A estratégia de negociação multiperíodo baseada no índice de volatilidade e no oscilador estocástico

Autora:ChaoZhang, Data: 2023-12-21 14:34:42Tags:

Resumo Esta estratégia combina o índice de volatilidade VIX e o oscilador estocástico RSI através de uma composição de indicadores em diferentes períodos de tempo, a fim de alcançar entradas de ruptura e saídas de sobrecompra/supervenda eficientes.

Princípios

-

Calcule o índice de volatilidade VIX: tome os preços mais altos e mais baixos nos últimos 20 dias para calcular a volatilidade.

-

Calcule o oscilador do RSI: tome as mudanças de preço nos últimos 14 dias.

-

Combine os dois indicadores. vá longo quando o VIX ultrapassar a faixa superior ou o percentil mais alto. feche compras quando o RSI ultrapassar 70.

Vantagens

- Integra múltiplos indicadores para uma avaliação abrangente do calendário do mercado.

- Os indicadores verificam-se mutuamente e melhoram a precisão das decisões.

- Os parâmetros personalizáveis podem ser otimizados para diferentes instrumentos comerciais.

Riscos

- A regulação incorreta dos parâmetros pode causar múltiplos sinais falsos.

- Um único indicador de saída pode perder as inversões de preços.

Sugestões de otimização

- Incorporar mais indicadores de confirmação, como médias móveis e bandas de Bollinger para as entradas de tempo.

- Adicione mais indicadores de saída, como padrões de candelabro de reversão.

Resumo Esta estratégia utiliza o VIX para medir o momento do mercado e os níveis de risco, e filtra os negócios desfavoráveis usando leituras de sobrecompra / sobrevenda do RSI, a fim de entrar em momentos oportunos e sair em tempo há amplo espaço para otimização para atender às condições mais amplas do mercado.

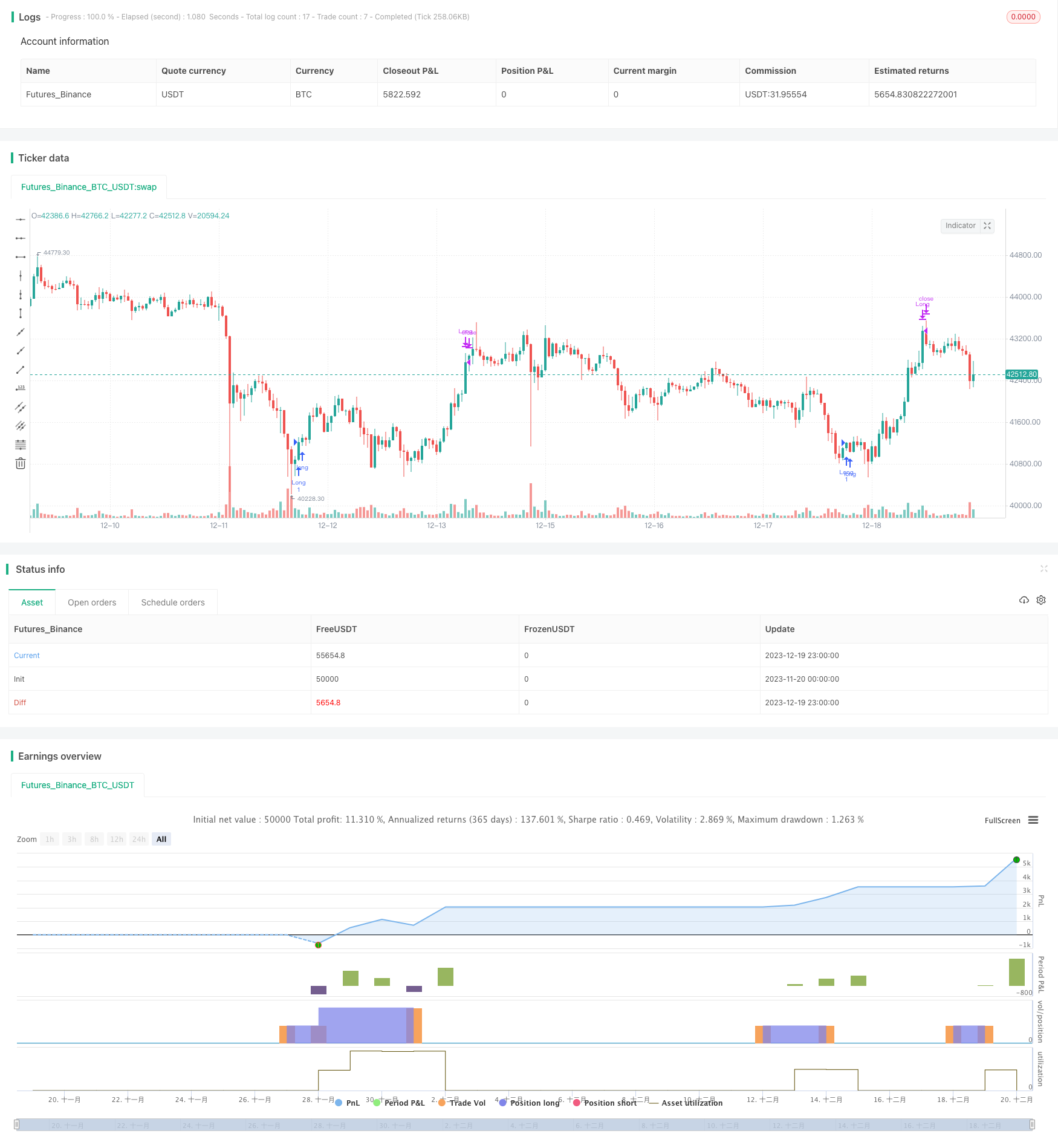

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © timj

strategy('Vix FIX / StochRSI Strategy', overlay=true, pyramiding=9, margin_long=100, margin_short=100)

Stochlength = input.int(14, minval=1, title="lookback length of Stochastic")

StochOverBought = input.int(80, title="Stochastic overbought condition")

StochOverSold = input.int(20, title="Stochastic oversold condition")

smoothK = input(3, title="smoothing of Stochastic %K ")

smoothD = input(3, title="moving average of Stochastic %K")

k = ta.sma(ta.stoch(close, high, low, Stochlength), smoothK)

d = ta.sma(k, smoothD)

///////////// RSI

RSIlength = input.int( 14, minval=1 , title="lookback length of RSI")

RSIOverBought = input.int( 70 , title="RSI overbought condition")

RSIOverSold = input.int( 30 , title="RSI oversold condition")

RSIprice = close

vrsi = ta.rsi(RSIprice, RSIlength)

///////////// Double strategy: RSI strategy + Stochastic strategy

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input.float(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

new = input(false, title="-------Text Plots Below Use Original Criteria-------" )

sbc = input(false, title="Show Text Plot if WVF WAS True and IS Now False")

sbcc = input(false, title="Show Text Plot if WVF IS True")

new2 = input(false, title="-------Text Plots Below Use FILTERED Criteria-------" )

sbcFilt = input(true, title="Show Text Plot For Filtered Entry")

sbcAggr = input(true, title="Show Text Plot For AGGRESSIVE Filtered Entry")

ltLB = input.float(40, minval=25, maxval=99, title="Long-Term Look Back Current Bar Has To Close Below This Value OR Medium Term--Default=40")

mtLB = input.float(14, minval=10, maxval=20, title="Medium-Term Look Back Current Bar Has To Close Below This Value OR Long Term--Default=14")

str = input.int(3, minval=1, maxval=9, title="Entry Price Action Strength--Close > X Bars Back---Default=3")

//Alerts Instructions and Options Below...Inputs Tab

new4 = input(false, title="-------------------------Turn On/Off ALERTS Below---------------------" )

new5 = input(false, title="----To Activate Alerts You HAVE To Check The Boxes Below For Any Alert Criteria You Want----")

sa1 = input(false, title="Show Alert WVF = True?")

sa2 = input(false, title="Show Alert WVF Was True Now False?")

sa3 = input(false, title="Show Alert WVF Filtered?")

sa4 = input(false, title="Show Alert WVF AGGRESSIVE Filter?")

//Williams Vix Fix Formula

wvf = ((ta.highest(close, pd)-low)/(ta.highest(close, pd)))*100

sDev = mult * ta.stdev(wvf, bbl)

midLine = ta.sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (ta.highest(wvf, lb)) * ph

//Filtered Bar Criteria

upRange = low > low[1] and close > high[1]

upRange_Aggr = close > close[1] and close > open[1]

//Filtered Criteria

filtered = ((wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh))

filtered_Aggr = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and not (wvf < upperBand and wvf < rangeHigh)

//Alerts Criteria

alert1 = wvf >= upperBand or wvf >= rangeHigh ? 1 : 0

alert2 = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh) ? 1 : 0

alert3 = upRange and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered ? 1 : 0

alert4 = upRange_Aggr and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered_Aggr ? 1 : 0

//Coloring Criteria of Williams Vix Fix

col = wvf >= upperBand or wvf >= rangeHigh ? color.lime : color.gray

isOverBought = (ta.crossover(k,d) and k > StochOverBought) ? 1 : 0

isOverBoughtv2 = k > StochOverBought ? 1 : 0

filteredAlert = alert3 ? 1 : 0

aggressiveAlert = alert4 ? 1 : 0

if (filteredAlert or aggressiveAlert)

strategy.entry("Long", strategy.long)

if (isOverBought)

strategy.close("Long")

- Estratégia de negociação a curto prazo baseada no indicador de volatilidade Chaikin

- Estratégia de acompanhamento da tendência de dupla MA

- Estratégia Tripla de Super Tendência

- Estratégia dinâmica de suspensão de perdas

- Estratégia de cruzamento de média móvel com stop-loss e take-profit

- Estratégia inversa de reversão da média baseada na média móvel

- Estratégia de negociação de alta frequência baseada em bandas de Bollinger

- Uma Estratégia Quantitativa de Negociação na Nuvem Ichimoku

- Estratégia de impulso baseada no modelo de ruptura de fundo duplo

- Estratégia de vórtice estocástico

- Estratégia alargada de comércio de mercadorias da pesca de fundo adaptativa da CCI

- Estratégia de Impulso Baseada no Espremimento do LazyBear

- Estratégia de paragem de lucros da Sawtooth baseada na média móvel

- Estratégia de negociação de média móvel dinâmica ponderada

- Estratégia da última vela

- Estratégia quantitativa de inversão do índice de volume negativo

- Estratégia de ruptura de supertrend triplo

- MACD da estratégia de força relativa

- Sistema de Três Dragões

- Top Trading Based Only on Weekly EMA8 Strategy (Tónico baseado na estratégia semanal do EMA8)