O valor da posição ponderada deve ser calculado em conformidade com o modelo CR SA.

Autora:ChaoZhang, Data: 2023-12-26 16:21:58Tags:

Resumo

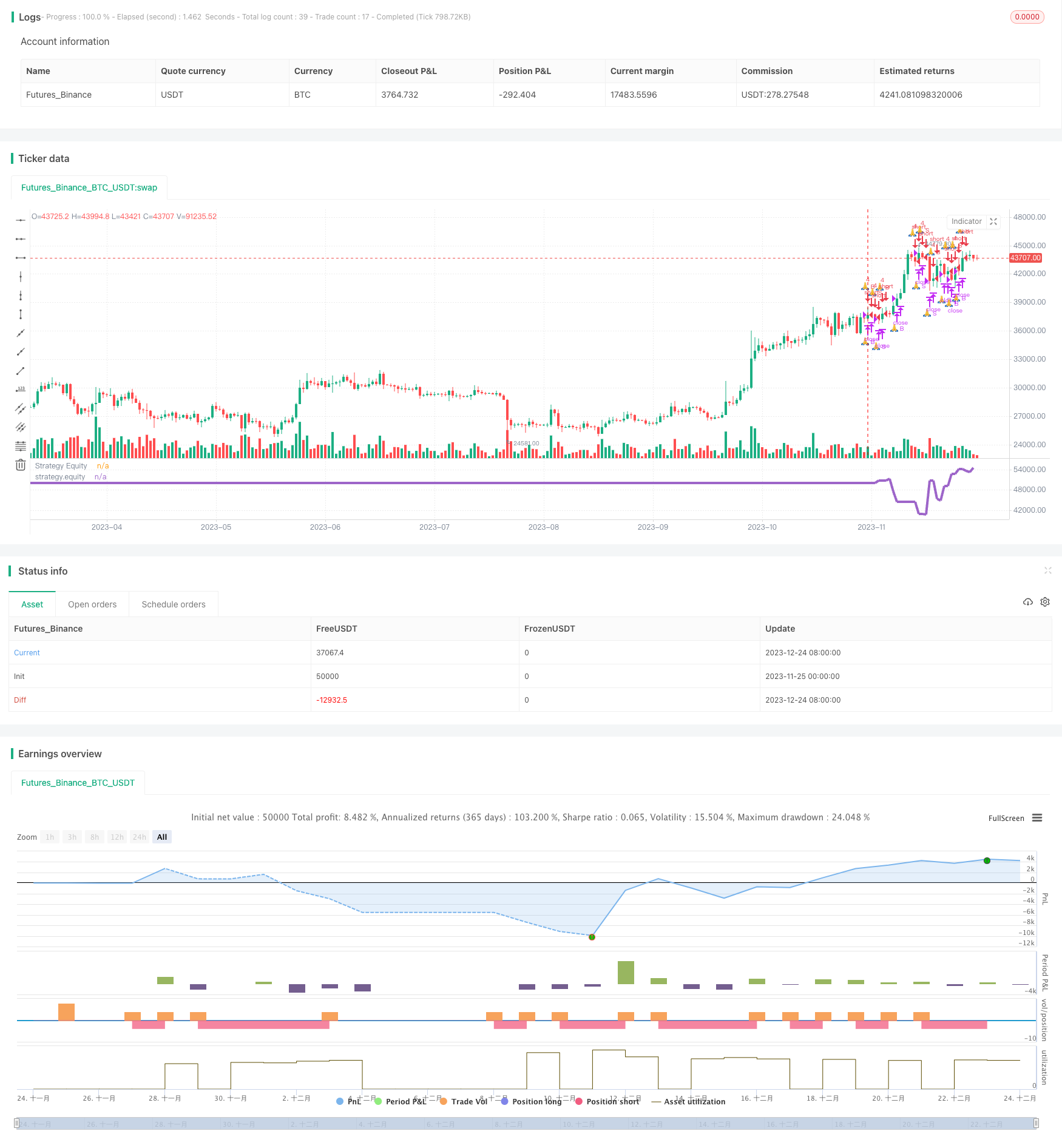

Esta estratégia gerencia o risco através da definição de condições de apalancamento e de margem elevadas para fechar posições durante flutuações significativas do mercado.

Estratégia lógica

- Defina alavancagem elevada, por exemplo, 4x

- Defina o nível de chamada de margem, por exemplo, $25.000

- Cessar a abertura de novas operações quando o capital próprio cair abaixo do nível de chamada de margem

- Fechar todas as posições quando a chamada de margem for desencadeada à medida que o capital próprio continua a cair

Assim, a estratégia pode reduzir as perdas no tempo durante movimentos drásticos do mercado para evitar riscos de chamadas de margem.

Análise das vantagens

- Adaptação flexível da alavancagem com base na tolerância pessoal ao risco

- Mecanismo de margem de chamadas previne expansões de contas

- O risco de perdas de liquidação deve ser reduzido em tempo útil com uma alavancagem elevada para mitigar os riscos.

Análise de riscos

- A alavancagem amplifica tanto os lucros como os riscos

- Nível de chamada de margem precisa de alinhamento com o stop loss

- Ativos de capital de risco

Os riscos podem ser reduzidos ajustando a alavancagem, alinhando a chamada de margem e o stop loss, otimizando o stop loss, etc.

Orientações de otimização

- Adicionar filtro de tendência para evitar transações contra-tendência

- Otimizar o stop loss para evitar deslizamentos

- Configure filtros de hora de negociação para evitar negociações em determinadas sessões

- Incorporar modelos de aprendizagem de máquina para ajustar dinamicamente parâmetros

Resumo

A estratégia gerencia o risco com configurações de alavancagem e chamada de margem para evitar explosões de contas. No entanto, a alavancagem alta também aumenta os riscos. Esforços adicionais como validação de tendências, otimização de stop loss e controle de horas de negociação podem ajudar a reduzir ainda mais os riscos. Técnicas complexas como aprendizado de máquina também podem ser alavancadas para otimizar dinamicamente os parâmetros e alcançar um equilíbrio entre rentabilidade e gerenciamento de riscos.

/*backtest

start: 2023-11-25 00:00:00

end: 2023-12-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

//@author=Daveatt

// Breakout on 2H high/low break Strategy

SystemName = "Leverage Strategy"

TradeId = "🙏"

InitCapital = 100000

InitPosition = 1

UseMarginCall = input(true, title="Use Margin Call?")

MarginValue = input(25000, title="Margin Value", type=input.float)

// use 1 for no leverage

// use 0.1 for be underleveraged and bet 1/10th of a pip value

// use any value > 1 for full-degen mode

UseLeverage = input(true, title="Use Leverage")

LeverageValue = input(4, title="Leverage mult (1 for no leverage)", minval=0.1, type=input.float)

// Risk Management

UseRiskManagement = input(true, title="Use Risk Management?")

// ticks = 1/10th of a pip value

StopLoss = input(5, title="Stop Loss in ticks value", type=input.float)

TakeProfit = input(500, title="Take Profit in ticks value", type=input.float)

InitCommission = 0.075

InitPyramidMax = 1

CalcOnorderFills = false

CalcOnTick = true

DefaultQtyType = strategy.cash

DefaultQtyValue = strategy.cash

Currency = currency.USD

Precision = 2

Overlay=false

MaxBarsBack=3000

strategy

(

title=SystemName,

shorttitle=SystemName,

overlay=Overlay

)

//////////////////////////// UTILITIES ///////////////////////////

f_print(_txt, _condition) =>

var _lbl = label(na)

label.delete(_lbl)

if _condition

// saving the candle where we got rekt :(

_index = barssince(_condition)

_lbl := label.new(bar_index - _index, highest(100), _txt, xloc.bar_index, yloc.price, size = size.normal, style=label.style_labeldown)

//////////////////////////// STRATEGY LOGIC ///////////////////////////

// Date filterigng

_Date = input(true, title="[LABEL] DATE")

FromYear = input(2019, "From Year", minval=1900), FromMonth = input(12, "From Month", minval=1, maxval=12), FromDay = input(1, "From Day", minval=1, maxval=31)

ToYear = input(2019, "To Year", minval=1900), ToMonth = input(12, "To Month", minval=1, maxval=12), ToDay = input(9, "To Day", minval=1, maxval=31)

FromDate = timestamp(FromYear, FromMonth, FromDay, 00, 00)

ToDate = timestamp(ToYear, ToMonth, ToDay, 23, 59)

TradeDateIsAllowed = true

// non-repainting security version

four_hours_H = security(syminfo.tickerid, '240', high[1], lookahead=true)

four_hours_L = security(syminfo.tickerid, '240', low[1], lookahead=true)

buy_trigger = crossover(close, four_hours_H)

sell_trigger = crossunder(close, four_hours_L)

// trend states

since_buy = barssince(buy_trigger)

since_sell = barssince(sell_trigger)

buy_trend = since_sell > since_buy

sell_trend = since_sell < since_buy

change_trend = (buy_trend and sell_trend[1]) or (sell_trend and buy_trend[1])

// plot(four_hours_H, title="4H High", linewidth=2, color=#3c91c2, style=plot.style_linebr, transp=0,

// show_last=1, trackprice=true)

// plot(four_hours_L, title="4H Low", linewidth=2, color=#3c91c2, style=plot.style_linebr, transp=0,

// show_last=1, trackprice=true)

plot(strategy.equity, color=color.blue, linewidth=3, title="Strategy Equity")

// get the entry price

entry_price = valuewhen(buy_trigger or sell_trigger, close, 0)

// SL and TP

SL_price = buy_trend ? entry_price - StopLoss : entry_price + StopLoss

is_SL_hit = buy_trend ? crossunder(low, SL_price) : crossover(high, SL_price)

TP_price = buy_trend ? entry_price + TakeProfit : entry_price - TakeProfit

is_TP_hit = buy_trend ? crossover(high, TP_price) : crossunder(low, TP_price)

// Account Margin Management:

f_account_margin_call_cross(_amount)=>

_return = crossunder(strategy.equity, _amount)

f_account_margin_call(_amount)=>

_return = strategy.equity <= _amount

is_margin_call_cross = f_account_margin_call_cross(MarginValue)

is_margin_call = f_account_margin_call(MarginValue)

plot(strategy.equity, title='strategy.equity', transp=0, linewidth=4)

//plot(barssince(is_margin_call ), title='barssince(is_margin_call)', transp=100)

can_trade = iff(UseMarginCall, not is_margin_call, true)

trade_size = InitPosition * (not UseLeverage ? 1 : LeverageValue)

// We can take the trade if not liquidated/margined called/rekt

buy_final = can_trade and buy_trigger and TradeDateIsAllowed

sell_final = can_trade and sell_trigger and TradeDateIsAllowed

close_long = buy_trend and

(UseRiskManagement and (is_SL_hit or is_TP_hit)) or sell_trigger

close_short = sell_trend and

(UseRiskManagement and (is_SL_hit or is_TP_hit)) or buy_trigger

strategy.entry(TradeId + ' B', long=true, qty=trade_size, when=buy_final)

strategy.entry(TradeId + ' S', long=false, qty=trade_size, when=sell_final)

strategy.close(TradeId + ' B', when=close_long)

strategy.close(TradeId + ' S', when=close_short)

// FULL DEGEN MODE ACTIVATED

// Margin called - Broker closing your account

strategy.close_all(when=is_margin_call)

if UseMarginCall and is_margin_call_cross

f_print("☠️REKT☠️", is_margin_call_cross)

- JBravo Estratégia de tendência quantitativa

- Estratégia de recuperação do canal de Keltner

- Trending Darvas Box Estratégia de negociação quantitativa

- Estratégia de reversão quantitativa baseada em IFM e MA

- Estratégia de velas fechadas com filtro EMA e prazos de sessão

- Estratégia de avanço duplo do RSI

- Estratégia quantitativa de cruzamento de pares de Bollinger Bands

- Estratégia de compra e venda

- Quant Bitcoin Trading Strategy Combinando MACD, RSI e FIB

- Estratégia quantitativa de média móvel dupla Golden Cross

- Estratégia da Linha de Equilíbrio de Ichimoku

- Nuvem Ichimoku com estratégia de cruzamento de média móvel dupla

- Uma estratégia de negociação de ETF baseada no ATR e no breakout

- Estratégia de Supertrend de rastreamento

- Estratégia de negociação de envelopes de média móvel

- Estratégia quantitativa de média móvel dupla Golden Cross

- Estratégia de inversão quantitativa do índice que integra sinais de tendência dupla

- Estratégia de negociação de indicadores de inércia

- Estratégia de dupla linha do Bollinger Band RSI

- Estratégia de tendência de ruptura de resistência de suporte dinâmico