Strategi Perdagangan Pembalikan Penembusan Volatiliti

Penulis:ChaoZhang, Tarikh: 2024-02-19 15:12:44Tag:

Ringkasan

Strategi Perdagangan Pembalikan Penembusan Volatiliti adalah strategi perdagangan pembalikan yang mengesan saluran harga dengan titik stop profit dan stop loss bergerak adaptif. Ia menubuhkan kedudukan panjang atau pendek apabila harga keluar dari saluran yang dikira berdasarkan turun naik.

Logika Strategi

Strategi ini mula-mula menggunakan penunjuk Julat Benar Purata (ATR) Wilder untuk mengukur turun naik harga. Ia kemudian mengira Constant Julat Purata (ARC) berdasarkan nilai ATR. ARC mewakili separuh lebar saluran harga. Seterusnya, jalur atas dan bawah saluran dikira sebagai titik berhenti keuntungan dan titik berhenti kerugian, juga dikenali sebagai titik SAR. Apabila harga melanggar band atas, kedudukan pendek dibuka. Apabila harga melanggar band bawah, kedudukan panjang dibuka.

Secara khusus, ATR di atas N bar terakhir dikira terlebih dahulu. ATR kemudian dikalikan dengan faktor untuk mendapatkan ARC, yang mengawal lebar saluran harga. Menambah ARC ke harga penutupan tertinggi di atas N bar memberikan jalur atas saluran, atau SAR tinggi. Mengurangkan ARC dari harga penutupan terendah memberikan jalur bawah, atau SAR rendah. Jika harga ditutup di atas jalur atas, kedudukan pendek diambil. Jika harga ditutup di bawah jalur bawah, kedudukan panjang diambil.

Kelebihan

- Menggunakan turun naik untuk mengira saluran penyesuaian yang mengesan perubahan pasaran

- Perdagangan pembalikan sesuai pasaran pembalikan trend

- Memindahkan kunci stop profit dan stop loss dalam keuntungan dan mengawal risiko

Risiko

- Perdagangan pembalikan cenderung untuk terperangkap, parameter memerlukan penyesuaian yang betul

- Pergerakan turun naik yang tajam boleh menutup kedudukan lebih awal

- Parameter yang tidak betul boleh menyebabkan perdagangan berlebihan

Penyelesaian:

- Mengoptimumkan tempoh ATR dan faktor ARC untuk lebar saluran yang munasabah

- Tambah penapis trend untuk isyarat kemasukan

- Tingkatkan tempoh ATR ke kekerapan perdagangan yang lebih rendah

Peluang Peningkatan

- Mengoptimumkan tempoh ATR dan faktor ARC

- Tambah syarat kemasukan seperti MACD

- Memasukkan strategi stop loss

Kesimpulan

Strategi Perdagangan Pembalikan Penembusan Volatiliti menggunakan saluran untuk mengesan perubahan harga dan membalikkan kedudukan apabila lonjakan turun naik. Ia berfungsi dengan baik di pasaran terhad dengan pembalikan, menghasilkan pulangan yang baik jika titik pembalikan dikenal pasti dengan tepat.

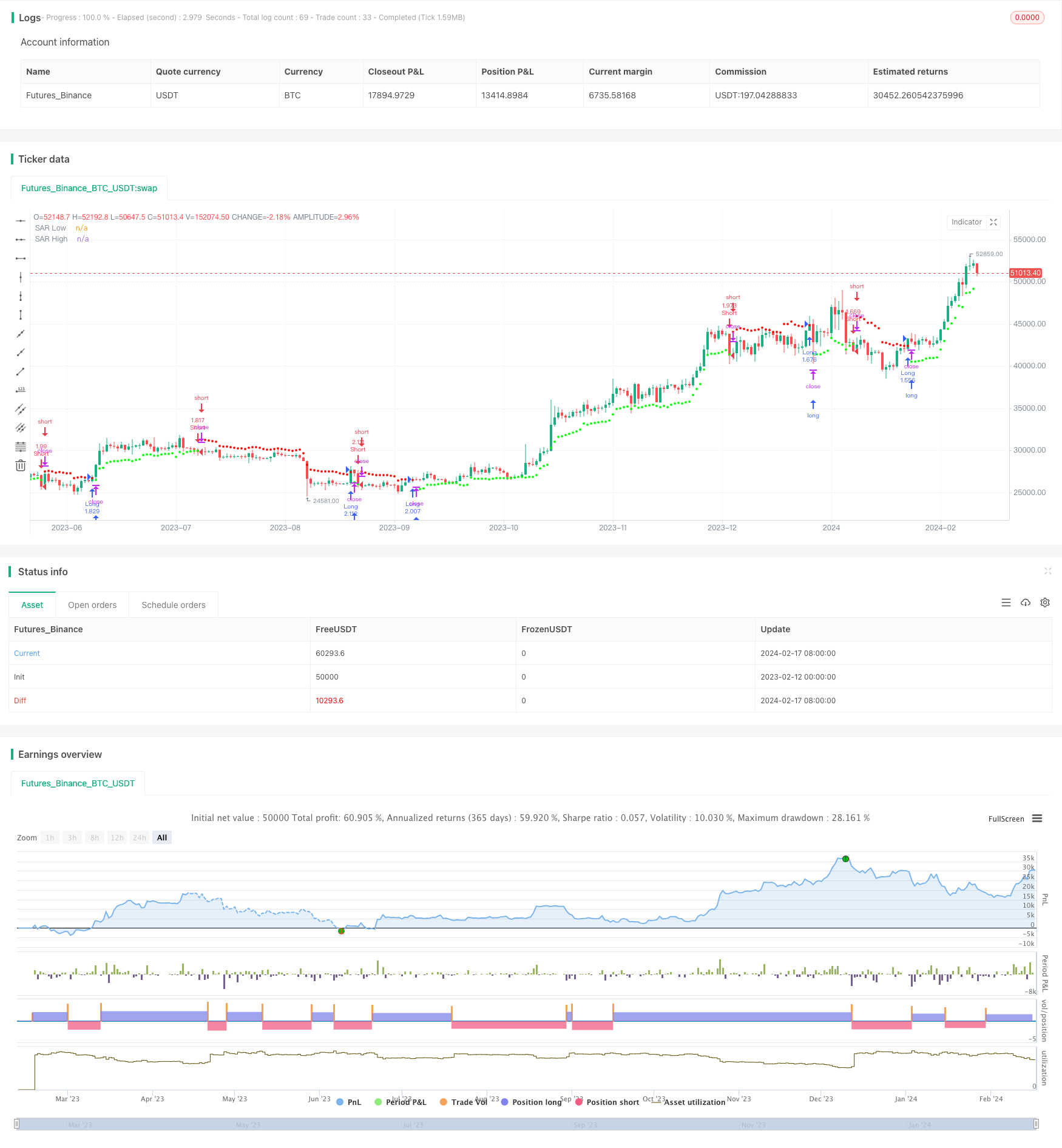

/*backtest

start: 2023-02-12 00:00:00

end: 2024-02-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//@author=LucF

// Volatility System [LucF]

// v1.0, 2019.04.14

// The Volatility System was created by Welles Wilder.

// It first appeared in his seminal masterpiece "New Concepts in Technical Trading Systems" (1978).

// He describes it on pp.23-26, in the chapter discussing the first presentation ever of the "Volatility Index",

// which later became known as ATR.

// Performance of the strategy usually increases with the time frame.

// Tuning of ATR length and, especially, the ARC factor, is key.

// This code runs as a strategy, which cannot generate alerts.

// If you want to use the alerts it must be converted to an indicator.

// To do so:

// 1. Swap the following 2 lines by commenting the first and uncommenting the second.

// 2. Comment out the last 4 lines containing the strategy() calls.

// 3. Save.

strategy(title="Volatility System by Wilder [LucF]", shorttitle="Volatility System [Strat]", overlay=true, precision=8, pyramiding=0, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1)

// study("Volatility System by Wilder [LucF]", shorttitle="Volatility System", precision=8, overlay=true)

// -------------- Colors

MyGreenRaw = color(#00FF00,0), MyGreenMedium = color(#00FF00,50), MyGreenDark = color(#00FF00,75), MyGreenDarkDark = color(#00FF00,92)

MyRedRaw = color(#FF0000,0), MyRedMedium = color(#FF0000,30), MyRedDark = color(#FF0000,75), MyRedDarkDark = color(#FF0000,90)

// -------------- Inputs

LongsOnly = input(false,"Longs only")

ShortsOnly = input(false,"Shorts only")

AtrLength = input(9, "ATR length", minval=2)

ArcFactor = input(1.8, "ARC factor", minval=0, type=float,step=0.1)

ShowSAR = input(false, "Show all SARs (Stop & Reverse)")

HideSAR = input(false, "Hide all SARs")

ShowTriggers = input(false, "Show Entry/Exit triggers")

ShowTradedBackground = input(false, "Show Traded Background")

FromYear = input(defval = 2000, title = "From Year", minval = 1900)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 1900)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

// -------------- Date range filtering

FromDate = timestamp(FromYear, FromMonth, FromDay, 00, 00)

ToDate = timestamp(ToYear, ToMonth, ToDay, 23, 59)

TradeDateIsAllowed() => true

// -------------- Calculate Stop & Reverse (SAR) points using Average Range Constant (ARC)

Arc = atr(AtrLength)*ArcFactor

SarLo = highest(close, AtrLength)-Arc

SarHi = lowest(close, AtrLength)+Arc

// -------------- Entries/Exits

InLong = false

InShort = false

EnterLong = TradeDateIsAllowed() and not InLong[1] and crossover(close, SarHi[1])

EnterShort = TradeDateIsAllowed() and not InShort[1] and crossunder(close, SarLo[1])

InLong := (InLong[1] and not EnterShort[1]) or (EnterLong[1] and not ShortsOnly)

InShort := (InShort[1] and not EnterLong[1]) or (EnterShort[1] and not LongsOnly)

// -------------- Plots

// SAR points

plot( not HideSAR and ((InShort or EnterLong) or ShowSAR)? SarHi:na, color=MyRedMedium, style=circles, linewidth=2, title="SAR High")

plot( not HideSAR and ((InLong or EnterShort) or ShowSAR)? SarLo:na, color=MyGreenMedium, style=circles, linewidth=2, title="SAR Low")

// Entry/Exit markers

plotshape( ShowTriggers and not ShortsOnly and EnterLong, style=shape.triangleup, location=location.belowbar, color=MyGreenRaw, size=size.small, text="")

plotshape( ShowTriggers and not LongsOnly and EnterShort, style=shape.triangledown, location=location.abovebar, color=MyRedRaw, size=size.small, text="")

// Exits when printing only longs or shorts

plotshape( ShowTriggers and ShortsOnly and InShort[1] and EnterLong, style=shape.triangleup, location=location.belowbar, color=MyRedMedium, transp=70, size=size.small, text="")

plotshape( ShowTriggers and LongsOnly and InLong[1] and EnterShort, style=shape.triangledown, location=location.abovebar, color=MyGreenMedium, transp=70, size=size.small, text="")

// Background

bgcolor( color=ShowTradedBackground? InLong and not ShortsOnly?MyGreenDarkDark: InShort and not LongsOnly? MyRedDarkDark:na:na)

// ---------- Alerts

alertcondition( EnterLong or EnterShort, title="1. Reverse", message="Reverse")

alertcondition( EnterLong, title="2. Long", message="Long")

alertcondition( EnterShort, title="3. Short", message="Short")

// ---------- Strategy reversals

strategy.entry("Long", strategy.long, when=EnterLong and not ShortsOnly)

strategy.entry("Short", strategy.short, when=EnterShort and not LongsOnly)

strategy.close("Short", when=EnterLong and ShortsOnly)

strategy.close("Long", when=EnterShort and LongsOnly)

- OBV, CMO dan Strategi Dagangan Berasaskan Kurva Coppock

- Strategi Zon Tindakan CDC

- Strategi Perdagangan Kuantitatif Berbilang Faktor

- Trend Mengikut Strategi Berdasarkan Penyimpangan yang Dihaluskan

- Strategi Dagangan Ichimoku Cloud Oscillator

- Strategi Grid DCA Peralihan Rendah Berganda

- Assassin's Grid B

Strategi Perdagangan Grid Dinamik - Multi Timeframe Moving Average Crossover Strategi

- Adaptive Zero Lag Eksponensial Moving Average Strategi Dagangan Kuantitatif

- Strategi Brick Momentum

- Pattern Candle Strategi Perdagangan

- Strategi Dagangan Pivot SuperTrend yang Difilterkan ADX

- Strategi pembalikan purata bergerak

- Strategi Dagangan Crossover Momentum Moving Average

- Strategi Sinergi Trend Momentum

- Robot Perdagangan Rasional yang dikuasakan oleh Strategi RSI

- DYNAMIC MOMENTUM OSCILLATOR TRAILING STOP STRATEGI

- Strategi Dagangan Bugra Berdasarkan Purata Bergerak Kinetik Berganda

- Strategi Perdagangan Kuantitatif Berasaskan Fraktal dan Corak

- Strategi CAT Fluktuasi Pembalikan