Strategi Dagangan Pembalikan RSI Pantas

Gambaran keseluruhan

Strategi dagangan berbalik RSI pantas untuk menentukan titik berbalik trend dengan menggunakan kombinasi indikator RSI pantas, penapis entiti K-line, penapis harga maksimum dan minimum dan penapis garis rata SMA untuk mencapai perdagangan berbalik yang berisiko rendah. Strategi ini bertujuan untuk menangkap peluang berbalik jangka pendek.

Prinsip Strategi

Strategi ini dibuat berdasarkan beberapa petunjuk berikut:

Indeks RSI pantas: Mengira RSI melalui fungsi RMA, menjadikannya lebih sensitif untuk menangkap isyarat overbought dan oversold yang lebih cepat.

Penapis entiti K: Memerlukan saiz entiti K lebih besar daripada 1⁄5 daripada garis purata entiti EMA untuk penapis perubahan kecil.

Penapis harga maksimum minimumUntuk menentukan apakah harga inovasi tinggi atau rendah, pastikan trend telah berbalik.

Penapisan rata SMA: Meminta harga untuk melepasi garis purata SMA, menambah asas penilaian.

Isyarat dagangan dihasilkan apabila beberapa syarat di atas dicetuskan pada masa yang sama. Logik khusus adalah:

Masuk berganda: Indeks RSI pantas di bawah kawasan oversold dan entiti garis K lebih besar daripada entiti garis purata EMA 1⁄5 dan mempunyai nilai minimum untuk menembusi dan harga untuk menembusi garis purata SMA

Masuk kosong: Indeks RSI cepat lebih tinggi daripada kawasan oversold dan entiti garis K lebih besar daripada entiti garis rata-rata EMA 1⁄5 dan mempunyai nilai maksimum untuk menembusi dan harga di bawah garis rata-rata SMA

Keluar dari kedudukan rata: Indeks RSI cepat kembali ke kawasan normal

Kelebihan Strategik

Strategi ini mempunyai kelebihan berikut:

- Menangkap turun naik dalam jangka pendek

- Indeks RSI pantas sangat sensitif

- Penapisan berganda mengurangkan isyarat palsu

- Risiko boleh dikawal, penarikan balik kecil

Risiko dan pengoptimuman

Strategi ini mempunyai beberapa risiko:

- Bahaya Kegagalan Pembalikan

- Ruang untuk mengoptimumkan parameter terhad

Ia boleh dioptimumkan dengan:

- Penapisan jumlah transaksi

- Meningkatkan strategi hentikan kerugian

- Kombinasi parameter pengoptimuman

ringkaskan

Strategi ini secara keseluruhan merupakan strategi perdagangan berbalik jangka pendek yang berisiko rendah. Ia menilai titik beli dan jual dengan indikator RSI yang cepat, dan menggunakan pelbagai penapis untuk mengurangkan isyarat palsu, sehingga menghasilkan perdagangan berbalik yang terkawal risiko dan sesuai untuk operasi garis pendek.

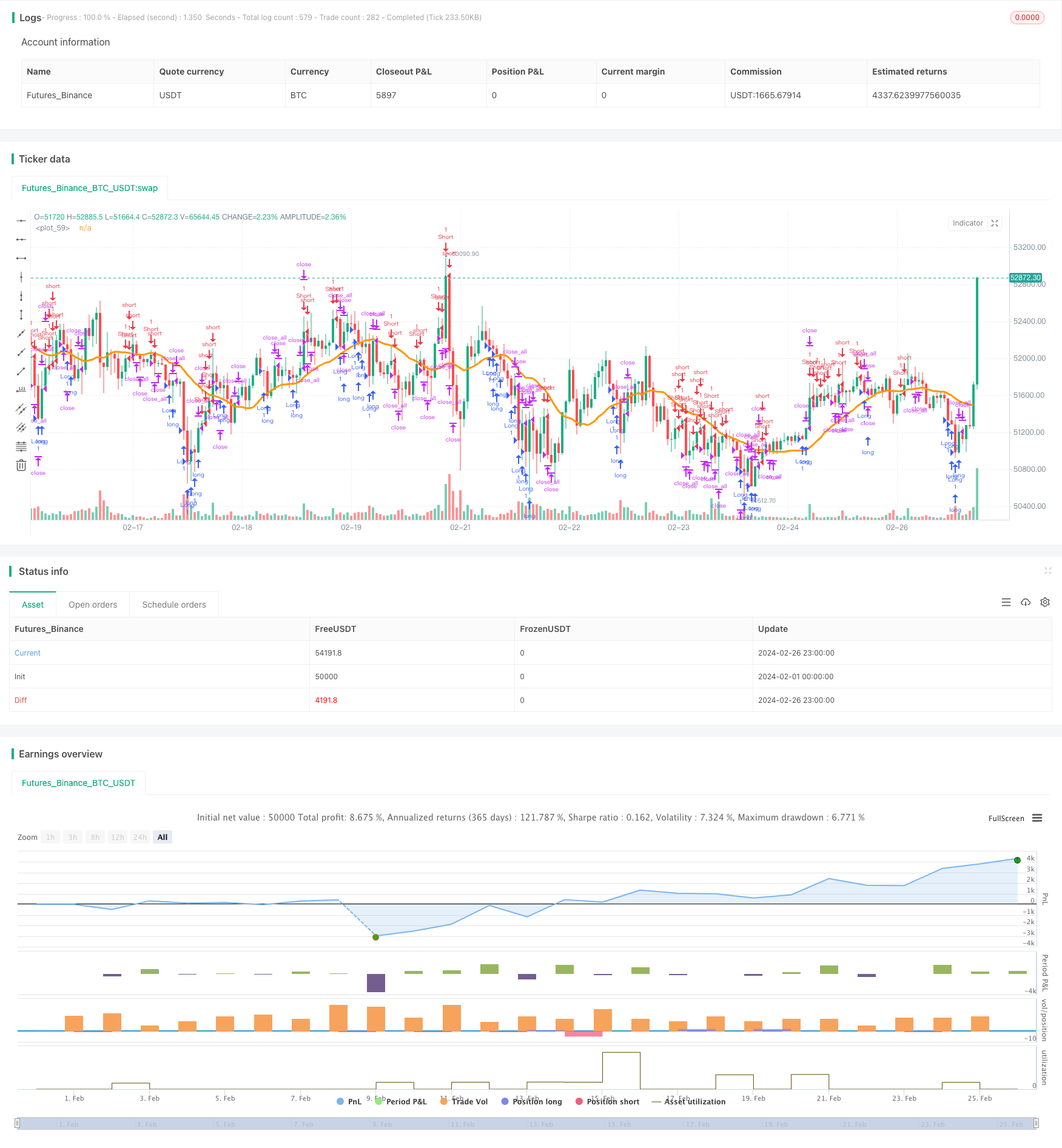

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-26 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=3

strategy(title = "Noro's Fast RSI Strategy v1.4", shorttitle = "Fast RSI str 1.4", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 5)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usersi = input(true, defval = true, title = "Use Fast RSI Strategy")

usemm = input(true, defval = true, title = "Use Min/Max Strategy")

usesma = input(true, defval = true, title = "Use SMA Filter")

smaperiod = input(20, defval = 20, minval = 2, maxval = 1000, title = "SMA Filter Period")

rsiperiod = input(7, defval = 7, minval = 2, maxval = 50, title = "RSI Period")

limit = input(30, defval = 30, minval = 1, maxval = 100, title = "RSI limit")

rsisrc = input(close, defval = close, title = "RSI Price")

rsibars = input(1, defval = 1, minval = 1, maxval = 20, title = "RSI Bars")

mmbars = input(1, defval = 1, minval = 1, maxval = 5, title = "Min/Max Bars")

showsma = input(false, defval = false, title = "Show SMA Filter")

showarr = input(false, defval = false, title = "Show Arrows")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

fastup = rma(max(change(rsisrc), 0), rsiperiod)

fastdown = rma(-min(change(rsisrc), 0), rsiperiod)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Limits

bar = close > open ? 1 : close < open ? -1 : 0

uplimit = 100 - limit

dnlimit = limit

//RSI Bars

upsignal = fastrsi > uplimit ? 1 : 0

dnsignal = fastrsi < dnlimit ? 1 : 0

uprsi = sma(upsignal, rsibars) == 1

dnrsi = sma(dnsignal, rsibars) == 1

//Body

body = abs(close - open)

emabody = ema(body, 30)

//MinMax Bars

min = min(close, open)

max = max(close, open)

minsignal = min < min[1] and bar == -1 and bar[1] == -1 ? 1 : 0

maxsignal = max > max[1] and bar == 1 and bar[1] == 1 ? 1 : 0

mins = sma(minsignal, mmbars) == 1

maxs = sma(maxsignal, mmbars) == 1

//SMA Filter

sma = sma(close, smaperiod)

colorsma = showsma ? blue : na

plot(sma, color = colorsma, linewidth = 3)

//Signals

up1 = bar == -1 and (strategy.position_size == 0 or close < strategy.position_avg_price) and dnrsi and body > emabody / 5 and usersi

dn1 = bar == 1 and (strategy.position_size == 0 or close > strategy.position_avg_price) and uprsi and body > emabody / 5 and usersi

up2 = mins and (close > sma or usesma == false) and usemm

dn2 = maxs and (close < sma or usesma == false) and usemm

exit = ((strategy.position_size > 0 and fastrsi > dnlimit and bar == 1) or (strategy.position_size < 0 and fastrsi < uplimit and bar == -1)) and body > emabody / 2

//Arrows

col = exit ? black : up1 or dn1 ? blue : up2 or dn2 ? red : na

needup = up1 or up2

needdn = dn1 or dn2

needexitup = exit and strategy.position_size < 0

needexitdn = exit and strategy.position_size > 0

plotarrow(showarr and needup ? 1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needdn ? -1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needexitup ? 1 : na, colorup = black, colordown = black, transp = 0)

plotarrow(showarr and needexitdn ? -1 : na, colorup = black, colordown = black, transp = 0)

//Trading

if up1 or up2

strategy.entry("Long", strategy.long, needlong == false ? 0 : na)

if dn1 or dn2

strategy.entry("Short", strategy.short, needshort == false ? 0 : na)

if time > timestamp(toyear, tomonth, today, 00, 00) or exit

strategy.close_all()