Estratégia de Equilíbrio de Controle Psicológico de Negociação

Visão geral

O objetivo desta estratégia é equilibrar a performance psicológica e de negociação dos comerciantes, para obter um retorno mais estável, através da configuração de diferentes parâmetros. Ela usa indicadores como a linha média, a faixa de Bryn e o canal Keltner para avaliar a tendência e a volatilidade do mercado, em combinação com o indicador PSAR para avaliar os sinais de reversão e o indicador de esmagamento TTM para avaliar a dinâmica. Os sinais de negociação são gerados por uma combinação desses indicadores.

Princípio da estratégia

A principal lógica da estratégia é a seguinte:

Determinação de tendência: uso da linha média da EMA para determinar a direção da tendência do preço, com o preço acima da EMA como alta e abaixo como baixa

Reversão de julgamento: Use o PSAR para determinar o ponto de reversão de preço. O ponto PSAR aparece acima do preço como sinal de otimismo e abaixo do preço como sinal de pessimismo

O indicador TTM Squeeze mede a volatilidade comparando a largura das faixas de Bryn e do canal Keltner. A compressão significa que a volatilidade é muito baixa. A liberação da compressão significa que a volatilidade aumenta e o preço está prestes a produzir um movimento direcional maior.

Geração de sinais de negociação: quando o preço atravessa a linha média EMA, o ponto PSAR, e o indicador TTM Squeeze desacelera, gera um sinal de compra; quando o preço atravessa a linha média EMA, o ponto PSAR, e o indicador TTM Squeeze entra em compressão, gera um sinal de compra

Método de stop loss: usar um stop loss de alto ou baixo ponto. De acordo com o preço mais alto ou mais baixo de um determinado período recente, multiplicar o múltiplo definido como ponto de stop loss

Método de suspensão: a suspensão automática do risco-retorno é obtida multiplicando o parâmetro de risco-retorno definido de acordo com a proporção da distância do ponto de parada do preço atual

Através de configuração de parâmetros, você pode controlar a frequência de negociação, gerenciamento de posição, ponto de parada e ponto de parada, equilibrar a psicologia de negociação.

Análise de vantagens

A estratégia tem as seguintes vantagens:

Avaliar múltiplos indicadores para melhorar a precisão do sinal

Reversão principal, tendência secundária, captura de pontos de reversão, redução da probabilidade de surtos e quedas, surtos e quedas

O indicador TTMSqueeze é eficaz para avaliar a correção na tendência e evitar transações inválidas durante a correção

O método de alto e baixo stop-loss é simples e prático, e a distância de stop-loss pode ser ajustada de acordo com o mercado

O método de compensação de risco-retorno-comparação-limite digitaliza a relação de lucro-lucro para facilitar o ajuste

Configuração flexível de vários parâmetros, ajustável de acordo com as preferências de risco individuais

Análise de Riscos

A estratégia também apresenta os seguintes riscos:

A combinação de múltiplos indicadores aumenta a precisão do sinal, mas também a probabilidade de saltar o ponto de entrada.

Uma estratégia de inversão dominante pode não funcionar bem em um cenário de tendência

O alto e baixo limite de perda pode ser ultrapassado, mas não pode ser totalmente evitado.

O risco-retorno pode ser reduzido por um salto de preço ou por um ajuste

Parâmetros mal definidos podem causar perdas ou paralisações frequentes

Direção de otimização

A estratégia pode ser melhorada em:

Adicionar ou ajustar o peso do indicador para que o sinal seja mais preciso

Optimizar os parâmetros dos indicadores de inversão e de tendência para aumentar a probabilidade de lucro

Optimizar os parâmetros de alto e baixo stop para tornar o stop mais razoável

Testar diferentes proporções de risco-retorno para obter melhores resultados

Ajustar os parâmetros do número de posições para reduzir o impacto de perdas individuais

Resumir

A estratégia em geral, através de um conjunto de indicadores de julgamento e ajuste de parâmetros, pode efetivamente equilibrar a psicologia de negociação e obter um lucro positivo estável. Embora ainda haja algum espaço para melhoria, a estratégia já tem valor de aplicação no mercado. Através do feedback do mercado e do ajuste de parâmetros, a estratégia pode ser uma ferramenta eficaz para controlar a psicologia de negociação e obter lucros estáveis a longo prazo.

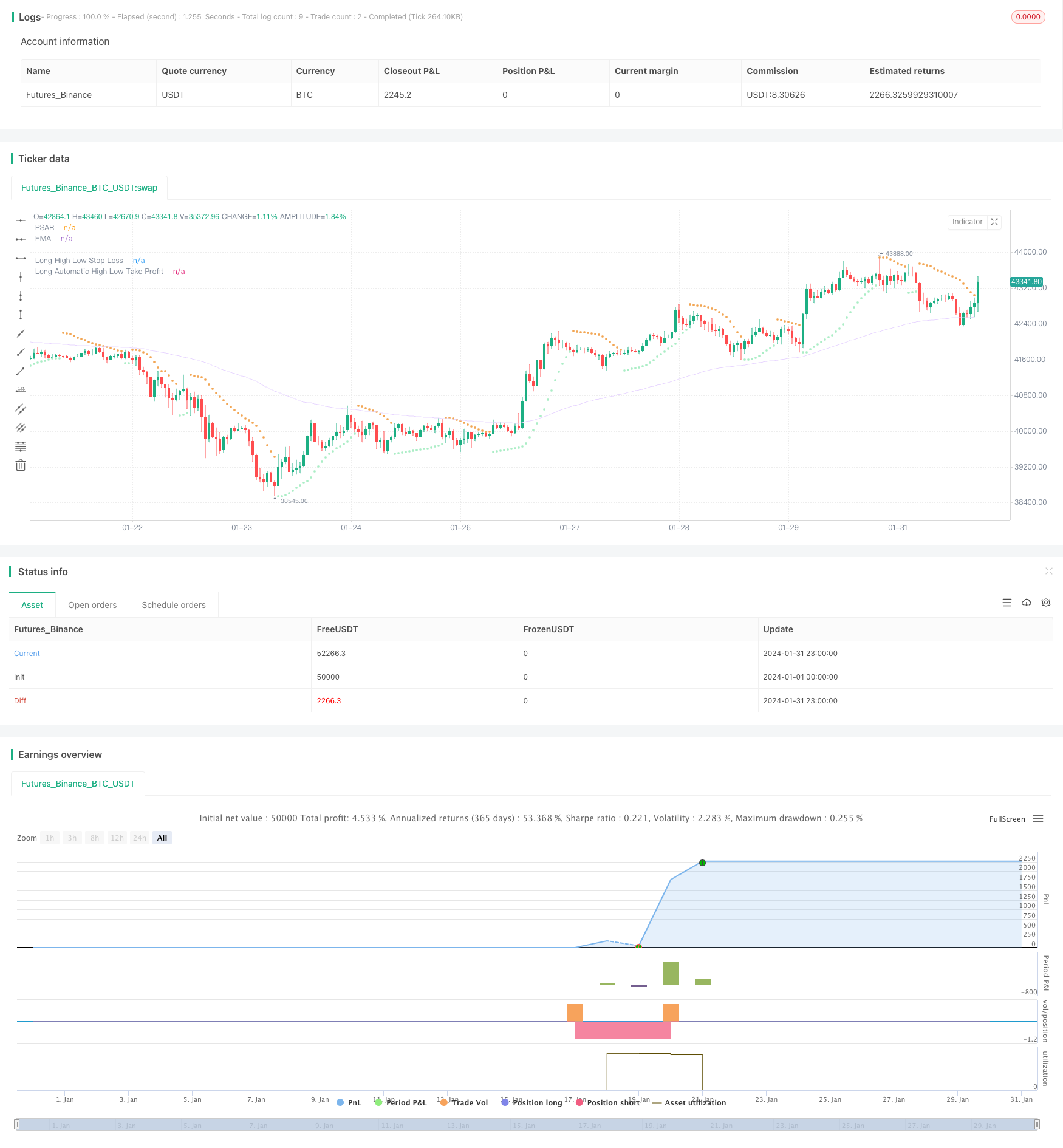

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © simwai

strategy('Octopus Nest Strategy 🐙', shorttitle='🐙', overlay=true )

// -- Colors --

color maximumYellowRed = color.rgb(255, 203, 98) // yellow

color rajah = color.rgb(242, 166, 84) // orange

color magicMint = color.rgb(171, 237, 198)

color languidLavender = color.rgb(232, 215, 255)

color maximumBluePurple = color.rgb(181, 161, 226)

color skyBlue = color.rgb(144, 226, 244)

color lightGray = color.rgb(214, 214, 214)

color quickSilver = color.rgb(163, 163, 163)

color mediumAquamarine = color.rgb(104, 223, 153)

color carrotOrange = color.rgb(239, 146, 46)

// -- Inputs --

float src = input.source(close, 'Choose Source', group='General', inline='1')

bool isSignalLabelEnabled = input.bool(title='Show Signal Labels?', defval=true, group='General', inline='2')

bool isPsarAdaptive = input.bool(title='Is PSAR Adaptive?', defval=false, group='General', inline='2')

float highLowStopLossMultiplier = input.float(defval=0.98, step=0.01, minval=0, maxval=1, title='Multiplier', group='High Low Stop Loss', inline='1')

float highLowStopLossBackupMultiplier = input.float(defval=0.98, step=0.01, minval=0, maxval=1, title='Backup Multiplier', group='High Low Stop Loss', inline='1')

int highLowStopLossLookback = input.int(defval=20, step=5, minval=1, title='Lookback', group='High Low Stop Loss', inline='2')

float automaticHighLowTakeProfitRatio = input.float(defval=1.125, step=0.1, minval=0, title='Risk Reward Ratio', group='Automatic High Low Take Profit', inline='2')

int emaLength = input.int(100, minval=2, title='Length', group='EMA', inline='1')

int ttmLength = input.int(title='Length', defval=20, minval=0, group='TTM Squeeze', inline='1')

float psarStart = input.float(0.02, 'Start', step=0.01, minval=0.0, group='PSAR', inline='1')

float psarInc = input.float(0.02, 'Increment', step=0.01, minval=0.01, group='PSAR', inline='1')

float psarMax = input.float(0.2, 'Max', step=0.05, minval=0.0, group='PSAR', inline='2')

startAFactor = input.float(0.02, 'Starting Acceleration Factor', step = 0.001, group='Adaptive PSAR', inline='1')

minStep = input.float(0.0, 'Min Step', step = 0.001, group='Adaptive PSAR', inline='1')

maxStep = input.float(0.02, 'Max Step', step = 0.001, group='Adaptive PSAR', inline='2')

maxAFactor = input.float(0.2, 'Max Acceleration Factor', step = 0.001, group='Adaptive PSAR', inline='2')

hiloMode = input.string('On', 'HiLo Mode', options = ['Off', 'On'], group='Adaptive PSAR')

adaptMode = input.string('Kaufman', 'Adaptive Mode', options = ['Off', 'Kaufman', 'Ehlers'], group='Adaptive PSAR')

adaptSmth = input.int(5, 'Adaptive Smoothing Period', minval = 1, group='Adaptive PSAR')

filt = input.float(0.0, 'Filter in Pips', group='Adaptive PSAR', minval = 0)

minChng = input.float(0.0, 'Min Change in Pips', group='Adaptive PSAR', minval = 0)

SignalMode = input.string('Only Stops', 'Signal Mode', options = ['Only Stops', 'Signals & Stops'], group='Adaptive PSAR')

// -- Functions --

tr(_high, _low, _close) => math.max(_high - _low, math.abs(_high - _close[1]), math.abs(_low - _close[1]))

// -- Calculation --

var string lastTrade = 'initial'

float _low = low

float _high = high

float _close = close

// -- TTM Squeeze – Credits to @Greeny --

bband(ttmLength, mult) =>

ta.sma(src, ttmLength) + mult * ta.stdev(src, ttmLength)

keltner(ttmLength, mult) =>

ta.ema(src, ttmLength) + mult * ta.ema(tr(_high, _low, _close), ttmLength)

e1 = (ta.highest(_high, ttmLength) + ta.lowest(_low, ttmLength)) / 2 + ta.sma(src, ttmLength)

osc = ta.linreg(src - e1 / 2, ttmLength, 0)

diff = bband(ttmLength, 2) - keltner(ttmLength, 1)

osc_color = osc[1] < osc[0] ? osc[0] >= 0 ? #00ffff : #cc00cc : osc[0] >= 0 ? #009b9b : #ff9bff

mid_color = diff >= 0 ? color.green : color.red

// -- PSAR --

// Credits to @Bjorgum

calcBaseUnit() =>

bool isForexSymbol = syminfo.type == 'forex'

bool isYenPair = syminfo.currency == 'JPY'

float result = isForexSymbol ? isYenPair ? 0.01 : 0.0001 : syminfo.mintick

// Credits to @loxx

_afact(mode,input, per, smooth) =>

eff = 0., seff = 0.

len = 0, sum = 0., max = 0., min = 1000000000.

len := mode == 'Kaufman' ? math.ceil(per) : math.ceil(math.max(20, 5 * per))

for i = 0 to len

if (mode == 'Kaufman')

sum += math.abs(input[i] - input[i + 1])

else

max := input[i] > max ? input[i] : max

min := input[i] < min ? input[i] : min

if (mode == 'Kaufman' and sum != 0)

eff := math.abs(input - input[len]) / sum

else

if (mode == 'Ehlers' and (max - min) > 0)

eff := (input - min) / (max - min)

seff := ta.ema(eff, smooth)

seff

hVal2 = nz(high[2]), hVal1 = nz(high[1]), hVal0 = high

lowVal2 = nz(low[2]), lowVal1 = nz(low[1]), lowVal0 = low

hiprice2 = nz(high[2]), hiprice1 = nz(high[1]), hiprice0 = high

loprice2 = nz(low[2]), loprice1 = nz(low[1]), loprice0 = low

upSig = 0., dnSig = 0.

aFactor = 0., step = 0., trend = 0.

upTrndSAR = 0., dnTrndSAR = 0.

length = (2 / maxAFactor - 1)

if (hiloMode == 'On')

hiprice0 := high

loprice0 := low

else

hiprice0 := src

loprice0 := hiprice0

if bar_index == 1

trend := 1

hVal1 := hiprice1

hVal0 := math.max(hiprice0, hVal1)

lowVal1 := loprice1

lowVal0 := math.min(loprice0, lowVal1)

aFactor := startAFactor

upTrndSAR := lowVal0

dnTrndSAR := 0.

else

hVal0 := hVal1

lowVal0 := lowVal1

trend := nz(trend[1])

aFactor := nz(aFactor[1])

inputs = 0.

inprice = src

if (adaptMode != 'Off')

if (hiloMode == 'On')

inprice := src

else

inprice := hiprice0

if (adaptMode == 'Kaufman')

inputs := inprice

else

if (adaptMode == 'Ehlers')

if (nz(upTrndSAR[1]) != 0.)

inputs := math.abs(inprice - nz(upTrndSAR[1]))

else

if (nz(dnTrndSAR[1]) != 0.)

inputs := math.abs(inprice - nz(dnTrndSAR[1]))

step := minStep + _afact(adaptMode, inputs, length, adaptSmth) * (maxStep - minStep)

else

step := maxStep

upTrndSAR := 0., dnTrndSAR := 0., upSig := 0., dnSig := 0.

if (nz(trend[1]) > 0)

if (nz(trend[1]) == nz(trend[2]))

aFactor := hVal1 > hVal2 ? nz(aFactor[1]) + step : aFactor

aFactor := aFactor > maxAFactor ? maxAFactor : aFactor

aFactor := hVal1 < hVal2 ? startAFactor : aFactor

else

aFactor := nz(aFactor[1])

upTrndSAR := nz(upTrndSAR[1]) + aFactor * (hVal1 - nz(upTrndSAR[1]))

upTrndSAR := upTrndSAR > loprice1 ? loprice1 : upTrndSAR

upTrndSAR := upTrndSAR > loprice2 ? loprice2 : upTrndSAR

else

if (nz(trend[1]) == nz(trend[2]))

aFactor := lowVal1 < lowVal2 ? nz(aFactor[1]) + step : aFactor

aFactor := aFactor > maxAFactor ? maxAFactor : aFactor

aFactor := lowVal1 > lowVal2 ? startAFactor : aFactor

else

aFactor := nz(aFactor[1])

dnTrndSAR := nz(dnTrndSAR[1]) + aFactor * (lowVal1 - nz(dnTrndSAR[1]))

dnTrndSAR := dnTrndSAR < hiprice1 ? hiprice1 : dnTrndSAR

dnTrndSAR := dnTrndSAR < hiprice2 ? hiprice2 : dnTrndSAR

hVal0 := hiprice0 > hVal0 ? hiprice0 : hVal0

lowVal0 := loprice0 < lowVal0 ? loprice0 : lowVal0

if (minChng > 0)

if (upTrndSAR - nz(upTrndSAR[1]) < minChng * calcBaseUnit() and upTrndSAR != 0. and nz(upTrndSAR[1]) != 0.)

upTrndSAR := nz(upTrndSAR[1])

if (nz(dnTrndSAR[1]) - dnTrndSAR < minChng * calcBaseUnit() and dnTrndSAR != 0. and nz(dnTrndSAR[1]) != 0.)

dnTrndSAR := nz(dnTrndSAR[1])

dnTrndSAR := trend < 0 and dnTrndSAR > nz(dnTrndSAR[1]) ? nz(dnTrndSAR[1]) : dnTrndSAR

upTrndSAR := trend > 0 and upTrndSAR < nz(upTrndSAR[1]) ? nz(upTrndSAR[1]) : upTrndSAR

if (trend < 0 and hiprice0 >= dnTrndSAR + filt * calcBaseUnit())

trend := 1

upTrndSAR := lowVal0

upSig := SignalMode == 'Signals & Stops' ? lowVal0 : upSig

dnTrndSAR := 0.

aFactor := startAFactor

lowVal0 := loprice0

hVal0 := hiprice0

else if (trend > 0 and loprice0 <= upTrndSAR - filt * calcBaseUnit())

trend := -1

dnTrndSAR := hVal0

dnSig := SignalMode == 'Signals & Stops' ? hVal0 : dnSig

upTrndSAR := 0.

aFactor := startAFactor

lowVal0 := loprice0

hVal0 := hiprice0

psar = upTrndSAR > 0 ? upTrndSAR : dnTrndSAR

psar := isPsarAdaptive ? psar : ta.sar(psarStart, psarInc, psarMax)

plot(psar, title='PSAR', color=src < psar ? rajah : magicMint, style=plot.style_circles)

// -- EMA --

float ema = ta.ema(src, emaLength)

plot(ema, title='EMA', color=languidLavender)

// -- Signals --

var string isTradeOpen = ''

var string signalCache = ''

bool enterLong = src > ema and ta.crossover(src, psar) and ta.crossover(osc, 0)

bool enterShort = src < ema and ta.crossunder(src, psar) and ta.crossunder(osc, 0)

// bool exitLong = ta.crossunder(src, ema)

// bool exitShort = ta.crossover(src, ema)

if (signalCache == 'long entry')

signalCache := ''

enterLong := true

else if (signalCache == 'short entry')

signalCache := ''

enterShort := true

if (isTradeOpen == '')

if (enterLong)

isTradeOpen := 'long'

else if (enterShort)

isTradeOpen := 'short'

else if (isTradeOpen == 'long')

if (enterLong)

enterLong := false

else if (isTradeOpen == 'short')

if (enterShort)

enterShort := false

plotshape((isSignalLabelEnabled and enterLong and (isTradeOpen == 'long')) ? psar : na, title='LONG', text='L', style=shape.labelup, color=mediumAquamarine, textcolor=color.white, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and enterShort and (isTradeOpen == 'short')) ? psar : na, title='SHORT', text='S', style=shape.labeldown, color=carrotOrange, textcolor=color.white, size=size.tiny, location=location.absolute)

// -- High Low Stop Loss and Take Profit --

bool isHighLowStopLossEnabled = true

bool isAutomaticHighLowTakeProfitEnabled = true

bool recalculateStopLossTakeProfit = false

bool isStrategyEntryEnabled = false

bool isLongEnabled = true

bool isShortEnabled = true

bool isStopLossTakeProfitRecalculationEnabled = true

bool longStopLossTakeProfitRecalculation = isStopLossTakeProfitRecalculationEnabled ? true : (lastTrade == 'short' or lastTrade == 'initial')

bool shortStopLossTakeProfitRecalculation = isStopLossTakeProfitRecalculationEnabled ? true : (lastTrade == 'long' or lastTrade == 'initial')

var float longHighLowStopLoss = 0

var float shortHighLowStopLoss = 0

float highLowStopLossLowest = ta.lowest(_low, highLowStopLossLookback)

float highLowStopLossHighest = ta.highest(_high, highLowStopLossLookback)

if (isHighLowStopLossEnabled)

if (((enterLong and longStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size > 0) : true))

if (highLowStopLossLowest == _low)

longHighLowStopLoss := _high * highLowStopLossBackupMultiplier

else if (highLowStopLossLowest > 0)

longHighLowStopLoss := highLowStopLossLowest * highLowStopLossMultiplier

if (((enterShort and shortStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size < 0) : true))

if (highLowStopLossHighest == _high)

shortHighLowStopLoss := _high * (1 + (1 - highLowStopLossBackupMultiplier))

else if (highLowStopLossHighest > 0)

shortHighLowStopLoss := highLowStopLossHighest * (1 + (1 - highLowStopLossMultiplier))

plot((isLongEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'long')) ? longHighLowStopLoss : na, 'Long High Low Stop Loss', color=magicMint, style=plot.style_circles, trackprice=false)

plot((isShortEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'short')) ? shortHighLowStopLoss : na, 'Short High Low Stop Loss ', color=rajah, style=plot.style_circles, trackprice=false)

// -- Automatic High Low Take Profit --

var float longAutomaticHighLowTakeProfit = na

var float shortAutomaticHighLowTakeProfit = na

if (isAutomaticHighLowTakeProfitEnabled)

if (((enterLong and longStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size > 0) : true))

longHighLowStopLossPercentage = 1 - (longHighLowStopLoss / _close)

longAutomaticHighLowTakeProfit := _close * (1 + (longHighLowStopLossPercentage * automaticHighLowTakeProfitRatio))

if (((enterShort and shortStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size > 0) : true))

shortHighLowStopLossPercentage = 1 - (_close / shortHighLowStopLoss)

shortAutomaticHighLowTakeProfit := _close * (1 - (shortHighLowStopLossPercentage * automaticHighLowTakeProfitRatio))

plot((isAutomaticHighLowTakeProfitEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'long')) ? longAutomaticHighLowTakeProfit : na, 'Long Automatic High Low Take Profit', color=magicMint, style=plot.style_circles, trackprice=false)

plot((isAutomaticHighLowTakeProfitEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'short')) ? shortAutomaticHighLowTakeProfit : na, 'Short Automatic High Low Take Profit', color=rajah, style=plot.style_circles, trackprice=false)

// log.info('Automatic Long High Low Take Profit: ' + str.tostring(longAutomaticHighLowTakeProfit))

// log.info('Automatic Short High Low Take Profit: ' + str.tostring(shortAutomaticHighLowTakeProfit))

// log.info('Long High Low Stop Loss: ' + str.tostring(longHighLowStopLoss))

// log.info('Short High Low Stop Loss: ' + str.tostring(shortHighLowStopLoss))

bool longHighLowStopLossCondition = ta.crossunder(_close, longHighLowStopLoss)

bool shortHighLowStopLossCondition = ta.crossover(_close, shortHighLowStopLoss)

bool longAutomaticHighLowTakeProfitCondition = ta.crossover(_close, longAutomaticHighLowTakeProfit)

bool shortAutomaticHighLowTakeProfitCondition = ta.crossunder(_close, shortAutomaticHighLowTakeProfit)

bool exitLong = (longHighLowStopLossCondition or longAutomaticHighLowTakeProfitCondition) and strategy.position_size > 0

bool exitShort = (shortHighLowStopLossCondition or shortAutomaticHighLowTakeProfitCondition) and strategy.position_size < 0

plotshape((isSignalLabelEnabled and exitLong and (isTradeOpen == 'long')) ? psar : na, title='LONG EXIT', style=shape.circle, color=magicMint, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and exitShort and (isTradeOpen == 'short')) ? psar : na, title='SHORT EXIT', style=shape.circle, color=rajah, size=size.tiny, location=location.absolute)

// Long Exits

if (exitLong)

strategy.close('long', comment=longAutomaticHighLowTakeProfitCondition ? 'EXIT_LONG_TP' : 'EXIT_LONG_SL')

isTradeOpen := ''

// Short Exits

if (exitShort)

strategy.close('short', comment=shortAutomaticHighLowTakeProfitCondition ? 'EXIT_SHORT_TP' : 'EXIT_SHORT_SL')

isTradeOpen := ''

// Long Entries

if (enterLong and (strategy.position_size == 0))

strategy.entry('long', strategy.long, comment='ENTER_LONG')

// Short Entries

if (enterShort and (strategy.position_size == 0))

strategy.entry('short', strategy.short, comment='ENTER_SHORT')

// Save last trade state

if (enterLong or exitLong)

lastTrade := 'long'

if (enterShort or exitShort)

lastTrade := 'short'

barcolor(color=isTradeOpen == 'long' ? mediumAquamarine : isTradeOpen == 'short' ? carrotOrange : na)