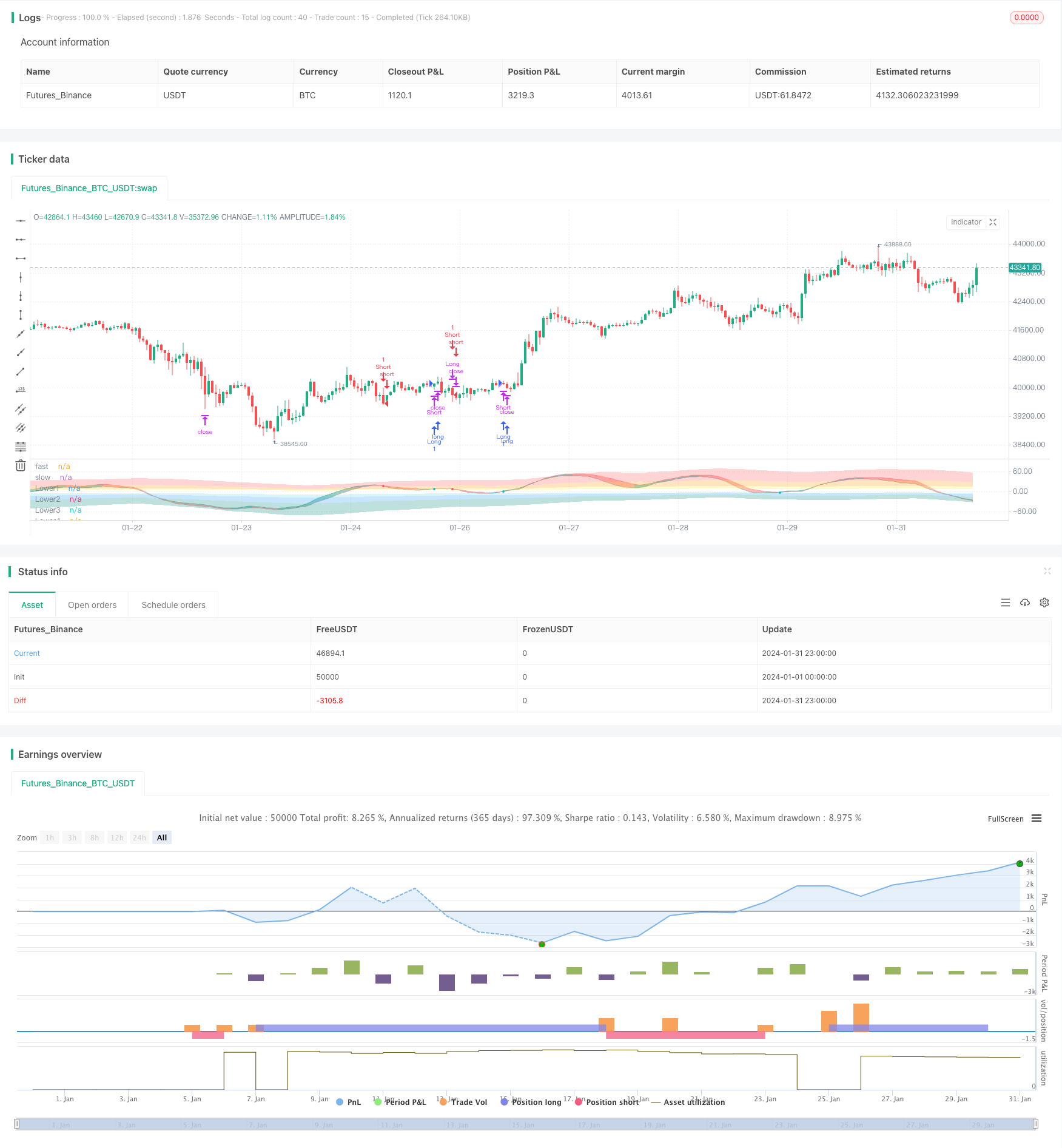

Strategi Perdagangan Pengayun Pelangi

Gambaran keseluruhan

Strategi perdagangan Rainbow Vibrator menggunakan beberapa indeks rata-rata bergerak yang lancar dan indikator goyah untuk membina saluran goyah berlapis, membentuk isyarat pelbagai ruang yang jelas di peringkat, dan merupakan strategi jenis trend. Strategi ini menggunakan gabungan RSI, CCI, Stochastic dan MA untuk menentukan pergerakan keseluruhan pasaran dan kawasan overbought dan oversold, dan merupakan strategi penilaian pelbagai faktor.

Prinsip Strategi

- Mengira purata tertimbang tiga nilai RSI, CCI, dan Stochastic untuk membina Indeks Kecemasan Komprehensif Magic;

- Mengambil beberapa kali pemprosesan indeks untuk Magic, anda akan mendapat dua garis kurva yang disampel MagicFast dan disampel MagicSlow;

- SampledMagicFast mewakili purata pantas, sampledMagicSlow mewakili purata perlahan;

- Sinyal beli dihasilkan apabila memakai sampledMagicSlow pada sampledMagicFast;

- Sinyal jual dihasilkan apabila disampledMagicFast disampledMagicSlow;

- Mengira arah perubahan sampledMagicFast pada bar terakhir berbanding bar sebelumnya untuk menilai trend semasa;

- Masa masuk dan keluar berdasarkan arah trend dan persilangan antara sampledMagicFast dan sampledMagicSlow.

Kelebihan Strategik

- Menggabungkan pelbagai petunjuk untuk menilai pergerakan keseluruhan pasaran dan meningkatkan ketepatan isyarat;

- Penguat bunyi isyarat yang berkesan berdasarkan penunjuk MA yang halus;

- Isyarat gegaran dipasarkan secara berlapis-lapis dengan jelas dan mudah dikendalikan.

- Gabungan penapis trend, boleh dikonfigurasikan sebagai trend-following atau pembalikan;

- Kekuatan zon overbought dan oversold yang boleh disesuaikan.

Risiko Strategik

- Peraturan parameter yang salah boleh menyebabkan kurva menjadi terlalu licin dan kehilangan masa masuk yang terbaik;

- Kaedah yang tidak betul untuk menetapkan kawasan overbought dan oversold boleh menyebabkan tempoh kosong terlalu lama;

- Kegagalan beberapa indikator dalam penarafan pelbagai faktor akan mengurangkan keberkesanan isyarat.

Penyelesaian:

- Optimumkan parameter untuk kelancaran kurva sederhana;

- Menyesuaikan intensiti kawasan overbought dan oversold untuk mengurangkan kadar kosong;

- Uji kebolehan ramalan setiap indikator, dengan penyesuaian berat.

Arah pengoptimuman strategi

- Mengubah parameter indeks secara dinamik berdasarkan ciri-ciri pasaran;

- Memperkenalkan kaedah pembelajaran mesin untuk mengoptimumkan kombinasi berat indikator secara automatik;

- Menapis isyarat masuk dengan faktor seperti peningkatan jumlah dan kadar turun naik.

ringkaskan

Strategi Rainbow Vibrator menggabungkan pelbagai isyarat indikator, meningkatkan kestabilan melalui pemprosesan indeks yang lancar. Strategi ini boleh dikonfigurasi untuk menyesuaikan diri dengan trend dan pasaran goyah, atau hanya untuk pergerakan goyah jenis tertentu. Dengan pengoptimuman parameter dan pengembangan indikator, kualiti isyarat dapat ditingkatkan lagi.

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © businessduck

//@version=5

strategy("Rainbow Oscillator [Strategy]", overlay=false, margin_long=100, margin_short=100, initial_capital = 2000)

bool trendFilter = input.bool(true, 'Use trend filter')

float w1 = input.float(0.33, 'RSI Weight', 0, 1, 0.01)

float w2 = input.float(0.33, 'CCI Weight', 0, 1, 0.01)

float w3 = input.float(0.33, 'Stoch Weight', 0, 1, 0.01)

int fastPeriod = input.int(16, 'Ocillograph Fast Period', 4, 60, 1)

int slowPeriod = input.int(22, 'Ocillograph Slow Period', 4, 60, 1)

int oscillographSamplePeriod = input.int(8, 'Oscillograph Samples Period', 1, 30, 1)

int oscillographSamplesCount = input.int(2, 'Oscillograph Samples Count', 0, 4, 1)

string oscillographMAType = input.string("RMA", "Oscillograph Samples Type", options = ["EMA", "SMA", "RMA", "WMA"])

int levelPeriod = input.int(26, 'Level Period', 2, 100)

int levelOffset = input.int(0, 'Level Offset', 0, 200, 10)

float redunant = input.float(0.5, 'Level Redunant', 0, 1, 0.01)

int levelSampleCount = input.int(2, 'Level Smooth Samples', 0, 4, 1)

string levelType = input.string("RMA", "Level MA type", options = ["EMA", "SMA", "RMA", "WMA"])

perc(current, prev) => ((current - prev) / prev) * 100

smooth(value, type, period) =>

float ma = switch type

"EMA" => ta.ema(value, period)

"SMA" => ta.sma(value, period)

"RMA" => ta.rma(value, period)

"WMA" => ta.wma(value, period)

=>

runtime.error("No matching MA type found.")

float(na)

getSample(value, samples, type, period) =>

float ma = switch samples

0 => value

1 => smooth(value, type, period)

2 => smooth(smooth(value, type, period), type, period)

3 => smooth(smooth(smooth(value, type, period), type, period), type, period)

4 => smooth(smooth(smooth(smooth(value, type, period), type, period), type, period), type, period)

float takeProfit = input.float(5, "% Take profit", 0.8, 100, step = 0.1) / 100

float stopLoss = input.float(2, "% Stop Loss", 0.8, 100, step = 0.1) / 100

float magicFast = w2 * ta.cci(close, fastPeriod) + w1 * (ta.rsi(close, fastPeriod) - 50) + w3 * (ta.stoch(close, high, low, fastPeriod) - 50)

float magicSlow = w2 * ta.cci(close, slowPeriod) + w1 * (ta.rsi(close, slowPeriod) - 50) + w3 * (ta.stoch(close, high, low, slowPeriod) - 50)

float sampledMagicFast = getSample(magicFast, oscillographSamplesCount, oscillographMAType, oscillographSamplePeriod)

float sampledMagicSlow = getSample(magicSlow, oscillographSamplesCount, oscillographMAType, oscillographSamplePeriod)

float lastUpperValue = 0

float lastLowerValue = 0

if (magicFast > 0)

lastUpperValue := math.max(magicFast, magicFast[1])

else

lastUpperValue := math.max(0, lastUpperValue[1]) * redunant

if (magicFast <= 0)

lastLowerValue := math.min(magicFast, magicFast[1])

else

lastLowerValue := math.min(0, lastLowerValue[1]) * redunant

float level1up = getSample( (magicFast >= 0 ? magicFast : lastUpperValue) / 4, levelSampleCount, levelType, levelPeriod) + levelOffset

float level2up = getSample( (magicFast >= 0 ? magicFast : lastUpperValue) / 2, levelSampleCount, levelType, levelPeriod) + levelOffset

float level3up = getSample( magicFast >= 0 ? magicFast : lastUpperValue, levelSampleCount, levelType, levelPeriod) + levelOffset

float level4up = getSample( (magicFast >= 0 ? magicFast : lastUpperValue) * 2, levelSampleCount, levelType, levelPeriod) + levelOffset

float level1low = getSample( (magicFast <= 0 ? magicFast : lastLowerValue) / 4, levelSampleCount, levelType, levelPeriod) - levelOffset

float level2low = getSample( (magicFast <= 0 ? magicFast : lastLowerValue) / 2, levelSampleCount, levelType, levelPeriod) - levelOffset

float level3low = getSample( magicFast <= 0 ? magicFast : lastLowerValue, levelSampleCount, levelType, levelPeriod) - levelOffset

float level4low = getSample( (magicFast <= 0 ? magicFast : lastLowerValue) * 2, levelSampleCount, levelType, levelPeriod) - levelOffset

var transparent = color.new(color.white, 100)

var overbough4Color = color.new(color.red, 75)

var overbough3Color = color.new(color.orange, 75)

var overbough2Color = color.new(color.yellow, 75)

var oversold4Color = color.new(color.teal, 75)

var oversold3Color = color.new(color.blue, 75)

var oversold2Color = color.new(color.aqua, 85)

upperPlotId1 = plot(level1up, 'Upper1', transparent)

upperPlotId2 = plot(level2up, 'Upper2', transparent)

upperPlotId3 = plot(level3up, 'Upper3', transparent)

upperPlotId4 = plot(level4up, 'Upper4', transparent)

fastColor = color.new(color.teal, 60)

slowColor = color.new(color.red, 60)

fastPlotId = plot(sampledMagicFast, 'fast', color = fastColor)

slowPlotId = plot(sampledMagicSlow, 'slow', color = slowColor)

lowerPlotId1 = plot(level1low, 'Lower1', transparent)

lowerPlotId2 = plot(level2low, 'Lower2', transparent)

lowerPlotId3 = plot(level3low, 'Lower3', transparent)

lowerPlotId4 = plot(level4low, 'Lower4', transparent)

fill(upperPlotId4, upperPlotId3, overbough4Color)

fill(upperPlotId3, upperPlotId2, overbough3Color)

fill(upperPlotId2, upperPlotId1, overbough2Color)

fill(lowerPlotId4, lowerPlotId3, oversold4Color)

fill(lowerPlotId3, lowerPlotId2, oversold3Color)

fill(lowerPlotId2, lowerPlotId1, oversold2Color)

upTrend = sampledMagicFast > sampledMagicFast[1]

buySignal = ((upTrend or not trendFilter) and ta.crossunder(sampledMagicSlow, sampledMagicFast)) ? sampledMagicSlow : na

sellSignal = ((not upTrend or not trendFilter) and ta.crossover(sampledMagicSlow, sampledMagicFast)) ? sampledMagicSlow : na

diff = sampledMagicSlow - sampledMagicFast

fill(fastPlotId, slowPlotId, upTrend ? fastColor : slowColor)

plot(buySignal, color = color.aqua, style = plot.style_circles, linewidth = 4)

plot(sellSignal, color = color.red, style = plot.style_circles, linewidth = 4)

// longCondition = upTrend != upTrend[1] and upTrend

long_take_level = strategy.position_avg_price * (1 + takeProfit)

long_stop_level = strategy.position_avg_price * (1 - stopLoss)

short_take_level = strategy.position_avg_price * (1 - takeProfit)

short_stop_level = strategy.position_avg_price * (1 + stopLoss)

strategy.close(id="Long", when=sellSignal, comment = "Exit")

strategy.close(id="Short", when=buySignal, comment = "Exit")

strategy.entry("Long", strategy.long, when=buySignal)

strategy.entry("Short", strategy.short, when=sellSignal)

strategy.exit("Take Profit/ Stop Loss","Long", stop=long_stop_level, limit=long_take_level)

strategy.exit("Take Profit/ Stop Loss","Short", stop=short_stop_level, limit=short_take_level)

// plot(long_stop_level, color=color.red, overlay=true)

// plot(long_take_level, color=color.green)