Gambaran keseluruhan

Strategi tersebut ialah strategi pecah aliran berdasarkan VWAP (Volume Weighted Average Price) dan saluran sisihan piawai. Ia membina julat turun naik harga yang dinamik dengan mengira VWAP dan saluran sisihan piawai atas dan bawah untuk menangkap peluang dagangan apabila harga menembusi ke atas. Strategi ini bergantung terutamanya pada isyarat penembusan jalur sisihan piawai untuk perdagangan, dan menetapkan sasaran keuntungan dan selang pesanan untuk mengawal risiko.

Prinsip Strategi

- Pengiraan penunjuk teras:

- Kira VWAP menggunakan harga dan volum HL2 intrahari

- Kira sisihan piawai berdasarkan turun naik harga

- Tetapkan 1.28 kali sisihan piawai saluran atas dan bawah

- Logik urus niaga:

- Syarat kemasukan: Harga melintasi landasan bawah dan kemudian naik ke landasan atas

- Syarat keluar: mencapai sasaran keuntungan yang telah ditetapkan

- Tetapkan selang pesanan minimum untuk mengelakkan perdagangan yang kerap

Kelebihan Strategik

- Statistik Asas

- Rujukan Pangsi Harga Berdasarkan VWAP

- Menggunakan sisihan piawai untuk mengukur kemeruapan

- Laraskan julat dagangan secara dinamik

- Kawalan Risiko

- Tetapkan sasaran keuntungan tetap

- Mengawal kekerapan transaksi

- Strategi panjang sahaja mengurangkan risiko

Risiko Strategik

- Risiko Pasaran

- Kemeruapan liar boleh menyebabkan jerawat palsu

- Sukar untuk memahami titik perubahan arah aliran dengan tepat

- Penurunan berat sebelah membawa kepada kerugian yang lebih besar

- Risiko Parameter

- Sisihan piawai kepekaan tetapan berbilang

- Penetapan sasaran keuntungan perlu dioptimumkan

- Selang dagangan mempengaruhi prestasi keuntungan

Arah pengoptimuman

- Pengoptimuman Isyarat

- Tambah penapis pertimbangan arah aliran

- Disahkan oleh perubahan dalam volum dagangan

- Tambahkan penunjuk teknikal lain untuk mengesahkan

- Pengoptimuman pengurusan risiko

- Tetapkan kedudukan stop loss secara dinamik

- Laraskan kedudukan berdasarkan turun naik

- Meningkatkan mekanisme pengurusan pesanan

ringkaskan

Ini adalah strategi perdagangan kuantitatif yang menggabungkan prinsip statistik dan analisis teknikal. Melalui penyelarasan VWAP dan jalur sisihan piawai, sistem perdagangan yang agak boleh dipercayai dibina. Kelebihan teras strategi terletak pada asas statistik saintifik dan mekanisme kawalan risiko yang sempurna, tetapi ia masih perlu terus mengoptimumkan parameter dan logik dagangan dalam aplikasi praktikal.

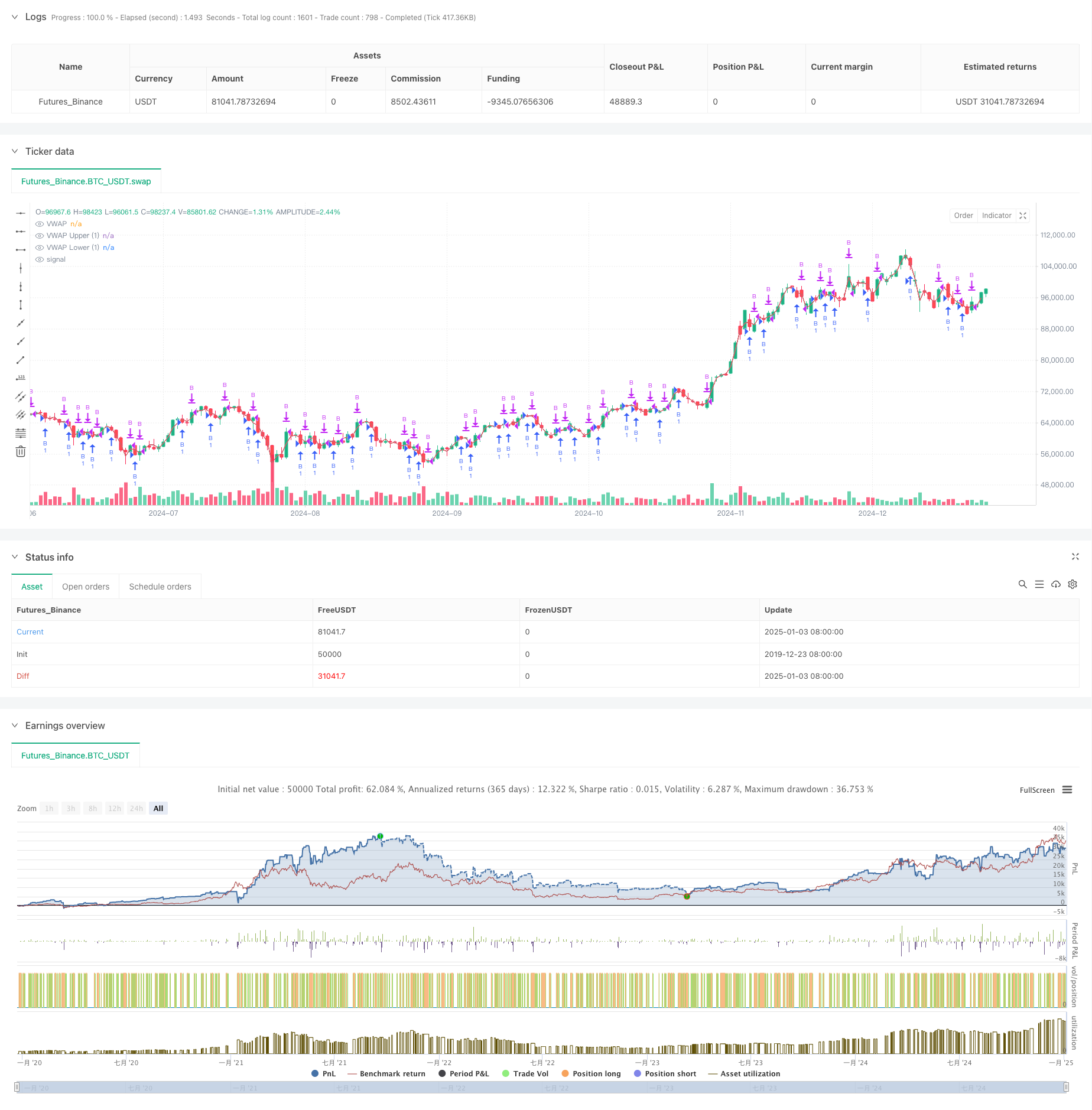

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("VWAP Stdev Bands Strategy (Long Only)", overlay=true)

// Standard Deviation Inputs

devUp1 = input.float(1.28, title="Stdev above (1)")

devDn1 = input.float(1.28, title="Stdev below (1)")

// Show Options

showPrevVWAP = input(false, title="Show previous VWAP close?")

profitTarget = input.float(2, title="Profit Target ($)", minval=0) // Profit target for closing orders

gapMinutes = input.int(15, title="Gap before new order (minutes)", minval=0) // Gap for placing new orders

// VWAP Calculation

var float vwapsum = na

var float volumesum = na

var float v2sum = na

var float prevwap = na // Track the previous VWAP

var float lastEntryPrice = na // Track the last entry price

var int lastEntryTime = na // Track the time of the last entry

start = request.security(syminfo.tickerid, "D", time)

newSession = ta.change(start)

vwapsum := newSession ? hl2 * volume : vwapsum[1] + hl2 * volume

volumesum := newSession ? volume : volumesum[1] + volume

v2sum := newSession ? volume * hl2 * hl2 : v2sum[1] + volume * hl2 * hl2

myvwap = vwapsum / volumesum

dev = math.sqrt(math.max(v2sum / volumesum - myvwap * myvwap, 0))

// Calculate Upper and Lower Bands

lowerBand1 = myvwap - devDn1 * dev

upperBand1 = myvwap + devUp1 * dev

// Plot VWAP and Bands with specified colors

plot(myvwap, style=plot.style_line, title="VWAP", color=color.green, linewidth=1)

plot(upperBand1, style=plot.style_line, title="VWAP Upper (1)", color=color.blue, linewidth=1)

plot(lowerBand1, style=plot.style_line, title="VWAP Lower (1)", color=color.red, linewidth=1)

// Trading Logic (Long Only)

longCondition = close < lowerBand1 and close[1] >= lowerBand1 // Price crosses below the lower band

// Get the current time in minutes

currentTime = timestamp("GMT-0", year(timenow), month(timenow), dayofmonth(timenow), hour(timenow), minute(timenow))

// Check if it's time to place a new order based on gap

canPlaceNewOrder = na(lastEntryTime) or (currentTime - lastEntryTime) >= gapMinutes * 60 * 1000

// Close condition based on profit target

if (strategy.position_size > 0)

if (close - lastEntryPrice >= profitTarget)

strategy.close("B")

lastEntryTime := na // Reset last entry time after closing

// Execute Long Entry

if (longCondition and canPlaceNewOrder)

strategy.entry("B", strategy.long)

lastEntryPrice := close // Store the entry price

lastEntryTime := currentTime // Update the last entry time

// Add label for the entry

label.new(bar_index, close, "B", style=label.style_label_down, color=color.green, textcolor=color.white, size=size.small)

// Optional: Plot previous VWAP for reference

prevwap := newSession ? myvwap[1] : prevwap[1]

plot(showPrevVWAP ? prevwap : na, style=plot.style_circles, color=close > prevwap ? color.green : color.red)