Estratégia baseada em cartas

Visão geral

Trata-se de uma estratégia de negociação automática baseada no formato da carta. A estratégia controla o risco através da identificação de vários sinais de formato da carta, fazendo entrada quando as condições do formato estão em conformidade e configurando stop loss, stop-loss e stop-loss de rastreamento.

Princípio da estratégia

A estratégia identifica principalmente os seguintes formatos de cartão como sinais de entrada: formato de pacote, formato de envolvimento, formato de dupla tomada, formato de estrela, formato de cidade de pressão de nuvem escura, formato de linha de gestação, formato de tropa de três soldados, formato de base, etc. Quando for detectado o sinal de compra acima, faça mais entrada; Quando for detectado o sinal de venda, faça entrada vazia.

Além disso, a estratégia também estabelece um stop loss, um stop and trace stop para controlar o risco. Concretamente, o stop loss é definido como uma determinada porcentagem abaixo do preço de entrada, o stop loss é um valor fixo acima do preço de entrada, e o stop trace é um ponto dinâmico acima do preço de entrada. Isso pode prevenir efetivamente os prejuízos acima do aceitável.

É importante ressaltar que a estratégia também estabelece períodos de negociação em que todas as posições são eliminadas durante os períodos de negociação definidos pela estratégia, evitando o risco de overnight.

Análise de vantagens

A maior vantagem dessa estratégia é o uso da forma de cartão, um indicador técnico eficaz, como base de entrada. Uma grande quantidade de dados históricos mostra que, quando ocorrem certas formas de linha K, é provável que marquem uma mudança na relação de demanda e oferta e na psicologia do mercado, o que fornece um bom momento para nossa entrada.

Outra vantagem é a instalação de um mecanismo de controle de risco perfeito. Seja o stop loss, o stop loss ou o stop loss de rastreamento, é possível evitar o máximo de perdas além da faixa tolerável e controlar o risco.

Finalmente, a estratégia funciona de forma flexível, podendo ser adaptada a diferentes variedades e preferências de negociação, ajustando os parâmetros de forma e os parâmetros de controle de risco.

Análise de Riscos

O maior risco desta estratégia reside na instabilidade do formato do cartão como indicador técnico em si. Embora o formato do cartão possa refletir claramente as tendências de mudança do mercado, ele também é vulnerável a flutuações aleatórias do mercado, com uma probabilidade de sinais errados.

Além disso, não há uma relação de causalidade necessária entre a forma do cartão e a mudança de preço comprovada posteriormente. Mesmo se a forma típica for detectada, a probabilidade de o preço entrar na direção oposta à expectativa da forma também existe.

Para reduzir os riscos acima, além de cumprir rigorosamente as regras de stop loss, stop loss e stop loss tracking, também pode ser considerado a combinação com outros indicadores mais estáveis, evitando os riscos potenciais decorrentes de um único indicador técnico.

Direção de otimização

Considerando as limitações da estabilidade do formato do cartão, pode-se tentar combiná-lo com indicadores mais estáveis, como indicadores de tendência, como bandas de Bryn, médias móveis, ou indicadores de choque, como RSI e MACD. Isso pode ser usado para filtrar o tempo de entrada e reduzir a probabilidade de negociação de ruído.

Outra direção possível de otimização é a adoção de métodos de aprendizagem de máquina. Treinar grandes quantidades de dados históricos, como redes neurais, para criar modelos de relações estatísticas entre a forma e a movimentação real dos preços. Isso pode melhorar a precisão dos sinais de forma.

Finalmente, a estratégia pode ser usada como uma estrutura básica e pode ser otimizada com algoritmos mais complexos para se adaptar às transações de alta frequência. Por exemplo, um modo mais refinado de parar o prejuízo ou uma modelagem mais complexa através de linguagens avançadas com mais interfaces de dados.

Resumir

Em geral, esta estratégia utiliza o formato do cartão, um indicador técnico eficaz como entrada de sinal, configura um bom risco de controle de lógica de stop loss, stop-loss e tracking stop loss, um conjunto de estratégias que vale a pena testar em campo. A Coding Angle incentiva a utilização desta estratégia como uma estrutura básica para otimização, permitindo melhores efeitos em campo.

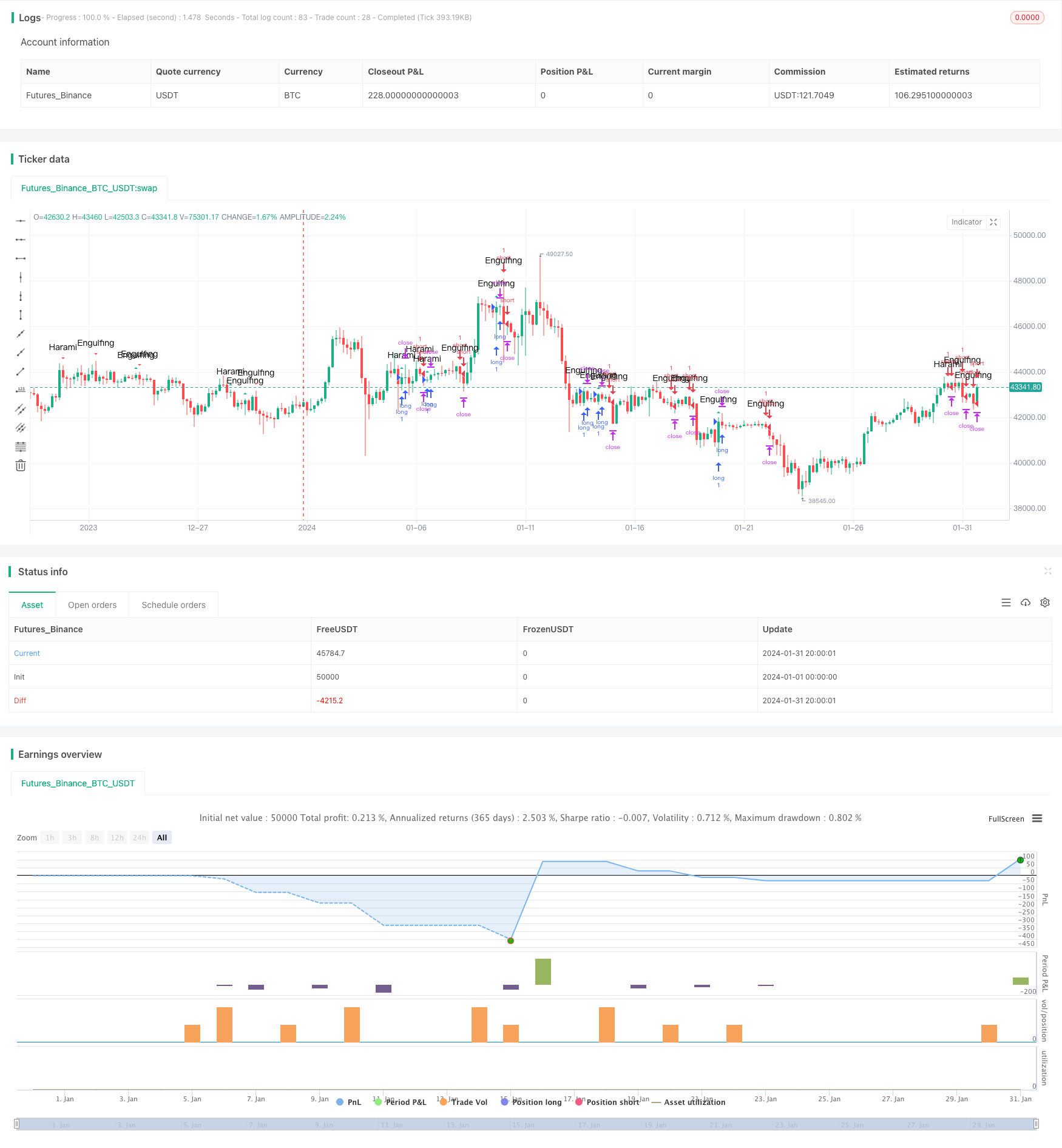

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//DanyChe

//The script allows you to test popular candlestick patterns on various instruments and timeframes. In addition, you can configure risk management (if the value is zero, it means the function is disabled), and you can also specify the time of the trading session (for example, so that the positions are not transferred to the next day).

//The author is grateful to JayRogers and Phi35, their code examples helped a lot in writing the strategy.

strategy("Candle Patterns Strategy", shorttitle="CPS", overlay=true)

//--- Patterns Input ---

OnEngulfing = input(defval=true, title="Engulfing")

OnHarami = input(defval=true, title="Harami")

OnPiercingLine = input(defval=true, title="Piercing Line / Dark Cloud Cover")

OnMorningStar = input(defval=true, title="Morning Star / Evening Star ")

OnBeltHold = input(defval=true, title="Belt Hold")

OnThreeWhiteSoldiers = input(defval=true, title="Three White Soldiers / Three Black Crows")

OnThreeStarsInTheSouth = input(defval=true, title="Three Stars in the South")

OnStickSandwich = input(defval=true, title="Stick Sandwich")

OnMeetingLine = input(defval=true, title="Meeting Line")

OnKicking = input(defval=true, title="Kicking")

OnLadderBottom = input(defval=true, title="Ladder Bottom")

//--- Risk Management Input ---

inpsl = input(defval = 100, title="Stop Loss", minval = 0)

inptp = input(defval = 1000, title="Take Profit", minval = 0)

inptrail = input(defval = 40, title="Trailing Stop", minval = 0)

// If the zero value is set for stop loss, take profit or trailing stop, then the function is disabled

sl = inpsl >= 1 ? inpsl : na

tp = inptp >= 1 ? inptp : na

trail = inptrail >= 1 ? inptrail : na

//--- Session Input ---

sess = input(defval = "0000-0000", title="Trading session")

t = time('240', sess)

session_open = na(t) ? false : true

// --- Candlestick Patterns ---

//Engulfing

bullish_engulfing = high[0]>high[1] and low[0]<low[1] and open[0]<open[1] and close[0]>close[1] and close[0]>open[0] and close[1]<close[2] and close[0]>open[1] ? OnEngulfing : na

bearish_engulfing = high[0]>high[1] and low[0]<low[1] and open[0]>open[1] and close[0]<close[1] and close[0]<open[0] and close[1]>close[2] and close[0]<open[1] ? OnEngulfing : na

//Harami

bullish_harami = open[1]>close[1] and close[1]<close[2] and open[0]>close[1] and open[0]<open[1] and close[0]>close[1] and close[0]<open[1] and high[0]<high[1] and low[0]>low[1] and close[0]>=open[0] ? OnHarami : na

bearish_harami = open[1]<close[1] and close[1]>close[2] and open[0]<close[1] and open[0]>open[1] and close[0]<close[1] and close[0]>open[1] and high[0]<high[1] and low[0]>low[1] and close[0]<=open[0] ? OnHarami : na

//Piercing Line/Dark Cloud Cover

piercing_line = close[2]>close[1] and open[0]<low[1] and close[0]>avg(open[1],close[1]) and close[0]<open[1] ? OnPiercingLine : na

dark_cloud_cover = close[2]<close[1] and open[0]>high[1] and close[0]<avg(open[1],close[1]) and close[0]>open[1] ? OnPiercingLine : na

//Morning Star/Evening Star

morning_star = close[3]>close[2] and close[2]<open[2] and open[1]<close[2] and close[1]<close[2] and open[0]>open[1] and open[0]>close[1] and close[0]>close[2] and open[2]-close[2]>close[0]-open[0] ? OnMorningStar : na

evening_star = close[3]<close[2] and close[2]>open[2] and open[1]>close[2] and close[1]>close[2] and open[0]<open[1] and open[0]<close[1] and close[0]<close[2] and close[2]-open[2]>open[0]-close[0] ? OnMorningStar : na

//Belt Hold

bullish_belt_hold = close[1]<open[1] and low[1]>open[0] and close[1]>open[0] and open[0]==low[0] and close[0]>avg(close[0],open[0]) ? OnBeltHold :na

bearish_belt_hold = close[1]>open[1] and high[1]<open[0] and close[1]<open[0] and open[0]==high[0] and close[0]<avg(close[0],open[0]) ? OnBeltHold :na

//Three White Soldiers/Three Black Crows

three_white_soldiers = close[3]<open[3] and open[2]<close[3] and close[2]>avg(close[2],open[2]) and open[1]>open[2] and open[1]<close[2] and close[1]>avg(close[1],open[1]) and open[0]>open[1] and open[0]<close[1] and close[0]>avg(close[0],open[0]) and high[1]>high[2] and high[0]>high[1] ? OnThreeWhiteSoldiers : na

three_black_crows = close[3]>open[3] and open[2]>close[3] and close[2]<avg(close[2],open[2]) and open[1]<open[2] and open[1]>close[2] and close[1]<avg(close[1],open[1]) and open[0]<open[1] and open[0]>close[1] and close[0]<avg(close[0],open[0]) and low[1]<low[2] and low[0]<low[1] ? OnThreeWhiteSoldiers : na

//Three Stars in the South

three_stars_in_the_south = open[3]>close[3] and open[2]>close[2] and open[2]==high[2] and open[1]>close[1] and open[1]<open[2] and open[1]>close[2] and low[1]>low[2] and open[1]==high[1] and open[0]>close[0] and open[0]<open[1] and open[0]>close[1] and open[0]==high[0] and close[0]==low[0] and close[0]>=low[1] ? OnThreeStarsInTheSouth : na

//Stick Sandwich

stick_sandwich = open[2]>close[2] and open[1]>close[2] and open[1]<close[1] and open[0]>close[1] and open[0]>close[0] and close[0]==close[2] ? OnStickSandwich : na

//Meeting Line

bullish_ml = open[2]>close[2] and open[1]>close[1] and close[1]==close[0] and open[0]<close[0] and open[1]>=high[0] ? OnMeetingLine : na

bearish_ml = open[2]<close[2] and open[1]<close[1] and close[1]==close[0] and open[0]>close[0] and open[1]<=low[0] ? OnMeetingLine : na

//Kicking

bullish_kicking = open[1]>close[1] and open[1]==high[1] and close[1]==low[1] and open[0]>open[1] and open[0]==low[0] and close[0]==high[0] and close[0]-open[0]>open[1]-close[1] ? OnKicking : na

bearish_kicking = open[1]<close[1] and open[1]==low[1] and close[1]==high[1] and open[0]<open[1] and open[0]==high[0] and close[0]==low[0] and open[0]-close[0]>close[1]-open[1] ? OnKicking : na

//Ladder Bottom

ladder_bottom = open[4]>close[4] and open[3]>close[3] and open[3]<open[4] and open[2]>close[2] and open[2]<open[3] and open[1]>close[1] and open[1]<open[2] and open[0]<close[0] and open[0]>open[1] and low[4]>low[3] and low[3]>low[2] and low[2]>low[1] ? OnLadderBottom : na

// ---Plotting ---

plotshape(bullish_engulfing, text='Engulfing', style=shape.triangleup, color=#1FADA2, editable=true, title="Bullish Engulfing Text")

plotshape(bearish_engulfing,text='Engulfing', style=shape.triangledown, color=#F35A54, editable=true, title="Bearish Engulfing Text")

plotshape(bullish_harami,text='Harami', style=shape.triangleup, color=#1FADA2, editable=true, title="Bullish Harami Text")

plotshape(bearish_harami,text='Harami', style=shape.triangledown, color=#F35A54, editable=true, title="BEarish Harami Text")

plotshape(piercing_line,text='Piercing Line', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(dark_cloud_cover,text='Dark Cloud Cover', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(morning_star,text='Morning Star', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(evening_star,text='Evening Star', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(bullish_belt_hold,text='Belt Hold', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bearish_belt_hold,text='Belt Hold', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(three_white_soldiers,text='Three White Soldiers', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(three_black_crows,text='Three Black Crows', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(three_stars_in_the_south,text='3 Stars South', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(stick_sandwich,text='Stick Sandwich', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bullish_ml,text='Meeting Line', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bearish_ml,text='Meeting Line', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(bullish_kicking,text='Kicking', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bearish_kicking,text='Kicking', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(ladder_bottom,text='Ladder Bottom', style=shape.triangleup, color=#1FADA2, editable=false)

// --- STRATEGY ---

SignalUp = bullish_engulfing or bullish_harami or piercing_line or morning_star or bullish_belt_hold or three_white_soldiers or three_stars_in_the_south or stick_sandwich or bullish_ml or bullish_kicking or ladder_bottom

SignalDown = bearish_engulfing or bearish_harami or dark_cloud_cover or evening_star or bearish_belt_hold or three_black_crows or bearish_ml or bearish_kicking

strategy.entry("long", true, when = SignalUp and session_open)

strategy.entry("short", false, when = SignalDown and session_open)

strategy.close("long", when = not session_open)

strategy.close("short", when = not session_open)

strategy.exit("Risk Exit long", from_entry = "long", profit = tp, trail_points = trail, loss = sl)

strategy.exit("Risk Exit short", from_entry = "short", profit = tp, trail_points = trail, loss = sl )