Estratégia de impulso baseada no modelo de ruptura de fundo duplo

Autora:ChaoZhang, Data: 21 de dezembro de 2023 15:16:24Tags:

Resumo

Esta estratégia é baseada no modelo de fundo duplo usando indicadores técnicos. Ele procura sinais de ruptura quando o mercado está em um estado de sobrevenda e um padrão de fundo duplo é formado perto da área inferior. A estratégia combina vários indicadores para julgar o estado de sobrecompra e sobrevenda do mercado e gera sinais de compra quando um fundo duplo se forma. Esta estratégia é principalmente adequada para negociação de médio e curto prazo.

Princípio da estratégia

Esta estratégia avalia principalmente se os preços estão a formar um fundo duplo em torno dos níveis de apoio essenciais e se o mercado está em estado de sobrevenda.

-

Indicador RSI: Quando o indicador RSI mostra que o mercado está sobrevendido, é considerado um sinal de compra.

-

Indicador RVI: Quando o indicador RVI mostra que o mercado está sobrevendido, é considerado um sinal de compra.

-

Indicador das IFM: Quando o indicador das IFM mostra que o mercado está sobrevendido, é considerado um sinal de compra.

-

Indicador SAR: Quando os preços ultrapassam o indicador SAR, é considerado um sinal de compra.

-

Indicador SMA500: Quando os preços ultrapassam o indicador SMA500, é considerado um sinal de compra.

Esta estratégia leva em conta os julgamentos dos múltiplos indicadores acima e gera sinais de compra quando se forma um padrão de duplo fundo em torno dos principais níveis de suporte.

Vantagens da estratégia

Esta estratégia tem as seguintes vantagens:

-

A combinação de múltiplos indicadores para julgar o estado do mercado torna os sinais mais confiáveis.

-

A geração de sinais de compra quando se formam fundos duplos tem uma probabilidade relativamente elevada de lucro.

-

Usando combinações de indicadores para julgar os estados de sobrevenda e sobrecompra, evita-se perder oportunidades de compra.

-

A integração do modelo de ruptura de fundo duplo com as estratégias de indicadores combina as vantagens da negociação de tendência e de reversão da média.

-

A estratégia tem um grande espaço de otimização de parâmetros e os parâmetros podem ser ajustados para diferentes mercados.

Riscos da Estratégia

A estratégia apresenta igualmente os seguintes riscos:

-

O risco de sinais falsos dos indicadores, resultando em perdas de compra.

-

O risco de que os fundos duplos não conseguem romper.

-

A dificuldade da otimização de parâmetros de alta dimensão é grande e requer um apoio maciço de dados históricos.

-

Dependendo dos dados históricos para os resultados dos testes, o desempenho real será diferente.

Orientações de otimização

As principais direcções de otimização desta estratégia incluem:

-

Otimizar os pesos dos indicadores de compra para determinar a combinação de pesos ideal.

-

Otimização dos parâmetros do indicador para determinar a melhor combinação de parâmetros.

-

Adicionar estratégias de stop loss para reduzir a perda por negociação.

-

Aumentar os módulos de gestão de posições para obter lucros mais constantes.

-

Incorporar algoritmos de aprendizagem de máquina para construir mecanismos de otimização de parâmetros adaptativos.

Conclusão

Esta estratégia integra o modelo de ruptura de fundo duplo e os julgamentos do indicador de sobrevenda, gerando sinais de compra quando os fundos duplos se formam em torno dos níveis de suporte-chave.

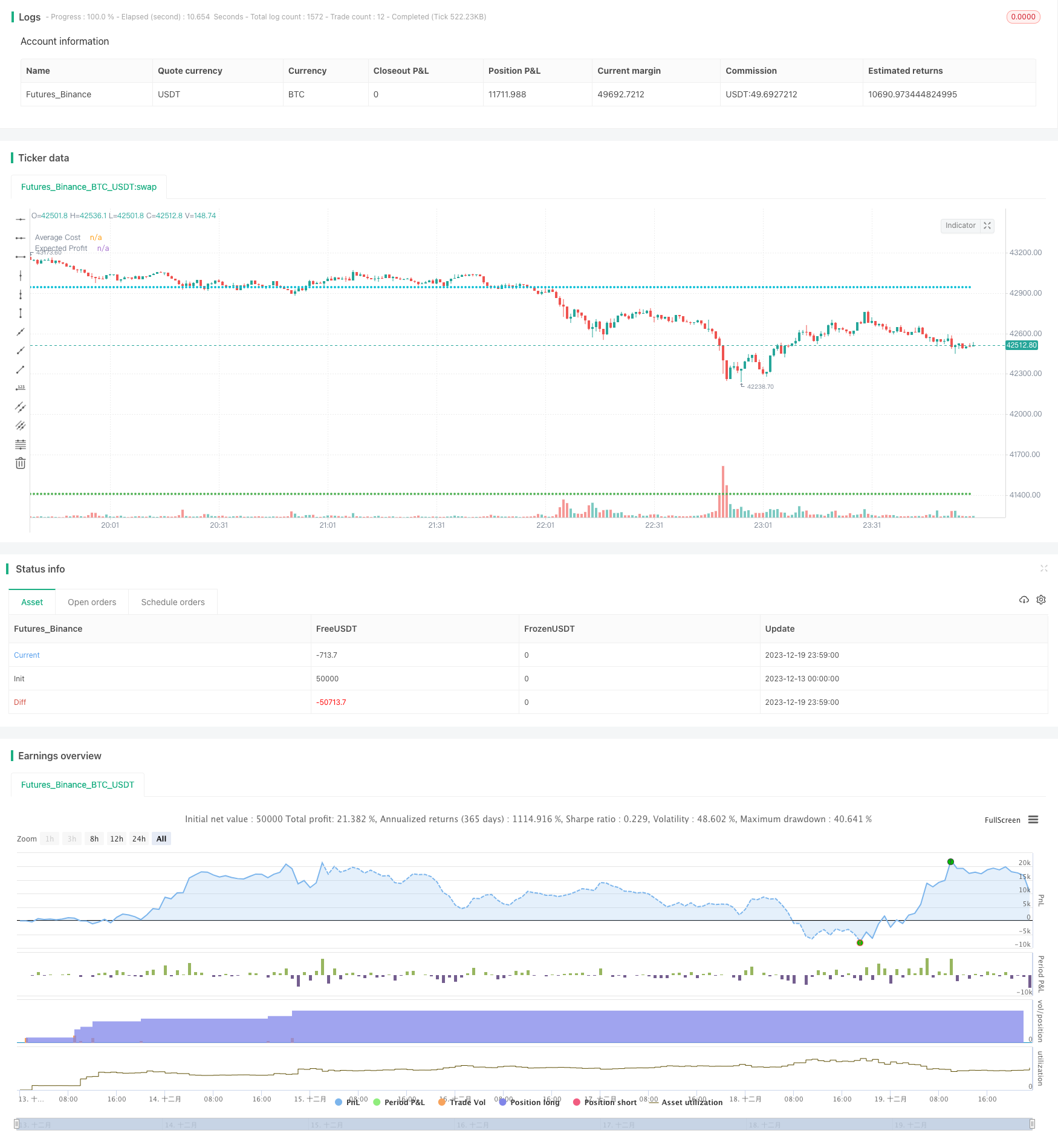

/*backtest

start: 2023-12-13 00:00:00

end: 2023-12-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("UP & DOWN - BNB/USDT 15min", shorttitle="U&D - BNB 15min", overlay=true, calc_on_order_fills=true, calc_on_every_tick=true, initial_capital = 1000,pyramiding = 40,backtest_fill_limits_assumption = 1, process_orders_on_close=true, currency = currency.USD, default_qty_type = strategy.cash, default_qty_value = 25, commission_type = strategy.commission.percent, commission_value = 0.1)

// This startergy optimized to BNB 15 min standerd candlestic chart and buy & sell signals were based on technical analysis.

UP_DOWN = input.string( title='Trade in', options=['Only on Up Trends', 'Uptrend and down trend'], defval='Uptrend and down trend')

var profit_cal = input.float( defval = 3.7, title = "Expected profit %", minval = 0.2, step = 0.1)

//Backtest dates

fromMonth = input.int(defval = 10,title = "From Month", minval = 1, maxval = 12, group = 'Time Period Values')

fromDay = input.int(defval = 1, title = "From Day", minval = 1, maxval = 31, group = 'Time Period Values')

fromYear = input.int(defval = 2021, title = "From Year", minval = 1970, group = 'Time Period Values')

thruMonth = input.int(defval = 1, title = "Thru Month", minval = 1, maxval = 12, group = 'Time Period Values')

thruDay = input.int(defval = 1, title = "Thru Day", minval = 1, maxval = 31, group = 'Time Period Values')

thruYear = input.int(defval = 2112, title = "Thru Year", minval = 1970, group = 'Time Period Values')

//showDate = input(defval = true, title = "Show Date Range", group = 'Time Period Values')

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

// inputs

//Inputs of SAR Indicator

sar1 = input.float(defval=0.0002, title='SAR value 1',step=0.0001, group = 'SAR Values')

sar2 = input.float(defval=0.0004, title='SAR value 2',step=0.0001, group = 'SAR Values')

sar3 = input.float(defval=0.1, title='SAR value 3',step=0.1, group = 'SAR Values')

src_close = input(close, "SAR Source - close", group = 'SAR Values')

src_open = input(open, "SAR Source - open", group = 'SAR Values')

bool sar_visible = input(false, "Show SAR",group = 'SAR Values' )

// Inputs of Super trend indicator

ST_T = input.int(defval=16, title = 'Supertrend - Trend', step =1, group = 'Super Trend')

ST_D = input.int(defval=7, title = 'Supertrend - Direction', step =1, group = 'Super Trend')

ST_SMA = input.int(defval=1, title = 'Supertrend - SMA', step = 1, group = 'Super Trend')

bool ST_visible = input(false, "Show Super Trend",group = 'Super Trend' )

//Inputs of SMA500 indicator

src_sma500 = input(high, 'SMA500 - Source', group = 'SMA500')

lb_sma500 = input.int(defval = 143, title = 'SMA500 - Look back period', step=10, group = 'SMA500')

bool sma500_visible = input(false, "Show SMA500",group = 'SMA500' )

// Calculations

// SMA500 Indicator

SMA500 = ta.sma(src_sma500,lb_sma500)

SMA700 = ta.sma(close,700)

SMA_Open = ta.sma(open,9)

//SMA9 Indicator

SMA9 = ta.sma((high+low)/2,5)

risingSMA9 = ta.rising(SMA9,1)

fallingSMA9 = ta.falling(SMA9,1)

color plotcolor1 = color.black

if risingSMA9

plotcolor1 := color.green

// SAR Indicator

sar = ta.sar(sar1, sar2, sar3)

sma2_close = ta.sma(src_close,1)

sma2_open = ta.sma(src_open,1)

//Supertrend

[supertrend, direction] = ta.supertrend(ST_T, ST_D)

up_trend = ta.sma(direction < 0 ? supertrend : na,ST_SMA)

down_trend = ta.sma(direction < 0? na : supertrend, ST_SMA)

// Color change

color plotcolor2 = color.green

if open>down_trend or close>down_trend

plotcolor2 := color.lime

if open<down_trend or close<down_trend

plotcolor2 := color.red

color plotcolor3 = color.green

if open>up_trend or close>up_trend

plotcolor3 := color.yellow

if open<up_trend or close<up_trend

plotcolor3 := color.red

color plotcolor4 = color.black

if (open>sar or close>sar)

plotcolor4 := color.white

if (open<sar or close<sar)

plotcolor4 := color.red

color plotcolor5 = color.black

if (open>SMA500 or close>SMA500)

plotcolor5 := color.green

if (open<SMA500 or close<SMA500)

plotcolor5 := color.red

color plotcolor6 = color.green

rising_taalma = ta.rising (ta.alma(open,10,.99,1),1)

falling_taalma = ta.falling (ta.alma(open,10,.99,1),1)

if rising_taalma

plotcolor6 := color.green

if falling_taalma

plotcolor6 := color.red

// buy and sell conditions for uptrend

longCondition1 = (open >= down_trend or high>= down_trend or ta.crossover(open,down_trend)or ta.crossover(high,down_trend))

longCondition2 = (open >= up_trend or high>= up_trend or ta.crossover(open,up_trend)or ta.crossover(high,up_trend))

longCondition3 = (open >= SMA500 or high>= SMA500 or ta.crossover(open,SMA500)or ta.crossover(high,SMA500))

longCondition4 = (open >= sar or high>= sar or ta.crossover(open,sar)or ta.crossover(high,sar))

longCondition5 = rising_taalma

shortCondition1 = (close < down_trend or low< down_trend or ta.crossunder(close,down_trend)or ta.crossunder(low,down_trend))

shortCondition2 = (close < up_trend or low< up_trend or ta.crossunder(close,up_trend)or ta.crossunder(low,up_trend))

shortCondition3 = (close < SMA500 or low< SMA500 or ta.crossunder(close,SMA500)or ta.crossunder(low,SMA500))

shortCondition4 = (close < sar or low< sar or ta.crossunder(close,sar)or ta.crossunder(low,sar))

shortCondition5 = falling_taalma

comp_buy1 = longCondition1 and longCondition2 and longCondition3 and longCondition4 and longCondition5

op_buy1 = shortCondition3 and longCondition1 and longCondition2 and longCondition4

op_buy2 = shortCondition1 and shortCondition2 and longCondition3 and longCondition4 and longCondition5

comp_sell1 = shortCondition1 and shortCondition2 and shortCondition3 and shortCondition4 and shortCondition5

op_sell1 = shortCondition3 and shortCondition4 and longCondition1 and longCondition2

op_sell2 = shortCondition4 and longCondition1 and longCondition2 and longCondition3

op_sell3 = longCondition2 and shortCondition1 and shortCondition4 and shortCondition3

op_sell4 = longCondition2 and shortCondition1 and shortCondition4

var b1 = 0

var b2 = 0

var b3 = 0

if comp_buy1 == true and comp_buy1[1] == false

b1 := 1

else

b1 := 0

if op_buy1 == true and op_buy1[1] == false

b2 := 1

else

b2 := 0

if op_buy2 == true and op_buy2[1] == false

b3 := 1

else

b3 := 0

// DCA method based on indicators

//RSI Indicator

len_rsi_10 = input.int(10, title="Length", group = "RSI Indicator - 10", minval=1, maxval = 10, step = 1)

src_rsi_10 = input(ohlc4, "Source", group = "RSI Indicator - 10")

up_rsi_10 = ta.rma(math.max(ta.change(src_rsi_10), 0), len_rsi_10)

down_rsi_10 = ta.rma(-math.min(ta.change(src_rsi_10), 0), len_rsi_10)

rsi_10 = down_rsi_10 == 0 ? 100 : up_rsi_10 == 0 ? 0 : 100 - (100 / (1 + up_rsi_10 / down_rsi_10))

var p_rsi = 0

if rsi_10>= 0 and rsi_10<10

p_rsi := 0

else if rsi_10>= 10 and rsi_10<20

p_rsi := 10

else if rsi_10>= 20 and rsi_10<30

p_rsi := 20

else if rsi_10>= 30 and rsi_10<40

p_rsi := 30

else if rsi_10>= 40 and rsi_10<50

p_rsi := 40

else if rsi_10>= 50 and rsi_10<60

p_rsi := 50

else if rsi_10>= 60 and rsi_10<70

p_rsi := 60

else if rsi_10>= 70 and rsi_10<80

p_rsi := 70

else if rsi_10>= 80 and rsi_10<90

p_rsi := 80

else if rsi_10>= 90 and rsi_10<100

p_rsi := 90

len_rsi_50 = input.int(50, title="Length", group = "RSI Indicator - 50", minval=11, maxval = 50, step = 1)

src_rsi_50 = input(high, "Source", group = "RSI Indicator - 50")

up_rsi_50 = ta.rma(math.max(ta.change(src_rsi_50), 0), len_rsi_50)

down_rsi_50 = ta.rma(-math.min(ta.change(src_rsi_50), 0), len_rsi_50)

rsi_50 = down_rsi_50 == 0 ? 100 : up_rsi_50 == 0 ? 0 : 100 - (100 / (1 + up_rsi_50 / down_rsi_50))

var p_rsi_50 = 0

if rsi_50>= 0 and rsi_50<10

p_rsi_50 := 0

else if rsi_50>= 10 and rsi_50<20

p_rsi_50 := 10

else if rsi_50>= 20 and rsi_50<30

p_rsi_50 := 20

else if rsi_50>= 30 and rsi_50<40

p_rsi_50 := 30

else if rsi_50>= 40 and rsi_50<50

p_rsi_50 := 40

else if rsi_50>= 50 and rsi_50<60

p_rsi_50 := 50

else if rsi_50>= 60 and rsi_50<70

p_rsi_50 := 60

else if rsi_50>= 70 and rsi_50<80

p_rsi_50 := 70

else if rsi_50>= 80 and rsi_50<90

p_rsi_50 := 80

else if rsi_50>= 90 and rsi_50<100

p_rsi_50 := 90

len_rsi_100 = input.int(100, title="Length", group = "RSI Indicator - 100", minval=51, maxval = 200, step = 10)

src_rsi_100 = input(ohlc4, "Source", group = "RSI Indicator - 100")

up_rsi_100 = ta.rma(math.max(ta.change(src_rsi_100), 0), len_rsi_100)

down_rsi_100 = ta.rma(-math.min(ta.change(src_rsi_100), 0), len_rsi_100)

rsi_100 = down_rsi_100 == 0 ? 100 : up_rsi_100 == 0 ? 0 : 100 - (100 / (1 + up_rsi_100 / down_rsi_100))

var p_rsi_100 = 0

if rsi_100>= 0 and rsi_100<10

p_rsi_100 := 0

else if rsi_100>= 10 and rsi_100<20

p_rsi_100 := 10

else if rsi_100>= 20 and rsi_100<30

p_rsi_100 := 20

else if rsi_100>= 30 and rsi_100<40

p_rsi_100 := 30

else if rsi_100>= 40 and rsi_100<50

p_rsi_100 := 40

else if rsi_100>= 50 and rsi_100<60

p_rsi_100 := 50

else if rsi_100>= 60 and rsi_100<70

p_rsi_100 := 60

else if rsi_100>= 70 and rsi_100<80

p_rsi_100 := 70

else if rsi_100>= 80 and rsi_100<90

p_rsi_100 := 80

else if rsi_100>= 90 and rsi_100<100

p_rsi_100 := 90

// Relative Volatility Indicator

length_rvi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - RVI", group = "RVI Indicator - 10")

len_rvi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - EMA", group = "RVI Indicator - 10")

src_rvi_10 = input(high, title = "Source", group = "RVI Indicator - 10")

stddev_rvi_10 = ta.stdev(src_rvi_10, length_rvi_10)

upper_rvi_10 = ta.ema(ta.change(src_rvi_10) <= 0 ? 0 : stddev_rvi_10, len_rvi_10)

lower_rvi_10 = ta.ema(ta.change(src_rvi_10) > 0 ? 0 : stddev_rvi_10, len_rvi_10)

rvi_10 = upper_rvi_10 / (upper_rvi_10 + lower_rvi_10) * 100

var p_rvi_10 = 0

if rvi_10 >= 0 and rvi_10 <10

p_rvi_10 := 0

else if rvi_10 >= 10 and rvi_10 <20

p_rvi_10 := 10

else if rvi_10 >= 20 and rvi_10 <30

p_rvi_10 := 20

else if rvi_10 >= 30 and rvi_10 <40

p_rvi_10 := 30

else if rvi_10 >= 40 and rvi_10 <50

p_rvi_10 := 40

else if rvi_10 >= 50 and rvi_10 <60

p_rvi_10 := 50

else if rvi_10 >= 60 and rvi_10 <70

p_rvi_10 := 60

else if rvi_10 >= 70 and rvi_10 <80

p_rvi_10 := 70

else if rvi_10 >= 80 and rvi_10 <90

p_rvi_10 := 80

else if rvi_10 >= 90 and rvi_10 <100

p_rvi_10 := 90

length_rvi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - RVI", group = "RVI Indicator - 50")

len_rvi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - EMA", group = "RVI Indicator - 50")

src_rvi_50 = input(close, title = "source", group = "RVI Indicator - 50")

stddev_rvi_50 = ta.stdev(src_rvi_50, length_rvi_50)

upper_rvi_50 = ta.ema(ta.change(src_rvi_50) <= 0 ? 0 : stddev_rvi_50, len_rvi_50)

lower_rvi_50 = ta.ema(ta.change(src_rvi_50) > 0 ? 0 : stddev_rvi_50, len_rvi_50)

rvi_50 = upper_rvi_50 / (upper_rvi_50 + lower_rvi_50) * 100

var p_rvi_50 = 0

if rvi_50 >= 0 and rvi_50 <10

p_rvi_50 := 0

else if rvi_50 >= 10 and rvi_50 <20

p_rvi_50 := 10

else if rvi_50 >= 20 and rvi_50 <30

p_rvi_50 := 20

else if rvi_50 >= 30 and rvi_50 <40

p_rvi_50 := 30

else if rvi_50 >= 40 and rvi_50 <50

p_rvi_50 := 40

else if rvi_50 >= 50 and rvi_50 <60

p_rvi_50 := 50

else if rvi_50 >= 60 and rvi_50 <70

p_rvi_50 := 60

else if rvi_50 >= 70 and rvi_50 <80

p_rvi_50 := 70

else if rvi_50 >= 80 and rvi_50 <90

p_rvi_50 := 80

else if rvi_50 >= 90 and rvi_50 <100

p_rvi_50 := 90

length_rvi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - RVI", group = "RVI Indicator - 100")

len_rvi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - EMA", group = "RVI Indicator - 100")

src_rvi_100 = input(close, title = "Source", group = "RVI Indicator - 100")

stddev_rvi_100 = ta.stdev(src_rvi_100, length_rvi_100)

upper_rvi_100 = ta.ema(ta.change(src_rvi_100) <= 0 ? 0 : stddev_rvi_100, len_rvi_100)

lower_rvi_100 = ta.ema(ta.change(src_rvi_100) > 0 ? 0 : stddev_rvi_100, len_rvi_100)

rvi_100 = upper_rvi_100 / (upper_rvi_100 + lower_rvi_100) * 100

var p_rvi_100 = 0

if rvi_100 >= 0 and rvi_100 <10

p_rvi_100 := 0

else if rvi_100 >= 10 and rvi_100 <20

p_rvi_100 := 10

else if rvi_100 >= 20 and rvi_100 <30

p_rvi_100 := 20

else if rvi_100 >= 30 and rvi_100 <40

p_rvi_100 := 30

else if rvi_100 >= 40 and rvi_100 <50

p_rvi_100 := 40

else if rvi_100 >= 50 and rvi_100 <60

p_rvi_100 := 50

else if rvi_100 >= 60 and rvi_100 <70

p_rvi_100 := 60

else if rvi_100 >= 70 and rvi_100 <80

p_rvi_100 := 70

else if rvi_100 >= 80 and rvi_100 <90

p_rvi_100 := 80

else if rvi_100 >= 90 and rvi_100 <100

p_rvi_100 := 90

// Money flow index

len_mfi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - MFI", group = "MFI Indicator - 10")

src_mfi_10 = input(high, title = "source", group = "MFI Indicator - 10")

mf_10 = ta.mfi(src_mfi_10, len_mfi_10)

var p_mfi_10 = 0

if mf_10>= 0 and mf_10<10

p_mfi_10 := 0

else if mf_10>= 10 and mf_10<20

p_mfi_10 := 10

else if mf_10>= 20 and mf_10<30

p_mfi_10 := 20

else if mf_10>= 30 and mf_10<40

p_mfi_10 := 30

else if mf_10>= 40 and mf_10<50

p_mfi_10 := 40

else if mf_10>= 50 and mf_10<60

p_mfi_10 := 50

else if mf_10>= 60 and mf_10<70

p_mfi_10 := 60

else if mf_10>= 70 and mf_10<80

p_mfi_10 := 70

else if mf_10>= 80 and mf_10<90

p_mfi_10 := 80

else if mf_10>= 90 and mf_10<100

p_mfi_10 := 90

len_mfi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - MFI", group = "MFI Indicator - 50")

src_mfi_50 = input(high, title = "source", group = "MFI Indicator - 50")

mf_50 = ta.mfi(src_mfi_50, len_mfi_50)

var p_mfi_50 = 0

if mf_50>= 0 and mf_50<10

p_mfi_50 := 0

else if mf_50>= 10 and mf_50<20

p_mfi_50 := 10

else if mf_50>= 20 and mf_50<30

p_mfi_50 := 20

else if mf_50>= 30 and mf_50<40

p_mfi_50 := 30

else if mf_50>= 40 and mf_50<50

p_mfi_50 := 40

else if mf_50>= 50 and mf_50<60

p_mfi_50 := 50

else if mf_50>= 60 and mf_50<70

p_mfi_50 := 60

else if mf_50>= 70 and mf_50<80

p_mfi_50 := 70

else if mf_50>= 80 and mf_50<90

p_mfi_50 := 80

else if mf_50>= 90 and mf_50<100

p_mfi_50 := 90

len_mfi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - MFI", group = "MFI Indicator - 100")

src_mfi_100 = input(high, title = "source", group = "MFI Indicator - 100")

mf_100 = ta.mfi(src_mfi_100, len_mfi_100)

var p_mfi_100 = 0

if mf_100>= 0 and mf_100<10

p_mfi_100 := 0

else if mf_100>= 10 and mf_100<20

p_mfi_100 := 10

else if mf_100>= 20 and mf_100<30

p_mfi_100 := 20

else if mf_100>= 30 and mf_100<40

p_mfi_100 := 30

else if mf_100>= 40 and mf_100<50

p_mfi_100 := 40

else if mf_100>= 50 and mf_100<60

p_mfi_100 := 50

else if mf_100>= 60 and mf_100<70

p_mfi_100 := 60

else if mf_100>= 70 and mf_100<80

p_mfi_100 := 70

else if mf_100>= 80 and mf_100<90

p_mfi_100 := 80

else if mf_100>= 90 and mf_100<100

p_mfi_100 := 90

//Balance of power indicator

bop = ((((close - open) / (high - low))*100)+50)

bop_sma_100 = ta.sma(bop,100)

// Buy and Sell lavels based on Indicators

l_val_rsi = input.int (defval = 40, title = "Lower value of RSI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

l_val_rvi = input.int (defval = 40, title = "Lower value of RVI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

l_val_mfi = input.int (defval = 40, title = "Lower value of MFI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_rsi = input.int (defval = 60, title = "Higher value of RSI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_rvi = input.int (defval = 50, title = "Higher value of RVI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_mfi = input.int (defval = 50, title = "Higher value of MFI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

buy_rsi = p_rsi_100 <= l_val_rsi and p_rsi_50<p_rsi_100 and p_rsi<=p_rsi_50

buy_rvi = p_rvi_100 <= l_val_rvi and p_rvi_50<=p_rvi_100 and p_rvi_10<=p_rvi_50

buy_mfi = p_mfi_100 <= l_val_mfi and p_mfi_50<=p_mfi_100 and p_mfi_10<=p_mfi_50

buy_compound = buy_rsi and buy_rvi and buy_mfi ? 100 : 0

var float buy_compound_f = na

if (buy_compound[1] == 100 and buy_compound == 0) //and open > close

buy_compound_f := 1

else

buy_compound_f := na

ma_9 = ta.ema(close,2)

co_l1 = strategy.position_avg_price*0.95

co_l2 = strategy.position_avg_price*0.90

co_l3 = strategy.position_avg_price*0.85

co_l4 = strategy.position_avg_price*0.80

//Take profit in Market bottoms

profit_f = 1.0 + (profit_cal/100)

// Trading

var final_option = UP_DOWN == 'Uptrend and down trend' ? 1 : 2

if final_option == 1

if ((buy_compound_f ==1 or ta.crossover(ma_9, co_l1) or ta.crossover(ma_9, co_l2) or ta.crossover(ma_9, co_l3) or ta.crossover(ma_9, co_l4)) and window())

strategy.entry("long", strategy.long,comment = "BUY")

else if ( comp_sell1 and window()) and strategy.position_avg_price * profit_f < close

strategy.close("long", qty_percent = 100, comment = "SELL")

else if final_option == 2

if (b1 or b2 or b3) and window()

strategy.entry("long", strategy.long, comment = "BUY")

else if (comp_sell1 or op_sell1 or op_sell2 or op_sell3 or op_sell4 ) and window()

strategy.close("long", qty_percent = 100, comment = "SELL")

bool PM_visible = input(false, "Show Profit marjin and average price", group = 'Safty Margins')

bool SM_visible = input(false, "Show Safty Grids", group = 'Safty Margins' )

//Graphs

plot(PM_visible or final_option == 1 ? strategy.position_avg_price : na, color = color.green, title = "Average Cost", style = plot.style_circles)

plot(PM_visible or final_option == 1 ? strategy.position_avg_price* profit_f :na, color = color.aqua, title = "Expected Profit", style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.95 : na, color = color.gray, title = "SAFTY MARGIN - 95%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.90 : na, color = color.gray, title = "SAFTY MARGIN - 90%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.85 : na, color = color.gray, title = "SAFTY MARGIN - 85%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.80 : na, color = color.gray, title = "SAFTY MARGIN - 80%", linewidth = 1, style = plot.style_circles)

plot(ST_visible or final_option == 2 ? down_trend:na, "Down trend", color = plotcolor2, linewidth=2)

plot(ST_visible or final_option == 2 ? up_trend: na , "Up direction", color = plotcolor3, linewidth=2)

plot(sar_visible or final_option == 2 ? sar:na, title='SAR', color=plotcolor4, linewidth=2)

plot(sma500_visible or final_option == 2 ? SMA500:na,title='SMA500', color=plotcolor5, linewidth=3)

- Estratégia de tendência do canal Donchian de confirmação dupla

- Estratégia de inversão de momento baseada no modelo multifator

- Estratégia de negociação a curto prazo baseada no indicador de volatilidade Chaikin

- Estratégia de acompanhamento da tendência de dupla MA

- Estratégia Tripla de Super Tendência

- Estratégia dinâmica de suspensão de perdas

- Estratégia de cruzamento de média móvel com stop-loss e take-profit

- Estratégia inversa de reversão da média baseada na média móvel

- Estratégia de negociação de alta frequência baseada em bandas de Bollinger

- Uma Estratégia Quantitativa de Negociação na Nuvem Ichimoku

- Estratégia de vórtice estocástico

- A estratégia de negociação multiperíodo baseada no índice de volatilidade e no oscilador estocástico

- Estratégia alargada de comércio de mercadorias da pesca de fundo adaptativa da CCI

- Estratégia de Impulso Baseada no Espremimento do LazyBear

- Estratégia de paragem de lucros da Sawtooth baseada na média móvel

- Estratégia de negociação de média móvel dinâmica ponderada

- Estratégia da última vela

- Estratégia quantitativa de inversão do índice de volume negativo

- Estratégia de ruptura de supertrend triplo

- MACD da estratégia de força relativa