 and adx > 20 and signalLine < 0 and macdSlope < 0 and rsiSignal < 60

//White L's indicate that 5 of 6 conditions are met due to impending uptrend w/ missing one in green below it

//Yellow L's indicate that 6 of 6 conditions still are met

//White S's indicate that 5 of 6 conditions are met due to impending downtrend w/ missing condition in red above it

//Yellow S's indicate that 6 of 6 conditions still are met

//After a downtrend or uptrend is established, once it closes it can't repeat for 10 minutes

//Won't open any trades on last two minutes of any hours to avoid volatility

//Will close any open trades going into last minute of hour

// Initialize variables

var float long_entry_price = na

var float short_entry_price = na

var float stop_loss = na

var float take_profit = na

var float short_stop_loss = na

var float short_take_profit = na

var float option_SL = 0.3 //approx 15 cents on SPY 1 DTE

var float option_TP = 0.3 //approx 15 cents on SPY 1 DTE

var long_entry_time = 0

var short_entry_time = 0

var allow_long_entry = true

var allow_short_entry = true

var allow_trades = true

var hourlyclose = 0

var notify = 0

var shortnotify = 0

// Calculate the EMAs & SMAs

ema5 = ta.ema(close, 5)

ema13 = ta.ema(close, 13)

sma20 = ta.sma(close, 20)

// Input parameters

fastLength = input.int(12, minval=1, title="Fast Length")

slowLength = input.int(26, minval=1, title="Slow Length")

signalLength = input.int(9, minval=1, title="Signal Smoothing")

// Inputs

length = input.int(14, "Length")

smoothK = input.int(3, "SmoothK")

src = input(close, "Source")

overbought = input.float(80, "Overbought")

oversold = input.float(20, "Oversold")

//Stochastic Calculation

highestHigh = ta.highest(src, length)

lowestLow = ta.lowest(src, length)

k = 100 * ((src - lowestLow) / (highestHigh - lowestLow))

d = ta.sma(k, smoothK)

// Calculate MACD

[macdLines, signalLines, _] = ta.macd(close, fastLength, slowLength, signalLength)

// Calculate slope of MACD line

macdSlope = (macdLines - macdLines[1]) / (bar_index - bar_index[1])

// Calculate the RSI

rsiValue = ta.rsi(close, 5)

// Calculate the signal line as the SMA of the RSI for 5 minute over 9 periods

rsiSignal = ta.sma(rsiValue, 9)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Length of the ATR

atr_length = input.int(14, title="ATR Length", minval=1)

// Calculate the True Range

tr = ta.tr(true)

// Calculate the ATR

atr = ta.atr(atr_length)

// Length of the ADX

len = input.int(14, minval=1)

// Set minimum number of bars between trades

min_bars_between_trades = 10

// Calculate the Directional Movement

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

// Calculate the Smoothed Directional Movement

plusDI = 100 * ta.ema(plusDM, len) / ta.ema(tr, len)

minusDI = 100 * ta.ema(minusDM, len) / ta.ema(tr, len)

// Calculate the Directional Index (DX)

DX = 100 * math.abs(plusDI - minusDI) / (plusDI + minusDI)

// Calculate the ADX

adx = ta.ema(DX, len)

// Get high, low, and close prices

highPrice = high

lowPrice = low

closePrice = close

// Determine buy and sell signals - Tried to optimize as much as possible - changing these do impact results

buy_signal = ema5 > ema13 and macdLine < .5 and adx > 20 and macdSlope > 0 and signalLine > -.1 and rsiSignal > 40

short_buy_signal = ema5 < ema13 and macdLine > -.5 and adx > 20 and signalLine < 0 and macdSlope < 0 and rsiSignal < 60

// Define long entry conditions

C1 = ema5 > ema13 ? 1 : 0 //E below bar when only one missing

C2 = d < 70 ? 1 : 0 //no longer part of signal - but was Smoothed Stoicastic

C3 = macdLine < .5 ? 1 : 0 //M below bar when only one missing

C4 = adx > 20 ? 1 : 0 //A below bar when only one missing

C5 = macdSlope > 0 ? 1 : 0 //% below bar when only one missing

C6 = signalLine > -.01 ? 1 : 0 //S (MACD Signal) below bar when only one missing

C7 = rsiSignal > 50 ? 1 : 0 //R below bar when only one missing

// Define short entry conditions

C8 = ema5 < ema13 ? 1 : 0 //E above bar when only one missing

C9 = d > 40 ? 1 : 0 //no longer part of signal - but was Smoothed Stoicastic

C10 = macdLine > -0.5 ? 1 : 0 //M above bar when only one missing

C11 = adx > 20 ? 1 : 0 //A above bar when only one missing

C12 = macdSlope < 0 ? 1 : 0 //% above bar when only one missing

C13 = signalLine < 0 ? 1 : 0 //S (MACD Signal) above bar when only one missing

C14 = rsiSignal < 50 ? 1 : 0 //R above bar when only one missing

// Long or Short Incoming denoted by white color and gold means all conditions met

plotchar((C1 + C3 + C4 + C5 + C6 + C7) == 5 ? 1 : na, title="Pivot Up White", char="L", location=location.belowbar, color=color.white, size = size.tiny)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) == 5 ? 1 : na, title="Pivot Down White", char="S", location=location.abovebar, color=color.white, size = size.tiny)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) > 5 ? 1 : na, title="Pivot Up Gold", char="L", location=location.belowbar, color=color.yellow, size = size.tiny)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) > 5 ? 1 : na, title="Pivot Down Gold", char="S", location=location.abovebar, color=color.yellow, size = size.tiny)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C1) != 1 ? 1 : na, title="Missing", char = "", text="E", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C3) != 1 ? 1 : na, title="Missing", char = "", text="M", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C4) != 1 ? 1 : na, title="Missing", char = "", text="A", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C5) != 1 ? 1 : na, title="Missing", char = "", text="%", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C6) != 1 ? 1 : na, title="Missing", char = "", text="S", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C7) != 1 ? 1 : na, title="Missing", char = "", text="R", location=location.belowbar, color=color.green, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C8) != 1 ? 1 : na, title="Missing", char = "", text="E", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C10) != 1 ? 1 : na, title="Missing", char = "", text="M", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C11) != 1 ? 1 : na, title="Missing", char = "", text="A", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C12) != 1 ? 1 : na, title="Missing", char = "", text="%", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C13) != 1 ? 1 : na, title="Missing", char = "", text="S", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C14) != 1 ? 1 : na, title="Missing", char = "", text="R", location=location.abovebar, color=color.red, size = size.small)

// Execute buy and sell orders

if buy_signal and allow_trades and allow_long_entry //Don't buy on last 2 minutes of hour

long_entry_price := open

strategy.entry("Pivot Up", strategy.long)

stop_loss := long_entry_price - option_SL

take_profit := long_entry_price + option_TP

long_entry_time := time

allow_long_entry := false

allow_trades := false

notify := 1

plotshape(notify == 1 ? 1 : na, "Pivot Up", style=shape.triangleup, offset = 1, location=location.belowbar, size=size.normal, textcolor = color.orange, color=color.orange)

if notify == 1

notify := notify - 1

if short_buy_signal and allow_trades and allow_short_entry //Don't buy on last 2 minutes of hour

short_entry_price := open

strategy.entry("Pivot Down", strategy.short)

short_stop_loss := short_entry_price + option_SL

short_take_profit := short_entry_price - option_TP

short_entry_time := time

allow_short_entry := false

allow_trades := false

shortnotify := 1

plotshape(shortnotify == 1 ? 1 : na, "Pivot Down", style=shape.triangledown, offset = 1, location=location.abovebar, size=size.normal, textcolor = color.orange, color=color.orange)

if shortnotify == 1

shortnotify := shortnotify - 1

// Take scalp when in a position and 5 or more parameters are met!

if strategy.position_size != 0 and (C1 + C3 + C4 + C5 + C6 + C7) >5

strategy.exit("Exit Longs", "Pivot Up", stop=stop_loss, limit = take_profit)

else if strategy.position_size != 0 and (C8 + C10 + C11 + C12 + C13 + C14) >5

strategy.exit("Exit Shorts", "Pivot Down", stop=short_stop_loss, limit = short_take_profit)

// Reset allow_trades after cool-down period of min_bars_between_trades bars set above

if time > long_entry_time + (time - time[1]) * min_bars_between_trades

allow_long_entry := true

allow_trades := true

if time > short_entry_time + (time - time[1]) * min_bars_between_trades

allow_short_entry := true

allow_trades := true

// Close all positions at the end of the trading day and when volatile hours approach!

if strategy.position_size != 0

strategy.close("Pivot Up")

strategy.close("Pivot Down")

hourlyclose := 1

plotshape(hourlyclose == 1 ? 1 : na, "Suggested Volatile Hour Close", text="Suggested Volatile Hour Close", offset = 1, style=shape.triangledown, location=location.abovebar, size=size.tiny, textcolor = color.orange, color=color.orange)

if hourlyclose == 1

hourlyclose := hourlyclose - 1