Estratégia de ruptura de desvio padrão de bandas de Bollinger

Autora:ChaoZhang, Data: 2023-11-21 17:14:04Tags:

Resumo

Esta estratégia é baseada no indicador clássico de Bollinger Bands. Ele vai longo quando o preço fecha acima da faixa superior e fica curto quando o preço fecha abaixo da faixa inferior. Ele pertence à tendência após a estratégia de ruptura.

Estratégia lógica

- A linha de base é a média móvel simples de 55 dias.

- As bandas superior e inferior são um desvio-padrão acima e abaixo da linha de base, respectivamente.

- Um sinal longo é gerado quando o preço fecha acima da faixa superior.

- Um sinal curto é gerado quando o preço fecha abaixo da faixa inferior.

- A utilização de um desvio-padrão em vez dos dois desvios-padrão clássicos reduz o risco.

Análise das vantagens

- Usar o desvio-padrão em vez do valor fixo reduz o risco.

- A média móvel de 55 dias pode refletir melhor a tendência a médio prazo.

- A fuga próxima filtra as falsas fugas.

- Fácil de determinar a direcção da tendência através de análise de vários prazos.

Análise de riscos

- Prendido a fazer pequenos lucros.

- Precisa de considerar o impacto das taxas de transacção.

- Os sinais de fuga podem ser falsos.

- Pode ocorrer perda por deslizamento.

Os riscos podem ser mitigados através da definição de stop loss, da consideração de taxas de transação ou da adição de filtros de indicadores.

Orientações de otimização

- Otimizar os parâmetros de referência para encontrar a melhor média móvel.

- Otimizar o tamanho do desvio padrão para encontrar os parâmetros ideais.

- Adicionar indicadores de volume auxiliares para avaliação.

- Adicione o mecanismo de stop loss.

Resumo

A lógica geral desta estratégia é clara. Ajusta o risco através da largura da banda de desvio padrão e evita falsas rupturas usando ruptura próxima. Mas ainda é necessário evitar perdas oscilantes usando stop loss, adicionando filtros etc.

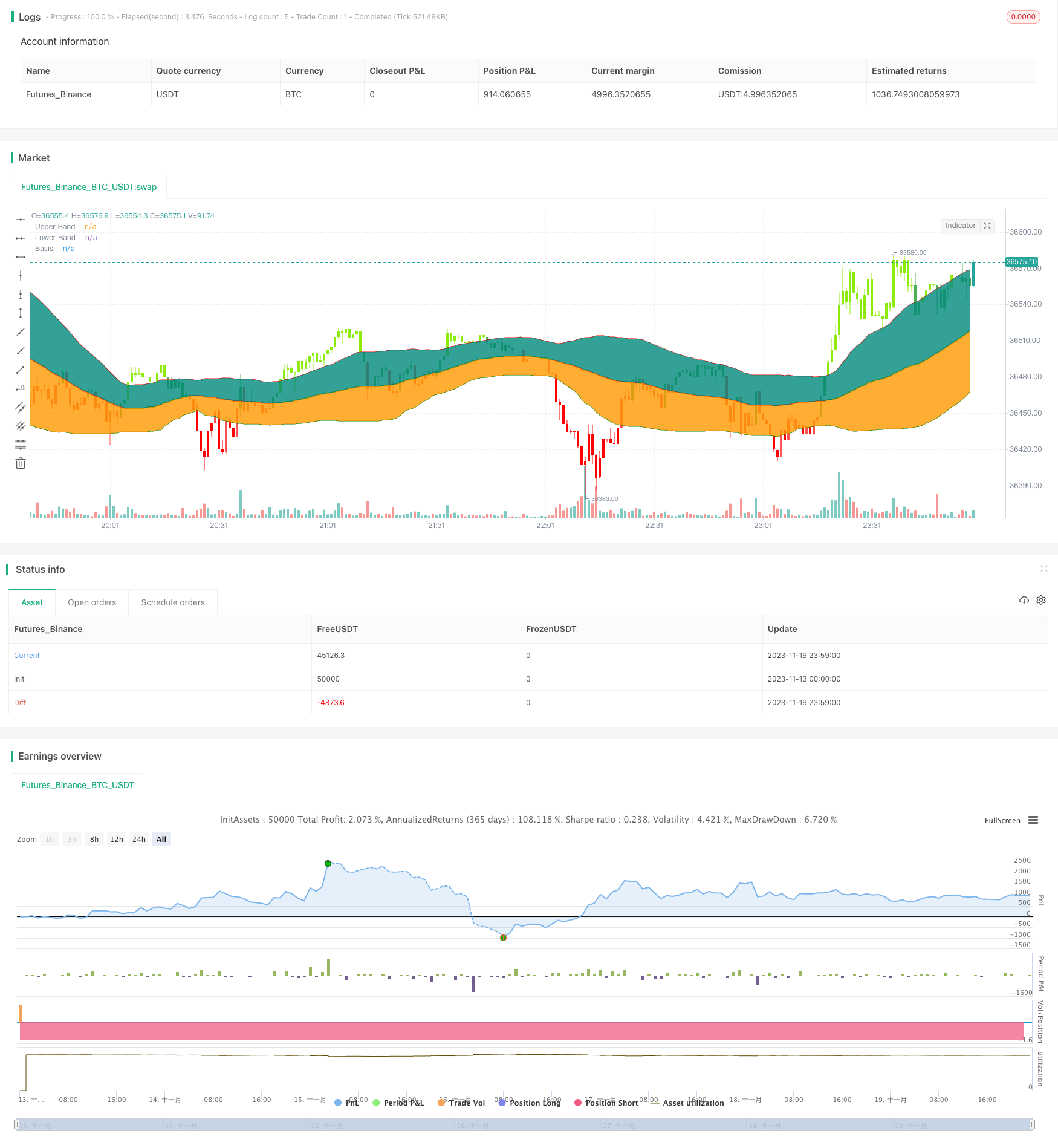

/*backtest

start: 2023-11-13 00:00:00

end: 2023-11-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//┌───── •••• ─────┐//

// TradeChartist //

//└───── •••• ─────┘//

//Bollinger Bands is a classic indicator that uses a simple moving average of 20 periods along with upper and lower bands that are 2 standard deviations away from the basis line.

//These bands help visualize price volatility and trend based on where the price is in relation to the bands.

//This Bollinger Bands filter plots a long signal when price closes above the upper band and plots a short signal when price closes below the lower band.

//It doesn't take into account any other parameters such as Volume/RSI/fundamentals etc, so user must use discretion based on confirmations from another indicator or based on fundamentals.

//This filter's default is 55 SMA and 1 standard deviation, but can be changed based on asset type

//It is definitely worth reading the 22 rules of Bollinger Bands written by John Bollinger.

strategy(shorttitle="BB Breakout Strategy", title="Bollinger Bands Filter", overlay=true,

pyramiding=1, currency=currency.NONE ,

initial_capital = 10000, default_qty_type = strategy.percent_of_equity,

default_qty_value=100, calc_on_every_tick= true, process_orders_on_close=false)

src = input(close, title = "Source")

length = input(55, minval=1, title = "SMA length")// 20 for classis Bollinger Bands SMA line (basis)

mult = input(1., minval=0.236, maxval=2, title="Standard Deviation")//2 for Classic Bollinger Bands //Maxval = 2 as higher the deviation, higher the risk

basis = sma(src, length)

dev = mult * stdev(src,length)

CC = input(true, "Color Bars")

upper = basis + dev

lower = basis - dev

//Conditions for Long and Short - Extra filter condition can be used such as RSI or CCI etc.

short = src<lower// and rsi(close,14)<40

long = src>upper// and rsi(close,14)>60

L1 = barssince(long)

S1 = barssince(short)

longSignal = L1<S1 and not (L1<S1)[1]

shortSignal = S1<L1 and not (S1<L1)[1]

//Plots and Fills

////Long/Short shapes with text

// plotshape(S1<L1 and not (S1<L1)[1]?close:na, text = "sᴇʟʟ", textcolor=#ff0100, color=#ff0100, style=shape.triangledown, size=size.small, location=location.abovebar, transp=0, title = "SELL", editable = true)

// plotshape(L1<S1 and not (L1<S1)[1]?close:na, text = "ʙᴜʏ", textcolor = #008000, color=#008000, style=shape.triangleup, size=size.small, location=location.belowbar, transp=0, title = "BUY", editable = true)

// plotshape(shortSignal?close:na, color=#ff0100, style=shape.triangledown, size=size.small, location=location.abovebar, transp=0, title = "Short Signal", editable = true)

// plotshape(longSignal?close:na, color=#008000, style=shape.triangleup, size=size.small, location=location.belowbar, transp=0, title = "Long Signal", editable = true)

p1 = plot(upper, color=#ff0000, display=display.all, transp=75, title = "Upper Band")

p2 = plot(lower, color=#008000, display=display.all, transp=75, title = "Lower Band")

p = plot(basis, color=L1<S1?#008000:S1<L1?#ff0000:na, linewidth=2, editable=false, title="Basis")

fill(p,p1, color=color.teal, transp=85, title = "Top Fill") //fill for basis-upper

fill(p,p2, color=color.orange, transp=85, title = "Bottom Fill")//fill for basis-lower

//Barcolor

bcol = src>upper?color.new(#8ceb07,0):

src<lower?color.new(#ff0000,0):

src>basis?color.green:

src<basis?color.red:na

barcolor(CC?bcol:na, editable=false, title = "Color Bars")

// //Alerts ---- // Use 'Once per bar close'

// alertcondition(condition=longSignal, title="Long - BB Filter", message='BB Filter Long @ {{close}}') // Use 'Once per bar close'

// alertcondition(condition=shortSignal, title="Short - BB Filter", message='BB Filter Short @ {{close}}') // Use 'Once per bar close'

Notestart1 = input(true, "╔═══ Time Range to BackTest ═══╗")

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input(defval=2018, title="From Year", minval=2015)

ToMonth = input(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input(defval=9999, title="To Year", minval=2010)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => // create function "within window of time"

time >= start and time <= finish ? true : false

if(window())

strategy.entry("Long", long=true, when = longSignal)

// strategy.close("Long", when = (short and S3==0), comment = "Close Long")

if(window())

strategy.entry("Short", long=false, when = shortSignal)

// strategy.close("Short", when = (long and L3==0), comment = "Close Short")

Mais.

- 123 Média móvel inversa Convergência Divergência Estratégia de combinação

- Heikin Ashi Estratégia de negociação de média móvel dinâmica de alto e baixo canal

- Estratégia Quantitativa da Cruz de Ouro

- Nuvem de Ichimoku e estratégia de impulso do MACD

- Estratégia de ruptura de média móvel múltipla

- Estratégia estocástica de negociação OTT

- Estratégia de inversão de média móvel dupla

- Estratégia de reversão de duplo clique

- Estratégia de negociação de reversão de velas baseada no canal de Fibonacci

- Estratégia de cruzamento da tendência da média móvel dinâmica

- VSTOCHASTIC RSI EMA CROSSOVER COMBINADO COM VMACD WAVEFINDER STRATEGY

- Estratégia de backtesting dinâmico de vários prazos

- Estratégia de negociação de breakout de curto prazo de reversão

- Estratégia de seta cruzada de média móvel dupla

- Estratégia de negociação de oscilação de impulso

- O valor da posição em risco deve ser calculado de acordo com o método de cálculo da posição em risco.

- Estratégia de negociação quantitativa de Fibonacci Retracement

- Estratégia de oscilação de indicadores duplos

- Estratégia de ruptura de preços de média móvel dupla

- Estratégia dinâmica de rastreamento de perdas