Estratégia da Teoria da Média Móvel Dupla

Visão geral

A estratégia de opinião de dupla linha de equilíbrio é uma estratégia de acompanhamento de tendências. Ela constrói um grupo de linha rápida e um grupo de linha lenta, calculando dois conjuntos de médias móveis e combinando a relação entre o preço e a linha de equilíbrio para determinar a direção da tendência.

A estratégia combina a direção da linha média rápida e lenta, o número de candelas de quebra de preço e outros fatores para determinar o momento específico de entrada e saída.

Princípio da estratégia

A estratégia de dupla linha de opinião é definida por meio da contagem de dois conjuntos de médias móveis, que representam os critérios de avaliação de tendências de curto e longo prazo.

- Grupo de médias rápidas, que inclui médias rápidas descendentes e médias rápidas ascendentes, representando tendências de curto prazo;

- O grupo de linhas médias lentas, que inclui linhas médias lentas descendentes e linhas médias lentas ascendentes, representa tendências de longo prazo.

A estratégia julga a racionalidade das tendências de curto e longo prazo, bem como o momento específico de entrada e saída, através da relação de preços entre a linha média rápida e a linha média lenta.

Condições de entradaComo segue:

- A linha de subida rápida quebra a linha de subida lenta 2 linhas K ou mais para entrar em jogo.

- A linha de descida rápida quebra a linha de descida lenta 2 linhas K ou mais para entrar em campo.

Condições de partidaComo segue:

- Durante a posse de vários jogadores, a linha média rápida é travada pela linha média lenta e é jogada por vários jogadores.

- Durante a posse de cabeça vazia, a linha média rápida passa pela linha média lenta como cabeça vazia.

Além disso, a estratégia também possui funções como Stop Loss, Stop Loss e Stop Loss Tracking para controlar o risco.

Análise de vantagens

As principais vantagens da estratégia de dupla linha de opinião são:

- A análise de dupla equilíbrio permite filtrar o ruído do mercado e fixar a direção da tendência.

- Combinando a média rápida e a relação de preço, a confiabilidade do sinal é maior.

- As regras da estratégia são simples, claras, fáceis de entender e aplicadas para transações de quantidade.

- Os meios de controle de risco, como o stop loss, o stop loss e o stop loss tracking, podem ser usados para controlar o risco de negociação.

Análise de Riscos

A estratégia de dupla linha de opinião também apresenta riscos, como:

- Em situações de turbulência, pode-se gerar um sinal falso, o que leva a transações desnecessárias.

- O sistema de linha média reage lentamente a eventos inesperados (como a divulgação de lucros significativos / lucros positivos) e pode causar grandes perdas.

- O tracking stop loss pode ser ultrapassado em determinadas circunstâncias, ampliando os prejuízos.

Para controlar os riscos acima, pode-se melhorar através de métodos como a otimização de parâmetros de média móvel ou filtragem em combinação com outros indicadores.

Direção de otimização

A estratégia de dupla linha de opinião pode ser otimizada a partir das seguintes dimensões:

- Otimizar os parâmetros da média móvel, ajustando o ciclo da linha média para se adaptar a diferentes situações de ciclo.

- Adicionar outros indicadores Filter, formar uma estratégia de combinação de indicadores múltiplos, melhorar a precisão do sinal.

- Optimizar as configurações de stop loss, stop-loss, setback e controle de perda máxima.

- Introdução de modelos de aprendizado de máquina para a previsão de tendências, auxiliando na determinação do timing de entrada.

Resumir

A estratégia de opinião de dupla linha é, em geral, uma estratégia de acompanhamento de tendências muito prática. As regras de julgamento são simples, a lógica é clara, o risco é controlado através de um sistema de dupla linha e a base teórica é sólida. O próximo passo pode ser melhorado em vários aspectos, como otimização de parâmetros, controle de risco e outros, para aumentar ainda mais a rentabilidade e a estabilidade da estratégia.

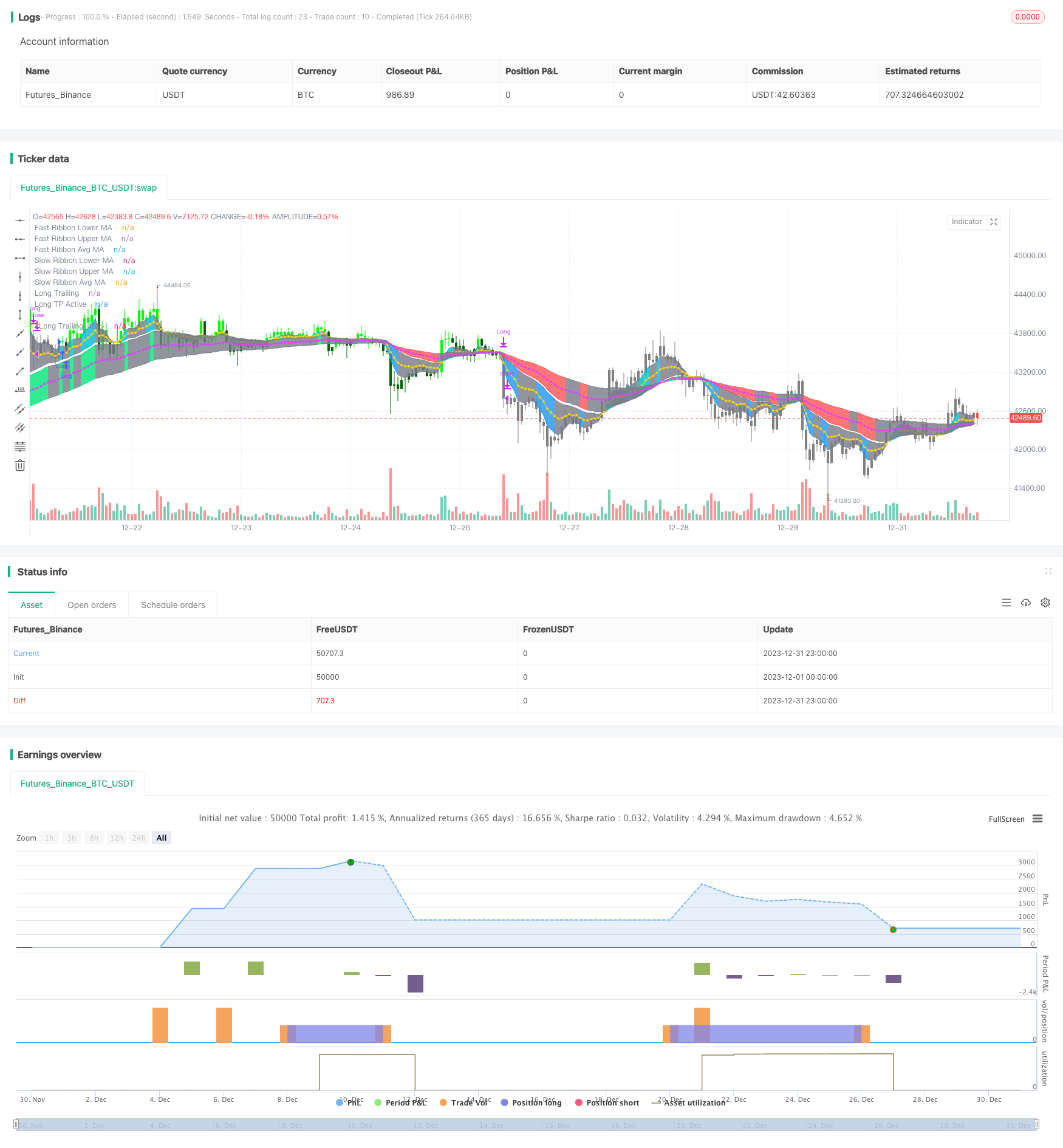

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="[Autoview][BackTest]Dual MA Ribbons R0.12 by JustUncleL", shorttitle="[BT]DualRibbons R0.12", overlay=true )

//study(title="[Autoview][Alerts]Dual MA Ribbons R0.12 by JustUncleL", shorttitle="[AL]DualRibbons R0.12", overlay=true)

//

// Author: JustUncleL

// Revision: R0.12 Beta

// Date: 30-Apr-2018

//

// Description:

// ============

// This is an implementaion of a strategy based on two MA Ribbonn, a Fast Ribbon

// and a Slow Ribbon.

// The strategy revolves around a pair of scripts: One to generate alerts signals for

// Autoview and one for Backtesting, to tune your settings.

// The risk management options are performed within the script to set SL(StopLoss),

// TP(TargetProfit), TSL(Trailing Stop Loss) and TTP (Trailing Target Profit).

// The only requirement for Autoview is to Buy and Sell as directed by this script,

// no complicated syntax is required.

//

// The Dual Ribbons are designed to capture the inferred behaviour of traders and

// investors by using two groups of averages:

// > Traders MA Ribbon:

// Lower MA and Upper MA (Aqua=Uptrend, Blue=downtrend, Gray=Neutral), with

// centre line Avg MA (Orange dotted line).

// > Investors MAs Ribbon:

// Lower MA and Upper MA (Green=Uptrend, Red=downtrend, Gray=Neutral), with

// centre line Avg MA (Fuchsia dotted line).

// > Anchor time frame (0=current). This is the time frame that the MAs are

// calculated for. This way 60m MA Ribbons can be viewed on a 15 min chart to establish

// tighter Stop Loss conditions.

//

// Trade Management options:

// -------------------------

// - Option to specify Backtest start and end time.

// - Trailing Stop, with Activate Level (as % of price) and Trailing Stop (as % of price)

// - Target Profit Level, (as % of price)

// - Stop Loss Level, (as % of price)

// - BUY green triandles and SELL dark red triangles

// - Trade Order closed colour coded Label:

// > Dark Red = Stop Loss Hit

// > Green = Target Profit Hit

// > Purple = Trailing Stop Hit

// > Orange = Opposite (Sell) Order Close

//

// Trade Management Indication:

// ----------------------------

// - Trailing Stop Activate Price = Blue dotted line

// - Trailing Stop Price = Fuschia solid stepping line

// - Target Profit Price = Lime '+' line

// - Stop Loss Price = Red '+' line

//

// Dealing With Renko Charts:

// --------------------------

// - If you choose to use Renko charts, make sure you have enabled the "IS This a RENKO Chart"

// option, (I have not so far found a way to Detect the type of chart that is running).

// - If you want non-repainting Renko charts you MUST use TRADITIONAL Renko Bricks. This

// type of brick is fixed and will not change size.

// - Also use Renko bricks with WICKS DISABLED. Wicks are not part of Renko, the whole

// idea of using Renko bricks is not to see the wick noise.

// - Set you chart Time Frame to the lowest possible one that will build enough bricks

// to give a reasonable history, start at 1min TimeFrame. Renko bricks are not dependent

// on time, they represent a movement in price. But the chart candlestick data is used

// to create the bricks, so lower TF gives more accurate Brick creation.

// - You want to size your bricks to 2/1000 of the pair price, so for ETHBTC the price is say 0.0805

// then your Renko Brick size should be about 2*0.0805/1000 = 0.0002 (round up).

// - You may find there is some slippage in value, but this can be accounted for in the Backtes

// by setting your commission a bit higher, for Binance for example I use 0.2

//

// References:

// ===========

// - MA Ribbon R#.# by JustUncleL

// - "How to automate this strategy for free using a chrome extension" by CryptoRox

//

// Revisions:

// ==========

// R0.12 - Beta 2 Version

//

//

//

// -----------------------------------------------------------------------------

// Copyright 2018 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

//

// Use Alternate Anchor TF for MAs

uRenko = input(true, title="IS This a RENKO Chart")

//

anchor = input(0,minval=0,maxval=1440,title="Alternate TimeFrame Multiplier (0=none)")

//

src = close //input(close, title="EMA Source")

showRibbons = input(true,title="Show Coloured MA Ribbons")

showAvgs = input(true,title="Show Ribbon Median MA Lines")

//

// Fast Ribbon MAs

// Lower MA - type, length

typeF1 = input(defval="EMA", title="FAST MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF1 = input(defval=5, title="FAST Ribbon Lower MA Length", minval=1)

gammaF1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeF11 = typeF1 //input(defval="WMA", title="FAST Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF11 = input(defval=25, title="FAST Ribbon Upper Length", minval=2)

gammaF11 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// Slow Ribbon MAs

// Lower MA - type, length

typeS1 = input(defval="EMA", title="SLOW MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS1 = input(defval=28, title="SLOW Ribbon Lower MA Length", minval=1)

gammaS1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeS16 = typeS1 //input(defval="WMA", title="SLOW Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS16 = input(defval=72, title="SLOW Ribbon Upper Length", minval=2)

gammaS16 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// - Constants

gold = #FFD700

// - FUNCTIONS

// - variant(type, src, len, gamma)

// Returns MA input selection variant, default to SMA if blank or typo.

// SuperSmoother filter

// © 2013 John F. Ehlers

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier.

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := isdwm? 1 : mult // Only available Daily or less

mult = anchor>0 ? anchor : 1

//

high_ = uRenko? max(close,open) : high

low_ = uRenko? min(close,open) : low

//adjust MA lengths with Anchor Multiplier

//Fast MA Ribbon

emaF1 = variant(typeF1, src, lenF1*mult, gammaF1)

emaF11 = variant(typeF11, src, lenF11*mult,gammaF11)

emafast = (emaF1+emaF11)/2 // Average of Upper and Lower MAs

//

//Slow MA Ribbon

emaS1 = variant(typeS1,src, lenS1*mult,gammaS1)

emaS16 = variant(typeS16, src, lenS16*mult, gammaS16)

emaslow = (emaS1+emaS16)/2 // Average of Upper and Lower MAs

//

// Count crossover candles

xup = 0

xdn = 0

fup = 0

fdn = 0

sup = 0

sdn = 0

//

xup := (emafast-emaslow)>0 and (emafast-emaslow)>(emafast[1]-emaslow[1]) ? nz(xup[1])+1 : 0

xdn := (emafast-emaslow)<0 and (emafast-emaslow)<(emafast[1]-emaslow[1]) ? nz(xdn[1])+1 : 0

fup := (emaF1-emaF11)>0 and (emaF1-emaF11)>(emaF1[1]-emaF11[1]) ? nz(fup[1])+1 : 0

fdn := (emaF1-emaF11)<0 and (emaF1-emaF11)<(emaF1[1]-emaF11[1]) ? nz(fdn[1])+1 : 0

sup := (emaS1-emaS16)>0 and (emaS1-emaS16)>(emaS1[1]-emaS16[1]) ? nz(sup[1])+1 : 0

sdn := (emaS1-emaS16)<0 and (emaS1-emaS16)<(emaS1[1]-emaS16[1]) ? nz(sdn[1])+1 : 0

//Fast EMA Final Color Rules

colFinal = fup>=2 ? aqua : fdn>=2 ? blue : gray

//Slow EMA Final Color Rules

colFinal2 = sup>=2 ? lime : sdn>=2 ? red : gray

//Fast EMA Plots

p1=plot(showRibbons?emaF1:na, title="Fast Ribbon Lower MA", style=line, linewidth=1, color=colFinal,transp=10)

p2=plot(showRibbons?emaF11:na, title="Fast Ribbon Upper MA", style=line, linewidth=1, color=colFinal,transp=10)

plot(showAvgs?emafast:na, title="Fast Ribbon Avg MA", style=circles,join=true, linewidth=1, color=gold,transp=10)

//

fill(p1,p2,color=colFinal, transp=90)

//Slow EMA Plots

p3=plot(showRibbons?emaS1:na, title="Slow Ribbon Lower MA", style=line, linewidth=1, color=colFinal2,transp=10)

p4=plot(showRibbons?emaS16:na, title="Slow Ribbon Upper MA", style=line, linewidth=1, color=colFinal2,transp=10)

plot(showAvgs?emaslow:na, title="Slow Ribbon Avg MA", style=circles,join=true, linewidth=1, color=fuchsia,transp=10)

//

fill(p3,p4, color=colFinal2, transp=90)

// Generate Buy Sell signals,

buy = 0

sell=0

//

buy := xup>=2 and sup>=2 and fup>=2 ? nz(buy[1])>0?buy[1]+1:1 : 0

sell := xdn>=2 and sdn>=2 and fdn>=2 ? nz(sell[1])>0?sell[1]+1 :1 : 0

//

//////////////////////////////////////////////////

//* Put Entry and special Exit conditions here *//

//////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////////////////////

//*** This Trade Management Section of code is a modified version of that found in ***//

//*** "How to automate this strategy for free using a chrome extension" by CryptoRox ***//

//*** Modifications made by JustUncleL. ***//

//////////////////////////////////////////////////////////////////////////////////////////

//

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made by JustUncleL*//

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

///////////////////////////////////////////////

//* Place Entry and Special Exit Logic here *//

///////////////////////////////////////////////

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

// Keep current state until opposite signal detected.

bsState = 0, bsState := nz(bsState[1])

bsState := buy==1 and bsState<=0? 1 :

sell==1 and bsState>=0? -1 :

bsState

//Entry Conditions, when state changes direction.

longLogic = change(bsState) and bsState==1 and (barstate.isconfirmed or barstate.ishistory)

shortLogic = change(bsState) and bsState==-1 and (barstate.isconfirmed or barstate.ishistory)

// Exit on Sell signal

longExitC = 0

shortExitC = 0

longExitC := (emafast<emaslow and close<emaslow)

and (barstate.isconfirmed or barstate.ishistory) ? nz(longExitC[1])+1 : 0

shortExitC := (emafast>emaslow and close>emaslow)

and (barstate.isconfirmed or barstate.ishistory) ? nz(shortExitC[1])+1 : 0

// Exit condition for no SL.

longExit = change(longExitC) and longExitC==1

shortExit = change(shortExitC) and shortExitC==1

//////////////////////////

//* Strategy Component *//

//////////////////////////

fastExit = input(false,title="Use Opposite Trade as a Close Signal")

clrBars = input(true,title="Colour Candles to Trade Order state")

orderType = input("LongsOnly",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly","Flip"])

//

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

//

long = longLogic

short = shortLogic

if orderType=="Flip"

long := shortLogic

short := longLogic

////////////////////////////////

//======[ Signal Count ]======//

////////////////////////////////

sectionLongs = 0

sectionLongs := nz(sectionLongs[1])

sectionShorts = 0

sectionShorts := nz(sectionShorts[1])

if long and isLong

sectionLongs := sectionLongs + 1

sectionShorts := 0

if short and isShort

sectionLongs := 0

sectionShorts := sectionShorts + 1

longCondition = (long and isLong)

shortCondition = (short and isShort)

////////////////////////////////

//======[ Entry Prices ]======//

////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

///////////////////////////////////////////////

//======[ Position Check (long/short) ]======//

///////////////////////////////////////////////

last_longCondition = na

last_shortCondition = na

last_longCondition := longCondition ? time : nz(last_longCondition[1])

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1])

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

/////////////////////////////////

//======[ Trailing Stop ]======//

/////////////////////////////////

isTS = input(true, "Trailing Stop")

ts = input(3.0, "Trailing Stop (%)", minval=0,step=0.1, type=float) /100

last_high = na

last_low = na

last_high_short = na

last_low_long = na

last_high := not in_longCondition ? na : in_longCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_high_short := not in_shortCondition ? na : in_shortCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_low := not in_shortCondition ? na : in_shortCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

last_low_long := not in_longCondition ? na : in_longCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

long_ts = isTS and not na(last_high) and (low_ <= last_high - last_high * ts) //and (last_high >= last_open_longCondition + last_open_longCondition * tsi)

short_ts = isTS and not na(last_low) and (high_ >= last_low + last_low * ts) //and (last_low <= last_open_shortCondition - last_open_shortCondition * tsi)

///////////////////////////////

//======[ Take Profit ]======//

///////////////////////////////

isTP = input(true, "Take Profit")

tp = input(3.0, "Take Profit (%)",minval=0,step=0.1,type=float) / 100

ttp = input(1.0, "Trailing Profit (%)",minval=0,step=0.1,type=float) / 100

ttp := ttp>tp ? tp : ttp

long_tp = isTP and (last_high >= last_open_longCondition + last_open_longCondition * tp) and (low_ <= last_high - last_high * ttp)

short_tp = isTP and (last_low <= last_open_shortCondition - last_open_shortCondition * tp) and (high_ >= last_low + last_low * ttp)

/////////////////////////////

//======[ Stop Loss ]======//

/////////////////////////////

isSL = input(false, "Stop Loss")

sl = input(3.0, "Stop Loss (%)", minval=0,step=0.1, type=float) / 100

long_sl = isSL and (low_ <= last_open_longCondition - last_open_longCondition * sl)

short_sl = isSL and (high_ >= last_open_shortCondition + last_open_shortCondition * sl)

////////////////////////////////////

//======[ Stop on Opposite ]======//

////////////////////////////////////

//NOTE Short exit signal is non-repainting, no need to force it, if Pyramiding keep going

long_sos = (fastExit or (not isTS and not isSL)) and longExit

short_sos = (fastExit or (not isTS and not isSL)) and shortExit

/////////////////////////////////

//======[ Close Signals ]======//

/////////////////////////////////

// Create a single close for all the different closing conditions, all conditions here are non-repainting

longClose = isLong and (long_tp or long_sl or long_ts or long_sos) and not longCondition

shortClose = isShort and (short_tp or short_sl or short_ts or short_sos) and not shortCondition

in_closeLong = longClose

in_closeLong := not isLong? false : longClose ? true : longCondition? false : in_closeLong[1]

in_closeShort = shortClose

in_closeShort := not isShort? false : shortClose ? true : shortCondition? false : in_closeShort[1]

///////////////////////////////

//======[ Plot Colors ]======//

///////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? green : long_sl ? maroon : long_ts ? purple : long_sos ? orange :longCloseCol[1]

shortCloseCol := short_tp ? green : short_sl ? maroon : short_ts ? purple : short_sos ? orange : shortCloseCol[1]

//

tpColor = isTP and in_longCondition ? lime : isTP and in_shortCondition ? lime : na

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : na

//////////////////////////////////

//======[ Strategy Plots ]======//

//////////////////////////////////

plot(isTS and in_longCondition and isLong and not in_closeLong?

last_high - last_high * ts : na, "Long Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_longCondition and isLong and not in_closeLong and last_high < last_open_longCondition + last_open_longCondition * tp ?

last_open_longCondition + last_open_longCondition * tp : na, "Long TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_longCondition and isLong and not in_closeLong and last_high >= last_open_longCondition + last_open_longCondition * tp ?

last_high - last_high * ttp : na, "Long Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_longCondition and isLong and not in_closeLong and last_low_long > last_open_longCondition - last_open_longCondition * sl ?

last_open_longCondition - last_open_longCondition * sl : na, "Long SL", slColor, style=3,join=false, linewidth=2,offset=1)

//

plot(isTS and in_shortCondition and isShort and not in_closeShort?

last_low + last_low * ts : na, "Short Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_shortCondition and isShort and not in_closeShort and last_low > last_open_shortCondition - last_open_shortCondition * tp ?

last_open_shortCondition - last_open_shortCondition * tp : na, "Short TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_shortCondition and isShort and not in_closeShort and last_low <= last_open_shortCondition - last_open_shortCondition * tp ?

last_low + last_low * ttp : na, "Short Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_shortCondition and isShort and not in_closeShort and last_high_short < last_open_shortCondition + last_open_shortCondition * sl ?

last_open_shortCondition + last_open_shortCondition * sl : na, "Short SL", slColor, style=3,join=false, linewidth=2,offset=1)

//

bclr = not clrBars ? na : in_closeLong and in_closeShort ? GRAY :

in_longCondition and not in_closeLong and isLong ? close<last_open_longCondition? DARKGREEN : LIME :

in_shortCondition and not in_closeShort and isShort ? close>last_open_shortCondition? DARKRED : RED : GRAY

barcolor(bclr,title="Trade State Bar Colouring")

///////////////////////////////

//======[ Alert Plots ]======//

///////////////////////////////

//plotshape(longCondition?close:na, title="Long", color=green, textcolor=green, transp=0,

// style=shape.triangleup, location=location.belowbar, size=size.small,text="LONG",offset=0)

//plotshape(longClose and not in_closeLong[1]?close:na, title="Long Close", color=longCloseCol, textcolor=white, transp=0,

// style=shape.labeldown, location=location.abovebar, size=size.small,text="Long\nClose",offset=0)

//plotshape(shortCondition?close:na, title="Short", color=red, textcolor=red, transp=0,

// style=shape.triangledown, location=location.abovebar, size=size.small,text="SHORT",offset=0)

//plotshape(shortClose and not in_closeShort[1]?close:na, title="Short Close", color=shortCloseCol, textcolor=white, transp=0,

// style=shape.labelup, location=location.belowbar, size=size.small,text="Short\nClose",offset=0)

// Autoview alert syntax - This assumes you are trading coins BUY and SELL on Binance Exchange

// WARNING*** Only use Autoview to automate a strategy after you've sufficiently backtested and forward tested the strategy.

// You can learn more about the syntax here:

// http://autoview.with.pink/#syntax and you can watch this video here: https://www.youtube.com/watch?v=epN5Tjinuxw

// For the opens you will want to trigger BUY orders on LONGS (eg ETHBTC) with alert option "Once Per Bar Close"

// and SELL orders on SHORTS (eg BTCUSDT)

// b=buy q=0.001 e=binance s=ethbtc t=market ( LONG )

// or b=sell q=0.001 e=binance s=btcusdt t=market ( SHORT )

//alertcondition(longCondition, "Open Long", "LONG")

//alertcondition(shortCondition, "Open Short", "SHORT")

// For the closes you will want to trigger these alerts on condition with alert option "Once Per Bar"

// (NOTE: with Renko you can only use "Once Per Bar Close" option)

// b=sell q=99% e=binance s=ethbtc t=market ( CLOSE LONGS )

// or b=buy q=99% e=binance s=btcusdt t=market ( CLOSE SHORTS )

// This gets it as it happens and typically results in a better exit live than in the backtest.

// It works really well for counteracting some market slippage

//alertcondition(longClose and not in_closeLong[1], "Close Longs", "CLOSE LONGS")

//alertcondition(shortClose and not in_closeShort[1], "Close Shorts", "CLOSE SHORTS")

////////////////////////////////////////////

//======[ Strategy Entry and Exits ]======//

////////////////////////////////////////////

if testPeriod() and isLong

strategy.entry("Long", 1, when=longCondition)

strategy.close("Long", when=longClose and not in_closeLong[1])

if testPeriod() and isShort

strategy.entry("Short", 0, when=shortCondition)

strategy.close("Short", when=shortClose and not in_closeShort[1])

// --- Debugs

//plotchar(longExit,location=location.bottom)

//plotchar(longCondition,location=location.bottom)

//plotchar(in_longCondition,location=location.bottom)

//plotchar(longClose,location=location.bottom)

//plotchar(in_closeLong,location=location.bottom)

// --- /Debugs

///////////////////////////////////

//======[ Reset Variables ]======//

///////////////////////////////////

if longClose or not in_longCondition or not isLong

last_high := na

last_high_short := na

sectionLongs := 0

if longClose and isLong and not in_closeLong[1] and bsState==1

bsState := 0

if shortClose or not in_shortCondition or not isShort

last_low := na

last_low_long := na

sectionShorts := 0

if shortClose and isShort and not in_closeShort[1] and bsState==-1

bsState := 0

//plotchar(bsState,location=location.bottom)

// EOF