Estratégia de negociação de DCA gradualmente ponderada e quantificada

Autora:ChaoZhang, Data: 2023-11-16 11:32:12Tags:

Resumo

A Estratégia de Negociação DCA gradual ponderada quantificada é uma estratégia quantitativa de negociação que combina indicadores de média móvel para acionamento de sinais e mecanismos de média gradual de custo em dólares.

Princípios

A estratégia consiste em três componentes principais:

-

Julgamento do sinal de entrada

Ele usa cruzamento de média móvel rápida e lenta como sinal de entrada. Os usuários podem escolher entre SMA, EMA ou HMA para as médias móveis rápidas e lentas. Quando o MA rápido cruza acima do MA lento, um sinal de compra é gerado. Quando o MA rápido cruza abaixo do MA lento, um sinal de venda é gerado.

-

DCA gradualmente ponderada

Após um sinal de compra, a estratégia abrirá imediatamente uma posição de base. À medida que o preço continua a cair, a estratégia aumentará gradualmente o tamanho de posições de segurança adicionais de forma ponderada. O preço de cada nova posição de segurança será reduzido em uma porcentagem fixa em relação à anterior. Além disso, os fundos alocados para cada nova posição de segurança serão amplificados por um fator.

Este aumento gradual da dimensão das posições permite uma forma de média de custos, obtendo um melhor custo médio, mantendo os riscos sob controlo.

-

Obter lucro e parar perdas

Quando o preço sobe acima da linha de take profit, a estratégia fechará as posições para obter lucro.

A linha de lucro é fixada ao preço médio da posição de base * (1 + percentagem fixa).

A linha de stop loss flutua com base no último preço da posição de segurança, percentagem fixa abaixo dele.

Vantagens

-

A combinação de tendência e média de custos torna mais estável

Usar tendências evita problemas sem sentido, e a média de custos proporciona melhores custos de entrada.

-

O dimensionamento gradual da posição controla o risco

A amplificação fixa dos tamanhos das posições de segurança, com limiar de reentrada, mantém o risco sob controlo.

-

Monitorização em tempo real dos fundos utilizados

O indicador de utilização do saldo incorporado previne a alavancagem excessiva e as liquidações forçadas.

-

TP/SL separados para cada posição

As saídas independentes permitem assegurar lucros e reduzir perdas.

Riscos e melhorias

-

A queda de preços pode desencadear várias ordens de segurança.

Na volatilidade extrema, várias ordens de segurança desnecessárias podem ser adicionadas, aumentando a perda.

-

Os parâmetros da média móvel precisam de otimização

Diferentes instrumentos precisam de períodos de média móvel diferentes.

-

Os níveis de TP/SL necessitam de otimização dos backtests

Os rácios TP/SL determinam o perfil risco/recompensa.

-

Adicionar saída forçada baseada no tempo máximo de retirada ou de retenção

Pode testar incorporando saídas forçadas com base no tempo de retirada ou de retenção para limitar ainda mais os riscos.

Resumo

A estratégia de negociação DCA gradual ponderada quantificada combina as vantagens da negociação de tendências e da média de custos para produzir retornos estáveis em tendências fortes. Com parâmetros otimizados, dimensionamento de posição e limiares de reentrada, pode alcançar negociações estáveis com risco controlado. Aplicável a fundos de hedge, CTAs e estratégias neutras de mercado.

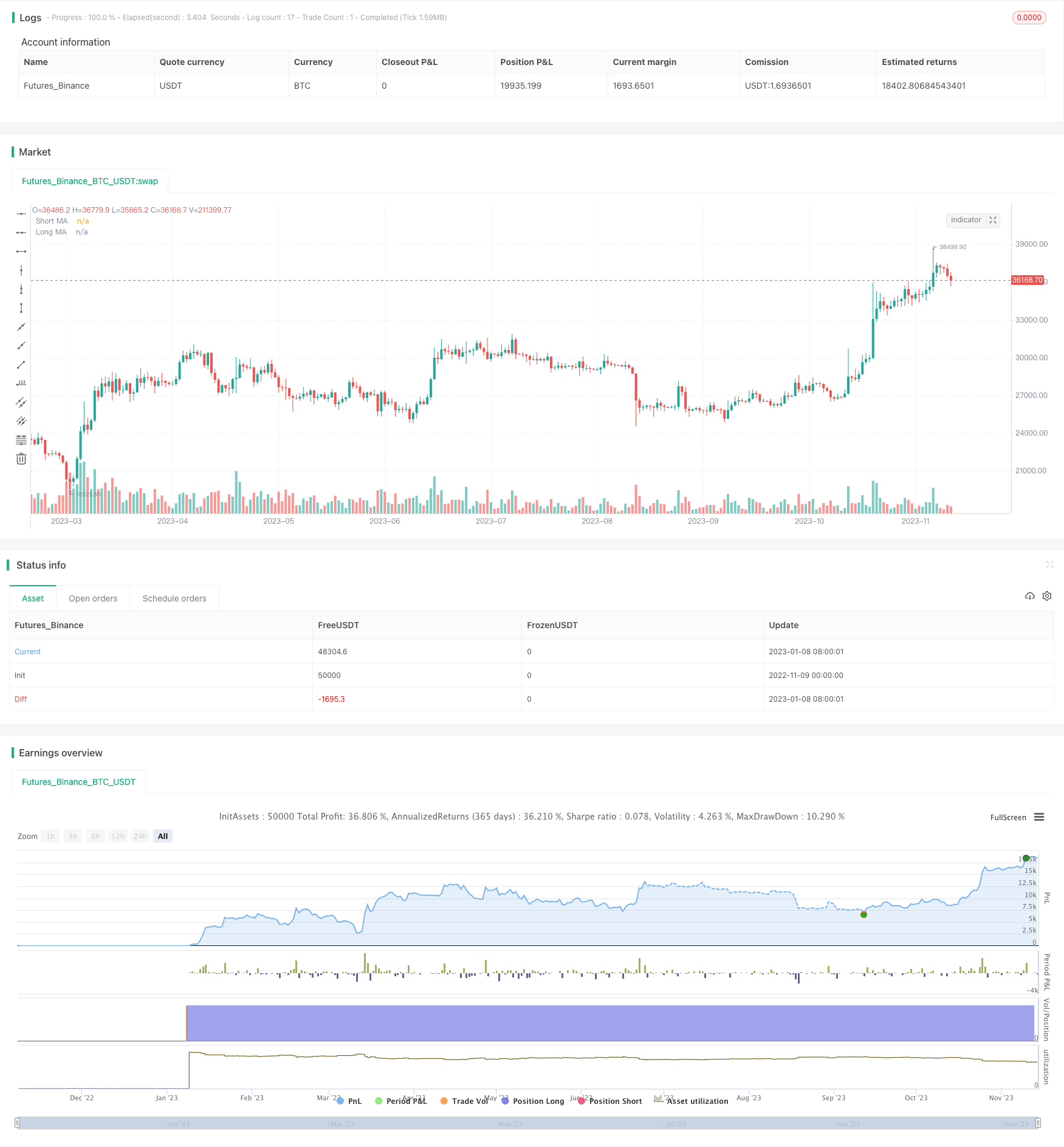

/*backtest

start: 2022-11-09 00:00:00

end: 2023-11-15 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MGTG

//@version=5

Strategy = input.string('Long', options=['Long'], group='Strategy', inline='1',

tooltip='Long bots profit when asset prices rise, Short bots profit when asset prices fall'

+ '\n\n' + 'Please note: to run a Short bot on a spot exchange account, you need to own the asset you want to trade. The bot will sell the asset at the current chart price and buy it back at a lower price - the profit made is actually trapped equity released from an asset you own that is declining in value.')

Profit_currency = input.string('Quote (USDT)', 'Profit currency', options=['Quote (USDT)', 'Quote (BTC)', 'Quote (BUSD)'], group='Strategy', inline='1')

Base_order_size = input.int(10, 'Base order Size', group='Strategy', inline='2',

tooltip='The Base Order is the first order the bot will create when starting a new deal.')

Safety_order_size = input.int(20, 'Safety order Size', group='Strategy', inline='2',

tooltip="Enter the amount of funds your Safety Orders will use to Average the cost of the asset being traded, this can help your bot to close deals faster with more profit. Safety Orders are also known as Dollar Cost Averaging and help when prices moves in the opposite direction to your bot's take profit target.")

Triger_Type = input.string('Over', 'Entry at Cross Over / Under', options=['Over', 'Under'], group='Deal start condition > Trading View custom signal', inline='1',

tooltip='Deal start condition decision')

Short_Moving_Average = input.string('SMA', 'Short Moving Average', group='Deal start condition > Trading View custom signal', inline='2',

options=["SMA", "EMA", "HMA"])

Short_Period = input.int(5, 'Period', group='Deal start condition > Trading View custom signal', inline='2')

Long_Moving_Average = input.string('HMA', 'Long Moving Average', group='Deal start condition > Trading View custom signal', inline='3',

options=["SMA", "EMA", "HMA"])

Long_Period = input.int(50, 'Period', group='Deal start condition > Trading View custom signal', inline='3')

Target_profit = input.float(1.5, 'Target profit (%)', step=0.05, group='Take profit / Stop Loss', inline='1') * 0.01

Stop_Loss = input.int(15, 'Stop Loss (%)', group='Take profit / Stop Loss', inline='1',

tooltip='This is the percentage that price needs to move in the opposite direction to your take profit target, at which point the bot will execute a Market Order on the exchange account to close the deal for a smaller loss than keeping the deal open.'

+ '\n' + 'Please note, the Stop Loss is calculated from the price the Safety Order at on the exchange account and not the Dollar Cost Average price.') * 0.01

Max_safety_trades_count = input.int(10, 'Max safety trades count', maxval=10, group='Safety orders', inline='1')

Price_deviation = input.float(0.4, 'Price deviation to open safety orders (% from initial order)', step=0.01, group='Safety orders', inline='2') * 0.01

Safety_order_volume_scale = input.float(1.8, 'Safety order volume scale', step=0.01, group='Safety orders', inline='3')

Safety_order_step_scale = input.float(1.19, 'Safety order step scale', step=0.01, group='Safety orders', inline='3')

// daily_volume = input.int(500, "Don't start deal(s) if the daily volume is less than", group='Advanced settings', inline='1')

// Minimum_price = input.int(500, "Minimum price to open deal", group='Advanced settings', inline='1')

// Maximum_price = input.int(500, "Maximum price to open deal", group='Advanced settings', inline='1')

// Close_deal_after_timeout = input.int(5, "Close deal after timeout (Hrs)", group='Advanced settings', inline='1')

initial_capital = 8913

strategy(

title='3Commas Visible DCA Strategy',

overlay=true,

initial_capital=initial_capital,

pyramiding=11,

process_orders_on_close=true,

commission_type=strategy.commission.percent,

commission_value=0.01,

max_bars_back=5000,

max_labels_count=50)

// Position

status_none = strategy.position_size == 0

status_long = strategy.position_size[1] == 0 and strategy.position_size > 0

status_long_offset = strategy.position_size[2] == 0 and strategy.position_size[1] > 0

status_short = strategy.position_size[1] == 0 and strategy.position_size < 0

status_increase = strategy.opentrades[1] < strategy.opentrades

Short_Moving_Average_Line =

Short_Moving_Average == 'SMA' ? ta.sma(close, Short_Period) :

Short_Moving_Average == 'EMA' ? ta.ema(close, Short_Period) :

Short_Moving_Average == 'HMA' ? ta.sma(close, Short_Period) : na

Long_Moving_Average_Line =

Long_Moving_Average == 'SMA' ? ta.sma(close, Long_Period) :

Long_Moving_Average == 'EMA' ? ta.ema(close, Long_Period) :

Long_Moving_Average == 'HMA' ? ta.sma(close, Long_Period) : na

Base_order_Condition = Triger_Type == "Over" ? ta.crossover(Short_Moving_Average_Line, Long_Moving_Average_Line) : ta.crossunder(Short_Moving_Average_Line, Long_Moving_Average_Line) // Buy when close crossing lower band

safety_order_deviation(index) => Price_deviation * math.pow(Safety_order_step_scale, index - 1)

pd = Price_deviation

ss = Safety_order_step_scale

step(i) =>

i == 1 ? pd :

i == 2 ? pd + pd * ss :

i == 3 ? pd + (pd + pd * ss) * ss :

i == 4 ? pd + (pd + (pd + pd * ss) * ss) * ss :

i == 5 ? pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss :

i == 6 ? pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss :

i == 7 ? pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss :

i == 8 ? pd + (pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss) * ss :

i == 9 ? pd + (pd + (pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss) * ss) * ss :

i == 10 ? pd + (pd + (pd + (pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss) * ss) * ss) * ss : na

long_line(i) =>

close[1] - close[1] * (step(i))

Safe_order_line(i) =>

i == 0 ? ta.valuewhen(status_long, long_line(0), 0) :

i == 1 ? ta.valuewhen(status_long, long_line(1), 0) :

i == 2 ? ta.valuewhen(status_long, long_line(2), 0) :

i == 3 ? ta.valuewhen(status_long, long_line(3), 0) :

i == 4 ? ta.valuewhen(status_long, long_line(4), 0) :

i == 5 ? ta.valuewhen(status_long, long_line(5), 0) :

i == 6 ? ta.valuewhen(status_long, long_line(6), 0) :

i == 7 ? ta.valuewhen(status_long, long_line(7), 0) :

i == 8 ? ta.valuewhen(status_long, long_line(8), 0) :

i == 9 ? ta.valuewhen(status_long, long_line(9), 0) :

i == 10 ? ta.valuewhen(status_long, long_line(10), 0) : na

TP_line = strategy.position_avg_price * (1 + Target_profit)

SL_line = Safe_order_line(Max_safety_trades_count) * (1 - Stop_Loss)

safety_order_size(i) => Safety_order_size * math.pow(Safety_order_volume_scale, i - 1)

plot(Short_Moving_Average_Line, 'Short MA', color=color.new(color.white, 0), style=plot.style_line)

plot(Long_Moving_Average_Line, 'Long MA', color=color.new(color.green, 0), style=plot.style_line)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 1 ? Safe_order_line(1) : na, 'Safety order1', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 2 ? Safe_order_line(2) : na, 'Safety order2', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 3 ? Safe_order_line(3) : na, 'Safety order3', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 4 ? Safe_order_line(4) : na, 'Safety order4', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 5 ? Safe_order_line(5) : na, 'Safety order5', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 6 ? Safe_order_line(6) : na, 'Safety order6', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 7 ? Safe_order_line(7) : na, 'Safety order7', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 8 ? Safe_order_line(8) : na, 'Safety order8', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 9 ? Safe_order_line(9) : na, 'Safety order9', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 10 ? Safe_order_line(10) : na, 'Safety order10', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 ? TP_line : na, 'Take Profit', color=color.new(color.orange, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 ? SL_line : na, 'Safety', color=color.new(color.aqua, 0), style=plot.style_linebr)

currency =

Profit_currency == 'Quote (USDT)' ? ' USDT' :

Profit_currency == 'Quote (BTC)' ? ' BTC' :

Profit_currency == 'Quote (BUSD)' ? ' BUSD' : na

if Base_order_Condition

strategy.entry('Base order', strategy.long, qty=Base_order_size/close, when=Base_order_Condition and strategy.opentrades == 0,

comment='BO' + ' - ' + str.tostring(Base_order_size) + str.tostring(currency))

for i = 1 to Max_safety_trades_count by 1

i_s = str.tostring(i)

strategy.entry('Safety order' + i_s, strategy.long, qty=safety_order_size(i)/close,

limit=Safe_order_line(i), when=(strategy.opentrades <= i) and strategy.position_size > 0,

comment='SO' + i_s + ' - ' + str.tostring(safety_order_size(i)) + str.tostring(currency))

for i = 1 to Max_safety_trades_count by 1

i_s = str.tostring(i)

// strategy.close('Base order', when=shortCondition)

// strategy.close('Safety order' + i_s, when=shortCondition)

// strategy.cancel('Safety order' + i_s, when=shortCondition)

strategy.cancel('SO' + i_s, when=ta.crossunder(low, SL_line) or ta.crossover(high, TP_line) or status_none)

strategy.exit('TP/SL','Base order', limit=TP_line, stop=SL_line, comment = Safe_order_line(100) > close ? 'SL' + i_s + ' - ' + str.tostring(Base_order_size) + str.tostring(currency) : 'TP' + i_s + ' - ' + str.tostring(Base_order_size) + str.tostring(currency))

strategy.exit('TP/SL','Safety order' + i_s, limit=TP_line, stop=SL_line, comment = Safe_order_line(100) > close ? 'SL' + i_s + ' - ' + str.tostring(safety_order_size(i)) + str.tostring(currency) : 'TP' + i_s + ' - ' + str.tostring(safety_order_size(i)) + str.tostring(currency))

// strategy.cancel('TP/SP' + i_s, when=Base_order_Condition)

// strategy.exit('Stop Loss','Base order', stop=SL_line)

// strategy.exit('Stop Loss','Safety order' + i_s, stop=SL_line)

//----------------label A----------------//

bot_usage(i) =>

i == 1 ? Base_order_size + safety_order_size(1) :

i == 2 ? Base_order_size + safety_order_size(1) + safety_order_size(2) :

i == 3 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) :

i == 4 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) :

i == 5 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) :

i == 6 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) :

i == 7 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) :

i == 8 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) + safety_order_size(8) :

i == 9 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) + safety_order_size(8) + safety_order_size(9) :

i == 10 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) + safety_order_size(8) + safety_order_size(9) + safety_order_size(10) : na

equity = strategy.equity

bot_use = bot_usage(Max_safety_trades_count)

bot_dev = float(step(Max_safety_trades_count)) * 100

bot_ava = (bot_use / equity) * 100

string label_A =

'Balance : ' + str.tostring(math.round(equity, 0), '###,###,###,###') + ' USDT' + '\n' +

'Max amount for bot usage : ' + str.tostring(math.round(bot_use, 0), '###,###,###,###') + ' USDT' + '\n' +

'Max safety order price deviation : ' + str.tostring(math.round(bot_dev, 0), '##.##') + ' %' + '\n' +

'% of available balance : ' + str.tostring(math.round(bot_ava, 0), '###,###,###,###') + ' %'

+ (bot_ava > 100 ? '\n \n' + '⚠ Warning! Bot will use amount greater than you have on exchange' : na)

if status_long

day_label =

label.new(

x=time[1],

y=high * 1.03,

text=label_A,

xloc=xloc.bar_time,

yloc=yloc.price,

color=bot_ava > 100 ? color.new(color.yellow, 0) : color.new(color.black, 50),

style=label.style_label_lower_right,

textcolor=bot_ava > 100 ? color.new(color.red, 0) : color.new(color.silver, 0),

size=size.normal,

textalign=text.align_left)

- Estratégia de cruzamento da média móvel do RSI de vários prazos

- Estratégia de ruptura da tendência baseada em bandas de Bollinger

- Estratégia de arbitragem de média móvel regularizada adaptativa

- Estratégia de rastreamento de tendências fortes duplas

- Estratégia do indicador de ímpeto

- Estratégia inversa de Heikin-Ashi

- Estratégia de ruptura de oscilação dinâmica

- Tendência na sequência da estratégia de cruzamento da EMA de 5 minutos

- Tendência do RSI seguindo a estratégia

- Estratégia de Divergência dos INR

- Desvio médio móvel duplo combinado com a tendência do indicador ATR Seguindo estratégia

- Estratégia multi-tendência

- Estratégia de preços de equilíbrio

- Tendência na sequência da estratégia de negociação a curto prazo

- BB21_SMA200 Tendência de seguir a estratégia

- Momentum Ichimoku Estratégia de negociação em nuvem

- Estratégia de negociação de volatilidade de fim de semana

- Estratégia de reversão da ruptura de impulso

- Alteração da estratégia de negociação quantitativa OBV e MACD

- Tendência baseada no indicador de fluxo de volume seguindo a estratégia