Estratégia de cobertura de futuros e spot manuais de criptomoedas

Autora:FMZ~Lydia, Criado: 2022-08-16 16:01:47, Atualizado: 2023-09-19 21:39:31

No entanto, se você fizer isso manualmente, é muito inconveniente mudar de página de várias bolsas, observar preços e calcular a diferença, e às vezes você pode querer ver mais variedades, e não é necessário configurar vários monitores para exibir o mercado. É possível alcançar esse objetivo de operação manual com uma estratégia semi-automática? É melhor ter várias espécies, oh! Sim, é melhor abrir e fechar posições com um clique. Oh! Sim, há também uma exibição de posição...

Quando houver necessidade, faça-o agora!

Projetar uma estratégia de cobertura de futuros e pontos manuais de criptomoedas

A escrita é bastante longa, com menos de 600 linhas de código.

function createManager(fuEx, spEx, symbolPairs, cmdHedgeAmount, fuMarginLevel, fuMarginReservedRatio) {

var self = {}

self.fuEx = fuEx

self.spEx = spEx

self.symbolPairs = symbolPairs

self.pairs = []

self.fuExTickers = null

self.spExTickers = null

self.tickerUpdateTS = 0

self.fuMarginLevel = fuMarginLevel

self.fuMarginReservedRatio = fuMarginReservedRatio

self.cmdHedgeAmount = cmdHedgeAmount

self.preUpdateAccTS = 0

self.accAndPosUpdateCount = 0

self.profit = []

self.allPairs = []

self.PLUS = 0

self.MINUS = 1

self.COVER_PLUS = 2

self.COVER_MINUS = 3

self.arrTradeTypeDesc = ["positive arbitrage", "reverse arbitrage", "close positive arbitrage", "close reverse arbitrage"]

self.updateTickers = function() {

self.fuEx.goGetTickers()

self.spEx.goGetTickers()

var fuExTickers = self.fuEx.getTickers()

var spExTickers = self.spEx.getTickers()

if (!fuExTickers || !spExTickers) {

return null

}

self.fuExTickers = fuExTickers

self.spExTickers = spExTickers

self.tickerUpdateTS = new Date().getTime()

return true

}

self.hedge = function(index, fuSymbol, spSymbol, tradeType, amount) {

var fe = self.fuEx

var se = self.spEx

var pair = self.pairs[index]

var timeStamp = new Date().getTime()

var fuDirection = null

var spDirection = null

var fuPrice = null

var spPrice = null

if (tradeType == self.PLUS) {

fuDirection = fe.OPEN_SHORT

spDirection = se.OPEN_LONG

fuPrice = pair.fuTicker.bid1

spPrice = pair.spTicker.ask1

} else if (tradeType == self.MINUS) {

fuDirection = fe.OPEN_LONG

spDirection = se.OPEN_SHORT

fuPrice = pair.fuTicker.ask1

spPrice = pair.spTicker.bid1

} else if (tradeType == self.COVER_PLUS) {

fuDirection = fe.COVER_SHORT

spDirection = se.COVER_LONG

fuPrice = pair.fuTicker.ask1

spPrice = pair.spTicker.bid1

} else if (tradeType == self.COVER_MINUS) {

fuDirection = fe.COVER_LONG

spDirection = se.COVER_SHORT

fuPrice = pair.fuTicker.bid1

spPrice = pair.spTicker.ask1

} else {

throw "unknow tradeType!"

}

fe.goGetAcc(fuSymbol, timeStamp)

se.goGetAcc(spSymbol, timeStamp)

var nowFuAcc = fe.getAcc(fuSymbol, timeStamp)

var nowSpAcc = se.getAcc(spSymbol, timeStamp)

if (!nowFuAcc || !nowSpAcc) {

Log(fuSymbol, spSymbol, ", failed to get account data")

return

}

pair.nowFuAcc = nowFuAcc

pair.nowSpAcc = nowSpAcc

var nowFuPos = fe.getFuPos(fuSymbol, timeStamp)

var nowSpPos = se.getSpPos(spSymbol, spPrice, pair.initSpAcc, pair.nowSpAcc)

if (!nowFuPos || !nowSpPos) {

Log(fuSymbol, spSymbol, ", failed to get position data")

return

}

pair.nowFuPos = nowFuPos

pair.nowSpPos = nowSpPos

var fuAmount = amount

var spAmount = amount

if (tradeType == self.PLUS || tradeType == self.MINUS) {

if (nowFuAcc.Balance < (pair.initFuAcc.Balance + pair.initFuAcc.FrozenBalance) * self.fuMarginReservedRatio + (fuAmount * fuPrice / self.fuMarginLevel)) {

Log(pair.fuSymbol, "insufficient deposit!", "this plan uses", (fuAmount * fuPrice / self.fuMarginLevel), "currently available:", nowFuAcc.Balance,

"Plan to reserve:", (pair.initFuAcc.Balance + pair.initFuAcc.FrozenBalance) * self.fuMarginReservedRatio)

return

}

if ((tradeType == self.PLUS && nowSpAcc.Balance < spAmount * spPrice)) {

Log(pair.spSymbol, "insufficient funds!", "this purchase plans to use", spAmount * spPrice, "currently available:", nowSpAcc.Balance)

return

} else if (tradeType == self.MINUS && nowSpAcc.Stocks < spAmount) {

Log(pair.spSymbol, "insufficient funds!", "this selling plans to use", spAmount, "currently available:", nowSpAcc.Stocks)

return

}

} else {

var fuLongPos = self.getLongPos(nowFuPos)

var fuShortPos = self.getShortPos(nowFuPos)

var spLongPos = self.getLongPos(nowSpPos)

var spShortPos = self.getShortPos(nowSpPos)

if ((tradeType == self.COVER_PLUS && !fuShortPos) || (tradeType == self.COVER_MINUS && !fuLongPos)) {

Log(fuSymbol, spSymbol, ", there is no corresponding position in futures!")

return

} else if (tradeType == self.COVER_PLUS && Math.abs(fuShortPos.amount) < fuAmount) {

fuAmount = Math.abs(fuShortPos.amount)

} else if (tradeType == self.COVER_MINUS && Math.abs(fuLongPos.amount) < fuAmount) {

fuAmount = Math.abs(fuLongPos.amount)

}

if ((tradeType == self.COVER_PLUS && !spLongPos) || (tradeType == self.COVER_MINUS && !spShortPos)) {

Log(fuSymbol, spSymbol, ", there is no corresponding position in the spot!")

return

} else if (tradeType == self.COVER_PLUS && Math.min(Math.abs(spLongPos.amount), nowSpAcc.Stocks) < spAmount) {

spAmount = Math.min(Math.abs(spLongPos.amount), nowSpAcc.Stocks)

} else if (tradeType == self.COVER_MINUS && Math.min(Math.abs(spShortPos.amount), nowSpAcc.Balance / spPrice) < spAmount) {

spAmount = Math.min(Math.abs(spShortPos.amount), nowSpAcc.Balance / spPrice)

}

}

fuAmount = fe.calcAmount(fuSymbol, fuDirection, fuPrice, fuAmount)

spAmount = se.calcAmount(spSymbol, spDirection, spPrice, spAmount)

if (!fuAmount || !spAmount) {

Log(fuSymbol, spSymbol, "order quantity calculation error:", fuAmount, spAmount)

return

} else {

fuAmount = fe.calcAmount(fuSymbol, fuDirection, fuPrice, fuAmount[1])

spAmount = se.calcAmount(spSymbol, spDirection, spPrice, Math.min(fuAmount[1], spAmount[1]))

if (!fuAmount || !spAmount) {

Log(fuSymbol, spSymbol, "order quantity calculation error:", fuAmount, spAmount)

return

}

}

Log("contract code:", fuSymbol + "/" + spSymbol, "direction:", self.arrTradeTypeDesc[tradeType], "difference:", fuPrice - spPrice, "quantity of futures:", fuAmount, "quantity of spots:", spAmount, "@")

fe.goGetTrade(fuSymbol, fuDirection, fuPrice, fuAmount[0])

se.goGetTrade(spSymbol, spDirection, spPrice, spAmount[0])

var feIdMsg = fe.getTrade()

var seIdMsg = se.getTrade()

return [feIdMsg, seIdMsg]

}

self.process = function() {

var nowTS = new Date().getTime()

if(!self.updateTickers()) {

return

}

_.each(self.pairs, function(pair, index) {

var fuTicker = null

var spTicker = null

_.each(self.fuExTickers, function(ticker) {

if (ticker.originalSymbol == pair.fuSymbol) {

fuTicker = ticker

}

})

_.each(self.spExTickers, function(ticker) {

if (ticker.originalSymbol == pair.spSymbol) {

spTicker = ticker

}

})

if (fuTicker && spTicker) {

pair.canTrade = true

} else {

pair.canTrade = false

}

fuTicker = fuTicker ? fuTicker : {}

spTicker = spTicker ? spTicker : {}

pair.fuTicker = fuTicker

pair.spTicker = spTicker

pair.plusDiff = fuTicker.bid1 - spTicker.ask1

pair.minusDiff = fuTicker.ask1 - spTicker.bid1

if (pair.plusDiff && pair.minusDiff) {

pair.plusDiff = _N(pair.plusDiff, Math.max(self.fuEx.judgePrecision(fuTicker.bid1), self.spEx.judgePrecision(spTicker.ask1)))

pair.minusDiff = _N(pair.minusDiff, Math.max(self.fuEx.judgePrecision(fuTicker.ask1), self.spEx.judgePrecision(spTicker.bid1)))

}

if (nowTS - self.preUpdateAccTS > 1000 * 60 * 5) {

self.fuEx.goGetAcc(pair.fuSymbol, nowTS)

self.spEx.goGetAcc(pair.spSymbol, nowTS)

var fuAcc = self.fuEx.getAcc(pair.fuSymbol, nowTS)

var spAcc = self.spEx.getAcc(pair.spSymbol, nowTS)

if (fuAcc) {

pair.nowFuAcc = fuAcc

}

if (spAcc) {

pair.nowSpAcc = spAcc

}

var nowFuPos = self.fuEx.getFuPos(pair.fuSymbol, nowTS)

var nowSpPos = self.spEx.getSpPos(pair.spSymbol, (pair.spTicker.ask1 + pair.spTicker.bid1) / 2, pair.initSpAcc, pair.nowSpAcc)

if (nowFuPos && nowSpPos) {

pair.nowFuPos = nowFuPos

pair.nowSpPos = nowSpPos

self.keepBalance(pair)

} else {

Log(pair.fuSymbol, pair.spSymbol, "portfolio position update failed, nowFuPos:", nowFuPos, " nowSpPos:", nowSpPos)

}

self.accAndPosUpdateCount++

}

})

if (nowTS - self.preUpdateAccTS > 1000 * 60 * 5) {

self.preUpdateAccTS = nowTS

self.profit = self.calcProfit()

LogProfit(self.profit[0], "futures:", self.profit[1], "spots:", self.profit[2], "&") // Print the total profit curve, use the & character not to print the profit log

}

var cmd = GetCommand()

if(cmd) {

Log("interactive commands:", cmd)

var arr = cmd.split(":")

if(arr[0] == "plus") {

var pair = self.pairs[parseFloat(arr[1])]

self.hedge(parseFloat(arr[1]), pair.fuSymbol, pair.spSymbol, self.PLUS, self.cmdHedgeAmount)

} else if (arr[0] == "cover_plus") {

var pair = self.pairs[parseFloat(arr[1])]

self.hedge(parseFloat(arr[1]), pair.fuSymbol, pair.spSymbol, self.COVER_PLUS, self.cmdHedgeAmount)

}

}

LogStatus("current time:", _D(), "data update time:", _D(self.tickerUpdateTS), "position account update count:", self.accAndPosUpdateCount, "\n", "Profit and loss:", self.profit[0], "futures profit and loss:", self.profit[1],

"spot profit and loss:", self.profit[2], "\n`" + JSON.stringify(self.returnTbl()) + "`", "\n`" + JSON.stringify(self.returnPosTbl()) + "`")

}

self.keepBalance = function (pair) {

var nowFuPos = pair.nowFuPos

var nowSpPos = pair.nowSpPos

var fuLongPos = self.getLongPos(nowFuPos)

var fuShortPos = self.getShortPos(nowFuPos)

var spLongPos = self.getLongPos(nowSpPos)

var spShortPos = self.getShortPos(nowSpPos)

if (fuLongPos || spShortPos) {

Log("reverse arbitrage is not supported")

}

if (fuShortPos || spLongPos) {

var fuHoldAmount = fuShortPos ? fuShortPos.amount : 0

var spHoldAmount = spLongPos ? spLongPos.amount : 0

var sum = fuHoldAmount + spHoldAmount

if (sum > 0) {

var spAmount = self.spEx.calcAmount(pair.spSymbol, self.spEx.COVER_LONG, pair.spTicker.bid1, Math.abs(sum), true)

if (spAmount) {

Log(pair.fuSymbol, pair.spSymbol, "excess spot positions", Math.abs(sum), "fuShortPos:", fuShortPos, "spLongPos:", spLongPos)

self.spEx.goGetTrade(pair.spSymbol, self.spEx.COVER_LONG, pair.spTicker.bid1, spAmount[0])

var seIdMsg = self.spEx.getTrade()

}

} else if (sum < 0) {

var fuAmount = self.fuEx.calcAmount(pair.fuSymbol, self.fuEx.COVER_SHORT, pair.fuTicker.ask1, Math.abs(sum), true)

if (fuAmount) {

Log(pair.fuSymbol, pair.spSymbol, "long futures positions", Math.abs(sum), "fuShortPos:", fuShortPos, "spLongPos:", spLongPos)

self.fuEx.goGetTrade(pair.fuSymbol, self.fuEx.COVER_SHORT, pair.fuTicker.ask1, fuAmount[0])

var feIdMsg = self.fuEx.getTrade()

}

}

}

}

self.getLongPos = function (positions) {

return self.getPosByDirection(positions, PD_LONG)

}

self.getShortPos = function (positions) {

return self.getPosByDirection(positions, PD_SHORT)

}

self.getPosByDirection = function (positions, direction) {

var ret = null

if (positions.length > 2) {

Log("position error, three positions detected:", JSON.stringify(positions))

return ret

}

_.each(positions, function(pos) {

if ((direction == PD_LONG && pos.amount > 0) || (direction == PD_SHORT && pos.amount < 0)) {

ret = pos

}

})

return ret

}

self.calcProfit = function() {

var arrInitFuAcc = []

var arrNowFuAcc = []

_.each(self.pairs, function(pair) {

arrInitFuAcc.push(pair.initFuAcc)

arrNowFuAcc.push(pair.nowFuAcc)

})

var fuProfit = self.fuEx.calcProfit(arrInitFuAcc, arrNowFuAcc)

var spProfit = 0

var deltaBalance = 0

_.each(self.pairs, function(pair) {

var nowSpAcc = pair.nowSpAcc

var initSpAcc = pair.initSpAcc

var stocksDiff = nowSpAcc.Stocks + nowSpAcc.FrozenStocks - (initSpAcc.Stocks + initSpAcc.FrozenStocks)

var price = stocksDiff > 0 ? pair.spTicker.bid1 : pair.spTicker.ask1

spProfit += stocksDiff * price

deltaBalance = nowSpAcc.Balance + nowSpAcc.FrozenBalance - (initSpAcc.Balance + initSpAcc.FrozenBalance)

})

spProfit += deltaBalance

return [fuProfit + spProfit, fuProfit, spProfit]

}

self.returnPosTbl = function() {

var posTbl = {

type : "table",

title : "positions",

cols : ["index", "future", "future leverage", "qunatity", "spot", "qunatity"],

rows : []

}

_.each(self.pairs, function(pair, index) {

var nowFuPos = pair.nowFuPos

var nowSpPos = pair.nowSpPos

for (var i = 0 ; i < nowFuPos.length ; i++) {

if (nowSpPos.length > 0) {

posTbl.rows.push([index, nowFuPos[i].symbol, nowFuPos[i].marginLevel, nowFuPos[i].amount, nowSpPos[0].symbol, nowSpPos[0].amount])

} else {

posTbl.rows.push([index, nowFuPos[i].symbol, nowFuPos[i].marginLevel, nowFuPos[i].amount, "--", "--"])

}

}

})

return posTbl

}

self.returnTbl = function() {

var fuExName = "[" + self.fuEx.getExName() + "]"

var spExName = "[" + self.spEx.getExName() + "]"

var combiTickersTbl = {

type : "table",

title : "combiTickersTbl",

cols : ["future", "code" + fuExName, "entrusted selling", "entrusted purchase", "spot", "code" + spExName, "entrusted selling", "entrusted purchase", "positive hedging spreads", "reverse hedging spreads", "positive hedge", "positive hedge closeout"],

rows : []

}

_.each(self.pairs, function(pair, index) {

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spTicker.originalSymbol)

combiTickersTbl.rows.push([

pair.fuTicker.symbol,

pair.fuTicker.originalSymbol,

pair.fuTicker.ask1,

pair.fuTicker.bid1,

pair.spTicker.symbol,

pair.spTicker.originalSymbol,

pair.spTicker.ask1,

pair.spTicker.bid1,

pair.plusDiff,

pair.minusDiff,

{'type':'button', 'cmd': 'plus:' + String(index), 'name': 'positive arbitrage'},

{'type':'button', 'cmd': 'cover_plus:' + String(index), 'name': 'close positive arbitrage'}

])

})

var accsTbl = {

type : "table",

title : "accs",

cols : ["code" + fuExName, "initial coin", "initial frozen coin", "initial money", "initial frozen money", "coin", "frozen coin", "money", "frozen money",

"code" + spExName, "initial coin", "initial frozen coin", "initial money", "initial frozen money", "coin", "frozen coin", "money", "frozen money"],

rows : []

}

_.each(self.pairs, function(pair) {

var arr = [pair.fuTicker.originalSymbol, pair.initFuAcc.Stocks, pair.initFuAcc.FrozenStocks, pair.initFuAcc.Balance, pair.initFuAcc.FrozenBalance, pair.nowFuAcc.Stocks, pair.nowFuAcc.FrozenStocks, pair.nowFuAcc.Balance, pair.nowFuAcc.FrozenBalance,

pair.spTicker.originalSymbol, pair.initSpAcc.Stocks, pair.initSpAcc.FrozenStocks, pair.initSpAcc.Balance, pair.initSpAcc.FrozenBalance, pair.nowSpAcc.Stocks, pair.nowSpAcc.FrozenStocks, pair.nowSpAcc.Balance, pair.nowSpAcc.FrozenBalance]

for (var i = 0 ; i < arr.length ; i++) {

if (typeof(arr[i]) == "number") {

arr[i] = _N(arr[i], 6)

}

}

accsTbl.rows.push(arr)

})

var symbolInfoTbl = {

type : "table",

title : "symbolInfos",

cols : ["contract code" + fuExName, "quantity accuracy", "price accuracy", "multiplier", "minimum order quantity", "spot code" + spExName, "quantity accuracy", "price accuracy", "multiplier", "minimum order quantity"],

rows : []

}

_.each(self.pairs, function(pair) {

var fuSymbolInfo = self.fuEx.getSymbolInfo(pair.fuTicker.originalSymbol)

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spTicker.originalSymbol)

symbolInfoTbl.rows.push([fuSymbolInfo.symbol, fuSymbolInfo.amountPrecision, fuSymbolInfo.pricePrecision, fuSymbolInfo.multiplier, fuSymbolInfo.min,

spSymbolInfo.symbol, spSymbolInfo.amountPrecision, spSymbolInfo.pricePrecision, spSymbolInfo.multiplier, spSymbolInfo.min])

})

var allPairs = []

_.each(self.fuExTickers, function(fuTicker) {

_.each(self.spExTickers, function(spTicker) {

if (fuTicker.symbol == spTicker.symbol) {

allPairs.push({symbol: fuTicker.symbol, fuSymbol: fuTicker.originalSymbol, spSymbol: spTicker.originalSymbol, plus: fuTicker.bid1 - spTicker.ask1})

}

})

})

_.each(allPairs, function(pair) {

var findPair = null

_.each(self.allPairs, function(selfPair) {

if (pair.fuSymbol == selfPair.fuSymbol && pair.spSymbol == selfPair.spSymbol) {

findPair = selfPair

}

})

if (findPair) {

findPair.minPlus = pair.plus < findPair.minPlus ? pair.plus : findPair.minPlus

findPair.maxPlus = pair.plus > findPair.maxPlus ? pair.plus : findPair.maxPlus

pair.minPlus = findPair.minPlus

pair.maxPlus = findPair.maxPlus

} else {

self.allPairs.push({symbol: pair.symbol, fuSymbol: pair.fuSymbol, spSymbol: pair.spSymbol, plus: pair.plus, minPlus: pair.plus, maxPlus: pair.plus})

pair.minPlus = pair.plus

pair.maxPlus = pair.plus

}

})

return [combiTickersTbl, accsTbl, symbolInfoTbl]

}

self.onexit = function() {

_G("pairs", self.pairs)

_G("allPairs", self.allPairs)

Log("perform tailing processing and save data", "#FF0000")

}

self.init = function() {

var fuExName = self.fuEx.getExName()

var spExName = self.spEx.getExName()

var gFuExName = _G("fuExName")

var gSpExName = _G("spExName")

if ((gFuExName && gFuExName != fuExName) || (gSpExName && gSpExName != spExName)) {

throw "the exchange object has changed and the data needs to be reset"

}

if (!gFuExName) {

_G("fuExName", fuExName)

}

if (!gSpExName) {

_G("spExName", spExName)

}

self.allPairs = _G("allPairs")

if (!self.allPairs) {

self.allPairs = []

}

var arrPair = _G("pairs")

if (!arrPair) {

arrPair = []

}

var arrStrPair = self.symbolPairs.split(",")

var timeStamp = new Date().getTime()

_.each(arrStrPair, function(strPair) {

var arrSymbol = strPair.split("|")

var recoveryPair = null

_.each(arrPair, function(pair) {

if (pair.fuSymbol == arrSymbol[0] && pair.spSymbol == arrSymbol[1]) {

recoveryPair = pair

}

})

if (!recoveryPair) {

var pair = {

fuSymbol : arrSymbol[0],

spSymbol : arrSymbol[1],

fuTicker : {},

spTicker : {},

plusDiff : null,

minusDiff : null,

canTrade : false,

initFuAcc : null,

initSpAcc : null,

nowFuAcc : null,

nowSpAcc : null,

nowFuPos : null,

nowSpPos : null,

fuMarginLevel : null

}

self.pairs.push(pair)

Log("初始化:", pair)

} else {

self.pairs.push(recoveryPair)

Log("恢复:", recoveryPair)

}

self.fuEx.pushSubscribeSymbol(arrSymbol[0])

self.spEx.pushSubscribeSymbol(arrSymbol[1])

if (!self.pairs[self.pairs.length - 1].initFuAcc) {

self.fuEx.goGetAcc(arrSymbol[0], timeStamp)

var nowFuAcc = self.fuEx.getAcc(arrSymbol[0], timeStamp)

self.pairs[self.pairs.length - 1].initFuAcc = nowFuAcc

self.pairs[self.pairs.length - 1].nowFuAcc = nowFuAcc

}

if (!self.pairs[self.pairs.length - 1].initSpAcc) {

self.spEx.goGetAcc(arrSymbol[1], timeStamp)

var nowSpAcc = self.spEx.getAcc(arrSymbol[1], timeStamp)

self.pairs[self.pairs.length - 1].initSpAcc = nowSpAcc

self.pairs[self.pairs.length - 1].nowSpAcc = nowSpAcc

}

Sleep(300)

})

Log("self.pairs:", self.pairs)

_.each(self.pairs, function(pair) {

var fuSymbolInfo = self.fuEx.getSymbolInfo(pair.fuSymbol)

if (!fuSymbolInfo) {

throw pair.fuSymbol + ", species information acquisition failure!"

} else {

Log(pair.fuSymbol, fuSymbolInfo)

}

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spSymbol)

if (!spSymbolInfo) {

throw pair.spSymbol + ", species information acquisition failure!"

} else {

Log(pair.spSymbol, spSymbolInfo)

}

})

_.each(self.pairs, function(pair) {

pair.fuMarginLevel = self.fuMarginLevel

var ret = self.fuEx.setMarginLevel(pair.fuSymbol, self.fuMarginLevel)

Log(pair.fuSymbol, "leverage settings:", ret)

if (!ret) {

throw "initial setting of leverage failed!"

}

})

}

self.init()

return self

}

var manager = null

function main() {

if(isReset) {

_G(null)

LogReset(1)

LogProfitReset()

LogVacuum()

Log("reset all data", "#FF0000")

}

if (isOKEX_V5_Simulate) {

for (var i = 0 ; i < exchanges.length ; i++) {

if (exchanges[i].GetName() == "Futures_OKCoin" || exchanges[i].GetName() == "OKEX") {

var ret = exchanges[i].IO("simulate", true)

Log(exchanges[i].GetName(), "switch analog disk")

}

}

}

var fuConfigureFunc = null

var spConfigureFunc = null

if (exchanges.length != 2) {

throw "two exchange objects need to be added!"

} else {

var fuName = exchanges[0].GetName()

if (fuName == "Futures_OKCoin" && isOkexV5) {

fuName += "_V5"

Log("Use OKEX V5 interface")

}

var spName = exchanges[1].GetName()

fuConfigureFunc = $.getConfigureFunc()[fuName]

spConfigureFunc = $.getConfigureFunc()[spName]

if (!fuConfigureFunc || !spConfigureFunc) {

throw (fuConfigureFunc ? "" : fuName) + " " + (spConfigureFunc ? "" : spName) + " not support!"

}

}

var fuEx = $.createBaseEx(exchanges[0], fuConfigureFunc)

var spEx = $.createBaseEx(exchanges[1], spConfigureFunc)

manager = createManager(fuEx, spEx, symbolPairs, cmdHedgeAmount, fuMarginLevel, fuMarginReservedRatio)

while(true) {

manager.process()

Sleep(interval)

}

}

function onerror() {

if (manager) {

manager.onexit()

}

}

function onexit() {

if (manager) {

manager.onexit()

}

}

Uma vez que a estratégia multi-espécies é mais adequada para o projeto IO, uma biblioteca de classes modelo chamadaMultiSymbolCtrlLibPor isso, a estratégia não pode ser testada de volta, mas pode ser testada com o bot simulado (embora o bot real tenha sido executado por 2 meses, a fase de teste e familiarização ainda é executada com o bot simulado).

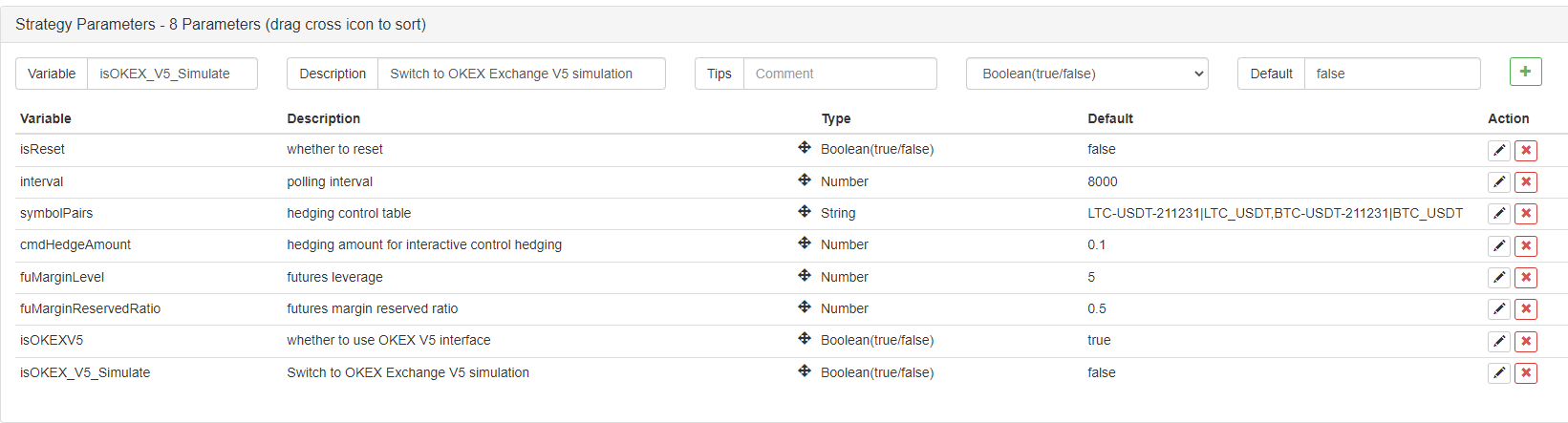

Parâmetros

Antes de começar o teste, vamos falar primeiro sobre o projeto de parâmetros.

Não existem muitos parâmetros estratégicos, os mais importantes são:

-

Tabela de controlo de cobertura

LTC-USDT-211231|LTC_USDT,BTC-USDT-211231|BTC_USDTAqui está a estratégia de configuração para monitorar essas combinações. Por exemplo, a configuração acima é para monitorar o contrato Litecoin (LTC-USDT-211231) da bolsa de futuros e o Litecoin (LTC_USDT) da bolsa de spot.

|As combinações diferentes são separadas por,Observe que os símbolos aqui estão todos no estado do método de entrada Inglês! Estes códigos de contrato e pares de negociação à vista são definidos pela bolsa, não pela plataforma FMZ. Por exemplo,LTC-USDT-211231é um contrato do segundo trimestre atualmente, chamadonext_quarterno FMZ, e o sistema de interface do OKEXé chamado LTC-USDT-211231Para oLitecoin/USDTO bot de simulação WexApp é escrito comoLTC_USDTEntão como preencher aqui depende do nome definido na troca. -

Valor de cobertura para a cobertura de controlo interativo Clique no botão de controle da barra de status para cobrir o valor. A unidade é o número de moedas, e a estratégia será automaticamente convertida no número de contratos para fazer uma ordem.

Outras funções são definir o disco analógico, redefinir os dados, usar a interface OKEX V5 (porque também é compatível com o V3) e assim por diante, que não são particularmente importantes.

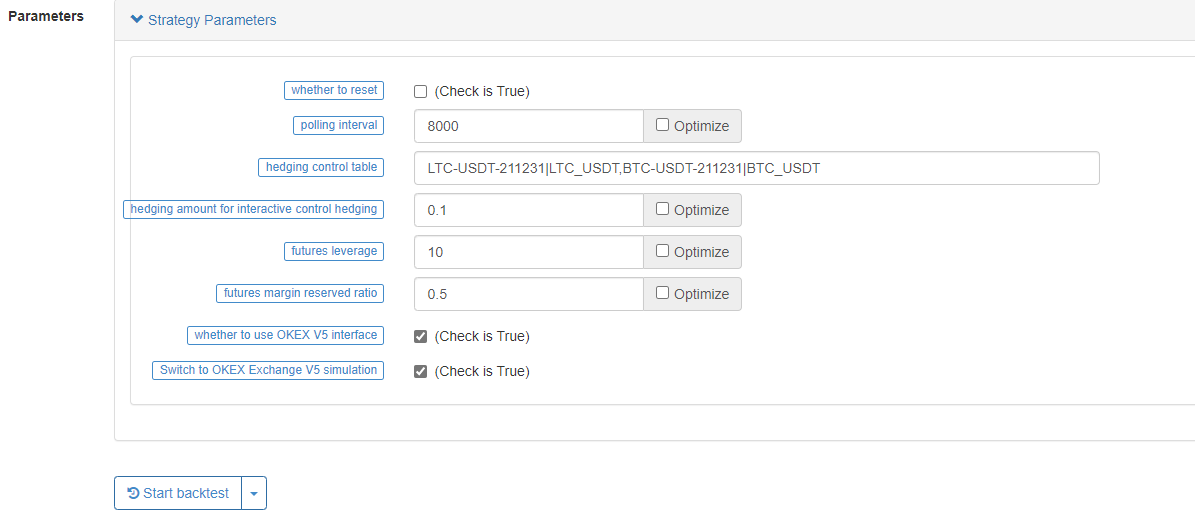

Testes

O primeiro objeto de troca adiciona a troca de futuros, e o segundo adiciona o objeto de troca spot.

As bolsas de futuros usam bots de simulação de interface OKEX

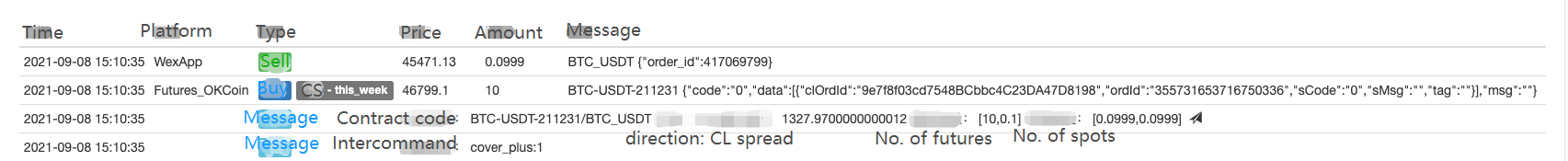

Clique no botão de configuração positiva da combinação BTC e abra a posição.

Clique para fechar a arbitragem positiva então.

Perder!!! Parece que o fechamento da posição não pode cobrir a taxa de manipulação quando o diferencial de lucro é pequeno, é necessário calcular a taxa de manipulação, o deslizamento aproximado e planejar o diferencial de forma razoável, e depois fechar a posição.

Código fonte da estratégia:https://www.fmz.com/strategy/314352

Os interessados podem usá-lo e modificá-lo.

- Práticas de quantificação da DEX exchange ((1) -- dYdX v4 Guia de uso

- Introdução ao conjunto de Lead-Lag na moeda digital (3)

- Introdução à arbitragem de lead-lag em criptomoedas (2)

- Introdução ao suporte de Lead-Lag na moeda digital (2)

- Discussão sobre a recepção de sinais externos da plataforma FMZ: uma solução completa para receber sinais com serviço HTTP em estratégia

- Discussão da recepção de sinais externos da plataforma FMZ: estratégias para o sistema completo de recepção de sinais do serviço HTTP embutido

- Introdução à arbitragem de lead-lag em criptomoedas (1)

- Introdução ao suporte de Lead-Lag na moeda digital

- Discussão sobre a recepção de sinais externos da plataforma FMZ: API estendida VS estratégia Serviço HTTP integrado

- Exploração da recepção de sinais externos da plataforma FMZ: API de extensão vs estratégia de serviços HTTP embutidos

- Discussão sobre o método de teste de estratégia baseado no gerador de tickers aleatórios

- Projeto de Sistema de Gestão da Sincronização de Encomendas Baseado no FMZ Quant (1)

- Análise da estratégia do LeeksReaper (1)

- O montante das posições em risco da derivada deve ser calculado de acordo com o método de classificação da derivada.

- Situação recente e funcionamento recomendado da estratégia de taxa de financiamento

- Revisão do Mercado de Moedas Digitais em 2021 e a Estratégia 10 vezes mais simples perdida

- Modelo de Fator de Moeda Digital

- A estratégia de dupla EMA equilátera é do YouTube.

- Escrever uma ferramenta de negociação semi-automática usando o linguagem Pine

- Modelo de fatores de moeda digital

- Seja seu próprio salvador no negócio.

- Conceção de uma estratégia de cobertura spot de criptomoedas (1)

- Uma estratégia de equilíbrio perpétuo adequada para um mercado de baixa

- Negociação Quantitativa de Criptomoedas para iniciantes - Levá-lo mais perto da Quantitativa de Criptomoedas (8)

- Negociação Quantitativa de Criptomoedas para iniciantes - Levá-lo mais perto de Criptomoeda Quantitativa (7)

- Negociação quantitativa de criptomoedas para iniciantes - aproximando-o da negociação quantitativa de criptomoedas (6)

- Visão geral e arquitetura da interface principal da plataforma de negociação quântica FMZ

- Projeto de estratégia Martingale para futuros de criptomoedas

- Negociação Quantitativa de Criptomoedas para iniciantes - Levá-lo mais perto da Criptomoeda Quantitativa (5)

- Negociação quantitativa de criptomoedas para iniciantes - aproximando-o da negociação quantitativa de criptomoedas (4)

- Negociação Quantitativa de Criptomoedas para iniciantes - Levá-lo mais perto da Criptomoeda Quantitativa (3)