Gambaran keseluruhan

Strategi ini adalah sistem perdagangan canggih yang berdasarkan analisis titik pivot, yang meramalkan perubahan trend yang berpotensi dengan mengenal pasti titik-titik perubahan utama di pasaran. Strategi ini menggunakan pendekatan “pivot of pivot” yang inovatif, yang dikombinasikan dengan indikator kadar turun naik ATR untuk pengurusan kedudukan, membentuk satu sistem perdagangan yang lengkap. Strategi ini sesuai untuk beberapa pasaran dan boleh dioptimumkan parameter mengikut ciri-ciri pasaran yang berbeza.

Prinsip Strategi

Inti strategi ini adalah untuk mengenal pasti peluang pembalikan pasaran melalui analisis titik pivot dua peringkat. Titik pivot pertama adalah titik tinggi dan rendah asas, dan titik pivot kedua adalah titik-titik perubahan yang ketara yang dipilih dari titik pivot pertama. Apabila harga menembusi tahap-tahap penting ini, sistem akan menghasilkan isyarat perdagangan.

Kelebihan Strategik

- Adaptif: Strategi boleh menyesuaikan diri dengan keadaan pasaran yang berbeza, dengan menyesuaikan parameter untuk menyesuaikan diri dengan tahap kadar turun naik yang berbeza.

- Pengurusan risiko yang sempurna: menggunakan ATR untuk seting stop loss yang dinamik, dapat menyesuaikan langkah perlindungan secara automatik mengikut turun naik pasaran.

- Pengesahan pelbagai peringkat: Mengurangkan risiko kebocoran palsu melalui analisis dua tahap.

- Pengurusan kedudukan yang fleksibel: saiz kedudukan disesuaikan mengikut saiz akaun dan dinamik turun naik pasaran.

- Peraturan kemasukan yang jelas: Terdapat mekanisme pengesahan isyarat yang jelas, mengurangkan penilaian subjektif.

Risiko Strategik

- Risiko tergelincir: kemungkinan tergelincir dalam pasaran yang bergelincir tinggi.

- Risiko penembusan palsu: Isyarat yang salah boleh berlaku apabila pasaran bergolak.

- Risiko Leverage Terlalu Besar: Penggunaan Leverage yang tidak betul boleh menyebabkan kerugian yang serius.

- Risiko pengoptimuman parameter: pengoptimuman berlebihan boleh menyebabkan overfit.

Arah pengoptimuman strategi

- Penapis isyarat: penapis trend boleh ditambah, hanya berdagang ke arah trend utama.

- Parameter dinamik: Secara automatik menyesuaikan parameter pivot berdasarkan keadaan pasaran.

- Melanjutkan pengesahan untuk meningkatkan ketepatan.

- Hentikan Kerosakan Pintar: Membangunkan strategi hentikan kerosakan yang lebih pintar, seperti menjejaki hentikan kerosakan.

- Kawalan risiko: Tambah langkah-langkah kawalan risiko seperti analisis relevansi.

ringkaskan

Ini adalah strategi perdagangan pembalikan trend yang direka dengan baik, membina sistem perdagangan yang mantap melalui analisis titik-titik pusat dua hala dan pengurusan kadar turun naik ATR. Kelebihan strategi ini adalah kerana ia sangat mudah disesuaikan dan pengurusan risiko yang sempurna, tetapi masih memerlukan pedagang untuk berhati-hati menggunakan leverage dan terus mengoptimumkan parameter. Dengan arah pengoptimuman yang disyorkan, strategi ini masih mempunyai ruang untuk peningkatan.

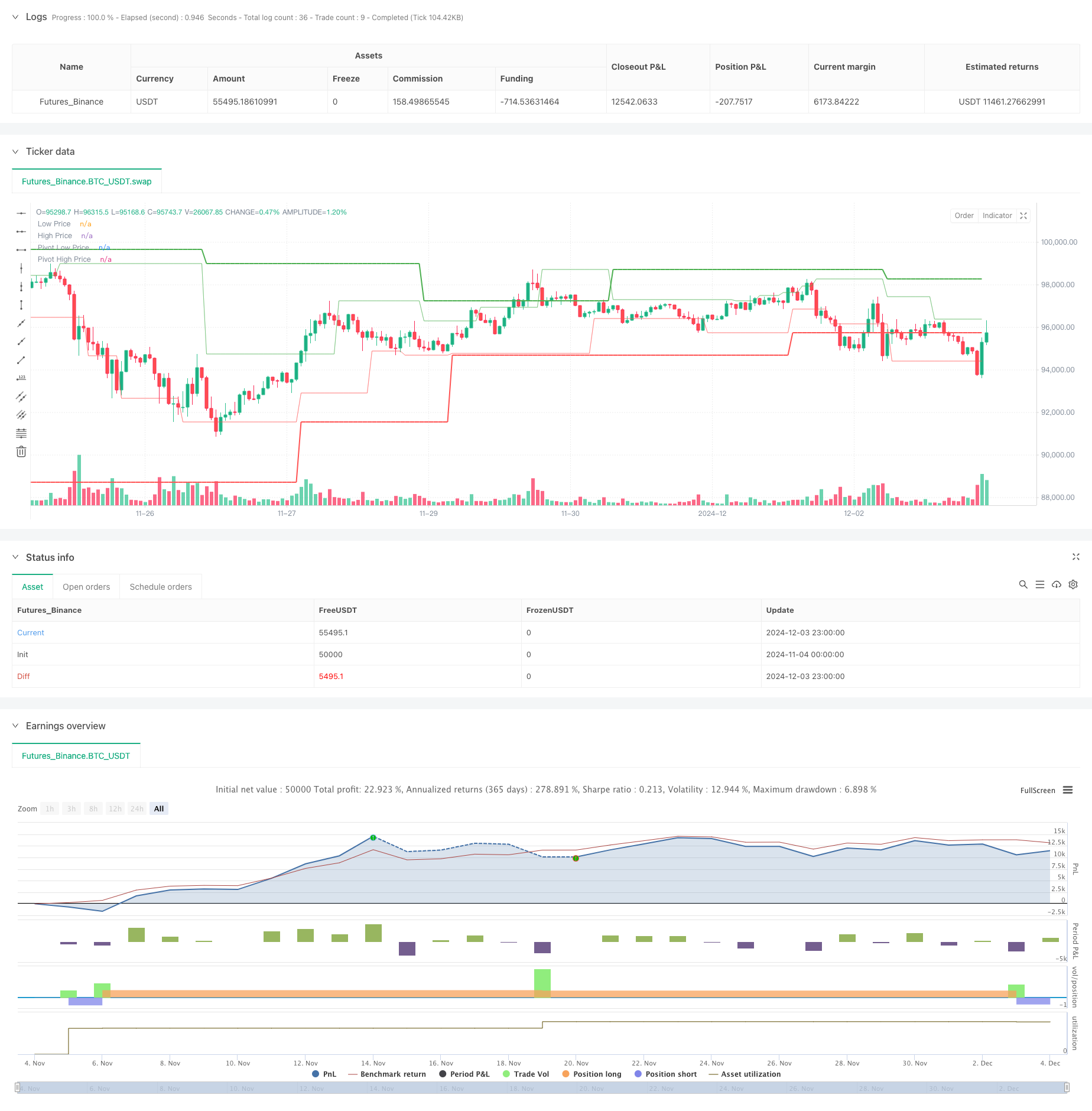

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Pivot of Pivot Reversal Strategy [MAD]", shorttitle="PoP Reversal Strategy", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// Inputs with Tooltips

leftBars = input.int(4, minval=1, title='PP Left Bars', tooltip='Number of bars to the left of the pivot point. Increasing this value makes the pivot more significant.')

rightBars = input.int(2, minval=1, title='PP Right Bars', tooltip='Number of bars to the right of the pivot point. Increasing this value delays the pivot detection but may reduce false signals.')

atr_length = input.int(14, minval=1, title='ATR Length', tooltip='Length for ATR calculation. ATR is used to assess market volatility.')

atr_mult = input.float(0.1, minval=0.0, step=0.1, title='ATR Multiplier', tooltip='Multiplier applied to ATR for pivot significance. Higher values require greater price movement for pivots.')

allowLongs = input.bool(true, title='Allow Long Positions', tooltip='Enable or disable long positions.')

allowShorts = input.bool(true, title='Allow Short Positions', tooltip='Enable or disable short positions.')

margin_amount = input.float(1.0, minval=1.0, maxval=100.0, step=1.0, title='Margin Amount (Leverage)', tooltip='Set the leverage multiplier (e.g., 3x, 5x, 10x). Note: Adjust leverage in strategy properties for accurate results.')

risk_reward_enabled = input.bool(false, title='Enable Risk/Reward Ratio', tooltip='Enable or disable the use of a fixed risk/reward ratio for trades.')

risk_reward_ratio = input.float(1.0, minval=0.1, step=0.1, title='Risk/Reward Ratio', tooltip='Set the desired risk/reward ratio (e.g., 1.0 for 1:1).')

risk_percent = input.float(1.0, minval=0.1, step=0.1, title='Risk Percentage per Trade (%)', tooltip='Percentage of entry price to risk per trade.')

trail_stop_enabled = input.bool(false, title='Enable Trailing Stop Loss', tooltip='Enable or disable the trailing stop loss.')

trail_percent = input.float(0.5, minval=0.0, step=0.1, title='Trailing Stop Loss (%)', tooltip='Percentage for trailing stop loss.')

start_year = input.int(2018, title='Start Year', tooltip='Backtest start year.')

start_month = input.int(1, title='Start Month', tooltip='Backtest start month.')

start_day = input.int(1, title='Start Day', tooltip='Backtest start day.')

end_year = input.int(2100, title='End Year', tooltip='Backtest end year.')

end_month = input.int(1, title='End Month', tooltip='Backtest end month.')

end_day = input.int(1, title='End Day', tooltip='Backtest end day.')

date_start = timestamp(start_year, start_month, start_day, 00, 00)

date_end = timestamp(end_year, end_month, end_day, 00, 00)

time_cond = time >= date_start and time <= date_end

// Pivot High Significant Function

pivotHighSig(left, right) =>

pp_ok = true

atr = ta.atr(atr_length)

for i = 1 to left

if high[right] < high[right + i] + atr * atr_mult

pp_ok := false

for i = 0 to right - 1

if high[right] < high[i] + atr * atr_mult

pp_ok := false

pp_ok ? high[right] : na

// Pivot Low Significant Function

pivotLowSig(left, right) =>

pp_ok = true

atr = ta.atr(atr_length)

for i = 1 to left

if low[right] > low[right + i] - atr * atr_mult

pp_ok := false

for i = 0 to right - 1

if low[right] > low[i] - atr * atr_mult

pp_ok := false

pp_ok ? low[right] : na

swh = pivotHighSig(leftBars, rightBars)

swl = pivotLowSig(leftBars, rightBars)

swh_cond = not na(swh)

var float hprice = 0.0

hprice := swh_cond ? swh : nz(hprice[1])

le = false

le := swh_cond ? true : (le[1] and high > hprice ? false : le[1])

swl_cond = not na(swl)

var float lprice = 0.0

lprice := swl_cond ? swl : nz(lprice[1])

se = false

se := swl_cond ? true : (se[1] and low < lprice ? false : se[1])

// Pivots of pivots

var float ph1 = 0.0

var float ph2 = 0.0

var float ph3 = 0.0

var float pl1 = 0.0

var float pl2 = 0.0

var float pl3 = 0.0

var float pphprice = 0.0

var float pplprice = 0.0

ph3 := swh_cond ? nz(ph2[1]) : nz(ph3[1])

ph2 := swh_cond ? nz(ph1[1]) : nz(ph2[1])

ph1 := swh_cond ? hprice : nz(ph1[1])

pl3 := swl_cond ? nz(pl2[1]) : nz(pl3[1])

pl2 := swl_cond ? nz(pl1[1]) : nz(pl2[1])

pl1 := swl_cond ? lprice : nz(pl1[1])

pphprice := swh_cond and ph2 > ph1 and ph2 > ph3 ? ph2 : nz(pphprice[1])

pplprice := swl_cond and pl2 < pl1 and pl2 < pl3 ? pl2 : nz(pplprice[1])

// Entry and Exit Logic

if time_cond

// Calculate order quantity based on margin amount

float order_qty = na

if margin_amount > 0

order_qty := (strategy.equity * margin_amount) / close

// Long Position

if allowLongs and le and not na(pphprice) and pphprice != 0

float entry_price_long = pphprice + syminfo.mintick

strategy.entry("PivRevLE", strategy.long, qty=order_qty, comment="PivRevLE", stop=entry_price_long)

if risk_reward_enabled or (trail_stop_enabled and trail_percent > 0.0)

float stop_loss_price = na

float take_profit_price = na

float trail_offset_long = na

float trail_points_long = na

if risk_reward_enabled

float risk_amount = entry_price_long * (risk_percent / 100)

stop_loss_price := entry_price_long - risk_amount

float profit_target = risk_amount * risk_reward_ratio

take_profit_price := entry_price_long + profit_target

if trail_stop_enabled and trail_percent > 0.0

trail_offset_long := (trail_percent / 100.0) * entry_price_long

trail_points_long := trail_offset_long / syminfo.pointvalue

strategy.exit("PivRevLE Exit", from_entry="PivRevLE",

stop=stop_loss_price, limit=take_profit_price,

trail_points=trail_points_long, trail_offset=trail_points_long)

// Short Position

if allowShorts and se and not na(pplprice) and pplprice != 0

float entry_price_short = pplprice - syminfo.mintick

strategy.entry("PivRevSE", strategy.short, qty=order_qty, comment="PivRevSE", stop=entry_price_short)

if risk_reward_enabled or (trail_stop_enabled and trail_percent > 0.0)

float stop_loss_price = na

float take_profit_price = na

float trail_offset_short = na

float trail_points_short = na

if risk_reward_enabled

float risk_amount = entry_price_short * (risk_percent / 100)

stop_loss_price := entry_price_short + risk_amount

float profit_target = risk_amount * risk_reward_ratio

take_profit_price := entry_price_short - profit_target

if trail_stop_enabled and trail_percent > 0.0

trail_offset_short := (trail_percent / 100.0) * entry_price_short

trail_points_short := trail_offset_short / syminfo.pointvalue

strategy.exit("PivRevSE Exit", from_entry="PivRevSE",

stop=stop_loss_price, limit=take_profit_price,

trail_points=trail_points_short, trail_offset=trail_points_short)

// Plotting

plot(lprice, color=color.new(color.red, 55), title='Low Price')

plot(hprice, color=color.new(color.green, 55), title='High Price')

plot(pplprice, color=color.new(color.red, 0), linewidth=2, title='Pivot Low Price')

plot(pphprice, color=color.new(color.green, 0), linewidth=2, title='Pivot High Price')