Gambaran keseluruhan

Ini adalah strategi perdagangan trend-tracking yang menggabungkan UT Bot dan EMA (50-period indeks bergerak rata-rata). Strategi ini melakukan perdagangan garis pendek pada tempoh masa 1 minit, dan menggunakan garis trend pada tempoh masa 5 minit sebagai penapis arah. Strategi ini menggunakan ATR untuk mengira kedudukan berhenti secara dinamik dan menetapkan sasaran berhenti ganda untuk mengoptimumkan keuntungan.

Prinsip Strategi

Logik teras strategi adalah berdasarkan komponen utama berikut:

- Menggunakan UT Bot untuk mengira kedudukan rintangan sokongan dinamik

- Menggunakan 50 kitaran EMA dalam kitaran 5 minit untuk menentukan arah trend keseluruhan

- Gabungan 21 kitaran EMA dan isyarat UT Bot menentukan titik masuk tertentu

- Tetapan Tracking Stop Loss Dinamik melalui ATR

- Tetapkan dua sasaran penangguhan 0.5% dan 1% untuk melonggarkan kedudukan 50% masing-masing

Apabila harga menembusi sokongan / rintangan yang dikira oleh UT Bot, dan 21 kitaran EMA bersilang dengan UT Bot, isyarat perdagangan akan dicetuskan jika harga berada di arah yang betul dalam 5 minit 50 kitaran EMA.

Kelebihan Strategik

- Kombinasi pelbagai kitaran masa meningkatkan kebolehpercayaan transaksi

- Hentian ATR dinamik boleh disesuaikan mengikut turun naik pasaran

- Dua sasaran penangguhan yang seimbang antara keuntungan dan kemenangan

- Pemindaian Heikin Ashi boleh menyaring beberapa penembusan palsu

- Menyokong pilihan arah dagangan yang fleksibel ((boleh melakukan hanya lebih, hanya kosong atau perdagangan dua hala)

Risiko Strategik

- Perdagangan kitaran pendek mungkin menghadapi perbezaan dan kos bayaran yang lebih tinggi

- Sinyal palsu yang sering berlaku dalam pasaran pengurutan mendatar

- Pembatasan berbilang syarat mungkin menyebabkan kehilangan peluang dagangan yang berpotensi

- Tetapan parameter ATR perlu dioptimumkan untuk pasaran yang berbeza

Arah pengoptimuman strategi

- Indeks pertukaran boleh ditambah sebagai pengesahan tambahan

- Pertimbangkan untuk memperkenalkan lebih banyak penunjuk sentimen pasaran

- Membangunkan parameter penyesuaian untuk ciri-ciri turun naik pasaran yang berbeza

- Menambah penapis tempoh transaksi

- Membangunkan Sistem Pengurusan Posisi yang Lebih Cerdas

ringkaskan

Strategi ini membina satu sistem perdagangan yang lengkap dengan menggabungkan pelbagai petunjuk teknikal dan kitaran masa. Ia bukan sahaja mengandungi syarat masuk dan keluar yang jelas, tetapi juga menyediakan mekanisme pengurusan risiko yang baik. Walaupun dalam aplikasi sebenar masih perlu mengoptimumkan parameter mengikut keadaan pasaran tertentu, kerangka keseluruhan mempunyai kepraktisan dan skalabiliti yang baik.

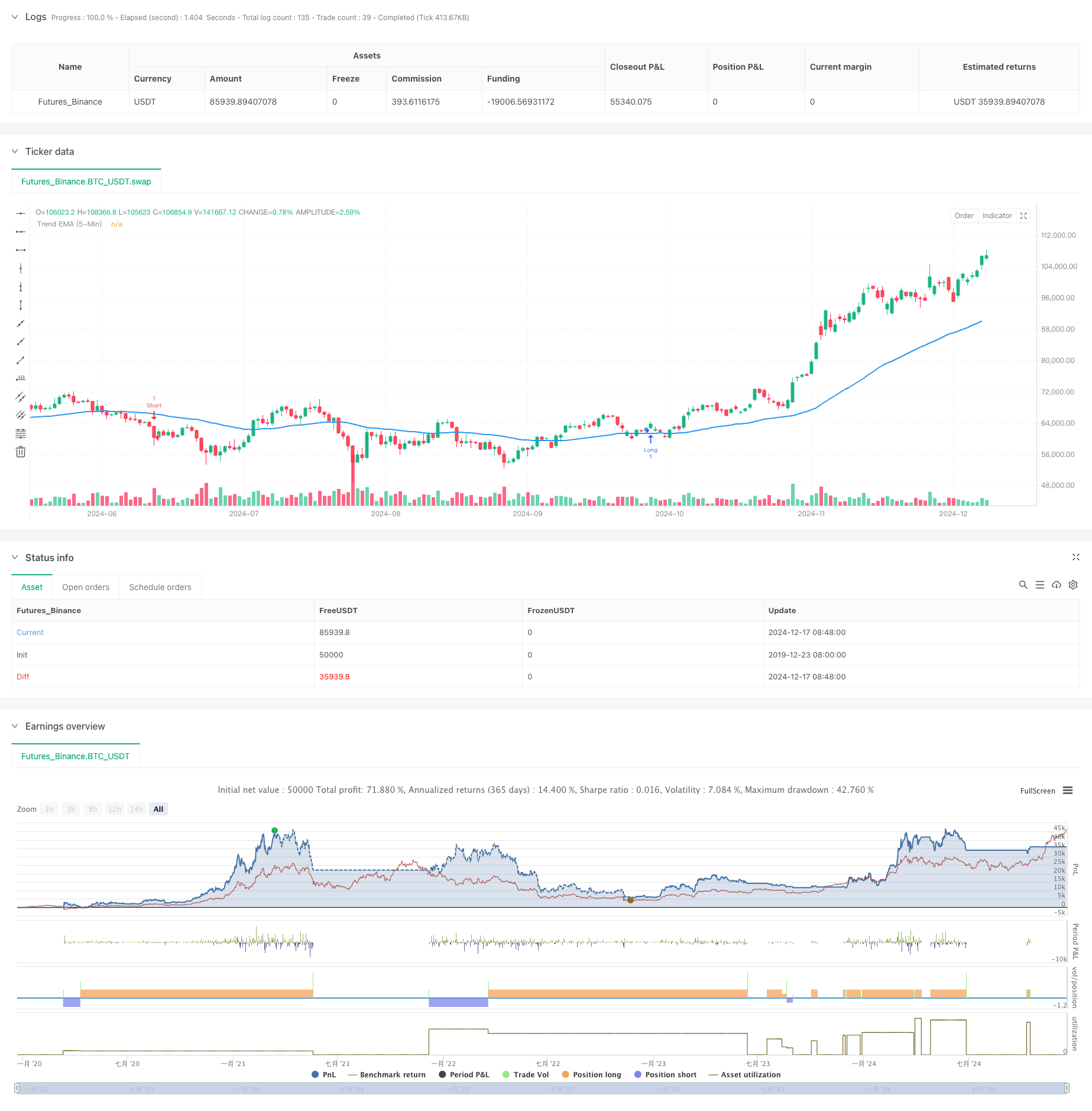

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Created by Nasser mahmoodsani' all rights reserved

// E-mail : [email protected]

strategy("UT Bot Strategy with T/P and S/L and Trend EMA", overlay=true)

// Inputs

along = input(1, title='Key Value (Sensitivity - Long)', group="LONG")

clong = input(10, title='ATR Period (Long)', group="LONG")

h = input(true, title='Signals from Heikin Ashi Candles')

ashort = input(7, title='Key Value (Sensitivity - Short)', group="SHORT")

cshort = input(2, title='ATR Period (Short)', group="SHORT")

tradeType = input.string("Both", title="Trade Type", options=["Buy Only", "Sell Only", "Both"])

tp1_percent = input.float(0.5, title="TP1 Percentage", step=0.1, group="TP Settings") // TP1 % input

tp2_percent = input.float(1.0, title="TP2 Percentage", step=0.1, group="TP Settings") // TP2 % input

sl_percent = input.float(1.0, title="Stop Loss Percentage", step=0.1, group="TP Settings") // SL % input

sl_in_percent = input(true, title="Use Stop Loss in Percentage", group="TP Settings")

tp1_qty = input.float(0.5, title="Take Profit 1 Quantity (as % of position size)", minval=0.0, maxval=1.0, step=0.1)

tp2_qty = input.float(0.5, title="Take Profit 2 Quantity (as % of position size)", minval=0.0, maxval=1.0, step=0.1)

// Check that total quantities for TPs do not exceed 100%

if tp1_qty + tp2_qty > 1

runtime.error("The sum of Take Profit quantities must not exceed 100%.")

// Calculate 50 EMA from 5-Minute Timeframe

trendEmaPeriod = 50

trendEma_5min = request.security(syminfo.tickerid, "5", ta.ema(close, trendEmaPeriod))

plot(trendEma_5min, title="Trend EMA (5-Min)", color=color.blue, linewidth=2)

// Calculations

xATRlong = ta.atr(clong)

xATRshort = ta.atr(cshort)

nLosslong = along * xATRlong

nLossshort = ashort * xATRshort

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close) : close

// LONG

var float xATRTrailingStoplong = na

var float stopLossLong = na

var float takeProfit1 = na

var float takeProfit2 = na

iff_1long = src > nz(xATRTrailingStoplong[1], 0) ? src - nLosslong : src + nLosslong

iff_2long = src < nz(xATRTrailingStoplong[1], 0) and src[1] < nz(xATRTrailingStoplong[1], 0) ? math.min(nz(xATRTrailingStoplong[1]), src + nLosslong) : iff_1long

xATRTrailingStoplong := src > nz(xATRTrailingStoplong[1], 0) and src[1] > nz(xATRTrailingStoplong[1], 0) ? math.max(nz(xATRTrailingStoplong[1]), src - nLosslong) : iff_2long

buy = src > xATRTrailingStoplong and ta.crossover(ta.ema(src, 21), xATRTrailingStoplong) and close > trendEma_5min

if buy and (tradeType == "Buy Only" or tradeType == "Both")

takeProfit1 := close * (1 + tp1_percent / 100)

takeProfit2 := close * (1 + tp2_percent / 100)

// Calculate stop loss based on percentage or ATR

if sl_in_percent

stopLossLong := close * (1 - sl_percent / 100)

else

stopLossLong := close - nLosslong

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit 1", from_entry="Long", limit=takeProfit1, qty=strategy.position_size * tp1_qty)

strategy.exit("Take Profit 2", from_entry="Long", limit=takeProfit2, qty=strategy.position_size * tp2_qty)

strategy.exit("Stop Loss", from_entry="Long", stop=stopLossLong, qty=strategy.position_size)

// // Create Position Projectile for Long

// var line tpLineLong1 = na

// var line tpLineLong2 = na

// var line slLineLong = na

// var label entryLabelLong = na

// // Update projectile on entry

// line.delete(tpLineLong1)

// line.delete(tpLineLong2)

// line.delete(slLineLong)

// label.delete(entryLabelLong)

// tpLineLong1 := line.new(x1=bar_index, y1=takeProfit1, x2=bar_index + 1, y2=takeProfit1, color=color.green, width=2, style=line.style_solid)

// tpLineLong2 := line.new(x1=bar_index, y1=takeProfit2, x2=bar_index + 1, y2=takeProfit2, color=color.green, width=2, style=line.style_dashed)

// slLineLong := line.new(x1=bar_index, y1=stopLossLong, x2=bar_index + 1, y2=stopLossLong, color=color.red, width=2, style=line.style_solid)

// SHORT

var float xATRTrailingStopshort = na

var float stopLossShort = na

var float takeProfit1Short = na

var float takeProfit2Short = na

iff_1short = src > nz(xATRTrailingStopshort[1], 0) ? src - nLossshort : src + nLossshort

iff_2short = src < nz(xATRTrailingStopshort[1], 0) and src[1] < nz(xATRTrailingStopshort[1], 0) ? math.min(nz(xATRTrailingStopshort[1]), src + nLossshort) : iff_1short

xATRTrailingStopshort := src > nz(xATRTrailingStopshort[1], 0) and src[1] > nz(xATRTrailingStopshort[1], 0) ? math.max(nz(xATRTrailingStopshort[1]), src - nLossshort) : iff_2short

sell = src < xATRTrailingStopshort and ta.crossover(xATRTrailingStopshort, ta.ema(src, 21)) and close < trendEma_5min

if sell and (tradeType == "Sell Only" or tradeType == "Both")

takeProfit1Short := close * (1 - tp1_percent / 100)

takeProfit2Short := close * (1 - tp2_percent / 100)

// Calculate stop loss based on percentage or ATR

if sl_in_percent

stopLossShort := close * (1 + sl_percent / 100)

else

stopLossShort := close + nLossshort

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit 1 Short", from_entry="Short", limit=takeProfit1Short, qty=strategy.position_size * tp1_qty)

strategy.exit("Take Profit 2 Short", from_entry="Short", limit=takeProfit2Short, qty=strategy.position_size * tp2_qty)

strategy.exit("Stop Loss Short", from_entry="Short", stop=stopLossShort, qty=strategy.position_size)

// Create Position Projectile for Short

// var line tpLineShort1 = na

// var line tpLineShort2 = na

// var line slLineShort = na

// var label entryLabelShort = na

// // Update projectile on entry

// line.delete(tpLineShort1)

// line.delete(tpLineShort2)

// line.delete(slLineShort)

// label.delete(entryLabelShort)

// tpLineShort1 := line.new(x1=bar_index, y1=takeProfit1Short, x2=bar_index + 1, y2=takeProfit1Short, color=color.green, width=2, style=line.style_solid)

// tpLineShort2 := line.new(x1=bar_index, y1=takeProfit2Short, x2=bar_index + 1, y2=takeProfit2Short, color=color.green, width=2, style=line.style_dashed)

// slLineShort := line.new(x1=bar_index, y1=stopLossShort, x2=bar_index + 1, y2=stopLossShort, color=color.red, width=2, style=line.style_solid)

// Updating Stop Loss after hitting Take Profit 1

if buy and close >= takeProfit1

strategy.exit("Adjusted Stop Loss", from_entry="Long", stop=close)

// Updating Stop Loss after hitting Take Profit 1 for Short

if sell and close <= takeProfit1Short

strategy.exit("Adjusted Stop Loss Short", from_entry="Short", stop=close)