Gambaran keseluruhan

Strategi ini menggabungkan beberapa petunjuk teknikal seperti indeks relatif kuat lemah (RSI), purata bergerak berhampiran dan menyebar (MACD), Bollinger Bands (Bollinger Bands) dan jumlah transaksi untuk menentukan masa perdagangan yang terbaik. Strategi ini mengenal pasti trend dan turun naik dengan menganalisis data harga dan jumlah transaksi, dan menghasilkan isyarat perdagangan dengan menggunakan isyarat momentum dan isyarat turun naik.

Prinsip Strategi

- Hitung RSI, MACD, Brin Belt dan Indeks Volume Pertukaran.

- Menggunakan purata bergerak jangka pendek dan jangka panjang untuk mengenal pasti arah trend.

- Tentukan titik tertinggi dan terendah di kawasan kecairan.

- Mencipta isyarat pembelian:

- Beli apabila RSI berada di bawah 30 dan harga penutupan berada di bawah Bollinger Bands dan di atas paras rendah kawasan kecairan.

- Beli apabila MACD lebih besar daripada 0, trend naik ditubuhkan, harga penutupan lebih tinggi daripada 10 garis K terdahulu, dan terletak di atas paras rendah kawasan kecairan.

- Beli apabila jumlah transaksi melonjak, harga penutupan lebih tinggi daripada Bollinger Bands dan terletak di atas paras rendah kawasan kecairan.

- Mencipta dan menjual isyarat:

- Apabila RSI lebih tinggi daripada 70, harga penutupan lebih tinggi daripada Bollinger Bands dan berada di bawah paras tertinggi kawasan kecairan, jual.

- Jual apabila MACD kurang daripada 0, trend menurun ditubuhkan, dan harga penutupan berada di bawah titik terendah 10 garis K terdahulu, dan terletak di bawah titik tinggi kawasan kecairan.

- Jual apabila jumlah transaksi meningkat, harga penutupan berada di bawah Bollinger Bands dan berada di bawah paras tinggi kawasan kecairan.

- Melakukan transaksi mengikut isyarat beli dan jual, mengelakkan transaksi berulang.

Kelebihan Strategik

- Portfolio pelbagai indikator: Strategi ini mengambil kira pelbagai aspek seperti harga, jumlah transaksi, trend dan turun naik untuk memberikan isyarat perdagangan yang lebih dipercayai.

- Pengesahan trend: Dengan membandingkan purata bergerak jangka pendek dan jangka panjang, strategi dapat mengenal pasti arah trend semasa.

- Pertimbangan Volatiliti: Memperkenalkan Brin’s Bands dan Indeks Volume, strategi ini dapat menangkap turun naik harga dan perubahan dalam sentimen pasaran.

- Kawasan kecairan: Dengan mengenal pasti kawasan kecairan, strategi boleh berdagang di sekitar titik sokongan dan rintangan utama, meningkatkan kadar kejayaan.

- Mencegah transaksi berlebihan: Strategi ini mempunyai mekanisme untuk mengelakkan transaksi berulang dan mengelakkan kos transaksi yang tidak perlu.

Risiko Strategik

- Risiko pengoptimuman parameter: Prestasi strategi bergantung kepada pilihan pelbagai parameter, dan tetapan parameter yang tidak tepat boleh menyebabkan strategi gagal.

- Risiko pasaran: Strategi yang dioptimumkan berdasarkan data sejarah mungkin tidak berfungsi dengan baik dalam menghadapi perubahan pasaran masa depan.

- Kejadian Black Swan: Strategi tidak dapat menangani turun naik yang luar biasa dalam keadaan pasaran yang melampau.

- Titik tergelincir dan kos urus niaga: Titik tergelincir dan kos urus niaga dalam urus niaga sebenar boleh mempengaruhi prestasi keseluruhan strategi.

Arah pengoptimuman strategi

- Pengoptimuman parameter dinamik: menyesuaikan parameter strategi mengikut keadaan pasaran yang dinamik untuk menyesuaikan diri dengan peringkat pasaran yang berbeza.

- Pengurusan risiko: Memperkenalkan mekanisme hentian dan hentian untuk mengawal risiko perdagangan tunggal.

- Ujian pelbagai pasaran: menerapkan strategi ke pasaran kewangan yang berbeza untuk menilai kebolehgunaan dan kestabilan mereka.

- Pengoptimuman pembelajaran mesin: menggunakan algoritma pembelajaran mesin untuk mengoptimumkan strategi dan menyesuaikan diri dengan perubahan pasaran.

ringkaskan

Strategi ini membentuk satu sistem perdagangan yang lengkap dengan menggabungkan beberapa petunjuk teknikal seperti RSI, MACD, Brin’s Belt dan Volume. Strategi ini mempertimbangkan pelbagai aspek seperti harga, trend, turun naik dan sentimen pasaran, dan memperkenalkan konsep zon kecairan untuk mengoptimumkan isyarat perdagangan. Walaupun strategi ini mempunyai kelebihan, ia masih menghadapi cabaran seperti pengoptimuman parameter, risiko pasaran.

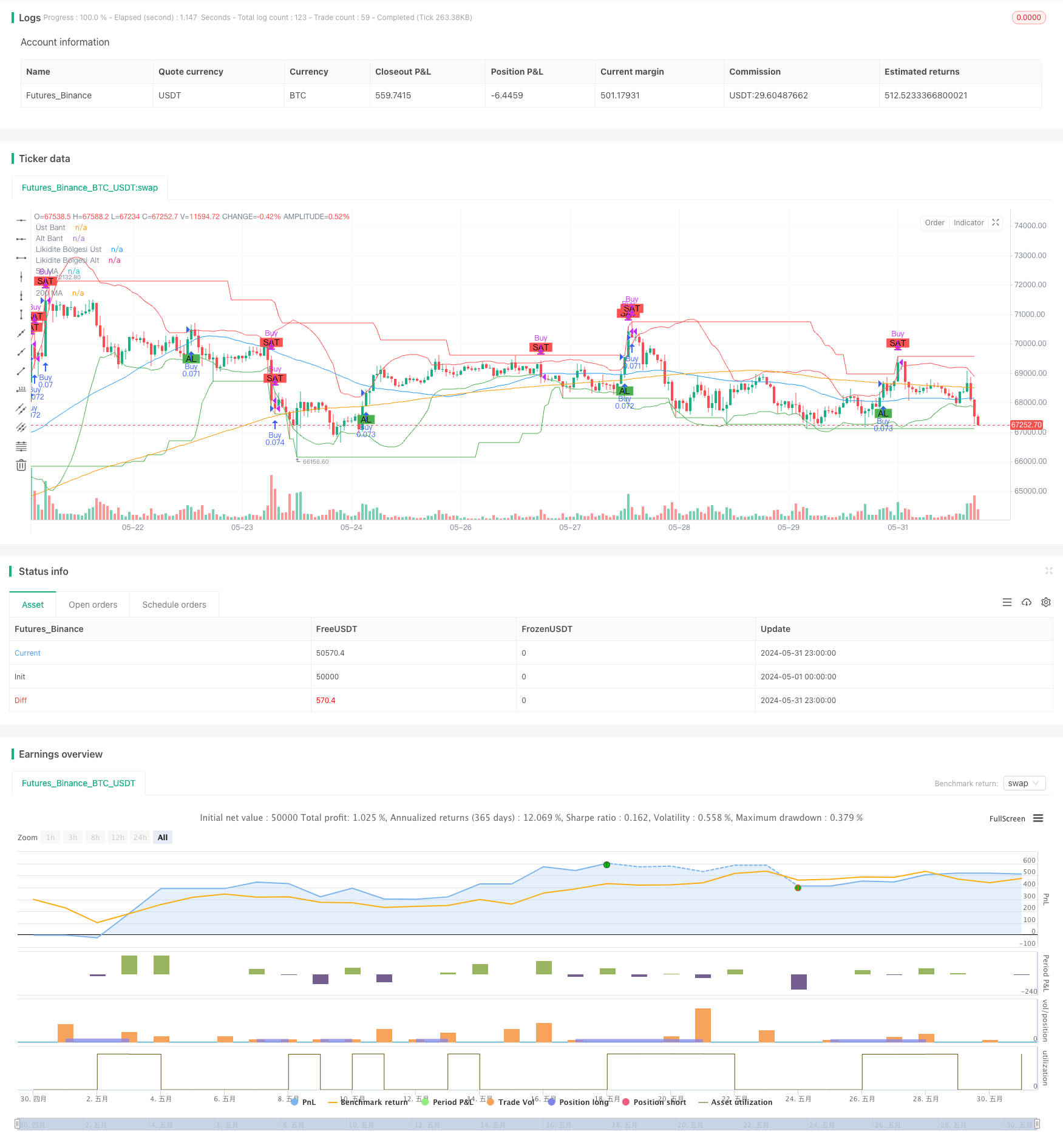

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimize Edilmiş Kapsamlı Ticaret Stratejisi - Likidite Bölgeleri ile 30 Dakika", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Optimize edilebilir parametreler

rsiPeriod = input.int(14, minval=5, maxval=30, title="RSI Periyodu")

macdShortPeriod = input.int(12, minval=5, maxval=30, title="MACD Kısa Periyodu")

macdLongPeriod = input.int(26, minval=20, maxval=50, title="MACD Uzun Periyodu")

macdSignalPeriod = input.int(9, minval=5, maxval=20, title="MACD Sinyal Periyodu")

smaPeriod = input.int(20, minval=10, maxval=50, title="SMA Periyodu")

bollingerMultiplier = input.float(2.0, minval=1.0, maxval=3.0, title="Bollinger Bantları Çarpanı")

volumeSpikeMultiplier = input.float(1.5, minval=1.0, maxval=3.0, title="Hacim Artış Çarpanı")

shortTermMAPeriod = input.int(50, minval=20, maxval=100, title="Kısa Dönem MA Periyodu")

longTermMAPeriod = input.int(200, minval=100, maxval=300, title="Uzun Dönem MA Periyodu")

liquidityZonePeriod = input.int(50, minval=10, maxval=100, title="Likidite Bölgesi Periyodu")

// İndikatörleri Tanımla

rsi = ta.rsi(close, rsiPeriod)

[macdLine, signalLine, _] = ta.macd(close, macdShortPeriod, macdLongPeriod, macdSignalPeriod)

macdHist = macdLine - signalLine

basis = ta.sma(close, smaPeriod)

dev = bollingerMultiplier * ta.stdev(close, smaPeriod)

upperBand = basis + dev

lowerBand = basis - dev

volumeSpike = volume > ta.sma(volume, 20) * volumeSpikeMultiplier

// Hareketli Ortalamaları Kullanarak Trend Takibi

shortTermMA = ta.sma(close, shortTermMAPeriod)

longTermMA = ta.sma(close, longTermMAPeriod)

trendUp = shortTermMA > longTermMA

trendDown = shortTermMA < longTermMA

// Likidite Bölgelerini Belirleme

liquidityZoneHigh = ta.highest(high, liquidityZonePeriod)

liquidityZoneLow = ta.lowest(low, liquidityZonePeriod)

// Likidite Bölgelerini Çiz

plot(liquidityZoneHigh, color=color.red, title="Likidite Bölgesi Üst")

plot(liquidityZoneLow, color=color.green, title="Likidite Bölgesi Alt")

// Sinyal Durumlarını Saklamak İçin Değişkenler

var bool inPosition = false

var bool isBuy = false

// Al ve Sat Sinyali Bayrakları

var bool buyFlag = false

var bool sellFlag = false

// Bayrakları Sıfırla

buyFlag := false

sellFlag := false

// Al ve Sat Sinyallerini Tanımla

var bool buySignal = false

var bool sellSignal = false

if (barstate.isconfirmed)

buySignal := ((rsi < 30 and close < lowerBand and close > liquidityZoneLow) or

(macdHist > 0 and trendUp and close > ta.highest(high, 10)[1] and close > liquidityZoneLow) or

(volumeSpike and close > upperBand and close > liquidityZoneLow))

sellSignal := ((rsi > 70 and close > upperBand and close < liquidityZoneHigh) or

(macdHist < 0 and trendDown and close < ta.lowest(low, 10)[1] and close < liquidityZoneHigh) or

(volumeSpike and close < lowerBand and close < liquidityZoneHigh))

// Aynı Sinyali Tekrarlamamak İçin Kontroller

if (buySignal and (not inPosition or not isBuy))

inPosition := true

isBuy := true

buyFlag := true

sellFlag := false

strategy.entry("Buy", strategy.long)

if (sellSignal and inPosition and isBuy)

inPosition := false

isBuy := false

sellFlag := true

buyFlag := false

strategy.close("Buy")

// Sinyalleri Grafiğe Çiz

plotshape(series=buyFlag, location=location.belowbar, color=color.green, style=shape.labelup, text="AL")

plotshape(series=sellFlag, location=location.abovebar, color=color.red, style=shape.labeldown, text="SAT")

// Hareketli Ortalamaları ve Bollinger Bantlarını Çiz

plot(shortTermMA, color=color.blue, title="50 MA")

plot(longTermMA, color=color.orange, title="200 MA")

plot(upperBand, color=color.red, title="Üst Bant")

plot(lowerBand, color=color.green, title="Alt Bant")