Microfone caindo aos pedaços e estratégia de média móvel de vários períodos de tempo

Visão geral

Esta estratégia combina o indicador MACD e a linha média do quadro de tempo múltipla para formar uma estratégia de negociação de longo prazo e bidirecional que utiliza a tendência e os sinais de reversão de tendência. A estratégia pode obter lucros adicionais em situações de tendência e, ao mesmo tempo, aproveitar oportunidades de reversão.

Princípio da estratégia

Utilizando dois grupos de EMAs de diferentes períodos de tempo, a equipe de EMAs colaborou com filtros de múltiplos quadros de tempo para determinar a direção do horizonte: 15 minutos de EMAs rápidas acima de 1 hora de EMAs lentas para filtros de baixa, e 15 minutos de EMAs rápidas abaixo de 1 hora de EMAs lentas para filtros de baixa.

Quando se observa a formação de um desvio de microfone (desvio entre a coluna e o preço), o julgamento pode ser invertido.

No início do filtro de baixa, se houver um mercado de touros desviado (preço novo alto e MACD não inovador alto), aguarde o MACD na linha zero, faça mais; no início do filtro de baixa, se houver um mercado de urso desviado (preço novo baixo e MACD não inovador baixo), aguarde o MACD na linha zero, faça vazio.

O método de stop loss é um stop loss de tipo de rastreamento contínuo, calculado de acordo com a faixa de flutuação do preço máximo e mínimo. O stop loss é um determinado múltiplo.

Quando a linha MACD em coluna ocorre na direção do eixo zero, a posição é plana.

Análise de vantagens

O portfólio de EMAs de quadros múltiplos permite avaliar as tendências do grande ciclo e evitar a negociação contracorrente.

O MACD está afastado da capacidade de capturar oportunidades de reversão de preços, o que é adequado para uma estratégia de reversão.

O Stop Loss Tracking permite bloquear o lucro e evitar a expansão dos prejuízos.

O retorno esperado é obtido com base no cálculo de stop loss da distância de parada.

Análise de Riscos

O EMA e o Grupo de Linhas Uniformes trabalham em conjunto como filtros, podendo ocorrer erros de orientação durante o período de avaliação.

O MACD tem uma pequena recuperação e pode não ser rentável.

A distância de travamento está mal definida e pode ser muito flexível ou muito compacta.

Não há espaço suficiente para a inversão e os lucros são limitados.

O que é preciso é ter uma boa noção do momento em que se deve fazer a curva de retorno, já que o atraso ou o atraso prematuro podem causar danos.

Direção de otimização

Pode testar diferentes combinações de EMAs para obter um julgamento de tendências mais preciso.

Pode-se tentar ajustar os parâmetros MACD para uma combinação de parâmetros mais sensível.

É possível testar diferentes configurações de parâmetros de stop loss.

Pode-se adicionar condições de filtragem adicionais para evitar o falso rebote. Por exemplo, pode-se adicionar um quadro de tempo mais alto para a EMA julgar a tendência global.

Pode-se otimizar as condições de confirmação de reversão para garantir que a reversão esteja madura o suficiente.

Resumir

Esta estratégia utiliza um conjunto de filtro de tendência, sinal de reversão de tendência, gestão de stop loss dinâmico e outros meios, que pode ser executado em sequência, mas também pode ser reversível. Através do ajuste de parâmetros e otimização das condições de filtragem, pode ser adaptado a um ambiente de mercado mais amplo, obtendo ganhos estáveis sob a premissa de controlar o risco.

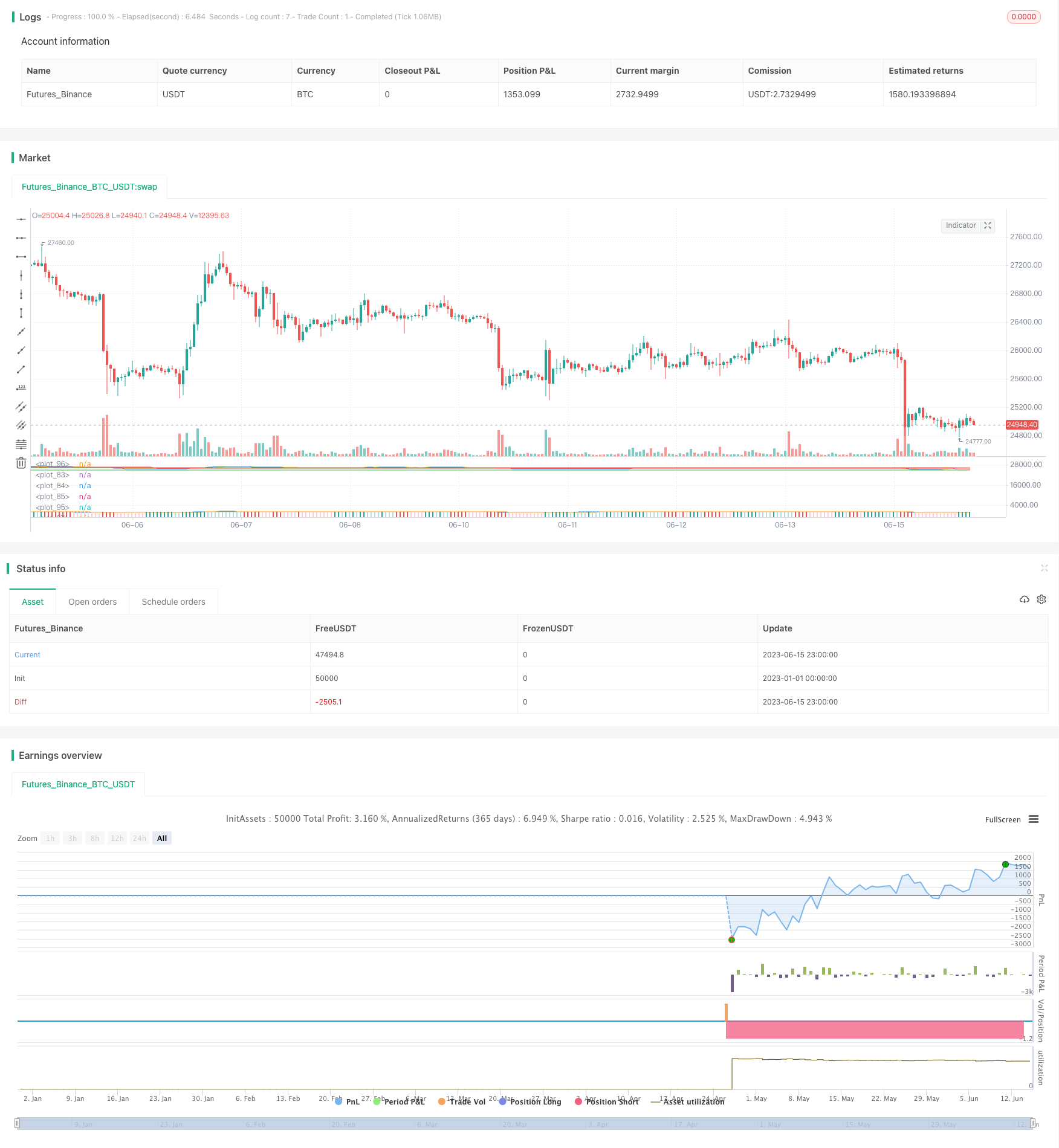

/*backtest

start: 2023-01-01 00:00:00

end: 2023-06-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © maxits

//@version=4

// MACD Divergence + Multi Time Frame EMA

// This Strategy uses 3 indicators: the Macd and two emas in different time frames

// The configuration of the strategy is:

// Macd standar configuration (12, 26, 9) in 1H resolution

// 10 periods ema, in 1H resolution

// 5 periods ema, in 15 minutes resolution

// We use the two emas to filter for long and short positions.

// If 15 minutes ema is above 1H ema, we look for long positions

// If 15 minutes ema is below 1H ema, we look for short positions

// We can use an aditional filter using a 100 days ema, so when the 15' and 1H emas are above the daily ema we take long positions

// Using this filter improves the strategy

// We wait for Macd indicator to form a divergence between histogram and price

// If we have a bullish divergence, and 15 minutes ema is above 1H ema, we wait for macd line to cross above signal line and we open a long position

// If we have a bearish divergence, and 15 minutes ema is below 1H ema, we wait for macd line to cross below signal line and we open a short position

// We close both position after a cross in the oposite direction of macd line and signal line

// Also we can configure a Take profit parameter and a trailing stop loss

// strategy("Macd + MTF EMA",

// overlay=true,

// initial_capital=1000,

// default_qty_value=20,

// default_qty_type=strategy.percent_of_equity,

// commission_value=0.1,

// pyramiding=0)

// User Inputs

i_time = input(defval = timestamp("01 Apr 2018 13:30 +0000"), title = "Start Time", type = input.time) // Starting time for backtest

f_time = input(defval = timestamp("30 Sep 2021 13:30 +0000"), title = "Finish Time", type = input.time) // Finishing time for backtest

long_pos = input(title="Show Long Positions", defval=true, type=input.bool) // Enable Long Positions

short_pos = input(title="Show Short Positions", defval=true, type=input.bool) // Enable Short Positions

src = input(close, title="Source") // Price value to calculate indicators

emas_properties = input(title="============ EMAS Properties ============", defval=false, type=input.bool) // Properties

mtf_15 = input(title="Fast EMA", type=input.resolution, defval="15") // Resolucion para MTF EMA 15 minutes

ma_15_length = input(5, title = "Fast EMA Period") // MTF EMA 15 minutes Length

mtf_60 = input(title="Slow EMA", type=input.resolution, defval="60") // Resolucion para MTF EMA 60 minutes

ma_60_length = input(10, title = "Slow EMA Period") // MTF EMA 60 minutes Length

e_new_filter = input(title="Enable a Third Ema filter?", defval=true, type=input.bool)

slowest_ema_len = input(100, title = "Fast EMA Period")

slowest_ema_res = input(title="Slowest EMA", type=input.resolution, defval="D")

macd_res = input(title="MACD TimeFrame", type=input.resolution, defval="") // MACD Time Frame

macd_properties = input(title="============ MACD Properties ============", defval="") // Properties

fast_len = input(title="Fast Length", type=input.integer, defval=12) // Fast MA Length

slow_len = input(title="Sign Length", type=input.integer, defval=26) // Sign MA Length

sign_len = input(title="Sign Length", type=input.integer, defval=9)

syst_properties = input(title="============ System Properties ============", defval="") // Properties

lookback = input(title="Lookback period", type=input.integer, defval=14, minval=1) // Candles to lookback for swing high or low

multiplier = input(title="Profit Multiplier based on Stop Loss", type=input.float, defval=6.0, minval=0.1) // Profit multiplier based on stop loss

shortStopPer = input(title="Short Stop Loss Percentage", type=input.float, defval=1.0, minval=0.0)/100

longStopPer = input(title="Long Stop Loss Percentage", type=input.float, defval=2.0, minval=0.0)/100

// Indicators

[macd, signal, hist] = security(syminfo.tickerid, macd_res, macd(src, fast_len, slow_len, sign_len))

ma_15 = security(syminfo.tickerid, mtf_15, ema(src, ma_15_length))

ma_60 = security(syminfo.tickerid, mtf_60, ema(src, ma_60_length))

ma_slo = security(syminfo.tickerid, slowest_ema_res, ema(src, slowest_ema_len))

// Macd Plot

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

plot(macd, color=color.new(color.blue, 0)) // Solo para visualizar que se plotea correctamente

plot(signal, color=color.new(color.orange, 0))

plot(hist, style=plot.style_columns,

color=(hist >= 0 ? (hist[1] < hist ? col_grow_above : col_fall_above) :

(hist[1] < hist ? col_grow_below : col_fall_below)))

// MTF EMA Plot

bullish_filter = e_new_filter ? ma_15 > ma_60 and ma_60 > ma_slo : ma_15 > ma_60

bearish_filter = e_new_filter ? ma_15 < ma_60 and ma_60 < ma_slo : ma_15 < ma_60

plot(ma_15, color=color.new(color.blue, 0))

plot(ma_60, color=color.new(color.yellow, 0))

plot(e_new_filter ? ma_slo : na, color = ma_60 > ma_slo ? color.new(color.green, 0) : color.new(color.red, 0))

////////////////////////////////////////////// Logic For Divergence

zero_cross = false

zero_cross := crossover(hist,0) or crossunder(hist,0) //Cruce del Histograma a la linea 0

// plot(zero_cross ? 1 : na)

// MACD DIVERGENCE TOPS (Bearish Divergence)

highest_top = 0.0

highest_top := (zero_cross == true ? 0.0 : (hist > 0 and hist > highest_top[1] ? hist : highest_top[1]))

prior_top = 0.0

prior_top := (crossunder(hist,0) ? highest_top[1] : prior_top[1]) // Búsqueda del Maximo en MACD

// plot(highest_top)

// plot(prior_top)

highest_top_close = 0.0

highest_top_close := (zero_cross == true ? 0.0 : (hist > 0 and hist > highest_top[1] ? close : highest_top_close[1]))

prior_top_close = 0.0

prior_top_close := (crossunder(hist,0) ? highest_top_close[1] : prior_top_close[1]) // Búsqueda del Maximo en pRECIO

// plot(highest_top_close)

// plot(prior_top_close)

top = false

top := highest_top[1] < prior_top[1]

and highest_top_close[1] > prior_top_close[1]

and hist < hist[1]

and crossunder(hist,0) // Bearish Divergence: top == true

// MACD DIVERGENCE BOTTOMS (Bullish Divergence)

lowest_bottom = 0.0

lowest_bottom := (zero_cross == true ? 0.0 : (hist < 0 and hist < lowest_bottom[1] ? hist : lowest_bottom[1]))

prior_bottom = 0.0

prior_bottom := (crossover(hist,0) ? lowest_bottom[1] : prior_bottom[1])

lowest_bottom_close = 0.0

lowest_bottom_close := (zero_cross == true ? 0.0 : (hist < 0 and hist < lowest_bottom[1] ? close : lowest_bottom_close[1]))

prior_bottom_close = 0.0

prior_bottom_close := (crossover(hist,0) ? lowest_bottom_close[1] : prior_bottom_close[1])

bottom = false

bottom := lowest_bottom[1] > prior_bottom[1]

and lowest_bottom_close[1] < prior_bottom_close[1]

and hist > hist[1]

and crossover(hist,0) // Bullish Divergence: bottom == true

////////////////////////////////////////////// System Conditions //////////////////////////////////////////////

inTrade = strategy.position_size != 0 // In Trade

longTrade = strategy.position_size > 0 // Long position

shortTrade = strategy.position_size < 0 // Short position

notInTrade = strategy.position_size == 0 // No trade

entryPrice = strategy.position_avg_price // Position Entry Price

////////////////////////////////////////////// Long Conditions //////////////////////////////////////////////

sl = lowest(low, lookback) // Swing Low for Long Entry

longStopLoss = 0.0 // Trailing Stop Loss calculation

longStopLoss := if (longTrade)

astopValue = sl * (1 - longStopPer)

max(longStopLoss[1], astopValue)

else

0

longTakeProf = 0.0 // Profit calculation based on stop loss

longTakeProf := if (longTrade)

profitValue = entryPrice + (entryPrice - longStopLoss) * multiplier

max(longTakeProf[1], profitValue)

else

0

// Long Entry Conditions

if bottom and notInTrade and bullish_filter and long_pos

strategy.entry(id="Go Long", long=strategy.long, comment="Long Position")

// strategy.close(id="Go Long", when=zero_cross)

if longTrade

strategy.exit("Exit Long", "Go Long", limit = longTakeProf, stop = longStopLoss)

plot(longTrade and longStopLoss ? longStopLoss : na, title="Long Stop Loss", color=color.new(color.red, 0), style=plot.style_linebr)

plot(longTrade and longTakeProf ? longTakeProf : na, title="Long Take Prof", color=color.new(color.green, 0), style=plot.style_linebr)

////////////////////////////////////////////// Short Conditions //////////////////////////////////////////////

sh = highest(high, lookback) // Swing High for Short Entry

shortStopLoss = 0.0

shortStopLoss := if (shortTrade)

bstopValue = sh * (1 + shortStopPer)

min(shortStopLoss[1], bstopValue)

else

999999

shortTakeProf = 0.0

shortTakeProf := if (shortTrade)

SprofitValue = entryPrice - (shortStopLoss - entryPrice) * multiplier

min(SprofitValue, shortTakeProf[1])

else

999999

// Short Entry

if top and notInTrade and bearish_filter and short_pos

strategy.entry(id="Go Short", long=strategy.short, comment="Short Position")

// strategy.close(id="Go Short", when=zero_cross)

if shortTrade

strategy.exit("Exit Short", "Go Short", limit = shortTakeProf, stop = shortStopLoss)

plot(shortTrade and shortStopLoss ? shortStopLoss : na, title="Short Stop Loss", color=color.new(color.red, 0), style=plot.style_linebr)

plot(shortTrade and shortTakeProf ? shortTakeProf : na, title="Short Take Prof", color=color.new(color.green, 0), style=plot.style_linebr)