Estratégia intradiária de acompanhamento de tendências com múltiplas paradas

Visão geral

A estratégia combina múltiplos ATRs com paradas dinâmicas e blocos Renko compatíveis para capturar a tendência intraday. Combina indicadores de tendência e blocos de indicadores, permitindo a análise de múltiplos períodos de tempo para identificar efetivamente a direção da tendência e interromper os perdas em tempo hábil.

Princípio da estratégia

O núcleo da estratégia está no mecanismo de stop multiplo ATR. Esta estratégia define três grupos de stop dinâmico ATR, com parâmetros de 5x ATR, 10x ATR e 15x ATR. Quando o preço cai abaixo desses três grupos de stop, indica uma mudança de tendência e, em seguida, é aberto. Esta configuração de stop multiplo pode filtrar eficazmente os falsos sinais causados pela volatilidade de curto prazo.

Outra parte central é o bloco Renko melhorado. O bloco divide o incremento de acordo com o valor do ATR e, em combinação com o indicador SMA, julga a direção da tendência. É mais sensível do que o bloco Renko comum e pode identificar mudanças de tendência mais cedo.

A condição de entrada é para fazer mais quando o preço quebra o 3o grupo de ATR para cima, e para fechar quando o preço cai para baixo quando o 3o grupo de ATR para baixo. A condição de saída é para o preço acionar um dos grupos de ATR para cima ou Renko bloquear a posição quando a cor da mudança.

Vantagens estratégicas

- Múltiplos ATRs para controlar os riscos

- Os blocos Renko, mais sensíveis e com perda antecipada

- Combinação de indicadores de tendências e indicadores de blocos para garantir a captura de tendências

- Análise de múltiplos quadros temporais para determinar a direção da tendência

- Parâmetros ajustáveis para diferentes cenários de mercado

Riscos e otimização estratégica

O principal risco desta estratégia é que o stop loss seja ampliado por uma ruptura. Pode ser otimizado através dos seguintes métodos:

- Ajustar o múltiplo do ATR para que o mercado se relaxe adequadamente quando a tendência é forte; se a tendência for fraca, deve ser apropriadamente apertado

- Ajustar os parâmetros do ciclo ATR do bloco Renko para equilibrar a sensibilidade com a estabilidade

- Adição de outros indicadores de stop loss, como o canal Donchian, para garantir um stop loss mais confiável

- Adição de filtros para evitar transações frequentes na liquidação

Resumir

A estratégia é adequada para a prática de tendências intraday fortes, caracterizada pela ciência de parada de perda, o indicador de bloco pode identificar a mudança de tendência antecipadamente. Adapta-se a diferentes ambientes de mercado por meio de ajustes de parâmetros, é uma estratégia de rastreamento de tendências que vale a pena testar em campo.

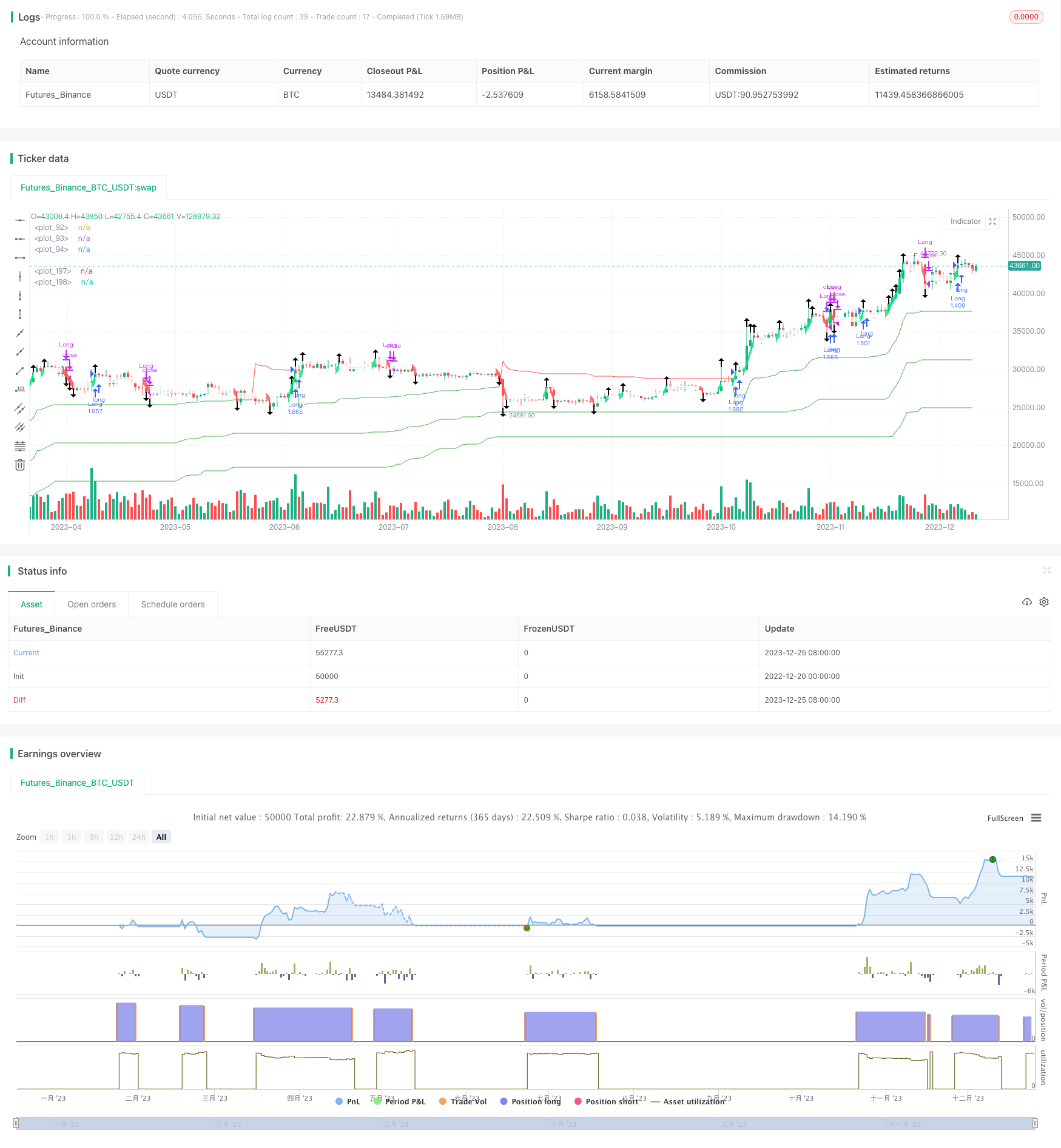

/*backtest

start: 2022-12-20 00:00:00

end: 2023-12-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Lancelot vstop intraday strategy", overlay=true, currency=currency.NONE, initial_capital = 100, commission_type=strategy.commission.percent,

commission_value=0.075, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

///Volatility Stop///

lengtha = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1a = 5

atr_a = atr(lengtha)

max1a = 0.0

min1a = 0.0

is_uptrend_preva = false

stopa = 0.0

vstop_preva = 0.0

vstop1a = 0.0

is_uptrenda = false

is_trend_changeda = false

max_a = 0.0

min_a = 0.0

vstopa = 0.0

max1a := max(nz(max_a[1]), ohlc4)

min1a := min(nz(min_a[1]), ohlc4)

is_uptrend_preva := nz(is_uptrenda[1], true)

stopa := is_uptrend_preva ? max1a - mult1a * atr_a : min1a + mult1a * atr_a

vstop_preva := nz(vstopa[1])

vstop1a := is_uptrend_preva ? max(vstop_preva, stopa) : min(vstop_preva, stopa)

is_uptrenda := ohlc4 - vstop1a >= 0

is_trend_changeda := is_uptrenda != is_uptrend_preva

max_a := is_trend_changeda ? ohlc4 : max1a

min_a := is_trend_changeda ? ohlc4 : min1a

vstopa := is_trend_changeda ? is_uptrenda ? max_a - mult1a * atr_a : min_a + mult1a * atr_a :

vstop1a

///Volatility Stop///

lengthb = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1b = 10

atr_b = atr(lengthb)

max1b = 0.0

min1b = 0.0

is_uptrend_prevb = false

stopb = 0.0

vstop_prevb = 0.0

vstop1b = 0.0

is_uptrendb = false

is_trend_changedb = false

max_b = 0.0

min_b = 0.0

vstopb = 0.0

max1b := max(nz(max_b[1]), ohlc4)

min1b := min(nz(min_b[1]), ohlc4)

is_uptrend_prevb := nz(is_uptrendb[1], true)

stopb := is_uptrend_prevb ? max1b - mult1b * atr_b : min1b + mult1b * atr_b

vstop_prevb := nz(vstopb[1])

vstop1b := is_uptrend_prevb ? max(vstop_prevb, stopb) : min(vstop_prevb, stopb)

is_uptrendb := ohlc4 - vstop1b >= 0

is_trend_changedb := is_uptrendb != is_uptrend_prevb

max_b := is_trend_changedb ? ohlc4 : max1b

min_b := is_trend_changedb ? ohlc4 : min1b

vstopb := is_trend_changedb ? is_uptrendb ? max_b - mult1b * atr_b : min_b + mult1b * atr_b :

vstop1b

///Volatility Stop///

lengthc = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1c = 15

atr_c = atr(lengthc)

max1c = 0.0

min1c = 0.0

is_uptrend_prevc = false

stopc = 0.0

vstop_prevc = 0.0

vstop1c = 0.0

is_uptrendc = false

is_trend_changedc = false

max_c = 0.0

min_c = 0.0

vstopc = 0.0

max1c := max(nz(max_c[1]), ohlc4)

min1c := min(nz(min_c[1]), ohlc4)

is_uptrend_prevc := nz(is_uptrendc[1], true)

stopc := is_uptrend_prevc ? max1c - mult1c * atr_c : min1c + mult1c * atr_c

vstop_prevc := nz(vstopc[1])

vstop1c := is_uptrend_prevc ? max(vstop_prevc, stopc) : min(vstop_prevc, stopc)

is_uptrendc := ohlc4 - vstop1c >= 0

is_trend_changedc := is_uptrendc != is_uptrend_prevc

max_c := is_trend_changedc ? ohlc4 : max1c

min_c := is_trend_changedc ? ohlc4 : min1c

vstopc := is_trend_changedc ? is_uptrendc ? max_c - mult1c * atr_c : min_c + mult1c * atr_c :

vstop1c

plot(vstopa, color=is_uptrenda ? color.green : color.red, style=plot.style_line, linewidth=1)

plot(vstopb, color=is_uptrendb ? color.green : color.red, style=plot.style_line, linewidth=1)

plot(vstopc, color=is_uptrendc ? color.green : color.red, style=plot.style_line, linewidth=1)

vstoplongcondition = close > vstopa and close > vstopb and close > vstopc and vstopa > vstopb and vstopa > vstopc and vstopb > vstopc

vstoplongclosecondition = crossunder(close, vstopa)

vstopshortcondition = close < vstopa and close < vstopb and close < vstopc and vstopa < vstopb and vstopa < vstopc and vstopb < vstopc

vstopshortclosecondition = crossover(close, vstopa)

///Renko///

TF = input(title='TimeFrame', type=input.resolution, defval="240")

ATRlength = input(title="ATR length", type=input.integer, defval=60, minval=2, maxval=100)

SMAlength = input(title="SMA length", type=input.integer, defval=5, minval=2, maxval=100)

SMACurTFlength = input(title="SMA CurTF length", type=input.integer, defval=20, minval=2, maxval=100)

HIGH = security(syminfo.tickerid, TF, high)

LOW = security(syminfo.tickerid, TF, low)

CLOSE = security(syminfo.tickerid, TF, close)

ATR = security(syminfo.tickerid, TF, atr(ATRlength))

SMA = security(syminfo.tickerid, TF, sma(close, SMAlength))

SMACurTF = sma(close, SMACurTFlength)

RENKOUP = float(na)

RENKODN = float(na)

H = float(na)

COLOR = color(na)

BUY = int(na)

SELL = int(na)

UP = bool(na)

DN = bool(na)

CHANGE = bool(na)

RENKOUP := na(RENKOUP[1]) ? (HIGH + LOW) / 2 + ATR / 2 : RENKOUP[1]

RENKODN := na(RENKOUP[1]) ? (HIGH + LOW) / 2 - ATR / 2 : RENKODN[1]

H := na(RENKOUP[1]) or na(RENKODN[1]) ? RENKOUP - RENKODN : RENKOUP[1] - RENKODN[1]

COLOR := na(COLOR[1]) ? color.white : COLOR[1]

BUY := na(BUY[1]) ? 0 : BUY[1]

SELL := na(SELL[1]) ? 0 : SELL[1]

UP := false

DN := false

CHANGE := false

if not CHANGE and close >= RENKOUP[1] + H * 3

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR * 3

RENKODN := RENKOUP[1] + ATR * 2

COLOR := color.lime

SELL := 0

BUY := BUY + 3

BUY

if not CHANGE and close >= RENKOUP[1] + H * 2

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR * 2

RENKODN := RENKOUP[1] + ATR

COLOR := color.lime

SELL := 0

BUY := BUY + 2

BUY

if not CHANGE and close >= RENKOUP[1] + H

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR

RENKODN := RENKOUP[1]

COLOR := color.lime

SELL := 0

BUY := BUY + 1

BUY

if not CHANGE and close <= RENKODN[1] - H * 3

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR * 3

RENKOUP := RENKODN[1] - ATR * 2

COLOR := color.red

BUY := 0

SELL := SELL + 3

SELL

if not CHANGE and close <= RENKODN[1] - H * 2

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR * 2

RENKOUP := RENKODN[1] - ATR

COLOR := color.red

BUY := 0

SELL := SELL + 2

SELL

if not CHANGE and close <= RENKODN[1] - H

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR

RENKOUP := RENKODN[1]

COLOR := color.red

BUY := 0

SELL := SELL + 1

SELL

plotshape(UP, style=shape.arrowup, location=location.abovebar, size=size.normal)

plotshape(DN, style=shape.arrowdown, location=location.belowbar, size=size.normal)

p1 = plot(RENKOUP, style=plot.style_line, linewidth=1, color=COLOR)

p2 = plot(RENKODN, style=plot.style_line, linewidth=1, color=COLOR)

fill(p1, p2, color=COLOR, transp=80)

///Long Entry///

longcondition = vstoplongcondition and UP

if (longcondition)

strategy.entry("Long", strategy.long)

///Long exit///

closeconditionlong = vstoplongclosecondition or DN

if (closeconditionlong)

strategy.close("Long")

// ///Short Entry///

// shortcondition = vstopshortcondition and DN

// if (shortcondition)

// strategy.entry("Short", strategy.short)

// ///Short exit///

// closeconditionshort = vstopshortclosecondition or UP

// if (closeconditionshort)

// strategy.close("Short")