Estratégia de negociação inteligente de posições futuras de Bitcoin

Data de criação:

2024-01-26 15:01:24

última modificação:

2024-01-26 15:01:24

cópia:

0

Cliques:

677

1

focar em

1629

Seguidores

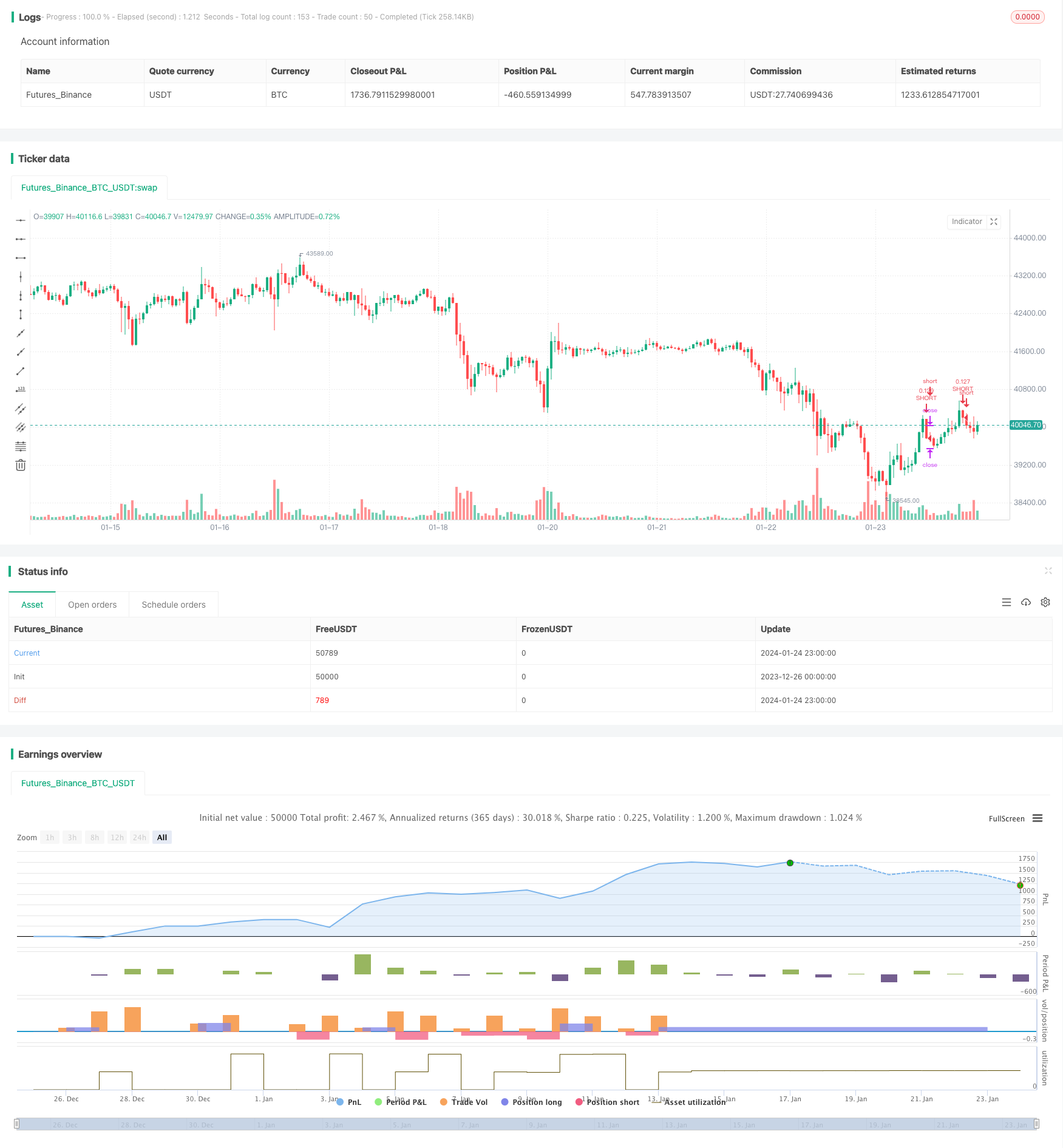

Descrição: A estratégia usa dados de posições de futuros de BTC da Bitfinex para orientar as negociações. Faça um curto-circuito quando o número de posições curtas aumenta e um longo-circuito quando o número de posições curtas diminui.

Princípios da estratégia:

- Usando o número de posições curtas de futuros de BTC da Bitfinex como indicador. A Bitfinex é considerada uma bolsa dominada por instituições e cúpulas de pensadores.

- Quando o número de posições curtas aumenta, o BTC é deixado em branco.

- Quando o número de posições curtas diminui, faça mais BTC em dinheiro. Neste momento, as instituições estão reduzindo suas posições, mostrando sinais de pessimismo.

- O RSI é usado para determinar os altos e baixos do número de posições curtas. O RSI acima de 75 é um sinal de alto e baixo de 30 é um sinal de baixo.

- Entrar em uma posição de fazer mais ou fazer menos quando o sinal de alta ou baixa é emitido.

Análise de vantagens:

- Utilizando dados de posições dos traders profissionais da Bitfinex como sinais indicadores, pode-se capturar a atividade de negociação da instituição.

- O indicador RSI ajuda a determinar os altos e baixos de uma posição curta e controla o risco de negociação.

- O banco monitora o movimento das transações em tempo real e ajusta suas posições a tempo.

- A ideia é que os investidores não precisem de analisar os seus próprios indicadores técnicos, mas sim seguir diretamente o pensamento de negociação dos grupos de pensamento de Liu.

- Os dados de retrospecção estão a funcionar bem e a taxa de retorno é considerável.

Análise de Riscos:

- Não se sabe se o aumento do número de posições curtas é uma especulação ou uma cobertura.

- A Bitfinex está atrasada na atualização dos dados de transação e pode ter perdido o melhor momento para entrar.

- As transações institucionais não são 100% corretas e podem falhar.

- A configuração incorreta dos parâmetros do RSI pode causar falsos sinais ou sinais perdidos.

- A configuração de stop-loss é muito flexível, podendo causar grandes perdas.

Otimização:

- Optimizar os parâmetros do RSI e testar a eficácia de diferentes períodos de posse.

- Tente outros indicadores como KD, MACD e outros para avaliar os altos e baixos de uma posição curta.

- A redução da margem de parada para reduzir os prejuízos individuais

- Aumentar os sinais de saída, como a reversão de tendência, breaker etc.

- Teste a variedade de moedas disponíveis, por exemplo, seguindo a posição curta do BTC na ETH.

Resumo: A estratégia de seguir o comerciante especialista em futuros de BTC da Bitfinex, para obter sinais de negociação da instituição em tempo hábil. Ajuda os investidores a monitorar o calor do mercado e a entender os altos e baixos.

Código-fonte da estratégia

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bitfinex Shorts Strat",

overlay=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10, precision=2, initial_capital=1000,

pyramiding=2,

commission_value=0.05)

//Backtest date range

StartDate = input(timestamp("01 Jan 2021"), title="Start Date")

EndDate = input(timestamp("01 Jan 2024"), title="Start Date")

inDateRange = true

symbolInput = input(title="Bitfinex Short Symbol", defval="BTC_USDT:swap")

Shorts = request.security(symbolInput, "", open)

// RSI Input Settings

length = input(title="Length", defval=7, group="RSI Settings" )

overSold = input(title="High Shorts Threshold", defval=75, group="RSI Settings" )

overBought = input(title="Low Shorts Threshold", defval=30, group="RSI Settings" )

// Calculating RSI

vrsi = ta.rsi(Shorts, length)

RSIunder = ta.crossover(vrsi, overSold)

RSIover = ta.crossunder(vrsi, overBought)

// Stop Loss Input Settings

longLossPerc = input.float(title="Long Stop Loss (%)", defval=25, group="Stop Loss Settings") * 0.01

shortLossPerc = input.float(title="Short Stop Loss (%)", defval=25, group="Stop Loss Settings") * 0.01

// Calculating Stop Loss

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// Strategy Entry

if (not na(vrsi))

if (inDateRange and RSIover)

strategy.entry("LONG", strategy.long, comment="LONG")

if (inDateRange and RSIunder)

strategy.entry("SHORT", strategy.short, comment="SHORT")

// Submit exit orders based on calculated stop loss price

if (strategy.position_size > 0)

strategy.exit(id="LONG STOP", stop=longStopPrice)

if (strategy.position_size < 0)

strategy.exit(id="SHORT STOP", stop=shortStopPrice)